Clinical Trials Market by Phase (Phase I, II, III), Service Type (Laboratory, Analytical Testing, Patient Recruitment, Protocol Designing), Therapeutic Area (Oncology, Cardiology, Neurology), and Application (Vaccine, mAbs, CGT) - Global Forecast to 2028

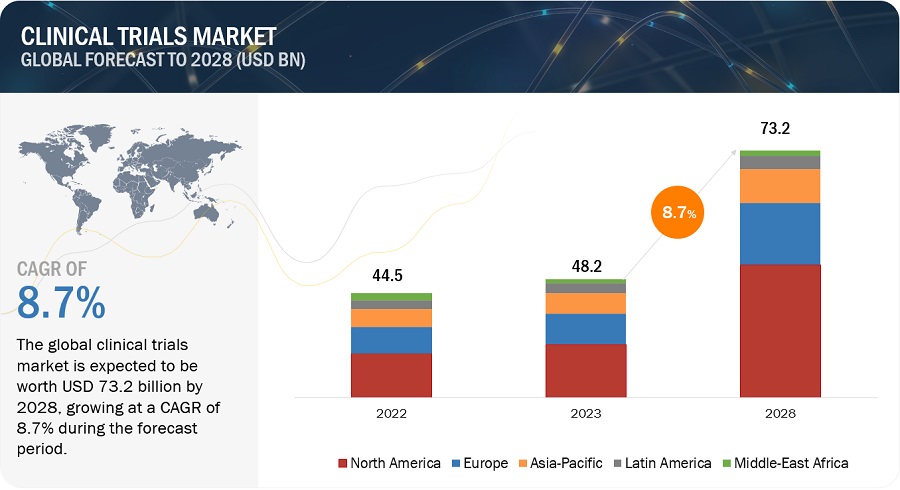

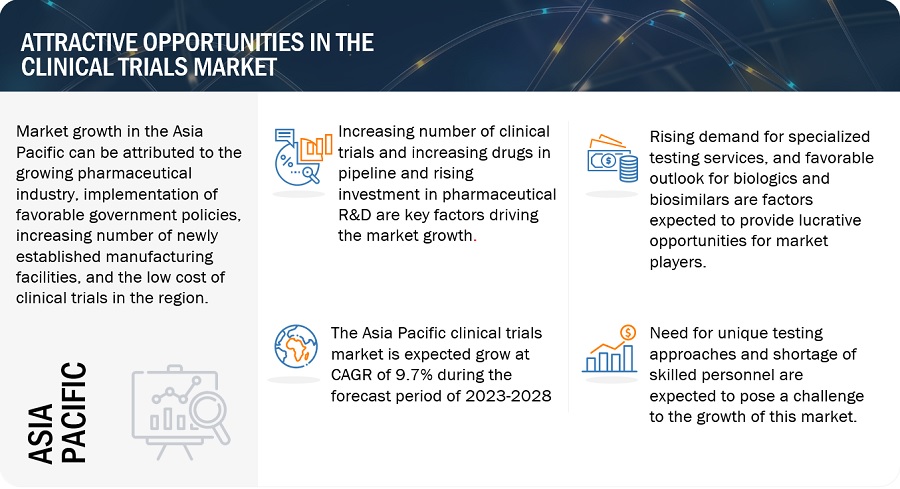

The global clinical trials market in terms of revenue was estimated to be worth $48.2 billion in 2023 and is poised to reach $73.2 billion by 2028, growing at a CAGR of 8.7% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth of this market is majorly driven by the increasing number of clinical trials, increasing drugs in the pipeline, and rising investment in pharmaceutical R&D. On the other hand, the shortage of skilled professionals for clinical trials is a major factor expected to pose a challenge to the growth of this market.

Attractive Opportunities in the Clinical Trials Market

To know about the assumptions considered for the study, Request for Free Sample Report

Global Clinical Trials Market Dynamics

DRIVER: Increasing drugs in the pipeline and rising investments in pharmaceutical R&D

Pharmaceutical, biopharmaceutical, and medical device companies are significant investors in the development of innovative drugs and devices. This industry is highly R&D intensive, with a focus on delivering both high-quality and novel products. Recent trends reveal that leading pharmaceutical companies are enhancing R&D efficiencies by making substantial R&D investments for long-term returns and fostering collaborative research activities. The rising R&D investments within the pharmaceutical and biopharmaceutical sectors are driving a shift towards comprehensive integrated or functionally outsourced services encompassing the entire process of drug discovery and development, starting from early-stage development to late-stage development phase. To enhance profitability, meet stringent drug development timelines, and achieve cost efficiencies, a significant number of pharmaceutical and biopharmaceutical companies now outsource their testing functions during R&D to CROs. This inclination is notably evident in recent partnerships between prominent pharmaceutical firms and Contract Research Organizations (CROs). Furthermore, advancements in biotechnology have resulted in a sharp increase in drug candidates in the pipeline. For instance, the number of drug candidates in the development pipeline has increased from 10,479 in 2013 to 17,737 by 2020. Projections indicate a continuation of this trend, with an estimated count of 21,292 drug candidates anticipated by the end of the year 2023. These trends are expected to drive the market during the forecast period.

Restraint: Need for unique testing approaches for innovative molecules

The pharmaceutical and biopharmaceutical industries have witnessed a considerable rise in competitiveness as they strive to create novel treatments and secure patent exclusivity through accelerated drug development. Bioanalytical testing plays a critical role across all stages of pharmaceutical and biopharmaceutical development and stands as the most frequently outsourced process within the scope of chemistry, manufacturing, and control (CMC) activities. CMC data also holds essential significance in meeting regulatory expectations and attaining approval for Investigational New Drug (IND) applications. The variety of requirements in chemistry, manufacturing, and control (CMC) for seeking approval for biopharmaceutical Investigational New Drug (IND) and developing innovative drug delivery systems presents different challenges. These challenges impose the use of novel and innovative analytical methods to test the new drug molecules.

OPPORTUNITY: Favorable outlook for biologics and biosimilars

The field of pharmaceuticals and biotechnology has experienced rapid expansion in recent times. Notable investments have been seen in R&D activities aimed at creating innovative medications and biological substances for tackling a range of illnesses. Many new drugs and biologics are currently in the clinical trial stages of development. s. With the continuous influx of novel pharmaceutical products in the pipeline, the demand for clinical trial services is expected to witness substantial growth. Despite an overall reduction in approvals by the US FDA in 2022 due to the COVID-19 impact, the biologics sector remained unaffected, recording the approval for 15 new molecules and maintaining momentum from prior years. As in previous years, cancer continued to be the condition most addressed by monoclonal antibodies, which also continued to be the medicine class with the most approvals.

CHALLENGE: Shortage of Skilled Professionals in Clinical Trials

Clinical research organizations (CROs) are facing a tough time finding and keeping skilled people. They're competing with drug companies, biotech firms, medical device makers, and academic research institutes for qualified and experienced scientists. To compete effectively, these companies have to offer better pay and perks. But this can affect their financials and results, especially for small-scale clinical trials service providers. This shortage of skilled professionals may hamper the adoption of new technologies and methodologies and inhibit the growth of the market in the coming years.

According to the Global Workforce Intelligence (GWI) Project, by 2025, there will be a staggering demand-supply gap of 2.1 million healthcare workers, with one in three roles remaining unfilled. Per CareerBuilder, only 5.7 million people were available for recruitment in the US in September 2022, despite the 6.6 million clinical research positions offered. Additionally, seven positions are listed for every CRC searching for employment.

Even though small-molecule drugs dominate the global pharmaceutical market, the share of biologics, biosimilars, and large-molecule drugs is growing, led by the launch of new biologic-based drugs and increased revenues from existing biologics. Biologics and biosimilars require more specialty testing services such as biomarker testing and virology testing at each stage than small molecules. The increasing need for outsourcing these services to CROs is expected to stimulate the growth of the market in the coming years.

Clinical Trials Market Ecosystem

The global clinical trials market ecosystem includes raw material suppliers, clinical trials service providers, and end users such as pharmaceutical & biotechnology companies, medical device companies, and academic institutes. Raw material suppliers and service providers offer supplies and services for Phase I to Phase IV clinical trials and other studies. This includes consumables, assays, kits, accessories, and other products required throughout drug development.

Clinical research entities partner with their clients (such as pharmaceutical and biotechnology companies) to design strategies, implement them, and manage services. This long-term relationship enables the partners to conduct trials successfully and bring new products to market. Also, as the partners work together for a long time, the contracted work volume can expand, depending on how comfortable they are in taking their partnership forward.

The laboratory services segment dominated the clinical trials industry by service type.

The laboratory services segment held the largest share of the global clinical trials market in 2022. The increasing importance of laboratory services to establish regulatory compliance is expected to boost the growth of the segment during the forecast period. Laboratory services play a crucial role across every phase of drug development, encompassing clinical advancement. These services act as a basis for pharmaceutical, biopharmaceutical, and medical device enterprises, supporting them in adhering to regulatory benchmarks and ensuring the production of high-quality products. Furthermore, the increasing number of CROs providing a comprehensive range of laboratory services is expected to drive the segment growth.

The phase III segment accounted for the largest share of the clinical trials industry in 2022 by Phase.

The phase III segment accounted for the major share of the global clinical trials market in 2022. Additionally, the segment is expected to grow at a higher CAGR during the forecast. Factors such as large patient population for the clinical study as compared to other phases and utilization of sophisticated services to study the safety and efficacy of the drug candidates have contributed to the growth of this segment. Additionally, phase III clinical trials are considered complex clinical trials that require both robust technologies and reliable clinical resources to recruit patients efficiently, initiate sites quickly, and provide cost-effective study management. Most pharmaceutical, biopharmaceutical, and medical device manufacturers outsource services for Phase III clinical trials to CROs; this has contributed to the largest market share of the segment in the global market.

The Cardiology segment of the clinical trials industry is projected to register a higher growth rate during the forecast period by therapeutic area.

The cardiology segment of the clinical trials market is expected to grow at a higher CAGR during the forecast period. The growth of this segment is attributed to the high prevalence of cardiovascular diseases, the rising geriatric population, and the increasing number of partnerships between clinical trial service providers and pharmaceutical & biotechnology companies. Cardiovascular diseases (CVDs) are one of the leading causes of death worldwide. According to a report published by the World Heart Federation, Cardiovascular illnesses continue to impact more than half a billion people worldwide and were responsible for 20.5 million deaths in 2021, or close to a third of all deaths worldwide, and a rise from the anticipated 121 million CVD fatalities. This has created a demand for advanced cardiology drugs, which in turn drive the adoption of clinical trial services for the same.

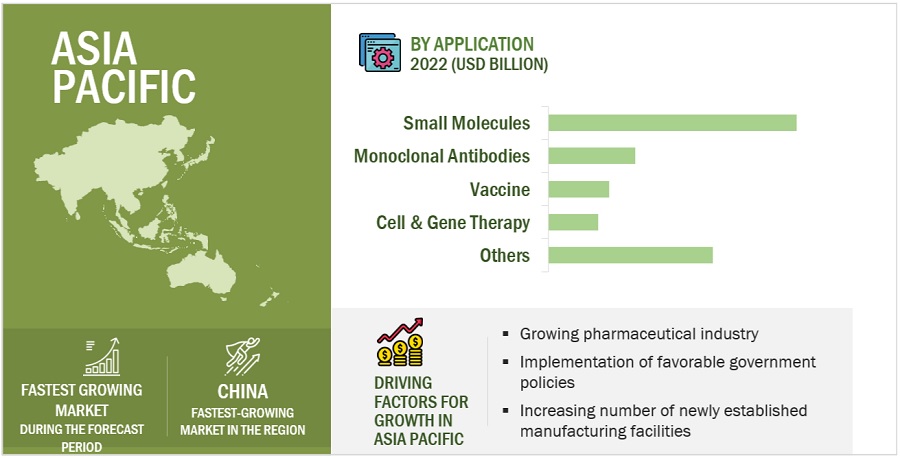

Asia Pacific region of the clinical trials industry is estimated to register the highest CAGR during the forecast period.

Asia Pacific offers lucrative growth potential for the clinical trials market. This can be attributed to the growing pharmaceutical industry, implementation of favorable government policies, increasing number of newly established manufacturing facilities, and the low cost of clinical trials in the region.

Additionally, The APAC market is also becoming a major drug development and clinical research destination. The expansion of clinical trial operations in the region is mostly attributed to cost benefits, a sizable treatment population, participant retention in clinical trials, and ongoing regulatory procedural improvements. These benefits have caused the majority of pharmaceutical, biopharmaceutical, and medical device businesses to outsource their clinical trial efforts to CROs in this industry. Rapid growth in the outsourcing of preclinical, clinical, and laboratory testing services to Asia Pacific countries is expected to significantly drive market growth during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

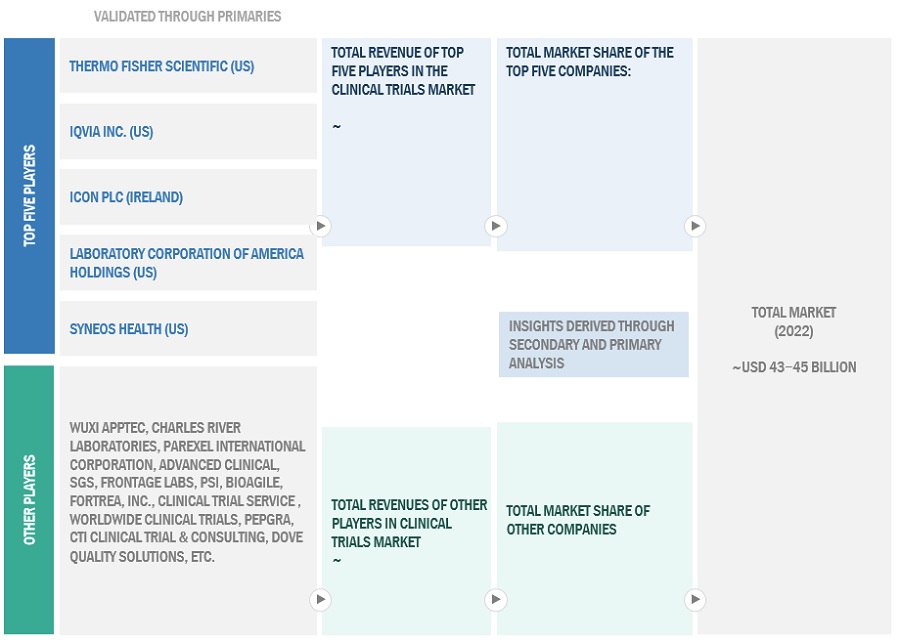

Key players in the clinical trials market include IQVIA Inc. (US), Laboratory Corporation of America Holdings (US), Syneos Health (US), WuXi AppTec (China), Charles River Laboratories (US), Parexel International Corporation (US), Thermo Fisher Scientific Inc. (US), ICON plc (Ireland), Medpace (US), ACM Global Laboratories (US), Advanced Clinical (US), SGS (Switzerland), Frontage Labs (US), PSI (Switzerland), Bioagile (India), Fortrea Inc. (US), Clinical Trial Service (Netherlands), Worldwide Clinical Trials (US), Pepgra (UK), CTI Clinical Trial & Consulting (US), Dove Quality Solutions (UK), Firma Clinical Research (US), Celerion (US), Novotech (Australia), and Linical Americas (Japan).

Scope of the Clinical Trials Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$48.2 billion |

|

Estimated Value by 2028 |

$73.2 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 8.7% |

|

Market Driver |

Increasing drugs in the pipeline and rising investments in pharmaceutical R&D |

|

Market Opportunity |

Favorable outlook for biologics and biosimilars |

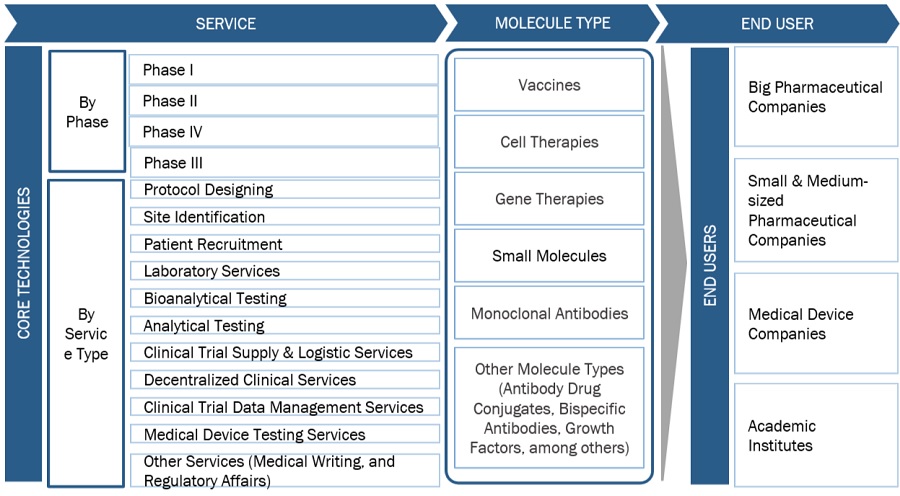

This report categorizes the Clinical trials market to forecast revenue and analyze trends in each of the following submarkets:

By Phase

- Phase III

- Phase II

- Phase IV

- Phase

By Service Type

- Laboratory Services

-

Bioanalytical Testing Services

- Cell-Based Assay

- Virology Testing

- Serology, Immunogenicity, & Neutralizing Antibodies

- PK/PD Testing

- Method Development, Optimization & Validation

- Biomarker Testing

- Other Bioanalytical Testing Services

- Decentralized Clinical Trial Services

- Patient Recruitment

- Site Identification

- Analytical Testing Services

- Clinical Trial Supply & Logistic Services

- Protocol Designing

- Clinical Trial Data Management Services

- Medical Device Testing Services

- Other Services

By Therapeutic Area

- Oncology

- Infectious Diseases

- Neurology

- Metabolic Disorders

- Immunology

- Cardiology

- Genetic Diseases

- Women's Health

- Other Therapeutic Areas

By Application

- Small Molecules

- Monoclonal Antibodies

- Vaccine

- Cell & Gene Therapy

- Other Applications

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific (APAC)

- China

- Japan

- India

- Rest of Asia Pacific (RoAPAC)

- Latin America (LATAM)

- Middle East and Africa (MEA)

Recent Developments of Clinical Trials Industry

- In March 2023, Syneos Health entered into a multiyear agreement with Microsoft to create a platform that uses machine learning to elevate biopharma companies’ commercial performance and speed up clinical trial analysis, planning, and operation.

- In September 2022, Parexel International established a new clinical trial supplies and logistics facility in Suzhou, China. This facility provides both local and international biopharmaceutical clients with quick access to clinical trial materials and medications for sites and patients, thus expediting the progress of clinical trials in the region.

- In April 2021, CRL and Valence Discovery entered an alliance to provide AI-enabled drug design capabilities. The partnership will grant access to Valence’s ML platform.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global clinical trials market?

The global clinical trials market boasts a total revenue value of $73.2 billion by 2028.

What is the estimated growth rate (CAGR) of the global clinical trials market?

The global clinical trials market has an estimated compound annual growth rate (CAGR) of 8.7% and a revenue size in the region of $48.2 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This research study of the global clinical trials market involved the extensive use of secondary sources, directories, and databases to identify and collect relevant information. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess market growth prospects. The global size of the clinical trials market (estimated through various research approaches) was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as the Association of Clinical Research Organization (ACRO), Clinical Research Society (CRS), Clinical Research Association of Canada (CRAC), Association of International Contract Research Organizations (AICROS), Clinical and Contract Research Association (CCRA), American Association of Pharmaceutical Scientists (AAPS), Eurostat, Food and Drug Administration (FDA), Pharmaceutical Research and Manufacturers of America (PhRMA), Japan CRO Association, Chinese Association for Laboratory Animal Sciences (CALAS), and Indian Society for Clinical Research. Secondary sources also include corporate and regulatory filings (such as annual reports, SEC filings, investor presentations, and financial statements), business magazines and research journals, press releases, and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global clinical trials market, which was validated through primary research.

Primary Research

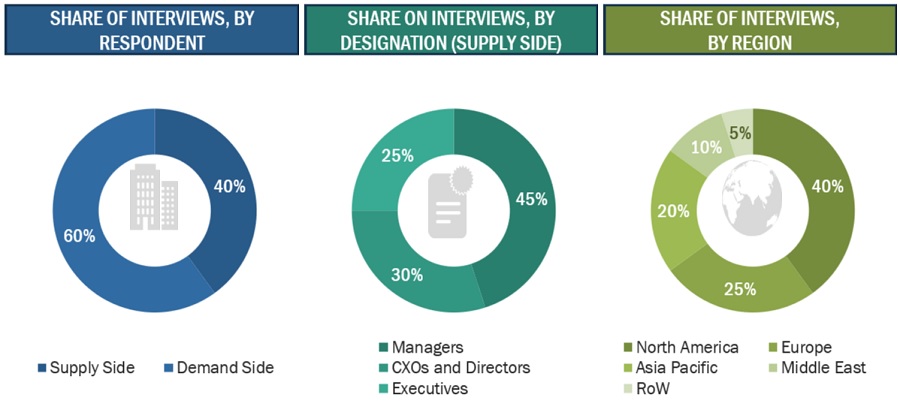

Extensive primary research was conducted after acquiring basic knowledge about the global clinical trials market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand side (personnel from pharmaceutical & biopharmaceutical companies, medical device companies, and academic institutes) and supply side (C-level and D-level executives, product managers, and marketing and sales managers of key manufacturers, distributors, and channel partners, among others, from Tier 1 and Tier 2 companies engaged in offering services) across five major regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. Approximately 40% of primary interviews were conducted with supply-side representatives, while demand-side participants accounted for the remaining share. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

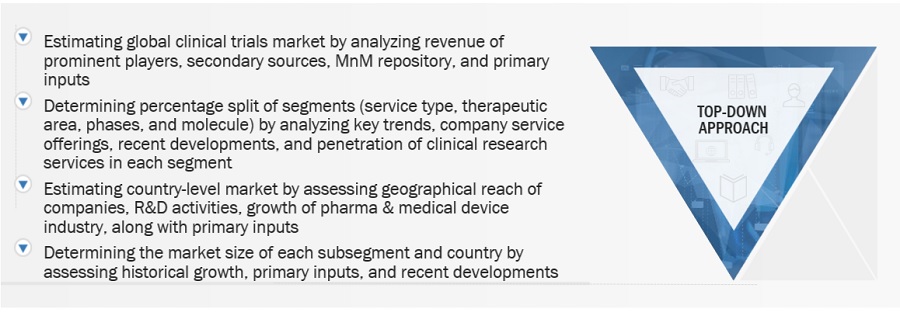

Market Size Estimation

The global size of the market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the clinical trials market and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the clinical trial services business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Market Size Estimation Methodology-bottom-up approach:

To know about the assumptions considered for the study, Request for Free Sample Report

Market Size Estimation Methodology-top-down approach:

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition

Clinical trial service providers offer research services contractually to pharmaceutical & biotechnology companies, medical device companies, and academic institutes. These services include clinical research, laboratory, consulting, and data management. A sponsor, i.e., a company investigating the safety and efficacy of new drugs, therapies, or medical devices, partners with a CRO on a contractual or project-by-project basis. A CRO provides advice and guidance for the planning, designing, and execution of clinical trials; it offers a comprehensive and diverse range of services for each phase of clinical trials.

Key Stakeholders

- Contract Research Organizations (CROs)/Clinical Trial Service Providers

- Pharmaceutical and Biopharmaceutical Companies

- Medical Device Manufacturing Companies

- Academic and Research Institutes

- Venture Capitalists and Investors

- Market Research and Consulting Firms

- Government Associations

- Medical Institutions and Universities

Report Objectives

- To define, describe, and forecast the clinical trials market based on phase, service type, therapy area, application, and region.

- To provide detailed information regarding the major factors influencing the market growth (drivers, opportunities, and industry-specific challenges) along with the current trends

- To strategically analyze micro markets concerning their growth trends, prospects, and contributions to the total clinical trials market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders.

- To forecast the revenue of market segments in five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile key players and comprehensively analyze their market shares and core competencies.

- To track and analyze competitive developments in the clinical trials market, such as service launches, agreements, partnerships, collaborations, mergers & acquisitions, and R&D activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the Rest of Europe's clinical trials market, by country

- Further breakdown of the Rest of Asia Pacific clinical trials market, by country

- Further breakdown of the Latin American Middle Eastern & African clinical trials markets, by country

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Segment Analysis

- Further breakdown of the therapeutic area segment as per the service portfolios of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Clinical Trials Market

Which segment, Based on the therapy area, accounted for the major share of the global Clinical Trials Market?

Can you share the detailed report on the geographical analysis of the global Clinical Trials Market?

Which of the global leaders holds the largest share of the global Clinical Trials Market?