APAC Infusion Pumps Market by Product (Accessories (Dedicated, Non-dedicated), Devices (Volumetric, Insulin, Syringe, Ambulatory)), Technology (Traditional, Specialty), Application (Cancer, Diabetes), End User (Hospital, Home Care) & Region - Global Forecasts to 2027

Updated on : February 13, 2023

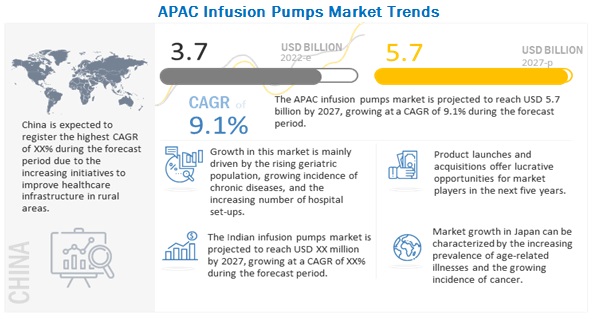

The global APAC infusion pumps market in terms of revenue was estimated to be worth $3.7 billion in 2022 and is poised to reach $5.7 billion by 2027, growing at a CAGR of 9.1% from 2022 to 2027.

The increasing incidence of chronic diseases along with the rapid growth of the geriatric population, rising demand for ambulatory infusion pumps, and the growing volume of surgical procedures performed across the globe are some of the key factors driving the growth of the infusion pumps market. However, the presence of stringent regulations for new products, product recalls, and the increasing adoption of refurbished and rental infusion pumps are expected to restrain the growth of this market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

APAC Infusion Pumps Market Dynamics

Drivers: Rising demand for ambulatory infusion pumps in homecare settings and Increasing incidence of chronic diseases

Infusion pumps such as ambulatory chemotherapy pumps, implantable pumps, and insulin pumps are useful for managing various diseases, such as cancer and diabetes, in homecare settings. Ambulatory infusion pumps are designed to be portable or wearable. Infusion pumps are used to deliver fluids such as nutrients, medicines, and antibiotics in a patient¡¯s body precisely and under a controlled environment. They are commonly used in hospitals, ambulatory surgery centers, homecare settings, infusion clinics, and long-term care facilities. In the last few years, the demand for home healthcare has increased owing to the high incidence and prevalence of chronic diseases and rising healthcare expenditure, mainly on hospitalization. Home healthcare provides patients with an affordable option compared to expensive hospital care, which, in turn, helps reduce the public expenditure on healthcare services. With the growing need to reduce hospital stays, patients are increasingly adopting ambulatory infusion pumps that are cheaper than most other infusion pumps as well as easier to use.

Restraints: Product recalls

Infusion pumps are used to administer critical fluids, including high-risk medications. Errors in using these systems can cause serious harm to patients and may even lead to death. In the past five years, the Emergency Care Research Institute (ECRI) has been pointing out errors in drug administration involving the use of infusion pumps in its Top 10 list of health technology hazards. In 2017, ECRI warned that infusion errors could be fatal if simple safety steps are ignored.

During the period of 2017 and March 2022, the Pharmaceutical and Medical Device Agency (PMDA), and the Central Drugs Standard Control Organization (CDSCO) recalled various batches of infusion pumps due to device-related medication errors. The recall of these products due to safety and efficacy failures is a key concern for device manufacturers as it affects the sales of infusion pumps. These recall activities require manufacturers to replace erroneous infusion pumps with updated models and compel them to pay for serious injuries in mishaps. Hence, product recalls affect the growth of the APAC infusion pumps market.

Opportunities: High growth opportunities in the emerging countries

Emerging economies such as China, India, and Brazil offer significant growth opportunities for players in the infusion pumps market. This can primarily be attributed to the diversified healthcare markets in this region, the growing incidence of infectious and chronic disorders, and increasing R&D initiatives to develop innovative medical technologies. In addition, infrastructural developments in healthcare facilities, increasing healthcare expenditures, and the low-cost manufacturing advantage offered by emerging countries in the Asia Pacific are expected to encourage market players to invest in this region in the coming years. With visible growth prospects, many APAC infusion pump manufacturers are investing in the emerging markets of the Asia Pacific region. The low-cost manufacturing in these emerging markets also provides an added advantage for players to establish manufacturing facilities in these regions and improve profits.

Challenges: Increasing incidence of medication errors and lack of wireless connectivity in most hospitals

Medication errors are the most significant causes of medical injuries, representing 19.4% of all adverse events. According to an article of Business Standard, published in 2018, medical errors triggered by lack of practical knowledge among the doctors and nurses to handle patients when brought to the hospital are estimated to account for 5,000,000 deaths annually in India. Intravenous (IV) infusions have been identified as frequent contributors to medication errors. Wireless connectivity of infusion pumps with the Barcoded Medication Administration (BCMA) system, Hospital Information System (HIS), and Electronic Medical Record (EMR) can help overcome these shortcomings and elevate the current smart pumps to the new level of ¡°intelligent¡± infusion systems. Integrated smart pumps create a closed-loop, fully integrated medication safety system for infusion pumps to accomplish both auto-preprogramming and auto-documentation. However, the lack of interoperability among smart infusion devices and hospital information systems in most hospitals due to lack of wireless connectivity and low hospital budgets poses a significant challenge for the growth of the APAC infusion pumps market.

Based on product type, the accessories & consumables segment of APAC infusion pumps market, is expected to register the highest CAGR during the forecast period.

Based on products, the global market has been segmented into accessories & consumables and devices. In the forecasted period accessories & consumables segment is expected to witness the highest growth segment. Growth in this segment is mainly driven by the increasing adoption of infusion pumps for the delivery of medications in a controlled environment and the recurrent use of accessories & consumables.

Based on dedicated accessories & consumables type, the volumetric infusion pump accounted for the highest market share of APAC infusion pumps market, during the forecast period.

Based on dedicated accessories & consumables by type, global market is segmented into volumetric infusion pumps, insulin pumps, enteral infusion pumps, ambulatory infusion pumps, syringe infusion pumps, patient-controlled analgesia (PCA) pumps, and implantable infusion pumps. The volumetric infusion pumps segment accounted for the largest share of the dedicated accessories & consumables market, by type in 2021. Increasing adoption of volumetric infusion pumps to deliver large volumes of medication and nutrients to patients in hospitals drives the market growth

Based on application, the diabetes segment of APAC infusion pumps market, is expected to register the highest CAGR during the forecast period.

Based on application, the global market is segmented into chemotherapy/oncology, diabetes management, gastroenterology, analgesia/pain management, pediatrics/neonatology, hematology, and other applications (includes infectious diseases, autoimmune diseases, and diseases of the heart, kidney, lung, and liver). The diabetes management segment is expected to witness the highest growth rate during the forecast period. The factors that will lead to the growth of this market during the forecast period are the rising demand for insulin pumps to manage diabetes in homecare settings and the increasing prevalence of diabetes in the APAC region.

To know about the assumptions considered for the study, download the pdf brochure

China is expected to account for the largest share of the APAC infusion pumps market in 2021

In 2021, China accounted for the largest share of the global market, followed by Japan and India. The large share of China can primarily be attributed to the high prevalence of chronic diseases, rising geriatric population and growing investment in healthcare infrastructural development in the region.

The prominent players in the APAC infusion pumps market are Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Fresenius Kabi AG (Germany), Baxter International, Inc. (US), Medtronic PLC (Ireland), ICU Medical, Inc. (US), Avanos Medical, Inc. (US), Terumo Corporation (Japan), Nipro Corporation (Japan), JMS Co., Ltd. (Japan), Cardinal Health, Inc. (US), Epic Medical (Singapore), F. Hoffmann-La Roche Ltd. (Switzerland), Abbott Laboratories(US), Danaher Corporation(US), Mindray Medical International Limited (China), SOOIL Development Co., Ltd. (South Korea), Micrel Medical Devices SA (Greece), Tandem Diabetes Care, Inc. (US), Ypsomed Holding AG (Switzerland), Shenzhen MedRena Biotech Co., Ltd. (China), Allied Medical Limited (India), BPL Medical Technologies (India), Shanghai LEIEN Medical Equipment Co., Ltd. (China), and Plenum Tech Pvt. Limited (India).

APAC Infusion Pumps Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020¨C2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022¨C2027 |

|

Forecast units |

Value (USD) |

|

Segments covered |

By product, application, and end user |

|

Geographies covered |

China, Japan, India, Australia, Thailand, Indonesia, Vietnam, Southeast Asia and Rest of Asia Pacific |

|

Companies covered |

Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Fresenius Kabi AG (Germany), Baxter International, Inc. (US), Medtronic PLC (Ireland), ICU Medical, Inc. (US), Avanos Medical, Inc. (US), Terumo Corporation (Japan), Nipro Corporation (Japan), JMS Co., Ltd. (Japan), Cardinal Health, Inc. (US), Epic Medical (Singapore), F. Hoffmann-La Roche Ltd. (Switzerland), Abbott Laboratories(US), Danaher Corporation(US), Mindray Medical International Limited (China), SOOIL Development Co., Ltd. (South Korea), Micrel Medical Devices SA (Greece), Tandem Diabetes Care, Inc. (US), Ypsomed Holding AG (Switzerland), Shenzhen MedRena Biotech Co., Ltd. (China), Allied Medical Limited (India), BPL Medical Technologies (India), Shanghai LEIEN Medical Equipment Co., Ltd. (China), and Plenum Tech Pvt. Limited (India). |

The study categorizes the APAC infusion pumps market into following segments & sub-segments:

By Product

-

Accessories and Consumables

-

Dedicated Accessories and Consumables

- Volumetric Infusion Pumps

- Insulin Pumps

- Enteral Infusion Pumps

- Syringe Infusion Pumps

- Ambulatory Infusion Pumps

- PCA Pumps

- Implantable Infusion Pumps

-

Non- Dedicated Accessories and Consumables

- Infusion Catheters

- IV/administration Sets

- Needleless Connectors

- Cannulas

- Tubing & Extension Sets

- Valves

- Other Non- Dedicated Accessories and Consumables

-

Dedicated Accessories and Consumables

-

Devices

-

By Product

- Volumetric Infusion Pumps

- Insulin Pumps

- Enteral Infusion Pumps

- Syringe Infusion Pumps

- Ambulatory Infusion Pumps

- PCA Pumps

- Implantable Infusion Pumps

-

By Technology

- Traditional Infusion Pumps

- Specialty Infusion Pumps

-

By Type

- Stationary Infusion Pumps

- Portable Infusion Pumps

-

By Product

By Application

- Chemotherapy/Oncology

- Diabetes Management

- Gastroenterology

- Pain Management/ Analgesia

- Pediatrics/ Neonatology

- Hematology

- Other Applications

By End User

- Hospitals

- Homecare Settings

- Ambulatory Care Settings

- Academic and Research Institutes

By Region

- China

- Japan

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Southeast Asia

- Rest of Asia Pacific

Recent Developments

- In January 2022, ICU Medical, Inc. (US) acquired smiths medical from Smiths Group Plc, that includes syringe and ambulatory infusion devices, vascular access, and vital care products in its portfolio.

- In March 2021, JMS, Co., Ltd. (Japan) launched a new syringe pump designed specifically for enteral nutrition applications.

- In February 2021, Mindray Medical International Limited (China) launched BeneFusion e series- eSP, eVP, and eDS, new infusion systems, thereby expanding its product portfolio.

- In 2020, Medtronic PLC (Ireland) launched Exillia the infusion pump system to cater to the increasing demand during the COVID-19 pandemic.

Frequently Asked Questions (FAQs):

What is the projected market value of the global APAC infusion pumps market?

The global market of APAC infusion pumps is projected to reach USD 5.7 billion.

What is the estimated growth rate (CAGR) of the global APAC infusion pumps market for the next five years?

The global APAC infusion pumps market is projected to grow at a Compound Annual Growth Rate (CAGR) of 9.1% from 2022 to 2027.

What are the major revenue pockets in the APAC infusion pumps market currently?

China accounted for the largest share of the global market, followed by Japan and India. The large share of China can primarily be attributed to the high prevalence of chronic diseases, rising geriatric population and growing investment in healthcare infrastructural development in the region.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.2.2 MARKETS COVERED

FIGURE 1 APAC INFUSION PUMPS MARKET SEGMENTATION

1.2.3 YEARS CONSIDERED FOR THE STUDY

1.3 CURRENCY

1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH APPROACH

FIGURE 2 APAC INFUSION PUMPS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY RESEARCH

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

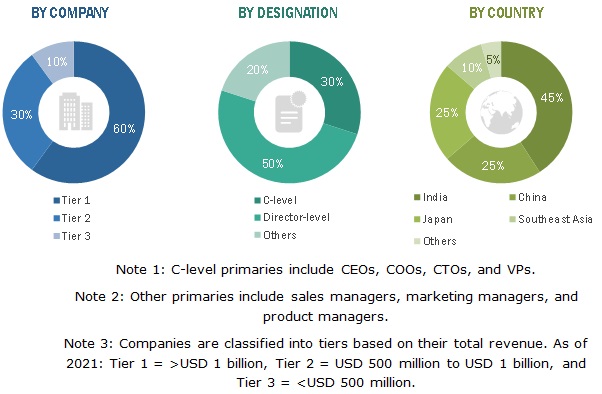

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

2.2 MARKET SIZE ESTIMATION

FIGURE 6 SUPPLY-SIDE MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 7 REVENUE SHARE ANALYSIS ILLUSTRATION: BECTON, DICKINSON AND COMPANY

FIGURE 8 DEMAND-SIDE ANALYSIS: GLOBAL MARKET

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE GLOBAL MARKET (2022¨C2027)

FIGURE 11 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 12 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 1 RISK ASSESSMENT: INFUSION PUMPS MARKET

2.7 LIMITATIONS

2.7.1 METHODOLOGY-RELATED LIMITATIONS

2.7.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 13 APAC INFUSION PUMPS MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 14 APAC INFUSION PUMPS ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 15 APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2022 VS. 2027 (USD MILLION)

FIGURE 16 GLOBAL MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 17 GLOBAL MARKET, BY END USER, 2022 VS. 2027 (USD MILLION)

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 APAC INFUSION PUMPS MARKET OVERVIEW

FIGURE 18 THE GROWING INCIDENCE OF CHRONIC DISEASES IS A KEY FACTOR DRIVING THE MARKET GROWTH

4.2 ASIA PACIFIC: INFUSION PUMPS MARKET, BY DEVICE & COUNTRY

FIGURE 19 THE VOLUMETRIC INFUSION PUMPS SEGMENT ACCOUNTED FOR THE LARGEST SHARE OF THE MARKET IN 2021

4.3 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 CHINA IS EXPECTED TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 GLOBAL MARKET, BY REGION (2020¨C2027)

FIGURE 21 CHINA TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 63)

5.1 MARKET DYNAMICS

FIGURE 22 APAC INFUSION PUMPS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.1.1 MARKET DRIVERS

5.1.1.1 Rising demand for ambulatory infusion pumps in homecare settings

5.1.1.2 Rapid growth in the geriatric population and the subsequent rise in chronic diseases

FIGURE 23 ASIAN CANCER INCIDENCE, 2020¨C2040

FIGURE 24 ESTIMATED DIABETIC POPULATION, BY REGION, 2019 VS. 2030 VS. 2040

5.1.1.3 Increasing adoption of enteral feeding pumps due to a surge in pre-term births

5.1.1.4 Rising number of surgical procedures performed worldwide

5.1.1.5 Increasing number of ICU beds in countries with a high prevalence of COVID-19

TABLE 2 MARKET DRIVERS: IMPACT ANALYSIS

5.1.2 MARKET RESTRAINTS

5.1.2.1 Product recalls

TABLE 3 INDICATIVE LIST OF PRODUCT RECALLS FOR INFUSION PUMPS (2017¨CMARCH 2022)

5.1.2.2 Stringent regulatory requirements for the approval of new products

5.1.2.3 Increasing adoption of refurbished & rented infusion pumps

TABLE 4 MARKET RESTRAINTS: IMPACT ANALYSIS

5.1.3 MARKET OPPORTUNITIES

5.1.3.1 High growth opportunities in emerging markets

TABLE 5 RISING INCOME LEVELS IN EMERGING COUNTRIES

5.1.3.2 Growing adoption of specialty infusion systems

TABLE 6 MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.1.4 MARKET CHALLENGES

5.1.4.1 Increasing incidence of medication errors and inadequate wireless connectivity in most hospitals

TABLE 7 MARKET CHALLENGES: IMPACT ANALYSIS

5.2 INDUSTRY TRENDS

5.2.1 SMART PUMP©¤EMR INTEROPERABILITY

TABLE 8 RECENT DEVELOPMENTS IN SMART PUMP©¤EMR INTEROPERABILITY

5.2.2 GROWING FOCUS ON THE DEVELOPMENT OF HYBRID CLOSED-LOOP SYSTEMS/ARTIFICIAL PANCREAS DEVICE SYSTEMS

TABLE 9 HYBRID CLOSED-LOOP SYSTEMS: CURRENT MARKET SCENARIO

5.2.3 GROWING FOCUS ON SPECIALTY PUMPS WITH ADDITIONAL ADVANCED FEATURES

5.3 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 10 GLOBAL MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.4 PRICING ANALYSIS

TABLE 11 ASP OF INFUSION PUMP DEVICES

TABLE 12 ASP OF NON-DEDICATED ACCESSORIES & CONSUMABLES

5.5 VALUE CHAIN ANALYSIS

FIGURE 25 GLOBAL MARKET: VALUE CHAIN ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS

FIGURE 26 GLOBAL MARKET: SUPPLY CHAIN ANALYSIS

5.7 ECOSYSTEM MARKET MAP

FIGURE 27 INFUSION PUMPS MARKET: ECOSYSTEM MARKET MAP

5.8 PORTER¡¯S FIVE FORCES ANALYSIS

TABLE 13 PORTER¡¯S FIVE FORCES ANALYSIS

5.8.1 THREAT FROM NEW ENTRANTS

5.8.2 THREAT FROM SUBSTITUTES

5.8.3 BARGAINING POWER OF SUPPLIERS

5.8.4 BARGAINING POWER OF BUYERS

5.8.5 COMPETITIVE RIVALRY

5.9 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA-PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10 REGULATORY ANALYSIS

5.10.1 APAC

5.10.1.1 Japan

TABLE 15 JAPAN: MEDICAL DEVICE CLASSIFICATION UNDER PMDA

5.10.1.2 China

TABLE 16 CHINA: CFDA CLASSIFICATION OF MEDICAL DEVICES

5.10.1.3 India

5.11 IMPACT OF COVID-19 ON THE GLOBAL MARKET

5.12 PATENT ANALYSIS

5.12.1 PATENT PUBLICATION TRENDS FOR INFUSION PUMPS

FIGURE 28 PATENT PUBLICATION TRENDS (2011¨CMARCH 2022)

5.12.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 29 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR INFUSION PUMP PATENTS (JANUARY 2011¨CMARCH 2022)

FIGURE 30 TOP APPLICANT COUNTRIES/REGIONS FOR INFUSION PUMP PATENTS (JANUARY 2011¨CMARCH 2022)

TABLE 17 LIST OF PATENTS/PATENT APPLICATIONS IN THE ORGAN PRESERVATION MARKET, 2021¨C2022

5.13 TECHNOLOGY ANALYSIS

5.13.1 KEY TECHNOLOGIES

5.13.1.1 Flow generation

5.13.1.2 Flow control

5.13.2 ADJACENT TECHNOLOGIES

5.13.2.1 Embedded software

5.13.2.2 Sensing technology

5.13.3 COMPLEMENTARY TECHNOLOGIES

5.13.3.1 Dose error reduction systems

5.13.3.2 Wireless connectivity

5.14 TRADE ANALYSIS

TABLE 18 AISA PACIFIC EXPORT DATA OF INFUSION PUMPS FOR 2020

TABLE 19 TRADE DATA ANALYSIS OF INFUSION PUMP IMPORTS TO INDIA

6 APAC INFUSION PUMPS MARKET, BY PRODUCT (Page No. - 97)

6.1 INTRODUCTION

TABLE 20 GLOBAL MARKET, BY PRODUCT, 2020¨C2027 (USD MILLION)

6.2 IMPACT OF COVID-19 ON THE GLOBAL MARKET, BY PRODUCT

6.3 ACCESSORIES AND CONSUMABLES

TABLE 21 KEY INFUSION PUMP ACCESSORIES & CONSUMABLES AVAILABLE IN THE MARKET

TABLE 22 APAC INFUSION PUMP ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 23 APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY COUNTRY 2020¨C2027 (USD MILLION)

6.3.1 DEDICATED ACCESSORIES AND CONSUMABLES

TABLE 24 DEDICATED ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 25 DEDICATED ACCESSORIES AND CONSUMABLES MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.1.1 Volumetric infusion pumps

6.3.1.1.1 Increasing adoption of volumetric infusion pumps to deliver large volumes of medication and nutrients to patients in hospitals drives the market growth

TABLE 26 DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR VOLUMETRIC INFUSION PUMPS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.1.2 Insulin pumps

6.3.1.2.1 The rising demand for insulin pumps for the increasing number of insulin-dependent diabetic patients supports market growth

TABLE 27 IDF SOUTH-EAST ASIA AND WESTERN PACIFIC REGION AT A GLANCE, 2019

TABLE 28 DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR INSULIN PUMPS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.1.3 Enteral infusion pumps

6.3.1.3.1 Delivery of precise and consistent infusion results in higher adoption of enteral infusion pumps

TABLE 29 DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR ENTERAL INFUSION PUMPS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.1.4 Syringe infusion pumps

6.3.1.4.1 Adoption of dedicated syringe pump accessories is high in developed countries¡ªa key factor driving the market growth

TABLE 30 DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR SYRINGE INFUSION PUMPS, BY REGION, 2020¨C2027 (USD MILLION)

6.3.1.5 Ambulatory infusion pumps

6.3.1.5.1 The growing home healthcare market fuels the adoption of dedicated ambulatory infusion pumps & accessories

TABLE 31 DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR AMBULATORY INFUSION PUMPS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.1.6 PCA pumps

6.3.1.6.1 Adoption of PCA pumps is driven by the increasing demand for pain management treatment

TABLE 32 DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR PCA PUMPS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.1.7 Implantable infusion pumps

6.3.1.7.1 Dedicated infusion pump accessories are preferred due to their compatibility with the implantable infusion pumps

TABLE 33 DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR IMPLANTABLE INFUSION PUMPS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.2 NON-DEDICATED ACCESSORIES AND CONSUMABLES

TABLE 34 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 35 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET, BY COUNTRY 2020¨C2027 (USD MILLION)

6.3.2.1 Infusion catheters

6.3.2.1.1 Recurrent use of infusion catheters to drive the market growth

TABLE 36 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR INFUSION CATHETERS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.2.2 IV/Administration sets

6.3.2.2.1 IV/administration sets are the primary requirement for infusion pumps¡ªa key factor driving market growth

TABLE 37 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR IV/ADMINISTRATION SETS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.2.3 Needleless connectors

6.3.2.3.1 Needleless connectors reduce bloodstream infection risks

TABLE 38 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR NEEDLELESS CONNECTORS, BY COUNTRY 2020¨C2027 (USD MILLION)

6.3.2.4 Cannulas

6.3.2.4.1 Cannulas are preferred over steel needles as they do not cause discomfort to patients during body movements

TABLE 39 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR CANNULAS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.2.5 Tubing & extension sets

6.3.2.5.1 Tubing & extension sets are used to provide a consistent connection between a patient¡¯s body and the infusion pump

TABLE 40 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR TUBING & EXTENSION SETS, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.2.6 Valves

6.3.2.6.1 Valves are used to regulate the flow of infusion fluids

TABLE 41 NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET FOR VALVES, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.3.2.7 Other Non-dedicated accessories and consumables

TABLE 42 OTHER NON-DEDICATED ACCESSORIES AND CONSUMABLES MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4 DEVICES

6.4.1 DEVICES MARKET, BY PRODUCT

TABLE 43 APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027 (USD MILLION)

TABLE 44 APAC INFUSION PUMP DEVICES MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.1 Volumetric infusion pumps

6.4.1.1.1 Wide range of applications for volumetric infusion pumps to drive the market growth

TABLE 45 VOLUMETRIC INFUSION PUMPS AVAILABLE IN THE MARKET

TABLE 46 APAC VOLUMETRIC INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.2 Insulin pumps

6.4.1.2.1 Growing demand for smart insulin pumps and portable insulin pumps in homecare settings to drive the market growth

TABLE 47 INSULIN PUMPS AVAILABLE IN THE MARKET

TABLE 48 APAC INSULIN PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.3 Ambulatory infusion pumps

TABLE 49 AMBULATORY INFUSION PUMPS AVAILABLE IN THE MARKET

TABLE 50 APAC AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 51 APAC AMBULATORY INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.3.1 Disposable infusion pumps

6.4.1.3.1.1 Disposable infusion pumps are mainly used in homecare settings and pediatric departments

TABLE 52 DISPOSABLE INFUSION PUMPS AVAILABLE IN THE MARKET

TABLE 53 APAC DISPOSABLE INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.3.2 Chemotherapy infusion pumps

6.4.1.3.2.1 These pumps administer continuous infusion to cancer patients in homecare settings

TABLE 54 CHEMOTHERAPY INFUSION PUMPS AVAILABLE IN THE MARKET

TABLE 55 APAC CHEMOTHERAPY INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.4 Syringe infusion pumps

6.4.1.4.1 Syringe infusion pumps are used to deliver a lower volume of fluids at a low flow rate

TABLE 56 SYRINGE INFUSION PUMPS AVAILABLE IN THE MARKET

TABLE 57 APAC SYRINGE INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.5 Enteral infusion pumps

6.4.1.5.1 Enteral infusion pumps are designed to deliver nutrients and medicines into a patient¡¯s digestive tract

TABLE 58 ENTERAL INFUSION PUMPS AVAILABLE IN THE MARKET

TABLE 59 APAC ENTERAL INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.6 PCA pumps

6.4.1.6.1 Growth in this segment is driven by the rising preference for effective pain management therapies

TABLE 60 PCA PUMPS AVAILABLE IN THE MARKET

TABLE 61 APAC PCA PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.1.7 Implantable infusion pumps

6.4.1.7.1 High costs of implantable infusion pump therapies and procedures to restrict the segment growth

TABLE 62 IMPLANTABLE INFUSION PUMPS AVAILABLE IN THE MARKET

TABLE 63 APAC IMPLANTABLE INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.2 DEVICES MARKET, BY TECHNOLOGY

TABLE 64 APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027 (USD MILLION)

6.4.2.1 Traditional infusion pumps

6.4.2.1.1 Wide applications of traditional infusion pumps due to low costs to drive the segment growth

TABLE 65 APAC TRADITIONAL INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.2.2 Specialty infusion pumps

6.4.2.2.1 Technological advancements & the rising adoption of specialty infusion pumps in homecare settings supports segment growth

TABLE 66 APAC SPECIALTY INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.3 DEVICES MARKET, BY TYPE

TABLE 67 APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

6.4.3.1 Stationary infusion pumps

6.4.3.1.1 High adoption of stationary infusion pumps in hospitals to drive the market growth

TABLE 68 APAC STATIONARY INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

6.4.3.2 Portable infusion pumps

6.4.3.2.1 Technological advancements in portable infusion pumps to drive the growth of this segment

TABLE 69 APAC PORTABLE INFUSION PUMPS MARKET, BY COUNTRY, 2020¨C2027 (USD MILLION)

7 APAC INFUSION PUMPS MARKET, BY APPLICATION (Page No. - 136)

7.1 INTRODUCTION

TABLE 70 GLOBAL MARKET, BY APPLICATION, 2020¨C2027 (USD MILLION)

7.2 CHEMOTHERAPY/ONCOLOGY

7.2.1 THE DEMAND FOR INFUSION PUMPS FOR CHEMOTHERAPY IS MAINLY DRIVEN BY THE GROWING INCIDENCE OF CANCER

FIGURE 31 ASIA PACIFIC: ESTIMATED NUMBER OF NEW CANCER CASES, BY REGION, 2020¨C2040

TABLE 71 GLOBAL MARKET FOR CHEMOTHERAPY/ONCOLOGY, BY COUNTRY, 2020¨C2027 (USD MILLION)

7.3 DIABETES MANAGEMENT

7.3.1 THE RISING PREVALENCE OF DIABETES HAS INCREASED THE DEMAND FOR ACCESSIBLE & EFFECTIVE DIABETES MANAGEMENT¡ªA KEY FACTOR DRIVING THE MARKET GROWTH

FIGURE 32 ASIA PACIFIC: DIABETES INCIDENCE, BY REGION, 2015¨C2045

TABLE 72 GLOBAL MARKET FOR DIABETES MANAGEMENT, BY COUNTRY, 2020¨C2027(USD MILLION)

7.4 GASTROENTEROLOGY

7.4.1 DOCTORS PREFER TREATING PATIENTS WITH SEVERE DIGESTIVE SYSTEM DISORDERS BY USING INFUSION PUMPS TO DELIVER DRUGS INTO THE SYSTEM

TABLE 73 DISEASES & DISORDERS OF THE DIGESTIVE SYSTEM

TABLE 74 GLOBAL MARKET FOR GASTROENTEROLOGY, BY COUNTRY, 2020¨C2027(USD MILLION)

7.5 ANALGESIA/PAIN MANAGEMENT

7.5.1 THE RISING NUMBER OF SURGICAL PROCEDURES PROPEL THE MARKET GROWTH OF THIS SEGMENT

TABLE 75 ASIA PACIFIC: CHRONIC PAIN STATISTICS, 2018

TABLE 76 GLOBAL MARKET FOR ANALGESIA/PAIN MANAGEMENT, BY COUNTRY, 2020¨C2027(USD MILLION)

7.6 PEDIATRICS/NEONATOLOGY

7.6.1 INCREASING INCIDENCE OF PRETERM BIRTHS AND NEWBORN DEATHS DRIVE THE UPTAKE OF INFUSION PUMPS IN THIS SEGMENT

TABLE 77 ASIAN COUNTRIES WITH THE HIGHEST NUMBER OF PRETERM BIRTHS (2018)

TABLE 78 ASIAN COUNTRIES WITH THE HIGHEST NUMBER OF NEWBORN DEATHS (2020)

TABLE 79 GLOBAL MARKET FOR PEDIATRICS/NEONATOLOGY, BY COUNTRY, 2020¨C2027(USD MILLION)

7.7 HEMATOLOGY

7.7.1 INCREASING PREVALENCE OF BLOOD DISORDERS TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 80 ASIA PACIFIC: PREVALENCE OF ANEMIA IN WOMEN OF REPRODUCTIVE AGE (15¨C49 YEARS) (% OF THE POPULATION), BY COUNTRY

TABLE 81 GLOBAL MARKET FOR HEMATOLOGY, BY COUNTRY, 2020¨C2027(USD MILLION)

7.8 OTHER APPLICATIONS

TABLE 82 GLOBAL MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020¨C2027(USD MILLION)

8 APAC INFUSION PUMPS MARKET, BY END USER (Page No. - 150)

8.1 INTRODUCTION

TABLE 83 GLOBAL MARKET, BY END USER, 2020¨C2027 (USD MILLION)

8.2 HOSPITALS

8.2.1 STRONG PURCHASING POWER BY HOSPITALS FOR HIGH-PRICED INFUSION PUMPS TO DRIVE THE MARKET GROWTH

TABLE 84 NUMBER OF HOSPITALS, BY COUNTRY, 2010¨C2020

TABLE 85 GLOBAL MARKET FOR HOSPITALS, BY COUNTRY, 2020¨C2027 (USD MILLION)

8.3 HOMECARE SETTINGS

8.3.1 PATIENTS ARE INCREASINGLY OPTING TO GET TREATED AT HOME¡ª A KEY FACTOR DRIVING MARKET GROWTH

TABLE 86 GLOBAL MARKET FOR HOMECARE SETTINGS, BY COUNTRY, 2020¨C2027(USD MILLION)

8.4 AMBULATORY CARE SETTINGS

8.4.1 GROWING NUMBER OF SURGICAL PROCEDURES PERFORMED IN ASCS TO DRIVE THE MARKET GROWTH

TABLE 87 GLOBAL MARKET FOR AMBULATORY CARE SETTINGS, BY COUNTRY, 2020¨C2027(USD MILLION)

8.5 ACADEMIC & RESEARCH INSTITUTES

8.5.1 INCREASING MEDICAL RESEARCH ACTIVITIES TO SUPPORT THE GROWTH OF THIS SEGMENT

TABLE 88 INFUSION PUMPS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2020¨C2027(USD MILLION)

9 APAC INFUSION PUMPS MARKET, BY COUNTRY (Page No. - 157)

9.1 INTRODUCTION

FIGURE 33 APAC: NUMBER OF CRITICAL BEDS PER 100,000 PEOPLE

FIGURE 34 ASIA PACIFIC: INFUSION PUMPS MARKET SNAPSHOT

TABLE 89 GLOBAL MARKET, BY COUNTRY, 2020¨C2027(USD MILLION)

9.2 COVID-19 IMPACT ON THE GLOBAL MARKET

9.2.1 CHINA

9.2.1.1 Growing investments in healthcare infrastructure development in China to drive the market growth

TABLE 90 KEY MACRO INDICATORS FOR CHINA

TABLE 91 CHINA: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027 (USD MILLION)

TABLE 92 CHINA: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 93 CHINA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 94 CHINA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 95 CHINA: INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 96 CHINA: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 97 CHINA: INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027(USD MILLION)

TABLE 98 CHINA: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 99 CHINA: MARKET, BY APPLICATION, 2020¨C2027(USD MILLION)

TABLE 100 CHINA: MARKET, BY SETTING, 2020¨C2027(USD MILLION)

9.2.2 JAPAN

9.2.2.1 The extensive geriatric population in Japan is expected to drive the subsequent demand for infusion pumps & devices

TABLE 101 KEY MACRO INDICATORS FOR JAPAN

TABLE 102 JAPAN: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 103 JAPAN: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 104 JAPAN: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 105 JAPAN: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 106 JAPAN: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 107 JAPAN: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 108 JAPAN: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027(USD MILLION)

TABLE 109 JAPAN: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 110 JAPAN: AAPC INFUSION PUMPS MARKET, BY APPLICATION, 2020¨C2027(USD MILLION)

TABLE 111 JAPAN: MARKET, BY SETTING, 2020¨C2027(USD MILLION)

9.2.3 INDIA

9.2.3.1 The high prevalence of lifestyle diseases drives the market growth for infusion pumps in India

TABLE 112 KEY MACRO INDICATORS FOR INDIA

TABLE 113 INDIA: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 114 INDIA: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 115 INDIA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 116 INDIA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 117 INDIA: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 118 INDIA: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 119 INDIA: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027(USD MILLION)

TABLE 120 INDIA: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 121 INDIA: MARKET, BY APPLICATION, 2020¨C2027(USD MILLION)

TABLE 122 INDIA: MARKET, BY SETTING, 2020¨C2027(USD MILLION)

9.2.4 AUSTRALIA

9.2.4.1 The high prevalence of chronic diseases in the country supports the market growth

TABLE 123 KEY MACRO INDICATORS FOR AUSTRALIA

TABLE 124 AUSTRALIA: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 125 AUSTRALIA: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 126 AUSTRALIA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 127 AUSTRALIA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 128 AUSTRALIA: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 129 AUSTRALIA: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 130 AUSTRALIA: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027(USD MILLION)

TABLE 131 AUSTRALIA: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 132 AUSTRALIA: MARKET, BY APPLICATION, 2020¨C2027(USD MILLION)

TABLE 133 AUSTRALIA: MARKET, BY SETTING, 2020¨C2027(USD MILLION)

9.2.5 THAILAND

9.2.5.1 The rising prevalence of cancer supports the market growth for infusion pumps in Thailand

TABLE 134 KEY MACRO INDICATORS FOR THAILAND

TABLE 135 THAILAND: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 136 THAILAND: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 137 THAILAND: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 138 THAILAND: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 139 THAILAND: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 140 THAILAND: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 141 THAILAND: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027(USD MILLION)

TABLE 142 THAILAND: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 143 THAILAND: MARKET, BY APPLICATION, 2020¨C2027(USD MILLION)

TABLE 144 THAILAND: MARKET, BY SETTING, 2020¨C2027(USD MILLION)

9.2.6 INDONESIA

9.2.6.1 The rising prevalence of cancer supports the market for infusion pumps in Indonesia

TABLE 145 KEY MACRO INDICATORS FOR INDONESIA

TABLE 146 INDONESIA: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027 (USD MILLION)

TABLE 147 INDONESIA: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 148 INDONESIA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 149 INDONESIA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 150 INDONESIA: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027 (USD MILLION)

TABLE 151 INDONESIA: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 152 INDONESIA: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027 (USD MILLION)

TABLE 153 INDONESIA: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 154 INDONESIA: MARKET, BY APPLICATION, 2020¨C2027 (USD MILLION)

TABLE 155 INDONESIA: MARKET, BY SETTING, 2020¨C2027 (USD MILLION)

9.2.7 VIETNAM

9.2.7.1 The high incidence of preterm births in the country has propelled the growth of the infusion pumps market

TABLE 156 KEY MACRO INDICATORS FOR VIETNAM

TABLE 157 VIETNAM: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027 (USD MILLION)

TABLE 158 VIETNAM: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 159 VIETNAM: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 160 VIETNAM: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 161 VIETNAM: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027 (USD MILLION)

TABLE 162 VIETNAM: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 163 VIETNAM: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027 (USD MILLION)

TABLE 164 VIETNAM: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027 (USD MILLION)

TABLE 165 VIETNAM: MARKET, BY APPLICATION, 2020¨C2027 (USD MILLION)

TABLE 166 VIETNAM: MARKET, BY SETTING, 2020¨C2027 (USD MILLION)

9.2.8 SOUTHEAST ASIA

9.2.8.1 Growth in medical tourism in the SEA countries to drive the market for infusion pumps

FIGURE 35 PREVALENCE OF DIABETES IN SOUTHEAST ASIA, 2019

TABLE 167 ESTIMATED NUMBER OF CANCER CASES IN SOUTHEAST ASIAN COUNTRIES, 2020 VS. 2040 (IN THOUSAND)

FIGURE 36 HEALTHCARE EXPENDITURE (% GDP) IN SOUTHEAST ASIA (2019)

FIGURE 37 GERIATRIC POPULATION IN 2020 (% OF TOTAL POPULATION)

TABLE 168 SOUTHEAST ASIA: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 169 SOUTHEAST ASIA: INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 170 SOUTHEAST ASIA: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 171 SOUTHEAST ASIA: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 172 SOUTHEAST ASIA: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 173 SOUTHEAST ASIA: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 174 SOUTHEAST ASIA: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027(USD MILLION)

TABLE 175 SOUTHEAST ASIA: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 176 SOUTHEAST ASIA: MARKET, BY APPLICATION, 2020¨C2027(USD MILLION)

TABLE 177 SOUTHEAST ASIA: MARKET, BY SETTING, 2020¨C2027(USD MILLION)

9.2.9 REST OF ASIA PACIFIC (ROAPAC)

FIGURE 38 ESTIMATED NUMBER OF CANCER CASES IN REST OF APAC COUNTRIES, 2020 VS. 2040 (IN THOUSAND)

TABLE 178 ROAPAC: APAC INFUSION PUMPS MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 179 ROAPAC: APAC INFUSION PUMP ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 180 ROAPAC: DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 181 ROAPAC: NON-DEDICATED ACCESSORIES & CONSUMABLES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 182 ROAPAC: APAC INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2020¨C2027(USD MILLION)

TABLE 183 ROAPAC: AMBULATORY INFUSION PUMPS MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 184 ROAPAC: APAC INFUSION PUMP DEVICES MARKET, BY TECHNOLOGY, 2020¨C2027(USD MILLION)

TABLE 185 ROAPAC: APAC INFUSION PUMP DEVICES MARKET, BY TYPE, 2020¨C2027(USD MILLION)

TABLE 186 ROAPAC: MARKET, BY APPLICATION, 2020¨C2027(USD MILLION)

TABLE 187 ROAPAC: MARKET, BY SETTING, 2020¨C2027(USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 207)

10.1 OVERVIEW

FIGURE 39 KEY PLAYER STRATEGIES

10.2 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 40 REVENUE ANALYSIS OF THE TOP PLAYERS IN THE APAC INFUSION PUMPS MARKET

10.3 MARKET SHARE ANALYSIS

FIGURE 41 GLOBAL MARKET SHARE BY KEY PLAYER, 2021

TABLE 188 GLOBAL MARKET: DEGREE OF COMPETITION

10.4 COMPANY EVALUATION QUADRANT

10.4.1 STARS

10.4.2 EMERGING LEADERS

10.4.3 PERVASIVE PLAYERS

10.4.4 PARTICIPANTS

FIGURE 42 INFUSION PUMPS MARKET: COMPANY EVALUATION QUADRANT (2021)

10.5 COMPANY FOOTPRINTS

TABLE 189 FOOTPRINT OF COMPANIES IN THE GLOBAL MARKET

TABLE 190 PRODUCT PORTFOLIO ANALYSIS: GLOBAL MARKET

TABLE 191 APPLICATION PORTFOLIO ANALYSIS: GLOBAL MARKET

TABLE 192 END USER PORTFOLIO ANALYSIS: GLOBAL MARKET

10.6 COMPETITIVE SCENARIO

10.6.1 PRODUCT LAUNCHES

TABLE 193 PRODUCT LAUNCHES (JANUARY 2018 ¨C FEBRUARY 2022)

10.6.2 DEALS

TABLE 194 DEALS (JANUARY 2018¨CFEBRUARY 2022)

10.6.3 OTHER DEVELOPMENTS

TABLE 195 OTHER DEVELOPMENTS (JANUARY 2018¨C FEBRUARY 2022)

11 COMPANY PROFILES (Page No. - 223)

11.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

11.1.1 BECTON, DICKINSON AND COMPANY

TABLE 196 BECTON, DICKINSON AND COMPANY: BUSINESS OVERVIEW

FIGURE 43 BECTON, DICKINSON AND COMPANY: COMPANY SNAPSHOT (2021)

11.1.2 B. BRAUN MELSUNGEN AG

TABLE 197 B. BRAUN MELSUNGEN AG: BUSINESS OVERVIEW

FIGURE 44 B. BRAUN MELSUNGEN AG: COMPANY SNAPSHOT (2021)

11.1.3 FRESENIUS KABI AG

TABLE 198 FRESENIUS KABI: BUSINESS OVERVIEW

FIGURE 45 FRESENIUS KABI AG: COMPANY SNAPSHOT (2021)

11.1.4 BAXTER INTERNATIONAL INC.

TABLE 199 BAXTER INTERNATIONAL INC.: BUSINESS OVERVIEW

FIGURE 46 BAXTER INTERNATIONAL INC.: COMPANY SNAPSHOT (2021)

11.1.5 MEDTRONIC PLC

TABLE 200 MEDTRONIC PLC: BUSINESS OVERVIEW

FIGURE 47 MEDTRONIC PLC: COMPANY SNAPSHOT (2021)

11.1.6 ICU MEDICAL, INC.

TABLE 201 ICU MEDICAL: BUSINESS OVERVIEW

FIGURE 48 ICU MEDICAL: COMPANY SNAPSHOT (2021)

11.1.7 AVANOS MEDICAL, INC.

TABLE 202 AVANOS MEDICAL, INC.: BUSINESS OVERVIEW

FIGURE 49 AVANOS MEDICAL, INC.: COMPANY SNAPSHOT (2021)

11.1.8 TERUMO CORPORATION

TABLE 203 TERUMO CORPORATION: BUSINESS OVERVIEW

FIGURE 50 TERUMO CORPORATION: COMPANY SNAPSHOT (2020)

11.1.9 NIPRO CORPORATION

TABLE 204 NIPRO CORPORATION: BUSINESS OVERVIEW

FIGURE 51 NIPRO CORPORATION: COMPANY SNAPSHOT (2021)

11.1.10 JMS CO., LTD.

TABLE 205 JMS CO., LTD.: BUSINESS OVERVIEW

FIGURE 52 JMS CO., LTD.: COMPANY SNAPSHOT (2021)

11.1.11 CARDINAL HEALTH, INC.

TABLE 206 CARDINAL HEALTH, INC.: BUSINESS OVERVIEW

FIGURE 53 CARDINAL HEALTH, INC.: COMPANY SNAPSHOT (2021)

11.1.12 EPIC MEDICAL

TABLE 207 EPIC MEDICAL: BUSINESS OVERVIEW

11.1.13 F. HOFFMANN-LA ROCHE LTD.

TABLE 208 F. HOFFMANN-LA ROCHE LTD.: BUSINESS OVERVIEW

FIGURE 54 F. HOFFMANN-LA ROCHE LTD.: COMPANY SNAPSHOT (2021)

11.1.14 ABBOTT LABORATORIES

TABLE 209 ABBOTT LABORATORIES: BUSINESS OVERVIEW

FIGURE 55 ABBOTT LABORATORIES: COMPANY SNAPSHOT (2021)

11.1.15 DANAHER CORPORATION

TABLE 210 DANAHER CORPORATION: BUSINESS OVERVIEW

FIGURE 56 DANAHER CORPORATION: COMPANY SNAPSHOT (2021)

11.2 OTHER PLAYERS

11.2.1 MINDRAY MEDICAL INTERNATIONAL LIMITED

TABLE 211 MINDRAY MEDICAL INTERNATIONAL LIMITED: BUSINESS OVERVIEW

11.2.2 SOOIL DEVELOPMENT CO., LTD.

TABLE 212 SOOIL DEVELOPMENT CO., LTD.: BUSINESS OVERVIEW

11.2.3 MICREL MEDICAL DEVICES SA

TABLE 213 MICREL MEDICAL DEVICES SA: BUSINESS OVERVIEW

11.2.4 TANDEM DIABETES CARE, INC.

TABLE 214 TANDEM DIABETES CARE, INC.: BUSINESS OVERVIEW

FIGURE 57 TANDEM DIABETES CARE, INC.: COMPANY SNAPSHOT (2021)

11.2.5 YPSOMED HOLDING AG

TABLE 215 YPSOMED HOLDING AG: BUSINESS OVERVIEW

FIGURE 58 YPSOMED HOLDING AG: COMPANY SNAPSHOT (2020)

11.2.6 SHENZHEN MEDRENA BIOTECH CO., LTD.

TABLE 216 SHENZHEN MEDRENA BIOTECH CO., LTD.: BUSINESS OVERVIEW

11.2.7 ALLIED MEDICAL LIMITED

TABLE 217 ALLIED MEDICAL LIMITED: BUSINESS OVERVIEW

11.2.8 BPL MEDICAL TECHNOLOGIES

TABLE 218 BPL MEDICAL TECHNOLOGIES: BUSINESS OVERVIEW

11.2.9 SHANGHAI LEIEN MEDICAL EQUIPMENT CO., LTD.

TABLE 219 SHANGHAI LEIEN MEDICAL EQUIPMENT CO., LTD.: BUSINESS OVERVIEW

11.2.10 PLENUM TECH LIMITED

TABLE 220 PLENUM TECH LIMITED: BUSINESS OVERVIEW

11.3 LIST OF DISTRIBUTORS AND SUPPLIERS IN THE APAC REGION

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 298)

12.1 INSIGHTS FROM INDUSTRY EXPERTS

12.2 DISCUSSION GUIDE

12.3 KNOWLEDGESTORE: MARKETSANDMARKETS¡¯ SUBSCRIPTION PORTAL

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved comprehensive secondary sources; directories; databases such as Bloomberg Business, Factiva, and Dun & Bradstreet; white papers; annual reports; company house documents; investor presentations; and SEC filings of companies. Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the APAC infusion pumps market. It was also used to obtain important information about the key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side and demand side are detailed below.

A breakdown of the primary respondents is provided below:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the APAC infusion pumps market was arrived at after data triangulation from different approaches. After each approach, the weighted average of all approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The following figure shows the market validation, source structure, and data triangulation methodology implemented in the market engineering process.

Objectives of the Study

- To define, describe and forecast the APAC infusion pumps market based on product, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall APAC infusion pumps market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To estimate the market size and growth potential of the infusion pumps market in the Asia Pacific region

- To profile the key players operating in the APAC infusion pumps market and comprehensively analyze their revenue shares, core competencies2, and market shares

- To track and analyze competitive developments such as geographical expansions, acquisitions, collaborations, product launches, agreements, collaborations, and partnerships in the APAC infusion pumps market

- To benchmark players in the market using the proprietary ¡°Competitive Leadership Mapping¡± framework, which analyzes market players on various parameters within the board categories of business strategy and product offering

- To evaluate and analyze the impact of COVID-19 on the infusion pumps market across the Asia Pacific region

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company¡¯s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Southeast Asia infusion pump market into Singapore, Malaysia, and South Korea

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in APAC Infusion Pumps Market

I would like to know more about the Infusion Pumps market in Australia. What will the market look like in this region and which major companies are operating here?