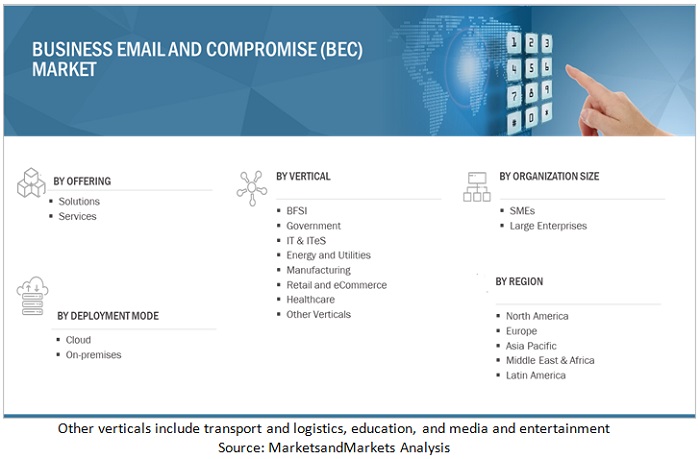

Business Email Compromise (BEC) Market by Offering (Solutions and Services), Deployment Mode (Cloud and On-premises), Organization Size (SMEs and Large Enterprises), Vertical (BFSI, Government, Healthcare) and Region - Global Forecast to 2027

Business Email Compromise Market Growth & Trends

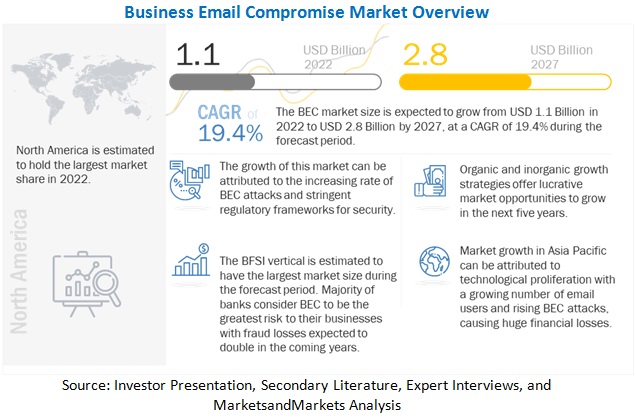

The global Business Email Compromise Market size as per revenue was exceeded $1.1 billion in 2022 and is poised to hit around $2.8 billion by the end of 2027, records a CAGR of 19.4% for anticipated period, 2022-2027.

There has been a rise in the number of BEC and spear-phishing attacks post the pandemic. The increased use of mobile devices, internet penetration, and cloud deployment models is expected to boost the use of email platforms and would contribute to the growth of the deployment of BEC solutions and services. The increased regulatory compliances on the use of emails is also contributing to the growth in the use of BEC solutions. There is an significant demand for holistic email protection solutions across verticals such as BFSI, government, IT and ITeS, healthcare, and retail and eCommerce.

To know about the assumptions considered for the study, Request for Free Sample Report

Business Email Compromise Market Dynamics

Driver: Huge financial losses due to BEC crimes.

Emails are becoming a target of phishing attacks, virus attacks, spam emails, identity thefts, zero-day attacks, APTs, and many other advanced attacks. With more than 215.3 billion emails being sent and received every day, it is highly susceptible to target data breaches. FBI’s Internet Crime Report (IC3) revealed that in 2018, victims in the US lost over USD 2.7 billion due to internet crimes; the report also disclosed that BEC attacks cost the US businesses more than USD 1.2 billion in the same year. A report - 2019 Email Security Trends by Barracuda Networks, which surveyed 660 executives and IT security professionals from the Americas, Europe, Middle East and Africa, and Asia Pacific, found that 78% of organizations said that the cost of email breaches is increasing. According to IBM, a successful phishing campaign costs approximately USD 3.86 million; in the US, the average cost accrued by a company for a data breach increased to USD 8.19 million in 2019 from USD 7.9 million in 2018. Such financial implications are urging organizations to deploy email encryption solutions to highly protect their email environments. BEC protection is crucial because of the profound risks BEC attacks create. BEC attacks can cause serious financial loss to companies, affecting its reputation. According to FBI, BEC is the costliest of internet crimes, accounting for 44% of the USD 4.1 billion in losses reported in 2020. In 2020, BEC scammers made over USD 1.8 billion—far more than any other type of cybercrime.

Restraint: Use of free, open-source, and pirated email security software

BEC solutions help organizations and users in reducing the risk of data loss. There are numerous open-source email security software available in market. Email encryption software such as VeraCrypt, FileVault, DiskCryptor, and AxCrypt offer almost all features provided by the prominent vendors in the market. This software is easily available over the internet as free downloads. However, these do not have rich functionalities to cater to the needs of an organization. The growing threats of email hacking have made key industries concerned about the privacy of their inboxes. The use of traditional email security solutions, such as PGP and S/MIME, has enough drawbacks to keep users from adopting them. Various users do not know how to use the free email security software effectively; others are lured into downloading the pirated versions available at a cheap cost. Software piracy refers to the unauthorized copying of the licensed versions of the software. Internet-based software piracy is one of the emerging issues in piracy. Despite threats associated with piracy, some companies still prefer pirated software, as they are price-sensitive. However, the presence of such software in the market hampers the market presence of major vendors that provide solutions to combat BEC scams, directly hitting their bottom lines. Hence, the availability of such free solutions is expected to restrain the market growth during the forecast period.

Opportunity: Growing use of ML/AI-powered BEC solutions

In a BEC scam, attackers pose as someone their victims trust and trick them into making fraudulent financial payments. BEC scams include gift card scams, payment redirect, and supplier invoicing fraud. Vendors operating in the market leverage AI/ML capabilities to analyze every email message to combat BEC scams. Some such vendors are Mimecast, Proofpoint, Agari, Cisco, Check Point, Trend Micro, and Abnormal Security. ML/AI-powered BEC detection solutions help detect and stop email fraud attacks more effectively to avoid any large financial losses. Email threats are becoming more sophisticated and harder to stop. AI and ML techniques help organizations identify and block any phishing or BEC attacks against the enterprise.

Challenge: Lack of awareness related to BEC solutions among enterprises

The major limitation to the BEC market growth is the lack of awareness about the correct use of them. The growing threat to on-premises and cloud data has increased IT spending for on-premises and cloud security. The inability of in-house enterprise security teams to safeguard on-premises data has forced enterprises to move their data to the cloud. The lack of adequate BEC knowledge may lead to errors, resulting in a huge loss for enterprises. Several organizations hire security professionals who lack the right skills to analyze and identify advanced threats. Chief information security officers play an important role in ensuring enterprises are well-equipped with best-in-class email protection solutions and employees do not fall prey to adversaries, such as malware, phishing, spoof, ransomware, BEC spams, and Advanced Persistent Threat (APT). With changes in the business environment, the security requirements are also evolving with the rise in zero-day threats and phishing attacks. This lack of awareness about advanced security threats has put businesses at risk and is restraining the growth of the BEC solutions market.

Business Email Compromise Market Ecosystem

To know about the assumptions considered for the study, Request for Free Sample Report

By deployment mode, cloud to grow at the highest CAGR during the forecast period.

The cloud deployment mode is the fastest-growing deployment mode in the BEC market. With the onset of COVID-19, the use of cloud services is gaining traction. Businesses are proactively deploying cloud-based email encryption solutions for remotely protecting end users from BEC threats. Companies have increasingly turned to the cloud for their email solution. This trend has been witnessed by cybercriminals or attackers and are finding ways to access email hosted in the cloud. Businesses are proactively deploying cloud-based BEC solutions for remotely protecting end users from phishing emails. Enterprises are seeking cloud-based BEC solutions to enable cost-effectiveness, rapid deployment, and on-demand access to expertise for mitigating advanced threats on email platforms. Small and medium-sized companies often rely on cloud BEC security from providers. All incoming and outgoing emails pass through the provider’s servers. Cloud-based BEC services provide security features, such as advanced phishing protection and MFA, which are either not enabled by default or are only available at additional cost depending upon the vendor.

By organization size, large enterprises to hold a larger market size during the forecast period.

Enterprises are witnessing high adoption of BEC solutions. They are mostly publicly traded companies with more than 1,000 employees. Large enterprises usually have a large infrastructure and complex network. Larger companies, who deal with a high number of transactions and invoices are expected to be targeted. Hackers are aware that there is a longer and slower chain of command in large enterprises. Hence, it will take more time for a single invoice to be approved for payment and also will take more time before they are caught. It gives ample time to hackers to cover their tracks and successfully escape with the stolen goods. Companies who employ a high number of vendors and outsourced companies may not be able to properly distinguish a real invoice from a fake one; hence, these companies are expected to fall for BEC attacks. In the large enterprises segment, North America is expected to hold the largest market size during the forecast period. Large enterprises in North America have adopted BEC solutions due to stringent regulatory norms and prevent huge financial losses caused by advanced email-borne threats. Various large enterprises are providing effective and innovative BEC solutions such as Proofpoint, Cisco, Trend Micro, Check Point, and Broadcom.

By vertical, BFSI to have the largest market size during the forecast period.

Due to the high frequency and large sums of money transferred between organizations, BEC scams are rife in the finance sector. Another reason that they are popular in the BFSI sector is because the returns are often much higher than that of typical email phishing scams. A paradigm shift in how these attacks are being conducted is represented by the risks related to the client relationship that come into play. For example, during a BEC attack, if an institution is conducting a transaction on behalf of a real client, there is no way for banks to know if the request is being made on behalf of an impersonated officer of the company. Often the client will become confused during the process and may lose trust in the security of the financial institution due to the incident. The BFSI vertical is an early adopter of cutting-edge technology solutions due to the regular transmission of highly sensitive financial data over emails. With COVID-19, there is an increase in the adoption of BYOD and WFH trends, leading to the increased spear phishing and BEC attacks on the BFSI infrastructure. There are strong data security requirements for BFSI companies due to their sensitive and private data. Hence, the demand for BEC solutions in the BFSI vertical is increasing.

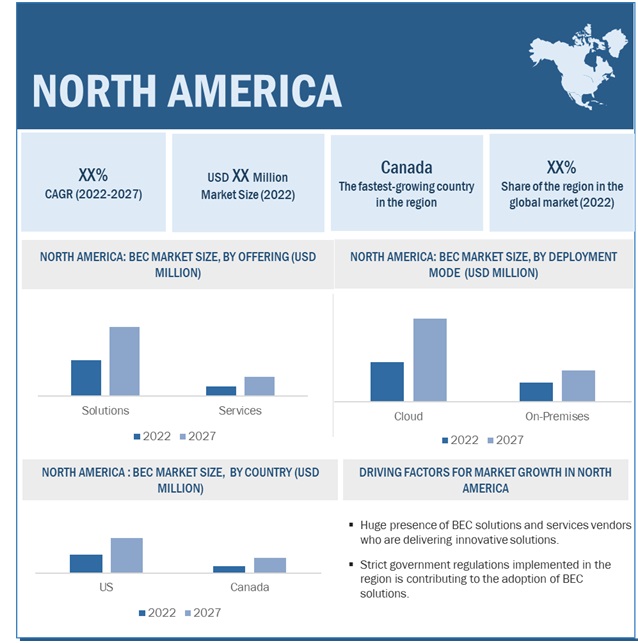

By region, North America to have the largest market size during the forecast period

North America leads the global BEC market with regards to the presence of the largest number of BEC solutions vendors in the region. The region is the most advanced region in terms of security technology innovation and adoption. Several regulations control the overall protection of the communication infrastructures in the region. The National Institute of Standards and Technology (NIST) encourages the US organizations by providing regulatory standards to protect the critical infrastructures in the organizations. The PCI DSS, HIPAA, GLBA, SOX, and other regulatory compliances help organizations in protecting the sensitive data of their customers. The region is witnessing an increasing number of cyberattacks. According to the Internet Crime Report 2021 by IC3, a division of Federal Bureau of Investigation (FBI), IC3 received 19,954 complaints of BEC with adjusted losses of nearly 2.4 billion dollars during the reported period. In 2019, the Cabarrus County reported a loss of USD 1.7 million to a BEC fraud. The regional presence of key industry players offering BEC technology solutions is one of the factors driving the growth of the North American BEC market. The adherence to compliance and regulations, increasing BEC frauds, growth in the adoption of mobile and other connected devices, and increasing internet usage are the factors driving the growth of the BEC market in the region.

Key Market Players:

The key players in the global BEC market include Proofpoint (US), Mimecast (UK), Check Point (Israel), Cisco (US), Broadcom (US), Agari (US), Trend Micro (Japan), Zix (US), Barracuda Networks (US), GreatHorn (US), IRONSCALES (US), Area 1 Security (US), Clearswift (UK), Fortinet (US), Tessian (US), Terranova Security (Canada), ZeroFox (US), Heimdal Security (Denmark), Acronis (Switzerland), PhishLabs (US), Redscan (UK), Armorblox (US), Cellopoint (Taiwan), Trustifi (US), and Abnormal Security (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/ Billion) |

|

Segments covered |

Offering, Deployment Mode, Organization Size, Vertical |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Major companies covered |

Proofpoint (US), Mimecast (UK), Check Point (Israel), Cisco (US), Broadcom (US), Agari (US), Trend Micro (Japan), Zix (US), Barracuda Networks (US), GreatHorn (US), IRONSCALES (US), Area 1 Security (US), Clearswift (UK), Fortinet (US), Tessian (US), Terranova Security (Canada), ZeroFox (US), Heimdal Security (Denmark), Acronis (Switzerland), PhishLabs (US), Redscan (UK), Armorblox (US), Cellopoint (Taiwan), Trustifi (US), and Abnormal Security (US). |

Market Segmentation:

Recent Developments

- In June 2021, Proofpoint’s Threat Protection Platform introduced Advanced BEC Defense, which focuses on stopping attempted BEC frauds. Leveraging inbound and outbound gateway telemetry, supply chain risk analytics, and API data from cloud productivity platforms, it accurately uncovers the most sophisticated email fraud attacks.

- In August 2021, Check Point announced the acquisition of Avanan, a fast-growing cloud email security company. Avanan will integrate into the Check Point Infinity architecture and the unified solution will protect workforce from malicious files, URLs, and phishing across email, web, network, and endpoint.

- In August 2021, Mimecast announced a strategic partnership with Humio, a CrowdStrike owned company. The solution is designed to deliver email-based threat intelligence with advanced detection, investigation, and threat hunting.

Frequently Asked Questions (FAQ):

How big is the Business Email Compromise (BEC) Market?

What is growth rate of the Business Email Compromise Market?

What are the key trends affecting the global BEC Market?

Who are the key players in Business Email Compromise Market?

Who will be the leading hub for Business Email Compromise Market?

What is Business Email Compromise (BEC)?

To know about the assumptions considered for the study, download the pdf brochure

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 35)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.4 YEARS CONSIDERED

1.5 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2018–2022

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 40)

2.1 RESEARCH DATA

FIGURE 1 BUSINESS EMAIL COMPROMISE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 DATA TRIANGULATION

FIGURE 2 MARKET: RESEARCH FLOW

2.3 MARKET SIZE ESTIMATION

2.3.1 REVENUE ESTIMATES

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 1 (SUPPLY-SIDE): REVENUE OF SOLUTIONS/SERVICES OF BUSINESS EMAIL COMPROMISE MARKET VENDORS

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 1, SUPPLY-SIDE ANALYSIS

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS AND SERVICES OF BUSINESS EMAIL COMPROMISE VENDORS

2.3.2 DEMAND-SIDE ANALYSIS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY–APPROACH 3, TOP-DOWN (DEMAND-SIDE)

2.4 COMPANY EVALUATION QUADRANT METHODOLOGY

FIGURE 7 COMPANY EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.5 STARTUPS EVALUATION QUADRANT METHODOLOGY

FIGURE 8 STARTUP EVALUATION QUADRANT: CRITERIA WEIGHTAGE

2.6 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.7 ASSUMPTIONS

2.8 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 51)

TABLE 3 BUSINESS EMAIL COMPROMISE MARKET SIZE AND GROWTH, 2021–2027 (USD MILLION, Y-O-Y GROWTH)

FIGURE 9 GLOBAL MARKET TO WITNESS SIGNIFICANT GROWTH DURING FORECAST PERIOD

FIGURE 10 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

FIGURE 11 FASTEST-GROWING SEGMENTS OF MARKET

4 PREMIUM INSIGHTS (Page No. - 55)

4.1 BRIEF OVERVIEW OF BUSINESS EMAIL COMPROMISE MARKET

FIGURE 12 INSTANCES OF EMAIL PHISHING AND BUSINESS EMAIL COMPROMISE SCAMS TO DRIVE MARKET DEMAND

4.2 MARKET, BY OFFERING, 2022

FIGURE 13 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MISE MARKET, BY DEPLOYMENT MODE, 2022

FIGURE 14 CLOUD SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY VERTICAL, 2022

FIGURE 15 BFSI VERTICAL TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4.5 MARKET INVESTMENT SCENARIO

FIGURE 16 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 58)

5.1 INTRODUCTION

FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: BUSINESS EMAIL COMPROMISE MARKET

5.1.1 DRIVERS

5.1.1.1 Growing scale of business email compromise scams and spear-phishing attacks

FIGURE 18 NUMBER OF BUSINESS EMAIL COMPROMISE ATTACKS, 2017–2019

5.1.1.2 Huge financial losses due to business email compromise crimes

FIGURE 19 AVERAGE COST OF DATA BREACH, 2014–2020

5.1.1.3 Stringent regulatory standards and data privacy compliances

5.1.2 RESTRAINTS

5.1.2.1 Use of free, open-source, and pirated email security software

5.1.2.2 Cost issues

5.1.3 OPPORTUNITIES

5.1.3.1 Growing use of ML/AI-powered business email compromise solutions

5.1.3.2 Increasing number of email users globally

FIGURE 20 GLOBAL EMAIL USERS, 2017–2024

5.1.4 CHALLENGES

5.1.4.1 Lack of awareness related to business email compromise solutions among enterprises

5.2 VALUE CHAIN ANALYSIS

FIGURE 21 VALUE CHAIN: BUSINESS EMAIL COMPROMISE MARKET

5.3 BUSINESS EMAIL COMPROMISE ECOSYSTEM ANALYSIS

FIGURE 22 ECOSYSTEM OF MARKET

5.4 PATENT ANALYSIS

FIGURE 23 MARKET: PATENT ANALYSIS

TABLE 4 PATENTS RELATED TO BUSINESS EMAIL COMPROMISE

5.5 PRICING ANALYSIS

TABLE 5 MARKET: PRICING ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.6.1 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

5.6.2 BIG DATA ANALYTICS

5.6.3 CLOUD

5.7 KEY STAKEHOLDERS AND BUYING CRITERIA

5.7.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS (%)

TABLE 6 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.8 USE CASES

5.8.1 SEATTLE CHILDREN'S HOSPITAL DEPLOYED PROOFPOINT’S EMAIL FRAUD DEFENSE SOLUTION TO COMBAT BUSINESS EMAIL COMPROMISE ATTACKS

5.8.2 A FORTUNE 500 COMPANY CHOSE AREA 1 SECURITY’S SOLUTION FOR EMAIL PROTECTION

5.8.3 SOLCYBER PARTNERED WITH AREA 1 SECURITY FOR COMPREHENSIVE CLOUD-EMAIL SECURITY

5.9 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

FIGURE 25 BUSINESS EMAIL COMPROMISE MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 7 PORTER’S FIVE FORCES IMPACT ON MARKET

5.10.1 THREAT OF NEW ENTRANTS

5.10.2 THREAT OF SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 REGULATORY LANDSCAPE

5.11.1 ADVANCED ENCRYPTION STANDARDS

5.11.2 FEDERAL INFORMATION PROCESSING STANDARDS

5.11.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.11.4 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.11.5 GENERAL DATA PROTECTION REGULATION

5.11.6 GRAMM-LEACH-BLILEY ACT

5.11.7 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 8 LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING (Page No. - 76)

6.1 INTRODUCTION

FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 9 MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 10 MARKET, BY OFFERING, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

6.2.1 SOLUTIONS: MARKET DRIVERS

TABLE 11 SOLUTIONS: MARKET, BY REGION, 2016–2021 USD MILLION)

TABLE 12 SOLUTIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

6.3.1 SERVICES: MARKET DRIVERS

TABLE 13 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 14 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 BUSINESS EMAIL COMPROMISE MARKET, BY DEPLOYMENT MODE (Page No. - 81)

7.1 INTRODUCTION

FIGURE 27 CLOUD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 16 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

7.2 CLOUD

7.2.1 CLOUD: MARKET DRIVERS

TABLE 17 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 18 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 ON-PREMISES

7.3.1 ON-PREMISES: MARKET DRIVERS

TABLE 19 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 20 ON-PREMISES: MARKET, 2022–2027 (USD MILLION)

8 BUSINESS EMAIL COMPROMISE MARKET, BY ORGANIZATION SIZE (Page No. - 85)

8.1 INTRODUCTION

FIGURE 28 SMALL- AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 21 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 22 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 SMALL- AND MEDIUM-SIZED ENTERPRISES

8.2.1 SMALL- AND MEDIUM-SIZED ENTERPRISES: BEC MARKET DRIVERS

TABLE 23 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 SMALL- AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 LARGE ENTERPRISES

8.3.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 25 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 BUSINESS EMAIL COMPROMISE MARKET, BY VERTICAL (Page No. - 90)

9.1 INTRODUCTION

FIGURE 29 HEALTHCARE VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 27 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 28 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BFSI

9.2.1 BFSI: MARKET DRIVERS

TABLE 29 BFSI: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 BFSI: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 GOVERNMENT

9.3.1 GOVERNMENT: MARKET DRIVERS

TABLE 31 GOVERNMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 32 GOVERNMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 IT AND ITES

9.4.1 IT AND ITES: BUSINESS EMAIL COMPROMISE MARKET DRIVERS

TABLE 33 IT AND ITES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 IT AND ITES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 ENERGY AND UTILITIES

9.5.1 ENERGY AND UTILITIES: MARKET DRIVERS

TABLE 35 ENERGY AND UTILITIES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 HEALTHCARE

9.6.1 HEALTHCARE: MARKET DRIVERS

TABLE 37 HEALTHCARE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 HEALTHCARE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 RETAIL AND ECOMMERCE

9.7.1 RETAIL AND ECOMMERCE: BEC MARKET DRIVERS

TABLE 39 RETAIL AND ECOMMERCE: BUSINESS EMAIL COMPROMISE MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 RETAIL AND ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 MANUFACTURING

9.8.1 MANUFACTURING: MARKET DRIVERS

TABLE 41 MANUFACTURING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER VERTICALS

TABLE 43 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 44 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 BUSINESS EMAIL COMPROMISE MARKET, BY REGION (Page No. - 102)

10.1 INTRODUCTION

FIGURE 30 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 45 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 31 NORTH AMERICA: MARKET SNAPSHOT

TABLE 47 NORTH AMERICA: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.3 US

TABLE 57 US: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 58 US: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 59 US: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 60 US: MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 61 US: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 62 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 63 US: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 64 US: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.2.4 CANADA

TABLE 65 CANADA: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 66 CANADA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 67 CANADA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 68 CANADA: MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 69 CANADA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 70 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 71 CANADA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 72 CANADA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: BUSINESS EMAIL COMPROMISE MARKET DRIVERS

10.3.2 EUROPE: REGULATORY LANDSCAPE

TABLE 73 EUROPE: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.3 UK

TABLE 83 UK: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 84 UK: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 85 UK: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 86 UK: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 87 UK: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 88 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 89 UK: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 90 UK: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.4 GERMANY

TABLE 91 GERMANY: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 92 GERMANY: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 94 GERMANY: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 95 GERMANY: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 96 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 97 GERMANY: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 98 GERMANY: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.3.5 REST OF EUROPE

TABLE 99 REST OF EUROPE: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 102 REST OF EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 103 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 104 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 105 REST OF EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 106 REST OF EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: BUSINESS EMAIL COMPROMISE MARKET DRIVERS

10.4.2 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 32 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 107 ASIA PACIFIC: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.3 CHINA

TABLE 117 CHINA: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 118 CHINA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 119 CHINA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 120 CHINA: MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 121 CHINA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 122 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 123 CHINA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 124 CHINA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.4 JAPAN

TABLE 125 JAPAN: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 126 JAPAN: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 127 JAPAN: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 128 JAPAN: MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 129 JAPAN: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 130 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 131 JAPAN: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 132 JAPAN: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.5 AUSTRALIA AND NEW ZEALAND

TABLE 133 AUSTRALIA AND NEW ZEALAND: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 134 AUSTRALIA AND NEW ZEALAND: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 135 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 136 AUSTRALIA AND NEW ZEALAND: MARKET, BY DEPLOYMENT MODE, 2022–2027(USD MILLION)

TABLE 137 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 138 AUSTRALIA AND NEW ZEALAND: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 139 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 140 AUSTRALIA AND NEW ZEALAND: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.4.6 REST OF ASIA PACIFIC

TABLE 141 REST OF ASIA PACIFIC: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 142 REST OF ASIA PACIFIC: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 143 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 144 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 145 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 146 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 147 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 148 REST OF ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST AND AFRICA

10.5.1 MIDDLE EAST AND AFRICA: BUSINESS EMAIL COMPROMISE MARKET DRIVERS

10.5.2 MIDDLE EAST AND AFRICA: REGULATORY LANDSCAPE

TABLE 149 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 150 MIDDLE EAST AND AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 151 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 152 MIDDLE EAST AND AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 MIDDLE EAST

TABLE 159 MIDDLE EAST: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 160 MIDDLE EAST: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 161 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 162 MIDDLE EAST: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 163 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 164 MIDDLE EAST: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 165 MIDDLE EAST: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 166 MIDDLE EAST: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.5.4 AFRICA

TABLE 167 AFRICA: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 168 AFRICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 169 AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 170 AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 171 AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 172 AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 173 AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 174 AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: BUSINESS EMAIL COMPROMISE MARKET DRIVERS

10.6.2 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 175 LATIN AMERICA: MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 176 LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 184 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.3 MEXICO

TABLE 185 MEXICO: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 186 MEXICO: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 187 MEXICO: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 188 MEXICO: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 189 MEXICO: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 190 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 191 MEXICO: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 192 MEXICO: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

10.6.4 REST OF LATIN AMERICA

TABLE 193 REST OF LATIN AMERICA: BUSINESS EMAIL COMPROMISE MARKET, BY OFFERING, 2016–2021 (USD MILLION)

TABLE 194 REST OF LATIN AMERICA: MARKET, BY OFFERING, 2022–2027 (USD MILLION)

TABLE 195 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 196 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 197 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 198 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 199 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 200 REST OF LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 161)

11.1 OVERVIEW

11.2 HISTORICAL REVENUE ANALYSIS

FIGURE 33 FIVE-YEAR REVENUE ANALYSIS OF KEY BUSINESS EMAIL COMPROMISE VENDORS (USD MILLION)

11.3 MARKET SHARE ANALYSIS OF LEADING PLAYERS

FIGURE 34 BUSINESS EMAIL COMPROMISE MARKET: REVENUE ANALYSIS

11.4 MARKET STRUCTURE

TABLE 201 MARKET: DEGREE OF COMPETITION

11.5 RANKING OF KEY PLAYERS

FIGURE 35 RANKING OF KEY MARKET PLAYERS

11.5.1 RECENT DEVELOPMENTS

TABLE 202 MARKET: PRODUCT LAUNCHES

TABLE 203 MARKET: DEALS

11.6 MARKET EVALUATION FRAMEWORK

FIGURE 36 BUSINESS EMAIL COMPROMISE MARKET EVALUATION FRAMEWORK BETWEEN 2020 AND 2022

11.7 COMPANY EVALUATION QUADRANT

11.7.1 COMPANY EVALUATION QUADRANT DEFINITIONS AND METHODOLOGY

TABLE 204 EVALUATION CRITERIA

11.8 COMPETITIVE BENCHMARKING

11.8.1 COMPANY FOOTPRINT

FIGURE 37 COMPANY FOOTPRINT OF MAJOR PLAYERS IN MARKET

11.9 COMPETITIVE LEADERSHIP MAPPING

11.9.1 STARS

11.9.2 EMERGING LEADERS

11.9.3 PERVASIVE PLAYERS

11.9.4 PARTICIPANTS

FIGURE 38 BUSINESS EMAIL COMPROMISE MARKET: COMPANY EVALUATION QUADRANT

11.10 COMPETITIVE SCENARIO

11.10.1 STARTUP/SME EVALUATION QUADRANT

11.10.1.1 Progressive companies

11.10.1.2 Responsive companies

11.10.1.3 Dynamic companies

11.10.1.4 Starting blocks

FIGURE 39 MARKET: STARTUP/SME EVALUATION QUADRANT

11.11 COMPETITIVE BENCHMARKING

TABLE 205 MARKET: LIST OF STARTUP/SMES

TABLE 206 BUSINESS EMAIL COMPROMISE MARKET: COMPETITIVE BENCHMARKING OF STARTUPS/SMES

12 COMPANY PROFILES (Page No. - 174)

12.1 INTRODUCTION

12.2 KEY PLAYERS

(Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Right to win, Strategic choices, and Weaknesses and competitive threats)*

12.2.1 PROOFPOINT

TABLE 207 PROOFPOINT: BUSINESS OVERVIEW

FIGURE 40 PROOFPOINT: COMPANY SNAPSHOT

TABLE 208 PROOFPOINT: PRODUCTS AND SOLUTIONS OFFERED

TABLE 209 PROOFPOINT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 210 PROOFPOINT: DEALS

12.2.2 MIMECAST

TABLE 211 MIMECAST: BUSINESS OVERVIEW

FIGURE 41 MIMECAST: COMPANY SNAPSHOT

TABLE 212 MIMECAST: PRODUCTS AND SOLUTIONS OFFERED

TABLE 213 MIMECAST: SERVICES OFFERED

TABLE 214 MIMECAST: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 215 MIMECAST: DEALS

12.2.3 CHECK POINT

TABLE 216 CHECK POINT: BUSINESS OVERVIEW

FIGURE 42 CHECK POINT: COMPANY SNAPSHOT

TABLE 217 CHECK POINT: PRODUCTS AND SOLUTIONS OFFERED

TABLE 218 CHECK POINT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 219 CHECK POINT: DEALS

12.2.4 CISCO

TABLE 220 CISCO: BUSINESS OVERVIEW

FIGURE 43 CISCO: COMPANY SNAPSHOT

TABLE 221 CISCO: PRODUCTS AND SOLUTIONS OFFERED

TABLE 222 CISCO: SERVICES OFFERED

TABLE 223 CISCO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 224 CISCO: DEALS

12.2.5 BROADCOM

TABLE 225 BROADCOM: BUSINESS OVERVIEW

FIGURE 44 BROADCOM: COMPANY SNAPSHOT

TABLE 226 BROADCOM: PRODUCTS AND SOLUTIONS OFFERED

TABLE 227 BROADCOM: SERVICES OFFERED

TABLE 228 BROADCOM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 229 BROADCOM: DEALS

12.2.6 AGARI

TABLE 230 AGARI: BUSINESS OVERVIEW

TABLE 231 AGARI: PRODUCTS AND SOLUTIONS OFFERED

TABLE 232 AGARI: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 233 AGARI: DEALS

12.2.7 TREND MICRO

TABLE 234 TREND MICRO: BUSINESS OVERVIEW

FIGURE 45 TREND MICRO: COMPANY SNAPSHOT

TABLE 235 TREND MICRO: PRODUCTS AND SOLUTIONS OFFERED

TABLE 236 TREND MICRO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 237 TREND MICRO: DEALS

12.2.8 ZIX

TABLE 238 ZIX: BUSINESS OVERVIEW

TABLE 239 ZIX: PRODUCTS AND SOLUTIONS OFFERED

TABLE 240 ZIX: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 241 ZIX: DEALS

12.2.9 BARRACUDA NETWORKS

TABLE 242 BARRACUDA NETWORKS: BUSINESS OVERVIEW

TABLE 243 BARRACUDA NETWORKS: PRODUCTS AND SOLUTIONS OFFERED

TABLE 244 BARRACUDA NETWORKS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 245 BARRACUDA NETWORKS: DEALS

12.2.10 GREATHORN

TABLE 246 GREATHORN: BUSINESS OVERVIEW

TABLE 247 GREATHORN: PRODUCTS AND SOLUTIONS OFFERED

TABLE 248 GREATHORN: PRODUCT LAUNCHES AND ENHANCEMENTS

12.3 OTHER PLAYERS

12.3.1 IRONSCALES

12.3.2 AREA 1 SECURITY

12.3.3 CLEARSWIFT

12.3.4 FORTINET

12.3.5 TESSIAN

12.3.6 TERRANOVA SECURITY

12.3.7 ZEROFOX

12.3.8 HEIMDAL SECURITY

12.3.9 ACRONIS

12.3.10 PHISHLABS

12.3.11 REDSCAN

12.4 STARTUPS

12.4.1 ARMORBLOX

12.4.2 CELLOPOINT

12.4.3 TRUSTIFI

12.4.4 ABNORMAL SECURITY

*Details on Business overview, Products/Solutions/Services offered, Recent developments, MNM view, Right to win, Strategic choices, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

13 ADJACENT MARKETS (Page No. - 216)

13.1 INTRODUCTION TO ADJACENT MARKETS

TABLE 249 ADJACENT MARKETS AND FORECASTS

13.2 LIMITATIONS

13.3 CYBERSECURITY MARKET

TABLE 250 CYBERSECURITY MARKET, BY COMPONENT, 2015–2020 (USD MILLION)

TABLE 251 CYBERSECURITY MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 252 CYBERSECURITY MARKET, BY SOFTWARE, 2015–2020 (USD MILLION)

TABLE 253 CYBERSECURITY MARKET, BY SOFTWARE, 2020–2026 (USD MILLION)

TABLE 254 SERVICES: CYBERSECURITY MARKET, BY TYPE, 2015–2020 (USD MILLION)

TABLE 255 SERVICES: CYBERSECURITY MARKET, BY TYPE, 2020–2026 (USD MILLION)

13.4 EMAIL ENCRYPTION MARKET

TABLE 256 EMAIL ENCRYPTION MARKET, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 257 EMAIL ENCRYPTION MARKET, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 258 SERVICES: EMAIL ENCRYPTION MARKET, BY TYPE, 2014–2019 (USD MILLION)

TABLE 259 SERVICES: EMAIL ENCRYPTION MARKET, BY TYPE, 2020–2026 (USD MILLION)

TABLE 260 EMAIL ENCRYPTION MARKET, BY VERTICAL, 2014–2019 (USD MILLION)

TABLE 261 EMAIL ENCRYPTION MARKET, BY VERTICAL, 2020–2026 (USD MILLION)

14 APPENDIX (Page No. - 221)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 CUSTOMIZATION OPTIONS

14.4 RELATED REPORTS

14.5 AUTHOR DETAILS

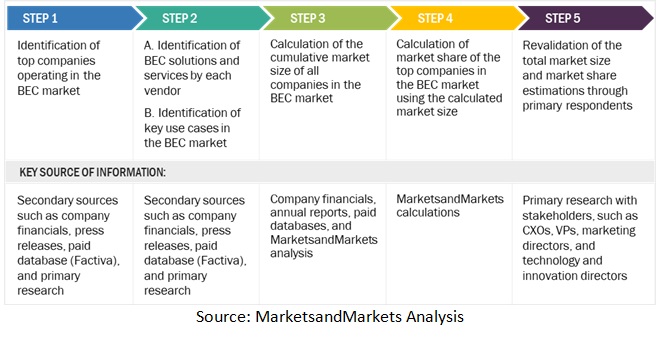

The study involved major activities in estimating the current market size for the BEC market. Exhaustive secondary research was done to collect information on the BEC industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches like top-down, bottom up were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the BEC market.

Secondary Research

The market size of companies offering BEC solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to, for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers, journals, certified publications; and articles from recognized authors, directories, and databases.

The cybersecurity investment and spending of various countries were extracted from their respective security associations, such as the US Department of Homeland Security (DHS) and European Union Agency for Cybersecurity (ENISA). Secondary research was used to obtain key information about the industry’s value chain and supply chain to identify key players according to their offerings and industry trends related to technology, application, and region and key developments from both market- and technology-oriented perspectives.

The factors considered for estimating the market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, Information and Communications Technology (ICT) spending, recent market developments, and market ranking analysis of major BEC solution providers.

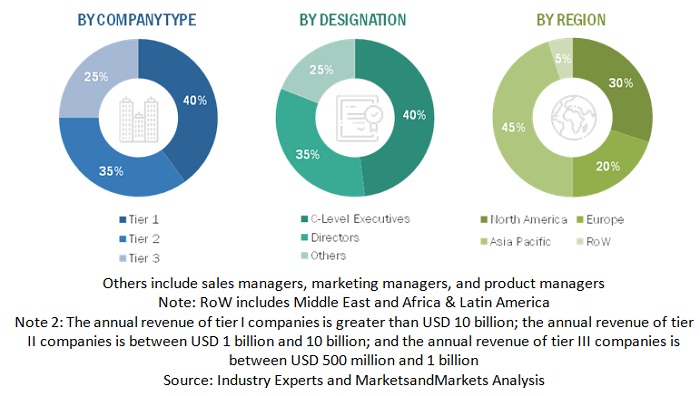

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the BEC market.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information, and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of BEC market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Multiple approaches were adopted to estimate and forecast the size of the BEC market. In the market engineering process, top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list key information/insights throughout the report. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the Business Email Compromise (BEC) market by offering, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the BEC market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the BEC market

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the BEC market and comprehensively analyze their market size and core competencies

- To track and analyze the competitive developments, such as product enhancements and new product launches; acquisitions; and partnerships and collaborations, in the BEC market globally

Available Customizations

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Business Email Compromise (BEC) Market