Ceramic Foams Market by Type (Silicon Carbide, Aluminum Oxide, Zirconium Oxide), Application (Molten Metal Filtration, Thermal & Acoustic Insulation, Automotive exhaust Filters), End-use Industry (Foundry, Automotive), and Region - Global Forecast to 2023

[126 Pages Report] Ceramic Foams Market was valued at USD 327.6 Million in 2017 and is projected to reach USD 441.7 Million by 2023, at a CAGR of 5.2% during the forecast period. In this study, 2017 has been considered as the base year and 2023 as the forecast year to estimate the ceramic foams market size.

Objectives of the study are:

- To analyze and forecast the global ceramic foams market, in terms of value

- To provide detailed information about key growth factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze and forecast the size of the market on the basis of type, application, and end-use industry

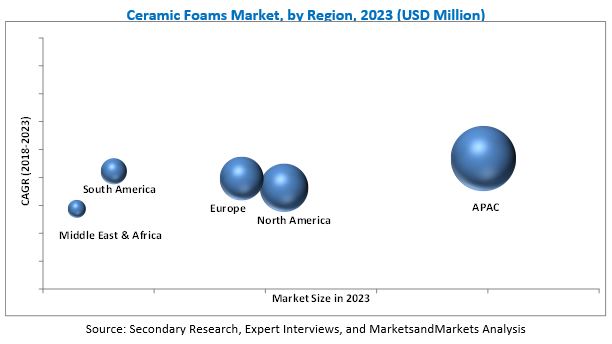

- To estimate and forecast the market size on the basis of 5 regions, namely, Europe, APAC, North America, Middle East & Africa, and South America

- To estimate and forecast the ceramic foams market at country-level in each of the regions

- To analyze market opportunities and competitive landscape of the market

- To analyze competitive developments such as new product launches & developments, expansions, mergers & acquisitions, and joint ventures & partnerships in the ceramic foams market

- To strategically identify and profile key market players and analyze their core competencies*

Note: Core competencies* of companies are determined in terms of their key developments and key strategies adopted by them to sustain their position in the market.

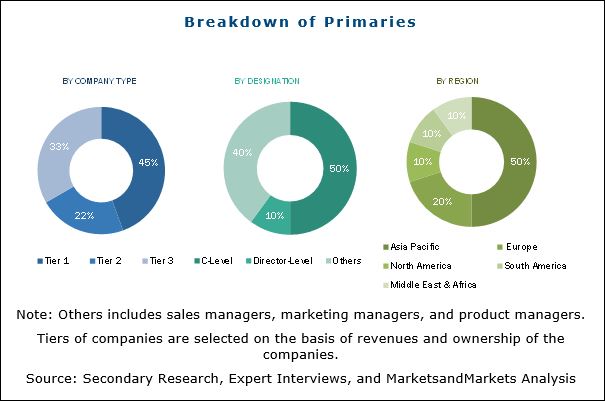

Various secondary sources, such as company websites, encyclopedia, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource have been used to identify and collect information useful for this extensive, commercial study of the global ceramic foams market. Primary sources, including experts from related industries, have been interviewed to verify and collect critical information and assess prospects of the market. The top-down approach has been implemented to validate the market size in terms of value. With data triangulation procedures and validation of data through primaries, the exact values of the overall parent market size and individual market sizes have been determined and confirmed in this study.

To know about the assumptions considered for the study, download the pdf brochure

The ceramic foams market has a diversified and established ecosystem of upstream players, such as raw material suppliers and downstream stakeholders, such as manufacturers, vendors, end users, and government organizations.

This study answers several questions for stakeholders, primarily, which market segments they should focus on during the next two to five years to prioritize their efforts and investments. These stakeholders include ceramic foams manufacturers such as Ultramet (US), Vesuvius Plc (UK), SELEE Corporation (US), ERG Aerospace Corp. (US), Saint-Gobain High-Performance Refractories (US), Pyrotek (US), Induceramics (US), LANIK s.r.o (Czech Republic), Drache GmbH (Germany), and Baoding Ningxin New Material Co., Ltd. (China).

Key Target Audience:

- Regional Manufacturers Associations

- Raw Material Manufacturers

- Traders, Distributors, and Suppliers of Ceramic Foams

- Government and Regional Agencies and Research Organizations

Get online access to the report on the World's First Market Intelligence Cloud

Request Sample Scope of the Report

:

This research report categorizes the global ceramic foams market based on type, application, end-use industry, and region, and forecasts revenue growth and provides an analysis of trends in each of the submarkets.

Based on Type:

- Silicon Carbide

- Aluminum Oxide

- Zirconium Oxide

- Others (silica oxide, magnesium oxide/magnesia, and alloys)

Each type is further described in detail in the report with value forecasts until 2023.

Based on Application:

- Molten Metal Filtration

- Furnace Lining

- Thermal & Acoustic Insulation

- Automotive Exhaust Filters

- Catalyst Support

- Others (mold making, scaffolds for fuel cells & batteries, and bone tissue engineering)

Each application is further described in detail in the report, with value forecasts until 2023.

Based on End-use Industry:

- Foundry

- Building & Construction

- Chemical Synthesis & Pollution Control

- Automotive

- Others (electronics and biomedical)

Each end-use industry is further described in detail in the report, with value forecasts until 2023.

Based on Region:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Each region is further segmented by key countries, such as China, India, Japan, South Korea, the US, Mexico, Canada, Germany, the UK, Italy, France, Russia, Turkey, South Africa, Argentina, and Brazil.

Available Customizations: The following customization options are available for the report:

- Company Information

Analysis and profiles of additional global as well as regional market players (up to three)

The global ceramic foams market is estimated to be USD 343.2 Million in 2018 and is projected to reach USD 441.7 Million by 2023, at a CAGR of 5.2% between 2018 and 2023. The market is witnessing growth due to the increasing use of ceramic foams as filters in the metal casting industry and stringent regulations regarding pollution control. The growth is further driven by the demand for thermally insulated and soundproof residential and non-residential infrastructure.

Silicon carbide was the largest type of ceramic foam consumed in 2017. Silicon carbide is a high-quality advanced-grade ceramic used to manufacture foams. Properties such as high strength, low thermal expansion, excellent thermal shock resistance, high wear resistance, and high chemical resistance make silicon carbide a preferred material for ceramic foams in the iron casting application. Thus, these factors are expected to drive the consumption of silicon carbide-based ceramic foams in the future.

Based on application, molten metal filtration was the largest segment of the global ceramic foams market in 2017. This can be attributed to the growing demand for iron, steel, and aluminum casting across all industrial verticals. This trend is responsible for the increased use of ceramic foams in the molten metal filtration application.

Foundry was the largest end-use industry segment of the ceramic foams market in 2017. The ncrease in the production of consumer electronics and automobiles as a result of rapidly evolving economies across the globe is expected to drive the growth of the foundry industry, thereby propelling the growth of the ceramic foams market.

APAC was the largest market for ceramic foams in 2017 and this market in APAC is projected to grow at the highest CAGR during the forecast period. Building & construction activities have increased exponentially in the past decade due to favorable demographics and a wide-scale manufacturing base in the region. The growth in metal casting production, especially in India and China, has propelled the demand for ceramic foams in the region.

Factors restraining and challenging the growth of the ceramic foams market are high capital-intensive production techniques and lack of recyclability and reparability of ceramic foams respectively.

Vesuvius Plc (UK), SELEE Corporation (US), Saint-Gobain High-Performance Refractories (US), LANIK s.r.o (Czech Republic), and Drache GmbH (Germany) are the leading players in the global ceramic foams market. These players are major manufacturers of ceramic foams and gaining a strong foothold in the market through the strategy of mergers & acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Years Considered for the Study

1.5 Currency

1.6 Limitations

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumption

3 Executive Summary (Page No. - 25)

4 Premium Insights (Page No. - 28)

4.1 Attractive Opportunities in the Ceramic Foams Market

4.2 Ceramic Foams Market, By Region

4.3 Ceramic Foams Market in APAC, By Type and Country

4.4 Ceramic Foams Market Attractiveness

5 Market Overview (Page No. - 31)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Use of Ceramic Foams in Metal Casting Industry

5.2.1.2 Stringent Pollution Control Regulations

5.2.1.3 Demand for Thermally Insulated and Soundproof Residential and Non-Residential Infrastructure

5.2.2 Restraints

5.2.2.1 Capital-Intensive Production Techniques

5.2.3 Opportunities

5.2.3.1 Growing Preference for Energy-Efficient Alternatives for High-Temperature Applications

5.2.4 Challenges

5.2.4.1 Lack of Recyclability and Reparability

5.2.5 Porters Five Forces Analysis

5.2.5.1 Threat of New Entrants

5.2.5.2 Bargaining Power of Buyers

5.2.5.3 Threat of Substitutes

5.2.5.4 Bargaining Power of Suppliers

5.2.5.5 Intensity of Competitive Rivalry

5.3 Macroeconomic Overview and Trends

5.3.1 Introduction

5.3.2 Metal Casting Production, By Country

6 Ceramic Foams Market, By Type (Page No. - 40)

6.1 Introduction

6.2 Silicon Carbide

6.3 Aluminum Oxide

6.4 Zirconium Oxide

6.5 Others

7 Ceramic Foams Market, By Application (Page No. - 46)

7.1 Introduction

7.2 Molten Metal Filtration

7.3 Thermal & Acoustic Insulation

7.4 Automotive Exhaust Filters

7.5 Furnace Lining

7.6 Catalyst Support

7.7 Others

8 Ceramic Foams Market, By End-Use Industry (Page No. - 55)

8.1 Introduction

8.2 Foundry

8.3 Building & Construction

8.4 Chemical Synthesis & Pollution Control

8.5 Automotive

8.6 Others

9 Ceramic Foams Market, By Region (Page No. - 62)

9.1 Introduction

9.2 APAC

9.2.1 China

9.2.2 India

9.2.3 Japan

9.2.4 South Korea

9.2.5 Rest of APAC

9.3 North America

9.3.1 US

9.3.2 Canada

9.3.3 Mexico

9.4 Europe

9.4.1 Germany

9.4.2 Russia

9.4.3 France

9.4.4 UK

9.4.5 Italy

9.4.6 Rest of Europe

9.5 South America

9.5.1 Brazil

9.5.2 Argentina

9.5.3 Rest of South America

9.6 Middle East & Africa

9.6.1 Turkey

9.6.2 South Africa

9.6.3 Rest of Middle East & Africa

10 Competitive Landscape (Page No. - 99)

10.1 Overview

10.2 Market Ranking of Key Players

10.3 Competitive Scenario

10.4 Merger & Acquisition

11 Company Profiles (Page No. - 102)

(Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis)*

11.1 Ultramet

11.2 Vesuvius Plc (Foseco)

11.3 SELEE Corporation

11.4 ERG Aerospace

11.5 Saint-Gobain High-Performance Refractories

11.6 Pyrotek

11.7 Induceramic

11.8 LANIK S.R.O.

11.9 Drache GmbH

11.10 Boading Ningxin Cast Material Co., Ltd. *Business Overview, Products Offered, Recent Developments, MnM View, SWOT Analysis Might Not Be Captured in Case of Unlisted Companies.

12 Additional Company Profiles (Page No. - 118)

12.1 Ferro-Term Sp. Z O.O.

12.2 FCRI Group

12.3 Vertix Co.

12.4 Filtec Precision Ceramics Co., Ltd.

12.5 Jiangxi Jintai Special Material LLC

12.6 Pingxiang Hualian Chemical Ceramic Co., Ltd.

12.7 Altech Alloys India Pvt. Ltd.

12.8 Galaxy Enterprise

12.9 Dynocast

12.10 Industrial Minerals

12.11 Jincheng Fuji Material Co., Ltd.

12.12 Pingxiang Yingchao Chemical Packing Co., Ltd.

13 Appendix (Page No. - 121)

13.1 Insights From Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Available Customizations

13.5 Related Reports

13.6 Author Details

List of Tables (81 Tables)

Table 1 Metal Casting Production in Top 20 Countries, in 2016

Table 2 Ceramic Foams Market Size, By Type, 20162023 (USD Million)

Table 3 Market of Silicon Carbide-Based Ceramic Foams, By Region, 20162023 (USD Million)

Table 4 Market of Aluminum Oxide-Based Ceramic Foams, By Region, 20162023 (USD Million)

Table 5 Market of Zirconium Oxide-Based Ceramic Foams, By Region, 20162023 (USD Million)

Table 6 Other Ceramic Foams Market, By Region, 20162023 (USD Million)

Table 7 Ceramic Foams Market Size, By Application, 20162023 (USD Million)

Table 8 Market of Ceramic Foams in Molten Metal Filtration, By Region, 20162023 (USD Million)

Table 9 Market of Ceramic Foams in Thermal & Acoustic Insulation, By Region, 20162023 (USD Million)

Table 10 Market of Ceramic Foams in Automotive Exhaust Filters, By Region, 20162023 (USD Million)

Table 11 Market of Ceramic Foams in Furnace Lining, By Region, 20162023 (USD Million)

Table 12 Market of Ceramic Foams in Catalyst Support, By Region, 20162023 (USD Million)

Table 13 Market of Ceramic Foams in Other Applications, By Region, 20162023 (USD Million)

Table 14 Ceramic Foams Market, By End-Use Industry, 20162023 (USD Million)

Table 15 Market Size in Foundry Industry, By Region, 20162023 (USD Million)

Table 16 Market Size in Building & Construction Industry, By Region, 20162023 (USD Million)

Table 17 Market Size in Chemical Synthesis & Pollution Control Industry, By Region, 20162023 (USD Million)

Table 18 Market Size in Automotive Industry, By Region, 20162023 (USD Million)

Table 19 Market Size in Other Industries, By Region, 20162023 (USD Million)

Table 20 Market Size, By Region, 20162023 (USD Million)

Table 21 APAC: Market Size, By Country, 20162023 (USD Million)

Table 22 APAC: Market, By Type, 20162023 (USD Million)

Table 23 APAC: Market, By Application, 20162023 (USD Million)

Table 24 APAC: Market, By End-Use Industry, 20162023 (USD Million)

Table 25 China: Market, By Type, 20162023 (USD Million)

Table 26 China: Market, By End-Use Industry, 20162023 (USD Million)

Table 27 India: Market, By Type, 20162023 (USD Million)

Table 28 India: Market, By End-Use Industry, 20162023 (USD Million)

Table 29 Japan: Market, By Type, 20162023 (USD Million)

Table 30 Japan: Market, By End-Use Industry, 20162023 (USD Million)

Table 31 South Korea: Market, By Type, 20162023 (USD Million)

Table 32 South Korea: Market, By End-Use Industry, 20162023 (USD Million)

Table 33 Rest of APAC: Market, By Type, 20162023 (USD Million)

Table 34 Rest of APAC: Market, By End-Use Industry, 20162023 (USD Million)

Table 35 North America: Market Size, By Country, 20162023 (USD Million)

Table 36 North America: Market, By Type, 20162023 (USD Million)

Table 37 North America: Market, By Application, 20162023 (USD Million)

Table 38 North America: Market, By End-Use Industry, 20162023 (USD Million)

Table 39 US: Market, By Type, 20162023 (USD Million)

Table 40 US: Market, By End-Use Industry, 20162023 (USD Million)

Table 41 Canada: Market, By Type, 20162023 (USD Million)

Table 42 Canada: Market, By End-Use Industry, 20162023 (USD Million)

Table 43 Mexico: Market, By Type, 20162023 (USD Million)

Table 44 Mexico: Market, By End-Use Industry, 20162023 (USD Million)

Table 45 Europe: Market Size, By Country, 20162023 (USD Million)

Table 46 Europe: Market, By Type, 20162023 (USD Million)

Table 47 Europe: Market, By Application, 20162023 (USD Million)

Table 48 Europe: Market, By End-Use Industry, 20162023 (USD Million)

Table 49 Germany: Market, By Type, 20162023 (USD Million)

Table 50 Germany: Market, By End-Use Industry, 20162023 (USD Million)

Table 51 Russia: Market, By Type, 20162023 (USD Million)

Table 52 Russia: Market, By End-Use Industry, 20162023 (USD Million)

Table 53 France: Market, By Type, 20162023 (USD Million)

Table 54 France: Market, By End-Use Industry, 20162023 (USD Million)

Table 55 UK: Market, By Type, 20162023 (USD Million)

Table 56 UK: Market, By End-Use Industry, 20162023 (USD Million)

Table 57 Italy: Market, By Type, 20162023 (USD Million)

Table 58 Italy: Market, By End-Use Industry, 20162023 (USD Million)

Table 59 Rest of Europe: Market, By Type, 20162023 (USD Million)

Table 60 Rest of Europe: Market, By End-Use Industry, 20162023 (USD Million)

Table 61 South America: Market, By Country, 20162023 (USD Million)

Table 62 South America: Market, By Type, 20162023 (USD Million)

Table 63 South America: Market, By Application, 20162023 (USD Million)

Table 64 South America: Market, By End-Use Industry, 20162023 (USD Million)

Table 65 Brazil: Market, By Type, 20162023 (USD Million)

Table 66 Brazil: Market, By End-Use Industry, 20162023 (USD Million)

Table 67 Argentina: Market, By Type, 20162023 (USD Million)

Table 68 Argentina: Market, By End-Use Industry, 20162023 (USD Million)

Table 69 Rest of South America: Market, By Type, 20162023 (USD Million)

Table 70 Rest of South America: Market, By End-Use Industry, 20162023 (USD Million)

Table 71 Middle East & Africa: Market Size, By Country, 20162023 (USD Million)

Table 72 Middle East & Africa: Market, By Type, 20162023 (USD Million)

Table 73 Middle East & Africa: Market, By Application, 20162023 (USD Million)

Table 74 Middle East & Africa: Market, By End-Use Industry, 20162023 (USD Million)

Table 75 Turkey: Market, By Type, 20162023 (USD Million)

Table 76 Turkey: Market, By End-Use Industry, 20162023 (USD Million)

Table 77 South Africa: Market, By Type, 20162023 (USD Million)

Table 78 South Africa: Market, By End-Use Industry, 20162023 (USD Million)

Table 79 Rest of Middle East & Africa: Market, By Type, 20162023 (USD Million)

Table 80 Rest of Middle East & Africa: Market, By End-Use Industry, 20162023 (USD Million)

Table 81 Mergers & Acquisitions, 20132018

List of Figures (45 Figures)

Figure 1 Ceramic Foams Market Segmentation

Figure 2 Ceramic Foams Market: Research Design

Figure 3 Market Size Estimation: Bottom-Up Approach

Figure 4 Market Size Estimation: Top-Down Approach

Figure 5 Ceramic Foams Market: Data Triangulation

Figure 6 Silicon Carbide Lead the Market of Ceramic Foams, By Type, in 2017

Figure 7 Molten Metal Filtration to Lead the Market of Ceramic Foams, By Application

Figure 8 Foundry to Lead the Market of Ceramic Foams, By End-Use Industry

Figure 9 APAC Lead the Market of Ceramic Foams in 2017

Figure 10 Growing Demand for Metal Casting to Drive the Market of Ceramic Foams

Figure 11 APAC to Be the Fastest-Growing Market Between 2018 and 2023

Figure 12 China Accounted for the Largest Share in the APAC Ceramic Foams Market

Figure 13 Ceramic Foams to Register High Market Growth in APAC Between 2018 and 2023

Figure 14 Factors Governing Market Growth of the Ceramic Foams

Figure 15 Ceramic Foams Market: Porters Five Forces Analysis

Figure 16 Top 20 Metal Casting Production Countries

Figure 17 Silicon Carbide to Dominate the Market of Ceramic Foams Between 2018 and 2023

Figure 18 APAC to Be the Fastest-Growing Silicon Carbide-Based Ceramic Foams Market

Figure 19 APAC to Be the Largest Market for Aluminum Oxide-Based Ceramic Foams

Figure 20 APAC to Be the Fastest-Growing Market for Zirconium Oxide-Based Ceramic Foams

Figure 21 Molten Metal Filtration Dominated the Market of Ceramic Foams in 2017

Figure 22 APAC to Be the Fastest-Growing Market for Ceramic Foams in Molten Metal Filtration

Figure 23 APAC to Be the Largest Market of Ceramic Foams in Thermal & Acoustic Insulation

Figure 24 APAC to Be the Largest Market of Ceramic Foams in Automotive Exhaust Filters

Figure 25 APAC to Be the Largest Market of Ceramic Foams in Furnace Lining

Figure 26 APAC to Be the Largest Market of Ceramic Foams in Catalyst Support

Figure 27 Foundry Accounted for the Largest Market Share in Ceramic Foams in 2017

Figure 28 APAC to Be the Largest Market for Ceramic Foams in Foundry Industry (USD Million)

Figure 29 North America to Be the Largest Market for Ceramic Foams in Building & Construction Industry

Figure 30 APAC to Be the Largest and Fastest-Growing Market for Ceramic Foams in Chemical Synthesis & Pollution Control Industry

Figure 31 Europe to Be the Fastest-Growing Market for Ceramic Foams in Automotive Industry

Figure 32 Ceramic Foams Regional Snapshot

Figure 33 APAC Market Snapshot

Figure 34 North American Market Snapshot

Figure 35 European Market Snapshot

Figure 36 South American Market Snapshot

Figure 37 Middle East & African Market Snapshot

Figure 38 Companies Primarily Adopted Inorganic Growth Strategies (20132018)

Figure 39 Ceramic Foams Market Ranking, 2017

Figure 40 Ultramet: SWOT Analysis

Figure 41 Vesuvius: Company Snapshot

Figure 42 Vesuvius: SWOT Analysis

Figure 43 SELEE: SWOT Analysis

Figure 44 ERG Aerospace: SWOT Analysis

Figure 45 Saint-Gobain High-Performance Refractories: SWOT Analysis

Growth opportunities and latent adjacency in Ceramic Foams Market