TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 33)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION AND STUDY SCOPE

1.2.1 INCLUSIONS AND EXCLUSIONS

1.2.2 MARKETS COVERED

FIGURE 1 VETERINARY ULTRASOUND MARKET

1.2.3 MARKETS COVERED – BY REGION

1.2.4 YEARS CONSIDERED

1.3 CURRENCY CONSIDERED

1.4 STAKEHOLDERS

1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Insights from primary experts

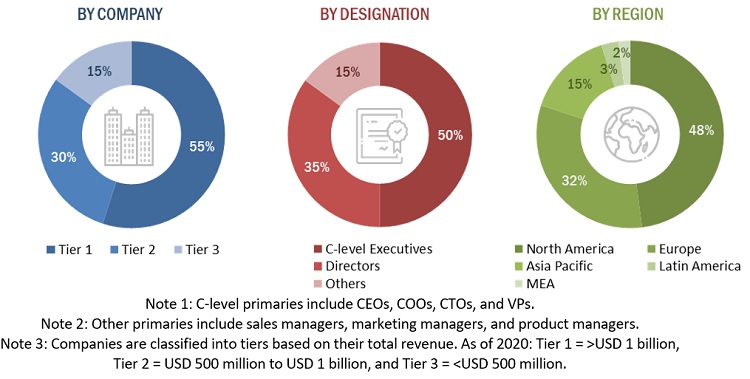

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: DEMAND SIDE MODELLING

FIGURE 6 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 CAGR PROJECTIONS FROM ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES (2022–2027)

FIGURE 8 CAGR PROJECTIONS: SUPPLY SIDE ANALYSIS

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

2.6.1 METHODOLOGY-RELATED LIMITATIONS

2.7 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: VETERINARY ULTRASOUND MARKET

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 10 VETERINARY ULTRASOUND MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 11 VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 12 VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2022 VS. 2027 (USD MILLION)

FIGURE 13 VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 14 VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 VETERINARY ULTRASOUND MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

FIGURE 16 GEOGRAPHICAL SNAPSHOT OF VETERINARY ULTRASOUND MARKET

4 PREMIUM INSIGHTS (Page No. - 54)

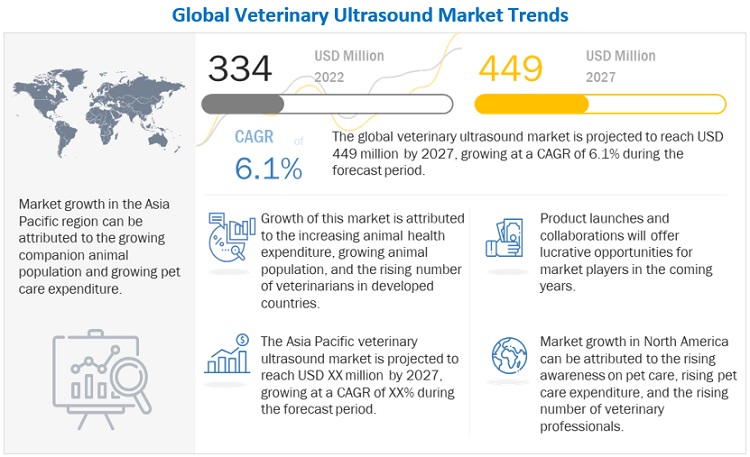

4.1 VETERINARY ULTRASOUND MARKET OVERVIEW

FIGURE 17 GROWING COMPANION ANIMAL POPULATION TO DRIVE MARKET

4.2 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY TYPE AND COUNTRY (2021)

FIGURE 18 2D ULTRASOUND DOMINATED ASIA PACIFIC MARKET IN 2021

4.3 VETERINARY ULTRASOUND MARKET: REGIONAL MIX

FIGURE 19 NORTH AMERICA TO DOMINATE MARKET IN 2027

4.4 VETERINARY ULTRASOUND MARKET: DEVELOPED VS. DEVELOPING COUNTRIES

FIGURE 20 DEVELOPING COUNTRIES TO REGISTER HIGHER GROWTH DURING FORECAST PERIOD

4.5 VETERINARY ULTRASOUND MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 21 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 58)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 VETERINARY ULTRASOUND MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing companion animal population

TABLE 2 PET POPULATION, BY ANIMAL, 2014–2020 (MILLION)

5.2.1.2 Rising demand for pet insurance and increasing pet care expenditure

FIGURE 23 INCREASING PET EXPENDITURE IN THE US, 2010–2021

TABLE 3 US: AVERAGE PREMIUMS PAID, 2019 VS. 2020

5.2.1.3 Growing prevalence of animal diseases

5.2.1.4 Increasing veterinary practitioners in developed economies

TABLE 4 NUMBER OF VETERINARIANS AND PARAVETERINARIANS IN DEVELOPED COUNTRIES, 2012–2018

5.2.2 RESTRAINTS

5.2.2.1 High cost of instruments and procedures

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing untapped emerging markets

5.2.4 CHALLENGES

5.2.4.1 Low animal health awareness in developing countries

5.2.4.2 Shortage of trained professionals

TABLE 5 NUMBER OF VETERINARY PROFESSIONALS, BY COUNTRY, 2005 VS. 2014 VS. 2018

5.3 PORTER’S FIVE FORCES ANALYSIS

TABLE 6 PORTER’S FIVE FORCES ANALYSIS

5.3.1 THREAT OF NEW ENTRANTS

5.3.2 THREAT OF SUBSTITUTES

5.3.3 BARGAINING POWER OF SUPPLIERS

5.3.4 BARGAINING POWER OF BUYERS

5.3.5 INTENSITY OF COMPETITIVE RIVALRY

5.4 PRICING ANALYSIS

TABLE 7 PRICE RANGE FOR VETERINARY ULTRASOUND DEVICES

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MAXIMUM VALUE ADDED DURING MANUFACTURING PHASE

5.6 ECOSYSTEM ANALYSIS

FIGURE 25 VETERINARY ULTRASOUND MARKET: ECOSYSTEM ANALYSIS

5.7 TECHNOLOGY ANALYSIS

5.8 REGULATORY ANALYSIS

5.8.1 US

5.8.2 EUROPE

5.8.3 OTHER REGIONS

5.9 ADJACENT MARKET ANALYSIS

5.9.1 VETERINARY DIAGNOSTICS MARKET

FIGURE 26 VETERINARY DIAGNOSTICS MARKET OVERVIEW

5.9.2 VETERINARY IMAGING MARKET

FIGURE 27 VETERINARY IMAGING MARKET OVERVIEW

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 28 REVENUE SHIFT IN VETERINARY ULTRASOUND MARKET

5.11 CASE STUDY ANALYSIS

5.11.1 CASE STUDY 1: BUTTERFLY NETWORK AND AMERICAN VETERINARY GROUP

5.11.2 CASE STUDY 2: LIFE-SAVER ULTRASOUND

5.12 TRADE ANALYSIS: KEY MARKETS FOR IMPORT/EXPORT (INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, AND VETERINARY SCIENCES)

5.12.1 EXPORT SCENARIO OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, AND VETERINARY SCIENCES

FIGURE 29 EXPORTS OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, AND VETERINARY SCIENCES, BY COUNTRY, 2020 (USD BILLION)

5.12.2 IMPORT SCENARIO OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, AND VETERINARY SCIENCES

FIGURE 30 IMPORTS OF INSTRUMENTS AND APPLIANCES USED IN MEDICAL, SURGICAL, AND VETERINARY SCIENCES, BY COUNTRY, 2020 (USD BILLION)

5.13 PATENT ANALYSIS

5.13.1 PATENT PUBLICATION TRENDS FOR VETERINARY ULTRASOUND

FIGURE 31 PATENT PUBLICATION TRENDS (JANUARY 2011–JUNE 2022)

5.13.2 JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 32 TOP APPLICANTS AND OWNERS (COMPANIES/INSTITUTIONS) FOR VETERINARY ULTRASOUND PATENTS (JANUARY 2011 TO OCTOBER 2021)

FIGURE 33 TOP APPLICANT COUNTRIES/REGIONS FOR VETERINARY ULTRASOUND PATENTS (JANUARY 2011 TO JUNE 2022)

6 INDUSTRY INSIGHTS (Page No. - 78)

6.1 INTRODUCTION

6.2 INDUSTRY TRENDS

6.2.1 GROWING ADOPTION OF PORTABLE VETERINARY ULTRASOUND SYSTEMS FOR POINT-OF-CARE SERVICES

6.2.2 GROWING PREFERENCE FOR 3D/4D VETERINARY ULTRASOUND

6.2.3 GROWING CONSOLIDATION IN VETERINARY ULTRASOUND MARKET

TABLE 8 MAJOR STRATEGIES ADOPTED BY VETERINARY ULTRASOUND MARKET PLAYERS (2018–2021)

7 VETERINARY ULTRASOUND MARKET, BY TYPE (Page No. - 80)

7.1 INTRODUCTION

TABLE 9 VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

7.2 2D ULTRASOUND

7.2.1 2D ULTRASOUND SEGMENT DOMINATED MARKET IN 2020

TABLE 10 COMPANIES OFFERING 2D ULTRASOUND SCANNERS

TABLE 11 VETERINARY 2D ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 DOPPLER ULTRASOUND

7.3.1 COLOR DOPPLER TO BE USED IN VETERINARY SONOGRAPHY EVALUATIONS

TABLE 12 COMPANIES OFFERING DOPPLER ULTRASOUND SCANNERS

TABLE 13 VETERINARY DOPPLER ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 3D/4D ULTRASOUND

7.4.1 3D/4D ULTRASOUND TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 14 COMPANIES OFFERING 3D/4D ULTRASOUND SCANNERS

TABLE 15 VETERINARY 3D/4D ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 VETERINARY ULTRASOUND MARKET, BY PRODUCT (Page No. - 87)

8.1 INTRODUCTION

TABLE 16 VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

8.2 CART-BASED ULTRASOUND SCANNERS

8.2.1 POPULARITY OF CART-BASED SCANNERS TO DECLINE DUE TO INTRODUCTION OF PORTABLE SCANNERS

TABLE 17 EXAMPLES OF CART-BASED VETERINARY ULTRASOUND SCANNERS

TABLE 18 VETERINARY ULTRASOUND MARKET FOR CART-BASED ULTRASOUND SCANNERS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 PORTABLE ULTRASOUND SCANNERS

8.3.1 TECHNOLOGICAL ADVANCEMENTS AND INCREASED DEMAND FOR POINT-OF-CARE DIAGNOSTICS TO DRIVE MARKET

TABLE 19 EXAMPLES OF PORTABLE VETERINARY ULTRASOUND SCANNERS

TABLE 20 VETERINARY ULTRASOUND MARKET FOR PORTABLE ULTRASOUND SCANNERS, BY COUNTRY, 2020–2027 (USD MILLION)

9 VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY (Page No. - 92)

9.1 INTRODUCTION

TABLE 21 VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

9.2 DIGITAL IMAGING

9.2.1 DIGITAL IMAGING SEGMENT DOMINATED MARKET IN 2021

TABLE 22 VETERINARY ULTRASOUND MARKET FOR DIGITAL IMAGING, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 CONTRAST IMAGING

9.3.1 CLINICAL INDICATIONS, INCLUDING M-MODE IMAGING AND MYOCARDIAL PERFUSION, DRIVE SEGMENT

TABLE 23 VETERINARY ULTRASOUND MARKET FOR CONTRAST IMAGING, BY COUNTRY, 2020–2027 (USD MILLION)

10 VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE (Page No. - 96)

10.1 INTRODUCTION

TABLE 24 VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

10.2 SMALL COMPANION ANIMALS

10.2.1 RISING PET POPULATION AND PET CARE EXPENDITURE TO DRIVE SEGMENT

TABLE 25 POPULATION OF SMALL COMPANION ANIMALS, BY COUNTRY, 2012-2018 (MILLION)

TABLE 26 VETERINARY ULTRASOUND MARKET FOR SMALL COMPANION ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

10.3 LARGE ANIMALS

10.3.1 DEVELOPMENT OF PORTABLE ULTRASOUND SCANNERS TO DRIVE DIAGNOSTIC REPRODUCTIVE MANAGEMENT

TABLE 27 VETERINARY ULTRASOUND MARKET FOR LARGE ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

10.4 OTHER ANIMALS

TABLE 28 VETERINARY ULTRASOUND MARKET FOR OTHER ANIMALS, BY COUNTRY, 2020–2027 (USD MILLION)

11 VETERINARY ULTRASOUND MARKET, BY APPLICATION (Page No. - 102)

11.1 INTRODUCTION

TABLE 29 VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

11.2 OBSTETRICS/GYNECOLOGY

11.2.1 OBSTETRICS/GYNECOLOGY DOMINATED MARKET IN 2021

FIGURE 34 MILK PRODUCTION, BY REGION, 2016–2020 (THOUSAND TONNES)

FIGURE 35 MEAT PRODUCTION, BY TYPE, 2019–2020 (THOUSAND TONNES)

TABLE 30 VETERINARY ULTRASOUND MARKET FOR OBSTETRICS/GYNECOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

11.3 CARDIOLOGY

11.3.1 INCREASING CARDIOVASCULAR DISEASES IN DOGS AND CATS TO DRIVE SEGMENT

TABLE 31 VETERINARY ULTRASOUND MARKET FOR CARDIOLOGY, BY COUNTRY, 2020–2027 (USD MILLION)

11.4 ORTHOPEDICS

11.4.1 ULTRASOUND FOR ORTHOPEDIC IMAGING IN SMALLER ANIMALS TO DRIVE SEGMENT

TABLE 32 VETERINARY ULTRASOUND MARKET FOR ORTHOPEDICS, BY COUNTRY, 2020–2027 (USD MILLION)

11.5 OTHER APPLICATIONS

TABLE 33 VETERINARY ULTRASOUND MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

12 VETERINARY ULTRASOUND MARKET, BY END USER (Page No. - 111)

12.1 INTRODUCTION

TABLE 34 VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

12.2 VETERINARY CLINICS

12.2.1 VETERINARY CLINICS SEGMENT DOMINATED MARKET IN 2021

FIGURE 36 GROWING NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES IN US (2012–2020)

TABLE 35 GLOBAL NUMBER OF VETERINARY PRIVATE CLINICAL PRACTICES (2010 TO 2018)

TABLE 36 VETERINARY ULTRASOUND MARKET FOR VETERINARY CLINICS, BY COUNTRY, 2020–2027 (USD MILLION)

12.3 VETERINARY HOSPITALS AND ACADEMIC INSTITUTES

12.3.1 VETERINARY ULTRASOUND ON A LARGER SCALE THAN CLINICS TO DRIVE MARKET

TABLE 37 VETERINARY ULTRASOUND MARKET FOR VETERINARY HOSPITALS AND ACADEMIC INSTITUTES, BY COUNTRY, 2020–2027 (USD MILLION)

12.4 OTHER END USERS

TABLE 38 VETERINARY ULTRASOUND MARKET FOR OTHER END USERS, BY COUNTRY, 2020–2027 (USD MILLION)

13 VETERINARY ULTRASOUND MARKET, BY REGION (Page No. - 118)

13.1 INTRODUCTION

FIGURE 37 VETERINARY ULTRASOUND MARKET: GEOGRAPHIC SNAPSHOT

TABLE 39 VETERINARY ULTRASOUND MARKET, BY REGION, 2020–2027 (USD MILLION)

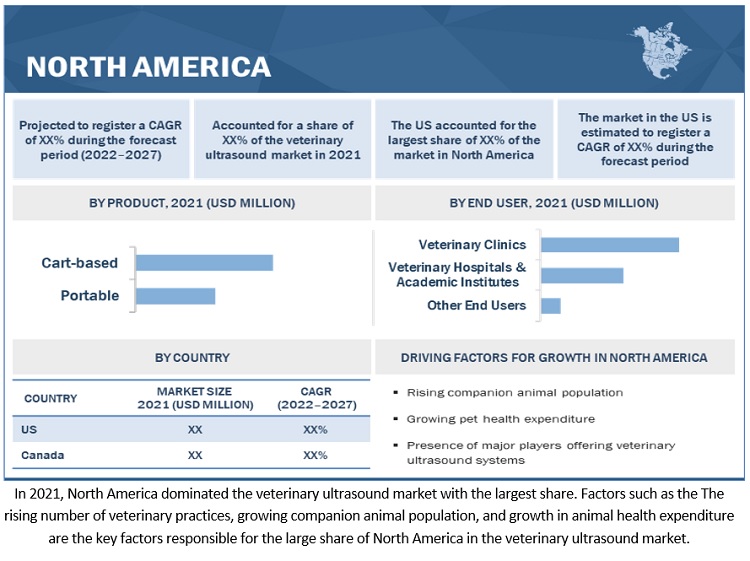

13.2 NORTH AMERICA

FIGURE 38 NORTH AMERICA: VETERINARY ULTRASOUND MARKET SNAPSHOT

TABLE 40 NORTH AMERICA: VETERINARY ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 41 NORTH AMERICA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 42 NORTH AMERICA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 44 NORTH AMERICA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 45 NORTH AMERICA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 46 NORTH AMERICA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.2.1 US

13.2.1.1 Growing companion animal population and pet expenditure to drive market

FIGURE 39 US: PET ADOPTION DURING PANDEMIC

FIGURE 40 US: INCREASE IN PET EXPENDITURE, 2011–2019 (USD BILLION)

TABLE 47 AVERAGE PREMIUMS PAID IN US, 2019 VS. 2020

TABLE 48 US: NUMBER OF VETERINARIANS IN PRIVATE CLINICAL PRACTICES, 2016 TO 2020

TABLE 49 US: FOOD-PRODUCING ANIMAL POPULATION, 2001 VS 2019 (MILLION)

TABLE 50 US: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 51 US: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 52 US: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 53 US: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 54 US: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 55 US: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.2.2 CANADA

13.2.2.1 Pet adoption to witness marginal increase over last few years

TABLE 56 CANADA: FOOD-PRODUCING ANIMAL POPULATION, 2001 VS 2019 (MILLION)

TABLE 57 CANADA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 58 CANADA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 59 CANADA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 60 CANADA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 61 CANADA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 62 CANADA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3 EUROPE

TABLE 63 EUROPE: VETERINARY ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 64 EUROPE: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 65 EUROPE: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 69 EUROPE: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.1 GERMANY

13.3.1.1 Germany to dominate European market during forecast period

TABLE 70 GERMANY: PET POPULATION, 2017 VS. 2020 (MILLION)

TABLE 71 GERMANY: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 72 GERMANY: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 73 GERMANY: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 74 GERMANY: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 75 GERMANY: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 76 GERMANY: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.2 UK

13.3.2.1 Involvement of corporates in veterinary practices to increase purchase of veterinary equipment

TABLE 77 UK: PET POPULATION, 2017 TO 2020 (MILLION)

TABLE 78 UK: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 UK: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 80 UK: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 81 UK: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 82 UK: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 83 UK: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.3 FRANCE

13.3.3.1 Growing companion and livestock population to support market

TABLE 84 FRANCE: PET POPULATION, 2017 TO 2020 (MILLION)

TABLE 85 FRANCE: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 86 FRANCE: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 87 FRANCE: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 88 FRANCE: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 89 FRANCE: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 90 FRANCE: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.4 ITALY

13.3.4.1 Increasing livestock population and awareness of animal health to drive demand

TABLE 91 ITALY: FOOD-PRODUCING ANIMAL POPULATION, 2001 VS 2019 (MILLION)

TABLE 92 ITALY: PET POPULATION, 2017 TO 2020 (MILLION)

TABLE 93 ITALY: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 94 ITALY: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 95 ITALY: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 96 ITALY: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 97 ITALY: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 ITALY: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.5 SPAIN

13.3.5.1 Increasing animal health expenditure to drive market

TABLE 99 SPAIN: FOOD-PRODUCING ANIMAL POPULATION, 2001 VS 2019 (MILLION)

TABLE 100 SPAIN: PET POPULATION, 2017 TO 2020 (MILLION)

TABLE 101 SPAIN: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 102 SPAIN: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 103 SPAIN: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 104 SPAIN: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 105 SPAIN: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 106 SPAIN: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.6 RUSSIA

13.3.6.1 Growing companion animal and livestock population to drive market

TABLE 107 RUSSIA: COMPANION ANIMAL POPULATION IN 2020

TABLE 108 RUSSIA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 109 RUSSIA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 110 RUSSIA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 111 RUSSIA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 112 RUSSIA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 113 RUSSIA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.7 SWEDEN

13.3.7.1 Increasing veterinary practitioners to drive market

TABLE 114 SWEDEN: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 115 SWEDEN: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 116 SWEDEN: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 117 SWEDEN: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 118 SWEDEN: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 119 SWEDEN: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.8 NORWAY

13.3.8.1 Increased veterinary practitioners in last few years to drive market

TABLE 120 NORWAY: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 121 NORWAY: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 122 NORWAY: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 123 NORWAY: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 124 NORWAY: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 125 NORWAY: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.3.9 REST OF EUROPE

TABLE 126 REST OF EUROPE: COMPANION ANIMAL OWNERSHIP, 2020 (MILLION)

TABLE 127 REST OF EUROPE: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 128 REST OF EUROPE: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 129 REST OF EUROPE: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 130 REST OF EUROPE: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 131 REST OF EUROPE: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 132 REST OF EUROPE: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 41 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET SNAPSHOT

TABLE 133 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 134 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 135 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 136 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 137 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 139 ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.1 CHINA

13.4.1.1 China to dominate Asia Pacific market during forecast period

TABLE 140 CHINA: FOOD-PRODUCING ANIMAL POPULATION, 2010 VS 2019 (MILLION)

TABLE 141 CHINA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 142 CHINA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 143 CHINA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 144 CHINA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 145 CHINA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 146 CHINA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.2 JAPAN

13.4.2.1 Rising pet health expenditure to drive market

TABLE 147 JAPAN: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 148 JAPAN: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 149 JAPAN: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 150 JAPAN: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 151 JAPAN: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 152 JAPAN: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.3 INDIA

13.4.3.1 Rising livestock animal population and awareness to propel market

TABLE 153 INDIA: FOOD-PRODUCING ANIMAL POPULATION, 2010 VS 2019 (MILLION)

TABLE 154 INDIA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 155 INDIA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 156 INDIA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 157 INDIA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 158 INDIA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 159 INDIA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.4.4 REST OF ASIA PACIFIC

TABLE 160 REST OF ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 REST OF ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 162 REST OF ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.5 LATIN AMERICA

TABLE 166 LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 167 LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 168 LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 169 LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 170 LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 171 LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 172 LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.5.1 BRAZIL

13.5.1.1 Brazil to dominate Latin American market during forecast period

TABLE 173 BRAZIL: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE (2010 VS. 2018)

TABLE 174 BRAZIL: FOOD-PRODUCING ANIMAL POPULATION, 2010 VS 2019 (MILLION)

TABLE 175 BRAZIL: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 176 BRAZIL: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 177 BRAZIL: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 178 BRAZIL: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 179 BRAZIL: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 180 BRAZIL: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.5.2 MEXICO

13.5.2.1 Rising demand for animal-derived food products to propel market

TABLE 181 MEXICO: NUMBER OF VETERINARIANS, BY TYPE OF PRACTICE (2010 VS. 2018)

TABLE 182 MEXICO: FOOD-PRODUCING ANIMAL POPULATION, 2010 VS 2019 (MILLION)

TABLE 183 MEXICO: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 184 MEXICO: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 185 MEXICO: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 186 MEXICO: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 187 MEXICO: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 188 MEXICO: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.5.3 REST OF LATIN AMERICA

TABLE 189 REST OF LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 190 REST OF LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 191 REST OF LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 192 REST OF LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 193 REST OF LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 194 REST OF LATIN AMERICA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

13.6 MIDDLE EAST & AFRICA

13.6.1 GROWING LIVESTOCK INDUSTRY TO DRIVE MARKET

TABLE 195 MIDDLE EAST & AFRICA: VETERINARY ULTRASOUND MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: VETERINARY ULTRASOUND MARKET, BY PRODUCT, 2020–2027 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: VETERINARY ULTRASOUND MARKET, BY TECHNOLOGY, 2020–2027 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: VETERINARY ULTRASOUND MARKET, BY ANIMAL TYPE, 2020–2027 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: VETERINARY ULTRASOUND MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: VETERINARY ULTRASOUND MARKET, BY END USER, 2020–2027 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 187)

14.1 OVERVIEW

FIGURE 42 KEY PLAYER STRATEGIES

14.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 43 REVENUE ANALYSIS OF TOP PLAYERS IN VETERINARY ULTRASOUND MARKET

14.3 MARKET SHARE ANALYSIS

FIGURE 44 VETERINARY ULTRASOUND MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

14.4 COMPETITIVE LEADERSHIP MAPPING

14.4.1 STARS

14.4.2 EMERGING LEADERS

14.4.3 PERVASIVE PLAYERS

14.4.4 PARTICIPANTS

FIGURE 45 VETERINARY ULTRASOUND MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

14.5 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS

14.5.1 PROGRESSIVE COMPANIES

14.5.2 DYNAMIC COMPANIES

14.5.3 STARTING BLOCKS

14.5.4 RESPONSIVE COMPANIES

FIGURE 46 VETERINARY ULTRASOUND MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS (2021)

14.6 COMPETITIVE SCENARIO

14.6.1 PRODUCT LAUNCHES AND APPROVALS

TABLE 201 PRODUCT LAUNCHES & APPROVALS, 2018–2022

14.6.2 DEALS

TABLE 202 DEALS (2018–2022)

14.7 COMPETITIVE BENCHMARKING

FIGURE 47 FOOTPRINT OF COMPANIES IN VETERINARY ULTRASOUND MARKET

TABLE 203 PRODUCT FOOTPRINT OF COMPANIES (25 COMPANIES)

TABLE 204 APPLICATION FOOTPRINT OF COMPANIES (25 COMPANIES)

TABLE 205 REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

15 COMPANY PROFILES (Page No. - 201)

(Business overview, Products/Services/Solutions offered, Recent Developments, MNM view)*

15.1 KEY PLAYERS

15.1.1 GE HEALTHCARE

TABLE 206 GE HEALTHCARE: COMPANY OVERVIEW

FIGURE 48 GE HEALTHCARE: COMPANY SNAPSHOT (2021)

15.1.2 ESAOTE SPA

TABLE 207 ESAOTE SPA: COMPANY OVERVIEW

15.1.3 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

TABLE 208 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.: COMPANY OVERVIEW

15.1.4 SIEMENS HEALTHINEERS

TABLE 209 SIEMENS HEALTHINEERS: COMPANY OVERVIEW

FIGURE 49 SIEMENS HEALTHINEERS: COMPANY SNAPSHOT (2021)

15.1.5 FUJIFILM HOLDINGS CORPORATION

TABLE 210 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

FIGURE 50 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

15.1.6 HESKA CORPORATION

TABLE 211 HESKA CORPORATION: COMPANY OVERVIEW

FIGURE 51 HESKA CORPORATION: COMPANY SNAPSHOT (2021)

15.1.7 SAMSUNG HEALTHCARE (SAMSUNG ELECTRONICS CO. LTD.)

TABLE 212 SAMSUNG HEALTHCARE (SAMSUNG ELECTRONICS CO. LTD.): COMPANY OVERVIEW

FIGURE 52 SAMSUNG HEALTHCARE (SAMSUNG ELECTRONICS CO. LTD.): COMPANY SNAPSHOT (2021)

15.1.8 DIAGNOSTIC IMAGING SYSTEMS INC.

TABLE 213 DIAGNOSTIC IMAGING SYSTEMS INC.: COMPANY OVERVIEW

15.1.9 IMV IMAGING

TABLE 214 IMV IMAGING: COMPANY OVERVIEW

15.1.10 SHENZHEN RICSO TECHNOLOGY CO., LTD.

TABLE 215 SHENZHEN RICSO TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

15.1.11 DRAMINSKI S.A.

TABLE 216 DRAMINSKI S.A.: COMPANY OVERVIEW

15.1.12 SHANTOU INSTITUTE OF ULTRASONIC INSTRUMENTS CO., LTD.

TABLE 217 SIUI: COMPANY OVERVIEW

15.1.13 CLARIUS MOBILE HEALTH

TABLE 218 CLARIUS MOBILE HEALTH: COMPANY OVERVIEW

15.1.14 SONOSCAPE MEDICAL CORP.

TABLE 219 SONOSCAPE MEDICAL CORP.: COMPANY OVERVIEW

15.1.15 E.I. MEDICAL IMAGING

TABLE 220 E.I. MEDICAL IMAGING: COMPANY OVERVIEW

15.2 OTHER PLAYERS

15.2.1 BMV TECHNOLOGY CO., LTD.

TABLE 221 BMV TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

15.2.2 EDAN INSTRUMENTS, INC.

TABLE 222 EDAN INSTRUMENTS, INC.: COMPANY OVERVIEW

15.2.3 XUZHOU KAIXIN ELECTRONIC INSTRUMENT CO., LTD.

TABLE 223 XUZHOU KAIXIN ELECTRONIC INSTRUMENT CO., LTD.: COMPANY OVERVIEW

15.2.4 SOUND

TABLE 224 SOUND: COMPANY OVERVIEW

15.2.5 REPROSCAN

TABLE 225 REPROSCAN: COMPANY OVERVIEW

15.2.6 INTERSON CORPORATION

TABLE 226 INTERSON CORPORATION: COMPANY OVERVIEW

15.2.7 SCINTICA INSTRUMENTATION, INC.

TABLE 227 SCINTICA INSTRUMENTATION, INC.: COMPANY OVERVIEW

15.2.8 LEPU MEDICAL TECHNOLOGY

TABLE 228 LEPU MEDICAL TECHNOLOGY.: COMPANY OVERVIEW

15.2.9 PROMED TECHNOLOGY CO., LTD.

TABLE 229 PROMED TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

*Details on Business overview, Products/Services/Solutions offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

16 APPENDIX (Page No. - 240)

16.1 INSIGHTS FROM INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATION OPTIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Veterinary Ultrasound Market