Battery Energy Storage System Market Size, Share, Statistics and Industry Growth Analysis Report by Element, Battery Type (Lithium-ion, Advanced Lead Acid, Flow), Connection Type (On-Grid and Off-Grid), Ownership (Customer Owned, Third-Party Owned, Utility Owned), Energy Capacity - Global Forecast to 2028

[287 Pages Report] The global Battery Energy Storage System Market Size is estimated to be worth USD 5.4 Billion in 2023 and is projected to reach USD 17.5 Billion by 2028, at a CAGR of 26.4% during the forecast period.

The market is expanding due to several factors. These include the rising demand for grid energy storage systems as part of ongoing grid modernization efforts, the increasing use of lithium-ion batteries, and the growing adoption of low-carbon and less fossil fuel-dependent economies. Additionally, the ongoing revolution in renewable energy is contributing to this battery energy storage system industry growth.

Battery Energy Storage Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Battery Energy Storage System Market Trends

Driver: Accelerated deployment of grid energy storage systems in ongoing grid modernization on projects

Grid modernization initiatives often involve the integration of renewable energy, such as solar and wind power, into the grid. However, renewable sources are intermittent in nature, which can lead to fluctuations in power supply. Battery energy storage systems help address this challenge by storing excess energy during periods of high generation and releasing it during times of high demand or when renewable sources are not actively generating electricity. This helps to stabilize the grid and ensure a reliable power supply. These systems help grid operators to save electricity when the electricity generated exceeds the electricity demand. The adoption of these systems improves the reliability and flexibility of electricity supply systems with respect to the generation, transmission, and distribution of electric power. During the transmission and distribution of electricity, battery energy storage systems can handle asset deferral, ensure frequency regulation, carry out harmonic suppression, offer voltage support, and ensure power quality. Electric energy time-shifting, baseload leveling and peak shaving, renewable energy time-shifting, and renewable capacity firming are other benefits offered by battery energy storage systems for grid-connected solutions.

Restraint: High initial investment costs of installing battery energy storage systems

Battery energy storage technologies, including lithium-ion batteries, flow batteries, and lead-acid batteries, require increased installation investment owing to the high energy density and improved performance offered by them. Lithium-ion batteries are costly as they offer high energy density, have a low rate of self-discharge, and require less maintenance. However, the costs of lithium-ion batteries are expected to decline in the future. These batteries are also used in electric vehicles (EVs) as they are lightweight and compact, as well as have a large capacity. Besides, the high initial investment cost required for the manufacturing of flow batteries can also act as a major restraint for the growth of the market. Additionally, battery energy storage systems require supporting infrastructure, such as power conversion systems, control systems, thermal management systems, and safety measures. These components add to the overall cost of the system. The overall cost associated with the flow battery includes capital costs, component costs, material costs, installation costs, and repair & maintenance costs, which is an extensive investment for small- and medium-sized enterprises.

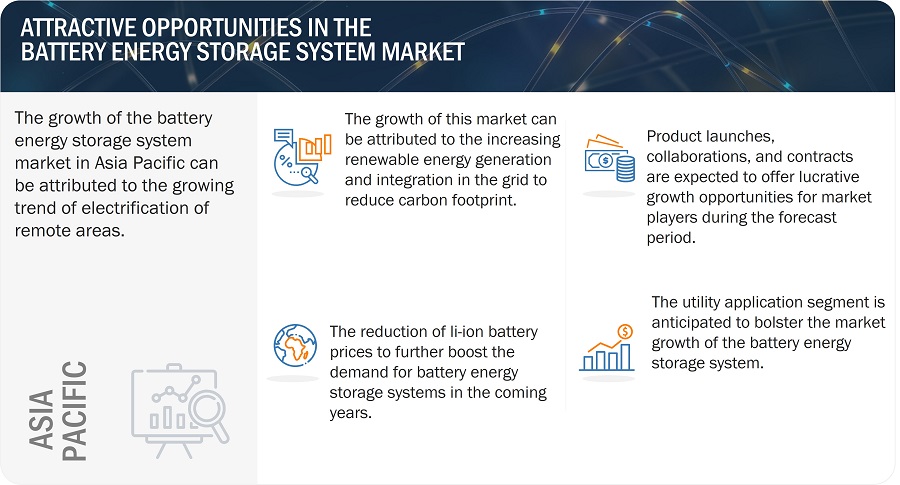

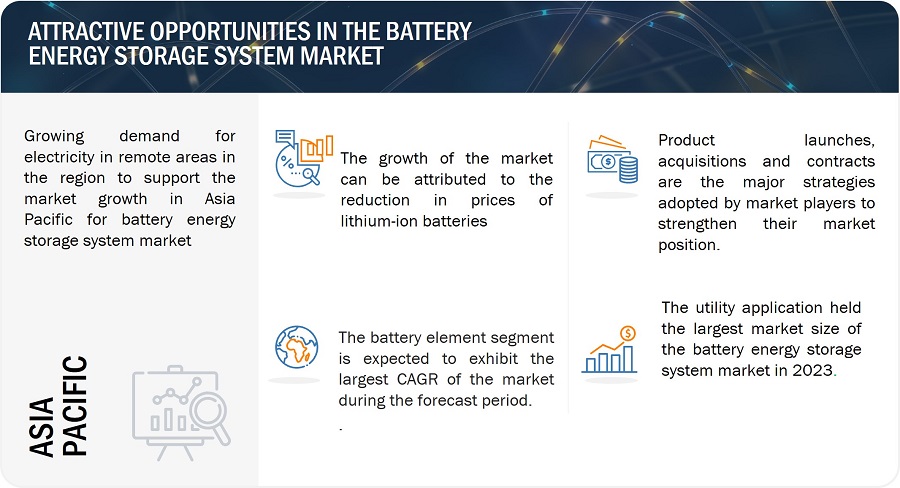

Opportunity: Reduction in prices of lithium-ion batteries

There has been a notable decline in the cost of lithium-ion batteries, driven by advancements in technology, economies of scale, and increased manufacturing efficiency. This price reduction has made battery energy storage systems more affordable and accessible for various applications. The lower cost per kilowatt-hour (kWh) of energy storage enables businesses to invest in larger and more robust systems, ensuring they have sufficient capacity to meet their power needs during outages or peak demand periods. Moreover, the reduction in prices of lithium-ion batteries is having a major impact on the BESS market growth. This is because lower battery prices are making BESS more affordable, more competitive, and a more attractive solution for ensuring reliable and uninterrupted power supply.

Challenge: Difficulties pertaining to installation of battery energy storage systems in remote and isolated locations

Installing battery energy storage systems in remote areas can be challenging due to the limited or unreliable availability of grid power. Establishing a reliable power source for the initial installation and subsequent maintenance activities may be necessary, which could involve alternative energy sources like solar panels. Moreover, providing regular maintenance and servicing for battery energy storage systems in remote areas can be difficult due to the lack of local service providers and limited access to spare parts. Subsequently, remote, and isolated locations may have harsh environmental conditions, such as extreme temperatures, high humidity, or corrosive atmospheres. These conditions can impact the performance and lifespan of the battery system and require additional measures for protection and durability.

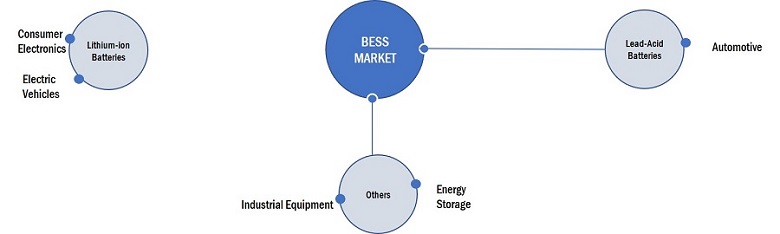

Battery Energy Storage System Market Ecosystem

Battery Energy Storage System Market: Key Trends

BYD Company Limited, SAMSUNG SDI Co., Ltd., LG Energy Solutions Co., Ltd., and Panasonic Corporation are the top players in the BESS market. These BESS companies boast battery technology trends with a comprehensive product portfolio and solid geographic footprint.

Lithium-ion batteries accounted for the largest share of the Battery Energy Storage Systems Market in 2022.

Lithium-ion batteries hold the largest share in the battery energy storage system market as they offer a high energy density, due to which they can store a significant amount of energy in a relatively small and lightweight package. Secondly, lithium-ion batteries have a longer cycle life compared to other battery technologies. They can withstand many charge-discharge cycles without significant degradation in performance. Furthermore, lithium-ion batteries exhibit excellent efficiency, with a high energy conversion rate during charging and discharging processes. This efficiency translates into reduced energy losses and higher overall system performance, making lithium-ion batteries a cost-effective solution.

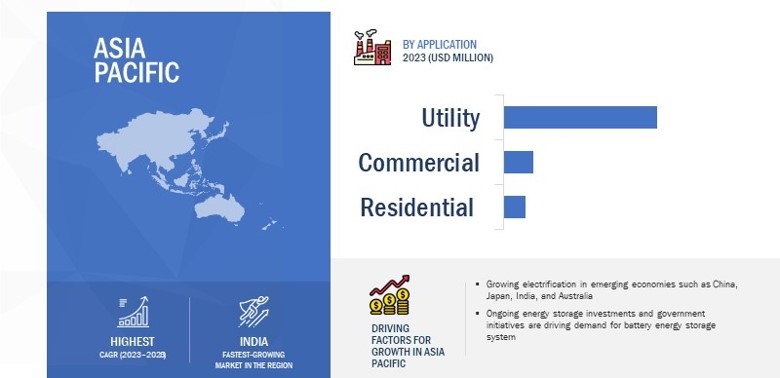

Utility-Owned battery energy storage system to account for the largest share in the market during forecast period.

The growing demand to meet peak electricity requirements is a key driver for the expansion of the utility application market. Utility battery energy storage systems (BESS) play a crucial role in providing power quality, frequency, and voltage control services in response to sudden fluctuations in energy supply. These systems enable grid operators to store excess electricity generated from renewable sources, ensuring efficient energy management. The increasing need for reliable and efficient electricity supply in various regions, coupled with the growing demand for renewable energy, is fueling the high market demand for battery energy storage systems in the utility sector.

Battery Energy Storage System for above 500 MWh capacity to contribute the largest market size in the market during 2023 to 2028.

Battery energy storage systems with capacities exceeding 500 MWh accounted for the largest share in the battery energy storage system market primarily due to their suitability for utility-scale applications, their ability to support grid stability and reliability, and their role in efficiently integrating and balancing intermittent renewable energy sources. These larger systems can store and release significant amounts of energy, meeting the demands of large-scale power grids and enabling the efficient utilization of renewable energy. Additionally, economies of scale and the increasing focus on decarbonization and clean energy systems have further propelled the demand for battery energy storage systems with capacities above 500 MWh, driving their dominant position in the market.

Asia Pacific held the largest share of the Battery Energy Storage System Market in 2022.

Battery Energy Storage Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major companies in the battery energy storage system companies include BYD Company Limited, SAMSUNG SDI Co., Ltd., LG Energy Solutions Co., Ltd., and Panasonic Corporation. These companies have used both organic and inorganic growth strategies such as product launches, acquisitions, and partnerships to strengthen their position in the battery energy storage system market.

Battery Energy Storage System Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 5.4 Billion |

|

Projected Market Size in 2028 |

USD 17.5 Billion |

|

Growth Rate |

CAGR of 26.4% |

|

Years Considered |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD million/billion) |

|

Segments Covered |

Element, Battery Type, Connection Type, Ownership, Energy Capacity, and Application |

|

Regions covered |

North America, Asia Pacific, Europe, and Rest of the World |

|

Companies covered |

BYD Company Limited (China), General Electric (US), LG Energy Solutions CO., Ltd. (South Korea), Panasonic Corporation (Japan), SAMSUNG SDI Co., Ltd. (South Korea). |

Battery Energy Storage Market Highlights

In this report, the overall battery energy storage system market has been segmented based on Input energy sources, storage system, element, battery type, connection type, ownership, energy capacity, application, and region.

|

Segment |

Subsegment |

|

By Element |

|

|

By Battery Type |

|

|

By Connection Type |

|

|

By Ownership |

|

|

By Energy Capacity |

|

|

By Application |

|

|

By Region |

|

Recent Developments

- In June 2022, General Electric announced its recent renewable hybrid factory that expand its manufacturing capacity for power electronics systems in solar and battery energy storage to 9 GW per year, tripling its current capacity.

- In May 2022, Toshiba Corporation introduced the 125VDC SCiB Energy Storage System (ESS), which combines the dependability of Lithium Titanium Oxide (LTO) battery chemistry with a flexible and expandable cabinet design. It is made suitable for integration with Uninterruptible Power Systems (UPS) or DC Load applications.

- In February 2022, LG Energy Solution has successfully acquired NEC Energy Solutions, a grid battery integrator based in the United States, from its parent company, NEC Corporation. This strategic move aims to enhance LG Energy Solution's Energy Storage System (ESS) business portfolio by expanding its offerings.

Frequently Asked Questions (FAQ):

What is the current size of the global battery energy storage system market?

The battery energy storage system market is estimated to be worth USD 5.4 billion in 2023 and is projected to reach USD 17.5 billion by 2028, at a CAGR of 26.4% during the forecast period. The growth of the battery energy storage system market is primarily driven by the increased demand for grid energy storage systems, the growing utilization of lithium-ion batteries, and the rising adoption of low-carbon and less fossil fuel-dependent economies.

Who are the global battery energy storage system market winners?

Companies such as BYD Company Limited, SAMSUNG SDI Co., Ltd., LG Energy Solutions Co., Ltd., and Panasonic Corporation fall under the winners’ category.

Which region is expected to hold the highest share of the battery energy storage system market?

Asia Pacific will dominate the battery energy storage system market in 2028. Countries in Asia Pacific are showing growth as the governments in growing economies are making new policies to improve the reliability and quality of the power distribution facilities to the residential customers. The governments of various countries in this region are focusing on minimizing the adverse effects of the energy sector on the environment.

What are the major drivers and opportunities related to the battery energy storage system market?

Surging demand for battery energy storage system in the utility application and growing demand for continuous power supply are some of the major drivers and opportunities for the battery energy storage system market.

What are the major strategies adopted by AMH companies?

The agitator companies have adopted product launches, acquisitions, expansions, and contracts to strengthen their position in the battery energy storage system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

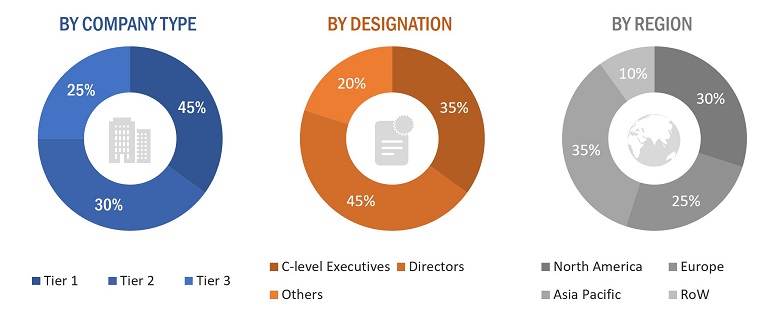

The study involves four major activities that estimate the size of the battery energy storage system market. Exhaustive secondary research was conducted to collect information related to the market. Following this was validating these findings, assumptions, and sizing with the industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the overall size of the battery energy storage system market. Subsequently, market breakdown and data triangulation procedures were used to determine the extent of different segments and subsegments of the market.

Secondary Research

Secondary sources in this research study include corporate filings (such as annual reports, investor presentations, and financial statements); trade, business, and professional associations; white papers, certified publications, articles from recognized authors; directories; and databases. The secondary data were collected and analyzed to estimate the overall market size, further validated by primary research.

Primary Research

In the primary research process, numerous sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information about this report. The primary sources from the supply-side included various industry experts such as Chief X Officers (CXOs), Vice Presidents (VPs), and Directors from business development, marketing, product development/innovation teams, and related key executives from battery energy storage system providers, such as BYD Company Limited (China), SAMSUNG SDI Co., Ltd. (South Korea), LG Energy Solutions Co., Ltd. (South Korea), and Panasonic Corporation (Japan).; research organizations, distributors, professional and managed service providers, industry associations, and key opinion leaders. Approximately 25% of the primary interviews were conducted with the demand side and 75% with the supply side. These data were collected mainly through questionnaires, emails, and telephonic interviews, accounting for 80% of the primary interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the market engineering process, both top-down and bottom-up approaches were implemented, along with several data triangulation methods, to estimate and validate the size of the battery energy storage system market and other dependent submarkets listed in this report.

- The key players in the industry and markets were identified through extensive secondary research.

- Both the supply chain of the industry and the market size, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After estimating the overall market size, the total market was split into several segments. The market breakdown and data triangulation procedures were employed wherever applicable to complete the overall market engineering process and gauge exact statistics for all segments. The data were triangulated by studying various factors and trends from both the demand and supply sides. The market was also validated using both top-down and bottom-up approaches.

Market Definition

A battery energy storage system is embedded with a rechargeable battery in the form of battery packs and modules. The system stores energy from solar arrays, wind, or the electric grid and then discharges that energy later to provide electricity or other grid services when needed. Rechargeable batteries are usually expensive and have less environmental impact than non-rechargeable (disposable) batteries. However, rechargeable batteries incur a high upfront cost as they can be charged several times after the initial purchase. Battery energy storage systems are used in low-peak periods to store surplus energy and provide this energy to the end users during the time of high peak demand for electricity.

Stakeholders

- Government bodies and policymakers

- Industry organizations, forums, alliances, and associations

- Market research and consulting firms

- Raw material suppliers and distributors

- Research institutes and organizations

- Original equipment manufacturers (OEMs) of battery energy storage systems

- Traders and suppliers

- Battery energy storage system manufacturers

- Energy storage solutions and service providers

- Energy storage research institutions

- Government and research organizations

- Grid operators

- Retail service providers

- Lithium-ion battery, electrochemical capacitor, and other energy storage products manufacturers

- Utility providers

- Power distribution and IT consultants

- Research organizations and consulting companies

- Technology investors

- Technology standard organizations, forums, alliances, and associations

- Associations and industrial bodies

- End-user industries

- Power bank manufacturers

- Power bank traders and suppliers

The main objectives of this study are as follows:

- To define, describe, and forecast the battery energy storage system market based on input energy sources, storage system, element, battery type, connection type, ownership, energy capacity, and application

- To describe and forecast the size of the battery energy storage system market based on four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW), along with their respective countries

- To provide detailed information regarding factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To provide a detailed overview of the process flow of the battery energy storage system market

- To analyze opportunities for stakeholders by identifying high-growth segments of the battery energy storage system market

- To study the complete value chain of the battery energy storage system market

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market size

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies2, along with detailing the competitive landscape for market leaders

- To analyze competitive developments, such as product launches, acquisitions, collaborations, agreements, and partnerships, in the battery energy storage system market

Available Customizations:

With the given market data, MarketsandMarkets offer customizations according to the specific requirements of companies. The following customization options are available for the report:

Country-wise Information:

- Analysis for additional countries (up to five)

Company Information:

- Detailed analysis and profiling of different market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Battery Energy Storage System Market

The increasing use of grid flexibility and grid connected solutions due to fluctuations of renewable energy sources such as solar & wind is expected to boost the battery energy system. Can you provide detailed information on this?

Increasing adoption of electric vehicles and fast-growing battery energy storage manufacturing capacity are driving innovations and growth of the market. I would like to get some more insights on the influence of electric vehicles on the BESS market.

The market for lithium-ion technology is expected to grow rapidly; this is likely to be used for storage solutions in various residential and non-residential applications. The declining prices of lithium-ion batteries are also propelling the adoption of this technology, thus supporting the growth of battery energy storage systems. Could you mention any other battery technology which would affect the battery energy storage system market in the near future?

APAC is on the track to become the world leader in energy storage, since China is leading in usage of renewable energy such as solar which requires battery energy storage systems , what could be an opportunity in the next 5-10 years for same.

Energy Storage-as-a-Service (ESaaS) is becoming a key service model, which is a combination of an advanced energy storage system, an energy management system, and a service contract delivering reliable power economically to a business. Can you provide the global numbers for the service segment?