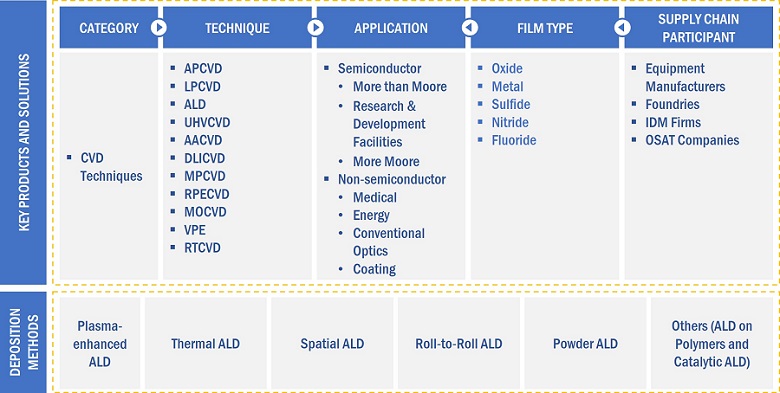

ALD Equipment Market by Deposition Method (Plasma Enhanced ALD, Thermal ALD, Spatial ALD), Film Type (Oxide Films, Fluoride Films), Semiconductor Application (More than Moore, More Moore), Non-semiconductor Application and Region - Global Forecast to 2028

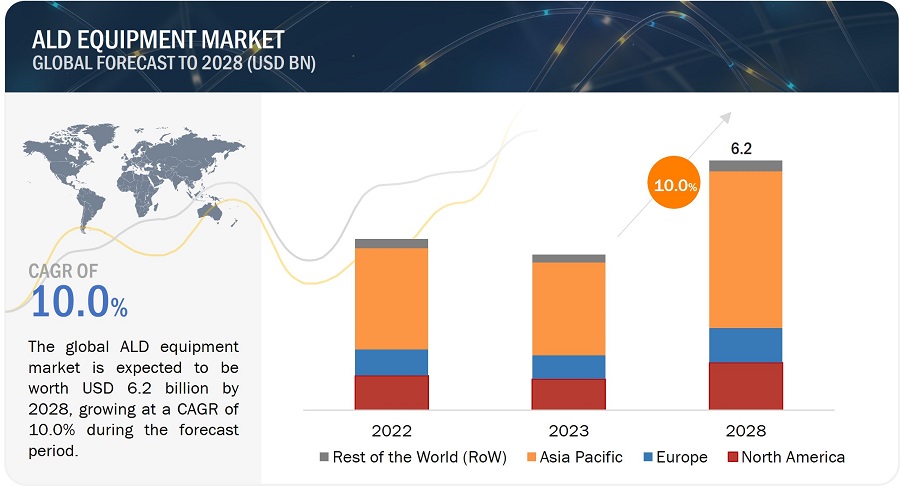

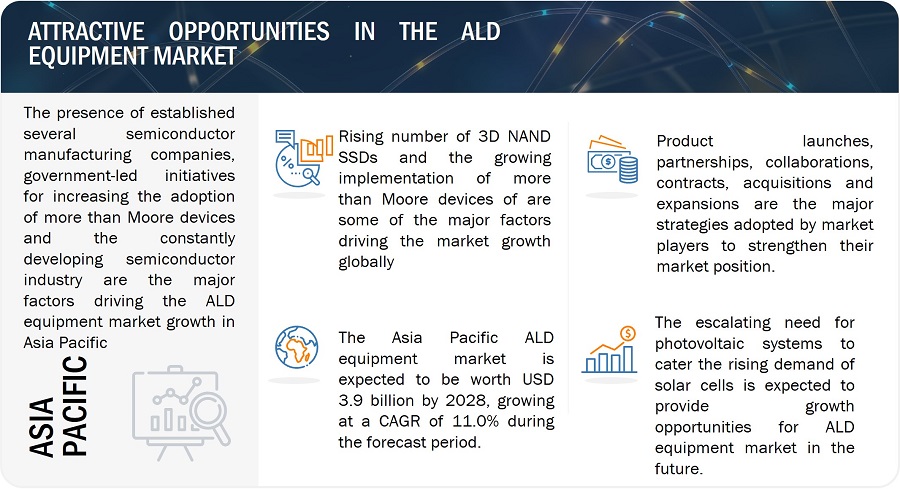

[222 Pages Report] The ALD equipment market is estimated to be worth USD 3.9 billion in 2023 and is projected to reach USD 6.2 billion by 2028, at a CAGR of 10.0% during the forecast period. The rising number of 3D NAND SSDs and the growing implementation of more than Moore devices are some of the major factors driving the market growth of ALD equipment globally.

ALD Equipment Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

ALD Equipment Market Dynamics

Driver: Rising number of 3D NAND SSDs

The growing trend of miniaturization in electronic devices, coupled with advancements such as 3D NAND memory and FinFET-based transistor devices, has generated a heightened demand for the precise deposition of conformal thin films. Therefore, ALD plays a crucial role in the miniaturization of electronic devices as it enables the deposition of materials with exceptional conformality even at temperatures around 400°C. Moreover, ALD provides a valuable means to achieve high-quality thin films, essential for optimizing the performance and efficiency of these cutting-edge technologies. Therefore, the increasing number of 3D NAND SSDs is expected to drive the market growth for ALD equipment.

Restraint: Shortage of trained workforce

The increasing demand for semiconductor devices from many end user industries, such as consumer electronics and automotive, has created several opportunities for the market players. However, the shortage of skilled technicians for such complex processes has not enabled the market players to utilize these opportunities to the fullest. So, the need for highly skilled workers to carry out these complicated tasks is a big problem that may restrain ALD equipment market growth.

Opportunity: The escalating need for photovoltaic systems

Photovoltaics are integrated into solar cells; the growing demand for solar cells contributes to the growing deployment of photovoltaics, which is expected to drive the market growth for ALD equipment. ALD films are also used in solar cells as surface passivation layers, buffer layers, window layers, absorber layers, and hole/electron contact, which can further drive the market growth of ALD equipment. Moreover, the health and environmental advantages of adopting photovoltaic power are particularly significant in densely populated areas heavily reliant on coal power, in contrast to sparsely populated regions abundant in clean hydropower or wind energy. Consequently, the surging demand for photovoltaics has led to an increased deployment of ALD equipment, which is expected to drive the market growth of ALD equipment in the future.

Challenge: Rising technical challenges and process complexities

Manufacturing semiconductors demands an extremely clean environment and equipment. Even a tiny speck of dust can disrupt the process and lead to significant financial losses. If there are manufacturing mistakes that cause supply delays, it can result in more losses and even canceled orders. Common problems in semiconductor manufacturing involve issues with the materials, mechanical strength, and the chips. Therefore, the increasing technical difficulties and process complexities in semiconductor manufacturing may impede the market growth of ALD equipment.

ALD Equipment Market Ecosystem

The prominent players in the ALD equipment market are ASM International N.V. (Netherlands), Tokyo Electron Limited. (Japan), Applied Materials, Inc. (US), LAM RESEARCH CORPORATION. (US), and Veeco Instruments Inc. (US). These companies perform organic and inorganic growth strategies to expand themselves globally by providing new and advanced ALD equipment solutions.

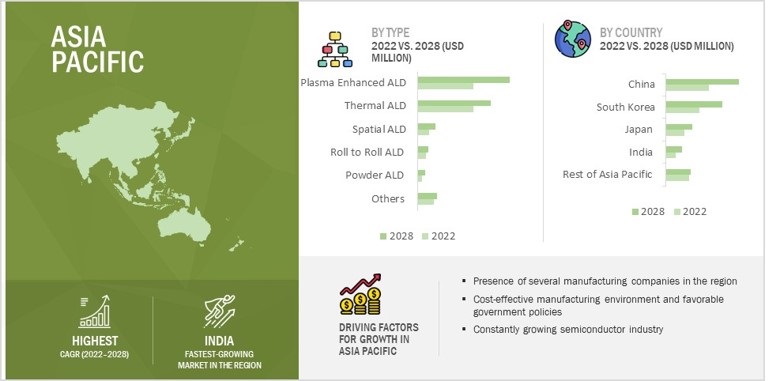

Plasma enhanced ALD (PEALD) equipment to register highest CAGR in the ALD equipment market during forecast period

Along with providing the benefits of conventional ALD methods, PEALD also offers supplementary advantages such as pre- and post-deposition in-situ treatment capabilities. It is primarily utilized in semiconductor applications like CMOS structures, MOSFETs, capacitors, and other semiconductor devices. Therefore, it provides distinct advantages over traditional ALD deposition methods. These advantages are key factors that contribute towards market growth for PEALD.

More Moore application held for the largest market size in the ALD equipment market during the forecast period.

The increasing proliferation of various logic and memory devices fuels the ALD equipment market for more Moore applications. In recent years, there has been a significant rise in demand for 3D NAND flash memory technology to facilitate the increasing need for storage speed without the requirement of reducing chip size. Therefore, the growing adoption of 3D NAND flash memory technology drives market growth.

Asia Pacific held for the largest share of the ALD equipment market in 2022.

Asia Pacific is expected to dominate the ALD equipment market during forecast period. The presence of established several semiconductor manufacturing companies such as Tokyo Electron Limited. (Japan), OPTORUN Co., Ltd. (Japan) and SHOWA SHINKU Co., Ltd. (Japan), government-led initiatives for increasing the adoption of more than Moore devices are the major factors driving the market growth in Asia Pacific

ALD Equipment Market by Region

To know about the assumptions considered for the study, download the pdf brochure

Key market players

The major players in the ALD equipment companies include ASM International N.V. (Netherlands), Tokyo Electron Limited. (Japan), Applied Materials, Inc. (US), LAM RESEARCH CORPORATION. (US), and Veeco Instruments Inc. (US). These companies have used both organic and inorganic growth strategies such as product launches, agreements, collaborations, acquisitions, partnerships and expansions to strengthen their position in the market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion), Volume (Million Units) |

|

Segments covered |

By Deposition Method, Film Type, Application (Non-Semiconductor), Application (Semiconductor), and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, and Rest of the World (RoW) |

|

Companies covered |

The major players in the ALD equipment market are ASM International N.V. (Netherlands), Tokyo Electron Limited. (Japan), Applied Materials, Inc. (US), LAM RESEARCH CORPORATION. (US), Veeco Instruments Inc. (US), Kurt J. Lesker Company (US), OPTORUN Co., Ltd. (Japan), CVD Equipment Corporation (US), EUGENE TECHNOLOGY CO. LTD. (South Korea), and Beneq (Finland). |

ALD Equipment Market Highlights

The study segments the ALD equipment market based on deposition method, film type, application (non-semiconductor), application (semiconductor), and region at the regional and global level.

|

Segment |

Subsegment |

|

By Deposition Method |

|

|

By Film Type |

|

|

By Application (Non-Semiconductor) |

|

|

By Application (Semiconductor) |

|

|

By Region |

|

Recent Developments

- In March 2022, ASM International N.V. acquired Reno Sub-Systems Inc., a company that offers RF matching sub-systems for equipment utilized to manufacture semiconductors such as ALD equipment. This acquisition strengthened the product portfolio of ASM International N.V.

- In March 2023, Tokyo Electron Limited. announced a new development facility at the Hosaka office in Nirasaki City, Yamanashi Prefecture. This expansion will serve the continuous technological advancements used to make semiconductors more diverse and complex. Therefore, to meet the increasing demand from the semiconductor industry, the company has also been investing extensively in the development of new facilities.

- in June 2022, Applied Materials announced the acquisition of Picosun Oy, a global leader in ALD based in Finland. This acquisition allows Applied Materials to harness Picosun’s capabilities to provide innovative solutions for the automotive, IoT, communications, sensor, and power markets. This acquisition would broaden Applied Materials’ product portfolio related to specialty chips.

- In September 2022, LAM RESEARCH CORPORATION announced its engineering center in Bengaluru, India, which will focus on the R&D, engineering, and testing of wafer fabrication hardware and software used in the manufacturing process of DRAM, NAND, and logic technologies. Therefore, in recent years, the company has also been constructing new manufacturing and research facilities to meet the increasing demand from the semiconductor market.

- In October 2022, Veeco Instruments Inc. announced its partnership with Justus Liebig University Giessen (Germany) so that the latter could perform hybrid gallium nitride deposition research.

Frequently Asked Questions (FAQs) :

What is the current size of the global ALD equipment market?

The ALD equipment market is estimated to be worth USD 3.9 billion in 2023 and is projected to reach USD 6.2 billion by 2028, at a CAGR of 10.0% during the forecast period. Rising interest in 3D NAND SSDs and the growing acceptance of More-than-Moore devices are some of the major factors driving the market growth of ALD equipment globally.

Who are the winners in the global ALD equipment market?

Companies such as ASM International N.V. (Netherlands), Tokyo Electron Limited. (Japan), Applied Materials, Inc. (US), LAM RESEARCH CORPORATION. (US), and Veeco Instruments Inc. (US), fall under the winners category.

Which region is expected to hold the highest market share?

Asia Pacific is expected to dominate the ALD equipment market during forecast period. The presence of established several semiconductor manufacturing companies such as Tokyo Electron Limited. (Japan), OPTORUN Co., Ltd. (Japan) and SHOWA SHINKU Co., Ltd. (Japan), government-led initiatives for increasing the adoption of more than Moore devices are the major factors driving the market growth in Asia Pacific.

What are the major drivers and opportunities related to the ALD equipment market?

Rising number of 3D NAND SSDs and the growing implementation of More-than-Moore devices are some of the major drivers and opportunities for ALD equipment market.

What are the major strategies adopted by market players?

The key players have adopted product launches, partnerships, collaborations, contracts, acquisitions, and expansions to strengthen their market position for the ALD equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

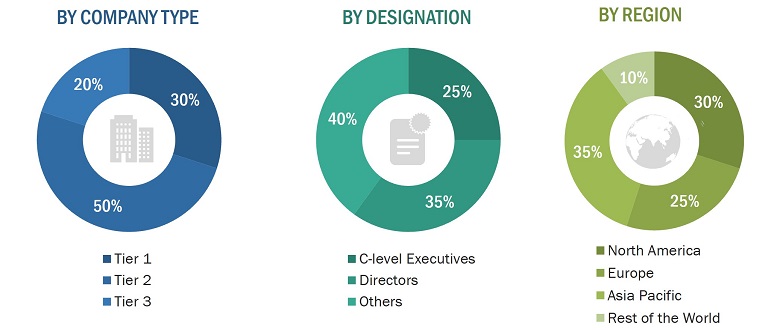

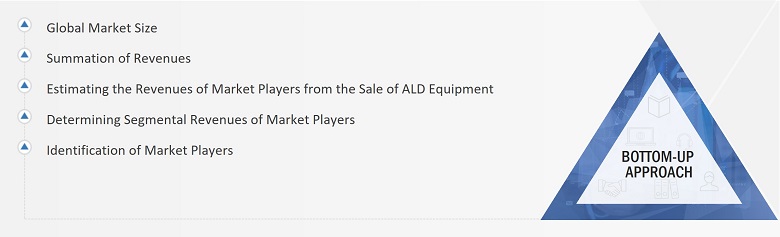

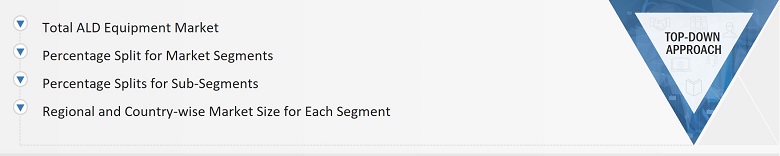

The research study involved 4 major activities in estimating the size of the ALD equipment market. Exhaustive secondary research has been done to collect important information about the market and peer markets. The validation of these findings, assumptions, and sizing with the help of primary research with industry experts across the supply chain has been the next step. Both top-down and bottom-up approaches have been used to estimate the market size. Post which the market breakdown and data triangulation have been adopted to estimate the market sizes of segments and sub-segments.

Secondary Research:

In the secondary research process, various secondary sources have been referred to for identifying and collecting information required for this study. The secondary sources include annual reports, press releases, and investor presentations of companies, white papers, and articles from recognized authors. Secondary research has been mainly done to obtain key information about the market’s value chain, the pool of key market players, market segmentation according to industry trends, regional outlook and developments from both market and technology perspectives.

Primary Research:

In primary research, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative insights required for this report. Primary sources from supply side include experts such as CEOs, vice presidents, marketing directors, manufacturers, technology and innovation directors, end users and related executives from multiple key companies and organizations operating in the ALD equipment market ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches have been used along with data triangulation methods to estimate and validate the size of the ALD equipment market and other dependent submarkets. The research methodology used to estimate the market sizes includes the following:

- Identifying stakeholders in the ALD equipment market that influence the entire market, along with participants across the value chain.

- Analyzing major manufacturers of ALD equipment and studying their product portfolios

- Analyzing trends related to the adoption of ALD equipment

- Tracking the recent and upcoming developments in the market that include investments, R&D activities, product launches, contracts, collaborations, acquisitions, agreements, and partnerships, as well as forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to identify the adoption trends of ALD equipment

- Segmenting the overall market into various other market segments

- Validating the estimates at every level through discussions with key opinion leaders, such as chief executives (CXOs), directors, and operation managers, and finally with the domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Market Size Estimation Methodology-Top-down Approach

Data Triangulation

After arriving at the overall market size by the market size estimation process explained in the earlier section, the overall ALD equipment market has been divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been used, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply side perspectives. Along with data triangulation and market breakdown, the market has been validated by top-down and bottom-up approaches.

Market Definition

ALD equipment refers to a specialized set of machinery and components designed for executing the atomic layer deposition process. ALD is a thin-film deposition technique that enables precise and controlled growth of thin films at the atomic or molecular level. ALD equipment facilitates the sequential and self-limiting exposure of a substrate to precursor gases, resulting in the formation of thin, conformal, and uniform layers on the substrate surface.

Researchers, engineers, and manufacturers in various fields utilize ALD equipment to deposit thin films for a wide range of applications, such as more than Moore, R&D facilities, and more Moore applications. Additionally, ALD equipment is also used in the medical and energy industries, conventional optics, and coating applications. The precise and controlled nature of ALD makes it a fundamental tool for achieving desired material properties and functionalities in nanotechnology and advanced material sciences.

Stakeholders

- Raw Material Suppliers

- Technology Investors

- Original Equipment Manufacturers (OEMs)

- Device Suppliers and Distributors

- Government Labs

- In-house Testing Labs

- System Integrators

- Resellers and Traders

- Research Institutes and Organizations

- Semiconductor Manufacturing Equipment Forums, Alliances, Consortiums, and Associations

- Governments, Financial Institutions, and Regulatory Bodies

- Market Research and Consulting Firms

The main objectives of this study are as follows:

- To analyze and forecast the ALD equipment market size by deposition method, film type, application (semiconductor and non-semiconductor), and region, in terms of value

- To analyze and forecast the ALD equipment market size, in terms of volume

- To forecast the market size for various segments with respect to four main regions, namely, North America, Europe, Asia Pacific, and Rest of the World (RoW)

- To provide detailed information regarding the major drivers, restraints, opportunities, and challenges influencing the growth of the ALD equipment market

- To study the complete supply chain and related industry segments for the ALD equipment market

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the supply chain, market ecosystem; trends/disruptions impacting customer business; technology analysis; pricing analysis; Porter’s five forces model; key stakeholders and buying criteria; case study analysis; trade analysis; patent analysis; key conferences and events, 2023–2024; and regulations related to the ALD equipment market

- To analyze opportunities in the market for various stakeholders by identifying the high-growth segments

- To strategically profile the key players and comprehensively analyze their market position in terms of ranking and core competencies, along with detailing the competitive landscape for the market leaders

- To analyze competitive developments such as product launches, partnerships, collaborations, contracts, acquisitions, expansions, and research and development (R&D) activities carried out by players in the ALD equipment market.

Customizations Options:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Information

- Detailed analysis of additional countries (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ALD Equipment Market