Air Brake System Market by Type (Disc & Drum), Component (Compressor, Governor, Tank, Air Dryer, Foot Valve, Brake Chamber, & Slack Adjuster), Rolling Stock, Vehicle Type (Rigid Body, Heavy-Duty, Semi-Trailer, & Bus), Region - Global Forecast to 2028

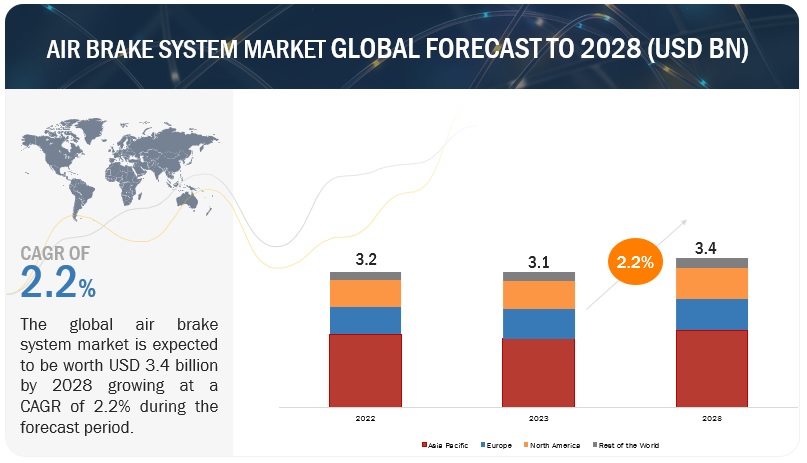

[267 Pages Report] The global air brake system market size was valued at USD 3.1 billion in 2023 and is expected to reach USD 3.4 billion by 2028, at a CAGR of 2.2% during the forecast period 2023-2028. The air brake system market is expected to grow due to several factors. These include the rising demand for heavy commercial vehicles, the expansion of railways, increased long-haul transportation, and upcoming safety-related regulatory requirements. These factors will contribute to the increased adoption of air disc brakes in developed and developing countries.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Increase in sales and production of commercial trucks and buses.

The air brake system market relies heavily on producing and selling heavy commercial vehicles and off-highway trucks, as they use air brakes for their fail-proof mechanism. The global production of commercial vehicles has significantly increased in recent years due to population growth, urbanization, and increased infrastructural spending worldwide. The demand for heavy trucks and buses has also risen, especially after 2020, driven by e-commerce growth and the recovery of the travel and tourism industry. This has led to a greater need for efficient transportation systems to meet the rising demands for goods and passenger transport, resulting in increased usage of air brake systems. As global heavy vehicle manufacturers adapt to these changes, ongoing investments in heavy trucks and buses will be crucial to sustain the high demand. The strong demand for these vehicles and the global economic recovery are expected to drive the market.

RESTRAINTS: Increasing focus on electric trucks and buses may hamper the air brake system market.

Due to environmental changes, all nations focus on reducing overall carbon emissions in the coming years. The automotive industry, responsible for significant carbon emissions, is trying to develop zero-emissions vehicles. In the current scenario, leading players such as Tesla, Daimler, Mitsubishi, BMW, Ford Motors, General Motors, and Volkswagen offer a wide range of electric passenger vehicles, due to which electric vehicles have witnessed a significant amount of growth in sales of these vehicles. Additionally, players such as Volvo, Tesla, BYD, and Daimler are launching certain heavy trucks and buses which will be electrically powered. The respective governments are providing subsidies to the buyers to push the development of electric commercial vehicles. These electric trucks and buses are jointly the existing fleets of the public/private institutions to reduce fleet-level emissions. As per the cost-benefit analysis, electric commercial vehicles will save significant fuel and maintenance costs for the owner. All these factors are estimated to increase the market for electric trucks and buses.

However, electric buses and trucks are equipped with a regenerative braking system, which is estimated to eradicate the requirement for air brakes in commercial vehicles. This may hinder the growth of the air brake market in the coming time. As per reports, the electric commercial vehicle market is estimated to witness a CAGR of 40.96% from 2022–2030 globally. This high growth rate may hamper the growth of the air brake market. Increasing global warming, concerns are forcing OEMs to adopt electric vehicles faster. Developed regions such as Europe and North America focus heavily on electrifying the commercial vehicle segment.

China, the world’s largest commercial vehicle producer, has the largest electric and hybrid bus fleet. Japan and India are also following in the footsteps of China. This high adoption rate of electrically powered vehicles will eradicate the need for the air brake system in commercial vehicles.

OPPORTUNITIES: Regulations on load-carrying capacity and mandates on installing air brakes.

Countries such as India increased their per axle load capacity by 20–25% in 2018. The increase in the load per axle has increased the demand for high-power brakes in the commercial vehicle segment in India. Due to increased weight per axle, many medium commercial vehicles have witnessed increased regulated load-carrying capacity per vehicle. For instance, the vehicles used to carry loads up to 6 tons can now carry weight up to 7.5 ton. According to MarketsandMarkets analysis, the installation rate of the air brake system is between 80 to 90% in the 7-to-14.9-ton GVWR segment.

Additionally, vehicles with 6-to-6.5-ton GVWR will be included in the 7 to 14.9-ton segment. Due to the axle load mandates, many LCVs will be pushed to the MHCV segment providing a potential market for the air brake system. Additionally, the 80–90% of air brake installation rate is estimated to increase to 90–95% in the coming time because of the mandates. Due to this, the demand for air brakes is expected from the medium-heavy trucks market. The higher axle loads improve transport efficiency, which will also increase safety concerns, which need to be addressed. Hence, it will increase the overall installation rate of the air brake system in medium-heavy commercial vehicles.

CHALLENGES: Freezing of air brakes at low temperature.

Air brakes comprise air pipes and air tanks filled with compressed air. The compression process creates heat, which interacts with the ambient temperature of the air brake system to create moisture. This moisture must be evacuated from the low spots in the tanks where it collects. If the moisture is allowed to remain in the system, the service life of the parts is significantly shortened; this is true in hot, warm, or cold weather conditions.

The moisture present at low temperatures in the compressor might affect the braking power of the air brake system, as at low temperatures, the moisture tends to turn into ice, which may partially block the air pipe. This may create a problem for the air brake system as compressed air will not be able to pass through the air pipe, and sufficient pressure will not be applied for the stopping of the commercial vehicle. Countries such as the US, Canada, Germany, the UK, Japan, and China have an area where the temperature dips to freezing. This may hamper the overall performance of air brakes and may threaten the vehicle's safety.

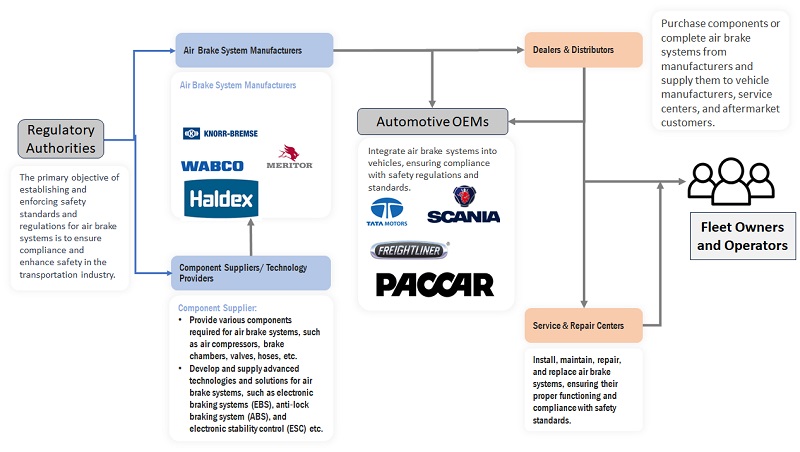

Air Brake System Market Ecosystem:

The ecosystem analysis highlights various players in the air brake system ecosystem, primarily represented by Air Brake System Manufacturers, component manufacturers (tier I), Automotive OEMs, and dealers and distributors.

Air Brake System manufacturers

Air Brake System manufacturers are responsible for creating, designing, and manufacturing air brake systems. They dedicate resources to research and development to enhance air brake system performance, safety, and features. Well-known air brake system manufacturers include Knorr-Bremse AG, WABCO Holdings, Inc., Meritor, Inc., Haldex AB, ZF Friedrichshafen AG, and Wabtec Corporation.

Component Supplier/ Technology provider

Component suppliers in the air brake system ecosystem are specialized manufacturers that produce specific parts or subassemblies required for air brake systems. These suppliers play a crucial role in the supply chain by manufacturing valves, compressors, brake chambers, air dryers, and electronic control units. Technology providers design and develop advanced technologies for air brake systems, such as electronic braking systems (EBS), anti-lock braking systems (ABS), and electronic stability control (ESC).

Automotive OEMs

Automotive OEMs such as truck manufacturers, bus manufacturers, and other vehicle OEMs work closely with air brake system manufacturers to incorporate air brake systems into their vehicles during manufacturing. This collaboration ensures that the air brake systems are compatible with the vehicles, perform optimally, and adhere to safety regulations. By integrating these systems effectively, commercial vehicle manufacturers prioritize safety and ensure the proper functioning of air brakes in their vehicles.

Government and Regulatory Authorities

Government agencies and regulatory bodies are responsible for setting safety standards, regulations, and certifications on air brake systems. Their primary objective is to ensure compliance with these standards and monitor the performance and reliability of air brake systems. Doing so aims to enhance road safety and minimize the risks associated with commercial vehicles equipped with air brake systems.

Dealer and Distributors

Dealers and distributors serve as intermediaries between air brake system manufacturers and customers. They buy air brake systems from manufacturers and then sell them to retail stores or consumers. Additionally, dealers offer post-purchase services like maintenance and repair.

Service & Repair Centers

Service and Repair centers in the air brake system market specialize in crucial tasks such as maintenance, repair, and replacement of air brake system components. Their expertise and services are essential for ensuring the proper functioning and safety of the braking system in commercial vehicles. By offering these services, they contribute significantly to the overall performance and reliability of air brake systems, thereby enhancing the safety of commercial vehicle operations.

Fleet Owners & Operators

End users are key participants in the air brake system ecosystem. Trucking companies and logistics firms, significant fleet owners, are key customers in the air brake system market. These organizations procure and manage fleets of commercial vehicles equipped with air brake systems to facilitate secure and efficient transportation operations. By prioritizing the purchase and maintenance of these vehicles, they ensure the safety and effectiveness of their transportation services.

Drum Air Brakes are estimated to be the largest market during the forecast period.

By Brake Type, Drum air brake holds the largest market share in the global air brake system market, whereas disc air brake is expected to grow fastest during the forecast period. Drum brakes in commercial vehicles primarily comprise brake drums, brake shoes, and linings. The drum brakes are the oldest braking mechanism, with a maximum adoption rate in Asia Pacific and North America owing to the comparatively lower cost than air disc brakes. In the present scenario, the Asia Pacific and North America have an adoption rate of 85–90% and 80–85% for drum brakes in heavy-duty vehicles. Moreover, the market is shifting toward deploying air disc brakes with a rising focus on safety and growing demand for high-loading carrying capacity trucks in developed regions such as Europe and North America. Europe is a prominent market for air disc brakes currently, and simultaneously the countries of North America and Asia Pacific are significantly adopting the deployment of air disc brakes. Thus, increasing stringency in vehicle-stopping distance-related regulations and introducing advanced braking mechanisms worldwide would impact the growth of air drum brakes in the coming years.

Semi-trailers are anticipated to grow at the highest rate during the forecast period in the air brake system market by vehicle type.

Semi-trailer tractor is anticipated to grow at the fastest CAGR of 3.0% during the forecast period. Semi-trailer tractor usage in developing countries such as India and Japan has increased significantly in the last few years. For instance, the growth in semi-trailer production in India and Japan has elevated by 34% and 8%, respectively, in 2022. This growth can be attributed to the increase in road infrastructure and the high rate of industrialization. For instance, the Indian government has allocated USD 8.07 billion for FY2022-2023 for road infrastructure.

The air brake system market for semi-trailer tractors considers the tractors only, not the trailer behind them, as it is an optional addition. On average, the semi-trailer tractor has three axles. The air brake system component, such as the compressor, must have a high capacity as the weight carrying capacity is more than thirty tons. The price of the air brake systems for semi-trailer tractors is comparatively higher than the rigid body and heavy-duty trucks owing to the requirement for higher quality air brakes. Asia Pacific has the largest market share in semi-trailer tractor air brake systems. The growth of semi-trailer tractor air brake systems in the Asia Pacific region can be attributed to factors such as growing road infrastructure, retail & distribution network expansion, and logistic and supply chain network development.

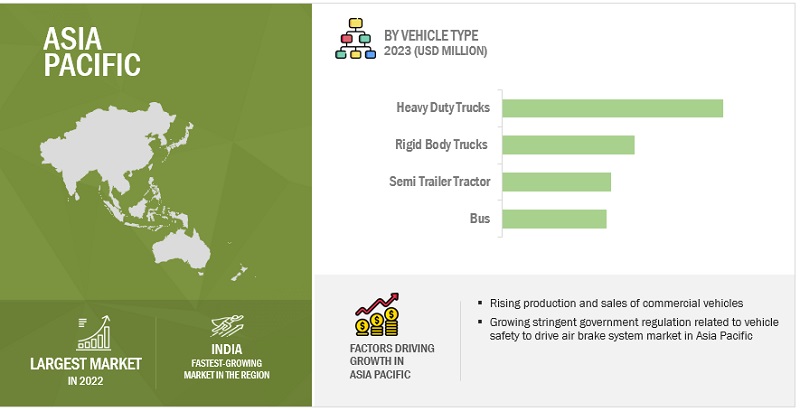

“Asia Pacific to be the largest market for air brake systems during the forecast period.”

Asia Pacific will lead the air brake system market during the forecast period. The Asia Pacific produced around 64% of global commercial vehicle production in 2022. Asia Pacific has emerged as a hub for automotive production in recent years owing to the increasing population and urbanization in the region. According to OICA, Asia Pacific accounted for ~60% of the global truck production in 2022 due to OEMs such as Zheng Zou Yutong, Xiamen Kinglong Motor, Tata Motors, and Ashok Leyland. Manufacturers in this region are focused on developing specific solutions that address the challenging driving and braking situations drivers face on the roads. As consumers in the region are showing an increased inclination toward safety awareness, the region has witnessed higher growth than the matured markets of Europe and North America. As most of the heavy commercial vehicles above the GVWR of 7 ton are equipped with air brakes, Asia Pacific is estimated to be the largest market.

Key Market Players & Startups

The air brake system market is dominated by players such as Knorr- Bremse AG (Germany), Meritor, Inc. (US), Haldex (Sweden), ZF Friedrichshafen AG (Germany), Wabtec Corporation (US), Nabtesco Corporation (Japan), TSE Brakes Inc. (Germany), Federal-Mogul (US), and SORL Auto Parts (China). These companies offer advanced air brake systems and have strong distribution networks at the global level. These companies have adopted comprehensive expansion strategies; and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the growing market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast volume |

Units |

|

Forecast value |

USD Million/Billion |

|

Segments Covered |

By Vehicle Type, Brake Type, component type, construction and mining truck by component, Rolling stock By component, and by Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and the Rest of the World |

|

Companies Covered |

Knorr- Bremse AG (Germany), Meritor, Inc. (US), Haldex (Sweden), ZF Friedrichshafen AG (Germany), and Wabtec Corporation (US), Nabtesco Corporation (Japan), TSE Brakes Inc. (Germany), and SORL Auto Parts (China). (Total of 20 companies) |

The study categorizes the air brake system market based on By vehicle type, brake type, component type, construction and mining trucks by component, rolling stock byb number of components, and region.

By Vehicle Type

- Rigid Body Trucks

- Heavy Duty Trucks

- Semi-Trailer Tractor

- Bus

By Brake Type

- Drum Air Brake

- Disc Air Brake

By Application

- Compressor

- Governor

- Storage Tank

- Air Dryer

- Foot Valve

- Brake Chamber

- Slack Adjuster

Construction and Mining Trucks by Component

- Compressor

- Governor

- Storage Tank

- Air Dryer

- Foot Valve

- Brake Chamber

- Slack Adjuster

Rolling Stock by Component Type

- Compressor

- Storage Tank

- Drivers Brake Valve

- Brake Cylinder

- Brake Pipe

By Region

- Asia Pacific

- Europe

- North America

- Rest of the World

Recent Developments

- In April 2023, Knorr-Bremse AG announced the launch of its commercial vehicle aftermarket brand Knorr-Bremse Truck Services in South America. The portfolio for dealers, workshops, and fleet operators was presented at Automec 2023 in South America.

- In September 2022, Knorr-Bremse AG introduced its updated SYNACT Braking system with Active Caliper Release (ACR). Compared to the previous generation, the latest pneumatic version is developed with higher braking torque and reduced-weight brake calipers and backing plates. The optional Active Caliper Release (ACR) uses a spring-loaded system to disengage the pads from the disc and re-center the caliper. This is aimed to reduce fuel consumption by up to one percent and reduce brake pad wear.

- In March 2022, Meritor, Inc. announced its collaboration with ConMet. This collaboration aimed to develop purpose-built trailer brakes to work with ConMet’s PreSet Plus eHub. This innovative system was sought to be designed to enable the production of zero-emissions refrigerated trailers.

- In March 2022, ZF Friedrichshafen AG announced its collaboration with the C.R. England. This collaboration aimed to update their fleet with a new brake technology. The MAXXUS L2.0 Air Disc Brakes was chosen mainly because of its advantages, including performance, reliability, and savings in total cost of ownership. The C.R. England converted its truck fleet of around 4,000 trucks to the MAXXUS L2.0 Air Disc Brakes.

- In March 2021, ZF Friedrichshafen AG introduced its MAXXUS L2.0 air disc brakes, which is the fifth generation. The MAXXUS L2.0 air disc brakes are engineered to be incorporated into commercial fleets.

- In November 2020, Meritor, Inc., and Daimler Trucks North America (DTNA) announced their partnership extension. With this, the Meritor EX+ LS air disc brakes (ADB) were made available as standard on Freightliner Cascadia truck models through 2025.

Frequently Asked Questions (FAQ):

What is the current size of the global air brake system market?

The global air brake system market will be USD 3.1 billion in 2023.

Which adjacent market will be impacted due to the air brake system market?

Air compressor manufacturers, sensor manufacturers, brake cylinder, and storage tank manufacturers will have a positive impact due to growing sales of air brake systems worldwide.

Who are the winners in the global air brake system market?

Knorr- Bremse AG (Germany), Meritor, Inc. (US), Haldex (Sweden), ZF Friedrichshafen AG (Germany), and Wabtec Corporation (US) are the leading players in the global air brake system market.

What are the key market trends impacting the growth of the air brake system market?

The emergence of various technologies, such as the integration of anti-lock braking systems and electronic stability control systems in air brakes, rising high-speed train and bullet trains, and increasing government regulations related to vehicle safety and stopping distance for commercial vehicles will drive the demand for air brake system in the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

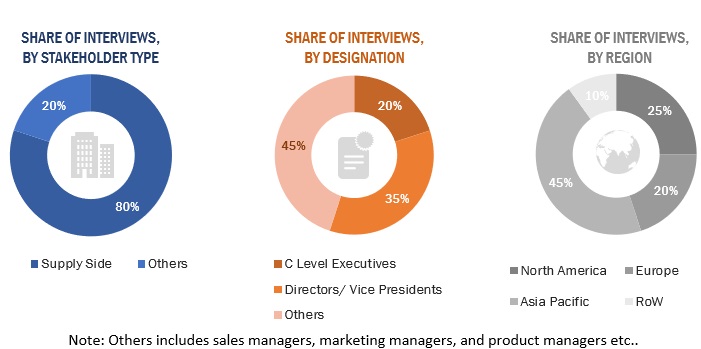

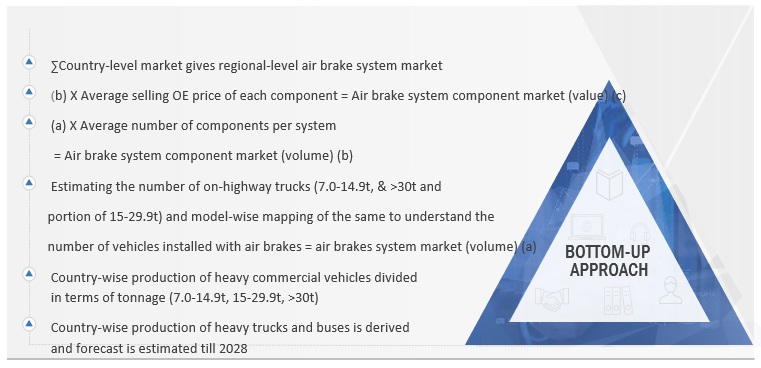

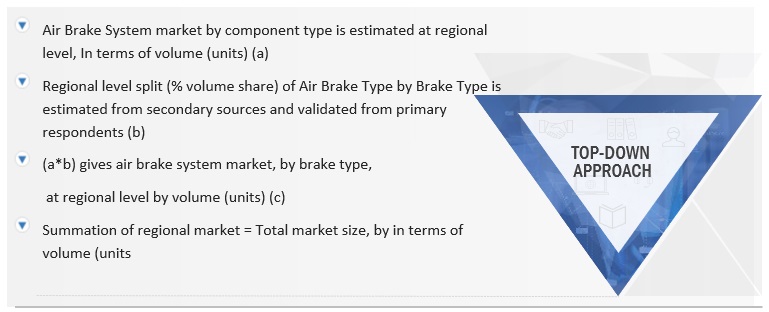

The study involved four major activities in estimating the current size of the air brake system market. Exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up and top-down approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

The air brake system market is directly dependent on commercial vehicle production. Commercial vehicle production was derived through secondary sources such the Organisation Internationale des Constructeurs d'Automobiles (OICA); corporate filings (such as annual reports, investor presentations, and financial statements), Factiva, Crunchbase, Bloomberg; and trade, business, and automotive associations. Historical production of commercial vehicle data was collected and analyzed, and the industry trend was considered to arrive at the forecast, which was further validated by primary research.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, vice presidents, directors from business development, marketing, and product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews were conducted to gather insights such as air brake system trends and forecasts, future technology trends, and upcoming technologies in the air brake system industry. Data triangulation of all these points was carried out with the information gathered from secondary research as well as model mapping. Stakeholders from the demand as well as supply sides were interviewed to understand their views on the points mentioned above.

Primary interviews were conducted with market experts from both the supply (air brake system solution and service providers) and demand sides (Automotive OEMs, and End customers) across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately 90% and 20% of primary interviews were conducted from the supply side and others, respectively. Primary data was collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the air brake system market and other dependent submarkets, as mentioned below:

- Key players in the market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included a study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and subsegments were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

- Qualitative aspects such as market drivers, restraints, opportunities, and challenges were taken into consideration while calculating and forecasting the market size.

Bottom-Up Approach: Air Brake System Market, By Vehicle Type And Region

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach: By Component Type, Brake Type

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition:

- Air brake system is defined as a brake mechanism in which compressed air is used as a working fluid and is applied at a certain pressure to stop the vehicle. Air compressor, governor, storage tank, air dryer, valves (safety, drain, and foot), and foundation brakes are the key components of an air brake system. Air brake systems are commonly employed in large trucks and buses, with the typical operational pressure ranging from around 100 to 120 psi (690 to 830 kPa or 6.9 to 8.3 bar).

Key Stakeholders:

- Sales Head

- Marketing Head

- Design Manager

- R&D Head

Report Objectives

-

To define, segment, analyze, and forecast (2023–2028) the air brake system market size, in terms of volume (Thousand units) and value (USD million) based on:

- Vehicle Type (Rigid body truck, heavy duty truck, semi-trailer tractor, and bus)

- By component (compressor, governor, storage tank, air dryer, foot valve, brake chamber, and slack adjuster)

- By brake type (drum air brake, and disc air brake)

- Construction and mining truck by component (compressor, governor, storage tank, air dryer, foot valve, brake chamber, and slack adjuster)

- Rolling stock by component (compressor, storage tank, drivers brake valve, brake cylinder, and brake pipe)

- Region (North America, Europe, Asia Pacific, and the Rest of the World (RoW))

- To analyze the recession impact on the market

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) of the market

-

To study the following with respect to the market

- Supply Chain Analysis

- Market Ecosystem

- Technology Analysis

- Trade Analysis

- Case Study Analysis

- Patent Analysis

- Buying Criteria

- Regulatory Landscape

-

To estimate the following with respect to the market

- Average Selling Price Analysis

- Market Share Analysis

- To analyze the competitive landscape and prepare a competitive evaluation quadrant for the global players operating in the air brake system market

- To analyze recent developments, alliances, joint ventures, mergers & acquisitions, new product launches, and other activities carried out by key industry participants in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs.

The following customization options are available for the report:

Air Brake System Market for Rolling Stock, By Rolling Stock Type

- Diesel Locomotive

- DMU

- EMU

- Metros

- Passenger Coaches

- Freight Wagon

Note: The Air Brake System Market for Rolling Stock, By Rolling Stock Type will be further offered at the regional level for regions: Asia Oceania, Europe, North America, and RoW

Air Brake System Market for On-highway Vehicles, By Component

- Compressor

- Governor

- Storage Tank

- Air Dryer

- Foot Valve

- Brake Chamber

- Slake Adjuster

Note: The Air Brake System Market for On-highway Vehicles, By Component, will be further offered at the regional level for regions: Asia Oceania, Europe, North America, and RoW

Note: The countries would be covered: Asia Pacific (China, Japan, India, South Korea and Rest of Asia Pacific), Europe (Germany, France, UK, Spain, Russia, Turkey, and the Rest of Europe), North America (US, Canada, and Mexico), and the Rest of World (Brazil, Argentina, and Rest of the World)

Growth opportunities and latent adjacency in Air Brake System Market

Can you please share the sample report for Air Brake system as we need to buy the report for Air Brake System.