Anti-Drone Market Size, Share & Industry Growth Analysis Report by Technology (Electronic, Laser, and Kinetic Systems), Application (Detection, Detection & Disruption), Vertical (Military & Defense, Homeland Security, Commercial), Platform Type and Region - Global Forecast to 2028

Anti-drone Market

Anti-drone Market and Top Companies

- SRC, INC. (US) − SRC, Inc. (US) is a privately-held not-for-profit research and development company offering solutions for defense, environmental, and intelligence applications. The company serves the US military with advanced RF system simulation, development, and analysis. SRC is applying its extensive background in electronic warfare, air surveillance, target detection, and tracking and classifying algorithms to help detect, track, and defend against low, slow, and small UAS threats. A few of its notable programs are Silent Archer Counter UAS Technology, Counter RCIED Electronic Warfare (CREW) Duke system, and LCMR counterfire radars (AN/TPQ-49 and 50).

- Raytheon Technologies Corp. (US) – Raytheon Technologies Corp. (US) is an aerospace and Defense Company that provides advanced systems and services for commercial, military, and government customers worldwide. Raytheon conducts extensive R&D activities to continually enhance its existing products and services and develop new products and services to meet its customers’ changing needs and requirements. Raytheon uses technologies such as sensing capabilities, non-kinetic effects, microwave energy, laser, and radar to engage classes of threats from small drones up to tactical ballistic missiles. One of the most significant strategies adopted by Raytheon is to obtain big contracts to continuously expand its business and customer base. The company is best positioned as a US defense contractor.

- Lockheed Martin Corp. (US) − Lockheed Martin Corp. (Lockheed Martin) operates as a global security and aerospace company, which engages in the research, design, development, manufacture, integration, and sustainment of technology systems, products, and services. . Lockheed Martin engineers are collaborating with customers and academia to research, develop, and implement the technology that will detect and defeat drones.

- Leonardo S.p.A. (Italy) − Leonardo S.p.A. (Leonardo) offers defense and security systems, helicopters, electronics, aeronautics, and space systems. The company focuses on the development of new products and upgrading the existing products to maintain its competitive position in the market. Leonardo DRS, a subsidiary of Leonardo S.p.A. develops innovative, flexible, scalable, and configurable anti-drone systems based on its range of high-performance electro-optical sensors and advanced radiofrequency effector technology. The company has been developing M-LIDS anti-drone systems since 2017 to disable small UAVs that pose threats to US military forces.

Anti-drone Market Platform Types

- Ground-Based − Ground-based anti-drone systems are designed to be used from the ground. Different electronic systems such as radars, EO-IR systems, acoustic systems, RF and GNSS jammers, can be used as ground-based anti-drone systems. Similarly, laser systems and kinetic weapons such as guns and missiles are operated from the ground. Ground-based systems can be configured as fixed and mobile anti-drone systems. EO/IR gimbals for anti-drone systems combine multiple cameras into one payload and can be mounted on a fixed site or moving vehicle. Anti-drone jamming systems may be fixed site or vehicle-mounted.

- Handheld − Handheld anti-drone systems are designed to be operated by a single individual by hand. Many of these systems resemble rifles or other small arms. Handheld anti-drone systems mostly use nets and RF and GNSS jammers. They provide a safe countermeasure against a wide range of drone models. Handheld anti-drone systems are capable of disrupting the control and navigation of multiple drones simultaneously.

- UAV-Based − UAV-based anti-drone systems are designed to be mounted on drones. They are designed to be portable, deadly, and cost-effective. They can counter a single or a swarm of target drones entirely autonomously using proprietary onboard AI and advanced machine vision processing. They can be operated beyond visual line-of-sight.

Anti-drone Market Technology Trends:

- High-energy Laser and high-power microwave systems

Military agencies across the world are investing in high-energy lasers and microwave technology for countering drones. For example, in June 2020, the US Army Rapid Capabilities and Critical Technologies Office (RCCTO) awarded Kratos Defense & Rocket Support Services (part of Kratos Defense & Security Solutions) a three-year other transaction for prototype agreement (pOTA) to establish a directed energy (DE) testbed to accelerate military development capability in the focus areas of high-energy laser (HEL) and/or high-power microwave (HPM) systems.

- Artificial intelligence in anti-drone systems

The growing interest in C-UAS solutions is one indication of the increasing use of UAS-based approaches to warfare. Artificial intelligence (AI) is a rapidly growing field of technology with potentially significant implications for national security. As such, the US DoD and other nations are developing AI applications for a range of military functions. In May 2020, DroneShield launched a new software product designed to support camera-based drone detection, identification, and tracking. The DroneOptID software has an AI/Machine Learning (ML) engine and uses computer vision technology to detect, verify, and track drones in real time.

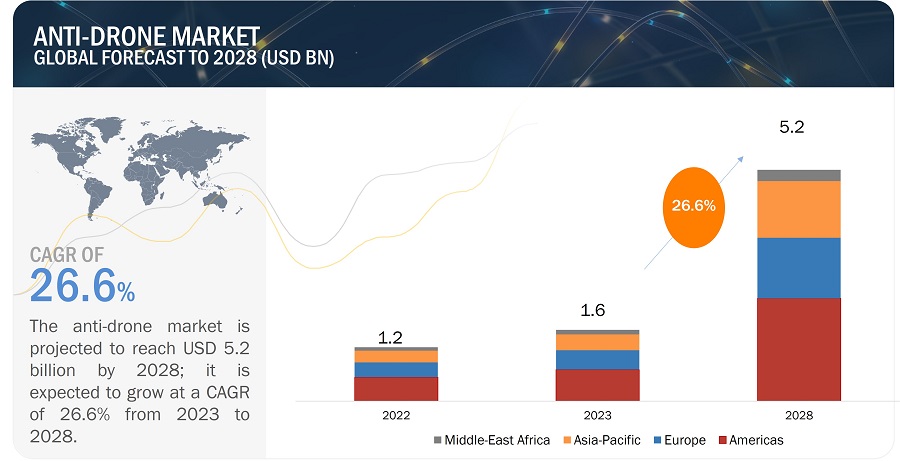

[284 Pages Report] The global anti-drone market size was valued at USD 1.2 billion in 2022 and is projected to reach USD 5.2 billion by 2028; it is expected to register a CAGR of 26.6% during the forecast period. The rising incidence of critical infrastructure security breaches by unauthorized drones and the surging adoption of aerial remote sensing technologies to safeguard critical infrastructure are among the factors driving the growth of the anti-drone industry.

Anti-Drone Market Statistics Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Global Anti-Drone Market Dynamics:

Driver: Increasing government spending on counter-drone technologies

Drones are becoming increasingly sophisticated and capable, and they are being used by a variety of actors, including terrorists, criminals, and rogue states. This has led to growing concerns among governments about the potential for drone attacks on critical infrastructure, military assets, and civilian populations. In response to these concerns, governments around the world are increasing their spending on anti-drone technologies. This spending is being used to develop and deploy new anti-drone systems, as well as to train military and law enforcement personnel on how to use these systems. For instance, in August 2023, the United States Department of Defense, in fiscal year 2023, planned to spend USD 668 million on counter-UAS research and development and an additional USD 78 million to procure the hardware.

Restraint: Requirement for high initial research and development investments

Drone is a nascent industry constantly evolving in terms of technology. Researching and finding new solutions to counter rogue drones requires significant investments and can sometimes lead to results that may not be technologically relevant by the time they are launched in the market. In its statement in 2018, the FAA stated that drone detection systems require redundant equipment to cover an airport, making the costs prohibitive. This is because drone technology is changing so rapidly, and any countermeasure rapidly becomes obsolete.

Key technologies deployed to manufacture counter-UAV systems are undergoing rigorous R&D activities. Several market players working on introducing these technologies are planning to patent them. Also, the cost incurred in R&D is relatively high due to the use of lasers and other advanced technologies. Hence, small- and medium-sized players cannot afford to develop and deploy anti-drone systems due to high initial investment requirements. Therefore, there is currently a limited demand for and supply of anti-UAV systems.

Opportunity: Development of versatile and long-range counter-drone systems

Anti-drone systems available can identify micro-UAVs within a range of 1.5–2 km and mini-UAVs within a range of 8–10 km. For example, Britain-based Blighters Surveillance Systems, Chess Dynamics, and Enterprise Control Systems launched an anti-UAV defense system that can detect, identify, and disrupt micro-UAVs up to 2 kilometers away and mini-UAVs up to 8 kilometers away. The use of small drones has increased over the years as drone technology advances, encouraging several companies to manufacture compact anti-drone systems. For instance, Boeing (US) has developed its compact laser weapon system (CLWS), which is lightweight enough to be mounted on helicopters or hummers, capable of destroying small UAVs up to 2,000 meters away, and can disable or destroy sensors (videocams) on a UAV up to 7,000 meters away. In February 2018, DroneShield Ltd also launched RadarZero, a revolutionary compact drone detection radar product that can detect drones up to 750 meters away.

Russia has developed its anti-drone laser tool and has used it in the Russia–Ukraine war in 2022. The tool has a range of 5 km and optical sensors for improved efficiency. After an initial deployment at a single site, military leaders recognized the value of the data and insight on airspace activity and unwanted drones that the Dedrone solution provides. Since then, its deployment has increased to cover more bases and add localization technology, which helps security personnel understand specific threats from drones detected in their airspace.

Challenge: Development of efficient and low-cost counter drones for commercial applications

The cost of developing anti-drone systems is relatively high. Components used in these systems, such as lasers, radars, advanced electronics, and radio beams, are expensive. This makes it difficult for manufacturers to reduce the cost of the system. Thus, due to the high cost, these systems cannot be used for commercial applications such as public places, affecting their demand. Market players, such as Detect, Inc. (US), Meritis (Switzerland), and MyDefence Communication (Denmark), have introduced anti-drone systems based on sensors. However, these systems can only detect UAVs and are incapable of destroying them. Thus, it is challenging for market players to introduce highly efficient and affordable anti-drone systems.

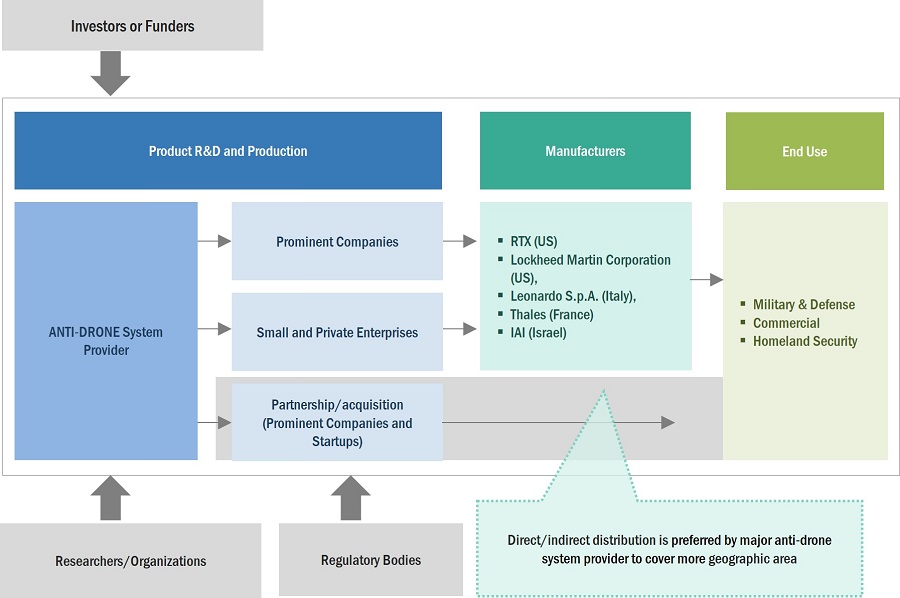

Anti-Drone Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of anti-drone systems. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include RTX (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Thales (France), IAI (Israel), Rafael Advanced Defense Systems Ltd. (Israel), Blighter Surveillance Systems Limited (UK), DroneShield Ltd (Australia), Dedrone (US)

By technology, the kinetic system segment is expected to grow with the highest CAGR from 2023 to 2028

The anti-drone market for the kinetic system segment is expected to grow at the highest CAGR from 2023 to 2028. Kinetic systems offer versatility and reliability, making them capable of countering drones across various threat levels and adapting to evolving drone technology. Their immediate threat mitigation capabilities are essential, particularly in scenarios where rapid response is crucial, such as safeguarding critical infrastructure or securing high-profile events. Kinetic systems have also demonstrated a high success rate in physically disabling drones, effectively preventing potential harm or damage.

By vertical, homeland security is expected to grow with the highest CAGR in 2028.

Homeland security is expected to exhibit the highest CAGR in the anti-drone market during the forecast period. The growth can be attributed as the escalating threat posed by drones, the need for advanced technology to counter these threats, the emergence of swarm drone capabilities, and a heightened awareness of the potential risks.

By platform type, the UAV-based segment is expected to grow with the highest CAGR during the forecast period.

The anti-drone market for the UAV-based segment is expected to grow at the highest CAGR from 2023 to 2028. The growth of UAV-based anti-drone systems is driven by the need for robust countermeasures against unauthorized or potentially malicious drones. Also, the ability to deploy countermeasures from UAVs themselves allows for more flexible and efficient responses to drone threats, enhancing security measures.

Anti-Drone Market Share

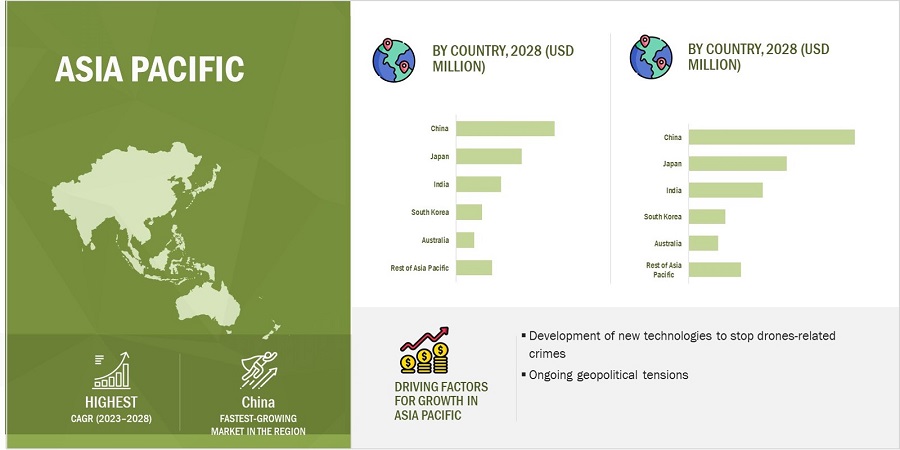

In 2028, Asia Pacific is projected to hold the highest CAGR of the overall anti-drone market

In 2028, Asia Pacific is projected to account for the largest share of the anti-drone market. The factors contributing to the regional market’s growth include the development of a broad range of counter-drone technologies to prevent drone-related crimes and several ongoing research and development activities by the market players in the region.

Anti-Drone Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Top Anti-Drone Companies - Key Market Players

RTX (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Thales (France), IAI (Israel), Rafael Advanced Defense Systems Ltd. (Israel), Blighter Surveillance Systems Limited (UK), DroneShield Ltd (Australia), Dedrone (US) are some of the key players in the anti-drone companies.

Anti-Drone Market Report Scope

|

Report Metric |

Details |

| Estimated Value | USD 1.2 billion in 2022 |

| Projected Value | USD 5.2 billion by 2028 |

| Anti-Drone Market Growth Rate | CAGR of 26.6% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD) |

|

Segments Covered |

By technology, application, platform type, vertical, and region |

|

Geographies Covered |

Americas, Europe, Asia Pacific, and RoW |

|

Companies Covered |

RTX (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Thales (France), IAI (Israel), Rafael Advanced Defense Systems Ltd. (Israel), Blighter Surveillance Systems Limited (UK), DroneShield Ltd (Australia), Dedrone (US) are some of the key players in the anti-drone market. |

Anti-Drone Market Highlights

This research report categorizes the anti-drone market based on technology, application, platform type, vertical, and region.

|

Segment |

Subsegment |

|

By Technology |

|

|

By Application |

|

|

By Platform Type |

|

|

By Vertical |

|

|

By Region |

|

Recent Developments in Anti-Drone Industry

- In August 2023, DroneShield Ltd introduced its Satellite Denial Systems designed for specific target areas. Various Global Navigation Satellite Systems (GNSS) are in use worldwide, including the well-known US GPS, along with the Russian GLONASS, the Chinese BeiDou, and the European Galileo system. DroneShield’s GNSS disruption solutions for drones and UAVs incorporate intelligent defeat capabilities. The company has developed several distinctive techniques and has gained recognition as a specialist in this field. Crucially, DroneShield’s systems are engineered to concentrate disruption efforts on precisely defined target areas.

- In July 2023, An agreement was signed between the Swedish Defence Materiel Administration (FMV) and Thales for delivering and installing SMART-L Multi-Mission Fixed (MM/F) long-range radars. These radars, featuring the latest Active Electronically Scanned Array (AESA) technology, are designed to offer versatile capabilities for both air and surface surveillance and target designation. By significantly enhancing Swedish Air Surveillance and bolstering abilities in detecting ballistic missiles and monitoring space activities, the SMART-L MM/F radar marks a significant advancement. Boasting advanced techniques, this next-generation radar is unparalleled in terms of its extended range performance, reaching up to 2000 km, and serves as a pivotal tool for long-range multi-mission radar applications in the domains of air, space surveillance, and Ballistic Missile detection.

- In June 2023, Leonardo S.p.A. launched two novel turrets, LIONFISH 30 and HITFIST 30 UL, catering to naval and land defense domains. These cutting-edge remote-controlled turrets incorporate the ITAR-free 30mm X-GUN, an in-house developed electric weapon system infused with patented technologies. LIONFISH 30 offers versatile configurations, including 12.7mm Ultralight, Inner Reloading, Top models, and a 20mm version, delivering protection against drones, helicopters, and multiple threats with AI-driven contextual analysis. For land applications, HITFIST 30 UL is a remote-controlled option suitable for weight-restricted vehicles, effectively countering asymmetrical threats using airburst ammunition.

- In June 2022, IAI launched the latest tactical multi-mission, multi-sensor system: the GREEN LOTUS (ELI-2139). Designed to provide high-performance Counter-Rocket, Artillery & Mortar (C-RAM), and Air & Ground Surveillance capabilities for maneuvering and stationary forces, GREEN LOTUS features a unique range of active and passive sensors that maximize situational awareness and efficiency of countermeasures. The GREEN LOTUS integrates a range of IAI-ELTA’s sensors into a highly automated system that detects, tracks, classifies, and identifies aerial targets from low Radar Cross Section (RCS) mortar, rocket and artillery fire, and small drones to manned and unmanned and fixed and rotary wing aircraft. It also performs ground surveillance and detects and tracks vehicles and slow-moving personnel.

- In May 2022, Raytheon Intelligence & Space, a Raytheon Technologies business, and Kord, a wholly owned subsidiary of KBR, completed a US Army operational assessment at White Sands Missile Range to defeat multiple 60 mm mortar rounds using a 50 kW-class high-energy laser integrated into a Stryker combat vehicle. Multiple tests were conducted to simulate real-world scenarios. The directed energy weapon system is part of the US Army’s Directed Energy Maneuver-Short Range Air Defense or DE M-SHORAD. It is designed to acquire, track, target, and defeat multiple mortars.

- In April 2023, The company launched the In-Sight 3800 vision system. Designed for high-speed production lines, In-Sight 3800 offers an extensive vision toolset, powerful imaging capabilities, and flexible software to deliver a fully integrated solution for a wide range of inspection applications.

Frequently Asked Questions (FAQs):

Which are the major companies in the anti-drone market? What are their major strategies to strengthen their market presence?

The major companies in the anti-drone market are – RTX (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Thales (France), IAI (Israel), Rafael Advanced Defense Systems Ltd. (Israel), Blighter Surveillance Systems Limited (UK), DroneShield Ltd (Australia), Dedrone (US). The major strategies adopted by these players are product launches and developments.

What is the anti-drone system?

The anti-drone technology system provides both soft kill and hard kill options to the desired authorities to tackle fast-emerging aerial threats. It basically detects, tracks, identifies, and mitigates the unsafe or rogue drones.

What are the technological trends going in the anti-drone market?

The rising usage of high-energy lasers and high-power microwave systems, increased use of artificial intelligence in the anti-drone systems, and blockchain technology has major penetration in the anti-drone market in terms of technologies.

Who are the winners in the global anti-drone market?

Companies such as RTX (US), Lockheed Martin Corporation (US), Leonardo S.p.A. (Italy), Thales (France), IAI (Israel), fall under the winner’s category. These companies cater to the requirements of their customers by providing anti-drone systems. Moreover, these companies are highly adopting organic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the anti-drone market?

Increasing government spending on counter-drone technologies is the driver, and Increasing government spending on counter-drone technologies is the opportunity in the anti-drone market .

What are the restraints and challenges for the anti-drone market?

Requirement for high initial research & and development investments and Development of efficient and low-cost counter drones for commercial applications restraints and challenges in the anti-drone market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the anti-drone market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering anti-drone systems have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the anti-drone market. Secondary sources considered for this research study include government sources, corporate filings, and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of anti-drone systems to identify key players based on their products and prevailing industry trends in the anti-drone market by technology, application, platform type, vertical, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

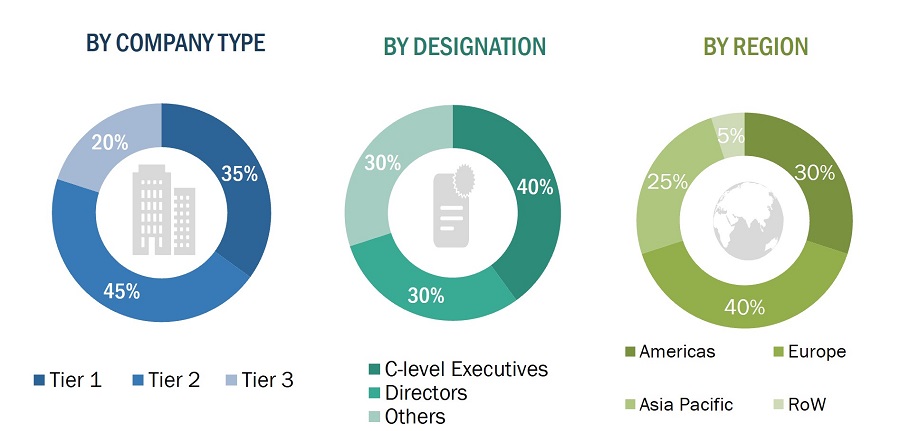

Primary Research

Extensive primary research has been conducted after understanding and analyzing the current scenario of the anti-drone market through secondary research. Several primary interviews have been conducted with the key opinion leaders from the demand and supply sides across four main regions—Americas, Europe, Asia Pacific, and the Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% were conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephone interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the anti-drone market.

- Identifying end users that are either using or are expected to use anti-drone.

- Analyzing major providers of anti-drone and original equipment manufacturers (OEMs) as well as studying their portfolios and understanding different technologies used.

- Analyzing historical and current data pertaining to the market, in terms of volume, for each product segment of the anti-drone market.

- Analyzing the average selling price of anti-drone based on different technologies used in different products.

- Arriving at the market estimates by analyzing the revenue of companies and then combining these figures to arrive at the market size.

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases, to gather the required information.

- Tracking the ongoing developments and identifying the upcoming ones in the market that include investments, research and development activities, product launches, collaborations, and partnerships undertaken, as well as forecasting the market based on these developments and other critical parameters.

- Carrying out multiple discussions with the key opinion leaders to understand the anti-drone and related raw materials, as well as products designed and developed to analyze the break-up of the scope of work carried out by the key companies’ manufacturing panels.

- Verifying and cross-checking the estimate at every level through discussions with key opinion leaders such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts in MarketsandMarkets.

The top-down approach has been used to estimate and validate the total size of the anti-drone market.

- Focusing on top-line investments and expenditures being made in the ecosystems of various Focusing on top-line investments and expenditures being made in the ecosystems of various end users.

- Calculating the market size considering revenues generated by major players through the cost of the anti-drone systems.

- Segmenting each application of anti-drone in each region and deriving the global market size based on region.

- Acquiring and analyzing information related to revenues generated by players through their key product offerings.

- Conducting multiple on-field discussions with key opinion leaders involved in the development of various anti-drone offerings.

- Estimating the geographic split using secondary sources based on various factors, such as the number of players in a specific country and region and the types of anti-drone systems used in platform type, technology, application, and vertical

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the anti-drone market.

Market Definition

Anti-drone systems are technologies that are used to detect, identify, track, and/or neutralize drones. Anti-drones, counter-unmanned aerial vehicles (UAVs), or counter-unmanned aircraft systems (UASs) are used to identify, track, neutralize, and/or destroy/disable unauthorized drones. Radars, EO/IR trackers, jammers, lasers, and net guns are a few countermeasure systems used to block areas from view and lock down certain zones, protecting against drone threats. Anti-drone systems are used by a variety of organizations, including the military, law enforcement, and private security companies, to protect against drone-based threats.

Key Stakeholders

- To describe and forecast the size of the anti-drone market, in terms of value, based on technology, application, Raw material suppliers

- Original equipment manufacturers (OEMs)

- OEM technology providers

- Technology, service, and solution providers

- Intellectual property (IP) core and licensing providers

- Suppliers and distributors

- Government and other regulatory bodies

- Forums, alliances, and associations

- Technology investors

- Research institutes and organizations

- Analysts and strategic business planners

- Market research and consulting firms

Report Objectives

- To describe and forecast the size of the anti-drone market in terms of value based on technology, application, platform type, and vertical

- To forecast the anti-drone market in terms of volume based on vertical

- To describe and forecast the market size of various segments across four key regions—Americas, Europe, Asia Pacific, and Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the anti-drone market

- To provide an overview of the value chain pertaining to the anti-drone ecosystem, along with the average selling price of anti-drone devices

- To strategically analyze the ecosystem, regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets1 with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze strategies, such as product launches, agreements, collaboration, contracts, joint ventures, mergers, acquisitions, and partnerships were adopted by players in the anti-drone market

- To profile key players in the anti-drone market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Anti-Drone Market

I visited IFSEC, London. There were few talks about the booming market for counter-drone system and hence would like to have a deep dive on this report for understanding preposition with drones market.

Final goal is the overview of anti-drone market in order to workout the strategy for planning protection of an oilfield .

The Federal Aviation Administration (FAA) of US prohibits the operation of drones near other aircraft, especially near airports, over groups of people, public events, or stadiums. Who are major regulating authorities impacting the drone regulations worldwide?

Hello, I am writing a report for a class at my University on innovation in the counter-UAV space. I cannot afford the $5.6K license, but I would really love to read your report. I will not share or send it to anybody else.

We observe that you have included analysis of counter UAS for commercial places too. Would like to know the companies specifically targeting these infrastructures.

We look forward to low-cost and effective counter-drone technology. Who are the players offering both detection and intrusion systems in the market? We are looking forward to acquiring or partnering with such players especially in Eastern Europe.

We are one of the main global consulting and technology companies in the world especially for detection systems. We would like to contribute to your analysis in order to increase the knowledge basis.

Would be interested in knowing the role of radars as counter drone defense systems. How is the adoption rate of radars in the next 5 years? Which application would be using radar counter drone systems?

I am looking for insights on the drone industry, information specifically on the use of drones in the military applications and counter drone market for the same. I need this information for presenting it to investors.

The report mentions companies such as Lockheed, SAAB, Blighter, etc. as providers of anti-drone systems. But these manufacturers have solutions suitable for governments and their national defense budgets, what about solutions for privately held companies and residential?

Dear Sir/Madam, I would like to kindly request the PDF brochure and a sample of the Anti-Drone Market Global Forecast to 2024 to evaluate the possibility of purchasing the complete study with the purpose of complementing the business outlook for our company.

It's hard to have any faith in your report given that you did not even mention the single largest supplier of anti-drone technology to the US Army, SRC, Inc. Gryphon Sensors is a subsidiary of SRC and builds sophisticated sensor systems of the commercial and near commercial drone security markets. Gryphon was also one of the 4 companies to demonstrate drone detection technology for the FAA Drone Detection CRDA.

Drone legislation is still scarce and differs from country to country. Does the report cover detailed analysis of regulations in major countries mentioned in the report?

I am looking to get some overall market statistics, market overview, and market forecasts (in $ and quantity).

We are a start-up company designing and manufacturing anti-drone radar. We are working on our business plan and hence would like to understand the dynamics from you.

I am doing research on Drone detection market. I am interested specifically in US market. Primary thing I am looking for is Porter's five force analysis.

Hi, I'm a student of a well-known University and my project is related to drones. Is it possible to get this report for education propose to cite it in my research publication?

Artificial intelligence and other related concepts are able to provide an early solution to future drone threats such as swarms, autonomous drones, and new types of drones with unique RF signatures. What are the latest trends in anti-drone technologies?

I am writing a research paper on the rise of Drone Technology and I need to cover up entire segments of the market. From ATC to Anti-Drone. I'm only a student and it would be great if you could assist me on this. Thanks.

I'm looking for a general understanding of the players involved in the anti-drone space, what technology they're developing and the commercial viability of said tech

I am more interested in share of various technologies in anti drone systems market, and which one should be preferred more for developing new system.