Call Center AI Market by Component, Mode of Channel (Phone, Social Media, & Chat), Application (Workforce Optimization & Predictive Call Routing), Deployment Mode, Vertical and Region - Global Forecast to 2027

The global Call Center AI Market size as per revenue was reasonably estimated at $1.6 billion in 2022 and is poised to generate revenue around $4.1 billion by the end of 2027, exhibits a CAGR of 21.3%. The major factors driving the growth of the call center AI market are the growth in customer engagement through social media platforms and increased data. However, unsupervised self-learning of chatbots is a major restraining factor for the adoption of call center AI solutions, as self-training of autonomous virtual agents through complex data and unsupervised learning algorithms is a very difficult task.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

The call center AI market is expected to witness a slowdown in 2020 due to the global lockdown, which is impacting global manufacturing, supply chains, and logistics. The manufacturing, transportation & logistics, and retail & consumer goods sectors have been most severely affected. The availability of essential items has also been impacted due to the lack of manpower to work on production lines, supply chains, and transportation, even though essential items are exempted from the lockdown. The situation is expected to come under control by early 2021. With COVID-19 spreading worldwide, global organizations with people who frequently travel internationally can leverage the use of mobile devices for important communications. Organizations can help keep those users who live abroad to handle potential risks by leveraging call center AI solutions to handle customers' queries in real-time.

Call Center AI Market Dynamics

Driver: Rising development in customer engagement through social media platforms

With advancements in AI technology in recent years, organizations are now leveraging AI in their customer service function, thereby shifting their focus from providing customer support services through email or messages to AI-powered chatbots that help enhance customer experience and engagement. For instance, AI technologies, such as chatbots and Intelligent Virtual Assistants (IVAs), can engage prospects with coupons or savings opportunities, enabling human sales reps to provide that all-important personal touch to close the deal. Likewise, AI can arm call center agents with robust historic data and insights about a customer, empowering agents to deliver meaningful cross-selling and up-selling opportunities. Organizations can also leverage AI-enabled chatbots and virtual agents to automate repetitive and manual processes, such as order placement, balance inquiries, general inquiries, technical assistance, and other customer services. Moreover, call center AI vendor enables enterprises to use AI to augment and improve their contact centers without the need for deep AI expertise.

Opportunity: Advancements in AI and ML-based technologies to facilitate real-time actionable customer insights

Organizations across the globe are dedicatedly investing in AI and ML technologies to improve user experience and stay competitive in the ever-changing market environment. AI-enabled solutions have witnessed wide-scale adoption across various applications, such as bots, predictive and prescriptive models, speech recognition, search engine optimization, Image Recognition, and text recognition. Furthermore, advanced AI and ML applications are used by call centers across various sectors, such as BFSI, IT & telecom, healthcare, and retail, to predict the outcomes and automatically take care of further processes. For instance, if a telecommunication customer service agent is unable to resolve queries regarding technical network issues, the chat AI can identify the problem as specific to a dedicated support channel and direct the customer toward it. Thus, AI for the customer service process brings comprehensive balance to the support system. While customers receive efficient solutions, agents fulfill their service commitments and relieve loaded support channels during rush hours.

Challenge: Data privacy and security concerns during pandemic

Data privacy is one of the key issues in the deployment of the AI platform model, where AI-based tools, such as NLP and ML, are used. For instance, chatbots need to collect data from users for better guidance, but people are hesitant to share personal information. Furthermore, large amounts of data are required to build new algorithms, as well as to get information about consumers to connect with them. Data ownership and privacy of collected data are the major concerns that risk the protection of the personal information of individuals. Government authorities have imposed various data security laws and regulations across regions. Therefore, enterprises must stay abreast of the changing rules and data-related regulations. For instance, the introduction of the General Data Protection Regulation (GDPR), a new data privacy law introduced in Europe, effective from May 25, 2018, requires contact centers to safeguard all personal customer and employee data termed Personally Identifiable Information (PII). Additionally, GDPR requirements include the customers’ “right to be forgotten,” security around data transfer, data visibility control/authorization, and access to data. Hence, contact centers need to introspect the location of data as well as its relevance and accessibility. As a part of GDPR compliance, Privacy Impact Assessment (PIA) is mandatory for controllers processing large chunks of sensitive data. Moreover, contact centers will have to upgrade their existing systems and infrastructure to provide customers with better control over their data, including the right to allow or block access to their data. Enterprises are expected to implement the latest security measures to ensure the privacy of their data.

The solution segment is expected to account for the largest market share during the forecast period

In the call center AI market, size of the solutions segment is expected to hold a larger market share during the forecast period due to the rising need to handle complex customer queries in real-time and reduced operational costs while the services segment is projected to grow at a higher CAGR during the forecast period. This can be attributed to the need for determining the time and cost required to install the solution that requires fully managed call center AI services . Call center AI solutions ensure the strengthening of customer relationships, resulting in increased first call resolution rate and improved customer experience.

North America is expected to hold the largest share during the forecast period

North America is expected to hold the largest share of the call center AI market, owing to the early adoption of call center AI technologies by the region’s call centers. In North America, call center AI solutions and services are highly effective in most organizations and verticals due to the increasing need to provide businesses with a way to operationalize and get more value from data assets. The increased smartphone adoption and technological advancements in the call centers boost the adoption across North America.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The major vendors in call center AI market are IBM (US), Microsoft (US), Oracle (US), AWS (US), SAP (Germany), Google (US), Avaya (US), NICE (Israel), Nuance Communications (US), Genesys (US), 8x8 (US), Artificial Solutions (Sweden), Zendesk (US), Five9 (US), RingCentral (US), Talkdesk (US), Dialpad (US), Twilio (US), Kore.ai (US), Inbenta (US), Creative Virtual (UK), Haptik (India), Rulai (US), Pypestream (US), Avaamo (US), Senseforth.ai (US), Observe.AI (US), Yellow.ai (US), Ultimate.ai (Germany), and Cognigy (Germany).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

US $1.6 Billion |

|

Market size value in 2027 |

US $4.1 Billion |

|

Growth Rate |

21.3% CAGR |

|

Largest Market |

North America |

|

Historical Data |

2016–2027 |

|

Base year for estimation |

2021 |

|

Forecast period |

2022–2027 |

|

Segments covered |

component (solutions and services), mode of channel, application, deployment mode, organization size, vertical, and region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America and Middle East & Africa |

|

Key Companies Profiled |

IBM (US), Microsoft (US), Oracle (US), AWS (US), SAP (Germany), Google (US), Avaya (US), NICE (Israel), Nuance Communications (US), Genesys (US), 8x8 (US), Artificial Solutions (Sweden), Zendesk (US), Five9 (US), RingCentral (US), Talkdesk (US), Dialpad (US), Twilio (US), Kore.ai (US), Inbenta (US), Creative Virtual (UK), Haptik (India), Rulai (US), Pypestream (US), Avaamo (US), Senseforth.ai (US), Observe.AI (US), Yellow.ai (US), Ultimate.ai (Germany), and Cognigy (Germany). |

This research report categorizes call center AI market, by component (solutions and services), mode of channel, application, deployment mode, organization size, vertical, and region.

Market by Component:

- Solutions

-

Services

-

Professional Services

- Training and Consulting

- System integration and implementations

- Support and Maintenance

- Managed Services

-

Professional Services

Market by Mode of Channel:

- Phone

- Social Media

- Chat

- Email or Text

- Website

Market by Application:

- Workforce Optimization

- Predictive Call Routing

- Journey Orchestration

- Agent Performance Management

- Sentiment Analysis

- Appointment Scheduling

- Other Applications (task management, lead generation, compliance tracking, inventory & order management)

Market by Deployment Mode

- Cloud

- On-premises

Market by Organization Size

- SMEs

- Large Enterprises

Market by Verticals

- BFSI

- Media & entertainment

- Retail & eCommerce

- Healthcare & Life Sciences

- Travel & Hospitality

- IT & Telecom

- Transportation & Logistics

- Others (Government, Education, Manufacturing, and Automotive)

Market by Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Thailand

- Rest of APAC

-

MEA

- Kingdom of Saudi Arabia (KSA)

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In March 2022, Avaya entered into a strategic partnership with Alcatel -Lucent to extend the availability of Avaya’s OneCloud CCaaS composable solutions to Alcatel -Lucent’s global base of customers while also making the digital networking solutions available on a global basis to Avaya customers.

- In January 2022, Sprinklr and Google Cloud partnered to help enterprises reimagine their Customer Experience Management strategies. Sprinklr partnered with Google Cloud to accelerate its go-to-market strategy and grow awareness among joint customers. Sprinklr will work closely with the global salesforce, benefitting from the deep relationships with enterprises that have chosen to build on Google Cloud.

- In September 2021, NICE collaborated with Google Cloud to address the growing demand for more effective and automated customer self-service systems that integrate with traditional contact centers. NICE is integrating its cloud-based, AI-powered CXone customer experience platform.

- In February 2022, Etisalat Digital collaborated with NICE following a comprehensive review of CCaaS providers that revealed CXone as the leading CX platform with a proven ability to drive digital transformation well into the future. It offers capabilities, such as easy migration to the cloud, the ability to rapidly innovate, flexibility to scale as needed along with the easy management of remote agents working from any location as well as multiple contact centers.

- In September 2021, Leidos partnered with Nuance Omnichannel Conversational AI Platform to enhance digital patient engagement solutions for healthcare organizations. Nuance Communications’ AI technology is part of its scalable and customizable digital patient engagement solutions for health systems and federal healthcare agencies.

Frequently Asked Questions (FAQ):

How big is the call center AI?

The global call center AI market size was valued USD 1.6 billion in 2022 and is projected to reach USD 4.1 billion by 2027, at a CAGR of 21.3% during the forecast period.

Which region has the largest market share in call canter AI market?

North America is expected to hold the largest share of the call center AI market, the increased smartphone adoption and technological advancements in the call centers boost the adoption across North America.

Which are the various region covered in Call Center AI Market?

The Call Center AI Market has been segmented into five regions: North America, Europe, Asia, Middle East & Africa, and Latin America.

What are the various verticals in Call Center AI Market?

The Call Center AI Market, by vertical, includes BFSI, Media and Entertainment, Retail and eCommerce, Healthcare and Life Sciences, Travel and Hospitality, IT and telecom, Transportation and Logistics, Other verticals (Government, Education, Manufacturing, and Automotive)

Who are the Major vendors in the Call Center AI Market?

Some of the major vendors in the Call Center AI Market are IBM (US), Microsoft (US), Oracle (US), AWS (US), SAP (Germany), Google (US), Avaya (US), NICE (Israel), Nuance Communications (US), Genesys (US), 8x8 (US), Artificial Solutions (Sweden), Zendesk (US), Five9 (US), RingCentral (US), Talkdesk (US), Dialpad (US), Twilio (US), Kore.ai (US), Inbenta (US), Creative Virtual (UK), Haptik (India), Rulai (US), Pypestream (US), Avaamo (US), Senseforth.ai (US), Observe.AI (US), Yellow.ai (US), Ultimate.ai (Germany), and Cognigy (Germany) .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 43)

1.1 OBJECTIVES OF STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 48)

2.1 RESEARCH DATA

FIGURE 1 CALL CENTER AI MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 2 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 3 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY- APPROACH 2, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF CALL CENTER AI MARKET

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 3, BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY-APPROACH 4, BOTTOM-UP (DEMAND-SIDE): SHARE OF CALL CENTER AI THROUGH OVERALL CALL CENTER AI SPENDING

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 8 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 9 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.7 ASSUMPTIONS FOR STUDY

2.8 LIMITATIONS OF STUDY

2.9 IMPLICATIONS OF COVID-19 ON CALL CENTER AI MARKET

FIGURE 10 QUARTERLY IMPACT OF COVID-19 DURING 2020–2021

3 EXECUTIVE SUMMARY (Page No. - 64)

TABLE 4 GLOBAL CALL CENTER AI MARKET SIZE AND GROWTH RATE, 2016–2021 (USD MILLION, Y-O-Y %)

TABLE 5 GLOBAL MARKET SIZE AND GROWTH RATE, 2022–2027 (USD MILLION, Y-O-Y %)

FIGURE 11 MARKET SNAPSHOT, BY COMPONENT

FIGURE 12 MARKET SNAPSHOT, BY SOLUTION

FIGURE 13 MARKET SNAPSHOT, BY SERVICE

FIGURE 14 MARKET SNAPSHOT, BY PROFESSIONAL SERVICE

FIGURE 15 MARKET SNAPSHOT, BY MODE OF CHANNEL

FIGURE 16 MARKET SNAPSHOT, BY DEPLOYMENT MODE

FIGURE 17 MARKET SNAPSHOT, BY ORGANIZATION SIZE

FIGURE 18 MARKET SNAPSHOT, BY APPLICATION

FIGURE 19 MARKET SNAPSHOT, BY VERTICAL

FIGURE 20 MARKET SNAPSHOT, BY REGION

4 PREMIUM INSIGHTS (Page No. - 70)

4.1 ATTRACTIVE MARKET OPPORTUNITIES IN CALL CENTER AI MARKET

FIGURE 21 ADVENT OF AI IN CALL CENTER OFFERING ENHANCED CUSTOMER SUPPORT SERVICES AND EXPERIENCE TO DRIVE GROWTH OF MARKET

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 22 PREDICTIVE CALL ROUTING SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET: BY REGION

FIGURE 23 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2022

4.4 MARKET IN NORTH AMERICA, BY TOP THREE APPLICATIONS AND MODE OF CHANNELS

FIGURE 24 PHONE MODE OF CHANNELS AND WORKFORCE OPTIMIZATION APPLICATION TO ACCOUNT FOR LARGEST SHARES IN MARKET IN 2022

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 73)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: CALL CENTER AI MARKET

5.2.1 DRIVERS

5.2.1.1 Advent of AI in call center to offer enhanced customer support services and better experience

5.2.1.2 Rising development in customer engagement through social media platforms

5.2.1.3 Increased data generation

5.2.2 RESTRAINTS

5.2.2.1 Unsupervised learning

5.2.3 OPPORTUNITIES

5.2.3.1 Advancements in AI and ML to facilitate real-time actionable insights

5.2.3.2 Integration of gesture recognition with AI-based chatbots and IVAs

5.2.4 CHALLENGES

5.2.4.1 Data privacy and security concerns during pandemic

5.2.4.2 Lack of skilled workforce to articulate business operations

5.2.4.3 Preference for online chat over chatbots

5.2.4.4 Slow digitization across emerging economies

5.2.5 CUMULATIVE GROWTH ANALYSIS

5.3 INDUSTRY TRENDS

5.3.1 CALL CENTER AI MARKET: EVOLUTION

FIGURE 26 EVOLUTION OF MARKET

5.3.2 ECOSYSTEM

FIGURE 27 MARKET: ECOSYSTEM

5.3.3 SUPPLY CHAIN ANALYSIS

FIGURE 28 SUPPLY CHAIN ANALYSIS

TABLE 6 MARKET: SUPPLY CHAIN

5.3.4 MARKET: COVID-19 IMPACT

FIGURE 29 MARKET TO WITNESS MINIMAL SLOWDOWN IN GROWTH IN 2020

5.3.5 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF CALL CENTER AI MARKET

FIGURE 30 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.3.6 CASE STUDY ANALYSIS

5.3.6.1 Citibot used Amazon Lex to build conversational interfaces for text and voice applications

5.3.6.2 OSU University used Amazon Connect and QnABot to provide seamless experience across voice and chat for customers and agents

5.3.6.3 Oscar Health chose CXone Workforce Management Enterprise to minimize administrative burden and focus on scheduling and forecasting

5.3.6.4 PLDT turned to Oracle Digital Assistant running on Oracle Cloud Infrastructure to power its self-service chatbot

5.3.6.5 ECHO chose Oracle Digital Assistant to help improve customer experience

5.3.6.6 Firefly Health switched to Dialpad to get new information quickly

5.3.6.7 SolarZero used Dialpad to have a modern phone system that is highly reliable and does not drop calls

5.3.6.8 Standard Chartered used Avaya OneCloud to achieve personalized and consistent client service

5.3.6.9 Preferred Home Care used Avaya Cloud Office to be able to reach patients during an outage or other crisis

5.3.6.10 Vodafone selected Amazon Connect to simplify contact center operations by drawing on AI and ML

5.3.7 TECHNOLOGY ANALYSIS

5.3.7.1 ML and deep learning

5.3.7.2 Natural Language Processing

5.3.7.3 Automatic speech recognition

5.3.7.4 Cloud computing

5.3.8 PATENT ANALYSIS

5.3.8.1 Methodology

5.3.8.2 Document Type

TABLE 7 PATENTS FILED, 2018-2022

5.3.8.3 Innovation and patent applications

FIGURE 31 TOTAL NUMBER OF PATENTS GRANTED IN ONE YEAR, 2018–2022

5.3.8.4 Top applicants

FIGURE 32 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS, 2018–2022

5.3.9 PRICING MODEL ANALYSIS, 2021

TABLE 8 CALL CENTER AI MARKET: PRICING MODEL ANALYSIS, 2021

5.3.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 9 IMPACT OF EACH FORCE ON MARKET

FIGURE 33 PORTER’S FIVE FORCES ANALYSIS

5.3.10.1 Threat of new entrants

5.3.10.2 Threat of substitutes

5.3.10.3 Bargaining power of suppliers

5.3.10.4 Bargaining power of buyers

5.3.10.5 Rivalry among existing competitors

5.3.11 SCENARIO

TABLE 10 CRITICAL FACTORS TO IMPACT GROWTH OF CALL CENTER AI MARKET

5.4 REGULATORY IMPLICATIONS

5.4.1 GENERAL DATA PROTECTION REGULATION

5.4.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

5.4.3 PAYMENT CARD INDUSTRY DATA SECURITY STANDARD

5.4.4 SARBANES-OXLEY ACT OF 2002

5.4.5 SOC 2 TYPE II COMPLIANCE

5.4.6 ISO/IEC 27001

5.4.7 THE GRAMM–LEACH–BLILEY ACT

5.5 KEY STAKEHOLDERS AND BUYING CRITERIA

5.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 34 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

TABLE 11 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS (%)

5.5.2 BUYING CRITERIA

FIGURE 35 KEY BUYING CRITERIA

TABLE 12 KEY BUYING CRITERIA FOR CALL CENTER AI

5.6 KEY CONFERENCES & EVENTS IN 2022-2023

TABLE 13 CONTACT CENTER AI MARKET: DETAILED LIST OF CONFERENCES & EVENTS

5.7 REGULATORY LANDSCAPE

5.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 17 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 18 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 CALL CENTER AI MARKET, BY COMPONENT (Page No. - 104)

6.1 INTRODUCTION

6.1.1 CALL CENTER AI: COVID-19 IMPACT

FIGURE 36 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 19 MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 20 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 37 PLATFORM SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 21 MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 22 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

6.2.1 PLATFORM

6.2.1.1 Rising demand for AI in call centers to enhance agent performance and enable customers

TABLE 23 PLATFORM: CALL CENTER AI MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 24 PLATFORM: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 SOFTWARE TOOLS

6.2.2.1 Call center AI software helps in deeper understanding of customers across different contexts and channel modes

TABLE 25 SOFTWARE TOOLS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 26 SOFTWARE TOOLS: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 38 MANAGED SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 27 MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 28 MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 29 SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 30 SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

FIGURE 39 SYSTEM INTEGRATION & IMPLEMENTATION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 31 PROFESSIONAL SERVICES: CALL CENTER AI MARKET, BY TYPE, 2016–2021 (USD MILLION)

TABLE 32 PROFESSIONAL SERVICES: MARKET, BY TYPE, 2022–2027 (USD MILLION)

TABLE 33 PROFESSIONAL SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 34 PROFESSIONAL SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.1 Training & consulting services

6.3.1.1.1 Training and consulting services help in initial phase of implementing call center AI

TABLE 35 TRAINING & CONSULTING SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 36 TRAINING & CONSULTING SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.2 Support & maintenance

6.3.1.2.1 Support & maintenance services help organizations understand changing business conditions and market trends

TABLE 37 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 38 SUPPORT & MAINTENANCE SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.1.3 System integration & implementation services

6.3.1.3.1 System integration & deployment services facilitate integration of devices and software and their deployment

TABLE 39 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: CALL CENTER AI MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 40 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 Enterprises must ensure provision of certain services for their clients to maintain their market position

TABLE 41 MANAGED SERVICES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 42 MANAGED SERVICES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 CALL CENTER AI MARKET, BY ORGANIZATION SIZE (Page No. - 118)

7.1 INTRODUCTION

FIGURE 40 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 43 MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 44 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 FOCUS ON SOLUTIONS TO EFFECTIVELY MANAGE COMPLEX BUSINESS PROCESSES TO ENHANCE CUSTOMER ENGAGEMENT

TABLE 45 LARGE ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 46 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 SMALL AND MEDIUM-SIZED ENTERPRISES

7.3.1 REDUCED OPERATIONAL COSTS, GOVERNMENT SUPPORT, AND ENHANCED IT INFRASTRUCTURE TO INFLUENCE ADOPTION OF CALL CENTER AI SOLUTIONS

TABLE 47 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 48 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 CALL CENTER AI MARKET, BY MODE OF CHANNEL (Page No. - 123)

8.1 INTRODUCTION

FIGURE 41 SOCIAL MEDIA SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 49 MARKET, BY MODE OF CHANNEL, 2016–2021 (USD MILLION)

TABLE 50 MARKET, BY MODE OF CHANNEL, 2022–2027 (USD MILLION)

8.2 PHONE

8.2.1 PHONE TO BE MOST-USED CUSTOMER SERVICE CHANNEL TO HELP CUSTOMERS GET QUICK RESOLUTION FOR THEIR QUERIES

TABLE 51 PHONE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 52 PHONE: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SOCIAL MEDIA

8.3.1 CUSTOMERS USE SOCIAL MEDIA PLATFORMS TO HIGHLIGHT POSITIVE OR NEGATIVE EXPERIENCES THEY HAVE HAD WITH BRANDS

TABLE 53 SOCIAL MEDIA: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 54 SOCIAL MEDIA: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.4 CHAT

8.4.1 CHAT-BASED CALL CENTER AI SOFTWARE TOOLS TO IMPROVE RESPONSE TIME AND LOWER OPERATIONAL COSTS IN LONG RUN

TABLE 55 CHAT: CALL CENTER AI MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 56 CHAT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.5 EMAIL OR TEXT

8.5.1 VERSATILE WEBSITE ENGAGEMENT TOOL TO COMMUNICATE PERSONAL CORRESPONDENCE AND ONE-ON-ONE CONVERSATIONS

TABLE 57 EMAIL OR TEXT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 58 EMAIL OR TEXT: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.6 WEBSITE

8.6.1 WEBSITE CHAT TO BE MOST COST-EFFECTIVE CHANNEL TO SUPPORT MULTIPLE CUSTOMERS AT ONE TIME

TABLE 59 WEBSITE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 60 WEBSITE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 CALL CENTER AI MARKET SIZE, BY DEPLOYMENT MODE (Page No. - 131)

9.1 INTRODUCTION

FIGURE 42 CLOUD SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE DURING FORECAST PERIOD

TABLE 61 MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 62 MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

9.2 CLOUD

9.2.1 CLOUD-BASED CALL CENTER AI SOLUTIONS TO GAIN TRACTION DUE TO THEIR COST-EFFECTIVENESS AND GLOBAL AVAILABILITY

TABLE 63 CLOUD: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 64 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 ON-PREMISES

9.3.1 DATA PRIVACY CONCERNS AND INCREASING IT INFRASTRUCTURE COSTS TO DRIVE GROWTH OF ON-PREMISES DEPLOYMENT MODE

TABLE 65 ON-PREMISES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 66 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 CALL CENTER AI MARKET, BY APPLICATION (Page No. - 136)

10.1 INTRODUCTION

FIGURE 43 PREDICTIVE CALL ROUTING SEGMENT TO REGISTER HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 67 MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 68 MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

10.2 WORKFORCE OPTIMIZATION

10.2.1 WORKFORCE OPTIMIZATION TO MODERNIZE CALL CENTER TECHNOLOGIES AND PLATFORMS

TABLE 69 WORKFORCE OPTIMIZATION: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 70 WORKFORCE OPTIMIZATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.3 PREDICTIVE CALL ROUTING

10.3.1 PREDICTIVE CALL ROUTING TO USE ARTIFICIAL INTELLIGENCE-BASED CALL CENTER TECHNIQUES AND ANALYTICS

TABLE 71 PREDICTIVE CALL ROUTING: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 72 PREDICTIVE CALL ROUTING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.4 JOURNEY ORCHESTRATION

10.4.1 JOURNEY ORCHESTRATION TO PROVIDE HOLISTIC VIEW OF CUSTOMER INTERACTIONS WITH ORGANIZATION

TABLE 73 JOURNEY ORCHESTRATION: CALL CENTER AI MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 74 JOURNEY ORCHESTRATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.5 AGENT PERFORMANCE MANAGEMENT

10.5.1 GROWING NEED TO MANAGE AND HANDLE AGENT PERFORMANCE TO DRIVE MARKET GROWTH

TABLE 75 AGENT PERFORMANCE MANAGEMENT: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 76 AGENT PERFORMANCE MANAGEMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.6 SENTIMENT ANALYSIS

10.6.1 RISING NEED TO AUTOMATE CONTACT CENTER PROCESSES AND GAIN CUSTOMER INSIGHTS TO BOOST CALL CENTER AI GROWTH

TABLE 77 SENTIMENT ANALYSIS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 78 SENTIMENT ANALYSIS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.7 APPOINTMENT SCHEDULING

10.7.1 NEED TO AUTOMATE MULTIPLE TASKS AND ENHANCE PERSONALIZED CUSTOMER EXPERIENCE TO DRIVE MARKET GROWTH

TABLE 79 APPOINTMENT SCHEDULING: CALL CENTER AI MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 80 APPOINTMENT SCHEDULING: MARKET, BY REGION, 2022–2027 (USD MILLION)

10.8 OTHER APPLICATIONS

TABLE 81 OTHER APPLICATIONS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 82 OTHER APPLICATIONS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11 CALL CENTER AI MARKET, BY VERTICAL (Page No. - 146)

11.1 INTRODUCTION

FIGURE 44 HEALTHCARE & LIFE SCIENCES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 83 MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 84 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

11.2 BANKING, FINANCIAL SERVICES, & INSURANCE

11.2.1 CALL CENTER AI SOLUTIONS TO HELP FINANCIAL INSTITUTIONS CONNECT WITH CUSTOMERS AND IMPROVE EXPERIENCE

TABLE 85 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 86 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.3 MEDIA & ENTERTAINMENT

11.3.1 MEDIA & ENTERTAINMENT FIRMS TO DELIVER SEAMLESS, PERSONAL, AND PROFI TABLE EXPERIENCE TO CUSTOMERS

TABLE 87 MEDIA & ENTERTAINMENT: CALL CENTER AI MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 88 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.4 RETAIL & ECOMMERCE

11.4.1 CALL CENTER AI SOLUTIONS TO PROVIDE BETTER CUSTOMER SERVICE FOR CUSTOMER LOYALTY AND RETENTION

TABLE 89 RETAIL & ECOMMERCE: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 90 RETAIL & ECOMMERCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.5 HEALTHCARE & LIFE SCIENCES

11.5.1 HEALTHCARE CENTERS TO UTILIZE CALL CENTERS AI SOLUTIONS TO IMPROVE THEIR QUALITY OF SERVICE

TABLE 91 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 92 HEALTHCARE & LIFESCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.6 TRAVEL & HOSPITALITY

11.6.1 CALL CENTER AI SOLUTIONS TO HELP CONSUMERS BY PROVIDING RELIABLE ACCESS TO MOST UP-TO-DATE INFORMATION

TABLE 93 TRAVEL & HOSPITALITY: CALL CENTER AI MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 94 TRAVEL & HOSPITALITY: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.7 IT & TELECOM

11.7.1 ENHANCED CUSTOMER SERVICE DELIVERY USING CHATBOTS TO OFFER COMPETITIVE ADVANTAGE TO TELECOM VENDORS

TABLE 95 IT & TELECOM: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 96 IT & TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.8 TRANSPORTATION & LOGISTICS

11.8.1 CALL CENTER AI SOLUTIONS TO SUPPORT TRANSPORTATION AND LOGISTICS FIRMS TO EFFECTIVELY HANDLE COMPLEX INVENTORY AND SUPPLY CHAIN OPERATIONS

TABLE 97 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 98 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

11.9 OTHER VERTICALS

TABLE 99 OTHER VERTICALS: MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 100 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

12 CALL CENTER AI MARKET, BY REGION (Page No. - 158)

12.1 INTRODUCTION

12.1.1 COVID-19 IMPACT

FIGURE 45 INDIA TO ACCOUNT FOR HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 46 ASIA PACIFIC TO WITNESS HIGHEST CAGR DURING FORECAST PERIOD

TABLE 101 MARKET, BY REGION, 2016–2021 (USD MILLION)

TABLE 102 CALL CENTER AI MARKET, BY REGION, 2022–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: REGULATIONS

12.2.1.1 Personal Information Protection and Electronic Documents Act (PIPEDA)

12.2.1.2 Gramm–Leach–Bliley (GLB) Act

12.2.1.3 Health Insurance Portability and Accountability Act (HIPAA) of 1996

12.2.1.4 Health Level Seven (HL7)

12.2.1.5 Occupational Safety and Health Administration (OSHA)

12.2.1.6 Federal Information Security Management Act (FISMA)

12.2.1.7 Federal Information Processing Standards (NIST)

12.2.1.8 California Consumer Privacy Act (CSPA)

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 103 NORTH AMERICA: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 104 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 105 NORTH AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 110 NORTH AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 111 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 112 NORTH AMERICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 113 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 114 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 115 NORTH AMERICA: CALL CENTER AI MARKET, BY MODE OF CHANNEL, 2016–2021 (USD MILLION)

TABLE 116 NORTH AMERICA: MARKET, BY MODE OF CHANNEL, 2022–2027 (USD MILLION)

TABLE 117 NORTH AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 118 NORTH AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 119 NORTH AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 120 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 121 NORTH AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 122 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.2.2 UNITED STATES

12.2.2.1 Reversing trend of local call center establishments to drive adoption of call center AI in US

TABLE 123 UNITED STATES: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 124 UNITED STATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.2.3 CANADA

12.2.3.1 Increasing acquisitions of companies in Canada by major call center AI players to drive AI market growth

TABLE 125 CANADA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 126 CANADA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: REGULATIONS

12.3.1.1 General Data Protection Regulation (GDPR)

12.3.1.2 Payment Card Industry Data Security Standard (PCI DSS)

12.3.1.3 European Committee for Standardization (CEN)

TABLE 127 EUROPE: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 128 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 129 EUROPE: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 130 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 131 EUROPE: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 132 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 133 EUROPE: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 134 EUROPE: MARKET BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 135 EUROPE: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 136 EUROPE: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 137 EUROPE: CALL CENTER AI MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 138 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 139 EUROPE: MARKET, BY MODE OF CHANNEL, 2016–2021 (USD MILLION)

TABLE 140 EUROPE: MARKET, BY MODE OF CHANNEL, 2022–2027 (USD MILLION)

TABLE 141 EUROPE: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 142 EUROPE: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 143 EUROPE: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 144 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 145 EUROPE: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 146 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.3.2 UNITED KINGDOM

12.3.2.1 Use of automated digital channels and customer self-service solutions to boost call center AI solutions adoption in UK

TABLE 147 UNITED KINGDOM: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 148 UNITED KINGDOM: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.3.3 GERMANY

12.3.3.1 High density of in-house call centers to drive adoption of conversational AI in Germany

TABLE 149 GERMANY: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 150 GERMANY: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.3.4 FRANCE

12.3.4.1 Increasing technological development in AI to drive factor adoption of call center AI solutions in France

TABLE 151 FRANCE: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 152 FRANCE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.3.5 REST OF EUROPE

TABLE 153 REST OF EUROPE: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 154 REST OF EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: REGULATIONS

12.4.1.1 Personal Data Protection Act (PDPA)

12.4.1.2 Act on the Protection of Personal Information (APPI)

12.4.1.3 International Organization for Standardization (ISO) 27001

FIGURE 48 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 155 ASIA PACIFIC: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 156 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 157 ASIA PACIFIC: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 158 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 159 ASIA PACIFIC: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 160 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 161 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 162 ASIA PACIFIC: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 163 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 164 ASIA PACIFIC: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 165 ASIA PACIFIC: CALL CENTER AI MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 166 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 167 ASIA PACIFIC: MARKET, BY MODE OF CHANNEL, 2016–2021 (USD MILLION)

TABLE 168 ASIA PACIFIC: MARKET, BY MODE OF CHANNEL, 2022–2027 (USD MILLION)

TABLE 169 ASIA PACIFIC: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 170 ASIA PACIFIC: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 171 ASIA PACIFIC: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 172 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 173 ASIA PACIFIC: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 174 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.4.2 INDIA

12.4.2.1 Rising smartphone usage coupled with growing innovations in chatbots or IVAs to boost contact center outsourcing businesses in India

TABLE 175 INDIA: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 176 INDIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.3 JAPAN

12.4.3.1 Advancements in innovative technologies coupled with strong IT infrastructure to drive market growth in Japan

TABLE 177 JAPAN: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 178 JAPAN: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.4 CHINA

12.4.4.1 Technological development and rising government support to drive growth of call center AI market in China

TABLE 179 CHINA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 180 CHINA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.5 THAILAND

12.4.5.1 Rising automation and need to improve customer service to drive adoption of call center AI solutions

TABLE 181 THAILAND: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 182 THAILAND: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.4.6 REST OF ASIA PACIFIC

TABLE 183 REST OF ASIA PACIFIC: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 184 REST OF ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5 MIDDLE EAST & AFRICA

12.5.1 MIDDLE EAST & AFRICA: REGULATIONS

12.5.1.1 Israeli Privacy Protection Regulations (Data Security), 5777-2017

12.5.1.2 GDPR Applicability in KSA

12.5.1.3 Protection of Personal Information Act (POPIA)

TABLE 185 MIDDLE EAST & AFRICA: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 186 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: MARKET, BY SOLUTON, 2016–2021 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 190 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 191 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 192 MIDDLE EAST & AFRICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 193 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 194 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 195 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 196 MIDDLE EAST & AFRICA: CALL CENTER AI MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 197 MIDDLE EAST & AFRICA: MARKET, BY MODE OF CHANNEL, 2016–2021 (USD MILLION)

TABLE 198 MIDDLE EAST & AFRICA: MARKET, BY MODE OF CHANNEL, 2022–2027 (USD MILLION)

TABLE 199 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 200 MIDDLE EAST & AFRICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 201 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 202 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 203 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 204 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.5.2 KINGDOM OF SAUDI ARABIA

12.5.2.1 Adoption of technology and transformation to data-driven economy to drive call center AI solutions’ growth

TABLE 205 KINGDOM OF SAUDI ARABIA: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 206 KINGDOM OF SAUDI ARABIA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.3 UNITED ARAB EMIRATES

12.5.3.1 Increasing trend toward adopting AI and analytics technologies to boost market growth

TABLE 207 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 208 UNITED ARAB EMIRATES: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.4 SOUTH AFRICA

12.5.4.1 Growing digitalization and rising government support to drive call center AI solutions growth in South African market

TABLE 209 SOUTH AFRICA: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 210 SOUTH AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.5.5 REST OF MIDDLE EAST & AFRICA

TABLE 211 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 212 REST OF MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: REGULATIONS

12.6.1.1 Brazil Data Protection Law

12.6.1.2 Argentina Personal Data Protection Law No. 25.326

12.6.1.3 Federal Law on Protection of Personal Data Held by Individuals

TABLE 213 LATIN AMERICA: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 214 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 215 LATIN AMERICA: MARKET, BY SOLUTION, 2016–2021 (USD MILLION)

TABLE 216 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 217 LATIN AMERICA: MARKET, BY SERVICE, 2016–2021 (USD MILLION)

TABLE 218 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 219 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2016–2021 (USD MILLION)

TABLE 220 LATIN AMERICA: MARKET, BY PROFESSIONAL SERVICE, 2022–2027 (USD MILLION)

TABLE 221 LATIN AMERICA: MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 222 LATIN AMERICA: CALL CENTER AI MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 223 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 224 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 225 LATIN AMERICA: MARKET, BY MODE OF CHANNEL, 2016–2021 (USD MILLION)

TABLE 226 LATIN AMERICA: MARKET, BY MODE OF CHANNEL, 2022–2027 (USD MILLION)

TABLE 227 LATIN AMERICA: MARKET, BY APPLICATION, 2016–2021 (USD MILLION)

TABLE 228 ATIN AMERICA: MARKET, BY APPLICATION, 2022–2027 (USD MILLION)

TABLE 229 LATIN AMERICA: MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 230 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 231 LATIN AMERICA: MARKET, BY COUNTRY, 2016–2021 (USD MILLION)

TABLE 232 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

12.6.2 BRAZIL

12.6.2.1 Rising need to enhance business efficiency coupled with growing utility of analytics to drive market growth

TABLE 233 BRAZIL: CALL CENTER AI MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 234 BRAZIL: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6.3 MEXICO

12.6.3.1 High density of contact center outsourcing and government’s AI initiatives to boost adoption of chatbots and IVAs

TABLE 235 MEXICO: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 236 MEXICO: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

12.6.4 REST OF LATIN AMERICA

TABLE 237 REST OF LATIN AMERICA: MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 238 REST OF LATIN AMERICA: CALL CENTER AI MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

13 COMPETITIVE LANDSCAPE (Page No. - 214)

13.1 OVERVIEW

13.2 KEY PLAYER STRATEGIES

13.3 REVENUE ANALYSIS

FIGURE 49 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST FIVE YEARS

13.4 MARKET SHARE ANALYSIS

FIGURE 50 MARKET SHARE ANALYSIS FOR KEY COMPANIES

TABLE 239 CALL CENTER AI MARKET: DEGREE OF COMPETITION

13.5 COMPANY EVALUATION QUADRANT

13.5.1 STARS

13.5.2 EMERGING LEADERS

13.5.3 PERVASIVE

13.5.4 PARTICIPANT

FIGURE 51 KEY MARKET PLAYERS, COMPANY EVALUATION QUADRANT, 2021

13.6 COMPETITIVE BENCHMARKING

13.6.1 COMPANY PRODUCT FOOTPRINT

FIGURE 52 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN MARKET

FIGURE 53 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN MARKET

TABLE 240 COMPANY COMPONENT FOOTPRINT

TABLE 241 COMPANY REGION FOOTPRINT

TABLE 242 CALL CENTER AI MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS

13.7 STARTUP/SME EVALUATION QUADRANT

13.7.1 PROGRESSIVE COMPANIES

13.7.2 RESPONSIVE COMPANIES

13.7.3 DYNAMIC COMPANIES

13.7.4 STARTING BLOCKS

FIGURE 54 STARTUP/SME MARKET EVALUATION QUADRANT, 2021

13.8 STARTUP/SME COMPETITIVE BENCHMARKING

13.8.1 COMPANY PRODUCT FOOTPRINT

FIGURE 55 PRODUCT PORTFOLIO ANALYSIS OF STARTUP/SMES IN MARKET

FIGURE 56 BUSINESS STRATEGY EXCELLENCE OF STARTUP/SMES IN MARKET

TABLE 243 STARTUP/SME COMPANY COMPONENT FOOTPRINT

TABLE 244 STARTUP/SME COMPANY REGION FOOTPRINT

TABLE 245 CALL CENTER AI MARKET: DETAILED LIST OF KEY STARTUPS/SMES

TABLE 246 CALL CENTER AI: COMPETITIVE BENCHMARKING OF KEY STARTUP/SMES

13.9 COMPETITIVE SCENARIO AND TRENDS

13.9.1 PRODUCT LAUNCHES

TABLE 247 MARKET: PRODUCT LAUNCHES, 2022–2020

13.9.2 DEALS

TABLE 248 MARKET: DEALS, 2021–2022

14 COMPANY PROFILES (Page No. - 231)

14.1 INTRODUCTION

14.2 KEY PLAYERS

(Business and financial overview, Products/Solutions/Services Offered, Recent developments, COVID-19 development, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats)*

14.2.1 IBM

TABLE 249 IBM: BUSINESS AND FINANCIAL OVERVIEW

FIGURE 57 IBM: COMPANY SNAPSHOT

TABLE 250 IBM: SOLUTIONS OFFERED

TABLE 251 IBM: SERVICES OFFERED

TABLE 252 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 253 IBM: DEALS

14.2.2 MICROSOFT

TABLE 254 MICROSOFT: BUSINESS OVERVIEW

FIGURE 58 MICROSOFT: COMPANY SNAPSHOT

TABLE 255 MICROSOFT: SOLUTIONS OFFERED

TABLE 256 MICROSOFT: SERVICES OFFERED

TABLE 257 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 258 MICROSOFT: DEALS

14.2.3 ORACLE

TABLE 259 ORACLE: BUSINESS OVERVIEW

FIGURE 59 ORACLE: COMPANY SNAPSHOT

TABLE 260 ORACLE: SOLUTIONS OFFERED

TABLE 261 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 262 ORACLE: DEALS

14.2.4 AWS

TABLE 263 AWS: BUSINESS OVERVIEW

FIGURE 60 AWS: COMPANY SNAPSHOT

TABLE 264 AWS: SOLUTIONS OFFERED

TABLE 265 AWS: SERVICES OFFERED

TABLE 266 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 267 AWS: DEALS AND OTHERS

14.2.5 GOOGLE

TABLE 268 GOOGLE: BUSINESS OVERVIEW

FIGURE 61 GOOGLE: COMPANY SNAPSHOT

TABLE 269 GOOGLE: SOLUTIONS OFFERED

TABLE 270 GOOGLE: SERVICES OFFERED

TABLE 271 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 272 GOOGLE: DEALS

14.2.6 SAP

TABLE 273 SAP: BUSINESS OVERVIEW

FIGURE 62 SAP: COMPANY SNAPSHOT

TABLE 274 SAP: SOLUTIONS OFFERED

TABLE 275 SAP: SERVICES OFFERED

TABLE 276 SAP: DEALS

14.2.7 AVAYA

TABLE 277 AVAYA: BUSINESS OVERVIEW

FIGURE 63 AVAYA: COMPANY SNAPSHOT

TABLE 278 AVAYA: SOLUTIONS OFFERED

TABLE 279 AVAYA: SERVICES OFFERED

TABLE 280 AVAYA: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 281 AVAYA: DEALS AND OTHERS

14.2.8 NICE

TABLE 282 NICE: BUSINESS OVERVIEW

FIGURE 64 NICE: COMPANY SNAPSHOT

TABLE 283 NICE: SOLUTIONS OFFERED

TABLE 284 NICE: SERVICES OFFERED

TABLE 285 NICE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 286 NICE: DEALS

14.2.9 NUANCE COMMUNICATIONS

TABLE 287 NUANCE COMMUNICATIONS: BUSINESS OVERVIEW

FIGURE 65 NUANCE COMMUNICATIONS: COMPANY SNAPSHOT

TABLE 288 NUANCE COMMUNICATIONS: SOLUTIONS OFFERED

TABLE 289 NUANCE COMMUNICATIONS: SERVICES OFFERED

TABLE 290 NUANCE COMMUNICATIONS: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 291 NUANCE COMMUNICATIONS: DEALS

14.2.10 GENESYS

TABLE 292 GENESYS: BUSINESS OVERVIEW

TABLE 293 GENESYS: SOLUTIONS OFFERED

TABLE 294 GENESYS: SERVICES OFFERED

TABLE 295 GENESYS: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 296 GENESYS: DEALS

14.2.11 8X8

TABLE 297 8X8: BUSINESS OVERVIEW

FIGURE 66 8X8: COMPANY SNAPSHOT

TABLE 298 8X8: SOLUTIONS OFFERED

TABLE 299 8X8: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 300 8X8: DEALS

14.2.12 ARTIFICIAL SOLUTIONS

TABLE 301 ARTIFICIAL SOLUTIONS: BUSINESS OVERVIEW

FIGURE 67 ARTIFICIAL SOLUTIONS: COMPANY SNAPSHOT

TABLE 302 ARTIFICIAL SOLUTIONS: SOLUTIONS OFFERED

TABLE 303 ARTIFICIAL SOLUTIONS: SERVICES OFFERED

TABLE 304 ARTIFICIAL SOLUTIONS: SOLUTION LAUNCHES AND ENHANCEMENTS

TABLE 305 ARTIFICIAL SOLUTIONS: DEALS

14.3 OTHER PLAYERS

14.3.1 RINGCENTRAL

14.3.2 TALKDESK

14.3.3 DIALPAD

14.3.4 TWILIO

14.3.5 ZENDESK

14.3.6 FIVE9

14.3.7 KORE.AI

14.3.8 INBENTA

14.3.9 CREATIVE VIRTUAL

14.4 STARTUPS/SMES

14.4.1 HAPTIK

14.4.2 RULAI

14.4.3 PYPESTREAM

14.4.4 AVAAMO

14.4.5 SENSEFORTH.AI

14.4.6 OBSERVE.AI

14.4.7 YELLOW.AI

14.4.8 ULTIMATE.AI

14.4.9 COGNIGY

*Details on Business and financial overview, Products/Solutions/Services Offered, Recent developments, COVID-19 development, MNM view, Key strengths/right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies

15 ADJACENT AND RELATED MARKETS (Page No. - 283)

15.1 INTRODUCTION

15.2 CONVERSATIONAL AI MARKET - GLOBAL FORECAST TO 2026

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.2.1 Conversational AI market, by component

TABLE 306 CONVERSATIONAL AI MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 307 CONVERSATIONAL AI MARKET SIZE, BY COMPONENT, 2021–2026 (USD MILLION)

15.2.2.2 Conversational AI market, by type

TABLE 308 CONVERSATIONAL AI MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 309 CONVERSATIONAL AI MARKET SIZE, BY TYPE, 2021–2026 (USD MILLION)

15.2.2.3 Conversational AI market, by deployment mode

TABLE 310 CONVERSATIONAL AI MARKET SIZE, BY DEPLOYMENT MODE, 2016–2020 (USD MILLION)

TABLE 311 CONVERSATIONAL AI MARKET SIZE, BY DEPLOYMENT MODE, 2021–2026 (USD MILLION)

15.2.2.4 Conversational AI market, by organization size

TABLE 312 CONVERSATIONAL AI MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 313 CONVERSATIONAL AI MARKET SIZE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

15.2.2.5 Conversational AI market, by mode of integration

TABLE 314 CONVERSATIONAL AI MARKET SIZE, BY MODE OF INTEGRATION, 2016–2020 (USD MILLION)

TABLE 315 CONVERSATIONAL AI MARKET SIZE, BY MODE OF INTEGRATION, 2021–2026 (USD MILLION)

15.2.2.6 Conversational AI market, by business function

TABLE 316 CONVERSATIONAL AI MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 317 CONVERSATIONAL AI MARKET SIZE, BY BUSINESS FUNCTION, 2021–2026 (USD MILLION)

15.2.2.7 Conversational AI market, by vertical

TABLE 318 CONVERSATIONAL AI MARKET SIZE, BY VERTICAL, 2016–2020 (USD MILLION)

TABLE 319 CONVERSATIONAL AI MARKET SIZE, BY VERTICAL, 2021–2026 (USD MILLION)

15.2.2.8 Conversational AI market, by region

TABLE 320 CONVERSATIONAL AI MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 321 CONVERSATIONAL AI MARKET SIZE, BY REGION, 2021–2026 (USD MILLION)

15.3 CHATBOT MARKET - GLOBAL FORECAST TO 2026

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

15.3.2.1 Chatbot market, by component

TABLE 322 CHATBOT MARKET SIZE, BY COMPONENT, 2015–2019 (USD MILLION)

TABLE 323 CHATBOT MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

15.3.2.2 Chatbot market, by type

TABLE 324 CHATBOT MARKET SIZE, BY TYPE, 2015–2019 (USD MILLION)

TABLE 325 CHATBOT MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

15.3.2.3 Chatbot market, by deployment mode

TABLE 326 CHATBOT MARKET SIZE, BY DEPLOYMENT MODE, 2015–2019 (USD MILLION)

TABLE 327 CHATBOT MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

15.3.2.4 Chatbot market, by channel integration

TABLE 328 CHATBOT MARKET SIZE, BY CHANNEL INTEGRATION, 2015–2019 (USD MILLION)

TABLE 329 CHATBOT MARKET SIZE, BY CHANNEL INTEGRATION, 2020–2026 (USD MILLION)

15.3.2.5 Chatbot market, by business function

TABLE 330 CHATBOT MARKET SIZE, BY BUSINESS FUNCTION, 2015–2019 (USD MILLION)

TABLE 331 CHATBOT MARKET SIZE, BY BUSINESS FUNCTION, 2020–2026 (USD MILLION)

15.3.2.6 Chatbot market, by application

TABLE 332 CHATBOT MARKET SIZE, BY APPLICATION, 2015–2019 (USD MILLION)

TABLE 333 CHATBOT MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

15.3.2.7 Chatbot market, by vertical

TABLE 334 CHATBOT MARKET SIZE, BY VERTICAL, 2015–2019 (USD MILLION)

TABLE 335 CHATBOT MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

15.3.2.8 Chatbot market, by region

TABLE 336 CHATBOT MARKET SIZE, BY REGION, 2015–2019 (USD MILLION)

TABLE 337 CHATBOT MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

16 APPENDIX (Page No. - 297)

16.1 INDUSTRY EXPERTS

16.2 DISCUSSION GUIDE

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

The research study for the call center AI market involved extensive secondary sources, directories, and several journals, including Call Centre Management Association (CCMI) and Call Center Journal. Primary sources were mainly industry experts from the core and related industries; preferred call center AI providers, third-party service providers, consulting service providers, end-users, and other commercial enterprises. In-depth interviews were conducted with various primary respondents, including key industry participants and subject matter experts, to obtain and verify critical qualitative and quantitative information, and assess the market’s prospects.

Secondary Research

The market size of companies offering call center AI solutions and services was arrived at based on secondary data available through paid and unpaid sources. It was also arrived at by analyzing the product portfolios of major companies and rating the companies based on their performance and quality.

In the secondary research process, various sources were referred to for identifying and collecting information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from other secondary sources, such as journals, government websites, blogs, and vendors' websites. Additionally, call center AI spending of various countries was extracted from the respective sources. Secondary research was mainly used to obtain key information related to the industry’s value chain and supply chain to identify key players based on solutions, services, market classification, and segmentation according to offerings of major players, industry trends related to components, mode of channel, application, deployment mode, Organisations Size, vertical, and regions, and key developments from both market and technology oriented perspectives.

Primary Research

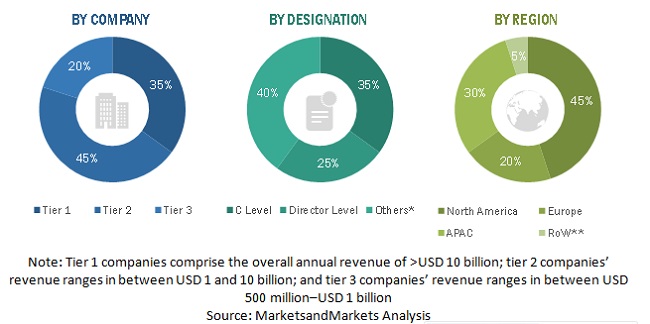

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and call center AI expertise; related key executives from call center AI solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end-users using call center AI solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of call center AI solutions and services, which would impact the overall call center AI market.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end-users using maritime safety solutions were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of call center AI solutions and services, which would impact the overall Call Center AI Market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted for estimating and forecasting the Call Center AI Market. The first approach involves estimating the market size by summation of companies’ revenue generated through the sale of solutions and services.

Key Market Players

Key market players were not limited to such as IBM (US), Microsoft (US), Oracle (US), AWS (US), SAP (Germany), Google (US), Avaya (US), NICE (Israel), Nuance Communications (US), Genesys (US), 8x8 (US), Artificial Solutions (Sweden), Zendesk (US), Five9 (US), RingCentral (US), Talkdesk (US), Dialpad (US), Twilio (US), Kore.ai (US), Inbenta (US), Creative Virtual (UK), Haptik (India), Rulai (US), Pypestream (US), Avaamo (US), Senseforth.ai (US), Observe.AI (US), Yellow.ai (US), Ultimate.ai (Germany), and Cognigy (Germany).

The market players were identified through extensive secondary research, and their revenue contribution in respective regions was determined through primary and secondary research.

- The entire procedure included studying annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives.

- All percentage splits and breakups were determined using secondary sources and verified through primary sources.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the Call Center AI Market, by component (solutions and services), mode of channel, application, deployment mode, organization size, vertical, and region.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Call Center AI Market

- To analyze the impact of the COVID-19 pandemic on the Call Center AI Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American call center AI market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Latin American market

- Further breakup of the Middle East & Africa market

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Call Center AI Market