Battery Recycling Market by Source (Automotive Batteries, Industrial Batteries, Consumer & Electronic Appliance Batteries), Chemistry (Lead Acid, Lithium-based, Nickel-based), Material (Metals, Electrolyte, Plastics) and Region - Global Forecast to 2030

Battery Recycling Market

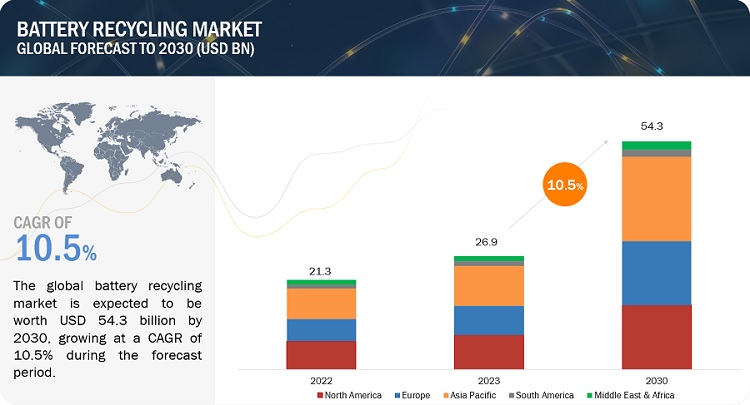

The global battery recycling market is valued at USD 26.9 billion in 2023 and is projected to reach USD 54.3 billion by 2030, growing at 10.5% cagr during the forecast period. The market has observed stable growth throughout the study period and is anticipated to continue with the same trend during the forecast period. Rising investments in the development of electric vehicles, stringent EPA guidelines, and government regulations & initiatives to encourage battery recycling are expected to drive the growth of the market in the upcoming years.

Attractive Opportunities in the Battery Recycling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Battery Recycling Market Dynamics

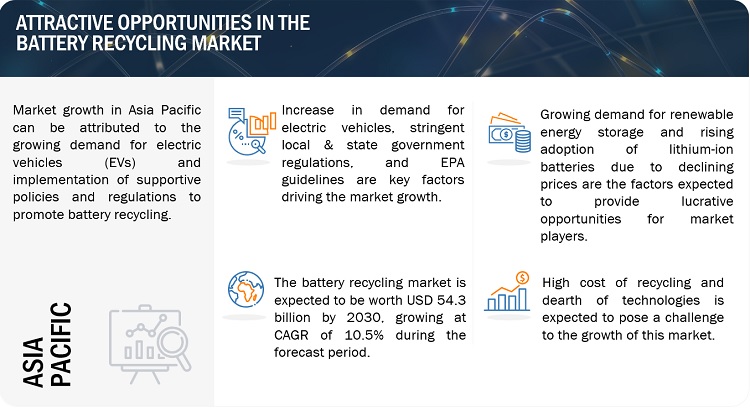

Driver: Increase in demand for electric vehicles

Shifting consumer preference towards more sustainable and environmentally friendly transportation alternatives is propelling the demand for electric vehicles. Also, the use of electric vehicles is increasing owing to factors such as energy efficiency, and pollution control that are driving up the adoption of batteries. The development of advanced battery technologies, improvements in energy density, charging capabilities, and minimal maintenance requirements are other factors contributing to the growth of electric vehicles. Hence, it is anticipated that the market for battery recycling would continue to expand as a result of the growing use of electric vehicles.

Restraint: Safety issues related to the storage and transportation of spent batteries

Spent batteries contain various hazardous materials including acids and heavy metals such as mercury and lead that can be harmful to human health and the environment. Improper storage or transportation can result in chemical leakage, leading to the release of toxic substances. Owing to these issues, state or federal governments restrict the transportation and storage of spent batteries.

Opportunity: Rising demand for renewable energy storage

The renewable energy sector, including solar and wind power, is witnessing rapid expansion. Most of the renewable energy storage systems utilize batteries such as lithium-ion, lead acid, and sodium-sulfur, to perform essential operations. Therefore, with the rise in renewable energy installations, there is a corresponding need for battery recycling to manage the end-of-life batteries and extract valuable materials for reuse.

Challenge: High cost of recycling and dearth of technologies

High cost of recycling and the dearth of technologies can pose a significant challenge for the battery recycling industry. The recycling of batteries involves a number of time-consuming and expensive phases, including collecting, sorting, disassembly, and the extraction of valuable materials including nickel, cobalt, lithium, and rare earth metals. The expense is further increased by the need to ensure safe handling and disposal of hazardous compounds found in batteries. The lack of efficient battery recycling methods is another problem. It is crucial to create scalable and effective procedures which can manage multiple battery types, including different chemistries. Additionally, recycling techniques must advance along with battery technology in order to efficiently recover valuable materials and reduce waste. Thus, investment in R&D for efficient battery recycling technologies is necessary to meet these challenges.

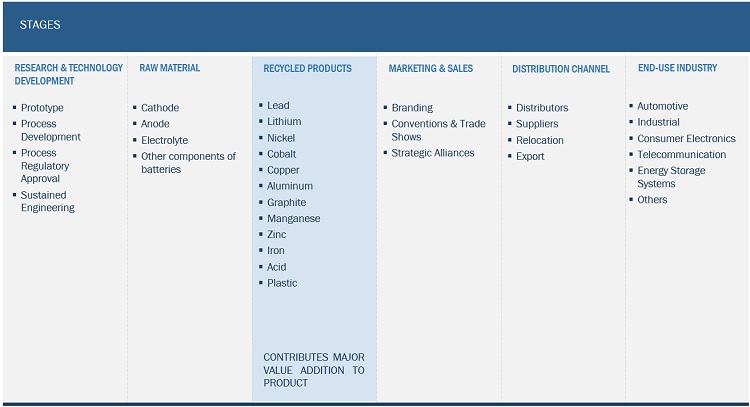

Battery Recycling Market Ecosystem

Prominent companies in this market include well-established, and financially stable recyclers of batteries. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Call2Recycle, Inc. (US), Cirba Solutions (US), Element Resources (US), Umicore (Belgium), Contemporary Amperex Technology Co., Limited (China), and Exide Industries Ltd. (India).

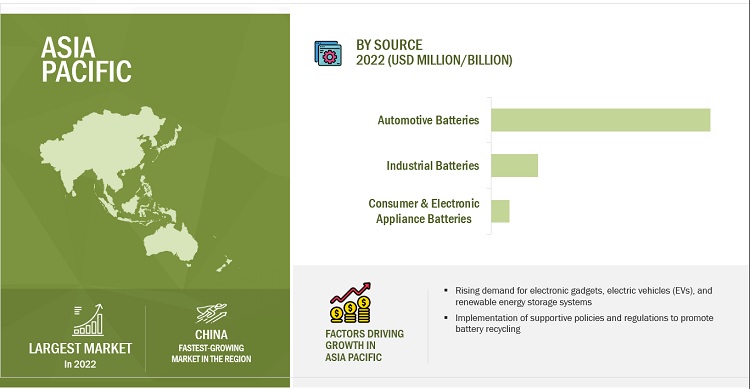

Based on source, the automotive batteries segment is projected to account for the largest share in 2023.

The automotive batteries segment is estimated to have the largest share of the global battery recycling market in 2023. The global market for automotive battery recycling is significantly being driven by the rising popularity of electric vehicles. The quantity of used batteries that need proper disposal and recycling is increasing along with the growth in EV sales. A sustainable infrastructure for end-of-life battery management and recycling is required as more people switch to electric vehicles, which will further boost the growth of this segment.

Based on chemistry, the lead acid batteries segment is projected to account for the largest share in 2023.

The lead acid batteries segment is estimated to have the largest share of the global battery recycling market in 2023. Lead acid batteries are categorized as hazardous waste as they contain lead and sulfuric acid. Proper management and recycling of lead acid batteries helps control the potential environmental and health risks associated with improper disposal. The growth of this segment can be attributed to the rising need for recycling facilities to handle hazardous materials and lower the possibility of pollution and contamination.

Based on region, Asia Pacific region is projected to account for the largest share in 2023.

Due to the expanding population, industrialization, urbanization, and rising demand for electronic gadgets, electric vehicles (EVs), and renewable energy storage systems, battery consumption is on the rise in the Asia Pacific region. Because of this increased battery use, there is a critical need for efficient battery recycling to handle the rising number of used batteries and reduce their negative effects on the environment. The growth is further aided by the implementation of supportive policies and regulations to promote battery recycling.

To know about the assumptions considered for the study, download the pdf brochure

Battery Recycling Market Players

ACCUREC Recycling GmbH (Germany), American Battery Technology Company (US), Aqua Metals, Inc. (US), Call2Recycle, Inc. (US), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), East Penn Manufacturing Company (US), Ecobat (US), Element Resources (US), EnerSys (US), Exide Industries Ltd. (India), Fortum (Finland), GEM Co., Ltd. (China), Glencore (Switzerland), Gopher Resource (US), Gravita India Limited (India), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Raw Materials Company (Canada), RecycLiCo Battery Materials Inc. (Canada), Redwood Materials Inc. (US), Shenzhen Highpower Technology Co., Ltd. (China), Stena Recycling (Sweden), TES (Singapore), Terrapure (Canada), The Doe Run Company (US), The International Metals Reclamation Company (US), and Umicore (Belgium), and others are among the major players leading the market through their innovative offerings, enhanced recycling capacities, and efficient distribution channels.

Battery Recycling Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 26.9 billion |

|

Revenue Forecast in 2030 |

USD 54.3 billion |

|

CAGR |

10.5% |

|

Market Size Available for Years |

2018 to 2030 |

|

Base Year Considered |

2022 |

|

Forecast Period |

2023–2030 |

|

Forecast Units |

Value (USD Million/Billion) |

|

Segments Covered |

Recycling Process, Processing State, Material, Source, Chemistry, and Region |

|

Geographies Covered |

Europe, Asia Pacific, North America, South America, and the Middle East & Africa |

|

Companies Covered |

The major market players include ACCUREC Recycling GmbH (Germany), American Battery Technology Company (US), Aqua Metals, Inc. (US), Call2Recycle, Inc. (US), Cirba Solutions (US), Contemporary Amperex Technology Co., Limited (China), East Penn Manufacturing Company (US), Ecobat (US), Element Resources (US), EnerSys (US), Exide Industries Ltd. (India), Fortum (Finland), GEM Co., Ltd. (China), Glencore (Switzerland), Gopher Resource (US), Gravita India Limited (India), Li-Cycle Corp. (Canada), Neometals Ltd. (Australia), Raw Materials Company (Canada), RecycLiCo Battery Materials Inc. (Canada), Redwood Materials Inc. (US), Shenzhen Highpower Technology Co., Ltd. (China), Stena Recycling (Sweden), TES (Singapore), Terrapure (Canada), The Doe Run Company (US), The International Metals Reclamation Company (US), and Umicore (Belgium), and others |

This research report categorizes the battery recycling market based on recycling processes, processing state, material, source, chemistry, and region.

Based on recycling process, the battery recycling market industry has been segmented as follows:

- Hydrometallurgical Process

- Pyrometallurgical Process

- Lead Acid Battery Recycling Process

- Lithium-ion Battery Recycling Process

Based on processing state, the battery recycling market has been segmented as follows:

- Extraction Of Material

- Reuse, Repackaging, & Second Life

- Disposal

Based on material, the battery recycling market industry has been segmented as follows:

- Metals

- Electrolyte

- Plastics

- Other Components

Based on source, the battery recycling market has been segmented as follows:

- Automotive Batteries

- Industrial Batteries

- Consumer & electric appliance Batteries

Based on chemistry, the battery recycling market industry has been segmented as follows:

- Lead Acid Batteries

- Lithium-based Batteries

- Nickel-based Batteries

- Others

Based on the region, the battery recycling market has been segmented as follows:

-

Asia Pacific

- Australia

- China

- India

- Indonesia

- Japan

- Malaysia

- South Korea

- Taiwan

- Thailand

- Rest of Asia Pacific

-

Europe

- France

- Germany

- Italy

- Netherlands

- Spain

- UK

- Rest of Europe

-

North America

- US

- Canada

- Mexico

-

Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Egypt

- Rest of Middle East & Africa

-

South America

- Brazil

- Argentina

- Chile

- Reast of South America

Recent Developments

- In April 2023, Cirba Solutions signed a Memorandum of Understanding (MoU) with Honda to collect, process, and return recycled battery materials to be used as raw material for Honda’s battery supply chain for application in future EV batteries.

- In February 2023, Contemporary Amperex Technology Co., Limited, Mercedes-Benz, and GEM Co., Ltd. signed a memorandum of understanding for the recycling of cobalt, nickel, manganese, and lithium metals from spent EV batteries of Mercedes-Benz and remanufacture them into battery cathode materials.

- In January 2023, Aqua Metals, Inc. announced its plans to develop a lithium battery recycling facility in Nevada (US), which can process more than 20 million pounds of lithium-ion batteries per year.

Frequently Asked Questions (FAQ):

What is the key driver for the battery recycling market?

Stringent local and state government regulations and EPA guidelines are the major driver for battery recycling market.

Which region is expected to hold the largest market share in the battery recycling market?

The battery recycling market in Asia Pacific is estimated to hold the largest market share. Due to the region's expanding population, industrialization, urbanization, and rising demand for electronic gadgets, electric vehicles (EVs), and renewable energy storage systems, battery consumption is on the rise in the Asia Pacific region.

What is the major source of batteries for recycling?

The automotive segment with an increasing number of electric vehicles is the major source of batteries for recycling.

Who are the major recyclers of batteries?

The key recyclers operating in the market include Call2Recycle, Inc. (US), Cirba Solutions (US), Element Resources (US), Umicore (Belgium), Contemporary Amperex Technology Co., Limited (China), and Exide Industries Ltd. (India).

What is the total CAGR expected to record for the battery recycling market during 2023-2030?

The market is expected to record a CAGR of 10.5% from 2023-2030 .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the current market size of battery recycling. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with industry experts across the value chain of battery recycling through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The research methodology used to estimate and forecast the access control market begins with capturing data on revenues of key vendors in the market through secondary research. In the secondary research process, various secondary sources, such as Hoovers, Bloomberg BusinessWeek, Factiva, World Bank, and Industry Journals, were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies; white papers; certified publications; articles by recognized authors; notifications by regulatory bodies; trade directories; and databases. Vendor offerings have also been taken into consideration to determine market segmentation.

Primary Research

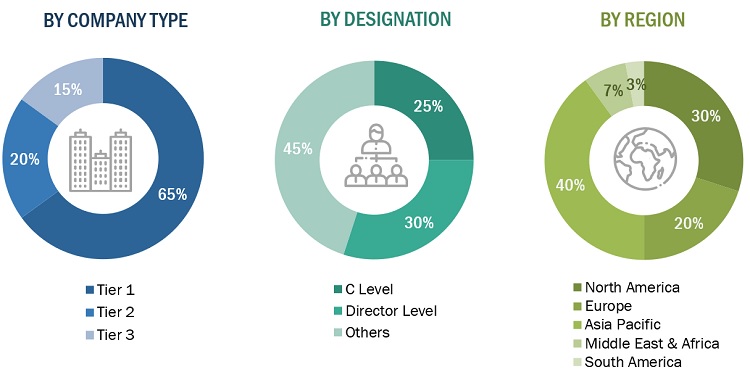

The battery recycling market comprises several stakeholders, such as such as battery suppliers, processors, recycling companies, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the battery recycling industry. Primary sources from the demand side included directors, marketing heads, and purchase managers from various sourcing industries. Following is the breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

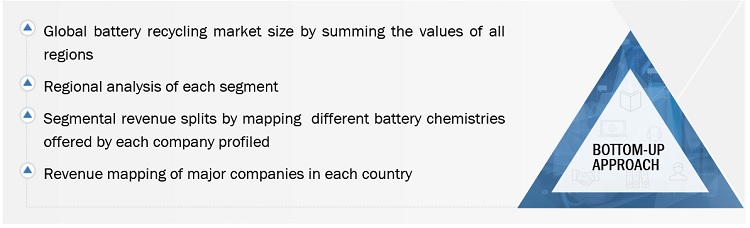

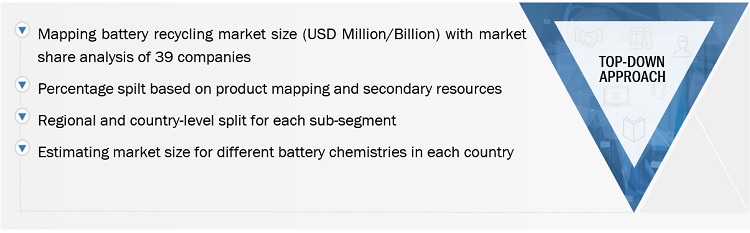

Both the top-down and bottom- up approaches were used to estimate and validate the total size of the battery recycling industry. These methods were also used extensively to determine the size of various sub-segments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the battery recycling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

Global Battery Recycling Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Battery Recycling Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the automotive and non-automotive sources.

Market definition

Battery recycling refers to the process of collecting and reprocessing used batteries to recover valuable materials and reduce environmental impact. It involves the safe and responsible disposal of batteries, followed by the extraction and recycling of materials such as precious metals (e.g., lead, lithium, copper, nickel, cobalt) and other components (e.g., plastic, acid) that can be reused or repurposed. Battery recycling helps conserve natural resources, minimize pollution, and prevent hazardous substances from entering the environment.

Key Stakeholders

- Governments and research organizations

- Battery manufacturers

- Electric vehicle manufacturers

- Mining companies

- Oil companies expanding into alternative energy

- Recycling associations and Industrial bodies

- Battery recycling manufacturers/traders

Report Objectives:

- To analyze and forecast the market size of battery recycling in terms of value

- To provide detailed information regarding the major factors (drivers, restraints, challenges, and opportunities) influencing the regional market

- To analyze and forecast the global battery recycling market on the basis of source, chemistry, and region

- To analyze the opportunities in the market for stakeholders and provide details of a competitive landscape for market leaders

- To strategically analyze the micromarkets with respect to individual growth trends, growth prospects, and their contribution to the overall market

- To forecast the size of various market segments based on five major regions: North America, Europe, Asia Pacific, South America, and the Middle East & Africa, along with their respective key countries

- To track and analyze the competitive developments, such as new technology launches, joint ventures, partnerships, contracts, collaborations, acquisitions, agreements, investments, and expansions, in the market

- To strategically profile the key players and comprehensively analyze their market shares and core competencies

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the client-specific needs.

The following customization options are available for the report:

- Additional country-level analysis of the battery recycling market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company.

Growth opportunities and latent adjacency in Battery Recycling Market