Building Information Modeling (BIM) Market Size, Share, Statistics and Industry Growth Analysis Report by Offering (Software, Services), Deployment (Cloud, On-Premise), Project Lifecycle (Preconstruction), Application (Buildings, Industrial), End User (AEC Professionals) and Region - Global Forecast to 2028

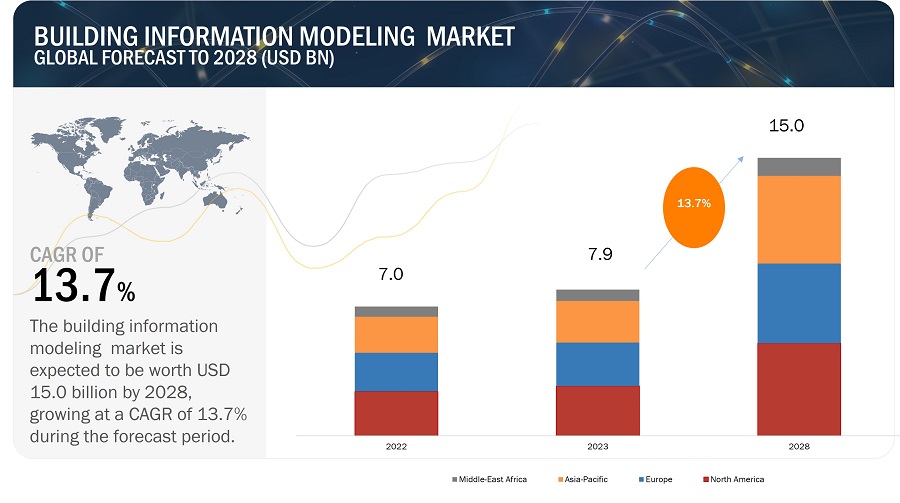

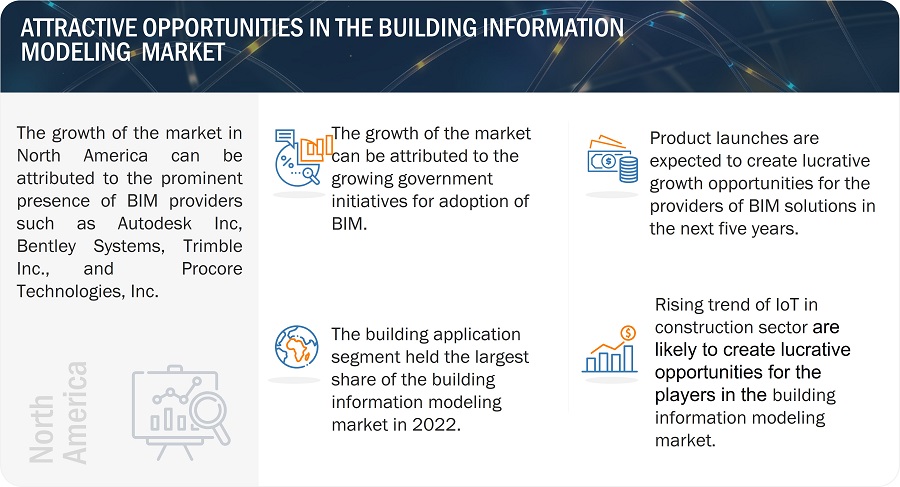

The global building information modeling market size was valued at USD 7.9 billion in 2023 and is projected to reach USD 15.0 billion by 2028; it is expected to register a CAGR of 13.7% during the forecast period. Growing government initiatives for the adoption of BIM are among the factors driving the growth of the building information modeling (BIM) market share.

Attractive Opportunities in the building information modeling market

Building Information Modeling Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

BIM Market Dynamics:

Driver: Growing use of BIM as it leads to sustainable development

Building Information Modeling (BIM) is considered a significant step toward achieving a more sustainable future for the construction industry. One of the main reasons for this is that BIM can help to reduce waste and optimize resource use throughout the entire lifecycle of a building or infrastructure project. By creating a digital model of the project, BIM enables designers and engineers to identify opportunities for energy efficiency, reduce greenhouse gas emissions, and minimize the environmental impact of construction activities. BIM can also facilitate the use of sustainable materials and construction practices, such as reducing waste, recycling materials, and reducing the carbon footprint of construction processes. Moreover, BIM can improve collaboration and communication between project teams, reducing errors and delays and leading to more efficient and sustainable construction projects. Therefore, BIM is considered an essential tool for achieving sustainable development goals in the construction industry, helping to create a more sustainable and resilient built environment.

BIM can also facilitate the use of sustainable materials and construction practices, such as reducing waste and optimizing resource use. In addition, BIM can improve collaboration and communication between project teams, helping to avoid errors and delays that can increase the environmental impact of construction projects. Overall, BIM can help to create more sustainable buildings and infrastructure, supporting the transition to a more sustainable and resilient built environment.

Restraint: High initial cost of BIM

Although BIM has huge benefits and cost savings, the initial cost observed is high. Also the cost of training and services is also high. Thus, the high initial cost associated with BIM would restrain the market growth.

Below mentioned are some factors that contribute to the high cost of BIM:

- Software and hardware: BIM requires specialized software and hardware, which can be expensive to purchase and maintain. In addition, upgrading the software and hardware can add to the overall cost of implementing BIM.

- Training and education: BIM requires specialized knowledge and skills, which may not be readily available within a company. Providing employee training and education can be costly, particularly if it involves hiring external experts or sending employees to training courses.

- Process changes: BIM involves a significant change in the way that construction projects are planned, designed, and executed. Implementing BIM often requires significant process changes within a company, which can be time-consuming and expensive.

- Data management: BIM generates a large amount of data that needs to be managed and stored. This can require additional resources and infrastructure, such as servers and storage devices, which can add to the overall cost of implementing BIM.

Also, various vendors promote BIM software by offering it for free or at a low price to students for learning purposes. Apart from cost, BIM software programs require a long duration of training. Despite these restraints, BIM software exhibits remarkable productivity, which, in turn, helps a firm increase its efficiency rate by up to 25–30%. BIM also helps mitigate design failures during construction, thereby saving time and resources.

Opportunity: Increasing use of BIM for safety measures

BIM can improve safety in construction projects in several ways. Here are some examples:

- Virtual design and simulation: BIM allows project teams to create a virtual model of the construction project, which can be used to simulate different scenarios and identify potential safety hazards. This enables designers and engineers to address safety issues early in the design phase, reducing the risk of accidents and injuries during construction.

- Clash detection: BIM can detect clashes between building systems, such as electrical and mechanical before construction begins. This can help avoid potential safety hazards arising from conflicts between these systems.

- Site safety planning: BIM can be used to create 3D models of the construction site, which can be used to plan safety measures such as access routes, safety barriers, and evacuation plans. This can help ensure that site workers and visitors are kept safe during construction activities.

- Maintenance and repair: BIM can provide detailed information about the building systems and components, such as the location of electrical systems, plumbing, and fire safety equipment. This information can help to facilitate maintenance and repair activities, reducing the risk of accidents and injuries.

Overall, BIM can be a powerful tool for improving safety in construction projects, helping to reduce the risk of accidents and injuries and ensuring that construction activities are carried out safely and efficiently. These factors serve as an opportunity in this market.

Challenge: Lack of understanding and awareness of BIM

The slow adoption of BIM is the high cost of implementation. BIM requires significant software, hardware, and training investment, which can be a barrier for small and medium-sized firms. Additionally, the transition from traditional methods of design and construction to BIM can be challenging and time-consuming, requiring changes in workflows and processes.

Furthermore, transitioning from traditional design and construction methods to BIM requires significant changes in workflows and processes, which can be challenging and time-consuming. Additionally, a lack of understanding and awareness of BIM's potential benefits and resistance to change has slowed its adoption. The fragmented nature of the construction industry, with various stakeholders involved in a project, each with its priorities and goals, can also hinder coordination and collaboration among these stakeholders, particularly if they are not using the same BIM software or tools.

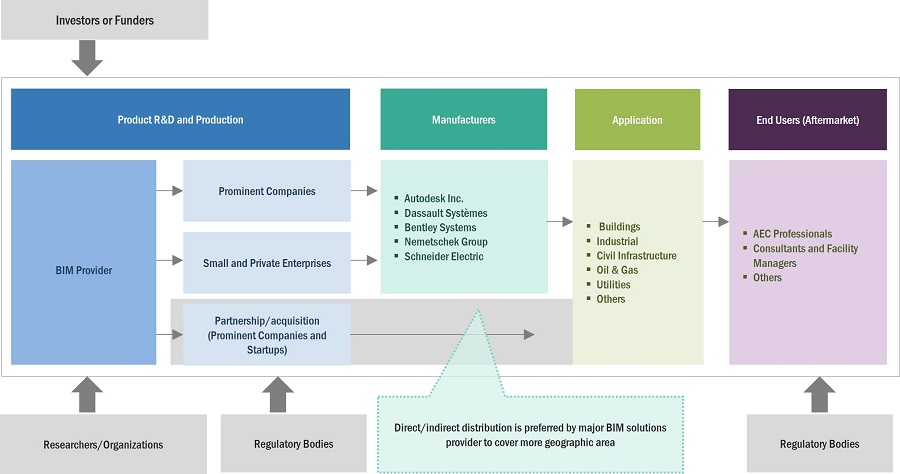

Building Information Modeling Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of BIM solutions. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Autodesk Inc. (US); Nemetschek Group (Germany); Bentley Systems (US); Trimble Inc. (US); Dassault Systèmes (France); Schneider Electric (France); Asitev (UK); Procore Technologies, Inc. (US); Hexagon (Sweden); Archidata Inc. (Canada).

By offering type, the software segment is expected to grow with a higher CAGR during the forecast period.

Software is expected to witness a higher CAGR during the forecast period. Software solutions used for BIM exhibit features such as interoperability between applications, easy visualization, and cost-effectiveness. The BIM software suite generally encompasses solutions for various objectives, such as architecture; sustainability; structures; mechanical, electrical, and plumbing (MEP); construction; and facility management in a project life cycle. Different types of BIM software solutions available in the market are Autodesk Revit Structure, Graphisoft ArchiCAD, Nemetschek ALLPLAN Architecture, Bentley Facilities Manager, and Tekla Structures. 3D BIM is increasingly being used by several architecture, engineering, and construction (AEC) professionals. 3D visualization of a project, reduction in costs and time, and flexibility in making design changes are the best features of the BIM software.

By project lifecycle, the construction segment is expected to grow with a higher CAGR during the forecast period.

The construction is expected to exhibit a higher CAGR during the forecast period. The growth in this phase is attributed to BIM significantly saving time during construction, particularly in projects with intricate designs, by enabling the efficient resolution of difficult tasks and complex geometric issues. This is made possible by its ability to provide real-time information in three dimensions, which the model offers. Moreover, BIM facilitates swift bidirectional data exchange among various software applications used for scheduling, clash detection, trade coordination, and more

By deployment, the On-premise segment is expected to grow with a higher CAGR during the forecast period.

On-premise segment is expected to witness a higher CAGR during the forecast period. Larger firms in the AEC industry, such as Autodesk. and Nemetschek, provide on-premises software for their customers in the industrial, healthcare, and residential sectors. Organizations have complete control over the on-premises data flow, as it is physically stored in organizations wherein these solutions and systems are deployed. This is one of the key reasons for the adoption of on-premises BIM software. On-premises deployment is feasible for small- and medium-sized enterprises as data management becomes easy for them.

By application, the civil infrastructure segment is expected to grow with a higher CAGR during the forecast period.

The civil infrastructure is expected to exhibit a higher CAGR during the forecast period. Implementing BIM in civil projects leads to improved outcomes as it enables the examination of multiple scenarios, offering data-driven confidence in delivering projects within the designated schedule and budget.

By end user, consultants & facility managers segment is expected to grow with a higher CAGR during the forecast period.

The consultants & facility managers are expected to exhibit a higher CAGR during the forecast period. The BIM consultant team is responsible for helping project owners solve people, process, and technological issues and deliver custom solutions and technology integration. BIM is mainly used by consultants and facility managers for building and infrastructure applications. BIM is important for lifecycle facility management, and thus, it is rapidly evolving as a major tool. BIM provides instant access to the location of building components that require monitoring or replacement. Facility management professionals are concerned with operating and maintaining buildings for their life cycle, which can span 30 years or even more and may include reconstruction and maintenance parts. BIM is an important tool for consultants and facility managers to track project progress. By maximizing the use of BIM data in facility management and building maintenance, operators and facility managers can reduce overall operational costs. BIM helps facility management for asset inventories and registries, space management applications, building system analysis, environmental analysis, and regulatory compliance management.

In 2028, Asia Pacific is projected to hold the largest share of the overall BIM market.

Building Information Modeling (BIM) Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Asia Pacific is also expected to witness the highest CAGR during the forecast period. The growth in this region can be attributed to the use of BIM for large-scale infrastructure and building projects. Additionally, government initiatives are expected to significantly drive the BIM market in Asia Pacific. Governments in the region have started imposing new regulations regarding building construction permits. For example, Japan, China, and South Korea have made BIM documents mandatory, especially for public buildings, along with green certification-related documents.

Key Market Players

Autodesk Inc. (US); Nemetschek Group (Germany); Bentley Systems (US); Trimble Inc. (US); Dassault Systèmes (France); Schneider Electric (France); Asitev (UK); Procore Technologies, Inc. (US); Hexagon (Sweden); Archidata Inc. (Canada) are some of the key players in the building information modeling companies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

BIM Market size value in 2023 |

USD 7.9 Billion |

|

BIM Market size value in 2028 |

USD 15.0 Billion |

|

CAGR (2023-2028) |

13.7% |

|

Market Size Availability for Years |

2019–2028 |

|

Base Year |

2022 |

|

Forecast Period |

2023–2028 |

|

Forecast Units |

Value (USD Million/USD Billion) |

|

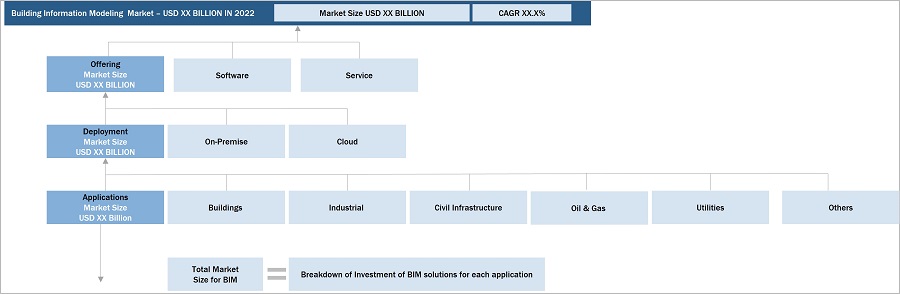

Segments Covered |

By offering type, deployment type, project lifecycle, application, end-user, and region |

|

Geographies Covered |

North America, Europe, Asia Pacific, and RoW |

|

Companies Covered |

Autodesk Inc. (US); Nemetschek Group (Germany); Bentley Systems (US); Trimble Inc. (US); Dassault Systèmes (France); Schneider Electric (France); Asitev (UK); Procore Technologies, Inc. (US); Hexagon (Sweden); Archidata Inc. (Canada) are some of the key players in the building information modeling market. |

Building Information Modeling Market Highlights

This research report categorizes the building information modeling industry based on offering type, deployment type, project lifecycle, application, end-user, and region./

- Software Support and Maintenance

- Project Management and Support

|

Segment |

Subsegment |

|

By Offering Type |

|

|

By Deployment Type |

|

|

By Project Lifecycle |

|

|

By Application |

|

|

By End User |

|

|

By Geography |

|

Recent Developments

- In April 2023, Bentley Systems partnered with Engineers Without Borders International (EWB-I) (US), an association of national EWB/ISF groups. With this partnership, EWB-I mission of bringing together the global Engineers Without Borders movement so that millions more people can benefit from work addressing today’s most pressing challenges and accelerating progress for a sustainable and equitable future for all.

- In April 2023, Asite acquired 3D Repo (UK), a pioneer in cloud-based Building Information Modelling (BIM) collaboration software. This acquisition strengthens Asite’s position as a leader in the digital engineering market, providing customers with advanced tools to manage the entire construction lifecycle.

- In March 2023, Autodesk Inc. acquired UNIFI Labs, Inc. (US), an essential cloud software solution for organizing, accessing, and managing content in Revit, Civil 3D, Plant 3D, and other digital design tools. The digital asset management capabilities of UNIFI would enable Autodesk’s customer base a faster and more accessible BIM content.

- In November 2022, Asite opened a new data center in Canada. The data center will support infrastructure developments and capital projects in the region, ensuring that information for projects within Canada will remain in Canada.

- In November 2022, Solibri Inside works as a native feature that can be used within the authoring tool and can run checks within a SaaS-based environment whenever the designer wishes. With the tool, the designer does not need to export the model and open other software to perform model checking. The innovative solution comes inbuilt within Nemetschek authoring tools Allplan, Graphisoft Archicad, and Vectorworks and can be easily accessed directly in the user interface of the authoring tool.

Frequently Asked Questions (FAQ):

Which are the major companies in the building information modeling market? What are their major strategies to strengthen their market presence?

The major companies in the building information modeling market are – Autodesk Inc. (US); Nemetschek Group (Germany); Bentley Systems (US); Trimble Inc. (US); Dassault Systèmes (France); Schneider Electric (France); Asitev (UK); Procore Technologies, Inc. (US); Hexagon (Sweden); Archidata Inc. (Canada) The major strategies adopted by these players are product launches and developments.

What is the potential market for BIM in terms of the region?

North America region is expected to dominate the building information modeling market owing to the major presence of BIM solution providers.

Who are the winners in the global building information modeling market share?

Companies such as Autodesk Inc. (US); Nemetschek Group (Germany); Bentley Systems (US); Dassault Systèmes (France); Schneider Electric (France)fall under the winner’s category. These companies cater to the requirements of their customers by providing BIM solutions. Moreover, these companies are highly adopting inorganic growth strategies to strengthen their global market position and customer base.

What are the drivers and opportunities for the building information modeling market?

Advanced sustainability with BIM and BIM improves safety is the driver and opportunity in the building information modeling market.

What are the restraints and challenges for the building information modeling market share?

High initial cost of BIM and Slow adoption of BIM are restraints and challenges in the building information modeling market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities in estimating the size of the building information modeling (BIM) market. Exhaustive secondary research has been carried out to collect information on the market, the peer markets, and the parent market. Both top-down and bottom-up approaches have been employed to estimate the total market size. Market breakdown and data triangulation methods have also been used to estimate the market for segments and subsegments.

Secondary Research

Revenues of companies offering BIM solutions have been obtained from the secondary data available through paid and unpaid sources. The revenues have also been derived by analyzing the product portfolio of key companies, and these companies have been rated according to the performance and quality of their products.

In the secondary research process, various sources have been referred to for identifying and collecting information for this study on the building information modeling market. Secondary sources considered for this research study include government sources; corporate filings; and trade, business, and professional associations. Secondary data has been collected and analyzed to arrive at the overall market size, which has been further validated through primary research.

Secondary research has been mainly used to obtain key information about the supply chain of BIM solutions to identify key players based on their products and prevailing industry trends in the building information modeling market by offering type, by deployment type, by project lifecycle, by application, by end-user, and region. Secondary research also helped obtain market information- and technology-oriented key developments undertaken by market players to expand their presence and increase their market share.

Primary Research

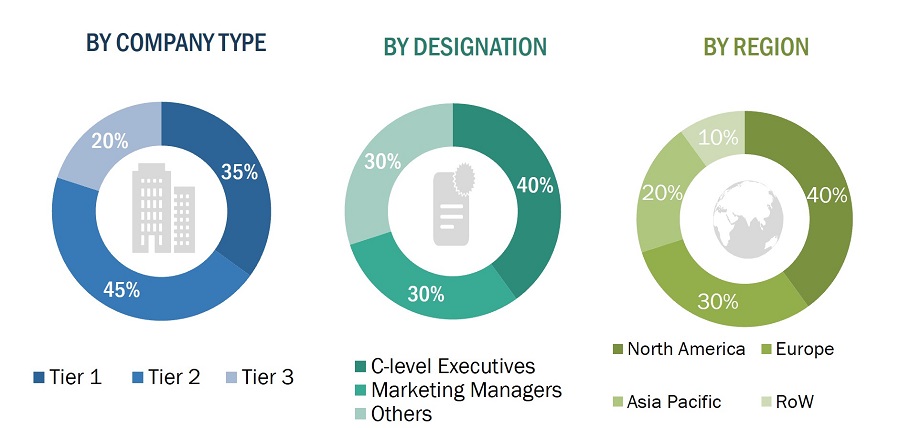

Extensive primary research has been conducted after understanding and analyzing the current scenario of the building information modeling market through secondary research. Several primary interviews have been conducted with the key opinion leaders from demand and supply sides across four main regions—the North America, Europe, Asia Pacific, and Rest of Europe. Approximately 25% of the primary interviews were conducted with the demand-side respondents, while approximately 75% have been conducted with the supply-side respondents. The primary data has been collected through questionnaires, emails, and telephonic interviews.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primary. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report. The breakdown of primary respondents is as follows:

To know about the assumptions considered for the study, download the pdf brochure

BIM Market Size Estimation

The bottom-up procedure has been employed to arrive at the overall size of the building information modeling market.

- Identifying approximate revenues of companies involved in the building information modeling ecosystem

- Identifying different offerings of players in the building information modeling market

- Analyzing the global penetration of each building information modeling offering through secondary and primary research

- Conducting multiple discussion sessions with key opinion leaders to understand the building information modeling solutions and their applications; analyzing the breakup of the work carried out by each key company

- Verifying and crosschecking estimates at every level with key opinion leaders, including chief executive officers (CEO), directors, and operation managers, and then, finally, with the domain experts of MarketsandMarkets

- Studying various paid and unpaid sources of information such as press releases, white papers, and databases of the company- and region-specific developments undertaken in the building information modeling market

The top-down approach has been used to estimate and validate the total size of the building information modeling market.

- Focusing initially on the top-line investments and expenditures made in the building information modeling ecosystem, further splitting into offering and listing key developments in key market areas

- Identifying all major players offering a variety of building information modeling solutions, which has been verified through secondary research and a brief discussion with industry experts

- Analyzing revenues, product mix, and geographic presence for which all identified players offer building information modeling products to estimate and arrive at the percentage splits for all key segments

- Discussing these splits with industry experts to validate the information and identify key growth domains across all major segments

- Breaking down the total market based on verified splits and key growth domains across all segments

Data Triangulation

After arriving at the overall market size-using the market size estimation processes as explained above—the market has been split into several segments and subsegments. To complete the entire market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from the demand and supply sides in the building information modeling market.

BIM Market Definition

Building Information Modeling (BIM) is a digital representation of the physical and functional characteristics of a building or infrastructure project. BIM involves creating and managing a 3D model that contains detailed information about the project's geometry, spatial relationships, materials, quantities, and other relevant data. BIM software goes beyond traditional 2D drafting by incorporating intelligent 3D models that contain detailed information about the project's components and their interactions.

Key Stakeholders

- Raw material suppliers

- Original equipment manufacturers (OEMs)

- Original design manufacturers (ODM)

- Research institutes

- Building information modeling solution provider

- Forums, alliances, and associations

- Governments and financial institutions

- Analysts and strategic business planners

Report Objectives

- To describe and forecast the size of the building information modeling market in terms of the offering, deployment type, project lifecycle, application, and end-user

- To describe and forecast the market size of various segments across four key regions—North America, Europe, Asia Pacific, and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the building information modeling market

- To provide an overview of the value chain pertaining to the building information modeling ecosystem, along with the average selling prices of building information modeling solutions

- To strategically analyze the ecosystem, tariff and regulatory landscape, patent landscape, Porter’s five forces, import and export scenarios, trade landscape, and case studies pertaining to the market under study

- To strategically analyze micromarkets with regard to individual growth trends, prospects, and contributions to the overall market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments

- To provide details of the competitive landscape for market leaders

- To analyze strategies, such as product launches and development, acquisition, partnership, agreement, collaboration, agreement, expansion, and mergers adopted by players in the building information modeling market

- To profile key players in the building information modeling market and comprehensively analyze their market ranking based on their revenue, market share, and core competencies

- Updated market developments of profiled players: The current report includes the market developments from March 2020 and April 2023.

Available customizations:

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

- Detailed analysis and profiling of additional market players based on various blocks of the supply chain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Building Information Modeling (BIM) Market

Hi, we need a sample brochure of this study and eagerly interested to have key insight discussion with your team.

We provides BIM services globally. we need some of clients so, we are looking for someone who will marketing our services in USA.

To understand the level of BIM development in the world and receive the real numbers of use in the market.

Software market valuations for construction commercial real estate, with a specific focus on warehouses, flex space, and offices.

In a construction project completed in 2025, multiple stake folders are considering using a common platform. We need an investigation for that.

What EMEA Emerging countries are included? Please respond including price to email, and methods to buy.

I am looking forward for developing a BIM based service provider company. I hope this brochure useful for me.

Good day! I am looking into figures on global acceptance and usage of BIM, forecasted global growth, percentage of growth it has brought to users and hindrances on adoption from consumers' perspective, all under the global area of focus.

I am seeking Data on the market size of Japan. Analysis regarding Japan is included on the Appendix, can you send me the sample data to confirm.

I am student from Brazil, doing a Master Degree in Project Management. As I am researching about BIM for my conclusion these, this study is very important to my work. Please, send me a free PDF, in order to support my research project.

I am participating as an invited speaker in a Master in BIM. During my speak, I will point to some BIM software in the market. It could be interesting to give pupils an insight of the market share of each software.

Interested in the global growth in key markets. Also, I Would like to see what the report contains on UK.

Hi, Does this report contain market share of Revit vs. other programs for Architects + AECs generally in the United States?

Role of BIM in improving and re-culturing the construction industry and the positive economics rewards and ROI's.

Learning more about the latest trends about BIM and how its making a big impact on todays modern world and what are the upcoming industry trends, which will drive this market?

I am requesting to get brochure for the BIM market.

Just trying to get a sense of the size of the BIM market

Which are the top players involved in this ecosystem.

What are the new upcoming trends for the growth of this market.

Which region along with country is dominating the BIM market and what are the major trends for the growth?

Please send us the sample brochure for the report.

Which application are will dominate the Bim market by 2024 or 2025, and what the driving factors for the same?

Total revenue share from BIM-software companies can generate revenue by targeting which customers?

Integration issue of BIM industry is the very important facts, we want to discuss many things related to Bim market and also will give me more information for the same. Before this, please send us the summary and scope of the report.

To track down the overview of BIM industry globally and find opportunities for it in india

I would like to know how much detailed information it contains for Building Information Modeling Market by Geography.

We are searching for the future market in BIM. We want to know that which are the dominant players present in this market and share captured by them in this market.

I am seeking access to this report as I am currently writing my thesis and would greatly benefit from the access to this report.

I'm developing a website to boost BIM negotiations around the world and I need the information of this article to measure the market that I'm getting into.

We are planning for a startup specializing in providing AEC services in the Asian Countries. Thus, we are interested in this report to have a better understanding of the market which would eventually help us in preparing an efficient business plan.

Hi, I would like to know what type of info is available for UK and also split for all industry/user types. Would you be able to provide some older data on UK as % of global and UK user group / industry split? Can the updated actuals + forecasts be purchased separately?

The geographic analysis is most important to me. I'm putting together an EU funding application and it would be good to be able to state what size the different markets were.

I would like to schedule a briefing with analysts of Building Information Modeling (BIM) report regarding ViZZ (https://www.vizz3d.com/), a transformative virtualization platform that brings to life data from various sources, creating immersive, experiential models that allow contractors, developers, prospective buyers, and investors to interact and walk-through them.