Automation Testing Market by Offering (Testing Types (Static Testing and Dynamic Testing) and Services), Endpoint Interface (Mobile, Web, Desktop, and Embedded Software), Vertical (BFSI, Automotive, IT & ITeS) and Region - Global Forecast to 2028

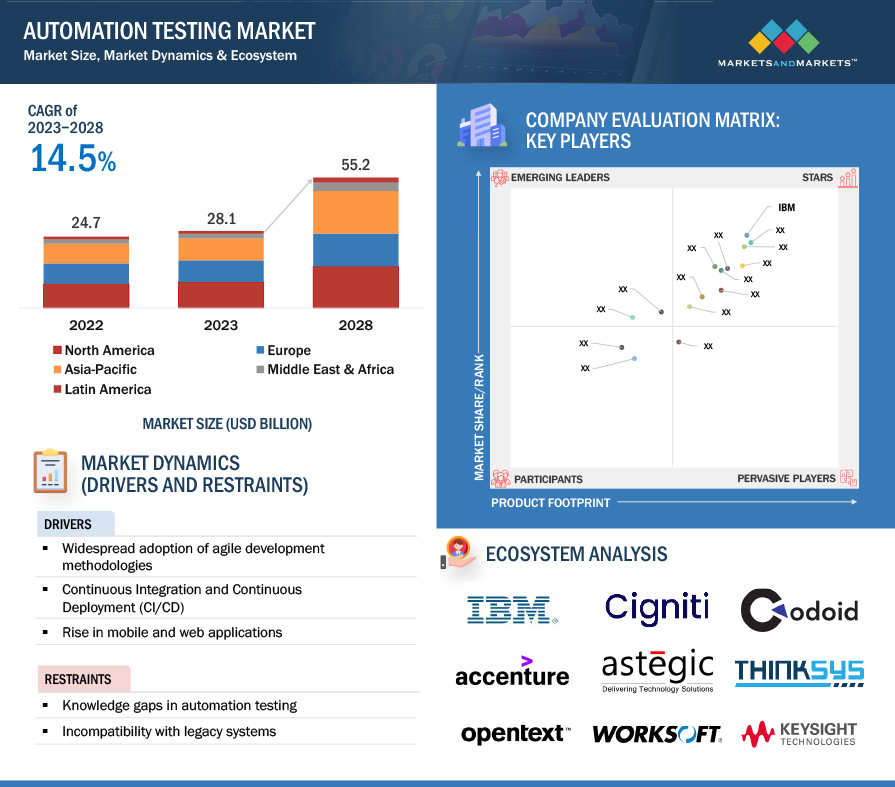

[295 Pages Report] The automation testing market is estimated to be worth USD 28.1 billion in 2023. It is projected to reach USD 55.2 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 14.5% during the forecast period. The escalating importance of delivering outstanding user experiences has propelled automation testing tools into a pivotal role in ensuring the seamless functionality, usability, and responsiveness of applications across diverse devices and platforms. Automation testing, equipped with specialized features for UX testing, addresses the critical need for software to provide an intuitive and efficient interface for end-users. By automating the validation of application behavior under various scenarios, including different devices, screen sizes, and operating systems, these tools contribute significantly to the growth of automation testing. This emphasis on user experience testing not only ensures that applications meet the expectations of modern users but also helps in identifying and rectifying potential issues early in the development process, leading to the creation of software that not only functions flawlessly but also provides a delightful and user-friendly experience. As businesses increasingly recognize the integral role of user experience in overall product success, incorporating UX testing within automation frameworks becomes a driving force for the continued expansion of automation testing methodologies.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Automation Testing Market Trends

The widespread adoption of Continuous Integration and Continuous Deployment (CI/CD) practices has revolutionized the software development lifecycle, aiming to enhance collaboration, code quality, and deployment speed. Automation testing plays a pivotal role in the success of CI/CD pipelines by ensuring the rapid and reliable validation of code changes. Automated test suites are seamlessly integrated into the CI/CD workflow, triggering the execution of tests whenever there is a new code commit. This integration allows for the continuous monitoring of code quality and functionality throughout the development process. By automating the testing phase within CI/CD, teams can detect and address issues early in the pipeline, reducing the likelihood of defects reaching production. This not only accelerates the overall development cycle but also instills confidence in the deployment process, enabling organizations to release software updates with greater frequency and efficiency while maintaining a high level of software quality. The combination of CI/CD and automation testing fosters a more agile and responsive development environment, aligning with the demands of the modern software industry..

Restraint: Incompatibility with legacy

Incompatibility with legacy systems poses a significant restraint for organizations seeking to implement automation testing. Many organizations heavily depend on legacy systems that were developed with technologies predating current automation standards. The challenge arises from the lack of necessary interfaces or Application Programming Interfaces (APIs) in these legacy systems, hindering the seamless integration of automation testing tools. Adapting these tools to effectively work with older technologies becomes a complex and cumbersome task, often requiring intricate workarounds or resorting to manual testing for specific components. This incompatibility can compromise the efficiency gains and benefits that automation testing typically offers, making it essential for organizations to carefully navigate and address compatibility issues when transitioning from manual to automated testing in a legacy system environment.

Opportunity: The integration of AI and machine learning ML technologies

The integration of AI and ML technologies into automation testing represents a transformative leap forward in the efficiency and adaptability of testing processes. AI and ML algorithms excel at recognizing patterns and trends within vast datasets, which is particularly beneficial in the context of testing dynamic and complex software applications. In automation testing, these technologies can contribute across various stages of the testing lifecycle. AI and ML can intelligently generate and optimize test scripts, identifying critical test scenarios and predicting potential issues based on historical data. During test execution, adaptive algorithms can dynamically adjust testing parameters and scenarios in response to changes in the application code, ensuring thorough coverage and more accurate results. Furthermore, AI and ML-powered analytics facilitate in-depth analysis of test results, aiding in the identification of subtle patterns or anomalies that might be challenging for traditional testing approaches to uncover. As the testing landscape continues to evolve, the incorporation of AI and ML technologies into automation testing tools is poised to enhance overall efficiency, reduce manual intervention, and provide organizations with more intelligent and adaptive solutions to meet the demands of rapidly changing software environments.

Challenge: Limited testing for UX and UI elements

Despite its effectiveness in functional and regression testing, automation testing faces challenges when it comes to evaluating user experience (UX) and user interface (UI) elements comprehensively. Manual testing remains essential for assessing certain aspects of UX, such as visual aesthetics and usability, which are inherently subjective and nuanced. Automation tools may not capture the subtleties of the user experience that are crucial for applications placing a strong emphasis on UX/UI. This limitation poses a challenge, particularly for organizations or projects where a meticulous evaluation of the user interface and overall user experience is paramount. Striking a balance between automated and manual testing becomes imperative to ensure a thorough assessment of both functional and subjective aspects of the application's performance and usability.

Ecosystem of Automation Testing Market

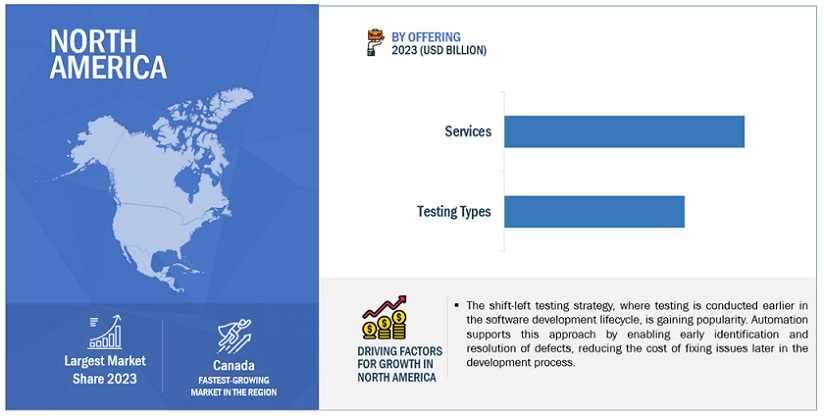

By offering, services segment to hold the largest market size during the forecast period.

The demand for automation testing services is driven by the need for comprehensive test automation strategies. Organizations seek to enhance their software testing processes by analyzing applications under test, identifying optimal test scenarios for automation, and establishing robust approaches for implementing automated testing. This driver stems from the necessity to streamline testing efforts, improve test coverage, and accelerate the delivery of high-quality software products. By prioritizing the development of effective test automation strategies, businesses can mitigate risks, optimize resource utilization, and meet the growing demands for faster and more reliable software releases. This market driver underscores the importance of strategic planning and execution in leveraging automation testing services to achieve desired outcomes in software development projects.

Static testing segment is expected to have the fastest growth rate during the forecast period.

Static testing, encompassing methodologies like code reviews and inspections, stands as a critical component in the software development life cycle, offering substantial benefits to the overall quality of the software. Through meticulous examination of the source code and project documentation without the need for program execution, static testing enables the early identification of defects and vulnerabilities. This proactive approach plays a pivotal role in minimizing the cost and effort required for addressing issues during later stages of development. By catching defects at their inception, development teams can swiftly rectify coding errors, ambiguities, and potential design flaws before they cascade into more intricate problems. This not only leads to cost savings but also contributes to the creation of a more robust and reliable software product. Additionally, static testing fosters collaborative knowledge-sharing among team members, enhancing the collective understanding of the codebase and promoting a culture of continuous improvement within the development team. Overall, the early defect detection capabilities of static testing contribute significantly to the efficiency and effectiveness of the software development process..

North America to have the largest market size during the forecast period.

The rise of low-code and no-code development platforms in North America has significantly influenced the demand for automation testing tools tailored to these environments. As organizations in the region increasingly adopt these platforms to accelerate application development and address skill shortages, the need for efficient testing solutions compatible with visually designed applications becomes paramount. Automation testing tools that can seamlessly integrate with low-code and no-code platforms enable organizations to maintain the agility and speed offered by these platforms while ensuring the reliability and quality of their applications. This trend is particularly prevalent in North America, where tech-savvy enterprises and startups leverage innovative development approaches to stay competitive in dynamic markets. Automation testing tools that adapt to low-code and no-code environments empower businesses to streamline their testing processes, reduce manual effort, and expedite time-to-market for new applications, driving the growth of automation testing solutions in the region.

Market Players:

The major players in the automation testing market are IBM (US), Accenture (Ireland), Broadcom (US), OpenText (Canada), Microsoft (US), Capgemini (France), Keysight Technologies (US), Cigniti Technologies (India), Tricentis (US), Cygnet Infotech (India), Invensis Technologies Pvt Ltd (India), QualityKiosk Technologies Pvt. Ltd. (India), Apexon (UDOneS), Idera, Inc. (US), QA Source (US), Astegic (US), Worksoft (US), ACCELQ (US), Sauce Labs (US), SmartBear (US), Parasoft (US), Applitools (US), AFour Technologies (India), QA mentor (US), Mobisoft Infotech (US), ThinkSys (US), Qt Group (Finland), Codoid (India). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and enhancements, and acquisitions to expand their automation testing market footprint.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Billion) |

|

Segments Covered |

By offering (testing type, services), testing type (static testing, dynamic testing), dynamic testing( functional testing, non-functional testing) services (advisory and consulting services, planning and development services, support and maintenance services, documentation and training services, implementation services, managed services, other services), endpoint Interface (mobile, web, desktop, embedded software) vertical ( banking, financial services, and insurance, automotive, aerospace and defense, healthcare and life sciences, retail, IT and ITeS, telecom, manufacturing, transportation and logistics, energy and utilities, media, and entertainment, other verticals) |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America. |

|

Companies covered |

IBM (US), Accenture (Ireland), Broadcom (US), OpenText (Canada), Capgemini (France), Microsoft (US), Keysight Technologies (US), Cigniti Technologies (India), Tricentis (US), Cygnet Infotech (India), Invensis Technologies Pvt Ltd (India), QualityKiosk Technologies Pvt. Ltd. (India), Apexon (US), Idera, Inc. (US), QA Source (US), Astegic (US), Worksoft (US), ACCELQ (US), Sauce Labs (US), SmartBear (US), Parasoft (US), Applitools (US), AFour Technologies (India), QA mentor (US), Mobisoft Infotech (US), ThinkSys (US), Qt Group (Finland), Codoid (India) |

This research report categorizes the automation testing market to forecast revenues and analyze trends in each of the following submarkets:

Based on the offering:

- Testing types

- Services

Based on Testing Type:

- Static testing

- Dynamic testing

Based on Dynamic Testing<

- Functional testing

-

Non-Functional testing

- Security testing

- Performance testing

- Compatibility testing

- Compliance testing

- Usability testing

- Others

By Services:

- Advisory and consulting services

- Planning & development services

- Support & maintenance services

- Documentation & training services

- Implementation services

- Managed services

- Other services

By Vertical:

- Banking, financial services, and insurance

- Automotive

- Aerospace & Defense

- Healthcare and life sciences

- Retail

- IT & ITeS

- Telecom

- Manufacturing

- Transportation and logistics

- Energy and utilities

- Media and entertainment

- Other verticals

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia & New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

-

GCC Countries

- Kingdom of Saudi Arabia (KSA)

- United Arab Emirates (UAE)

- Rest of GCC Countries

- South Africa

- Rest of the Middle East & Africa

-

GCC Countries

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2023, OpenText acquired Micro Focus, a UK-based business software and consulting firm .

- In June 2023, Microsoft and Leapwork partnered to provide test automation for users of Microsoft Dynamics 365 and Microsoft Power Platform. Leapwork's platform utilizes an AI-powered, visual, and codeless system, enabling non-technical business users to easily create and manage test automation. This facilitates continuous, end-to-end testing across applications, reducing the risk of disruptions during monthly software updates and supporting the consistent delivery of high-quality software.

- In August 2023, Keysight Technologies launched Eggplant Test 7.0, an improved iteration of the automated software testing solution. This version features integrations specifically crafted to assist QA teams in conducting simultaneous tests on mobile apps across various devices and operating systems.

- In July 2021, Capgemini and SharpEnd collaborated to introduce CornerShop, a retail innovation store. This dynamic space serves as a live testing environment, providing brands, retailers, and shoppers with hands-on experience with technologies that revolutionize the shopping journey in categories like food and drink, cosmetics, and fashion.

Frequently Asked Questions (FAQ):

What is the definition of the automation testing market?

Automation testing is a software testing technique where automated tools and scripts are utilized to perform tests on software applications, comparing the actual outcomes with the expected results. The primary goal of automation testing is to enhance the efficiency, effectiveness, and coverage of the software testing process. It involves using testing tools to execute pre-scripted test cases, validate application functionality, and identify any discrepancies or defects in the software. Automation testing is particularly beneficial for repetitive and time-consuming testing tasks, allowing for faster execution, improved accuracy, and early detection of issues in the software development lifecycle.

What is the market size of the automation testing market?

The automation testing market is estimated to be worth USD 28.1 billion in 2023 and is projected to reach USD 55.2 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 14.5%.

What are the major drivers in the automation testing market?

The major drivers in the automation testing market are the accelerated software development lifecycles and widespread adoption of Continuous Integration and Continuous Deployment (CI/CD) practices.

Who are the key players operating in the automation testing market?

The key market players profiled in the automation testing market are IBM (US), Accenture (Ireland), Broadcom (US), OpenText (Canada), Capgemini (France), Microsoft (US), Keysight Technologies (US), Cigniti Technologies (India), Tricentis (US), Cygnet Infotech (India), Invensis Technologies Pvt Ltd (India), QualityKiosk Technologies Pvt. Ltd. (India), Apexon (US), Idera, Inc. (US), QA Source (US), Astegic (US), Worksoft (US), ACCELQ (US), Sauce Labs (US), SmartBear (US), Parasoft (US), Applitools (US), AFour Technologies (India), QA mentor (US), Mobisoft Infotech (US), ThinkSys (US), Qt Group (Finland), Codoid (India).

What are the key technology trends prevailing in the automation testing market?

The key technology trends in automation testing include AI, ML, and Cloud computing. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

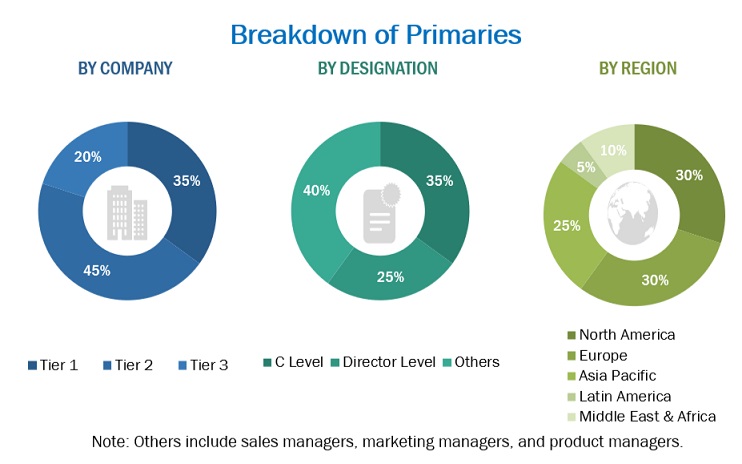

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun & Bradstreet (D&B) Hoovers and Bloomberg BusinessWeek, to identify and collect valuable information for a technical, market-oriented, and commercial study of the automation testing market. The primary sources have been mainly industry experts from the core and related industries and preferred suppliers, manufacturers, distributors, service providers, technology developers, alliances, and organizations related to all segments of the value chain of this market. In-depth interviews have been conducted with primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information.

Secondary Research

The market for companies offering automation testing solutions and services to different verticals has been estimated and projected based on the secondary data made available through paid and unpaid sources, as well as by analyzing their product portfolios in the ecosystem of the automation testing market. It also involved rating company products based on their performance and quality. In the secondary research process, various sources such as the International Journal of Computer Science Engineering (IJCSE), International Journal of Computer Applications Technology and Research (IJCSE), and International Research Journal of Engineering and Technology (IRJET) have been referred to for identifying and collecting information for this study on the automation testing market. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles by recognized authors, directories, and databases. Secondary research has been mainly used to obtain key information about the supply chain of the market, the total pool of key players, market classification, segmentation according to industry trends to the bottommost level, regional markets, and key developments from both market- and technology-oriented perspectives that have been further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from automation testing solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders. Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using automation testing solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of automation testing solutions which would impact the overall automation testing market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

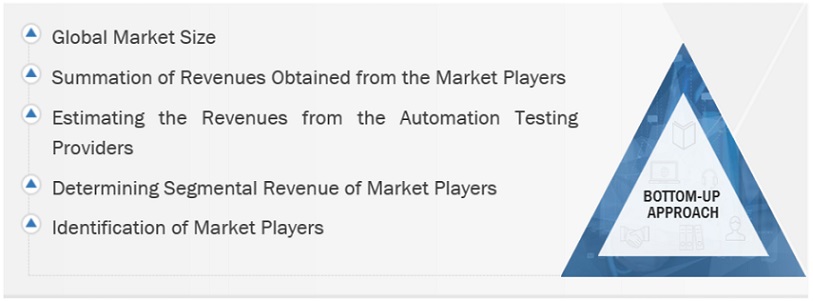

Multiple approaches were adopted to estimate and forecast the size of the automation testing market. The first approach involves estimating market size by summing up the revenue companies generate by selling automation testing offerings.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the automation testing market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up approach

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-Top-Down Approach

Data Triangulation

After arriving at the overall market size, the automation testing market was divided into several segments and subsegments. A data triangulation procedure was used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The automation testing market refers to the industry and ecosystem that involves the development, deployment, and utilization of automated tools, frameworks, and technologies to conduct software testing processes. Automation testing aims to streamline and enhance the efficiency of testing activities by automating the execution of test cases, reducing manual intervention, and providing rapid and repetitive testing capabilities. This market encompasses a wide range of tools and solutions designed to validate the functionality, performance, security, and reliability of software applications throughout the software development lifecycle. Key components of the automation testing market include test automation tools, frameworks, scripting languages, and associated services. The market addresses the growing need for organizations to accelerate their software development cycles, improve software quality, and adapt to the challenges posed by complex and dynamic software environments.

Key Stakeholders

- Automation Testing Tool Providers

- IT Departments

- Test Automation Engineers

- QA and Testing Teams

- IT Managers and Decision-Makers

- Government Agencies

- Investment Firms

- Automation testing Alliances/Groups

Report Objectives

- To determine, segment, and forecast the automation testing market by offering, vertical, end-point interface, and region in terms of value

- To forecast the size of the market segments concerning 5 main areas: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To study the complete value chain and related industry segments and perform a value chain analysis of the market landscape

- To strategically analyze the macro and micro-markets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze the industry trends, pricing data, patents, and innovations related to the market

- To analyze the opportunities for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the market and comprehensively analyze their market share/ranking and core competencies

- To track and analyze competitive developments, such as mergers & and acquisitions, product launches and developments, partnerships, agreements, collaborations, business expansions, and R&D activities

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Country-wise information

- Analysis for additional countries (up to five)

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Automation Testing Market