Aptamers Market by Product Type (DNA, RNA, XNA), Technology (SELEX), Application (Therapeutics, Diagnostics, R&D), End Users (Pharmaceutical & Biotechnology Companies, Academic & Government Research Institutes, CROs) - Global Forecast to 2026

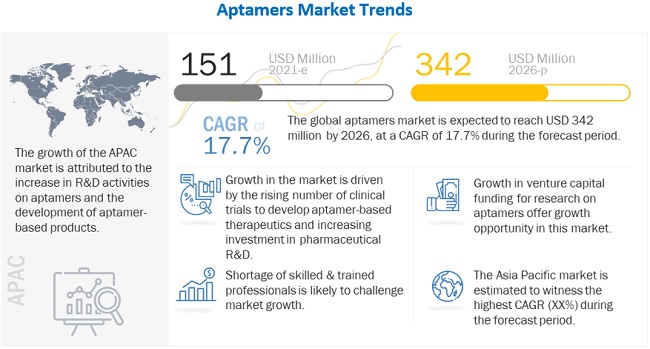

The global aptamers market in terms of revenue was estimated to be worth $151 million in 2021 and is poised to reach $342 million by 2026, growing at a CAGR of 17.7% from 2021 to 2026. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Growth of the market is attributed to factors such as increase in number of clinical trials for development of aptamer-based therapeutics, increase in awareness about advantages of aptamers as compared to antibodies, rising investment in pharmaceutical R&D, and rising prevalence of chronic and rare diseases to increase the demand for aptamer-based therapeutics and diagnostics. Growth in the venture capital funding for research on aptamers and growing collaborations with research institutes and pharmaceutical companies are also expected to offer a wide range of growth opportunities to players in the market. On the other hand, low market acceptance as compared to antibodies is likely to restrain the market growth while shortage of skilled & trained professionals may challenge market growth to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Aptamers Market Dynamics

Driver: Rising awareness of the advantages of aptamers over antibodies

While antibodies have certain limitations in targeting small molecules, aptamers perform better in targeting small molecules. They can bind to small molecules and dyes and thus be easily used in conventional diagnostic kits, extending their use to point-of-care diagnostics. This, in turn, will ensure a greater market value and increase in acceptance of aptamers in addressing both therapeutic and diagnostic applications. Also, aptamers can bind to large molecules. Nearly 98% of the molecules tend to be proteins, making it easier to discover biomarkers and diagnostic kits.

Antibodies are developed by raising an immune response in an animal model or recombinant DNA technology. On the other hand, aptamers can be synthesized using chemical methods which are less costly. Therefore, aptamers are more appealing for the development of new therapeutic drugs and diagnostic kits.

The blood-brain barrier has been a great challenge for antibody-based treatment for neurodegenerative disorders such as Alzheimer’s. Although technological developments have bridged the gap for this challenge, the effectiveness of antibodies against these disorders remains intact. Aptamers are short oligonucleotides that can diffuse across this blood-brain barrier and show potential in treating neurodegenerative disorders.

Furthermore, antibodies may cause an immunogenic response against the host, resulting in serious side-effects. In contrast, aptamers are non-immunogenic and much safer. Aptamers also offer various advantages such as lower cost of production, ease of designing & synthesis, and high efficiency. These factors make them relatively economical. The scale-up is also enormous and therefore shows significant potential in the development of therapeutics.

Restraint: Low market acceptance as compared to antibodies

One of the major drawbacks of aptamers is their low affinity. Even if aptamers can target a wide variety of molecules, studies have shown that they do not have high affinities for all types of molecules. The oligonucleotide structure of aptamers can limit certain interactions between the aptamer and the target molecule. Additionally, aptamers targets are mostly present in blood plasma or cells that are accessible from blood plasma. This leads to their exposure to renal filtration, nuclease degradation, or liver or spleen uptake. Hence, despite their advantages over antibodies, aptamers have low market acceptance and low adoption potential within the scientific society, which results in low market penetration. This is likely to restrain the growth of the market.

Opportunity: Growth in the venture capital funding for research on aptamers

Many aptamer development companies are identifying the potential of aptamers for use in therapeutic and diagnostic applications. These players are now focusing on securing funding from various investors to expand their offerings and strengthen their positions in the market. Therefore, increasing venture capital funding is projected to drive the growth of the market. SomaLogic, Inc. (US), Aptamer Group (UK), and Base Pair Technologies (IS) are striving to expand their capabilities in the market. Investor funding has enabled the companies to achieve their strategic goals. Recent funding activities include.

- In December 2020 — SomaLogic, Inc. (US) raised USD 81 million from leading life sciences investors Casdin Capital, Farallon Capital Management, and Foresite Capital. This will support the commercialization of the company’s products in clinical and life science markets.

- In November 2020, SomaLogic, Inc. (US) received funding of USD 121 million to support the expansion and commercialization of its proteomics platform serving the life science and clinical markets.

- In June 2018, Aptamer Group (UK) received USD 2.2 million from Meneldor, a biopharmaceutical investment company, and other overseas investors. These funds will be utilized to drive pre-clinical discovery programs involving the development of aptamer drug conjugates (ApDCs).

- In November 2017, Base Pair Biotechnologies, Inc. (US) received USD 3.2 million from investors such as Eventi Capital Partners Inc. (Canada) and BioTex, Inc. (US). This funding will be used to acquire new lab instruments and other technologies to help it expand its cellular and molecular analysis capabilities.

Challenge: Shortage of skilled & trained professionals

The development of aptamers and aptamer-based products requires skilled expertise. Also, modified forms of SELEX are needed to apply aptamers for various therapeutic and diagnostic purposes. These processes are highly technical and involve the use of various complex instruments and laboratory documentation systems. All these factors make aptamer development a tedious process and thus limit its uptake among researchers. Highly skilled and trained professionals are needed to carry out modifications; currently, there is a dearth of sufficient workforce in the market. Therefore, the shortage of professionals working in aptamer-related research is projected to restrain the market growth.

To know about the assumptions considered for the study, download the pdf brochure

The DNA-based aptamers segment will continue to dominate the aptamers industry during the forecast period

Based on type, the market is segmented into DNA aptamers, XNA aptamers, and RNA aptamers. The DNA-based aptamers segment dominated the market. The large share of this segment is attributed to their lower production cost and higher stability compared to other nucleic acid-based aptamers and the wide availability of DNA aptamers.

The others segment is estimated to grow at the highest CAGR in the aptamers industry, during the forecast period

Based on technology, the market is segmented into SELEX and other technologies. The SELEX technology segment dominated the market. The segment accounts for a large share of the global market as SELEX is one of the most widely used technologies. The other technologies segment is expected to register the highest CAGR during the forecast period due to the increasing focus on developing technologies for aptamer selection.

The therapeutics development segment will continue to dominate the aptamers industry during the forecast period

Based on the application, the market is segmented into therapeutics development, research & development, diagnostics, and other applications. The therapeutics development segment dominated the market due to the increasing number of clinical trials evaluating aptamers for new therapies and collaborations among aptamer companies & prominent pharmaceutical and biotechnology firms. The diagnostic segment is projected to grow at the highest CAGR due to the increasing prevalence of chronic diseases and the development of new diagnostic kits to detect cancer and other diseases.

Pharmaceutical & biotechnology companies are the largest end users of aptamers industry

Based on end user, the market is segmented into pharmaceutical companies & biotechnology companies, academic & government research institutes, contract research organizations, and other end users. Pharmaceutical & biotechnology companies dominated the market owing to the increasing number of market players offering custom aptamers for use in therapeutics development & rising R&D expenditure. The diagnostic segment will record the highest CAGR during the forecast period due to the development of diagnostic tools for cancer and infectious diseases.

Asia Pacific region to witness the highest growth in the aptamers industry during the forecast period

The market is segmented into five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. North America accounted for the largest share of this market. The largest share of North America is attributed to the availability of funds to develop innovative technologies, the presence of prominent market players, and growing collaborations among companies. The Asia Pacific market is estimated to record the highest CAGR during the forecast period. This is attributed to the rising R&D activities on aptamers, the development of aptamer-based products, and the rising focus on drug discovery and development.

Some of the key players operating in the aptamers market include Aptamer Group (UK), Raptamer Discovery Group (US), SomaLogic Inc. (US), Aptamer Sciences, Inc. (South Korea), Aptagen, LLC (US), Maravai Lifesciences (US), Kaneka Corporation (Japan), NeoVentures Biotechnology Inc. (Canada), Aptus Biotech (Spain), Base Pair Biotechnologies (US), AMSBIO (UK), Novaptech (France), Bio-Techne (US) among others.

Scope of the Aptamers Industry:

|

Report Metrics |

Details |

|

Market Revenue in 2021 |

$151 million |

|

Projected Revenue by 2026 |

$342 million |

|

Revenue Rate |

Poised to grow at a CAGR of 17.7% |

|

Market Driver |

Rising awareness of the advantages of aptamers over antibodies |

|

Market Opportunity |

Growth in the venture capital funding for research on aptamers |

The research report categorizes the aptamers market to forecast revenue and analyze trends in each of the following submarkets:

By Type

- DNA Aptamers

- XNA Aptamers

- RNA Aptamers

By Technology

- SELEX

- Others

By Application

- Therapeutics Development

- Research & Development

- Diagnostic

- Others

By End User

- Pharmaceutical & Biotechnology Companies

- Academic & Government Research Institutes

- CROs

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

-

APAC

- Japan

- China

- India

- Rest of APAC

-

Latin America

- Brazil

- Mexico

- RoLA

- Middle East and Africa

Recent Developments of Aptamers Industry

- In August 2021, Aptamer Group, Ltd. and BizCom Japan, Inc. entered into a distribution and marketing agreement to market Optimer discovery and development services in Japan.

- In August 2021, Aptamer Group entered a partnership with ProAxsis Limited. As per the partnership, Aptamer Group will develop validated Optimer ligands against critical targets for ProAxsis’s diagnostic assays

- In July 2021, Aptamer Sciences, Inc. was selected by the Korean government to support a non-clinical project for a new drug development project for COVID-19 treatment and vaccine and will receive a research grant of about USD 0.51 million for one year through this project.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the aptamers market?

The aptamers market boasts a total revenue value of $342 million by 2026.

What is the estimated growth rate (CAGR) of the aptamers market?

The global aptamers market has an estimated compound annual growth rate (CAGR) of 17.7% and a revenue size in the region of $151 million in 2021.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKET SCOPE

FIGURE 1 APTAMERS MARKET

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATION

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 3 APTAMERS MARKET: BREAKDOWN OF PRIMARIES

2.2 MARKET SIZE ESTIMATION

FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF APTAMERS IN THE MARKET

FIGURE 5 AVERAGE MARKET SIZE ESTIMATION, 2020

2.3 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

FIGURE 6 GLOBAL MARKET: CAGR PROJECTIONS, 2021–2026

FIGURE 7 GLOBAL MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION METHODOLOGY

2.5 INSIGHTS FROM PRIMARIES

FIGURE 10 MARKET VALIDATION FROM PRIMARY EXPERTS

2.6 RESEARCH ASSUMPTIONS

2.6.1 COVID-19-SPECIFIC ASSUMPTIONS

2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 11 APTAMERS MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 12 GLOBAL MARKET, BY TECHNOLOGY, 2021 VS. 2026 (USD MILLION)

FIGURE 13 GLOBAL MARKET, BY APPLICATION, 2021 VS. 2026 (USD MILLION)

FIGURE 14 GLOBAL MARKET, BY END USER, 2021 VS. 2026 (USD MILLION)

FIGURE 15 GEOGRAPHICAL SNAPSHOT: GLOBAL MARKET

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 APTAMERS MARKET OVERVIEW

FIGURE 16 INCREASING INVESTMENTS IN PHARMACEUTICAL R&D TO SUPPORT MARKET GROWTH

4.2 NORTH AMERICA: MARKET SHARE, BY TYPE & COUNTRY (2020)

FIGURE 17 DNA APTAMERS ACCOUNTED FOR THE LARGEST SHARE OF THE NORTH AMERICAN MARKET IN 2020

4.3 GLOBAL MARKET, BY TYPE, 2021 VS. 2026 (USD MILLION)

FIGURE 18 XNA APTAMERS SEGMENT WILL DOMINATE THE MARKET IN 2026

4.4 GLOBAL MARKET SHARE, BY END USER, 2020

FIGURE 19 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2020

4.5 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 20 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 49)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 21 APTAMERS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

TABLE 1 GLOBAL MARKET: IMPACT ANALYSIS

5.2.1 DRIVERS

5.2.1.1 Rising number of clinical trials to develop aptamer-based therapeutics

TABLE 2 LIST OF APTAMERS/APTAMER-BASED THERAPEUTICS IN PIPELINE

5.2.1.2 Rising awareness of the advantages of aptamers over antibodies

5.2.1.3 Investments in pharmaceutical R&D

FIGURE 22 INCREASE IN GLOBAL PHARMACEUTICAL R&D SPENDING, 2012–2026

TABLE 3 R&D SPENDING OF PROMINENT PHARMACEUTICAL COMPANIES IN 2019 & 2020 (USD BILLION

5.2.1.4 Rising prevalence of chronic and rare diseases

FIGURE 23 GLOBAL PREVALENCE OF CANCER, BY TYPE

5.2.2 RESTRAINTS

5.2.2.1 Low market acceptance as compared to antibodies

5.2.3 OPPORTUNITIES

5.2.3.1 Growth in the venture capital funding for research on aptamers

5.2.3.2 Growing collaborations with research institutes and pharmaceutical companies

5.2.4 CHALLENGES

5.2.4.1 Shortage of skilled & trained professionals

5.3 IMPACT OF COVID-19 OUTBREAK ON THE GLOBAL MARKET

FIGURE 24 GLOBAL MARKET SCENARIO WITH AND WITHOUT COVID-19 IMPACT, 2019-2021 (USD MILLION)

5.4 PIPELINE ANALYSIS

TABLE 4 THERAPEUTIC PIPELINE OF APTAMERS IN VARIOUS PHASES OF DRUG DEVELOPMENT

5.5 TECHNOLOGY ANALYSIS

5.6 PORTERS FIVE FORCES ANALYSIS

TABLE 5 PORTER’S FIVE FORCES ANALYSIS

5.6.1 THREAT OF NEW ENTRANTS

5.6.2 THREAT OF SUBSTITUTES

5.6.3 BARGAINING POWER OF SUPPLIERS

5.6.4 BARGAINING POWER OF BUYERS

5.6.5 INTENSITY OF COMPETITIVE RIVALRY

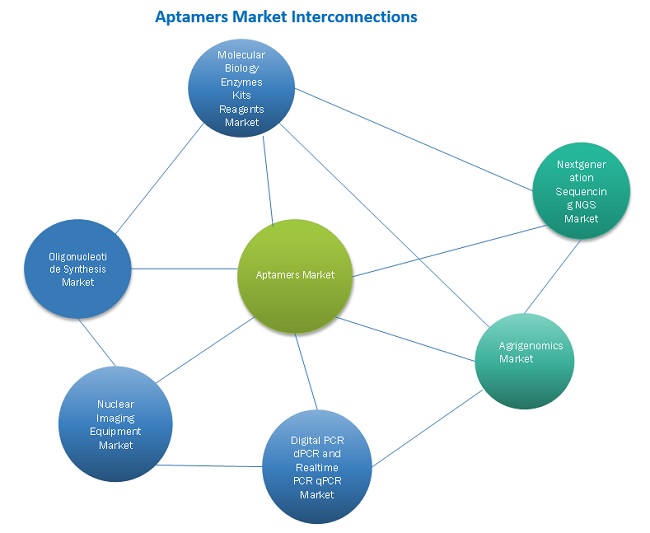

5.7 ECOSYSTEM ANALYSIS

FIGURE 25 GLOBAL MARKET: ECOSYSTEM ANALYSIS

5.8 VALUE CHAIN ANALYSIS

FIGURE 26 VALUE CHAIN: GLOBAL MARKET

5.9 PATENT ANALYSIS

5.9.1 PATENT PUBLICATION TRENDS

FIGURE 27 PATENT PUBLICATION TRENDS: 2010–2021

5.9.2 JURISDICTION ANALYSIS: TOP APPLICANTS (COUNTRIES) FOR APTAMER PATENTS

TABLE 6 JURISDICTION ANALYSIS: TOP APPLICANT COUNTRIES FOR APTAMER PATENTS

FIGURE 28 JURISDICTION ANALYSIS FOR THE US (2014–2021)

6 APTAMERS MARKET, BY TYPE (Page No. - 64)

6.1 INTRODUCTION

TABLE 7 GLOBAL MARKET, BY TYPE, 2019–2026 (USD MILLION)

6.2 DNA APTAMERS

6.2.1 INCREASING USE OF DNA APTAMERS AND THEIR WIDE AVAILABILITY BOOSTS SEGMENT GROWTH

TABLE 8 DNA APTAMERS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 9 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 10 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 11 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.3 XNA APTAMERS

6.3.1 FOCUS ON DEVELOPING NEXT-GENERATION APTAMERS FOR SPECIFIC TARGETS TO BOOST SEGMENT GROWTH

TABLE 12 XNA APTAMERS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 13 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 14 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 15 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

6.4 RNA APTAMERS

6.4.1 INCREASING RESEARCH ACTIVITIES FOR THE USE OF RNA APTAMERS BOOSTS SEGMENT GROWTH

TABLE 16 RNA APTAMERS MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 17 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 18 EUROPE: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 19 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7 APTAMERS MARKET, BY TECHNOLOGY (Page No. - 71)

7.1 INTRODUCTION

TABLE 20 GLOBAL MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

7.2 SELEX

7.2.1 SELEX IS THE MOST WIDELY USED TECHNOLOGY FOR APTAMERS SELECTION

TABLE 21 SELEX TECHNOLOGY MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 22 NORTH AMERICA: SELEX TECHNOLOGY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 23 EUROPE: SELEX TECHNOLOGY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 24 ASIA PACIFIC: SELEX TECHNOLOGY MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

7.3 OTHER TECHNOLOGIES

TABLE 25 OTHER TECHNOLOGIES MARKET, BY REGION, 2019–2026 (USD MILLION)

TABLE 26 NORTH AMERICA: OTHER TECHNOLOGIES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 27 EUROPE: OTHER TECHNOLOGIES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 28 ASIA PACIFIC: OTHER TECHNOLOGIES MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

8 APTAMERS MARKET, BY APPLICATION (Page No. - 76)

8.1 INTRODUCTION

TABLE 29 GLOBAL MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

8.2 THERAPEUTICS DEVELOPMENT

8.2.1 PROMINENT PLAYERS OFFERING SERVICES FOR THERAPEUTICS DEVELOPMENT TO BOOST THE MARKET GROWTH

TABLE 30 GLOBAL MARKET FOR THERAPEUTICS DEVELOPMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 31 NORTH AMERICA: MARKET FOR THERAPEUTICS DEVELOPMENT, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 32 EUROPE: MARKET FOR THERAPEUTICS DEVELOPMENT, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 33 ASIA PACIFIC: MARKET FOR THERAPEUTICS DEVELOPMENT, BY COUNTRY, 2019–2026 (USD MILLION)

8.3 RESEARCH & DEVELOPMENT

8.3.1 INCREASING AVAILABILITY OF APTAMERS FOR ACADEMIC RESEARCH TO DRIVE MARKET GROWTH

TABLE 34 GLOBAL MARKET FOR RESEARCH & DEVELOPMENT, BY REGION, 2019–2026 (USD MILLION)

TABLE 35 NORTH AMERICA: MARKET FOR RESEARCH & DEVELOPMENT, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 36 EUROPE: MARKET FOR RESEARCH & DEVELOPMENT, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 37 ASIA PACIFIC: MARKET FOR RESEARCH & DEVELOPMENT, BY COUNTRY, 2019–2026 (USD MILLION)

8.4 DIAGNOSTICS

8.4.1 THE INCREASING PREVALENCE OF DISEASES SUCH AS CANCER AND PRODUCT LAUNCHES ARE PROJECTED TO DRIVE THE SEGMENT GROWTH

TABLE 38 GLOBAL MARKET FOR DIAGNOSTICS, BY REGION, 2019–2026 (USD MILLION)

TABLE 39 NORTH AMERICA: MARKET FOR DIAGNOSTICS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 40 EUROPE: MARKET FOR DIAGNOSTICS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 41 ASIA PACIFIC: MARKET FOR DIAGNOSTICS, BY COUNTRY, 2019–2026 (USD MILLION)

8.5 OTHER APPLICATIONS

TABLE 42 GLOBAL MARKET FOR OTHER APPLICATIONS, BY REGION, 2019–2026 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 44 EUROPE: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 45 ASIA PACIFIC: MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2019–2026 (USD MILLION)

9 APTAMERS MARKET, BY END USER (Page No. - 85)

9.1 INTRODUCTION

TABLE 46 GLOBAL MARKET, BY END USER, 2019–2026 (USD MILLION)

9.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

9.2.1 PROMINENT PLAYERS OFFERING SERVICES FOR DRUG DEVELOPMENT TO DRIVE MARKET GROWTH

TABLE 47 GLOBAL MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY REGION, 2019–2026 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 49 EUROPE: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 50 ASIA PACIFIC: MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES, BY COUNTRY, 2019–2026 (USD MILLION)

9.3 ACADEMIC & GOVERNMENT RESEARCH INSTITUTES

9.3.1 COLLABORATIVE EFFORTS AMONG COMPANIES & RESEARCH INSTITUTES WILL DRIVE THE GROWTH OF THE MARKET

TABLE 51 GLOBAL MARKET FOR ACADEMIC & GOVERNMENT RESEARCH INSTITUTES, BY REGION, 2019–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET FOR ACADEMIC & GOVERNMENT RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 53 EUROPE: MARKET FOR ACADEMIC & GOVERNMENT RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 54 ASIA PACIFIC: MARKET FOR ACADEMIC & GOVERNMENT RESEARCH INSTITUTES, BY COUNTRY, 2019–2026 (USD MILLION)

9.4 CONTRACT RESEARCH ORGANIZATIONS

9.4.1 RESEARCH PARTNERSHIPS BETWEEN PHARMA PLAYERS AND CONTRACT ORGANIZATIONS DRIVE MARKET GROWTH

TABLE 55 GLOBAL MARKET FOR CROS, BY REGION, 2019–2026 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET FOR CROS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 57 EUROPE: MARKET FOR CROS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 58 ASIA PACIFIC: MARKET FOR CROS, BY COUNTRY, 2019–2026 (USD MILLION)

9.5 OTHER END USERS

TABLE 59 GLOBAL MARKET FOR OTHER END USERS, BY REGION, 2019–2026 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 62 ASIA PACIFIC: MARKET FOR OTHER END USERS, BY COUNTRY, 2019–2026 (USD MILLION)

10 APTAMERS MARKET, BY REGION (Page No. - 94)

10.1 INTRODUCTION

10.2 NORTH AMERICA

FIGURE 29 NORTH AMERICA: APTAMERS MARKET SNAPSHOT

TABLE 64 NORTH AMERICA: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 65 NORTH AMERICA: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.1 US

10.2.1.1 The US dominates the aptamers market

TABLE 69 US: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 70 US: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 71 US: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 72 US: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing government funding promotes market growth

TABLE 73 CANADA: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 74 CANADA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 75 CANADA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 76 CANADA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3 EUROPE

TABLE 77 EUROPE: APTAMERS MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.1 UK

10.3.1.1 Collaborative efforts for aptamer research and increasing investment in aptamers to drive market growth

TABLE 82 UK: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 83 UK: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 84 UK: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 85 UK: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.2 GERMANY

10.3.2.1 Germany has reported a significant increase in aptamer-related research

TABLE 86 GERMANY: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 87 GERMANY: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 88 GERMANY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 89 GERMANY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Rising investment in aptamer research to drive the market growth

TABLE 90 FRANCE: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 93 FRANCE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Growth of the life science and pharmaceutical industry to expand the market in Italy

TABLE 94 ITALY: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 95 ITALY: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 96 ITALY: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 97 ITALY: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Increased R&D funding in aptamer research to maximize market growth

TABLE 98 SPAIN: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 99 SPAIN: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 100 SPAIN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 101 SPAIN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 102 REST OF EUROPE: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 30 ASIA PACIFIC: APTAMERS MARKET SNAPSHOT

TABLE 106 ASIA PACIFIC: MARKET, BY COUNTRY, 2019–2026 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.1 CHINA

TABLE 111 CHINA: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 112 CHINA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 113 CHINA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 114 CHINA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.2 JAPAN

10.4.2.1 Collaborative efforts by market players will propel market growth in Japan

TABLE 115 JAPAN: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 116 JAPAN: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 117 JAPAN: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 118 JAPAN: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Government initiatives and increased disease burden to boost the market growth

TABLE 119 INDIA: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 120 INDIA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 121 INDIA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 122 INDIA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.4.4 ROAPAC

TABLE 123 ROAPAC: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 124 ROAPAC: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 125 ROAPAC: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 126 ROAPAC: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 INCREASE IN R&D EXPENDITURE TO SUPPORT THE MARKET GROWTH

TABLE 127 LATIN AMERICA: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 128 LATIN AMERICA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 129 LATIN AMERICA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 130 LATIN AMERICA: MARKET, BY END USER, 2019–2026 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 APTAMER RESEARCH AND INCREASING BURDEN OF CANCER TO PROMOTE MARKET GROWTH

TABLE 131 LUNG CANCER EPIDEMIOLOGY IN MIDDLE EAST COUNTRIES IN 2018

TABLE 132 MEA: APTAMERS MARKET, BY TYPE, 2019–2026 (USD MILLION)

TABLE 133 MEA: MARKET, BY TECHNOLOGY, 2019–2026 (USD MILLION)

TABLE 134 MEA: MARKET, BY APPLICATION, 2019–2026 (USD MILLION)

TABLE 135 MEA: MARKET, BY END USER, 2019–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 129)

11.1 INTRODUCTION

11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 31 APTAMERS MARKET: STRATEGIES ADOPTED

11.3 MARKET RANKING ANALYSIS

FIGURE 32 GLOBAL MARKET RANKING ANALYSIS, BY KEY PLAYER, 2020

11.4 COMPANY EVALUATION MATRIX

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVE PLAYERS

11.4.4 PARTICIPANTS

FIGURE 33 GLOBAL MARKET: COMPANY EVALUATION MATRIX, 2020

11.5 COMPETITIVE BENCHMARKING

11.5.1 COMPANY FOOTPRINT (10 COMPANIES)

FIGURE 34 COMPANY FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

11.5.2 COMPANY PRODUCT & SERVICE FOOTPRINT (10 COMPANIES)

TABLE 136 PRODUCT & SERVICE FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

11.5.3 COMPANY TECHNOLOGY FOOTPRINT (10 COMPANIES)

TABLE 137 TECHNOLOGY FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

11.5.4 COMPANY APPLICATION FOOTPRINT (10 COMPANIES)

TABLE 138 APPLICATION FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

11.5.5 COMPANY END-USER FOOTPRINT (10 COMPANIES)

TABLE 139 END-USER FOOTPRINT ANALYSIS OF KEY PLAYERS IN THE GLOBAL MARKET

11.6 COMPETITIVE SCENARIO AND TRENDS

11.6.1 PRODUCT & SERVICE LAUNCHES

TABLE 140 GLOBAL MARKET: PRODUCT & SERVICE LAUNCHES, JANUARY 2019–AUGUST 2021

11.6.2 DEALS

TABLE 141 GLOBAL MARKET: DEALS, JANUARY 2017–AUGUST 2021

12 COMPANY PROFILES (Page No. - 139)

12.1 KEY COMPANIES

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 APTAMER GROUP

TABLE 142 APTAMER GROUP: BUSINESS OVERVIEW

TABLE 143 APTAMER GROUP: PRODUCT/SERVICE OFFERINGS

TABLE 144 APTAMER GROUP: DEALS

12.1.2 RAPTAMER DISCOVERY GROUP

TABLE 145 RAPTAMER DISCOVERY GROUP: BUSINESS OVERVIEW

TABLE 146 RAPTAMER DISCOVERY GROUP: PRODUCT OFFERINGS

12.1.3 SOMALOGIC, INC.

TABLE 147 SOMALOGIC, INC.: BUSINESS OVERVIEW

TABLE 148 SOMALOGIC, INC.: PRODUCT OFFERINGS

TABLE 149 SOMALOGIC, INC.: PRODUCT LAUNCHES

TABLE 150 SOMALOGIC, INC.: DEALS

TABLE 151 SOMALOGIC, INC.: OTHER DEVELOPMENTS

12.1.4 APTAMER SCIENCES, INC.

TABLE 152 APTAMER SCIENCES, INC.: BUSINESS OVERVIEW

FIGURE 35 APTAMER SCIENCES, INC.: COMPANY SNAPSHOT

TABLE 153 APTAMER SCIENCES, INC.: PRODUCT/SERVICE OFFERINGS

TABLE 154 APTAMER SCIENCES, INC.: PRODUCT APPROVALS

TABLE 155 APTAMER SCIENCES, INC.: DEALS

12.1.5 APTAGEN, LLC

TABLE 156 APTAGEN, LLC: BUSINESS OVERVIEW

TABLE 157 APTAGEN, LLC: PRODUCT/SERVICE OFFERINGS

TABLE 158 APTAGEN, LLC: DEALS

12.1.6 MARAVAI LIFESCIENCES

TABLE 159 MARAVAI LIFESCIENCES: BUSINESS OVERVIEW

FIGURE 36 MARAVAI LIFESCIENCES: COMPANY SNAPSHOT

TABLE 160 MARAVAI LIFESCIENCES: SERVICE OFFERINGS

12.1.7 KANEKA CORPORATION

TABLE 161 KANEKA CORPORATION: BUSINESS OVERVIEW

FIGURE 37 KANEKA CORPORATION: COMPANY SNAPSHOT

TABLE 162 KANEKA CORPORATION: SERVICE OFFERINGS

12.1.8 NEOVENTURES BIOTECHNOLOGY INC.

TABLE 163 NEOVENTURES BIOTECHNOLOGY INC.: BUSINESS OVERVIEW

TABLE 164 NEOVENTURES BIOTECHNOLOGY INC.: PRODUCT/SERVICE OFFERINGS

12.1.9 APTUS BIOTECH

TABLE 165 APTUS BIOTECH: BUSINESS OVERVIEW

TABLE 166 APTUS BIOTECH: PRODUCT/SERVICE OFFERINGS

12.1.10 BASE PAIR BIOTECHNOLOGIES

TABLE 167 BASE PAIR BIOTECHNOLOGIES: BUSINESS OVERVIEW

TABLE 168 BASE PAIR BIOTECHNOLOGIES: PRODUCT/SERVICE OFFERINGS

TABLE 169 BASE PAIR BIOTECHNOLOGIES: OTHER DEVELOPMENTS

12.1.11 AMSBIO

TABLE 170 AMSBIO: BUSINESS OVERVIEW

TABLE 171 AMSBIO: PRODUCT/SERVICE OFFERINGS

12.1.12 NOVAPTECH

TABLE 172 NOVAPTECH: BUSINESS OVERVIEW

TABLE 173 NOVAPTECH: SERVICE OFFERINGS

TABLE 174 NOVAPTECH: DEALS

12.1.13 BIO-TECHNE

TABLE 175 BIO-TECHNE: BUSINESS OVERVIEW

FIGURE 38 BIO-TECHNE: COMPANY SNAPSHOT

TABLE 176 BIO-TECHNE: PRODUCT OFFERINGS

12.1.14 APTITUDE MEDICAL SYSTEMS

TABLE 177 APTITUDE MEDICAL SYSTEMS: BUSINESS OVERVIEW

TABLE 178 APTITUDE MEDICAL SYSTEMS: PRODUCT OFFERINGS

TABLE 179 APTITUDE MEDICAL SYSTEMS: DEALS

12.1.15 RAYBIOTECH, INC.

TABLE 180 RAYBIOTECH, INC.: BUSINESS OVERVIEW

TABLE 181 RAYBIOTECH, INC.: PRODUCT/SERVICE OFFERINGS

12.1.16 ALPHA DIAGNOSTIC INTERNATIONAL, INC.

TABLE 182 ALPHA DIAGNOSTIC INTERNATIONAL, INC.: BUSINESS OVERVIEW

TABLE 183 ALPHA DIAGNOSTIC INTERNATIONAL, INC.: PRODUCT OFFERINGS

12.1.17 CREATIVE BIOLABS

TABLE 184 CREATIVE BIOLABS: BUSINESS OVERVIEW

TABLE 185 CREATIVE BIOLABS: PRODUCT/SERVICE OFFERINGS

12.1.18 CREATIVE BIOGENE

TABLE 186 CREATIVE BIOGENE: BUSINESS OVERVIEW

TABLE 187 CREATIVE BIOGENE: PRODUCT/SERVICE OFFERINGS

12.1.19 VIVONICS INC.

TABLE 188 VIVONICS INC: BUSINESS OVERVIEW

TABLE 189 VIVONICS INC: PRODUCT/SERVICE OFFERINGS

12.1.20 IBA LIFESCIENCES GMBH

TABLE 190 IBA LIFESCIENCES GMBH: BUSINESS OVERVIEW

TABLE 191 IBA LIFESCIENCES GMBH: PRODUCT/SERVICE OFFERINGS

12.2 OTHER PLAYERS

12.2.1 APTABHARAT INNOVATIONS PVT. LTD

TABLE 192 APTABHARAT INNOVATIONS: COMPANY OVERVIEW

12.2.2 PROFACGEN

TABLE 193 PROFACGEN: COMPANY OVERVIEW

12.2.3 MEDIVEN

TABLE 194 MEDIVEN: COMPANY OVERVIEW

12.2.4 PURE BIOLOGICS SA

TABLE 195 PURE BIOLOGICS SA: COMPANY OVERVIEW

12.2.5 OAK BIOSCIENCES, INC.

TABLE 196 OAK BIOSCIENCES, INC.: COMPANY OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 177)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 AVAILABLE CUSTOMIZATIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities for estimating the current size of the global aptamers market. Exhaustive secondary research was conducted to collect information on the market as well as its peer and parent markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both the top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

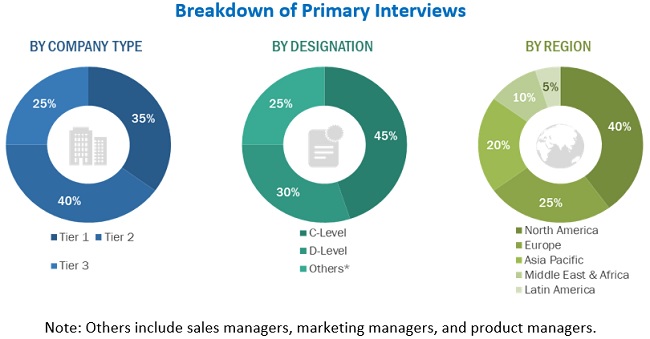

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the aptamers market. Primary sources from the demand side include experts from hospitals and diagnostic labs and research and academic laboratories. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size was arrived at after data triangulation from three different approaches. After completing each approach, the weighted average of the three approaches was taken based on each approach’s level of assumptions.

Approach 1: Revenue Share Analysis (Bottom-Up Approach)

- Revenues for individual companies were gathered from public sources and databases.

- The aptamers business shares of leading players were gathered from secondary sources to the extent available. In certain cases, the shares of product & services businesses were ascertained through a detailed analysis of various parameters, including product portfolios and market positioning.

- Individual shares or revenue estimates were validated through expert interviews.

Approach 2: Top-Down Approach

- The aptamers market was identified.

- Shares of related segments in the parent market were derived through primary sources.

- Market sizes of regional segments were determined.

- Shares of country-level segmentation were identified in the aptamers market.

Approach 3: Secondary Data

- The size of the aptamers market was obtained from secondary sources.

- The shares of various segments in the overall market were obtained from secondary data and validated through primary participants to arrive at the total aptamers market.

- Primary participants further validated the numbers.

Approach 4: MnM Repository Analysis

- For this report, the previous version of the aptamers market and reports on the oligonucleotide synthesis market were considered. The global and regional market values of aptamers and dependent submarkets were extracted from the MnM repository and validated through secondary and primary research. The final global market size was triangulated through the average of all approaches and validated through primary interviews with industry experts.

Approach 5: Primary Interviews

- As part of the primary research process, individual respondents were interviewed for insights into market size and growth.

- All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the aptamers market based on type, technology, application, end user, and region

- To provide detailed information regarding the major factors influencing market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five major regions, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East and Africa

- To profile key market players and comprehensively analyze their product portfolios, market shares, and core competencies

- To track and analyze competitive developments, such as product launches, expansions, acquisitions, agreements, and collaborations in the aptamers market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographical Analysis

- Further Breakdown Of The Roe Market, By Country

- Further Breakdown Of The Roapac Market, By Country

- Further Breakdown Of The Latin American And Mea Markets, By Country

Company Information

- Detailed Analysis And Profiling Of Additional Market Players (Up To Five)

Segment Analysis

- Further breakdown of the market, by therapeutic area, as per the product & service portfolio of prominent players in the market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Aptamers Market