Automotive Paints Market by Type (E-coat, Primer, Basecoat, Clearcoat), Resin (PU, Epoxy, Acrylic), Technology (Solvent, Water, Powder), Paint Equipment (Airless, Electrostatic), Texture, Content, ICE & EVs, Refinish and Region - Global Forecast to 2028

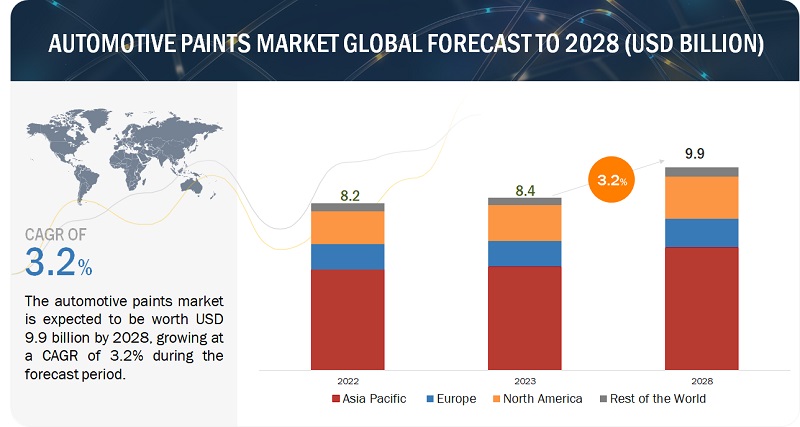

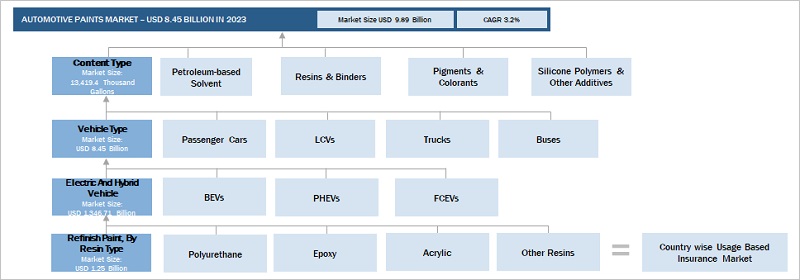

[319 Pages Report] The automotive paints market is projected to grow from USD 8.4 billion in 2023 to USD 9.9 billion by 2028, at a CAGR of 3.2%. The key factors driving the automotive paints is increase in production of passenger cars, EVS and increase in sales of SUVs is driving. Also, there is increase in adoption for powder coating and water-borne coating technologies in automotive sector to reduce the environmental impact. Hence these factors is driving the automotive paints market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

DRIVER: Stringent emission regulations has forced key players to produce sustainable and low-VOC paints

As environmental concerns and regulations intensify, the automotive industry is facing increasing pressure to reduce its environmental footprint. One of the key areas of focus is reducing volatile organic compound (VOC) emissions from automotive paints, which are a significant contributor to air pollution. To address this challenge, governing bodies worldwide are implementing stringent emission norms that mandate lower VOC content in automotive paints. These stringent emission norms are having a profound impact on the automotive paints industry, forcing manufacturers to invest heavily in research and development (R&D) to develop new, low-VOC paints. The primary focus of R&D efforts is on developing innovative technologies that significantly reduce VOC emissions from automotive paints. This includes advancements in waterborne paints, which use water as the primary solvent instead of traditional organic solvents, resulting in lower VOC emissions. Additionally, high-solids paints, which contain a higher concentration of solids and less solvent, are being explored as a promising alternative.

The overall impact of stringent emission norms on the automotive paints industry is undeniably positive. These norms are acting as a catalyst for innovation, driving manufacturers to invest in R&D and develop new, environmentally friendly, and durable automotive paints. To comply with the stringent emission norms set by governing bodies, key players in the automotive paint industry are investing heavily in research and development (R&D) to develop new, low-VOC paints and enhance the overall sustainability of their products. There was a significant shift towards waterborne paints, which utilize water as the primary solvent instead of traditional organic solvents, resulting in substantially lower VOC emissions. Companies like Axalta Coating Systems, LLC, PPG Industries, Inc., and BASF SE are actively investing in developing waterborne paint technologies that meet the performance and durability requirements of the automotive industry.

Overall, the stringent emission norms are a key driving force behind the R&D surge in the automotive paints industry. These norms are pushing manufacturers to develop innovative solutions that reduce VOC emissions, enhance paint durability, and promote sustainable practices. This R&D drive is shaping the future of automotive paints, ensuring a more environmentally conscious and technologically advanced industry.

RESTRAINT: Advancements in autonomous technologies reduce accidents, restricting refinish market

An increase in road accidents is a pressing concern for automobile manufacturers and governments. The National Highway Traffic Safety Administration (NHTSA) reported a increase of 0.3% in traffic-related fatalities in the US in 2022, estimating that approximately 42,795 individuals lost their lives in crashes. On average, this equated to 117 deaths occurring daily on the roads throughout the year. Over the past decade, there has been a significant surge of 30% in traffic fatalities, resulting in nearly 10,000 more deaths compared to the figures in 2013, which stood at 32,893. However, the automotive industry is witnessing a rapid integration of safety features. The demand for these features will increase exponentially in the coming years.

New safety features such as ADAS, pedestrian detection systems, and automated emergency calling (eCall) are making vehicles safer than before. In response, the number of accidents is declining, which, in turn, is restricting the growth of the automotive refinish market. A study by the NHTSA found that autonomous emergency braking (AEB) systems can reduce rear-end collisions by up to 40%. Another study by the Insurance Institute for Highway Safety (IIHS) found that lane departure warning (LDW) systems can reduce lane departure crashes by up to 11%. A study by the National Institute of Justice also suggests that eCall systems can reduce the time it takes for emergency services to arrive at the scene of a crash by up to 50%.

The advent of ADAs and autonomous driving along with vehicle connectivity are aimed towards reducing the number of accidents, which may affect the aftermarket consumption of automotive paints.

OPPORTUNITY: Booming sales of SUVs

The popularity of SUVs can be attributed to their versatility, offering spaciousness, comfort, and security due to their larger size and higher driving position. They cater to diverse consumer needs, both for urban and off-road use. The evolution of SUV designs has seen a shift towards more stylish and sleek models, appealing to a wider demographic beyond traditional off-road enthusiasts. This increased demand for SUVs has significantly impacted the automotive paints market. These vehicles require more paint due to their larger surface areas and come in a wide array of colors and finishes. As a result, automotive paint manufacturers have a significant opportunity to meet the demands of this expanding market segment.

Additionally, SUVs are often used in challenging environments, such as off-road trails and dusty roads, which means they need to be protected with durable and scratch-resistant paint. Automotive paint manufacturers are developing new products to meet these needs, such as ceramic-infused paints that are harder and more scratch-resistant than traditional paints. The demand for more unique and eye-catching paint colors and finishes is also increasing, as SUVs are often associated with luxury and adventure. In response, automotive paint manufacturers are developing new colors and finishes, including matte, satin, and pearlescent paints.

According to MarketsandMarkets analysis, the SUV market was worth 885.8 billion in 2022 and is expected to reach up to 1,221.5 billion in 2027 at a CAGR of 6.6%. This surge in SUV popularity has stimulated the automotive paint industry, creating new opportunities for paint manufacturers to cater to the growing demands of SUV owners and the automotive market. By developing new and innovative products, automotive paint manufacturers are well-positioned to capitalize on the growth of the SUV market in the coming years.

CHALLENGE: Rapidly changing consumer preferences

The automotive paint industry serves both OEMs and the aftermarket. The demand for paints from OEMs has increased due to the rise in vehicle production, while the aftermarket has seen an increase in demand due to shifting consumer preferences and an increase in the number of vehicles on the road. Customers are becoming more aware of leading paint brands and are upgrading from local automotive paint manufacturers to premium manufacturers like Axalta, AkzoNobel, and Sherwin-Williams. Emerging economies are playing a crucial role in changing consumer preferences. Rapid income growth, increasing urbanization, a larger share of the young population, and a preference for spending rather than saving are some of the macro indicators. These factors have led to the rapid growth of the automotive industry, which is reflected in the automotive paints market.

Over time, consumer preferences for colors are also changing. Customers are now choosing organized players as they are becoming more conscious of brand and product quality. People are changing the paint on their vehicles to make a style statement. OEMs are providing cars with various pleasant colors as customers demand more variety in colors. However, it is challenging for paint manufacturers and OEMs to meet the varied demands of customers in different markets. Hence, they have to stick to a limited product portfolio, which may not be able to fulfill the needs of all customers in the market. Therefore, catering to the preferences of a large customer base is a challenge for the automotive paint industry.

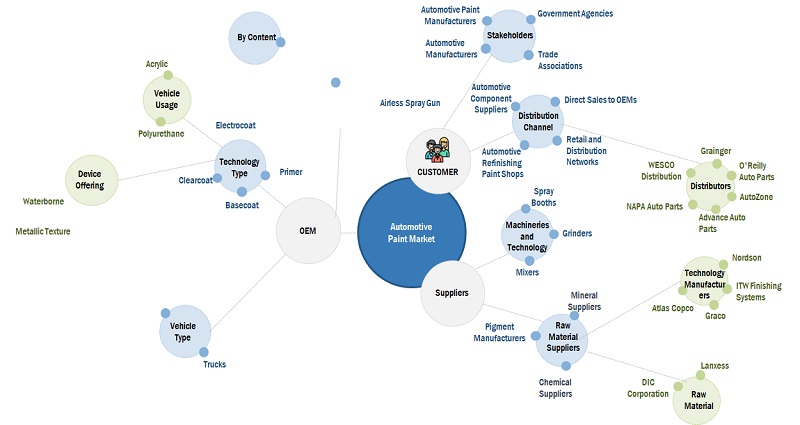

Automotive Paint Market Ecosystem.

The major companies in the automotive paints market have the latest technologies, diversified portfolios, and strong distribution networks globally. The major players in the automotive paints market include Axalta Coating System, LLC. (US), PPG Industries, Inc. (US), Akzo Nobel N.V. (Netherlands), The Sherwin Williams Company (US), and BASF SE (Germany).

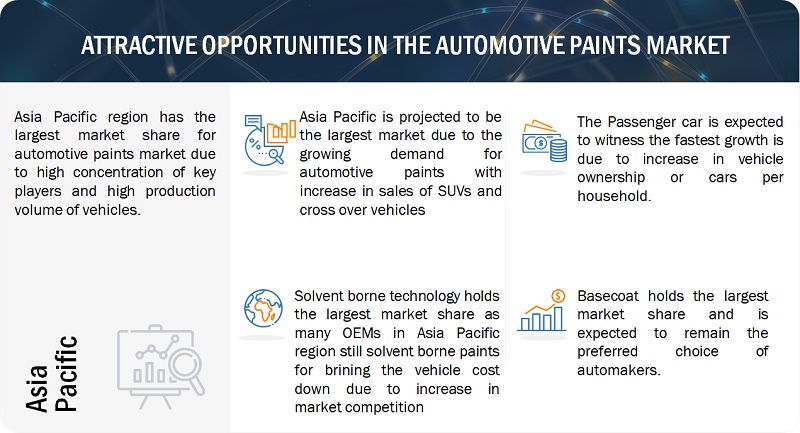

The solvent-borne paint segment, by technology type, holds the largest market share.

Solvent-borne paints have traditionally held the highest market share in automotive paint technology due to several advantages that have made them the preferred choice for many automotive manufacturers. While waterborne paints are gaining traction due to their environmental benefits, solvent-borne paints still offer several advantages such as superior durability & adhesion, easier to spray, faster drying time, and has wider range of colors and finishes that make them a popular choice.

For instance, A study by the Automotive Industry Action Group found that solvent-borne paints typically dry within 15-30 minutes, while waterborne paints can take up to several hours to fully cure. This difference in drying time can significantly impact production throughput. Also, solvent-borne paints generally exhibit better flow and leveling properties compared to waterborne paints, which gets spread more evenly on the surface, resulting in a smoother and more uniform finish. Hence, due to despite emergence of waterborne paints, solvent-borne paints continue to hold a significant share of the automotive paint market due to their superior performance, efficiency, and versatility, making them a crucial component in the automotive manufacturing process.

The electrostatic spray gun is the fastest-growing segment in painting equipment type for automotive paint market.

Electrostatic spray guns are rapidly gaining traction as the preferred choice for automotive paint applications due to their ability to improve efficiency, minimize paint waste, and improve overall paint quality. This has propelled them to become the fastest-growing segment in the automotive paints market. Electrostatic spray guns utilize an electrostatic charge to attract paint particles towards the target surface, resulting in a transfer efficiency of up to 98%. This significantly exceeds the 40-60% efficiency of conventional spray guns. The improved transfer efficiency translates into reduced paint waste, lower material costs, and minimized environmental impact. A study by the National Institute for Occupational Safety and Health (NIOSH) revealed that electrostatic spray guns can reduce paint consumption by up to 50%, leading to substantial cost savings for automotive manufacturers.

The electrostatic charge ensures an even distribution of paint particles, resulting in a smoother, more uniform finish. This minimizes defects like runs and sags, enhancing the overall appearance and durability of vehicles. The faster drying times and reduced overspray associated with electrostatic spray guns enable quicker production cycles and reduced downtime for automotive manufacturers. This efficiency boost contributes to increased productivity and lower production costs. Hence, the electrostatic spray guns have revolutionized the automotive paints market due to their ability to enhance transfer efficiency, minimize paint waste, improve paint quality, and increase production efficiency. These advantages have solidified their position as the fastest-growing segment in the market, driving their rapid adoption and transforming automotive painting processes worldwide.

Epoxy Resin holds the second largest market share automotive resin type of automotive paints.

Epoxy resin is the second most widely used resin type in automotive paints after polyurethane. It is a thermosetting resin, which means that it undergoes an irreversible chemical reaction when cured, resulting in a hard, durable film. Epoxy resins are known for their excellent adhesion, corrosion resistance, and chemical resistance. They are also relatively hard and have good impact resistance. Epoxy resin is a versatile and valuable material for automotive paints. It is expected to continue to be a major player in the automotive paint market for many years to come.

The refinishing of vehicles is a significant driving force behind the expanding market for epoxy resins in automotive paints. Epoxy paints provide several advantages over conventional paints, making them a popular choice for refinishing damaged or aged vehicles. Epoxy resins have also been favored for vehicle refinishing by both professional body shops and DIY enthusiasts. According to a primary, the refinishing market is expected to continue expanding in the coming years, driven by the increasing demand for durable, environmentally friendly, and high-performance paint solutions. Hence due to these factors has epoxy resin holds the second largest market for automobile resin type.

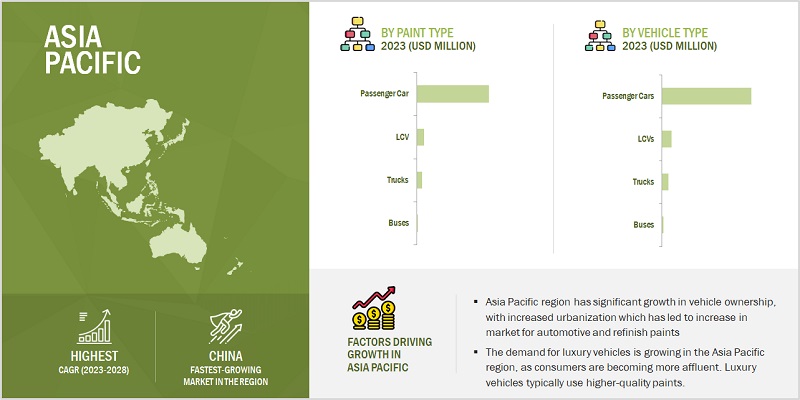

Asia Pacific holds the largest share in the automotive paints market.

The rapid adoption of electric vehicles (EVs) in the Asia Pacific region is driving demand for specialized automotive paints that can withstand the unique challenges of EV batteries and lightweight materials. Governments across the region are incentivizing EV adoption through subsidies and tax breaks, further fueling the demand for EV-specific paints. For instance, China, the world's largest EV market, offers generous subsidies to EV manufacturers and consumers. This has led to an explosion in EV sales, with China accounting for over 60% of global EV sales in 2022 according to The International Council on Clean Transport (ICCT). Similarly, India is also implementing policies to promote EV adoption. The Indian government has set ambitious targets for EV sales, aiming to have 30% of all new car sales be EVs by 2030.

Also, the rising popularity of SUVs in the Asia Pacific region is fueling the demand for automotive paints. On the same note, the market for SUVs in projected to grow from USD 885.8 billion in 2022 to USD 1,221.7 billion in 2027. SUVs are larger and more complex vehicles than traditional passenger cars, requiring more paint to cover their extensive surfaces. This region has major key players namely, Nippon Paint Holdings Company LTD (Japan), PPG Asian (India), Kansai Paint Co Ltd (Japan), Berger Paints (India), KCC Corporation (South Korea). These players are actively acquiring the other small players or investing in technology to cater the increasing demand from the automakers. For instance, Nippon Paint is establishing a new manufacturing facility in Okayama, Japan, and has started the production form the second half of 2023 for manufacturing a range of coatings, including auto OEM topcoats, plastic coatings, and other specialized coatings. Hence these factors is driving the automotive paints market in Asia Pacific region.

Key Market Players

Major manufacturers in the Automotive paints market include PPG Industries LLC. (US), Axalta Coating Systems LLC, (US), Akzo Nobel N.V. (Netherlands), BASF SE (Germany), The Sherwin Williams Company (US), Valspar (US), DOW Chemical (US), 3M (US), and KCC (South Korea).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Attribute |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Market Growth forecast |

USD 9.89 Billion by 2028 from USD 8.45 Billion in 2023 at 3.2% CAGR |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

By Paint type, ByTechnology type, By Resin type, By Texture type, By Electric & Hybrid Vehicle type, By Vehicle type, By Content type, By Resin Refinish Paint type, By Painting Equipment |

|

Geographies covered |

Asia Pacific, North America, Europe, and Rest of the World. |

|

Top Players |

PPG Industries LLC. (US), Axalta Coating Systems LLC, (US), Akzo Nobel N.V. (Netherlands), BASF SE (Germany), The Sherwin Williams Company (US), Valspar (US), DOW Chemical (US), 3M (US), and KCC (South Korea). |

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs.

The study segments the usage based insurance market:

Automotive Paints Market, By Paint Type

- Electrocoat

- Basecoat

- Primer

- Clearcoat

Automotive Paints Market, By Technology Type

- Solvent Borne

- Waterborne

- Powder Coating

Automotive Paints Market, By Resin Type

- Polyurethane

- Epoxy

- Acrylic

- Other Resins

Automotive Paints Market, By Texture Type

- Solid Texture

- Metallic Texture

- Matte Finish Paints

- Pearlescent Paints

- Solar Reflective Paints

Automotive Paints Market, By Content Type

- Petroleum-Based Solvent

- Resins & Binders

- Pigments & Colorants

- Silicone Polymers & Other Additives

Automotive Paints Market, By Painting Equipment Type

- Airless Spray Gun

- Electrostatic Spray Gun

Automotive Paints Market, By Vehicle Type

- Passenger Car

- Light Commercial Vehicle

- Trucks

- Buses

Electric And Hybrid Vehicle Paint Market, By Region

- Battery Electric Vehicle

- Hybrid Electric Vehicle

- Feul Cell Eletcric Vehicle

Automotive Refinish Paints Market, By Resin Type

- Polyurethane

- Epoxy

- Acrylic

- Other Resins

Automotive Paints Market, By Region

- North America

- Europe

- Asia Pacific

- Rest of the World

Recent Developments

- In June 2023, PPG industries, Inc. launched PPG ENVIRO-PRIME EPIC 200R, a suite of electrocoating (e-coat) products that cure at lower temperatures than competing technologies. The products provide sustainability benefits for customers, including lower energy use and reduced CO2 emissions at manufacturing facilities. PPG ENVIRO-PRIME EPIC 200R electro coat products cure at temperatures as low as 150°C (302°F), which is significantly lower than the typical cure temperatures of 180°C (356°F) or higher for conventional e-coats. This lower cure temperature helps to reduce energy consumption by up to 25%. In addition, the lower cure temperature helps to reduce CO2 emissions by up to 20%.

- In August 2023, Axalta announced adding RADAR-compliant color formulas to its global online color databases - ChromaWeb, Phoenix Cloud, and Standowin iQ Cloud. ADAS sensors are often located behind painted plastic surfaces on cars, and the coating layers can directly influence the signal emitted and received by the ADAS sensors. Some colors, such as those with high concentrations of aluminum flakes, can interfere with RADAR sensors. Axalta has developed RADAR-compliant color formulas for colors that are known to interfere with RADAR sensors.

- In December 2022, BASF launched its first biomass balance automotive coatings in China. The first product, ColorBrite Airspace Blue ReSource basecoat, is certified by REDcert² using a biomass balance approach. It was made from renewable raw materials used in the production of the basecoat and allocated to the product through a mass balance system. This results in a reduction of the product's carbon footprint by 20%. BASF has also received biomass certification for its resins plant in Caojing and its paint manufacturing sites in Minhang and Caojing, operated by BASF Shanghai Coatings Co., Ltd.

- In mArch 2022, The Sherwin Willaims Company introduced Collision Core is a comprehensive solution that includes applications for color retrieval, body shop management, and performance management. The suite is designed to help shops overcome critical industry challenges, such as skilled labor shortages, rising costs, complex repair processes, and customer satisfaction..

Frequently Asked Questions (FAQ):

What is the current size of the automotive paints market?

The automotive paints market is estimated to be USD 8.4 billion in 2023 and is projected to reach USD 9.9 billion by 2028 at a CAGR of 3.2%.

What are the driving factors of automotive paints market?

Increase in vehicle production, Implementation of stringent regulation in VOC content, increase in sales of SUVs, and change in consumer preference are driving the automotive paints market.

Who are the top key players in the automotive paints market?

Major manufacturers in the Automotive paints market include PPG Industries LLC. (US), Axalta Coating Systems LLC, (US), Akzo Nobel N.V. (Netherlands), BASF SE (Germany), The Sherwin Williams Company (US), Valspar (US), DOW Chemical (US), 3M (US), and KCC (South Korea). These companies focus on developing adopt expansion strategies new products, and partnerships, undertake collaborations, and mergers & acquisitions to gain traction in this growing automotive paints market.

What are the trends in the usage based insurance market?

Participants like automotive IOT and insurance platform providers, data platform and analytics companies, automotive embedded telematics box and telematics providers, big data companies, and cloud service providers are expected to see growth opportunities as the automotive usage-based insurance ecosystem develops.

What are the challenges faces by the automotive paint manufacturer globally?

Automotive paint wastage in developing country at OEM and refinish level, rapidly changing consumer preferences, and decline in vehicle sales . .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

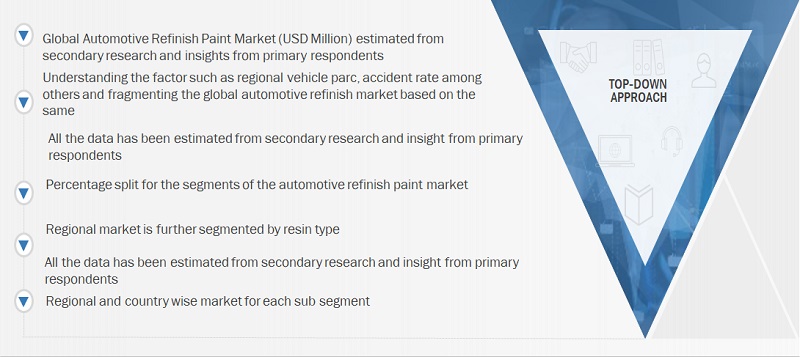

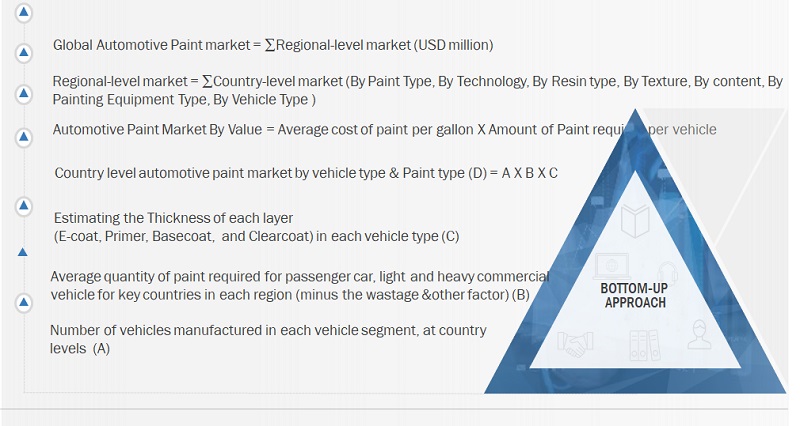

Various secondary sources, directories, and databases have been used to identify and collect information for an extensive study of the automotive paints market. The study involved four main activities in estimating the current size of the automotive paints market: secondary research, validation through primary research, assumptions, and market analysis. Exhaustive secondary research was carried out to collect information on the market, such as the paint types as well as the upcoming technologies and trends. The next step was to validate these findings, assumptions, and market analysis with industry experts across the value chain through primary research. The top-down approach was employed to estimate the complete market size for different segments considered in this study.

Secondary Research

In the secondary research process, various secondary sources have been used to identify and collect information useful for an extensive commercial study of the automotive paint market. Secondary sources include company annual reports/presentations, press releases, industry association publications [such as publications on vehicle sales, EEA (European Energy Agency), IEA (International Energy Agency), ACEA (European Automobile Manufacturers Association), T&E (Transport and Environment), country-level automotive associations and trade organizations, and the US Department of Transportation (DOT)], Automotive paint related magazine articles, directories, technical handbooks, World Economic Outlook, trade websites, and technical articles. Additionally, secondary research has been carried out to understand the average cost of automotive paints consumed by vehicle type, and historic sales of vehicles.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included industry experts such as CXOs, vice presidents, directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Primary interviews have been conducted to gather insights such as ICE vehicle and electric vehicle sales forecast, automotive paints market forecast, automotive paint regional penetration, future technology trends, and upcoming technologies for reducing the automotive painting. Data triangulation was then done with the information gathered from secondary research. Stakeholders from the demand as well as supply side have been interviewed to understand their views on the aforementioned points.

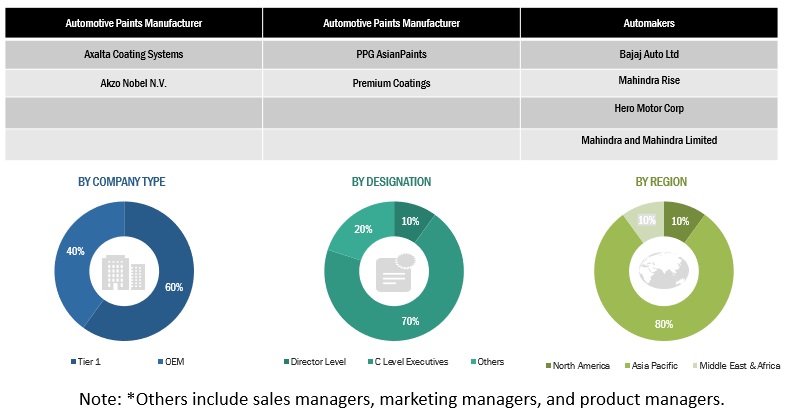

Primary interviews have been conducted with market experts from automotive paints manufacturers and automakers across four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. A similar percentage of primary interviews have been conducted with the automotive paint providers and automotive paint technology providers, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales and operations, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter expert’s opinions, has led us to the findings as described in the remainder of this report.

Breakdown Of Primary Interviews: By Company Type & Designation

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the automotive paints market and other dependent submarkets, as mentioned below:

- Key players in the automotive paints market were identified through secondary research, and their global market shares were determined through primary and secondary research.

- The research methodology included the study of annual and quarterly financial reports and regulatory filings of major market players (public) as well as interviews with industry experts for detailed market insights.

- All industry-level penetration rates, percentage shares, splits, and breakdowns for the automotive paints market were determined using secondary sources and verified through primary sources.

- All key macro indicators affecting the revenue growth of the market segments and sub-segments have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the validated and verified quantitative and qualitative data.

- The gathered market data was consolidated and added with detailed inputs, analyzed, and presented in this report.

Automotive Paints Market: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Automotive Paints Market: Top-Down Approach

The top-down approach has been used to estimate and validate the size of the automotive paints market, by paint. The market share of each technology was derived at regional level through secondary research & insights from industry experts. Further, automotive paints market was segmented based on market share for each paint type at regional level. The similar approach is used in, technology type, resin type, texture type, content type, and paint equipment type.

Bottom-Up Approach Automotive Paints By Technology At Regional Level

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub segment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends.

Market Definition

Automotive paint is a coating that provides an aesthetic appearance to the vehicle’s exterior body and protects it from external factors, such as rain, dust, and chemicals. Hence, the exterior paint is an integral part of the automotive industry. The demand for automotive paints is directly proportional to vehicle production and demand in the automotive industry.

Stakeholders

- Manufacturers of various types of automotive paints

- Raw material suppliers to automotive paint manufacturers

- Manufacturers of automotive coating technologies

- Dealers and distributors of automotive paints

- Automotive original equipment manufacturers (OEMs)

- Automobile industry as an end-user industry

- Regional manufacturer associations and automobile associations

- Government’s national and regional environmental regulatory agencies or organizations

Report Objectives

-

To define, describe, and forecast the automotive paints market, in terms of value

(USD million), based on the following segments:- By Paint Type [Electrocoat, Basecoat, Primer, Clearcoat]

- By Technology Type [Solvant Borne, Waterborne, Powder Coating]

- By Resin Type [Polyurethane, Epoxy, Acrylic, Other Resins]

- By Texture Type [Solid, Metallic, Matte, Pearlescent, Solar reflective]

- By Electric and Hybrid Vehicle Type [HEV, PHEV, FCEV]

- By Vehicle Type [Passenger cars, LCV, Trucks, Buses]

- By Content Type [E-coat, Solvent-Borne Basecoat, Solvent-Borne Clearcoat, Waterborne Basecoat, Waterborne Clearcoat]

- By Refinish Paints [Polyurethane, Epoxy, Acrylic, Other Resins]

- By Painting Equipment type [Airless Spray Gun, Electrostatic Spray Gun]

- By Region (Asia Pacific, Europe, North America, and RoW)

- To understand the market dynamics (drivers, restraints, opportunities, and challenges) and conduct patent analysis, case study analysis, supply chain analysis, regulatory analysis, and ecosystem analysis.

- To understand the dynamics of the market players and distinguish them into stars, emerging leaders, pervasive players, and participants according to their product portfolio strength and business strategies.

- To strategically analyze markets with respect to individual growth trends, prospects, and contributions to the total market.

- To understand the dynamics of competitors and distinguish them into stars, emerging leaders, pervasive players, and participants per the strength of their product portfolio and business strategies.

- To analyze recent developments, such as agreements/partnerships/collaborations, joint ventures/mergers and acquisitions, geographic expansions, and product developments of key players in the automotive paints market.

- To identify innovations and patents by assessing the intellectual property (IP) landscape for any particular product or technology.

- To understand the general impact of the recession on the automotive paints market and how it will affect the overall economy of the country or region.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations in accordance with company-specific needs.

The following customization options are available for the report:

Automotive Electric And Hybrid Paint Market By Country And Vehicle Type

- BEV

- FCEV

- PHEV

Additional Companies Profiled (Business Profile, Recent Developments, And Mnm Views)

Note: This will be further segmented by region.

Growth opportunities and latent adjacency in Automotive Paints Market

What is the percentage volume of matt finish vehicles across the globe as of today

I am looking to make contact with a paint manufacturer to supply my company with OEM alloy wheel base coats as well as powder primers. If you could recommend a company we could contact would be much appreciated. If you require further information on our requirements please feel to cont me by above email or telephone. Thank you for your time

More interested in Paints market in India - Architechural, Industrial, Automotive OEM / Refinish and Wood Coatings

Do you have a specific passage about primers? Is there any emphasis on conductive primers? Looking forward to hearing from you ASAP.

Automotive OEM paints but paints in general as well. In Indian, SEA, Taiwan, China, South Africa, Zimbabwe

My group and I are studying self-healing paint for a design class. A part of the project is study the market for all automobile paints, and this report seems to be exactly what we were searching for, though we could not find.

Automotive paint market, paint and equipment technologies, transfer efficiency,powder, bi-funtional coat, paint process, new paint process

I am working in automotive interiors design and development from past 6 years. I am intereseted to know the paint details as I often come accorss it as I work to support aquisition activities.

Does the report contain a review/comment on the manufacturing strategies of the major coatings producers in addressing their end markets?

looking to do a marketing research assignment on automotive paints in general, and specifically the target market for certain paint types

we are looking to optimize our technology for automotive paint lines and looking for help to understand the market size