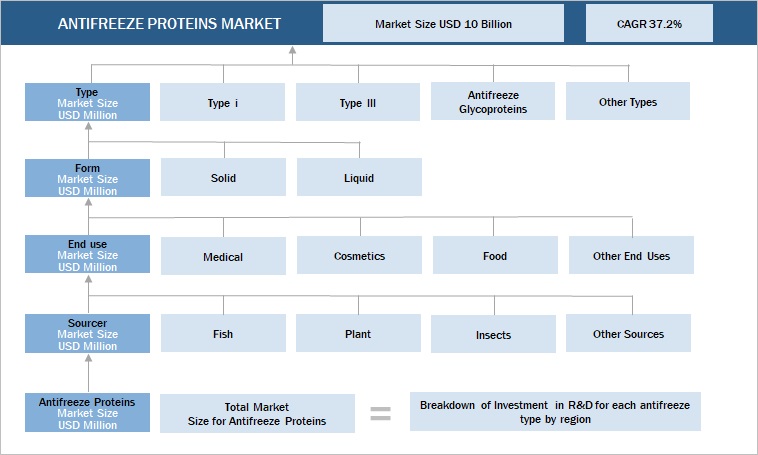

Antifreeze Proteins Market by Type (Type I, Type III, Antifreeze Glycoproteins), End-use (Medical, Cosmetics, Food), Source (Fish, Plants, Insects), Form, and Region(North America, Europe, Asia Pacific, South America, RoW) - Global Forecast to 2028

Antifreeze Protein Market Size, Share & Analysis Report, 2028

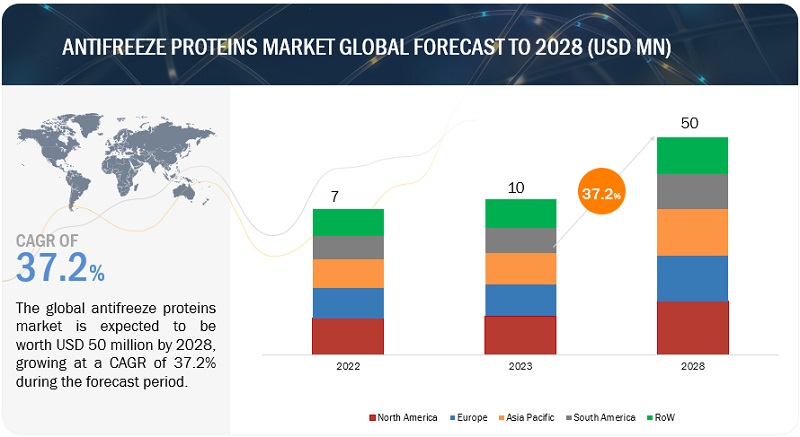

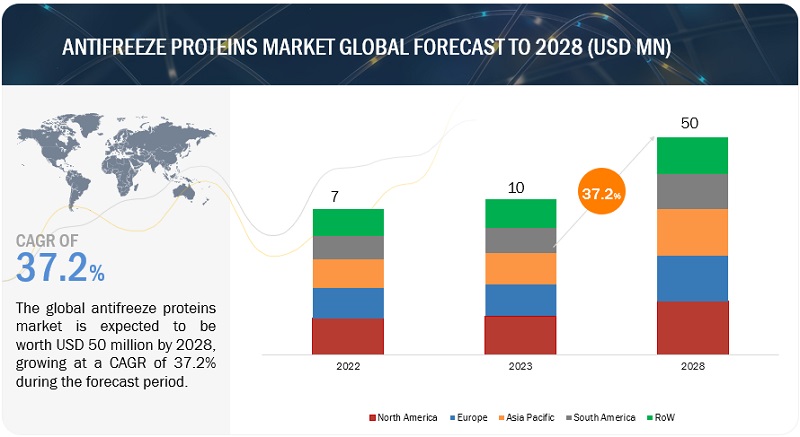

[199 Pages Report] The global antifreeze proteins market is estimated to be valued at USD 10 million in 2023 and it is projected to reach USD 50 million in 2028, growing at a CAGR of 37.2%. The factors driving the growth are the increasing demand for skin products, frozen foods, medicinal products, and the shift in focus of health-conscious consumers, and rising awareness of food nutrition supports the adoption of antifreeze proteins. The antifreeze protein market is driven by their rising usage in frozen food products globally. They also facilitate the cold storage of fresh food for trade which ensures the maintenance of food quality till the food reaches the end users thus their usage is growing.

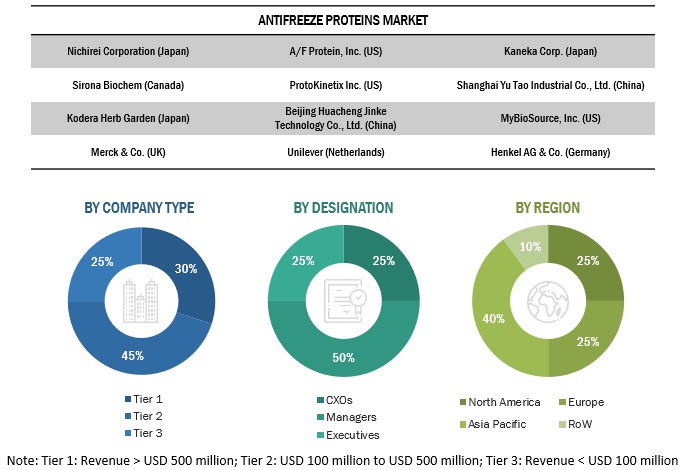

The expanding business has offered lucrative business opportunities to the players who are operating in the market segments. For instance, Unilever expanded its R&D capability by opening with a Foods Innovation Centre on the Wageningen University campus, with an investment of USD 96.92 million in the new center. It will lead its global foods innovation program for its brands. The overall antifreeze proteins market is classified as a consolidates market, with the top 5 key players namely Nichirei Corporation (Japan), A/F Protein Inc. (US), Kaneka Corporation (Japan), Unilever (Netherlands), Sirona Biochem (Canada), occupying >50% of the market share.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Antifreeze Proteins Market Dynamics

Driver: Rising awareness of benefits associated with antifreeze proteins

Antifreeze proteins are also known as ice structuring proteins which are produced by different fish, plants, insects, bacteria, and fungi to survive in sub-zero conditions. These work by binding to ice crystals in order to inhibit their growth. AFPs can block forming of ice crystals in fish and insects by lowering the freezing temperature in the body. Due to this mechanism, antifreeze proteins find a wide range of applications in the medical, cosmetics, and food industries.

Restraint: High cost of production and R&D expenditure

Any company involved in the extraction and manufacturing of antifreeze proteins incurs the high cost of research and development. The extraction of these antifreeze proteins from different sources requires complex instruments and research methods, which increases the overall production cost and price of the antifreeze proteins. Additionally, it also requires complex instruments and hence there are a lot of collaboration seen by key players with research institutes.

Opportunity: Emerging markets in developing regions presenting growth opportunities in the antifreeze protein market

The new generations always opt for convenience, due to its ease of availability. Technology innovation has provided engaging experiences for consumers. There has been a gradual shift in consumer choice towards conventional and sustainable products. Additionally, there has been a spike in demand for cosmetics and vaccines in developing countries like Brazil, India, etc., To fulfill the growing demand for these products which require antifreeze proteins, the market is set to expand in emerging economies.

Challenge: Adverse effects of vegan trends on antifreeze proteins from animal sources

Fish is the most prominent and accepted source of antifreeze proteins, however, due to the growing vegan population around the globe consumers are opting for animal-free ingredients. There are other sources from where antifreeze proteins can be obtained like bacteria, fungi, plants, insects, etc. However, extraction from these sources are very new or at a nascent stage due to which the acceptability of fish antifreeze proteins among vegan population is less and can be a challenging factor in the market growth.

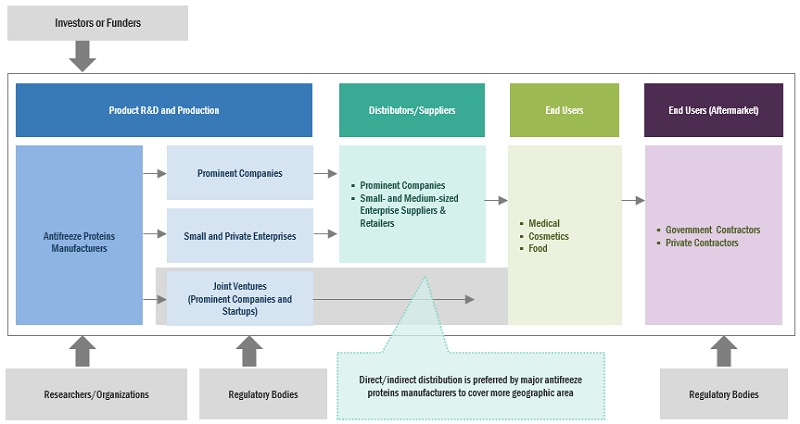

Antifreeze Proteins Market Ecosystem

Based on Type, Type III is anticipated to grow at a significant CAGR in the market

Type III marine collagen is mainly extracted from fish and is the second most important and viable source of antifreeze proteins. It works effectively in combination with type I and the medical and cosmetic industries create the highest demand for type III antifreeze proteins, owing to its diversified usage across multiple applications.

The liquid form segment is projected to occupy the second-largest market share in antifreeze protein market during the forecast period.

Liquid form occupies the second-largest market share in the antifreeze proteins market, due to its increasing application in cryopreservation. Though the liquid form has very less application as compared to the solid form, it finds its wider application in the cosmetics and cryopreservation in the pharmaceutical sectors.

Based on end use, the medical segment is projected to occupy the largest market share during the forecast period.

The medical segment largely demands antifreeze proteins due to its anti-infectant properties against viruses, bacteria, fungi. Food safety authorities have approved the use of antifreeze proteins in pharmaceutical products due to its multiple health benefits. It is relatively easily absorbed into the human body as a result, it provides better healing and repair opportunities.

Based on source, the insects segment is projected to grow at the highest CAGR during the study period

Insect antifreeze proteins is a high-quality protein extracted from various types of insects such as crickets, black soldier flies, mealworms, ants, and grasshoppers. Insects such as grasshoppers and beetles are also used as medicines to treat zoonotic diseases as well as human diseases. Although the acceptance of the use of grasshoppers in the pharmaceutical application is at a preliminary stage.

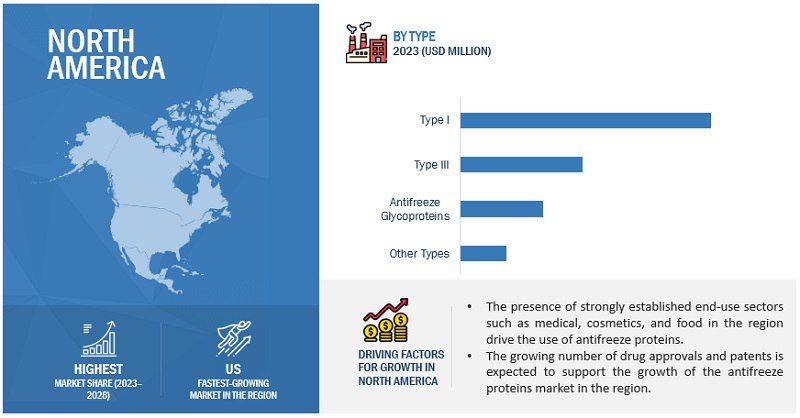

North America: Antifreeze Proteins Market Snapshot

North America holds the highest market share during the forecast period.

North America accounted for the largest antifreeze proteins market share in 2022. The antifreeze protein market in the North American region is largely driven by growing consumer awareness toward environmental sustainability. The region offers an excellent growth opportunity for the manufacturers of antifreeze proteins. Most of the players operating in the antifreeze proteins market are operating in the region and have a strong global presence. Moreover, North America is among the biggest consumer of packed and frozen foods. The region also offers increasing demand for different cosmetics and medicinal products, which are major end-user applications of antifreeze proteins. The region is mainly dominated by a large number of consumers and strong investment in R&D and technological advancements are expected to have a positive impact on the domestic production of antifreeze proteins in North America. These factors drive the market for antifreeze proteins in the North American region.

Key Market Players

Key players in this market include Nichirei Corporation (Japan), A/F Protein Inc. (US), Kaneka Corporation (Japan), Unilever (Netherlands), Sirona Biochem (Canada), ProtoKinetix, Inc. (US), Shanghai Yu Tao Industrial Co., Ltd. (China), Kodera Herb Garden Co., Ltd (Japan), Beijing Huacheng Jinke Technology Co., Ltd. (China), Rishon Biochem Co., Ltd (China), and MyBioSource, Inc. (US).

Antifreeze Protein Market Scope

|

Report Metric |

Details |

|

Market size estimation |

2023–2028 |

|

Base year considered |

2022 |

|

Forecast period considered |

2023–2028 |

|

Units considered |

Value (USD), Volume (Grams) |

|

Segments Covered |

Type, Form, End use, Source, and Region |

|

Regions covered |

North America, Europe, South America, Asia Pacific, and RoW |

|

Companies studied |

|

Target Audience:

- Supply-side: antifreeze proteins producers, suppliers, distributors, importers, and exporters

- Demand-side: Large-scale cosmetics manufacturers, medicinal product manufacturers, food ingredient manufacturers, and research organizations

- Regulatory side: Related government authorities, commercial Research & Development (R&D) institutions, and other regulatory bodies

- Other related associations, research organizations, and industry bodies:

Antifreeze Protein Market Segmentation:

This research report categorizes the antifreeze proteins market, type, form, end use, source, and region.

By Type

- Type I

- Type III

- Antifreeze Glycoproteins

- Other Types

By Form

- Solid

- Liquid

By End use

- Medical

- Cosmetics

- Food

- Other end uses

By Source

- Fish

- Plants

- Insects

- Other sources

By Region

- North America

- Europe

- Asia Pacific

- South America

- RoW

Recent Developments in Antifreeze Protein Market

- In August 2022, Beijing Huacheng Jinke Technology launched 2 different type I antifreeze membranes which are specific glycopeptides, and peptides made by different organisms to allow cells to survive in sub-zero conditions.

- In December 2021, Kaneka Corporation launched a series of type I antifreeze proteins for different food applications like noodles and rice. With the launch of these products, the company expanded its footprint in the food industry to cater to its different applications.

- In May 2021, Unilever announced that it would partner with ENOUGH, a food tech company, to bring new plant-based frozen food products. ENOUGH’s technology uses a unique zero-waste fermentation process to grow a high-quality frozen food product. This unique product will be apt for Unilever’s fast-growing food segments.

Frequently Asked Questions (FAQ):

Which are the major companies in the antifreeze proteins market? What are their major strategies to strengthen their presence?

Some of the key companies operating in the Nichirei Corporation (Japan), A/F Protein Inc. (US), Kaneka Corporation (Japan), Unilever (Netherlands), Sirona Biochem (Canada), ProtoKinetix, Inc. (US), Shanghai Yu Tao Industrial Co., Ltd. (China), Kodera Herb Garden Co., Ltd (Japan), Beijing Huacheng Jinke Technology Co., Ltd. (China), Rishon Biochem Co., Ltd (China), and MyBioSource, Inc. (US) and many more. In the past few years, the companies have adopted strategies such as joint ventures, partnerships, agreements, etc., to strengthen their market presence.

What are the drivers and opportunities for the antifreeze protein market?

Advancement in technology to enhance fish farming in cooler climate: There has been different techniques and technology which enables the production of antifreeze proteins on the laboratory scale. Additionally, increase in investment in R&D and innovations to strengthen demand for antifreeze proteins. These are the drivers and opportunities of the antifreeze proteins market.

Which is the biggest regional market for fish antifreeze proteins market?

The market for fish antifreeze proteins will be dominated by the North American market in 2022, showcasing strong demand from companies manufacturing antifreeze proteins. The region is growing drastically by companies investing in manufacturing facilities, which further fuels the demand.

What is the total CAGR projected to be recorded for the medical segment market from 2023 to 2028?

The CAGR is expected to be 37.2% from 2023 – 2028

What kind of information is provided in the competitive landscape section?

For the list of players mentioned, company profiles provide insights such as a business overview covering information on the company’s business segments, financials, geographic presence, revenue mix, and business revenue mix and key developments associated with the company.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research involves the extensive use of secondary sources; directories; and databases (Bloomberg and Factiva) to identify and collect information useful for a technical, market-oriented, and commercial study of the antifreeze proteins market. In-depth interviews were conducted with various primary respondents, such as key industry participants, Subject Matter Experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and to assess prospects.

Secondary Research

In the secondary research process, various sources, such as the Food and Agricultural Organization (FAO), United States Department of Agriculture (USDA), U.S. Food and Drug Administration (FDA) U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), World Health Organization (WHO), were referred to identify and collect information for this study. The secondary sources also include journals, press releases, investor presentations of companies, whitepapers, certified publications, articles by recognized authors and regulatory bodies, trade directories, and paid databases. Secondary research was mainly conducted to obtain critical information about the industry’s supply chain, the total pool of key players, and market classification & segmentation according to the industry trends to the bottom-most level, and geographical markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The antifreeze proteins market encompasses various stakeholders involved in the supply chain, including antifreeze proteins manufacturers and suppliers, raw material suppliers, regulatory organizations, and research institutions. To gather comprehensive information, primary sources from both the supply and demand sides were engaged. Primary interviewees from the supply side consisted of manufacturers, distributors, importers, and technology providers involved in the production and distribution of antifreeze proteins. On the demand side, key opinion leaders, executives, and CEOs of companies in the antifreeze proteins industry were approached through questionnaires, emails, and telephonic interviews. This approach ensured a comprehensive and well-rounded understanding of the antifreeze protein market from various perspectives.

To know about the assumptions considered for the study, download the pdf brochure

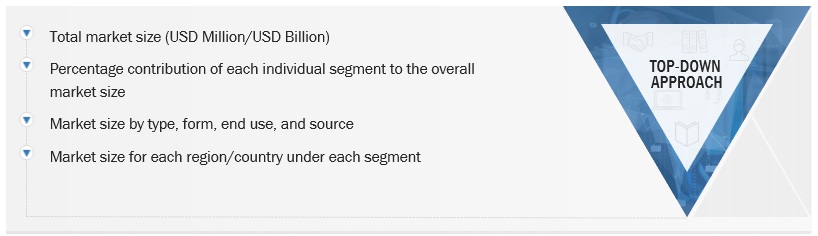

Antifreeze Protein Market Size Estimation

The research methodology used to estimate the size of the antifreeze proteins market includes the following details. The top-down and bottom-up approaches were used to estimate and validate the market’s and various dependent submarkets’ size. The research methodology used to estimate the market size includes extensive secondary research of key players, reports, reviews, and newsletters of top market players, along with extensive interviews from leaders, such as CEOs, directors, and marketing executives.

Global antifreeze proteins market size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global antifreeze proteins market size: Top-Down Approach

Data Triangulation

The data triangulation and market breakdown procedures explained above were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Antifreeze Protein Market Definition

According to Food Standards Australia New Zealand (FSANZ), “Various naturally occurring proteins and peptides have been extracted and identified from the blood of fish living in very cold waters. These proteins and peptides protect the fish from the damage that would be caused by freezing and allow them to survive. Such proteins were subsequently also found in many other organisms that survive in very cold environments, such as plants, insects, fungi, and bacteria. A number of these proteins are already consumed in foods that have been significant parts of the human diet, such as fish and carrots. These proteins have been known as thermal hysteresis proteins or antifreeze proteins

Stakeholders

- Raw material suppliers

- Importers and exporters of antifreeze proteins

- R&D laboratories

- Intermediary suppliers such as traders and distributors of food, medical, and cosmetics product

- Government and research organizations

- Venture capitalists and investors

- Association and industry bodies:

- Food and Agriculture Organization (FAO)

- Trade statistics for international business development

- European Food Safety Authority (EFSA)

- Food Safety Council (FSC)

- Commercial research & development (R&D) institutions and financial institutions:

- Importers and exporters of antifreeze proteins

Antifreeze Protein Market Report Objectives

- To define, segment, and project the global market for antifreeze proteins market on the basis of type, form, end use, source, and region

- To provide detailed information regarding the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micro markets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value with respect to the regions (along with the key countries)

- To strategically profile the key players and comprehensively analyze their market position and core competencies

- To analyze competitive developments in the antifreeze proteins market, including joint ventures, mergers & acquisitions, new product developments, and research & development activities

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to company-specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Antifreeze Proteins Market