ATP Assays Market Size by Product (Consumables (Reagents, Microplate), Instruments (Luminometer, Spectrophotometer)), Application (Contamination, Disease Testing, Drug Discovery), End User (Hospitals, Pharmaceuticals, F&B, Academics) & Region - Global Forecast to 2028

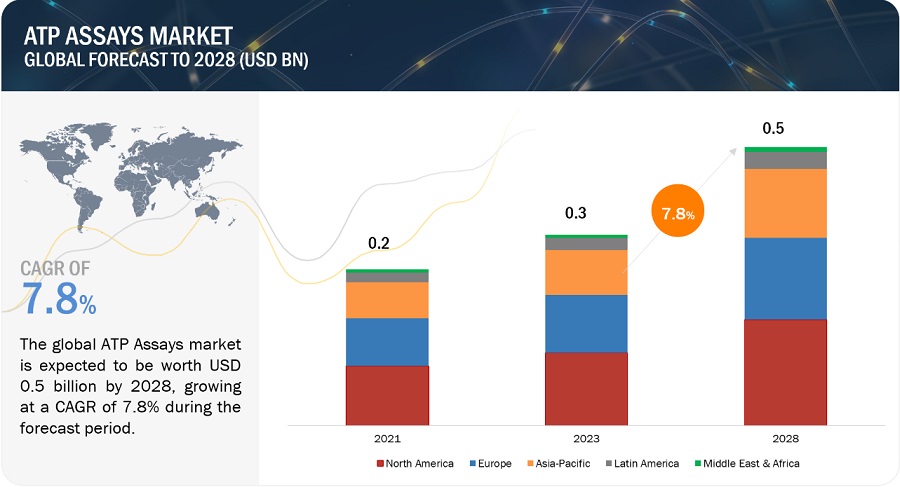

The size of global ATP assays market in terms of revenue was estimated to be worth $0.3 billion in 2023 and is poised to reach $0.5 billion by 2028, growing at a CAGR of 7.8% from 2023 to 2028. The research study consists of an industry trend analysis, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The expansion of this market is primarily propelled by the shift from culture-based tests to rapid tests, rising demand for cell-based assays in research, and the rising demand for ATP assays in pharmaceutical companies. However, lack of ability to differentiate between extracellular and intracellular ATP are factors restraining the growth of this market.

Global ATP Assays Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

ATP Assays Market Dynamics

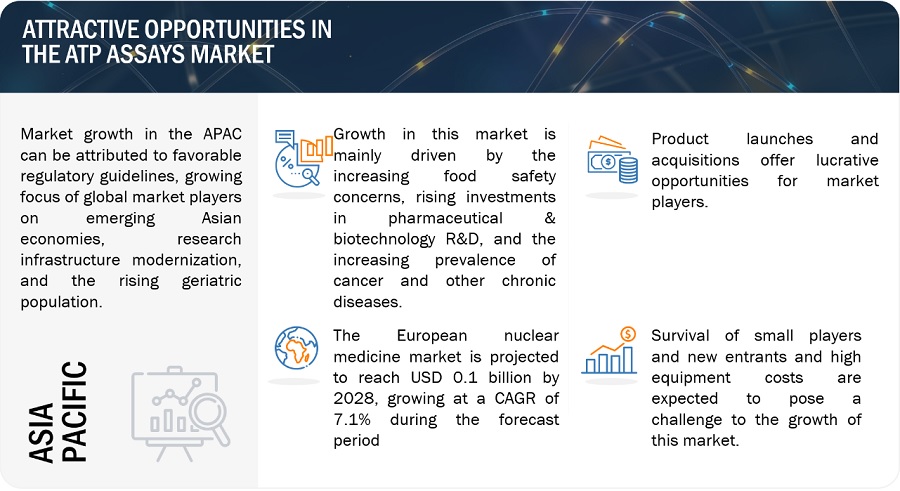

Driver: Increasing food safety concerns

Technological advancements have supported the food supply to be more distinct than ever before. To ensure best-quality products with lowest health risks, several governments and companies have declared regulations to stipulate tolerable levels of contaminants, residues, and additives in food products. Under the Food Safety Modernization Act (FSMA), food processing facilities should have food safety programs in place and collect quantitative data to determine that their cleaning and sanitation programs are working. It lowers the risk of foodborne illnesses, closures, and recalls and can also increase efficiency and decrease costs. According to the WHO, in 2022, unsafe food containing harmful bacteria, viruses, parasites, or chemical substances, resulted in more than 200 diseases, ranging from diarrhea to cancers. An estimated 600 million (almost 1 in 10 people in the world) fall ill after eating contaminated food, and 420,000 die every year, resulting in the loss of 33 million healthy life years (DALYs).

Restraint: High cost of instruments

Cell biology implies extensive research on the development of new therapies, such as stem cell and gene therapies. The instruments, reagents, and other products associated with these research activities are made to be of high quality to obtain accurate results. In biopharmaceutical companies, the overall cost of production of biopharmaceuticals increases significantly due to the use of expensive systems. The cost of research in cell biology is high because of the need to maintain high-quality standards (use of high-grade, expensive products) and comply with guidelines set up by regulatory authorities. Furthermore, it becomes difficult for small hospitals, diagnostic laboratories, and research & academic laboratories to acquire these instruments owing to budget constraints. In addition, the maintenance costs and several other indirect expenses result in an overall increase in the total cost of ownership of these instruments. This is a major factor limiting the adoption of instruments utilized for ATP assays in both clinical and research applications, especially in emerging markets.

Opportunity: Technological enhancements in ATP assay probes

ATP is a universal mediator of metabolism and signaling across unicellular and multicellular species. There is a basic interdependence between the dynamics of ATP and the physiology that arises at the intracellular and extracellular levels. Thus, characterizing and recognizing ATP dynamics offers valuable mechanistic insights into processes that varies from neurotransmission to the chemotaxis of immune cells. Therefore, there is a requirement for a methodology to interrogate both the temporal and spatial components of ATP dynamics from the subcellular to organismal levels in live specimens. In the last several decades, a number of molecular probes that are detailed to ATP have been developed. These probes have been combined with imaging approaches, mostly optical microscopy, to allow the qualitative and quantitative detection of this critical molecule.

Challenge: Survival of small players and new entrants

The survival of small players and new emerging players in the ATP assays market is a substantial challenge. Established players such as Thermo Fisher Scientific. (US), Merck KGaA (Germany), Lonza (Switzerland), PerkinElmer (US), and NEOGEN Corporation (US) hold for a major share of the market. These players have a robust product portfolio and deep brand recognition. As a result, it is difficult for small players and new entrants to participate with established players. Also, as large investments are wanted for the R&D and launch of innovative products in the market, it is hard for small players to sustain their operations and compete with established players that have huge R&D budgets.

ATP Assays Market Ecosystem Map

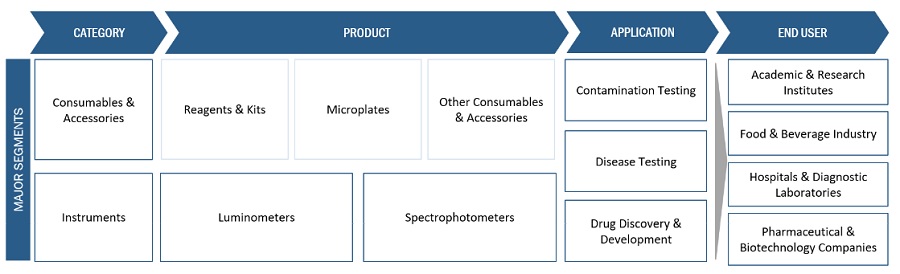

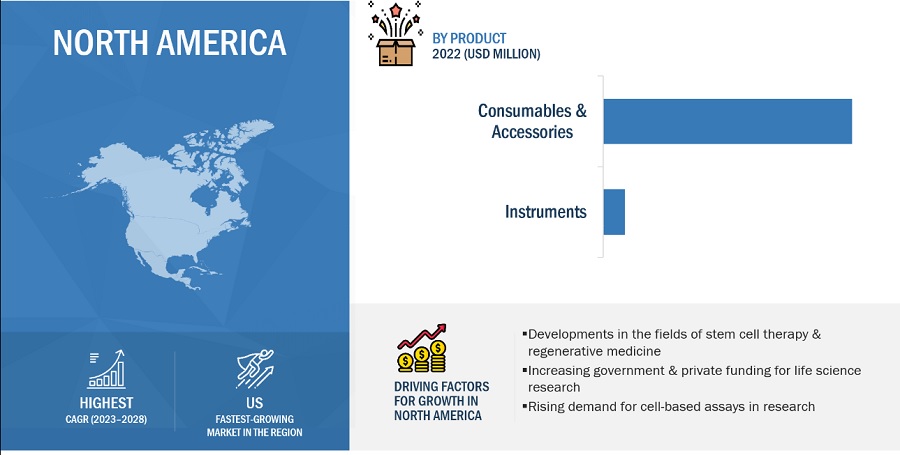

By product, the instruments segment is accounted for the second largest share of the ATP assays industry during the forecast period

Based on products, within the ATP assays market, there are consumables & accessories as well as instruments, with consumables & accessories holding a significant portion. This predominance is attributed to the widespread utilization of ATP assays in research institutes to assess cell viability, the growing demand for tumor testing and cell proliferation (especially in cancer) driven by the increase in chronic diseases, and the frequent procurement of consumables by pharmaceutical and biotechnology companies.

The contamination testing accounted for the largest share of the ATP assays industry during the forecast period.

Based on applications, The ATP assays market is divided into segments including contamination testing, disease testing, and drug delivery & development. The significant share of the contamination testing segment can be attributed to various factors. These factors include the escalating regulatory requirements imposed on pharmaceutical and food & beverage companies to ensure uncontaminated production, and the surge in drug discovery activities driven by the COVID-19 pandemic

The pharmaceutical & biotechnology companies segment accounted for the largest share of the ATP assays industry in 2022, by end user

Based on end users, The ATP assays market is categorized into pharmaceutical & biotechnology companies, the food & beverage industry, hospitals & diagnostic laboratories, and academic & research institutes. The dominance of this segment can be attributed to several significant factors. These factors include the substantial presence of pharmaceutical players who are making noteworthy investments in this market, the increasing regulatory approvals for cell culture-based vaccines that necessitate the use of ATP assays in contamination testing, the expansion of commercial activities by various pharmaceutical companies, the growing demand for cell and gene therapies to address chronic diseases, extensive research and development endeavors in the pharmaceutical & biopharmaceutical sector, the heightened production of drugs for COVID-19, the rising adoption of cell-based assays for drug development, and the user-friendly nature of ATP assays in contamination testing.

North America to witness significant growth in ATP assays industry from 2023 to 2028

On the basis of region, the ATP Assays market is divided into North America, Europe, Asia Pacific, Latin America and Middle East & Africa. In 2023, North America projected to lead market share of the market. This can be attributed to the use of advanced technologies in microbial detection, rising demand for cell-based assays in research, and the presence of high-quality infrastructure for clinical and laboratory research are also supporting market growth

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in this market are Thermo Fisher Scientific, Inc. (US), Promega Corporation (US), Merck KGaA (Germany), PerkinElmer, Inc. (US), Agilent Technologies, Inc. (US), Abcam plc (UK), Lonza Group (Switzerland), Neogen Corporation (US), 3M (US), Danaher Corporation (US), PromoCell GmbH (Germany), Geno Technology, Inc. (US), Abnova Corporation (Taiwan), AAT Bioquest,Inc. (US), BioThema AB (Sweden), Elabscience Biotechnology Inc. (US), MBL International Corporation (US), Biotium (US), Creative Bioarray (US), Canvax Biotech S.L. (Spain), Ruhof Corporation (US), Charm Sciences, Inc. (US), Bio Shield Tech, LLC (US), Cayman Chemical (US), and Cell Signaling Technology,Inc. (US).

Scope of the ATP Assays Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$0.3 billion |

|

Projected Revenue Size by 2028 |

$0.5 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 7.8% |

|

Market Driver |

Increasing food safety concerns |

|

Market Opportunity |

Technological enhancements in ATP assay probes |

The study categories the ATP Assays Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Consumables & Accessories

- Reagent

- Microplates

- Other Consumables & Accessories

- Instruments

- Luminometers

- Spectrophotometers

By Application

- Contamination Testing

- Disease Testing

- Drug Discovery and Development

By End User

- Pharmaceutical & Biotechnology companies

- Food and Beverage Industry

- Hospitals and Diagnostic Laboratories

- Academic and Research Institutions

By Region

-

North America

- US

- Canada

-

Europe

- France

- Spain

- UK

- Italy

- Germany

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of APAC

-

Latin America

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

Recent Developments of ATP Assays Industry:

- In January 2022, Agilent Technologies launched Seahorse XF Pro Analyzer, enabling operators at any skill level to access the most advanced cellular metabolism analysis technology for understanding cellular fate, fitness, and function.

- In May 2021, Neogen Corporation launched AccuPoint Advanced NG. It remains the only sanitation monitoring system in the market to utilize a flat tip sampler for maximized recovery of ATP and feature RFID technology for streamlined testing processes.

- In October 2021, Abcam has doubled the footprint of its immunoassay kit R&D and manufacturing facility in Eugene, Oregon. This enhanced capacity is another component of Abcam’s growth journey in the US and will further enable its commitment to support the research and biopharma sector globally.

- In May 2020, Thermo Fisher launched the Orbitrap 240 Mass Spectrometer. It is designed to give proteomics, metabolomics, and biopharmaceutical characterization to small molecules, which aid in research and high-throughput analyses. The new system helps drive discovery and identification with increased accuracy for confident scale-up along with operational simplicity and speed.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global ATP assays market?

The global ATP assays market boasts a total revenue value of $0.5 billion by 2028.

What is the estimated growth rate (CAGR) of the global ATP assays market?

The global ATP assays market has an estimated compound annual growth rate (CAGR) of 7.8% and a revenue size in the region of $0.3 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved the extensive use of both primary and secondary sources. The research process involved the study of various factors affecting the industry to identify the segmentation types, industry trends, key players, competitive landscape, key market dynamics, and key player strategies.

Secondary Research

This research study involved the use of comprehensive secondary sources; directories and databases such as D&B, Bloomberg Business, and Factiva; and white papers, annual reports, and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the ATP assays market. It was also used to obtain important information about the top players, market classification, and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

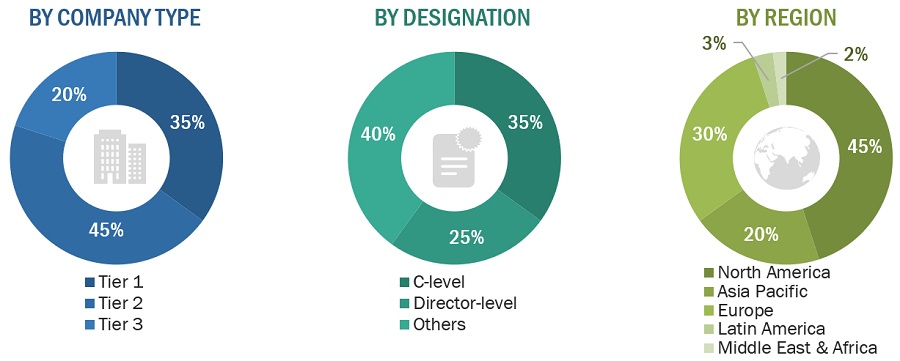

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side and demand side are detailed below. Industry experts such as CEOs, presidents, vice presidents, directors, marketing directors, marketing managers, and related executives from various key companies and organizations in the ATP assays industry were interviewed to obtain and verify both the qualitative and quantitative aspects of this research study. A robust primary research methodology has been adopted to validate the contents of the report and fill in the gaps.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2022: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

PerkinElmer, Inc. |

Assistant Manager Sales |

|

Thermo Fisher Scientific,Inc. |

Assistant Project Manager |

|

BioThema AB |

Business Development Manager |

Market Size Estimation

The market size estimates and forecasts provided in this study are derived through a mix of the bottom-up approach (revenue share analysis) primary interviews, and top-down approach (assessment of Individual shares of each ATP assay product, application, and end-user segment).

Data Triangulation

After arriving at the market size, the total market was divided into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments & subsegments, data triangulation, and market breakdown procedures were employed, wherever applicable.

Market Definition

ATP assays are procedures that can measure cell viability based on the detection of ATP using detection methods such as colorimetric, fluorescent, and bioluminescence. These assays are used to measure the presence of microorganisms through the detection of adenosine triphosphate (ATP). These assays are used for live cell quantification, contamination testing, and disease testing based on the amount of ATP present in different samples such as blood, urine, animal tissue, and food & beverage samples.

Key Stakeholders

- Senior Management

- Finance/Purchase Department

- Operations Department

- R&D Department

Objectives of the Study

- To define, describe, segment, and forecast the ATP assays market by product, application, end user, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall ATP assays market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To estimate and forecast the size of the ATP assays market in five main regions (along with their respective key countries), namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the ATP assays market and comprehensively analyze their core competencies2 and market shares

- To track and analyze competitive developments, such as acquisitions, product launches, expansions, collaborations, agreements, and partnerships, of the leading players in the ATP assays market

- To benchmark players within the ATP assays market using the competitive leadership mapping framework, which analyzes market players on various parameters within the broad categories of business strategy, market share, and product offering

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe ATP assays market into Switzerland, the Netherlands, Belgium, and others.

- Further breakdown of the Middle East & Africa ATP assays market into Saudi Arabia, the UAE, and others.

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in ATP Assays Market