Bike and Scooter Rental Market by Service (Pay as you go and Subscription-based), Propulsion (Pedal, Electric, and Gasoline), Operational Model (Dockless and Station-based), Vehicle (Bike, Scooter), and Region - Global Forecast to 2027

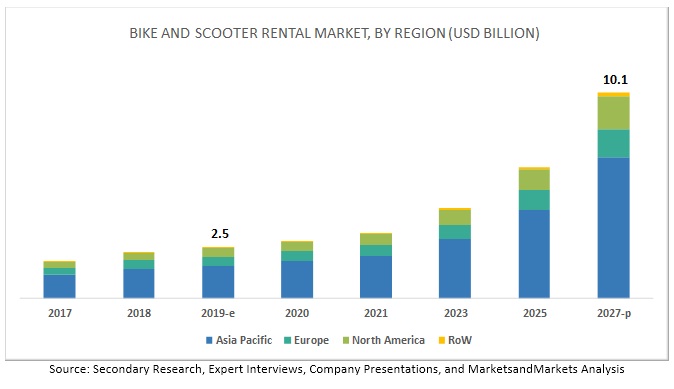

[127 Pages Report] The global bike and scooter rental market is projected to grow from USD 2.5 billion in 2019 to 10.1 billion by 2027, at a CAGR of 18.9%. The rising demand for micro mobility and emission-free vehicles, growing traffic congestion, strict emission norms, and increasing demand for an economical mode of transportation are some of the major growth factors for the market.

Dockless segment is expected to emerge as the fastest market during the forecast period

The dockless segment is expected to be the fastest growing market during the forecast period. The system allows bikes to be located and unlocked using a smartphone application. The demand for dockless system is more than station-based due to the lesser requirement of hardware for securing and managing inventory, expanded geographical location, and user flexibility in picking up and dropping off bikes. Many micro mobility sharing players have promoted the dockless model in the past few years in China, Europe, and the US-Mobike and ofo in the Chinese market; Lime and JUMP in the US and; Cityscoot in Europe-have begun expanding their dockless ride sharing model overseas. Other companies like Vogo, VOI, Mobycy, HOPR, and COUP also operate through dockless models.

Bike segment is expected to lead the bike and scooter rental market during the forecast period

Bike segment is expected to dominate the market. As micro mobility refers to transportation that covers small distances, bike sharing has made a remarkable change in the urban landscape. Apart from the convenience of pickup and drop-off anywhere, these dockless bikes are cheap. Lesser regulations offer the advantage of the quicker implementation of bike sharing, especially in Asia. China is an example of the bike sharing evolution, where around 60 firms have put 16 to 17 million bicycles on the Chinese streets. ofo was China’s first dockless bike sharing company. Shared bikes today are one of the most popular modes of public transport in China. Other Asian countries like India, Singapore, Taiwan, and South Korea are also making their way into micro mobility.

Asia Pacific is expected to lead the market during the forecast period.

The Asia Pacific is expected to be the fastest growing bike and scooter rental market. By 2027, it would also be the largest market. The largest market for automotive is Asia Pacific as the region comprises of rapidly emerging economies like China and India. The reason behind the rise of the market in China and India are the growing concerns over pollution and increasing traffic congestion due to the increased number of vehicles. Also, low charges of bike sharing when compared to cabs and taxis creates an opportunity in Asia Pacific. Moreover, the increased use of smartphones and emerging government regulations on pollution are likely to render a positive impact. The demand for clean, safe, and smart mobility in China, India, and Japan would boost the Asia Pacific market.

Key Market Players

The global bike and scooter rental market is dominated by major players such as Lime (US), Jump (US), Bird (US), ofo (China), Grow Mobility (China), nextbike (Germany), Cityscoot (France), and COUP (Germany), among others. These companies have strong distribution networks at a global level. Besides, these companies offer an extensive service range in the market. The key strategies adopted by these companies to sustain their market position are new product developments, collaborations, and contracts & agreements.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2018 |

|

Forecast period |

2019–2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Service Type, Propulsion, Operational Model, Vehicle Type, and Region |

|

Geographies covered |

North America, Asia Pacific, Europe, and Rest of the World. |

|

Companies Covered |

Lime (US), Jump (US), Bird (US), ofo (China), Grow Mobility (China), nextbike (Germany), Cityscoot (France), Coup (Germany) and many others. |

This research report categorizes the bike and scooter rental market based on service type, propulsion, operational model, vehicle type, and region.

On the basis of by service type, the bike and scooter rental market has been segmented as follows:

- Pay as you go

- Subscription-based

On the basis of propulsion, the bike and scooter rental market has been segmented as follows:

- Pedal

- Electric

- Gasoline

On the basis of operational model, the bike and scooter rental market has been segmented as follows:

- Dockless

- Station-Based

On the basis of vehicle type, the bike and scooter rental market has been segmented as follows:

- Bike

- Scooter

- Others

On the basis of region, the bike and scooter rental market has been segmented as follows:

-

Asia Pacific

- China

- India

- Japan

- South Korea

- Others

-

North America

- US

- Canada

- Mexico

-

Europe

- France

- Germany

- Italy

- Russia

- Spain

- UK

- Netherlands

- Others

-

Rest of the World

- Brazil

- South Africa

- Others

Recent Developments

- In June 2019, Bird announced Bird Cruiser, the first seated vehicle from Bird, featuring padded seats to make a rider’s journey comfortable; option of pedal-assist or peg to meet the preferences of riders; hydraulic disc brakes for reliable, safe, and responsive slowing and stopping; a 52 V battery to help ensure reliability and extend the “last mile”; advanced LCD matrix display for easy viewing; a custom motor to ensure a ride will not be disrupted by a hill or other incline; and industry leading standards for durability and reliability.

- In June 2019, Lyft introduced its new bikes, ‘Bay Wheels.’ These are all new hybrid e-bikes launched especially for the Bay Area. It has features that would make bike sharing better than ever—such as pedal-assist for those infamous hills and a new lock that will let users park outside of a station.

- In March 2019, nextbike offered e-Cargobikes for the first time. In Norderstädt, nextbike customers could borrow e-Cargobikes. Under the name "e-TINK," the existing system "TINK," which comprises 24 unmotorized cargo bikes, was supplemented with 15 electric transport bikes. e-TINK is the first e-Cargobike system operated by nextbike and supported by the Federal Ministry of Environment.

- In January 2019, Cityscoot expanded its services in Milan with its new service of electric scooters presented in bike sharing. Cityscoot expanded its service with 500 self-service electric scooters in Milan, after establishing in Paris and Nice.

- In October 2018, Lime introduced the Gen 3 Scooter which is heavier and built for small distance commuting. Designed in-house by engineers in both California and China and built by four different manufacturers, this vehicle signals a new phase for the USD 1.1 billion startup, and the broader scooter world.

Critical Questions:

- Where will rental and sharing services take the industry in the long term? What will be the growth of the market?

- How e-scooters and e-bikes will transform the outlook of the overall automotive industry?

- What are the upcoming trends in the market? What impact would they make post 2022?

- What are the key strategies adopted by the top players to increase their revenues?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Secondary Sources

2.1.1.2 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Sampling Techniques & Data Collection Methods

2.1.2.2 Primary Participants

2.1.2.3 Key Data From Primary Sources

2.2 Market Size Estimation

2.2.1 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 31)

4.1 Bike and Scooter Rental Market to Grow at A Significant Rate During the Forecast Period (2019–2027)

4.2 Asia Pacific to Lead the Global Market

4.3 Market, By Service and Operational Model

4.4 Market, By Service

4.5 Market, By Operational Model

4.6 Market, By Vehicle Type

4.7 Market, By Propulsion

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise of Micromobility as A Budget-Friendly Mode of Transportation

5.2.1.2 Sustainable and Technologically Advanced Mobility

5.2.2 Restraints

5.2.2.1 Lack of Supporting Infrastructure for Micromobility

5.2.3 Opportunities

5.2.3.1 Growing Traffic Congestion on Roads

5.2.3.2 Adoption of Electrically Powered Vehicles

5.2.4 Challenges

5.2.4.1 Occurrence of Theft and Vandalism

6 Industry Trends (Page No. - 40)

6.1 Introduction

6.2 Technological Overview

6.2.1 Application-Based Rental System

6.2.2 Bike Rental Services and Iot

6.2.3 Regenerative Braking

6.3 Regulatory Overview

6.3.1 US

6.3.2 Europe

6.3.3 China

6.4 Macroindicator Analysis

6.4.1 Growth of Bike and Scooter Rental

6.4.2 GDP (USD Billion)

6.4.3 GNI Per Capita, Atlas Method (USD)

6.4.4 GDP Per Capita PPP (USD)

6.4.5 Macroindicators Influencing the Vehicle Access Control Market, Top 3 Countries

6.4.5.1 Germany

6.4.5.2 US

6.4.5.3 China

7 Bike and Scooter Rental Market, By Operational Model (Page No. - 45)

7.1 Introduction

7.1.1 Rising Demand for Economical and Convenient Mode of Commuting is Likely to Propel the Market

7.2 Research Methodology

7.3 Dockless

7.3.1 Demand for User Flexibility and Expansion of Geographic Location Will Drive the Dockless Segment

7.4 Station-Based

7.4.1 Designated Parking Stations and Addressal of First and Last Mile Problem is Attributing to the Growth of Station-Based Segment

8 Bike and Scooter Rental Market, By Propulsion (Page No. - 49)

8.1 Introduction

8.1.1 Rising Micromobility to Reduce Traffic Congestion Will Continue to Drive the Market

8.2 Research Methodology

8.3 Gasoline

8.3.1 Ease of Availability and Accessibility of Gasoline Stations Will Keep the Demand for Gasoline Propulsion Steady

8.4 Electric

8.4.1 Demand for Alternate Sources of Energy to Limit Carbon Emissions Will Drive the Electric Propulsion Segment

8.5 Pedal

8.5.1 Integration of Bike Sharing Apps and Ride Hailing Services Will Fuel the Growth of Pedal Bikes

9 Bike and Scooter Rental Market, By Service (Page No. - 54)

9.1 Introduction

9.1.1 Introduction of Rental Schemes and Increased Usage of Smartphones Will Boost Demand

9.2 Research Methodology

9.3 Pay as You Go

9.3.1 Accuracy of Ride Cost Will Drive ‘Pay as You Go’ Model Significantly

9.4 Subscription-Based

9.4.1 Availability of Vehicles as Per User Convenience is the Growth Driver of Subscription-Based Model

10 Bike and Scooter Rental Market, By Vehicle Type (Page No. - 58)

10.1 Introduction

10.1.1 Shift From Gasoline to Electric-Powered Two-Wheelers is Going to Fuel the Market

10.2 Research Methodology

10.3 Bike

10.3.1 Accessibility to Stations and Lesser Regulations Would Drive the Demand

10.4 Scooter

10.4.1 Features Like Lightweight and Compact Design Will Boost the Scooter Rental Market

10.5 Others

10.5.1 Long Distance Coverage and Emergence of Tourism Will Boost the Market

11 Bike and Scooter Rental Market, By Region (Page No. - 63)

11.1 Introduction

11.2 Asia Pacific

11.2.1 China

11.2.1.1 Increasing Adoption of E-Bikes and E-Scooters and Government Incentives to Encourage Emission-Free Commute Will Boost the Chinese Market 67

11.2.2 India

11.2.2.1 Government Initiatives Will Impact the Indian Market Positively

11.2.3 Japan

11.2.3.1 Rising Sales of Electric Bikes and Rental Regulations Will Significantly Drive the Japanese Market

11.2.4 South Korea

11.2.4.1 Growing Awareness Will Provide an Opportunity to Propel the Bike and Scooter Market in South Korea

11.2.5 Rest of Asia Pacific

11.2.5.1 Partnerships Between Companies to Provide Smarter Transportation Will Drive the Overall Market

11.3 Europe

11.3.1 France

11.3.1.1 High Demand for E-Bikes and E-Scooters Will Drive the French Market

11.3.2 Germany

11.3.2.1 Structural Lanes and Developed Infrastructure Supporting Micromobility Will Drive the German Market

11.3.3 Italy

11.3.3.1 Increasing Use of Micromobility for Tourism Will Boost the Italian Market

11.3.4 Russia

11.3.4.1 Increasing Investments in Bike and Scooter Rental Will Fuel the Russian Market

11.3.5 Spain

11.3.5.1 Presence of Major Bike and Scooter Rental Providers is Likely to Shape the UK Market

11.3.6 UK

11.3.6.1 Increasing Focus on Low Speed Rental Vehicles is Driving the UK Market

11.3.7 Netherlands

11.3.7.1 Increasing Focus on Innovation is Driving the Dutch Market

11.3.8 Rest of Europe

11.4 North America

11.4.1 Canada

11.4.1.1 Infrastructure for Active Transportation Will Drive the Canadian Market

11.4.2 Mexico

11.4.2.1 Implementation of Innovative Programs and Dedicated Lanes Will Drive the Mexican Market

11.4.3 US

11.4.3.1 Emergence of Maximum Ride Sharing Companies in US Will Drive the Market

11.5 Rest of the World (RoW)

11.5.1 Brazil

11.5.1.1 Safety Concerns Will Impact the Brazilian Market Positively

11.5.2 South Africa

11.5.2.1 Growing Two-Wheeler Sales Will Impact the South African Market

11.5.3 Rest of RoW

11.5.3.1 Growing Vehicle Production May Impact the Market Positively

12 Competitive Landscape (Page No. - 83)

12.1 Overview

12.2 Market Ranking Analysis

12.3 Competitive Scenario

12.3.1 New Product Developments

12.3.2 Collaborations/Joint Ventures/Supply Contracts/Partnerships/Agreements

12.3.3 Expansions, 2017–2019

12.4 Competitive Leadership Mapping

12.4.1 Visionary Leaders

12.4.2 Innovators

12.4.3 Dynamic Differentiators

12.4.4 Emerging Companies

12.5 Strength of Product Portfolio

12.6 Business Strategy Excellence

13 Company Profiles (Page No. - 96)

(Business Overview, Products Offered, Recent Developments & SWOT Analysis)*

13.1 Lime

13.2 Bird

13.3 Nextbike

13.4 Cityscoot

13.5 Mobike

13.6 Spin

13.7 Scoot

13.8 Ecooltra

13.9 Lyft

13.10 Skip

13.11 COUP

13.12 Bolt

13.13 Hopr

13.14 Other Key Players

13.14.1 Asia Pacific

13.14.1.1 Yulu

13.14.1.2 Mobycy

13.14.1.3 Onn Bikes

13.14.1.4 Vogo

13.14.1.5 OFO

13.14.1.6 Beam

13.14.2 Europe

13.14.2.1 Yego

13.14.2.2 Muving

13.14.2.3 Blinkee.City

13.14.2.4 Voi Technology

13.14.2.5 Emmy

13.14.3 North America

13.14.3.1 Jump

13.14.3.2 Spinlister

*Details on Business Overview, Products Offered, Recent Developments & SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

14 Appendix (Page No. - 121)

14.1 Discussion Guide – Bike and Scooter Rental Market

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (43 Tables)

Table 1 Currency Exchange Rates (Per 1 USD)

Table 2 Average Rental Prices of Bikes and Scooters

Table 3 Impact of Market Dynamics

Table 4 Bike and Scooter Rental Market, By Operational Model, 2017–2027 (USD Million)

Table 5 Dockless: Bike and Scooter Rentals Market, By Region, 2017–2027 (USD Million)

Table 6 Station-Based: Bike and Scooter Rentals Market, By Region, 2017–2027 (USD Million)

Table 7 Market, By Propulsion, 2017–2027 (USD Million)

Table 8 Gasoline: Market, Region, 2017–2027 (USD Million)

Table 9 Electric: Bike and Scooter Market, By Region, 2017–2027 (USD Million)

Table 10 Pedal: Bike and Scooter Market, By Region, 2017–2027 (USD Million)

Table 11 Market, By Service, 2017–2027 (USD Million)

Table 12 Pay as You Go: Market, By Region, 2017–2027 (USD Million)

Table 13 Subscription-Based: Market, By Region, 2017–2027 (USD Million)

Table 14 Bike and Scooter Rental Market, By Vehicle Type, 2017–2027 (USD Million)

Table 15 Bike: Market, By Region, 2017–2027 (USD Million)

Table 16 Scooter: Market, By Region, 2017–2027 (USD Million)

Table 17 Others: Market, By Region, 2017–2027 (USD Million)

Table 18 Market, By Region, 2017–2027 (USD Million)

Table 19 Asia Pacific: Market, By Country, 2017–2027 (USD Million)

Table 20 China: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 21 India: Market, By Vehicle Type, 2017–2027(USD Million)

Table 22 Japan: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 23 South Korea: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 24 Rest of Asia: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 25 Europe: Market, By Country, 2017–2027 (USD Million)

Table 26 France: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 27 Germany: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 28 Italy: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 29 Russia: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 30 Spain: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 31 UK: Bike and Scooter Rental Market, By Vehicle Type, 2017–2027 (USD Million)

Table 32 Netherlands: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 33 Rest of Europe: Market, By Service Type, 2017–2027 (USD Million)

Table 34 North America: Market, By Country, 2017–2027 (USD Million)

Table 35 Canada: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 36 Mexico: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 37 US: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 38 RoW: Market, By Country, 2017–2027 (USD Million)

Table 39 Brazil: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 40 South Africa: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 41 Rest of RoW: Market, By Vehicle Type, 2017–2027 (USD Million)

Table 42 New Product Developments, 2017–2019

Table 43 Collaborations/Joint Ventures/Supply Contracts/Partnerships/ Agreements, 2017–2019

List of Figures (37 Figures)

Figure 1 Bike and Scooter Rental Market Segmentation

Figure 2 Market: Research Design

Figure 3 Research Methodology Model

Figure 4 Breakdown of Primary Interviews

Figure 5 Market Size Estimation Methodology for the Market: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Market: Market Dynamics

Figure 8 Market, By Region, 2019 (Market Share)

Figure 9 Bike Segment to Hold the Largest Share in the Bike and Scooter Rental Market in 2019

Figure 10 Growth of Connected Services and Increasing Focus on Road Safety Will Boost the Market

Figure 11 Market Share, By Region, 2019

Figure 12 Pay as You Go and Dockless are Expected to Account for the Largest Share By Service and Operational Model, Respectively, in 2019

Figure 13 Pay as You Go Service to Be the Fastest Segment During the Forecast Period, 2019 vs. 2027 (USD Million)

Figure 14 Dockless Segment to Be the Fastest During the Forecast Period, 2019 vs. 2027 (USD Million)

Figure 15 Bike Segment to Play A Major Role in the Bike and Scooter Rental Market, 2019 vs. 2027 (USD Million)

Figure 16 Electric Propulsion to Be the Largest Segment, By Propulsion, 2019 vs. 2027 (USD Million)

Figure 17 Bike and Scooter Rental: Market Dynamics

Figure 18 Nb-Iot Enables Smart Shared Bike Locks

Figure 19 Market, By Operational Model, 2019 vs. 2027 (USD Million)

Figure 20 Key Primary Insights

Figure 21 Market, By Propulsion, 2019 vs. 2027 (USD Million)

Figure 22 Key Primary Insights

Figure 23 Market, By Service, 2019 vs. 2027 (USD Million)

Figure 24 Key Primary Insights

Figure 25 Market, By Vehicle Type, 2019 vs. 2027 (USD Million)

Figure 26 Key Primary Insights

Figure 27 Market, By Region, 2019 vs. 2027

Figure 28 Asia Pacific: Bike and Scooter Rental Market Snapshot

Figure 29 Europe: Market Snapshot

Figure 30 Key Developments By Leading Players in the Market, 2017–2019

Figure 31 Market (Global): Competitive Leadership Mapping, 2019

Figure 32 Lime: SWOT Analysis

Figure 33 Bird: SWOT Analysis

Figure 34 Nextbike: SWOT Analysis

Figure 35 Cityscoot: SWOT Analysis

Figure 36 Mobike: SWOT Analysis

Figure 37 Lyft: Company Snapshot

The study involved estimating the current size of the bike and scooter rental market. Exhaustive secondary research was done to collect information on the market, the peer market, and model mapping. The next step was to validate these findings, assumptions, and sizing with the industry experts across value chains through primary research. The bottom-up approach was employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used in estimating the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as company annual reports/presentations, press releases, paid databases, journals, automobile magazines, articles, directories, technical handbooks, World Economic Outlook, trade websites, technical articles, and MarketsandMarkets data repository have been used to identify and collect information useful for an extensive commercial study of the global bike and scooter rental market.

Primary Research

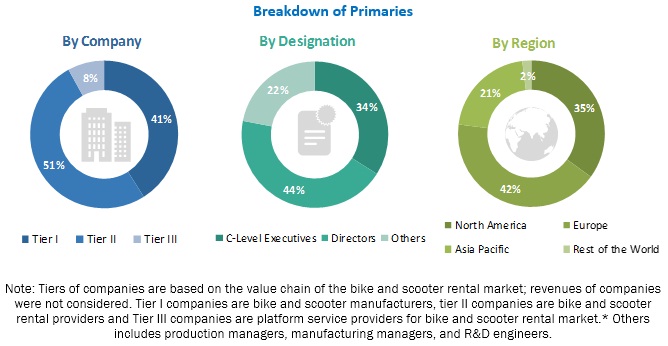

Extensive primary research has been conducted after acquiring an understanding of the bike and scooter rental market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand-side (government and public transport authorities and bike and scooter rental providers) and supply-side (bike and scooter rental manufacturers, suppliers, and platform service providers) across 4 major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. Approximately, 22% and 78% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, we have strived to cover various departments within organizations, such as sales, operations, and administration, to provide a holistic viewpoint in our report.

After interacting with industry experts, we have also conducted brief sessions with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject-matter experts’ opinions, has led us to the findings as described in the remainder of this report. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the total size of the bike and scooter rental market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above-the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To segment and forecast the bike and scooter rental market size, in terms of value (USD Million)

- To define, describe, and forecast the market based on operational model, vehicle, propulsion, operational model, and region.

- To analyze the regional markets for growth trends, prospects, and their contribution to the overall market

- To segment and forecast the market size, by operational model (dockless and station-based)

- To segment and forecast the market size, by vehicle type (bike, scooter, and others)

- To segment and forecast the market size, by propulsion (pedal, electric, and gasoline)

- To segment and forecast the market size, by subscription (pay as you go and subscription-based)

- To forecast market size with respect to key regions, namely, North America, Europe, Asia Pacific, and Rest of the World

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze markets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities for stakeholders and details of a competitive landscape for market leaders

- To strategically profile key players and comprehensively analyze their respective market share and core competencies

- To analyze recent developments, alliances, joint ventures, product innovations, and mergers & acquisitions in the bike and scooter rental market

Available Customizations

With the given market data, MarketsandMarkets offers customizations in accordance to the company’s specific needs.

- Bike and scooter rental market, by vehicle type at country level (for countries not covered in the report)

- Bike and scooter rental market, by propulsion at country level (for countries not covered in the report)

Company Information

- Profiling of Additional Market Players (Up to 3)

Growth opportunities and latent adjacency in Bike and Scooter Rental Market