Animal Genetics Market Size by Product (Live Animal (Poultry, Porcine, Bovine, Canine) Genetic Material (Semen (Bovine, Porcine, Equine), Embryo (Bovine, Equine)) Genetic Testing Service (Disease, Genetic Traits - Bovine, DNA Typing)) & Region - Global Forecast to 2028

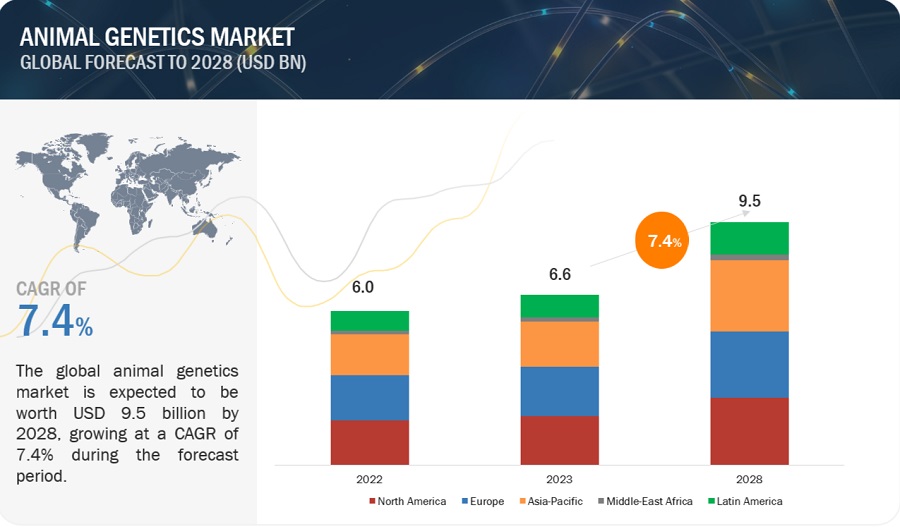

The size of global animal genetics market in terms of revenue was estimated to be worth $6.6 billion in 2023 and is poised to reach $9.5 billion by 2028, growing at a CAGR of 7.4% from 2023 to 2028. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

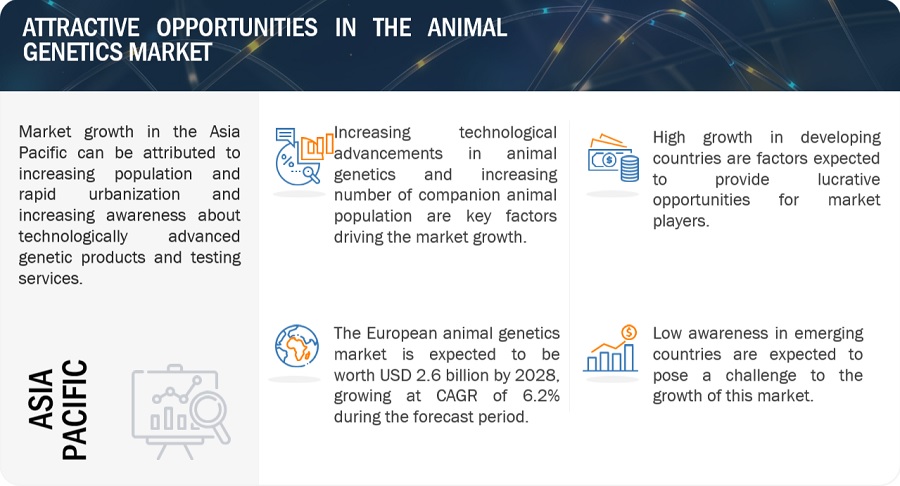

Market growth is largely driven by factors such as the increasing consumption of animal-derived protein, growing global population & rapid urbanization, growing customer awareness, growing demand for companion animals, focus on superior breeds, and an emphasis on genetic services to prevent genetic diseases & business loss. Market growth is hindered due to the emergence of alternatives to meat (such as lab-grown meat) and a shortage of professionals in veterinary research.

Attractive Opportunities in the Animal Genetics Market

To know about the assumptions considered for the study, Request for Free Sample Report

Animal Genetics Market Dynamics

Driver: Growing global population and rapid urbanization

Globally, farmers are expected to produce 70% more food to feed a population that is estimated to reach 9.6 billion by 2050, according to the UN Food and Agriculture Organization. Most of this projected growth is expected to be in developing countries. Although the global population growth is projected to stabilize during the present century, rapid population growth is expected to be one of the major challenges for achieving improvements in food security in some countries.

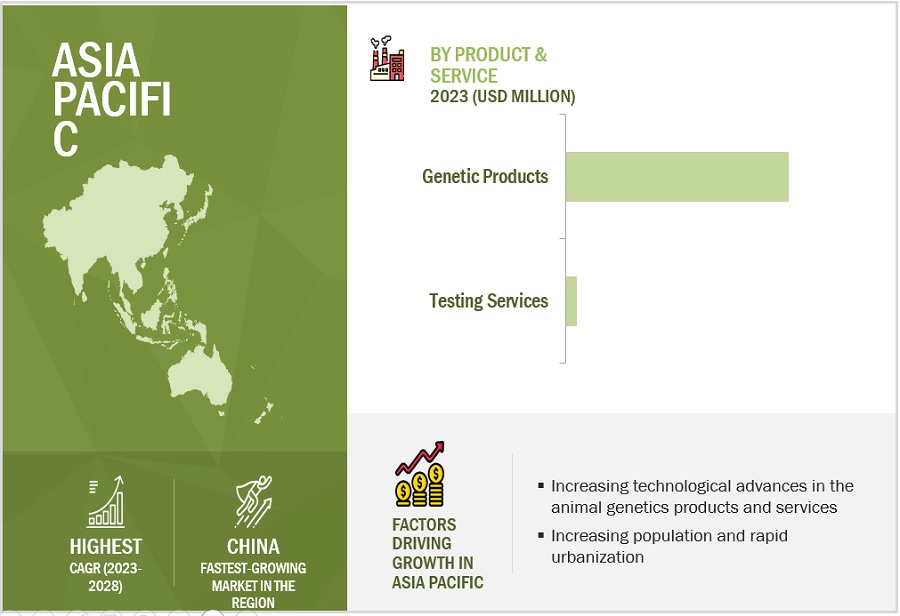

Furthermore, rapid urbanization in developing countries is responsible for increasing concerns regarding food security. According to the UN Department of Economic and Social Affairs, as of September 2021, approximately 55% of the global population lived in urban areas. This percentage is expected to increase to 73% by 2050 as urbanization continues to be a significant trend worldwide. Due to this trend, the consumption of animal products is expected to increase, as a large part of the population is moving from an agricultural lifestyle to an urban setting. This trend is highly evident in emerging economies such as Brazil, Russia, India, and China, where rapid urbanization drives the demand for animal food products.

To cater to the rising demand for animal proteins, livestock producers increasingly use advanced genetic approaches in animal breeding. In the dairy industry, artificial insemination is increasingly being used to increase milk production; in the porcine industry, high-quality porcine genetics are used to increase meat production. Such trends are expected to drive the demand for animal genetic products and technologies in the coming years.

Owing to the availability of advanced genetic technologies, developed countries will continue to account for a greater share of this demand than the developing countries across Asia Pacific and Latin America. However, rapid growth in the urban population and the adoption of advanced technologies in developing countries will boost the overall animal genetics market.

Restraint: The emergence of alternative such as lab-based meat

Although the ongoing population growth and urbanization in developing countries are drivers of its increase, the per capita meat consumption is partially offset by the shift towards a demand for quality products. This includes a move towards lab-based meat. Lab-grown meat, also known as cultured or cell-based meat, is an innovative technology that involves growing animal muscle tissue in a controlled environment, rather than raising and slaughtering animals for meat production. This technology has the potential to address various challenges associated with traditional meat production, such as environmental sustainability, animal welfare, and resource consumption.

For instance, in 2020, a US-based company, namely, Eat Just, passed a safety review by the Singapore Food Agency to market and sell its lab-grown chicken bits. In 2021 and 2022, Several startups and established food companies were actively investing in and researching cultured meat technology. Moreover, changing consumer preferences and attitudes towards meat consumption concerning its impact on health, the environment, animal welfare, and global greenhouse gas emissions could also drive demand from animal-based protein. This may negatively impact the demand for animal-based protein in the long run, which in turn would thwart the adoption of animal genetics.

Opportunity: Innovations in phenotyping services

Technological developments in animal genetic testing are mainly focused on two areas—the measurement of an increasingly large array of new phenotypes and the development of systems for automatic trait measurement and recording (such as automated milk-recording systems and pedometers for ambulatory activities). For instance, for animal breeds with limited scope for improving trait measurement, new phenotype tests are being developed. Milk quality trait measurement in dairy cattle now includes not only total protein and fat content but also the measurement of sub-components like lactoferrin and fatty acids. The measurement of health-related traits is also an emerging field of phenotypic investigation, which includes indirect measures for the detection of mastitis (electrical conductivity of milk and milk mineral content), female fertility (milk hormone assays and physical activity), and traits related to the detection of lameness or metabolic syndromes.

Owing to the reduced prices of genotyping tests, trait measurement has become a major economically limiting factor in livestock selection schemes; hence, there is a growing focus on research towards large-scale automatic phenotyping. Automated milk-recording systems, pedometers (for measuring fertility and lameness), and rumination tags (for monitoring rumination time, which is related to metabolic activity and methane emissions) are gaining greater importance in animal breeding. These innovations in phenotyping technologies have emerged as powerful tools to improve herd management and breeding schemes. The greater uptake of these technologies will provide new growth avenues for players in the genetic testing services market.

Challenge: Economic sustainability in local breeds

The implementation of genetic improvement programs for local breeds requires significant investments. A lack of infrastructure in areas where local breeds are present requires huge investments to develop said infrastructure. Such investments are often given low importance due to their economic feasibility and outcomes. For instance, artificial insemination in a small population of local animal breeds has higher per dose semen costs than the same in large animal populations due to economies of scale. The cost-benefit analysis in such cases results in negative or poorer outcomes against many required investments. Considering this scenario, the growing need to improve the productivity of local breeds and improve the affordability and economic feasibility of genetic improvement programs for these breeds is one of the major challenges in the animal genetics industry.

Animal Genetics Market Ecosystem

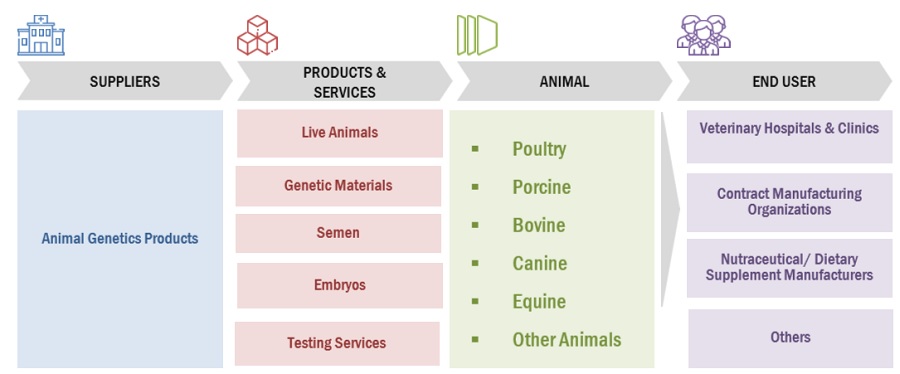

Leading players in this market include well-established and financially stable manufacturers of animal genetics. These companies have been operating in the market for several years and possess a diversified product portfolio, advanced technologies, and strong global presence. Prominent companies in animal genetics market include Neogen Corporation (US), Genus (Uk), Urus (US), EW Group Gmbh (Germany), Groupe Grimaud (France).

The genetic materials segment of the animal genetics industry is expected to register the highest CAGR during the forecast period.

The genetic materials segment of the animal genetics market is projected to grow at the highest CAGR during 2023 to 2028. This is attributed to high adoption of advanced genetic technologies such as artificial insemination, embryo transfer, and sexed semen for the large-scale production of high-yield live animals and enhanced breed quality. Genetic materials are used for animal breeding to improve the offspring’s traits. The two major genetic materials that are used for animal breeding are semen and embryos. Animal breeding using genetic materials can be done through artificial insemination, cloning, in vitro fertilization, embryo transfer, and semen sexing.

The embryos segment of the animal genetics industry is estimated to grow at a higher CAGR during the forecast period.

The embryos segment of the animal genetics market is estimated to grow at a higher CAGR during the forecast period. Embryo transfer technology is mainly used for cattle, sheep, goats, pigs, and to a smaller extent in buffaloes and camels. Significant growth has been observed in bovine embryo transfer in recent years. Embryo transfer in the bovine industry has recently gained considerable popularity with seed stock and beef producers. It has profited from technologies such as IVF, ultrasonography, and genomics. Producers use embryo transfer programs to increase the flock numbers of genetically elite animals.

APAC is estimated to be the fastest-growing regional market for animal genetics industry.

The global animal genetics market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2022, APAC is estimated to be the fastest-growing regional market for animal genetics. The high growth in this market can majorly be attributed to the rapid urbanization and rising per capita income and increasing per capita spending on animal care. Some of the major players in the Asia Pacific market are ABS Global (US), Groupe Grimaud (France), Zoetis (US), Hendrix Genetics (Netherlands), Topigs Norsvin (Netherlands), CRV Holding (Netherlands), and Neogen (US).

To know about the assumptions considered for the study, download the pdf brochure

The animal genetics market is dominated by a few globally established players such as Neogen Corporation (US), Genus (Uk), Urus (US), EW Group Gmbh (Germany), Groupe Grimaud (France). Major players adopt growth strategies to expand their geographical presence and garner higher shares in the global market, such as product launches and approvals, expansions, collaborations, and acquisitions.

Scope of the Animal Genetics Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$6.6 billion |

|

Projected Revenue Size by 2028 |

$9.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.4% |

|

Market Driver |

Growing global population and rapid urbanization |

|

Market Opportunity |

Innovations in phenotyping services |

The study categorizes the animal genetics market to forecast revenue and analyze trends in each of the following submarkets:

By Product & Service

-

Animal Genetic Products

-

Live Animals

- Poultry

- Porcine

- Bovine

- Canine

- Other live animals

-

Genetic Materials

-

Semen

- Bovine

- Porcine

- Equine

- Canine

- other animal semen

-

Embryos

- Bovine

- Equine

- Other animal embryos

-

Semen

-

Live Animals

-

Animal Genetic Testing Services

- Genetic Disease Tests

-

Genetic Trait Tests

- Bovine

- Other animal genetic trait tests

- DNA Typing

- Other services

By Region

-

North America

- US

- Canada

-

Europe

- France

- Germany

- UK

- Spain

- Italy

- Netherlands

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Australia

- South Korea

- Rest of Asia Pacific

-

Latin America

- Brazil

- Mexico

- Rest Of Latin America

- Middle East & Africa

Recent Developments of Animal Genetics Industry

- In March 2023, URUS Group collaborated with Genetics Australia. The JV will be 60 percent owned by URUS and 40 percent owned by Genetics Australia (GA). It will have access to the full suite of GENEX products and access to the PEAK program.

- In January 2023, Zoetis collaborated with VAS to give farmers better compatibility crossover between Vas's PULSE platform, a broad farm management cloud-based software, and DairyComp, a herd health system with Zoetis's CLARIFIDE genetic and fertility testing.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global animal genetics market?

The global animal genetics market boasts a total revenue value of $9.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global animal genetics market?

The global animal genetics market has an estimated compound annual growth rate (CAGR) of 7.4% and a revenue size in the region of $6.6 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the usage of comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for an extensive, technical, market-oriented, and commercial study of the animal genetics market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottommost level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include project/sales/marketing/business development managers, presidents, CEOs, vice presidents, chairpersons, chief operating officers, chief strategy officers, directors, chief information officers, chief medical information officers related to the animal genetics markets. Primary sources from the demand side include professionals from veterinary centers & institutes, professors, veterinanians and researchers.

A breakdown of the primary respondents is provided below:

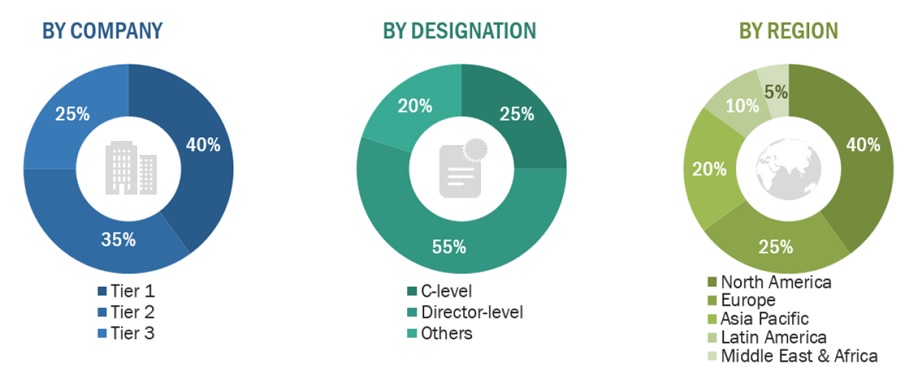

Breakdown of Primary Interviews: Supply-Side Participants, By Company Type, Designation, and Region

Supply side:

Note 1: C-level primaries include CEOs, COOs, CTOs, and VPs.

Note 2: Other primaries include sales managers, marketing managers, and product managers.

Note 3: Companies are classified into tiers based on their total revenue. As of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

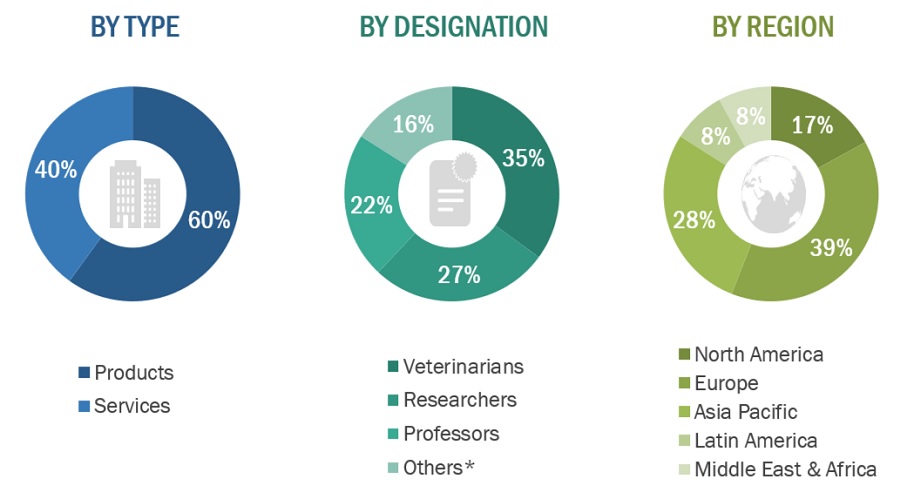

Breakdown of Primary Interviews: Demand-Side Participants, By Type, Designation, and Region

Demand Side:

To know about the assumptions considered for the study, Request for Free Sample Report

Note: Others include department heads, professionals from veterinary centers & institutes.

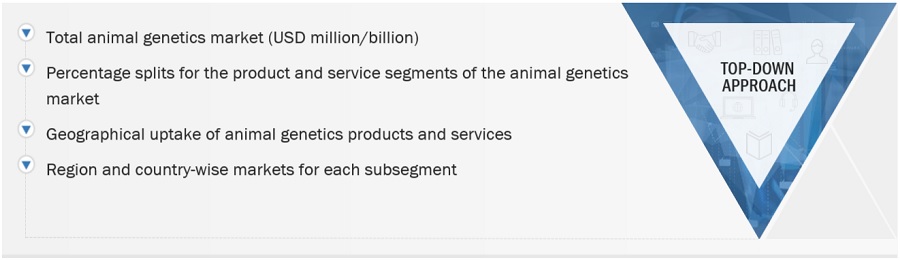

Market Size Estimation

The total size of the animal genetics market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Market Definition

Animal genetics refers to the practice of selective breeding of farm and companion animals by humans for specific benefits—for example, farmers are adopting gene modification and selective breeding practices to increase the yield of animal-derived products. This study covers the animal genetic products (live animals and genetic materials) and animal genetic testing services.

Key Stakeholders

- Animal genetics companies

- Animal breeders

- Research institutes and academic centers

- Contract research organizations (CROs)

- Government associations

- Milk and meat producers

- Market research and consulting firms

- Venture capitalists and investors

Objectives of the Study

- To define, describe, and forecast the animal genetics market by product & service and region

- To strategically analyze the industry trends, technology trends, pricing analysis, regulatory scenario, supply/value chain, ecosystem/market map, Porter’s Five Forces, trade & patent analysis, key stakeholders & buying criteria, and conferences & events

- To provide detailed information about the factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the market size based on region in Europe, North America, the Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile key players in the animal genetics market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as acquisitions, product launches, approvals, expansions, and partnerships

- To analyze the impact of the recession on the animal genetics market

Available customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakdown of the RoE animal genetics market into Austria, Finland, and others

- Further breakdown of the RoLATAM animal genetics market into Argentina, Colombia, Chile, and others

Competitive Landscape Assessment

- Market share analysis for the North America and Europe region, which provides market shares of the top 3–5 key players in the animal genetics market

- Competitive leadership mapping for established players in the US

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Animal Genetics Market

What are the major challenges faced by key players of the global animal genetics market?

I am looking for the detailed geographical analysis of the global animal genetics market

In what way the COVID19 is impacting the global growth of animal genetics market