AI In Genomics Market Size by Offering (Software & Services), Technology (Machine Learning), Functionality (Gene Sequencing, Gene Editing), Application (Diagnostics, Drug discovery), End User (Pharma, Hospitals) - Global Forecast to 2028

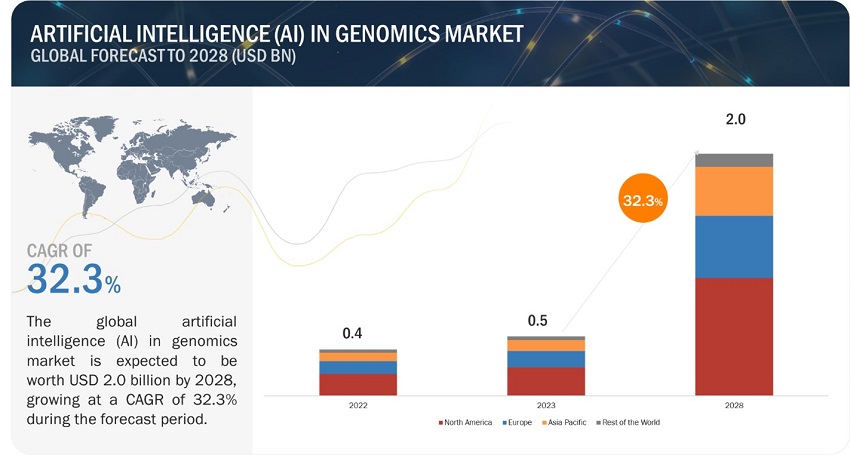

The size of global AI in genomics market in terms of revenue was estimated to be worth $0.5 billion in 2023 and is poised to reach $2.0 billion by 2028, growing at a CAGR of 32.3% from 2023 to 2028. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

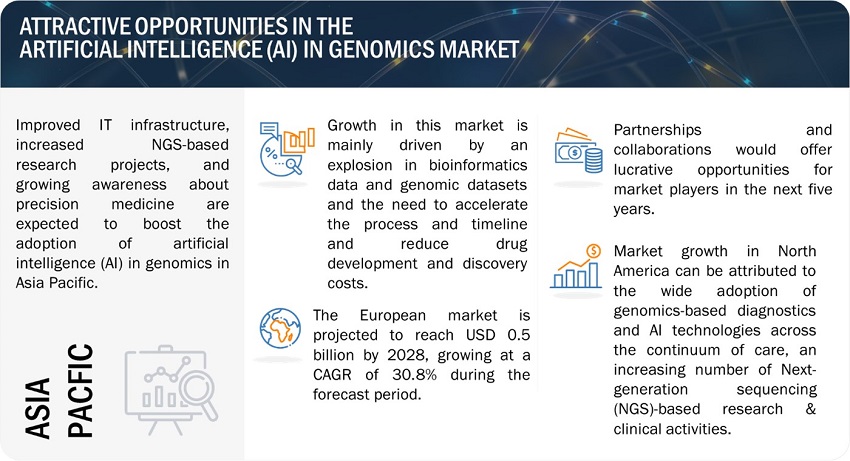

The need to control drug development and discovery costs and time, increasing public and private investments in AI in genomics, and the adoption of AI solutions in precision medicine are driving the growth of this market. The market growth is primarily driven by the need to accelerate processes and timeline and reduce drug development & discovery costs and increasing partnerships and collaborations among players and growing investments in AI in genomics. Additionally, factors such as improving computing power and declining hardware cost, rising adoption of AI in precision medicine, and explosion in bioinformatics data and genomic datasets are also contributing to the market growth.

To know about the assumptions considered for the study, download the pdf brochure

AI in Genomics Market Dynamics

Driver: Need to accelerate processes and timeline and reduce drug development and discovery costs

Drug discovery is an expensive and lengthy process, which creates a need for alternative tools to discover new drugs. Drug discovery and development are commonly conducted through in vivo and in vitro methods, which are costly and time-consuming. Furthermore, it takes ~10 years on average for a new drug to enter the market and costs ~USD 2.6 billion.

Only one out of 5,000–10,000 compounds is approved as a potential drug for a particular condition. Most drug candidates selected in the discovery phase fail in the late stages of development due to toxicity or other pharmacokinetic characteristics. Machine learning technology can help at this stage by predicting the outcome of a drug compound in the discovery phase and eliminating compounds without potential in the early discovery phase itself. This will significantly cut downtime and expenses in identifying potential drug candidates.

The potential for time and cost reductions in this process has drawn significant stakeholder attention and resulted in numerous investigative projects. For instance, in November 2020, Deep Genomics and BioMarin announced a collaboration to discover and develop oligonucleotide drug candidates for four rare diseases, combining BioMarin’s extensive rare disease expertise with Deep Genomics’ AI Workbench platform. With that, AI in genomics for drug discovery has the potential to significantly accelerate the drug development process, reduce costs, and improve patient outcomes by enabling the development of more targeted and effective drugs.

Restraint: Lack of skilled AI workforce and ambiguous regulatory guidelines for medical software

An AI is a complex system; to develop, manage, and implement AI systems, companies require a workforce with certain skill sets. Personnel working with AI systems, for instance, should be knowledgeable about image recognition, deep learning, cognitive computing, and ML and machine intelligence. In order to emulate human brain behavior, integrating AI technologies into current systems is a difficult operation that necessitates substantial data processing. Even a minor error can result in system failure or adversely affect the desired result. Additionally, the development of AI is being constrained by the lack of professional standards and certifications in AI/ML technologies. Because of a lack of technological understanding and a shortage of AI professionals, service providers encounter difficulties when delivering and maintaining their solutions at the locations of their clients.

Moreover, government or regulatory agencies must keep up regularly with advancements and guide AI system deployment, especially in healthcare. The accuracy, reliability, security, and clinical use of medical AI technologies are ensured by subjecting them to various standards and regulations. However, medical software regulation is still dynamic and dependent on changing guidelines and subjective interpretation by regulatory authorities. In the US, the FDA has regulatory authority over medical devices. To receive FDA approval, AI or machine learning tools that have healthcare applications must pass a series of tests to show that they can produce results at least as accurately as humans.

Similarly, there is no general exclusion for software in the European Union, and software may be regulated as a medical device if it has a medical purpose. Generally, a case-by-case assessment is required, considering the product characteristics, mode of use, and claims. However, the assessment is particularly complex because, unlike the classification of general medical devices, it is not immediately apparent how these parameters apply to software, given that software does not act on the human body to restore, correct, or modify bodily functions. As a result, the software used in healthcare settings is not necessarily a medical device. Such ambiguous regulatory guidelines sometimes create major barriers for market players.

Opportunity: Focus on developing human-aware AI systems

The aim of developing AI technologies was to make them human-aware or capable of human thinking patterns. However, creating interactive and scalable machines remains a challenge for the developers of AI machines. Additionally, increasing human interference with AI techniques has introduced new research challenges—interpretation and presentation challenges such as interaction issues with automating parts and intelligent control of crowdsourcing parts. Interpretation challenges include challenges faced by AI machines in understanding human input, such as knowledge and specific directives. Presentation challenges include issues related to delivering the AI system’s output and feedback. Thus, the development of human-aware AI systems remains the foremost opportunity for AI developers.

Challenge: Lack of curated genomic data

Data is a vital source to train and develop a complete and robust AI system. Earlier, datasets were mostly structured and entered manually. However, the growing digital footprint and technology adoption, such as IoT in healthcare and life science, has resulted in large data volumes that are unstructured (and in the form of text, voice, or images).

To train machine learning tools, developers require high-quality labeled data, along with skilled human trainers. Extracting and labeling unstructured data requires a large, skilled workforce and time. Moreover, patient information is extremely sensitive and subject to stringent privacy norms. For instance, legislations such as the HIPAA (implemented in the US in 1996) and the HITECH Act (implemented in the US in 2003) require entities responsible for sensitive health information to implement certain measures to ensure its privacy and security; these entities are also required to inform patients of instances when the privacy and security of their information have been compromised. This makes curated data hard to access due to privacy concerns, record identification concerns, and security requirements.

Thus, structured data plays a pivotal role in developing an efficient AI system. Companies are now practicing developing insights from semi-structured data (a combination of structured and unstructured data) that enables information from groupings and hierarchies. However, analytics tools and solutions for semi-structured data are still in the nascent stage.

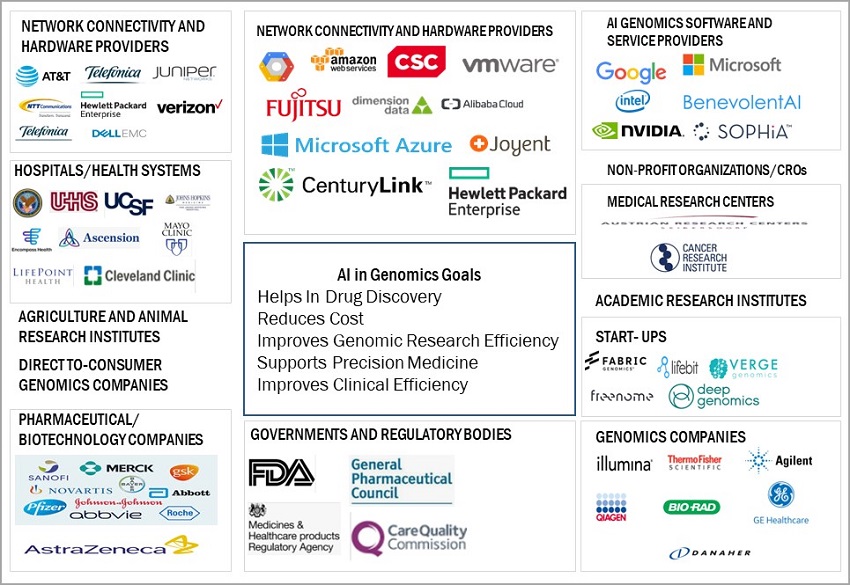

Artificial Intelligence (AI) in Genomics Market Ecosystem

Well-known, financially secure producers of AI in genomics systems and platforms are prominent players in this market. These companies have been in operation for a while and have a broad range of products, cutting-edge technologies, and robust international sales and marketing networks. Key companies in this market include NVIDIA Corporation (US), Microsoft Corporation (US), Google, Inc. (US), Intel Corporation (US), Illumina, Inc. (US), and SOPHiA GENETICS (Switzerland).

Machine learning acquires largest size of AI in genomics industry, by technology

Based on technology, the AI in genomics market is segmented into machine learning and other technologies. The machine learning segment dominated this market in 2022, as pharmaceutical companies, CROs, and biotechnology companies have widely adopted machine learning for drug genomics applications. This is because machine learning can extract insights from data sets, accelerating genomic research.

Based on application, diagnostics segment is anticipated to dominate the AI in genomics industry

Based on application, the AI in genomics market is segmented into diagnostics, drug discovery & development, precision medicine, agriculture & animal research, and other applications. Diagnostics was the largest application segment in the market, in 2022. The large share of this segment can be attributed to the increasing research on diseases and the decreasing cost of sequencing.

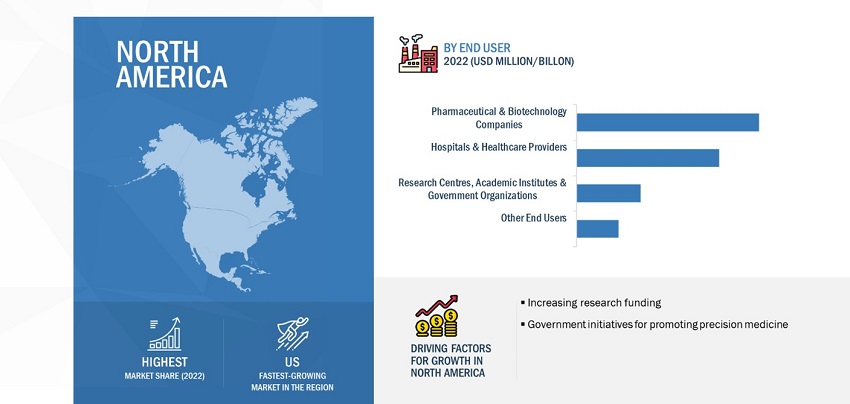

Based on the end user, hospitals & healthcare providers accounted for the second largest share of AI in genomics industry

Based on the end user, the AI in genomics market is broadly segmented into pharmaceutical & biotechnology companies; hospitals & healthcare providers; research centers, academic institutes, & government organizations; and other end users. Hospitals & healthcare providers accounted for the second largest share of the market in 2022. Factors such as rising demand for solutions to cut the time and costs of drug development drive the market growth.

North America is expected to account for the largest share in AI in genomics industry in 2022

Based on region, the global AI in genomics market has been segmented into North America, Europe, Asia Pacific, and the Rest of the World. In 2022, North America accounted for the largest market share followed by Europe. The large share of North America can be attributed to the increasing research funding and government initiatives for promoting precision medicine in the US.

The AI in genomics market is dominated by a few globally established players such as NVIDIA Corporation (US), Microsoft Corporation (US),Google, Inc. (US), Intel Corporation (US), BenevolentAI (UK), SOPHiA GENETICS (Switzerland), Illumina, Inc. (US), among others.

Scope of the AI in Genomics Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$0.5 billion |

|

Projected Revenue Size by 2028 |

$2.0 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 32.3% |

|

Market Driver |

Need to accelerate processes and timeline and reduce drug development and discovery costs |

|

Market Opportunity |

Focus on developing human-aware AI systems |

This research report categorizes the AI in genomics market to forecast revenue and analyze trends in each of the following submarkets:

By Offering

- Software

- Services

By Technology

-

Machine Learning

- Deep Learning

- Supervised Learning

- Reinforcement Learning

- Unsupervised Learning

- Other Machine Learning Technologies

- Other Technologies

By Functionality

- Genome Sequencing

- Gene Editing

- Clinical Workflows

- Predictive Genetic Testing & Preventive Medicine

By Application

- Diagnostics

- Drug Discovery & Development

- Precision Medicine

- Agriculture & animal Research

- Other Applications

By End User

- Pharmaceutical & Biotech Companies

- Healthcare Providers

- Research Centers, Academic Institutes, & Government Organizations

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Rest of Europe

- Asia Pacific

- Rest of the World

Recent Developments of AI in Genomics Industry

- In December 2022, Intel Labs and the Perelman School of Medicine at the University of Pennsylvania (Penn Medicine) completed of a joint research study using distributed machine learning (ML) and artificial intelligence (AI) approaches to help international healthcare and research institutions identify malignant brain tumors.

- In September 20222, NVIDIA Corporation partnered with the Broad Institute of MIT and Harvard to accelerate Genome analysis workflows and help teams to co-develop large language models for the discovery and development of targeted therapies. The collaboration connects NVIDIA’s AI expertise and healthcare computing platforms with the Broad Institute’s researchers, scientists, and open platforms with a focus on Making NVIDIA Clara Parabricks available in the Terra platform, building large language models, and providing improved deep learning to Genome Analysis Toolkit (GATK).

- In August 2021, Illumina, Inc. acquired GRAIL to provide patients with access to a potentially life-saving multi-cancer early-detection test.

- In March 2021, SOPHiA GENETICS collaborated with Hitachi. This collaboration agreement offered clinical, genomic, and real-world insights to healthcare practitioners and pharmaceutical and biotechnology firms and to further democratize Data-Driven Precision Medicine internationally for the benefit of patients.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the AI in genomics market?

The AI in genomics market boasts a total revenue value of $2.0 billion by 2028.

What is the estimated growth rate (CAGR) of the AI in genomics market?

The global AI in genomics market has an estimated compound annual growth rate (CAGR) of 32.3% and a revenue size in the region of $0.5 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

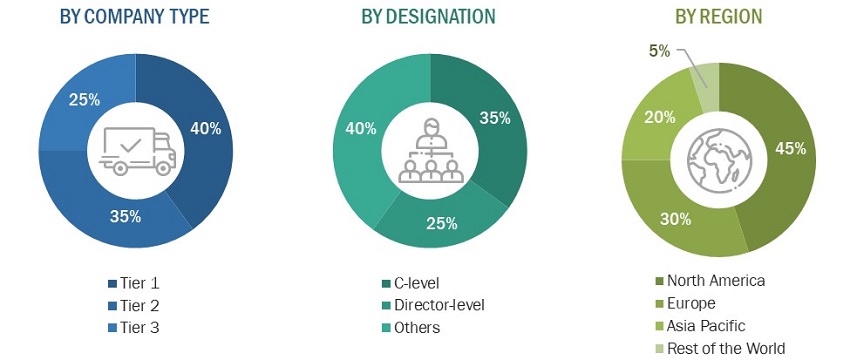

The study involved major activities in estimating the current size of the global artificial intelligence (AI) in genomics market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study involved the use of widespread secondary sources; directories; databases, such as D&B, Bloomberg Business, and Factiva; white papers; government sources; corporate filings (such as annual reports, investor presentations, and financial statements); and trade, business, and professional associations; and company house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the artificial intelligence (AI) in genomics market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the artificial intelligence (AI) in genomics market. The primary sources from the demand side include key executives from pharmaceutical & biotechnology companies, research centers, academic institutes, & government organizations, hospitals, healthcare providers, contract research organizations, non-profit organizations (NPOs), agri-genomics organizations, and direct-to-consumer genetic companies. After the complete market engineering process (which includes calculations for the market statistics, market breakdown, market size estimation, market forecasts, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers obtained.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to offering, technology, application, functionality, end user, and region.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down (segmental analysis of major segments) and bottom-up approaches (assessment of utilization/adoption/penetration trends, by product & service, end user, and region) were used to estimate and validate the total size of the artificial intelligence (AI) in genomics market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Market Size: Top-Down Approach --Image--

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Market Definition

AI refers to the theory and development of computer systems capable of performing tasks that usually require human intelligence. AI is being used to combine data generated from genomic analyses with relationships identified from literature to find potential clinically relevant genes. It also helps identify patterns within high-volume genetic data sets. These patterns are then translated to computer models that may help predict an individual’s probability of developing certain diseases or inform potential therapy design. DNA sequencing and other biological techniques have increased the number and complexity of such data sets. AI/ML-based computational tools have gained traction due to their capability to handle, extract, and interpret valuable information hidden within large datasets.

Key Stakeholders

- Artificial intelligence (AI) in genomics solution providers

- Platform providers

- Technology providers

- AI system providers

- Medical research and biotechnology companies

- Pharmaceutical companies and CROs

- Hospitals and clinics

- Universities and research organizations

- Forums, alliances, and associations

- Academic research institutes

- Healthcare institutions

- Laboratories

- Distributors

- Venture capitalists

- Government organizations

- Institutional investors and investment banks

- Investors/Shareholders

- Consulting companies in the genomics sector

- Raw material & component manufacturers

- Non-profit organizations (NPOs)

- Agri-genomics organizations

- Direct-to-consumer genetic companies

Report Objectives

- To define, describe, and forecast the artificial intelligence (AI) in genomics market in terms of value by offering, technology, functionality, application, end user, and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges).

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall artificial intelligence (AI) in genomics market.

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players.

- To forecast the size of the artificial intelligence (AI) in genomics market in four main regions (along with their respective key countries), namely, North America, Europe, Asia Pacific, and the Rest of the World.

- To profile the key players in the artificial intelligence (AI) in genomics market and comprehensively analyze their core competencies.

- To track competitive developments, such as acquisitions, product launches, expansions, collaborations, agreements, partnerships, investments, joint ventures, and R&D activities, of the leading players in the artificial intelligence (AI) in genomics market.

- To benchmark players within the artificial intelligence (AI) in genomics market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the client’s specific needs. The following customization options are available for this report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographical Analysis

- Further breakdown of the rest of the world the AI in genomics market in Latin America, and the Middle East & Africa.

- Further breakdown of Latin American the AI in genomics market into Brazil, Mexico, and the rest of Latin America.

- Further breakdown of the Middle East & Africa the AI in genomics market into the UAE, Saudi Arabia, South Africa, and the rest of MEA countries.

Company information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in AI In Genomics Market