AI Sensor Market with Recession Impact by Sensor Type (Motion, Pressure, Temperature, Optical, Position), Application (Automotive, Consumer Electronics, Manufacturing), Type, Technology (NLP, ML, Computer Vision) and Region - Global Forecast to 2028

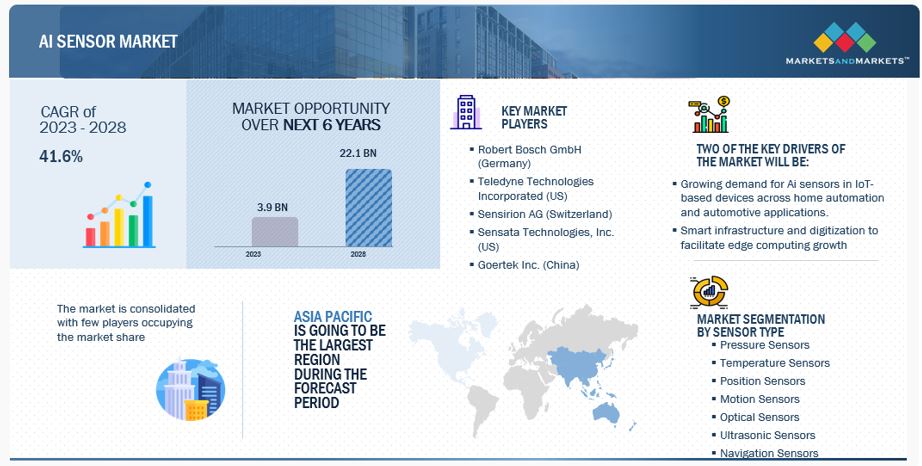

[227 Pages Report] The AI sensor market is projected to reach USD 22.1 billion by 2028, from USD 3.0 billion in 2022, at a CAGR of 41.6%. Factors such as the high installation and maintenance cost, lack of trust and awareness among end users, and complexity in data storage act as restraints for the growth of the market.

AI Sensor Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Market Dynamics

Smart infrastructure and digitalization to facilitate edge computing growth.

Rapid urbanization and digitalization significantly impact the growth of smart infrastructure. Edge computing is a critical technology increasingly used in smart infrastructure. It enables real-time data processing and analysis from smart sensors and other IoT devices. By processing data near the source, edge computing can reduce latency, increase reliability, and improve overall system performance. Smart infrastructure utilizes data and technology to optimize the performance of buildings, transportation systems, energy networks, and other essential infrastructure. With the help of smart sensors, IoT devices, and other digital tools, smart infrastructure can manage and monitor anything from traffic patterns to energy usage, enabling cities to make more informed decisions and provide better services to their residents.

The increasing urban population and rapid urbanization have increased the demand for more sustainable and efficient infrastructure solutions. Over 50% of the world’s population lives in urban areas. This is expected to grow by 1.5 times by 2045, which means nearly 75% of the global population will live in urban areas. This, in turn, will push the upgradation of manufacturing processes by implementing industry 4.0 norms that require AI sensors for operations. Furthermore, the development of smart cities, smart automotive, smart traffic systems, smart homes, smart factories, and smart transport systems depend on AI and IoT technologies and cannot be attained without AI sensors.

Restraint: High installation and maintenance cost

Cost plays a critical role in determining the growth of the AI sensor market. The huge capital requirement for the deployment and maintenance of integrated AI sensors can pose challenges for market players. Furthermore, additional expenditure on AI sensor software solutions, related software compatibility compliances, and software maintenance services make the deployment of AI sensors costly, limiting the adoption of these sensors. Artificial intelligence is still under development in some sectors as it cannot be applied to specific applications due to technical and implementation constraints. This, along with the high cost of ownership, may limit the growth of this market. End users also tend to be slightly more skeptical about the cost benefits of AI sensors across emerging use cases.

Opportunity: Growing preference for AI-sensor enabled wearables

Wearables based on AI sensors form one of the fastest-growing markets. Smartwatches and ear-worn devices are the leading market segments. This market is projected to account for USD 265.4 billion by 2026, registering a CAGR of 18.0% during the forecast period. Spending on hearables increased by 124% in 2020, and global shipments of wearable technology reached 570 million units in 2021 at a CAGR of 16.6% (Source: MarketsandMarkets). This growing preference for wearables will likely boost the market for AI sensors. The adoption of wearables is growing rapidly as users increasingly focus on improving their overall health and fitness, driving the demand for fitness and medical tracking equipment. This, in turn, drives the demand for AI sensors. These sensors are used in applications such as smart glasses/goggles; ring/fingerworn scanners; footwear such as athletic, fitness, and sports shoes; wristwear such as advanced electronic watches and wristbands; smart textiles; and headbands & neckwear. Bosch Sensortec (Germany) has started actively working on the wearable technology market. Bosch Sensortec has developed a revolutionary self-learning motion sensor, BHI260AP, that adds AI to portable devices. The sensor enables manufacturers of wearable and hearable devices to provide personalized fitness tracking through self-learning AI software in the sensor. This self-learning AI sensor will change how users interact with their fitness devices from a one-way approach to an interactive way of training.

Challenges: Lack of skilled workforce

The AI sensor market is growing rapidly, and there is a significant shortage of trained professionals with the skills and expertise necessary to develop and maintain AI sensor systems. This shortage of skilled workforce is a major challenge for companies operating in this market and can limit their ability to innovate and compete effectively. One of the main reasons for this shortage is the relatively new nature of the field, due to which few educational programs and training opportunities are available for those interested in pursuing careers in AI sensors. Additionally, the complexity of these systems requires a broad range of skills, including expertise in cognitive computing, machine learning, deep learning, image recognition technologies, data analytics, computer vision, and signal processing. Integrating AI solutions into existing systems requires extensive data processing to replicate the behavior of a human brain. Even minor errors can result in system failure or malfunctioning of a solution, affecting outcomes and desired results. This can make it difficult for companies to find individuals with the necessary skillsets to fill these roles.

AI sensor market Map:

Motion sensors in consumer electronics application to account for largest market share during forecast period.

Motion sensors are primarily used across consumer electronics applications. Major use cases for motion sensors lie across wearable electronic devices. Motion sensors, such as accelerometers, gyroscopes, MEMS, and a combination of these sensors, are the most used type of sensors incorporated in wearables. The market for these sensors is expected to grow due to consumers' increased focus on tracking real-time motion-sensing activities, such as step counting and walking distance covered. This generated data analysis provides users with specific results that can be used to define health and fitness goals.

Consumer electronics to account for second-largest market share of the AI sensor market during forecast period.

The consumer electronics segment is expected to hold the second-largest market share during the forecast period. Artificial intelligence has become pivotal in consumer electronics. Mobile devices, smart TVs, speakers, virtual personal assistants, and distributed and wearable sensors are among the many products and services benefiting from AI developments. With rapid urbanization and the rising use of the internet, consumer lifestyles are evolving, leading to changes in preferences. The growing inclination towards smart and intelligent devices has led to consumer electronics market growth at a fast rate. Moreover, the availability of low-cost AI chipsets also boosts the adoption of intelligent devices across the consumer electronics sector.

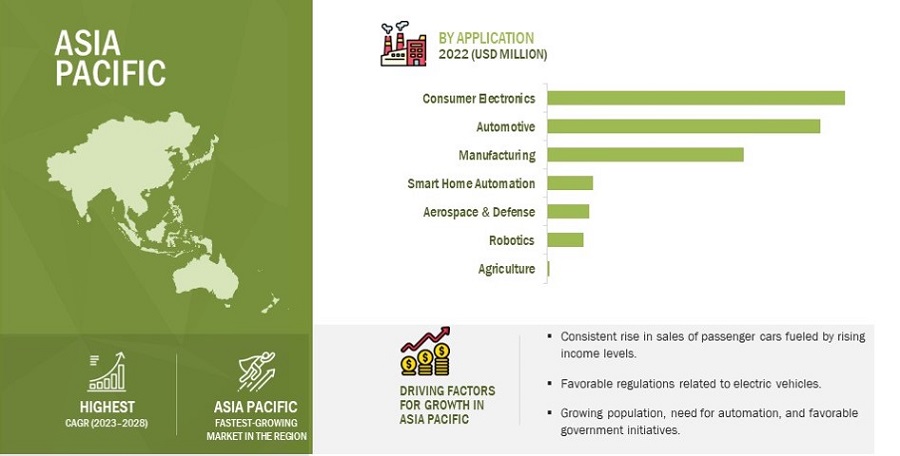

Asia Pacific to have the largest market share in the AI sensor market during the forecast period.

The Asia Pacific region is the market leader for AI sensors in various industries such as consumer electronics, automotive, and manufacturing sectors, with a huge demand coming from countries like China, Japan, and India. China has shown massive growth due to its rapidly expanding industrial sector and increasing adoption of smart home devices.

Japan is also expected to see a high growth in the AI sensor industry, driven by the country's strong focus on AI research and development. The Japanese government has launched several initiatives to promote the adoption of AI technology in various sectors, including healthcare, manufacturing, and transportation.

AI Sensor Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Robert Bosch GmbH (Germany), Teledyne Technologies Incorporated (US), Sensirion AG (Switzerland), Sensata Technologies, Inc. (US), Goertek Inc. (China), Hokuriku Electric Industry Co., Ltd. (Japan), MEMSIC Semiconductor Co., Ltd. (China), Movella Inc. (US), and Senodia Technologies (Shanghai) Co., Ltd. (China) are some AI sensor companies operating in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

| Estimated Market Size | USD 3.0 Billion |

| Projected Market Size | USD 22.1 Billion |

| Growth Rate | 41.6% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Million |

|

Segments covered |

Type, sensor type, technology, application, and Region. |

|

Regions covered |

North America, Asia Pacific, Europe, and RoW |

|

Companies covered |

Teledyne Technologies Incorporated (US), Robert Bosch GmbH (Germany), Goertek Inc. (China), Baidu, Inc. (China), Yokogawa Electric Corporation (Japan), Excelitas Technologies Corp. (US) Hokuriku Electric Industry Co., Ltd. (Japan), Sensata Technologies, Inc. (US), (China), Sensirion AG (Switzerland), Sensortek Technology Corporation (Taiwan), Silicon Sensing Systems Limited (UK), Sony Corporation (Japan), MEMSIC Semiconductor Co., Ltd. (China), Movella Inc. (US), Senodia Technologies (Shanghai) Co., Ltd., STMicroelectronics N.V. (Switzerland), Syntiant Corp. (US), TE Connectivity (US), Alif Semiconductor (US), and Augury (US) are among the key players operating in the AI sensor market. |

AI Sensor Market Highlights

This research report categorizes the AI sensor market based on Type, Sensor Type, Technology, Application, and Region

|

Segment |

Subsegment |

|

AI Sensor Market, By Type |

|

|

AI Sensor Market, By Sensor Type |

|

|

AI Sensor Market, By Technology |

|

|

AI Sensor Market, By Application |

|

|

AI Sensor Market, By Region |

|

Recent Developments

- In April 2022, Robert Bosch GmbH acquired Five AI (France), which builds self-driving software components and development platforms to combat the biggest problems in the self-driving car space. This acquisition helped Robert Bosch GmbH boost its presence in the smart mobility solutions and autonomous vehicles markets.

- In May 2022, Sensata Technologies, Inc. partnered with Nanoprecise (Canada) to launch a new asset monitoring solution that enables predictive maintenance for rotary assets. This partnership will deliver actionable insights to plant managers with the help of Nanoprecise’s AI algorithm, which can extract data from the six sensors offered by the Sensata IQ platform.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the AI sensor market?

The product launch, acquisition and collaboration has been and continues to be some of the major strategies adopted by the key players to grow in the AI sensor market.

What region dominates the AI sensor market?

Asia Pacific region will dominate AI sensor market.

What application dominates the AI sensor market?

Automotive applications are expected to dominate the AI sensor market.

Which sensor in by sensor type segment dominates AI sensor market?

Motion sensor is expected to have the largest market size during the forecast period.

Who are the major companies in the AI sensor market?

Robert Bosch GmbH (Germany), Teledyne Technologies Incorporated (US), Sensirion AG (Switzerland), Sensata Technologies, Inc. (US) and Goertek Inc.(China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

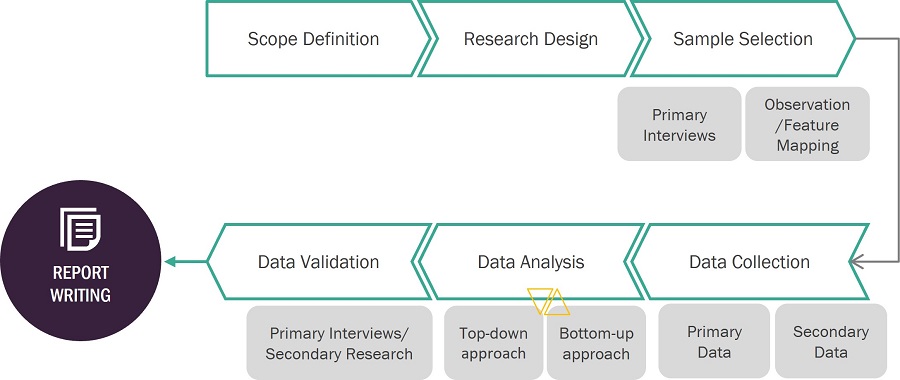

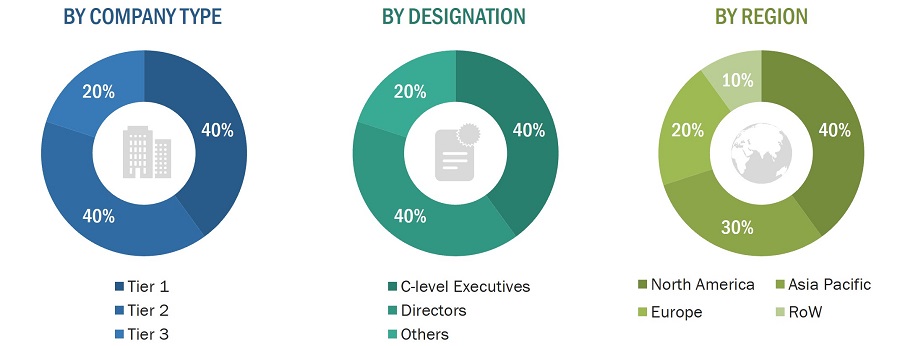

The study involved four major activities in estimating the current size of the AI sensor market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include sensor technology journals and magazines, annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the AI sensor market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

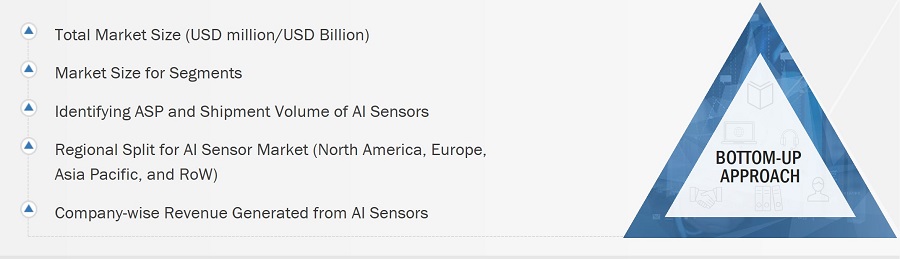

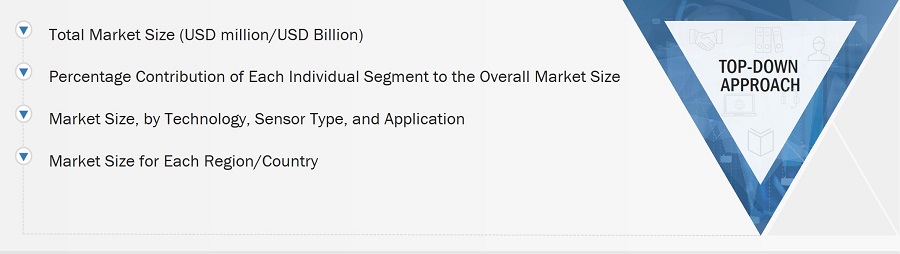

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the AI sensor market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Ai Sensor Market: Bottom-Up Approach

Ai Sensor Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Market Definition

An AI sensor is a smart sensor equipped with artificial intelligence capabilities, such as machine learning algorithms or neural networks, to analyze and interpret data in a sophisticated and intelligent way. AI sensors can learn from the data they collect and make decisions based on that learning. This study aims to determine the total addressable market and high-growth opportunities for AI sensors.

Key Stakeholders

- Raw Material Suppliers

- Component Manufacturers and Providers

- Sensor Manufacturers and Providers

- Original Equipment Manufacturers (OEMs)

- Technology Solution Providers

- Application Providers

- System Integrators

- Middleware Providers

- Assembly, Testing, and Packaging Vendors

- Market Research and Consulting Firms

- Associations, Organizations, Forums, and Alliances Related to the Smart Sensor Industry

- Technology Investors

- Governments, Regulatory Bodies, and Financial Institutions

- Venture Capitalists, Private Equity Firms, and Startups

- End Users

Report Objectives

The following are the primary objectives of the study.

- To describe and forecast the size of the AI sensor market, in terms of value, by sensor type, technology, and application

- To describe and forecast the size of the AI sensor market, in terms of volume, by sensor type

- To describe and forecast the size of the AI sensor market across four key regions, namely North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their country-level markets, in terms of value

- To provide information on drivers, restraints, opportunities, and challenges pertaining to the AI sensor market

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and their contribution to the AI sensor market

- To map competitive intelligence based on company profiles, key player strategies, and key developments

- To provide a detailed overview of the AI sensor value chain and ecosystem

- To provide information about key technology trends and patents related to the AI sensor market

- To provide information on trade data related to the AI sensor market

- To analyze opportunities for stakeholders by identifying high-growth segments of the AI sensor market

- To benchmark market players using the proprietary company evaluation matrix framework, which analyzes them on various parameters within the broad categories of market ranking/share and product portfolio

- To analyze competitive developments such as contracts, acquisitions, product launches, collaborations, and partnerships, along with research and development, in the AI sensor market

- To analyze the impact of the recession on the growth of the AI sensor market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AI Sensor Market