Application Delivery Controller Market by Type (Hardware-based, Virtual), Service (Integration and Implementation; Training, Support, and Maintenance), Organization Size (SME, Large Enterprise), Vertical and Region - Global Forecast to 2028

Application Delivery Controller Market Size & Revenue Forecast, Global Size

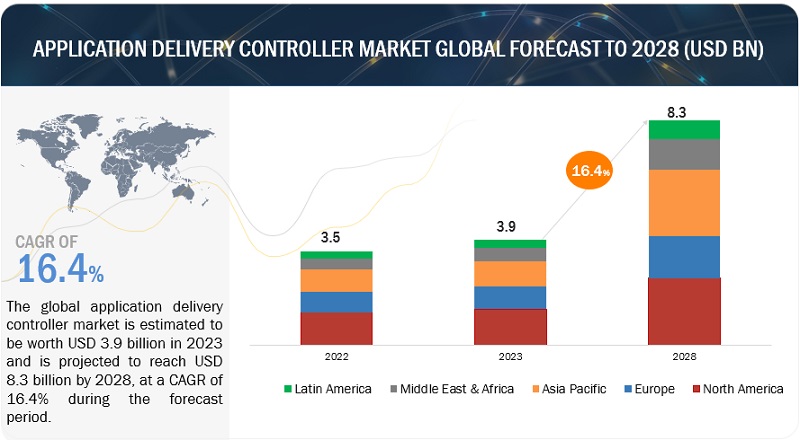

[218 Pages Report] The global Application Delivery Controller Market size was was worth approximately $3.9 billion in 2023 and is poised to reach over $8.3 billion by the end of 2028, at a effective CAGR of 16.4% during anticipated period. The base year for estimation is 2022 and the data available for the years 2017 to 2028.

The application delivery controller market is being propelled by a convergence of transformative factors reshaping the digital landscape. The surge in cloud adoption and the proliferation of modern application architectures, including microservices and containers, demand efficient application delivery solutions. The escalating expectations of users for seamless, secure, and high-performance experiences drive the need for ADCs that optimize traffic distribution and ensure responsive applications. The rising complexity of cyber threats necessitates ADCs with integrated security features like Web Application Firewalls to safeguard applications. In a world marked by remote work trends and the expansion of IoT technologies, ADCs play a pivotal role in facilitating smooth, reliable, and secure application interactions. As organizations navigate these shifts, the Application Delivery Controller market evolves, driven by the pursuit of enhanced performance, security, and user satisfaction in a rapidly advancing digital era.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Application Delivery Controller Market Growth Dynamics

Driver: Demand for seamless application performance and security propels the ADC market

The increasing adoption of cloud-native architectures, rising demand for seamless application performance, and the need for robust security mechanisms are key drivers. As digital transformation accelerates, ADCs play a critical role in optimizing application delivery, enhancing user experiences, and safeguarding sensitive data. Additionally, the surge in remote work and the growing complexity of cyber threats underscore the significance of ADCs in ensuring reliable and secure application interactions. This dynamic landscape fuels the growth of the ADC market, shaping a future where efficient, secure, and responsive application delivery remains paramount.

Restraint: Economic constraints may hinder the widespread adoption of advanced Application Delivery Controller solutions

While the demand for optimal application performance and security remains high, budget limitations can hinder the adoption of advanced ADC solutions. The costs associated with acquiring, implementing, and maintaining these technologies can pose challenges for businesses, particularly smaller enterprises. Economic uncertainties, budget allocation complexities, and the need to balance various IT priorities can delay or limit the adoption of ADC solutions.

Opportunity: ADCs seize opportunities in digital transformation, IoT traffic management, and fortified application security

The increasing emphasis on digital transformation and cloud migration presents a ripe opportunity for ADC solutions to optimize application delivery in these evolving environments. As the Internet of Things (IoT) gains momentum, ADCs can capitalize on managing the diverse data traffic generated by interconnected devices. Moreover, the growing awareness of cybersecurity threats highlights the demand for ADCs with integrated security features like Web Application Firewalls to fortify applications against vulnerabilities. As businesses explore new avenues for expansion and innovation, ADCs stand ready to address challenges in application performance, security, and scalability, positioning themselves as pivotal enablers for enhanced user experiences in an interconnected digital ecosystem.

Challenge: Modern ADCs grapple with challenges of diverse application complexity, evolving cyber threats, and seamless integration with DevOps workflows

The complexity of modern applications, including microservices and hybrid cloud deployments, poses a challenge for ADCs to efficiently manage and optimize diverse traffic patterns. As cyber threats become more sophisticated, the need for robust security measures integrated within ADC solutions, such as Web Application Firewalls (WAFs), is paramount. Moreover, the rapid pace of technology advancements necessitates ADC solutions that can seamlessly integrate with DevOps processes to ensure continuous delivery. Balancing performance, security, and scalability while meeting the unique requirements of various industries also presents challenges. As organizations navigate these hurdles, the evolution of ADC solutions is crucial to address these complex challenges and deliver streamlined application experiences in a fast-paced digital environment.

Application Delivery Controller Market Ecosystem

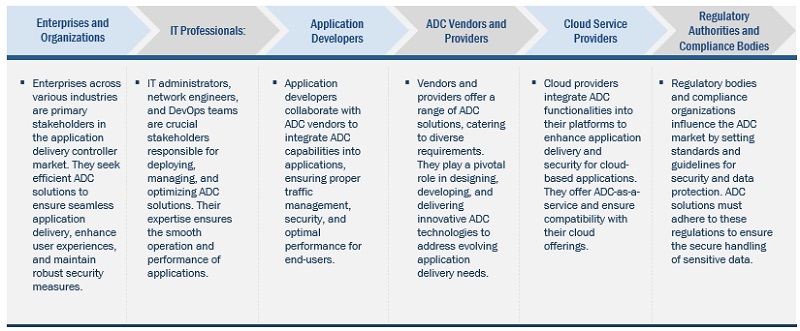

The major players in the application delivery controller market are F5 Networks, Citrix Systems, A10 Networks, Fortinet, Radware, and so on. The application delivery controller market is driven by prominent companies that have established themselves as leaders in the industry. These companies are well-established, financially stable, and have a proven track record of providing innovative solutions and services in application delivery controller. Their diverse product portfolio spans infrastructure, solutions, applications, and services, enabling them to cater to the market’s evolving needs. With state-of-the-art technologies and extensive capabilities, these companies are at the forefront of driving the advancement of application delivery controller technology.

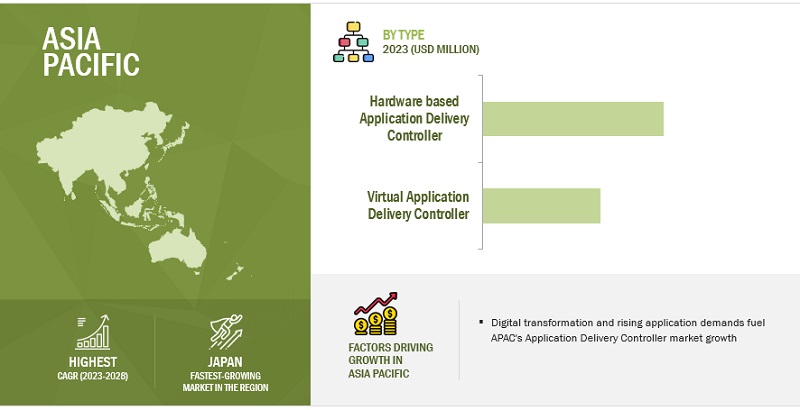

By type, the virtual application delivery controller has a higher CAGR in the application delivery controller market during the forecast period.

The virtual application delivery controller segment is poised to witness robust growth with a higher Compound Annual Growth Rate during the forecast period. This growth trajectory can be attributed to several factors driving the preference for virtual solutions. As organizations increasingly embrace cloud-native and hybrid environments, the flexibility and agility offered by virtual ADCs become highly advantageous. Virtual ADCs enable businesses to dynamically scale resources based on demand, making them well-suited for the evolving requirements of modern applications. The ease of deployment and cost-effectiveness associated with virtual solutions resonates with organizations seeking efficient ways to enhance their application delivery capabilities. The virtual application delivery controller's ability to seamlessly integrate with cloud platforms and accommodate evolving technology trends positions it as a pivotal solution for organizations striving to optimize application performance and security. As digital landscapes continue to evolve, the virtual ADC segment is positioned to leverage these advantages, driving its accelerated growth and influencing the overall trajectory of the application delivery controller market.

The BFSI vertical to hold a larger market size during the forecast period.

As the BFSI industry undergoes rapid digital transformation, the demand for seamless, secure, and high-performance application delivery is paramount. ADCs play a pivotal role in optimizing customer-facing applications such as online banking platforms and mobile apps, ensuring consistent performance even during peak usage. The robust security features offered by ADCs, including Web Application Firewalls (WAFs) and SSL offloading, align with the industry's stringent data protection and compliance requirements. The BFSI sector's increasing reliance on digital channels, fintech innovations, and data-driven analytics further amplifies the need for efficient and reliable application delivery. As the BFSI vertical continues to embrace technological advancements, ADCs play an instrumental role in supporting its digital evolution, enabling enhanced user experiences and ensuring the highest standards of security and performance.

Asia Pacific to grow at a higher CAGR during the forecast period.

As Asia Pacific experiences a surge in digital transformation and technology adoption, the demand for seamless application delivery and enhanced user experiences is on the rise. The region's burgeoning e-commerce sector, increasing mobile connectivity, and expanding digital services are contributing to the need for efficient ADC solutions that optimize performance and security. The dynamic growth of cloud computing, IoT technologies, and the shift towards hybrid and multi-cloud environments further accentuate the significance of ADCs in managing diverse data traffic and ensuring responsive application delivery. With organizations across Asia Pacific seeking to stay competitive in the digital age, ADCs provide the means to meet customer expectations while navigating the complexities of modern application landscapes. The Asia Pacific region is poised for accelerated ADC adoption, underscoring its pivotal role in driving market growth and technological advancement.

Key Market Players:

The major application delivery controller companies in this market are F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks(US), Kemp Technologies (US), Cloudflare (US), Broadcom Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

By type, service, organization size, and vertical |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks(US), Kemp Technologies (US), Cloudflare (US), Broadcom Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US) |

This research report categorizes the Application Delivery Controller Market to forecast revenues and analyze trends in each of the following submarkets:

Application Delivery Controller Market By Type:

- Hardware-based application delivery controller

- Virtual application delivery controller

Application Delivery Controller Industry By Service :

- Implementation and Integration

- Training, support, and maintenance

Application Delivery Controller Market By Organization Size:

- Large enterprises

- Small and Medium-sized Enterprises (SMEs)

Application Delivery Controller Industry By Vertical:

- BFSI

- IT and telecom

- Government and public sector

- Healthcare and life sciences

- Manufacturing

- Retail and consumer goods

- Energy and utilities

- Media and entertainment

- Others (education, travel, and hospitality)

Application Delivery Controller Market By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- Australia and New Zealand (ANZ)

- Japan

- China

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

-

MEA

- Kingdom of Saudi Arabia (KSA)

- South Africa

- United Arab Emirates (UAE)

- Rest of MEA

Recent Developments in Application Delivery Controller Market

- April 2023 - To provide security and resilience for hybrid cloud environments, A10 Networks unveiled a combined solution that combines the Thunder Application Delivery Controller (ADC) and the brand-new A10 Next-Generation Web Application Firewall (WAF).

- November 2021 - TD SYNNEX collaborated with Qualys, which enables TD SYNNEX resellers to have access to Qualys' cloud-based security and compliance solutions. It improves threat detection, lowers business compliance costs, and streamlines security operations. Qualys' presence is strengthened through this alliance and widens its access to the network of TD SYNNEX's partners.

- April 2021 - With Citrix's cloud-based digital workplace products, such as Citrix Virtual Apps and Citrix ADC, OneMain built flexible and hybrid work styles and acquired the agility to address continuously changing business requirements.

- March 2021 - In order to provide thorough protection on a single platform across all environments, Radware has announced that it has integrated extra application security into its Alteon series of Application Delivery Controllers (ADCs). A Web Application Firewall (WAF) to defend against web-based assaults, a Bot Manager to stop harmful automated threats, and Application Programming Interface (API) security to safeguard APIs and give full visibility on API-targeted threats are all included in Alteon's new Integrated Application security.

Frequently Asked Questions (FAQ):

What is an Application Delivery Controller (ADC)?

An application delivery controller is a specialized networking device or software solution that optimizes the delivery of web applications and services to end-users. It acts as an intermediary between clients (such as users' web browsers) and application servers, managing and distributing application traffic, ensuring efficient load balancing, enhancing security, and optimizing overall application performance. ADCs provide functionalities like traffic management, content compression, SSL offloading, caching, and application-level security features such as Web Application Firewalls (WAFs). By intelligently distributing and managing incoming traffic across multiple servers, ADCs enhance the availability, scalability, and reliability of applications, resulting in improved user experiences and streamlined IT operations.

What is the market size of the application delivery controller market?

The global application delivery controller market is estimated to be worth USD 3.9 billion in 2023 and is projected to reach USD 8.3 billion by 2028, at a CAGR of 16.4% during the forecast period.

What are the major drivers in the application delivery controller market?

The rapid pace of digital transformation, the proliferation of cloud-native architectures, and the growing complexity of modern applications are all driving the Application Delivery Controller (ADC) market. Organizations are seeking solutions that can ensure seamless application performance, optimize traffic distribution, and bolster security measures to meet the demands of a highly interconnected and dynamic digital landscape. Additionally, as remote work and online transactions become increasingly integral to business operations, ADCs play a crucial role in providing reliable and secure application experiences. These technological advancements and changing user behaviors are propelling the ADC market forward as organizations recognize the need for efficient, agile, and robust solutions to navigate the complexities of modern application delivery.

Who are the major players operating in the application delivery controller market?

The major players in the application delivery controller market are F5 Networks (US), Citrix Systems (US), A10 Networks (US), Fortinet (US), Radware (Israel), Barracuda Networks (US), Total Uptime (US), Array Networks(US), Kemp Technologies (US), Cloudflare (US), Broadcom Communication (US), Riverbed (Germany), Evanssion (UAE), NFWare (US), and Snapt (US).

Which key technology trends prevail in the application delivery controller market?

The rapid adoption of cloud-native architectures and the emergence of multi-cloud strategies are driving the need for ADC solutions that seamlessly handle application delivery across diverse cloud environments. The prevalence of microservices and containerization is challenging ADCs to dynamically manage traffic patterns within agile and distributed architectures. Security integration remains a critical trend, prompting ADCs to incorporate advanced security features such as Web Application Firewalls (WAFs) to safeguard against evolving cyber threats. ADCs are also aligning with DevOps practices, leveraging automation and APIs to integrate smoothly into continuous delivery pipelines. The rise of artificial intelligence and machine learning is enabling ADCs to optimize application performance by predicting and adapting to fluctuating traffic patterns. As edge computing gains traction, ADCs play a pivotal role in optimizing content delivery and reducing latency. These trends collectively underscore the evolving role of ADCs in ensuring seamless, secure, and high-performance application delivery in an increasingly interconnected digital landscape.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

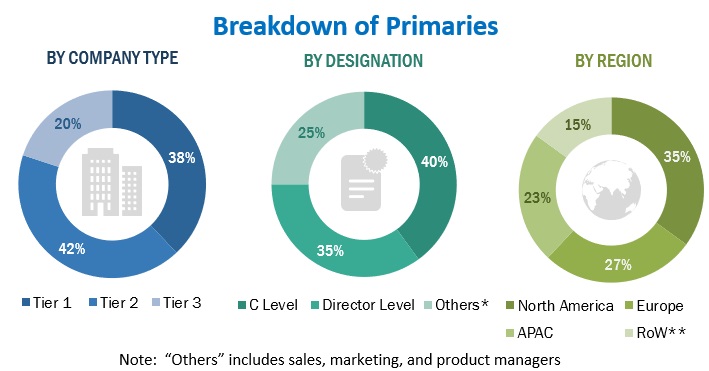

The research study involved four major activities in estimating the application delivery controller market size. Exhaustive secondary research has been done to collect important information about the market and peer markets. The next step has been to validate these findings, assumptions, and sizing with the help of primary research with industry experts across the value chain. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources were referred to identify and collect information for the study. These included journals, annual reports, press releases, investor presentations of companies and white papers, certified publications, and articles from recognized associations and government publishing sources. Secondary research was mainly used to obtain key information about industry insights, the market’s monetary chain, the overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the application delivery controller market. The primary sources from the demand side included consultants/specialists, Chief Information Officers (CIOs), and subject-matter experts.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

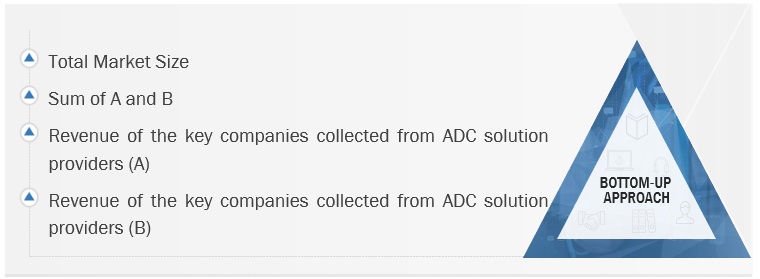

Multiple approaches were adopted to estimate and forecast the application delivery controller market. The first approach involved estimating the market size by summating companies’ revenue generated through application delivery controller solutions.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the application delivery controller market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach

Data Triangulation

The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

An application delivery controller is a specialized networking device or software solution that optimizes the delivery of web applications and services to end-users. It acts as an intermediary between clients (such as users' web browsers) and application servers, managing and distributing application traffic, ensuring efficient load balancing, enhancing security, and optimizing overall application performance. ADCs provide functionalities like traffic management, content compression, SSL offloading, caching, and application-level security features such as Web Application Firewalls. By intelligently distributing and managing incoming traffic across multiple servers, ADCs enhance the availability, scalability, and reliability of applications, resulting in improved user experiences and streamlined IT operations.

Key Stakeholders

- Application delivery controller vendors

- Managed service providers

- System integrators

- Consulting service providers

- Resellers and distributors

- Research organizations

- Enterprise users

- Technology providers

- Venture capitalists, private equity firms, and startup companies

The main objectives of this study are as follows:

- To define, describe, and forecast the application delivery controller market based on segments based on type, service, organization size, and vertical with regions covered.

- To forecast the size of the market segments with respect to five regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America.

- To provide detailed information on the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the global market.

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the global application delivery controller market.

- To profile the key market players, such as top and emerging vendors; provide a comparative analysis based on their business overviews, product offerings, and business strategies; and illustrate the market’s competitive landscape.

- To track and analyze competitive developments in the market, such as new product launches, product enhancements, partnerships, acquisitions, and agreements and collaborations.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Application Delivery Controller Market

Exhaustive coverage on the topic.

What is the future of software application delivery and open source application delivery?