Artificial Intelligence (AI) in Healthcare Market by Offering (Hardware, Software, Services), Technology (Machine Learning, Natural Language Processing), Application (Medical Imaging & Diagnostics, Patient Data & Risk Analysis), End User & Region - Global Forecast to 2029

Updated on : March 19, 2024

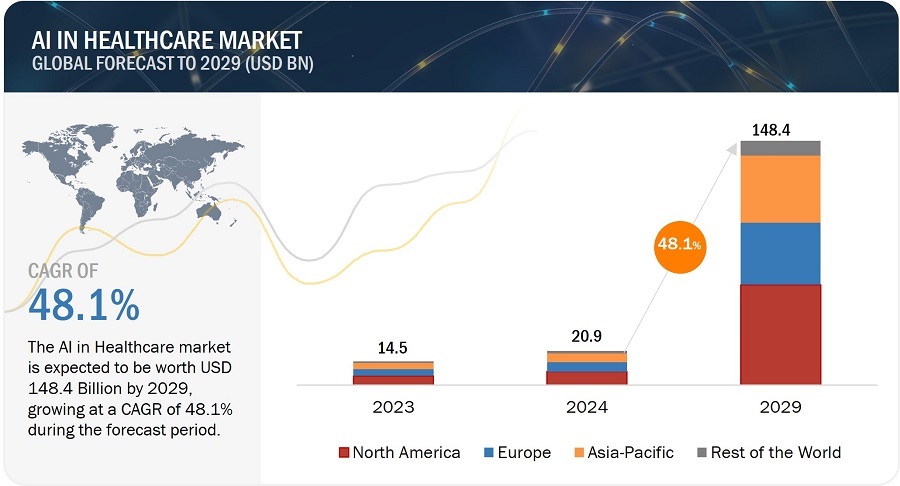

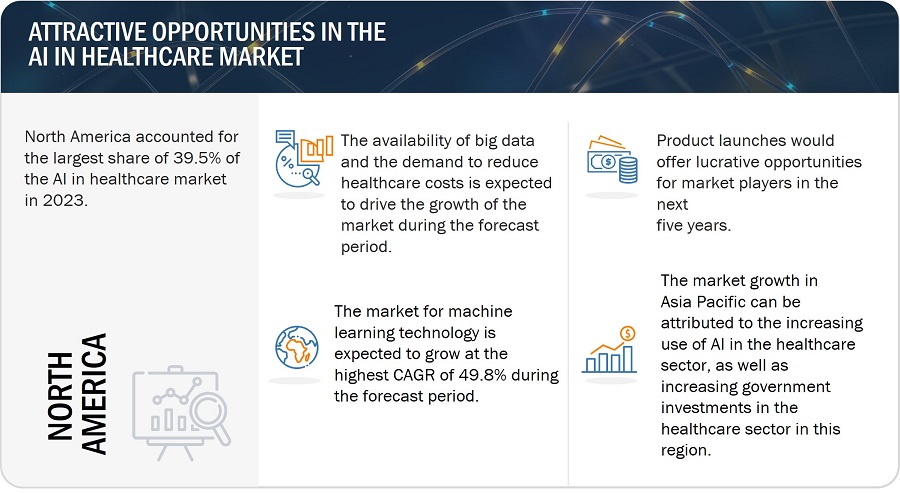

The global AI in Healthcare market size was valued at USD 20.9 billion in 2024 and is estimated to reach USD 148.4 billion by 2029, registering a CAGR of 48.1% during the forecast period. The growth of AI in the healthcare market is driven by the generation of large and complex healthcare datasets, the pressing need to reduce healthcare costs, improving computing power and declining hardware costs, and the rising number of partnerships and collaborations among different domains in the healthcare sector, and growing need for improvised healthcare services due to imbalance between healthcare workforce and patients.

Artificial Intelligence (AI) in Healthcare Market Statistics Forecast to 2029

To know about the assumptions considered for the study, Request for Free Sample Report

AI in Healthcare Market Dynamics:

Driver: Generation of large and complex healthcare datasets

Generating extensive and intricate healthcare datasets is a pivotal driver for AI in the healthcare Market. Advanced technologies enable the accumulation of diverse patient information, from medical records to genomic data. This abundance of data catalyzes AI applications, facilitating the identification of patterns and insights crucial for diagnostics, personalized medicine, and treatment planning. Integrating big data analytics and AI promises to revolutionize healthcare processes, enhancing accuracy and efficiency. In the coming years, the impact of this data-driven approach is expected to be high, ushering in a transformative era in healthcare delivery with improved patient outcomes and streamlined operations.

Restraint: Reluctance among medical practitioners to adopt AI-based technologies.

Stemming from concerns about job displacement, skepticism regarding AI system reliability, and unease over integration into established practices, this reluctance impedes the market's growth. Addressing the challenge requires significant investments in training, contributing to a learning curve that discourages healthcare professionals. Overcoming this obstacle necessitates focused initiatives that underscore education and foster collaboration between technology developers and healthcare institutions. Such efforts are crucial for fostering understanding and acceptance, enabling the realization of AI's potential in healthcare, including enhanced diagnostics, improved treatment plans, and ultimately superior patient outcomes.

Opportunities: The growing potential of AI-based tools for elderly care

Factors such as increased life expectancy, shifting demographics, and challenges in traditional caregiving contribute to the growing potential of AI in elderly care. AI holds the transformative potential to enhance elderly care, ensuring effective and affordable solutions. Through continuous health monitoring, AI facilitates early detection of health issues, while fall detection algorithms improve safety. AI-driven medication management ensures adherence to treatment plans, and personalized care plans optimize interventions based on individual health data. Cognitive assistance and social interaction facilitated by AI contribute to mental well-being, particularly for seniors with conditions like dementia. The integration of companion robots and virtual assistants addresses loneliness.

Moreover, AI streamlines routine tasks, improving resource allocation in healthcare settings and enhancing cost efficiency. AI in elderly care represents a paradigm shift, offering proactive, personalized, and cost-effective solutions to ensure the well-being of the aging population. AI opens opportunities for more effective applications in healthcare, such as predictive analytics for disease outbreaks, personalized treatment plans based on genetic profiles, and advanced diagnostic tools that improve accuracy and speed in identifying medical conditions.

Challenge: Lack of curated healthcare data

The profound potential of AI in healthcare faces a substantial impediment – the scarcity of curated healthcare data. This bottleneck hampers AI performance, leading to inaccurate predictions and potential patient harm. Data fragmentation, privacy concerns, high costs, and expertise barriers exacerbate the challenge. For instance, in November 2023, the World Health Organization (WHO) released guidelines outlining essential regulatory considerations for applying artificial intelligence (AI) in healthcare. Emphasizing safety, efficacy, and collaboration, the document addresses risks related to AI's use of health data, advocating for robust legal and regulatory frameworks to ensure privacy and security. The guidelines highlight six critical areas for regulating AI in healthcare: transparency, risk management, external validation of data, commitment to data quality, addressing complex regulations like GDPR and HIPAA, and encouraging collaboration among stakeholders. Proposed solutions encompass standardization initiatives, public-private partnerships for responsible data sharing, synthetic data generation, and AI-powered curation tools to streamline the process. Overcoming this obstacle requires proactive measures like data standardization, collaboration, and technological advancements. Addressing specific healthcare sub-areas, exploring ethical considerations, and analyzing regulatory roles will further enrich the understanding and advancement of AI in healthcare.

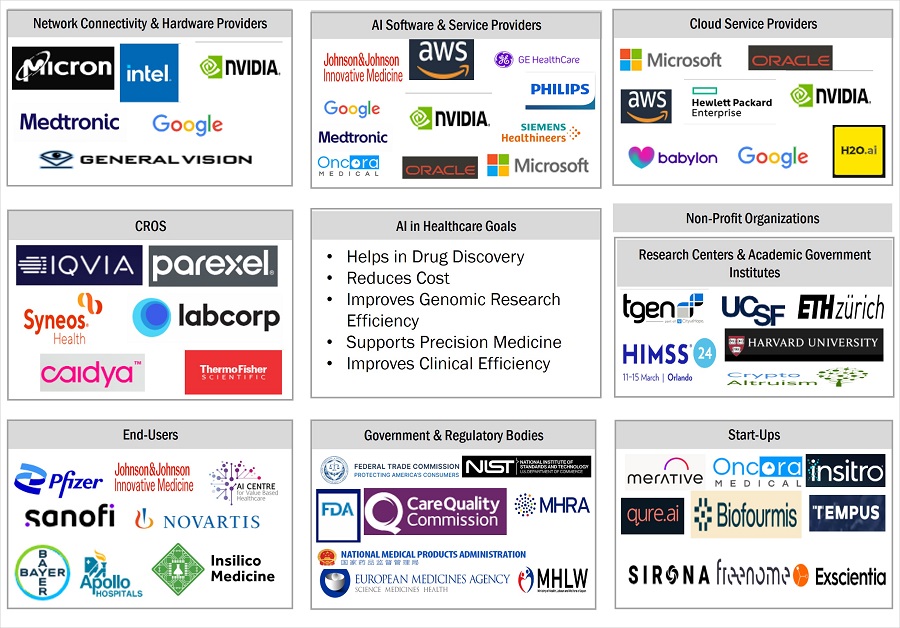

AI in Healthcare Ecosystem

The market for Software segment to hold largest market share during the forecast period.

The integration of non-procedural languages marks a transformative shift in the AI landscape of healthcare, traditionally dominated by procedural languages like Python and Java. These intuitive, declarative languages, such as SQL, offer a potential game-changer by emphasizing outcomes over step-by-step instructions. This shift democratizes AI development, enabling healthcare professionals to contribute directly, fostering collaboration, and leveraging domain expertise. Non-procedural languages enhance model explainability, streamline workflows, and focus on core clinical knowledge, promising significant segmental growth in areas like clinical decision support systems, medical imaging analysis, personalized medicine, and public health. Despite challenges, the potential benefits position non-procedural languages as a compelling avenue for advancing AI in healthcare, promising improved patient care and outcomes.

Deep learning segment in the machine learning technology to hold the largest share in the AI in Healthcare market during the forecast period.

Deep learning's transformative impact on healthcare lies in its ability to construct hierarchical representations through artificial neural networks (ANNs). These interconnected layers of neurons emulate the human brain's structure, learning from extensive datasets to extract intricate features and patterns. In medical imaging, deep learning excels in tasks like image classification, detecting diseases in X-rays and MRIs, and object segmentation for precise analysis. Natural Language Processing (NLP) enables the extraction of valuable information from clinical notes and research papers, facilitating diagnosis and drug discovery. Moreover, deep learning predicts molecular interactions in drug development and precision medicine, identifies drug targets, and tailors treatments based on individual genetic profiles. Clinical decision support, personalized healthcare plans, and predictive analytics further demonstrate the potential of deep learning.

Patient Data & Risk Analysis segment in application to hold the highest market share of the AI in Healthcare market during the forecast period.

Natural Language Processing (NLP) in healthcare enables computers to analyze, generate, and translate human language. It unlocks insights from unstructured data, streamlines tasks, empowers patients through chatbots, and enhances personalized medicine, revolutionizing healthcare delivery. Natural Language Processing (NLP) plays a pivotal role in revolutionizing patient data analysis and risk assessment within AI in healthcare. By converting unstructured text in medical records into structured data, NLP enables rapid and scalable analysis. It empowers clinicians to identify at-risk patients by detecting nuanced details often missed in structured data. For instance, in January 2023, IQVIA Inc’s (US) NLP Risk Adjustment Solution, applied by a large US healthcare payer, successfully automated, and digitalized their risk adjustment process, enhancing efficiency by over 25%. Utilizing NLP, they improved medical record reviews, enabling nurses to identify conditions more accurately and submit reimbursement claims to CMS with increased precision. The solution's clinically intelligent NLP, processing millions of records an hour, ensured high coding accuracy (>90% precision and recall), reduced review time, and provided a comprehensive audit trail for accepted ICD10-CM codes, enhancing overall risk adjustment submissions.

Patients segment to account for largest CAGR of the AI in Healthcare market during the forecast period.

Integrating artificial intelligence (AI) with smartphones and wearables is revolutionizing the healthcare landscape. This powerful combination is democratizing health data, allowing patients to actively participate in their well-being by tracking vital signs, sleep patterns, activity levels, and moods. The wealth of personal health data generated is analyzed by AI algorithms, enabling the identification of patterns, prediction of health risks, and personalization of treatment plans. This proactive and data-driven approach is reshaping healthcare, providing individuals with a deeper understanding of their health.

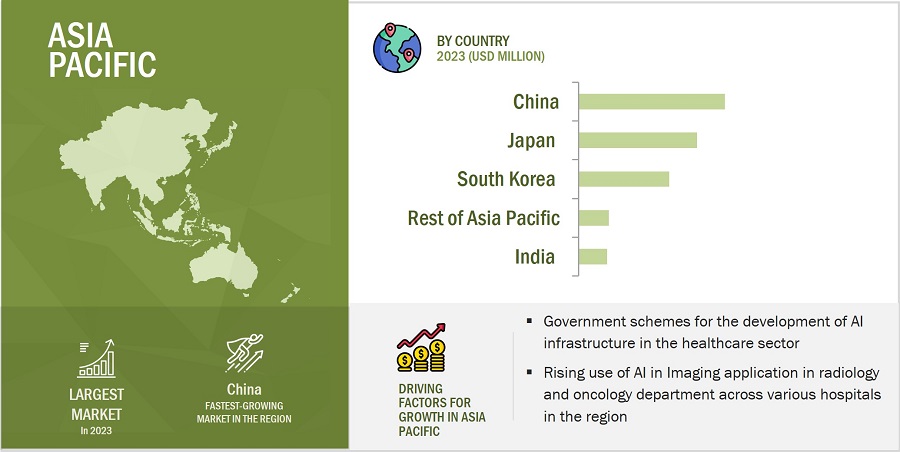

The AI in Healthcare market in the Asia Pacific is estimated to grow at a higher CAGR during the forecast period.

The factor driving the growth of the AI in healthcare Industry in the Asia Pacific region is the rise in the number of cancer patients in Asia Pacific countries. According to the report from the National Library of Medicine, in 2023, the Asia-Pacific region, home to over 60% of the global population, will account for half of all cancer cases and 58% of cancer-related deaths. Worldwide, there were 19.2 million new cancer cases and 9.9 million deaths, with the Asia-Pacific region witnessing nearly 50% of the new cases and over half of the cancer-related fatalities. These figures underscore the substantial cancer burden in the Asia-Pacific region. Given that nurses constitute more than half of the oncology healthcare workforce, acquiring new knowledge and embracing evidence-based practices is crucial for delivering efficient and effective cancer care.

Artificial Intelligence (AI) in Healthcare Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Top AI in Healthcare Companies - Key Market Players:

Major vendors in the AI in healthcare companies include Koninklijke Philips N.V. (Netherlands), Microsoft (US), Siemens Healthineers AG (Germany), Intel Corporation (US), NVIDIA Corporation (US), Google Inc. (US), GE HealthCare Technologies Inc. (US), Medtronic (US), Micron Technology, Inc (US), Amazon.com Inc (US), Oracle (US), and Johnson & Johnson Services, Inc. (US). Apart from this, Merative (US), General Vision, Inc., (US), CloudMedx (US), Oncora Medical (US), Enlitic (US), Lunit Inc., (South Korea), Qure.ai (India), Tempus (US), COTA (US), FDNA INC. (US), Recursion (US), Atomwise (US), Virgin Pulse (US), Babylon Health (UK), MDLIVE (US), Stryker (US), Qventus (US), Sweetch (Israel), Sirona Medical, Inc. (US), Ginger (US), Biobeat (Israel) are among a few emerging companies in the AI in Healthcare market.

AI in Healthcare Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 20.9 billion in 2024 |

| Projected Market Size | USD 148.4 billion by 2029 |

| Growth Rate | CAGR of 48.1% |

|

Market size available for years |

2020—2029 |

|

Base year |

2023 |

|

Forecast period |

2024—2029 |

|

Segments covered |

|

|

Geographic regions covered |

|

|

Companies covered |

The major players include Koninklijke Philips N.V. (Netherlands), Microsoft (US), Siemens Healthineers AG (Germany), Intel Corporation (US), NVIDIA Corporation (US), Google Inc. (US), GE HealthCare Technologies Inc. (US), Medtronic (US), Micron Technology, Inc (US), Amazon.com Inc (US), Oracle (US), and Johnson & Johnson Services, Inc. (US) and Others- total 33 players have been covered. |

Artificial Intelligence (AI) in Healthcare Market Highlights

This research report categorizes the AI in Healthcare market Offering, Technology, Application, and End User, and Region.

|

Segment |

Subsegment |

|

By Offering |

|

|

By Technology: |

|

|

By Application: |

|

|

By End User: |

|

|

By Region: |

|

Recent Developments in AI In Helthcare Industry :

- In October 2023, Microsoft (US) launched new data and AI solutions, Microsoft Cloud at the HLTH 2023 conference, aiming to empower healthcare organizations in unlocking insights and enhancing patient and clinician experiences. The introduced industry-specific data solutions in Microsoft Fabric provide a unified analytics platform, simplifying the integration of diverse health data sources and enabling secure access to valuable insights.

- In November 2023, Koninklijke Philips N.V., (Netherlands) collaborated with Vestre Viken Health Trust in Norway, deploying its AI Manager platform to enhance radiology workflows. The AI-enabled bone fracture application streamlined diagnoses, allowing radiologists to focus on complex cases. This initiative, spanning 30 hospitals and serving around 3.8 million people, marked Philips' most extensive AI deployment in Europe, contributing to improved patient care and accelerated diagnostic processes.

Key Questions Addressed in the Report:

What is the total CAGR expected to be recorded for the AI in Healthcare market during 2024-2029?

The global AI in Healthcare market is expected to record a CAGR of 48.1% from 2024-2029.

Which regions are expected to pose significant demand for the AI in Healthcare market from 2024-2029?

North America & Asia Pacific are expected to pose significant demand from 2024 to 2029. Major economies such as US, Canada, China, Japan, and India are expected to have a high potential for the future growth of the market.

What are the major market opportunities for the AI in Healthcare market?

Growing potential of Al-based tools for elderly care, increasing focus on developing human-aware Al systems, and Rising potential of Al technology in genomics, drug discovery, and imaging & and diagnostics are the significant market opportunities in the AI in Healthcare market during the forecast period.

Which are the significant players operating in the AI in Healthcare market?

Key players operating in the AI in Healthcare market are Koninklijke Philips N.V. (Netherlands), Microsoft (US), Siemens Healthineers AG (Germany), Intel Corporation (US), NVIDIA Corporation (US), Google Inc. (US), GE HealthCare Technologies Inc. (US), Oracle (US), and Johnson & Johnson Services, Inc. (US).

What are the major applications of the AI in Healthcare market?

Patient data & risk analysis, in-patient care & hospital management, medical imaging & diagnostics, lifestyle management & remote patient monitoring, virtual assistants, drug discovery, research, healthcare assistance robots, precision medicine, emergency room & surgery, wearables, mental health, and cybersecurity are the major applications of AI in Healthcare market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

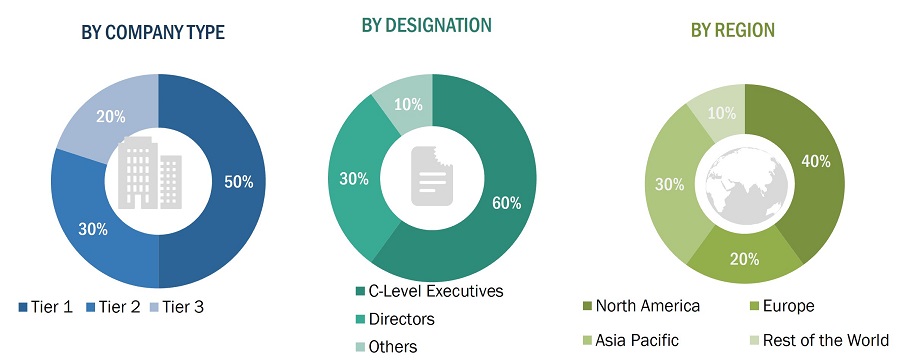

The research study involved the extensive use of secondary sources, directories, and databases (annual reports or presentations of companies, industry association publications, directories, technical handbooks, World Economic Outlook (WEO), trade websites, Hoovers, Bloomberg Businessweek, Factiva, and OneSource) to identify and collect information useful for this technical, market-oriented, and commercial study of the AI in Healthcare market. Primary sources mainly comprise several experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, system providers, technology developers, alliances, and standards and certification organizations related to various phases of this industry’s value chain.

Secondary Research

Various secondary sources have been referred to in the secondary research process for identifying and collecting information important for this study. The secondary sources include annual reports, press releases, and investor presentations of companies; white papers; journals and certified publications; and articles from recognized authors, websites, directories, and databases. Secondary research has been conducted to obtain key information about the industry’s supply chain, market’s value chain, the total pool of key players, market segmentation according to the industry trends (to the bottom-most level), geographic markets, and key developments from both market- and technology-oriented perspectives. The secondary data has been collected and analyzed to determine the overall market size, further validated by primary research.

Primary Research

In the primary research process, various primary sources from the supply and demand sides have been interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts, such as CEOs, vice presidents, marketing directors, technology & innovation directors, and related key executives from key companies and organizations operating in the AI in Healthcare market across four major regions: North America, Europe, Asia Pacific, and RoW (South America, GCC, and Rest of MEA). Primary data has been collected through questionnaires, e-mails, and telephonic interviews. Approximately 40% and 60% of primary interviews have been conducted from the demand and supply sides, respectively.

To know about the assumptions considered for the study, download the pdf brochure

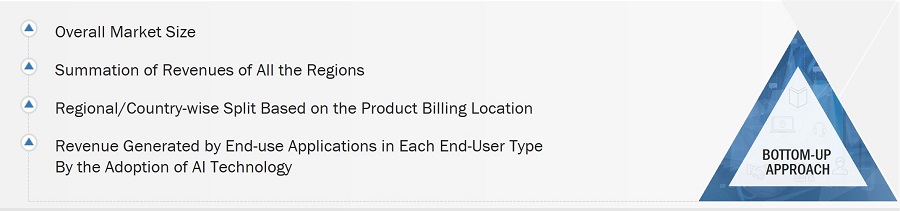

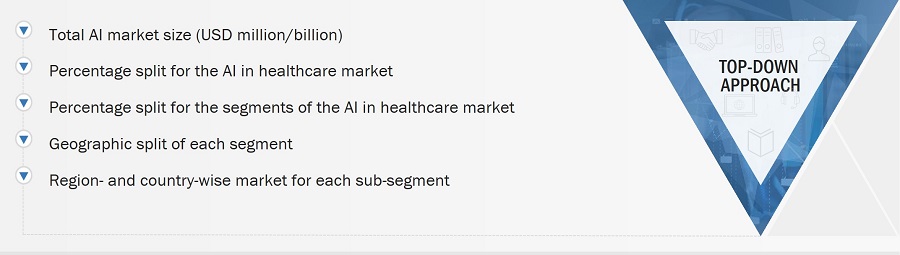

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been used along with several data triangulation methods to perform market estimation and forecasting for the overall market segments and subsegments listed in this report. Key players in the market have been identified through secondary research, and their market shares in the respective regions have been determined through primary and secondary research. This entire procedure includes the study of annual and financial reports of the top market players and extensive interviews for key insights (quantitative and qualitative) with industry experts (CEOs, VPs, directors, and marketing executives).

In this approach, important players, such Koninklijke Philips N.V. (Netherlands), Microsoft (US), Siemens Healthineers (Germany), Intel Corporation (US), and NVIDIA Corporation (US) have been identified. After confirming these companies through primary interviews with industry experts, their total revenue has been estimated by referring to annual reports, SEC filings, and paid databases. Revenues of these companies pertaining to the business units (Bus) that offer AI in Healthcare have been identified through similar sources. Industry experts have reconfirmed these revenues through primary interviews.

AI in Healthcare Market: Bottom-Up Approach

The bottom-up approach has been employed to arrive at the overall size of the AI in Healthcare market from the revenues of key players and their share in the market.

AI in Healthcare Market: Top-Down Approach

In the top-down approach, the overall market size has been used to estimate the size of the individual markets (mentioned in the market segmentation) through percentage splits from secondary and primary research. The most appropriate immediate parent market size has been used to implement the top-down approach to calculate the market size of specific segments. The top-down approach has been implemented for the data extracted from the secondary research to validate the market size obtained.

Each company’s market share has been estimated to verify the revenue shares used earlier in the supply-side approach. The overall parent market size and individual market sizes were determined and confirmed in this study by the data triangulation method and the validation of data through primaries. The data triangulation method used in this study is explained in the next section.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained earlier, the total market was split into several segments and subsegments. Data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the AI in healthcare market has been validated using both top-down and bottom-up approaches.

Market Definition

AI in Healthcare harnesses artificial intelligence's power to transform healthcare delivery and patient outcomes. It utilizes sophisticated machine learning, NLP, context-aware computing, and computer vision technologies to analyze massive amounts of medical data, enabling early disease detection, personalized treatment plans, enhanced clinical decision-making, and streamlined administrative processes.

The ecosystem of the AI in healthcare market comprises hardware providers, software providers, cloud service providers, AI solution providers, and end users of AI in healthcare. This market is competitive and diversified, with over 30 companies competing across its value chain to sustain their position and increase their share in the market. The market is expected to grow significantly in the coming years due to the increasing use of large and complex datasets in hospitals, biotechnology, and pharmaceutical companies.

Key Stakeholders

- Semiconductor companies

- Technology providers

- Universities and research organizations

- Hospitals and healthcare payers

- System integrators

- AI solution providers

- AI platform providers

- Cloud service providers

- AI system providers

- Medical research and biotechnology companies

- Investors and venture capitalists

- Manufacturers and individuals implementing AI technology in healthcare devices and systems

Report Objectives

- To describe and forecast the artificial intelligence (AI) in healthcare market, in terms of value, by offering, technology, application, and end-user

-

To describe and forecast the AI in healthcare market, in terms of value, for four main regions—

North America, Europe, Asia Pacific, and the Rest of the World (RoW) - To forecast the size and market segments of the AI in Healthcare market by volume based on Processor hardware.

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To provide an ecosystem analysis, case study analysis, patent analysis, technology analysis, ASP analysis, Porter’s Five Forces analysis, and regulations pertaining to the market.

- To provide a comprehensive overview of the value chain of the AI in healthcare market ecosystem

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies.

- To analyze the opportunities in the market for stakeholders and describe the competitive landscape of the market.

- To analyze competitive developments such as collaborations, agreements, partnerships, product developments, and research and development (R&D) in the market.

- To analyze the impact of the recession on the AI in Healthcare market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 7)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Artificial Intelligence (AI) in Healthcare Market

Interested about how AI will change the treatment process and its benefits.

I was going through the ToC of AI in Healthcare market, I would like to understand, what are the requirements to perform in the fields of AI?

I was going through the ToC of AI in Healthcare market, I would like to understand, what are the requirements to perform in the fields of AI?

We have specific interests in global AI in healthcare market and the US AI in healthcare market. Any further details related to market size of AI for early disease detection (for global and USA) would be appreciated.

I am looking to purchase this report to see the implications of AI on the workforce in Norway.

I am interested in understanding the market size and related insights on computer-assisted physician documentation (CAPD), clinical documentation improvement (CDI), computer-assisted coding (CAC), ambient voice and voice assistants, NLP, and machine learning for clinical, operational, and financial healthcare scenarios in AI in healthcare.

I am an automation enthusiast and would like to understand the impact of AI in healthcare. Could you provide me some brochure and sample to get into details.

I am conducting a research project on AI in healthcare as a part of my MHA/MBA marketing course. Could you share some relevant information in the form of sample brochure and estimated cost of the report, post discount mentioned on the website?

We are redeveloping our chart for Artificial Intelligence in Healthcare Market. Does your report covers regional market insights.