Business Process Management Market by Component, Deployment Type, Organization Size, Business Function (Sales and Marketing, HRM, Procurement and SCM, and Customer Service Support), Industry, and Region - Global Forecast to 2025

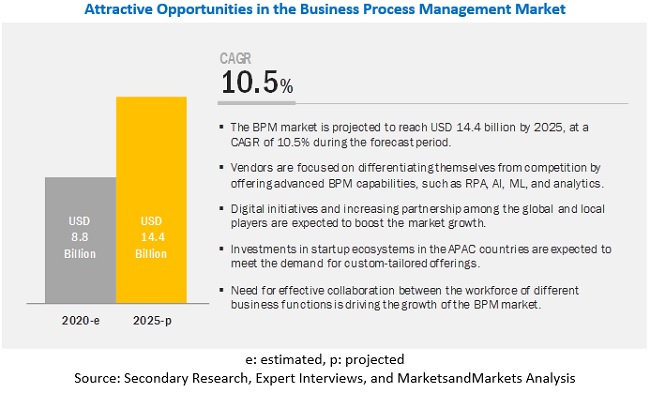

The Business Process Management Market size was valued USD 8.8 billion in 2020 and is projected to reach USD 14.4 billion by 2025, at a CAGR of 10.5% during the forecast period. Several factors that are expected to drive the growth of the BPM market include the integration of Artificial Intelligence (AI) and Machin Learning (ML) technologies with the BPM software, need for automated business process to reduce manual error, and improved IT systems to meet customers’ dynamic requirements. Industries such as manufacturing; Banking, Financial Services, and Insurance (BFSI); and telecommunications are expected to have significantly contributed to the growth of the Market.

Business Process Management Market Dynamics

Based on components, the platform segment to hold the larger market size during the forecast period

With the implementation of BPM platform, processes that earlier required human intervention are automated, and the workforce can focus on their core competencies. This leads to optimum utilization of resources; optimized resource utilization refers to a set of processes and practices that manage a balance between the available resources and the need of enterprises to achieve desired business goals. Moreover, BPM software provides professionals with efficient software to effectively design business rules as per the requirement of business project. The numerous benefits such as increased efficiency of workforce, faster time to market, agility of process, effective management of compliance and regulations, and transparency of business processes is expected to drive the growth of the Business Process Management Market.

Based on deployment types, the cloud-based segment to record the fastest growth rate during the forecast period

Among deployments, the cloud deployment type is expected to gain traction during the forecast period, as it offers the agility of on-demand resource deployment and consumption. This deployment type is being preferred by organizations, because it offers ease of access along with reduced capital and operational expenses.

Based on organization size, the SMEs segment to record the fastest growth rate during the forecast period

The Small and Medium-sized Enterprises (SMEs) segment is expected to grow at a higher CAGR during the forecast period. The growing need to reduce operational costs and streamline business processes is expected to drive the adoption of business process management software and services.

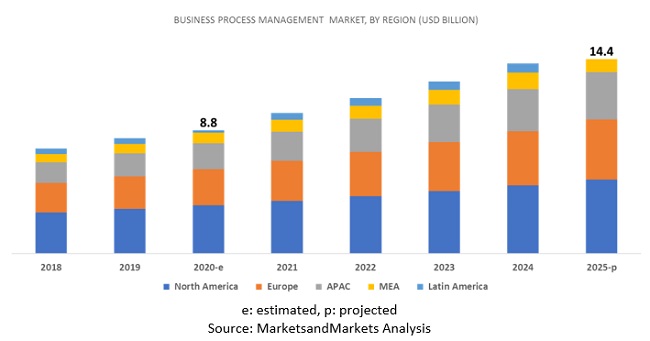

Based on regions, APAC to record the highest growth rate during the forecast period

APAC is expected to grow at the highest CAGR during the forecast period, due to the increase in demand for BPM software and services. BPM software enables an organization to fine-tune the business processes so that they can respond to the changing business trend in market. The APAC region is expected to experience extensive growth opportunities during the forecast period. China and Japan have emerged as undisputed leaders in the Business Process Management Market. Meanwhile, North America is projected to hold the largest market size during the forecast period

Key Market Players

Key market players profiled in this Business Process Management Market report Pegasystems (US), Appian (US), IBM (US), Oracle (US), Software AG (Germany), Nintex (US), OpenText (Canada), Newgen Software (India), Genpact (US), TIBCO (US), Bizagi (UK), ProcessMaker (US), Creatio (US), AgilePoint (US), BP Logix (US), K2 (US), Bonitasoft (France), Kissflow (India), Kofax (US), and AuraPortal (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2020 |

USD 8.8 billion |

|

Revenue forecast for 2025 |

USD 14.4 billion |

|

Key Market Drivers |

|

|

Key Market Opportunities |

|

|

Growth Rate |

10.5% CAGR |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Component, Business Function, Deployment Type, Organization Size, Industry, and Region |

|

Regions covered |

North America, Europe, APAC, Latin America, and MEA |

|

Companies covered |

Pegasystems (US), Appian (US), IBM (US), Oracle (US), Software AG (Germany), Nintex (US), OpenText (Canada), Newgen Software (India), Genpact (US), TIBCO (US), Bizagi (UK), ProcessMaker (US), Creatio (US), AgilePoint (US), BP Logix (US), K2 (US), Bonitasoft (France), Kissflow (India), Kofax (US), and AuraPortal (US) |

This research report categorizes the Business Process Management Market to forecast revenues and analyze trends in each of the following submarkets:

Based on component, the Business Process Management Market has the following segments:

- Platform

- Services

Based on business function, the Business Process Management Market has the following segments:

- Human Resource Management (HRM)

- Procurement and Supply Chain Management (SCM)

- Sales and Marketing

- Accounting and Finance

- Customer Service Support

- Others (Operations Management, Legal, and R&D)

Based on industry, the Business Process Management Market has the following segments:

- BFSI

- IT

- Telecommunication

- Retail and Consumer Goods

- Healthcare and Life Sciences

- Others (Transportation and Logistics, Government, and Media and Entertainment)

Based on region, the Business Process Management Market has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- Rest of APAC

-

MEA

- KSA

- UAE

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In January 2020, Appian entered into a technology partnership with Celonis, the market leader in AI-enhanced process mining and process excellence software. The partnership between Celonis and Appian is to unite Appian’s low-code automation platform with Celonis’ process mining technology for accelerating customers’ digital transformation journey.

- In January 2020, Nintex signed an agreement with Auswide Bank to accelerate its business transformation journey. Auswide Bank has optimized its business processes by leveraging the process mapping, management, and automation capabilities of the Nintex Process Platform.

- In January 2020, Appian acquired Novayre Solutions SL, developer of the Jidoka RPA platform. Acquisition of Novayre Solutions SL will empower Appian to unify low-code development and RPA into a single automation platform.

- In August 2019, Newgen Software opened a new office in Australia. The opening of the new office in Australia has increased the reach of the company in Australia and New Zealand (ANZ).

- In August 2019, Nintex released new digital forms designer for creating sophisticated electronic forms that help collect information anytime and anywhere. The new forms designer capability, which is part of Nintex Process Platform, enables enterprises to manage, automate, and optimize business processes with the help of drag-and-drop functionality instead of coding.

Frequently Asked Questions (FAQ):

How big is the Business Process Management Market?

What is the Business Process Management Market growth?

What is Business Process Management Market?

What are the different business functions where BPM is used?

What are the top companies providing Business Process Management solution and services?

What are the top industries adopting BPM solution?

What are various trends in Business Process Management Market?

- Driver: Optimized resource utilization through automated business processes Automated IT systems help serve Customers’ dynamic requirements

- Opportunities: Integration of AI and ML technologies Rising demand for robust solutions to maximize the visibility and control over processes

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 18)

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Inclusions and Exclusions

1.3 Market Scope

1.3.1 Market Segmentation

1.3.2 Regions Covered

1.4 Years Considered for the Study

1.5 Currency Considered

1.6 Stakeholders

2 Research Methodology (Page No. - 22)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Breakup of Primary Profiles

2.2 Breakup and Data Triangulation

2.3 Market Size Estimation

2.3.1 Top-Down Approach

2.3.2 Bottom-Up Approach

2.4 Competitive Leadership Mapping Methodology

2.5 Market Forecast

2.6 Assumptions for the Study

2.7 Limitations of the Study

3 Executive Summary (Page No. - 31)

4 Premium Insights (Page No. - 36)

4.1 Attractive Opportunities in the Business Process Management Market

4.2 Market By Business Function (2020 Vs. 2025)

4.3 Market By Deployment Type (2020 Vs. 2025)

4.4 Market By Organization Size (2020 Vs. 2025)

4.5 Market By Industry (2020 Vs. 2025)

4.6 Market Investment Scenario

5 Market Overview (Page No. - 39)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Optimized Resource Utilization Through Automated Business Processes

5.2.1.2 Automated It Systems Help Serve Customers’ Dynamic Requirements

5.2.1.3 Streamlined Communication Across Varied Business Functions in the Organization

5.2.2 Restraints

5.2.2.1 Persistent Growth in Cyberattacks and Security Issues

5.2.3 Opportunities

5.2.3.1 Integration of Ai and Ml Technologies

5.2.3.2 Rising Demand for Robust Solutions to Maximize the Visibility and Control Over Processes

5.2.4 Challenges

5.2.4.1 Growing Cultural Barrier to Adopt Advanced Solutions Over Traditional Systems

5.2.4.2 Selecting ApproPRIAte Processes to Implement Automation

5.3 Use Cases

5.3.1 Use Case 1: Automating Employee Survey Process By Deploying Business Process Management Solution

5.3.2 Use Case 2: Automating Core Business Operations and Service Function By Implementing Business Process Management Solution

5.3.3 Use Case 3: Transforming Supply Chain to Streamline Purchase Order By Implementing Business Process Management Solution

6 Business Process Management Market By Component (Page No. - 45)

6.1 Introduction

6.1.1 Component: Market Drivers

6.2 Platform

6.3 Services

7 Market By Business Function (Page No. - 51)

7.1 Introduction

7.1.1 Business Function: Market Drivers

7.2 Human Resource Management

7.3 Procurement and Supply Chain Management

7.4 Sales and Marketing

7.5 Accounting and Finance

7.6 Customer Service Support

7.7 Others

8 Market By Deployment Type (Page No. - 60)

8.1 Introduction

8.1.1 Deployment Type: Market Drivers

8.2 On-Premises

8.3 Cloud

9 Market By Organization Size (Page No. - 64)

9.1 Introduction

9.1.1 Organization Size: Market Drivers

9.2 Large Enterprises

9.3 Small and Medium-Sized Enterprises

10 Business Process Management Market By Industry (Page No. - 68)

10.1 Introduction

10.1.1 Industry: Market Drivers

10.2 Banking, Financial Services, and Insurance

10.3 Information Technology

10.4 Telecommunication

10.5 Retail and Consumer Goods

10.6 Manufacturing

10.7 Healthcare and Life Sciences

10.8 Other Industries

11 Market By Region (Page No. - 78)

11.1 Introduction

11.2 North America

11.2.1 North America: Market Drivers

11.2.2 United States

11.2.3 Canada

11.3 Europe

11.3.1 Europe: Market Drivers

11.3.2 United Kingdom

11.3.3 Germany

11.3.4 France

11.3.5 Rest of Europe

11.4 Asia Pacific

11.4.1 Asia Pacific: Business Process Management Market Drivers

11.4.2 China

11.4.3 Japan

11.4.4 Rest of Asia Pacific

11.5 Middle East and Africa

11.5.1 Middle East and Africa: Market Drivers

11.5.2 Kingdom of Saudi Arabia

11.5.3 United Arab Emirates

11.5.4 Rest of Middle East and Africa

11.6 Latin America

11.6.1 Latin America: Market Drivers

11.6.2 Brazil

11.6.3 Mexico

11.6.4 Rest of Latin America

12 Competitive Landscape (Page No. - 116)

12.1 Introduction

12.2 Competitive Scenario

12.2.1 New Product/Solution Launches and Product Enhancements

12.2.2 Business Expansions

12.2.3 Agreements/Partnerships/Collaborations

12.2.4 Acquisitions

12.3 Competitive Leadership Mapping

12.3.1 Visionary Leaders

12.3.2 Dynamic Differentiators

12.3.3 Innovators

12.3.4 Emerging Companies

13 Company Profiles (Page No. - 122)

13.1 Introduction

13.2 Pegasystems

(Business Overview, Products and Services Offered, Recent Developments, and SWOT Analysis)*

13.3 Appian

13.4 IBM

13.5 Oracle

13.6 Software AG

13.7 Nintex

13.8 OpenText

13.9 Genpact

13.10 Newgen Software

13.11 TIBCO

13.12 Bizagi

13.13 ProcessMaker

13.14 Creatio

13.15 AgilePoint

13.16 Bp Logix

13.17 K2

13.18 Kissflow

13.19 Bonitasoft

13.20 Kofax

13.21 AuraPortal

*Details on Business Overview, Products and Services Offered, Recent Developments, and SWOT Analysis Might Not be Captured in Case of Unlisted Companies.

13.22 Right-To-Win

14 Appendix (Page No. - 170)

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

List of Tables (107 Tables)

Table 1 United States Dollar Exchange Rate, 2016–2019

Table 2 Factor Analysis

Table 3 Business Process Management Market Size, By Component, 2018–2025 (USD Million)

Table 4 Platform: Market Size By Region, 2018–2025 (USD Million)

Table 5 Services: Market Size By Region, 2018–2025 (USD Million)

Table 6 Market Size, By Business Function, 2018–2025 (USD Million)

Table 7 Human Resource Management: Market Size By Region, 2018–2025 (USD Million)

Table 8 Procurement and Supply Chain Management: Market Size By Region, 2018–2025 (USD Million)

Table 9 Sales and Marketing: Market Size By Region, 2018–2025 (USD Million)

Table 10 Accounting and Finance: Market Size By Region, 2018–2025 (USD Million)

Table 11 Customer Service Support: Market Size By Region, 2018–2025 (USD Million)

Table 12 Others: Market Size By Region, 2018–2025 (USD Million)

Table 13 Market Size, By Deployment Type, 2020–2025 (USD Million)

Table 14 On-Premises: Market Size By Region, 2018–2025 (USD Million)

Table 15 Cloud: Market Size By Region, 2018–2025 (USD Million)

Table 16 Business Process Management Market Size, By Organization Size, 2018–2025 (USD Million)

Table 17 Large Enterprises: Market Size By Region, 2018–2025 (USD Million)

Table 18 Small and Medium-Sized Enterprises: Market Size By Region, 2018–2025 (USD Million)

Table 19 Market Size, By Industry, 2018–2025 (USD Million)

Table 20 Banking, Financial Services, and Insurance: Market Size By Region, 2018–2025 (USD Million)

Table 21 Information Technology: Market Size By Region, 2018–2025 (USD Million)

Table 22 Telecommunication: Market Size By Region, 2018–2025 (USD Million)

Table 23 Retail and Consumer Goods: Market Size By Region, 2018–2025 (USD Million)

Table 24 Manufacturing: Market Size By Region 2018–2025 (USD Million)

Table 25 Healthcare and Life Sciences: Market Size By Region, 2018–2025 (USD Million)

Table 26 Other Industries: Market Size By Region 2018–2025 (USD Million)

Table 27 Market Size, By Region, 2018–2025 (USD Million)

Table 28 North America: Business Process Management Market Size, By Component, 2018–2025 (USD Million)

Table 29 North America: Market Size By Business Function, 2018–2025 (USD Million)

Table 30 North America: Market Size Deployment Type, 2018–2025 (USD Million)

Table 31 North America: Market Size By Organization Size, 2016–2023 (USD Million)

Table 32 North America: Market Size By Industry, 2018–2025 (USD Million)

Table 33 North America: Market Size By Country, 2018–2025 (USD Million)

Table 34 United States: Market Size, By Component, 2018–2025 (USD Million)

Table 35 United States: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 36 United States: Market Size By Organization Size, 2018–2025 (USD Million)

Table 37 Canada: Market Size, By Component, 2018–2025 (USD Million)

Table 38 Canada: Market Size Deployment Type, 2018–2025 (USD Million)

Table 39 Canada: Market Size By Organization Size, 2018–2025 (USD Million)

Table 40 Europe: Market Size By Component, 2018–2025 (USD Million)

Table 41 Europe: Market Size By Business Function, 2018–2025 (USD Million)

Table 42 Europe: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 43 Europe: Market Size By Organization Size, 2018–2025 (USD Million)

Table 44 Europe: Market Size By Industry, 2018–2025 (USD Million)

Table 45 Europe: Market Size By Country, 2018–2025 (USD Million)

Table 46 United Kingdom: Business Process Management Market Size, By Component, 2018–2025 (USD Million)

Table 47 United Kingdom: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 48 United Kingdom: Market Size By Organization Size, 2018–2025 (USD Million)

Table 49 Germany: Market Size, By Component, 2018–2025 (USD Million)

Table 50 Germany: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 51 Germany: Market Size By Organization Size, 2018–2025 (USD Million)

Table 52 France: Market Size, By Component, 2018–2025 (USD Million)

Table 53 France: Market Size Deployment Type, 2018–2025 (USD Million)

Table 54 France: Market Size By Organization Size, 2018–2025 (USD Million)

Table 55 Rest of Europe: Market Size, By Component, 2018–2025 (USD Million)

Table 56 Rest of Europe: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 57 Rest of Europe: Market Size By Organization Size, 2018–20235(USD Million)

Table 58 Asia Pacific: Market Size, By Component, 2018–2025 (USD Million)

Table 59 Asia Pacific: Market Size By Business Function, 2018–2025 (USD Million)

Table 60 Asia Pacific: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 61 Asia Pacific: Market Size By Organization Size, 2018–2025 (USD Million)

Table 62 Asia Pacific: Market Size By Industry, 2018–2025 (USD Million)

Table 63 Asia Pacific: Market Size By Country, 2018–2025 (USD Million)

Table 64 China: Business Process Management Market Size, By Component, 2018–2025 (USD Million)

Table 65 China: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 66 China: Market Size By Organization Size, 2018–2025 (USD Million)

Table 67 Japan: Market Size By Component, 2018–2025 (USD Million)

Table 68 Japan: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 69 Japan: Market Size By Organization Size, 2018–2025 (USD Million)

Table 70 Rest of Asia Pacific: Market Size, By Component, 2018–2025 (USD Million)

Table 71 Rest of Asia Pacific: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 72 Rest of Asia Pacific: Market Size By Organization Size, 2018–2025 (USD Million)

Table 73 Middle East and Africa: Market Size By Component, 2018–2025 (USD Million)

Table 74 Middle East and Africa: Market Size By Business Function, 2018–2025 (USD Million)

Table 75 Middle East and Africa: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 76 Middle East and Africa: Market Size By Organization Size, 2018–2025 (USD Million)

Table 77 Middle East and Africa: Business Process Management Market Size, By Industry, 2018–2025 (USD Million)

Table 78 Middle East and Africa: Market Size By Country, 2018–2025 (USD Million)

Table 79 Kingdom of Saudi Arabia: Market Size By Component, 2018–2025 (USD Million)

Table 80 Kingdom of Saudi Arabia: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 81 Kingdom of Saudi Arabia: Market Size By Organization Size, 2018–2025 (USD Million)

Table 82 United Arab Emirates: Market Size, By Component, 2018–2025 (USD Million)

Table 83 United Arab Emirates: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 84 United Arab Emirates: Market Size By Organization Size, 2018–2025 (USD Million)

Table 85 Rest of Middle East and Africa: Market Size By Component, 2018–2025 (USD Million)

Table 86 Rest of Middle East and Africa: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 87 Rest of Middle East and Africa: Market Size By Organization Size, 2018–2025 (USD Million)

Table 88 Latin America: Business Process Management Market Size, By Component, 2018–2025 (USD Million)

Table 89 Latin America: Market Size By Business Function, 2018–2025 (USD Million)

Table 90 Latin America: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 91 Latin America: Market Size By Organization Size, 2018–2023 (USD Million)

Table 92 Latin America: Market Size By Industry, 2018–2025 (USD Million)

Table 93 Latin America: Market Size By Country, 2018–2025 (USD Million)

Table 94 Brazil: Market Size, By Component, 2018–2025 (USD Million)

Table 95 Brazil: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 96 Brazil: Market Size By Organization Size, 2018–2025 (USD Million)

Table 97 Mexico: Market Size By Component, 2018–2025 (USD Million)

Table 98 Mexico: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 99 Mexico: Market Size By Organization Size, 2018–2025 (USD Million)

Table 100 Rest of Latin America: Business Process Management Market Size, By Component, 2018–2025 (USD Million)

Table 101 Rest of Latin America: Market Size By Deployment Type, 2018–2025 (USD Million)

Table 102 Rest of Latin America: Market Size By Organization Size, 2018–2025 (USD Million)

Table 103 New Product/Solution Launches and Product Enhancements, 2018–2019

Table 104 Business Expansions, 2017–2019

Table 105 Agreements/Partnerships/Collaborations, 2018–2020

Table 106 Acquisitions, 2018–2020

Table 107 Evaluation Criteria

List of Figures (41 Figures)

Figure 1 Global Business Process Management Market: Research Design

Figure 2 Market Top-Down and Bottom-Up Approaches

Figure 3 Market Size Estimation Methodology: Approach 1 (Supply Side) – Revenue of Products/Solutions/Services of Market

Figure 4 Market Sizing Methodology: Approach 2 – Industry Level Bottom-Up

Figure 5 Competitive Leadership Mapping: Criteria Weightage

Figure 6 Market Snapshot, 2018–2025

Figure 7 Segments With High Growth Rates During the Forecast Period

Figure 8 Platform Segment to Hold a Larger Market Size During the Forecast Period

Figure 9 Large Enterprises Segment to Hold a Larger Market Size During the Forecast Period

Figure 10 Manufacturing Industry to Hold the Largest Market Size During the Forecast Period

Figure 11 North America to Hold the Highest Market Share During the Forecast Period

Figure 12 Advanced Business Process Management Capabilities for Digital Workplace By Well-Established Players to Drive the Business Process Management Market

Figure 13 Sales and Marketing Segment to Account for the Highest Market Share During the Forecast Period

Figure 14 On-Premises Segment to Account for a Higher Market Share During the Forecast Period

Figure 15 Large Enterprises Segment to Account for a Higher Market Share During the Forecast Period

Figure 16 Manufacturing Industry to Hold the Highest Market Share During the Forecast Period

Figure 17 Asia Pacific to Emerge as the Best Market for Investment in the Next Five Years

Figure 18 Drivers, Restraints, Opportunities, and Challenges: Market

Figure 19 Services Segment to Grow at a Higher Rate During the Forecast Period

Figure 20 Sales and Marketing Business Function to Hold the Largest Market Size in 2020

Figure 21 On-Premises Deployment Type to Hold a Larger Market Size

Figure 22 Small and Medium-Sized Enterprises Segment to Grow at a Higher CAGR During the Forecast Period

Figure 23 Manufacturing Industry to Register the Largest Market Size During the Forecast Period

Figure 24 North America to Hold the Largest Market Size During the Forecast Period

Figure 25 North America: Market Snapshot

Figure 26 Asia Pacific: Market Snapshot

Figure 27 Key Developments By the Leading Players in the Market, 2017–2020

Figure 28 Business Process Management Market (Global), Competitive Leadership Mapping, 2020

Figure 29 Pegasystems: Company Snapshot

Figure 30 Pegasystems: SWOT Analysis

Figure 31 Appian: Company Snapshot

Figure 32 Appian: SWOT Analysis

Figure 33 IBM: Company Snapshot

Figure 34 IBM: SWOT Analysis

Figure 35 Oracle: Company Snapshot

Figure 36 Oracle: SWOT Analysis

Figure 37 Software AG: Company Snapshot

Figure 38 Software AG: SWOT Analysis

Figure 39 OpenText: Company Snapshot

Figure 40 Genpact: Company Snapshot

Figure 41 Newgen Software: Company Snapshot

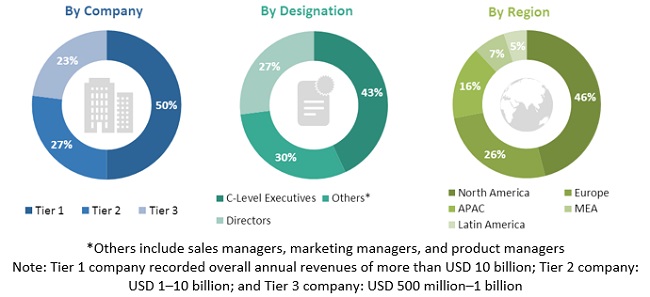

The study involved four major activities in estimating the current market size for the Business Process Management (BPM) market. Exhaustive secondary research was done to collect information on the Business Process Management Market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the BPM market.

Secondary Research

In the secondary research process, various secondary sources, such as D&B Hoovers, Bloomberg BusinessWeek, and Dun & Bradstreet, were referred to identify and collect information for this study. These secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers, certified publications, and articles by recognized authors; gold standard and silver standard websites; regulatory bodies; trade directories; and databases.

Primary Research

The Business Process Management Market comprises several stakeholders, such as BPM platform providers, BPM software vendors, cloud solution providers, cloud service brokers, system integrators, regulatory authorities, resellers and distributors, research organizations, government agencies, enterprise users, venture capitalists, private equity firms, and startup companies. The demand side of the BPM market consists of enterprises from different industries, such as Banking, Financial Service, and Insurance (BFSI); Information Technology (IT); telecommunication; retail and consumer goods; manufacturing; healthcare and life sciences; and others (transportation and logistics, government, and media and entertainment). The supply side includes BPM vendors, offering BPM platform, software, and services. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakup of the primary respondents:

Business Process Management Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the BPM market. These methods were also used extensively to determine the extent of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

- The primary research procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global Business Process Management Market by component, business function, deployment type, organization size, industry, and region from 2018 to 2025, and analyze the various macroeconomic and microeconomic factors that affect the market growth

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA) and Latin America

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall BPM market

- To profile key market players; generate a comparative analysis based on their business overviews, product/service offerings, regional presence, business strategies, and key financials; and comprehensively analyze their market size and core competencies in the market

- To track and analyze competitive developments, such as acquisitions, product developments, partnerships, agreements and collaborations, and Research and Development (R&D) activities, in the market

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the BPM market

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Key questions addressed by the report:

- What are the current trends that are driving the Business Process Management Market ?

- Who are the top vendors in the BPM market, and what is their competitive analysis?

- What are the innovations and developments done by the major market players?

- Which region is expected to lead the global BPM market during the forecast period?

Growth opportunities and latent adjacency in Business Process Management Market

I would like to know about the BPM market in Colombia specifically.