Cloud Data Security Market by Offering, Organization Size (Large Enterprises and SMEs), Offering Type, Vertical (BFSI, Retail & eCommerce, Government and Defense, Healthcare and Life Sciences, IT and ITeS, Telecom) and Region - Global Forecast to 2027

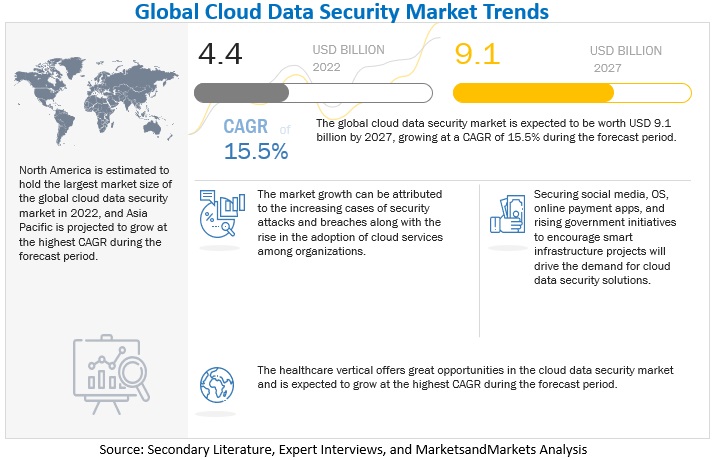

The global Cloud Data Security Market size is projected to grow from USD 4.4 billion in 2022 to USD 9.1 billion by 2027 at a CAGR of 15.5% during the forecast period. The rising occurrences of thefts and breaches and the rising popularity of cloud services among organizations are the primary factors driving the market growth. Moreover, securing social media, OS, online payment apps, and rising government initiatives to encourage smart infrastructure projects will drive the demand for these products in the near future.

To know about the assumptions considered for the study, Request for Free Sample Report

Covid-19 impact

The COVID-19 epidemic has altered how businesses function. It is stressing back-end support systems and increasing traffic on networks that connect users to these services as more employees utilize conferencing and collaboration services while working from home. Only service providers with enough architecture and a consistent level of customer service will be able to handle the additional load. Regarding their business continuity plans, cloud providers frequently face challenges. They must respond to challenging inquiries, such as whether their public cloud architecture is sufficiently durable and scalable to manage rising demand and if it can continue to provide services even if support personnel become unwell. They must continuously show that the auxiliary system is reliable enough to provide ongoing access to public cloud services and that the network infrastructure can handle the increased traffic volume. Cloud providers must, however, be aware of the hazards, chances, and events that may arise as a result of the pandemic for them to accomplish this. They must show that they are equipped to deal with sudden increases in demand. On the other hand, they also have the chance to show how their services' resilience and flexibility have been put to the test by the rapid and sharp rise in the number of individuals working from home. Cloud providers must also keep an eye on unfolding events to ensure they are proactive about meeting demand. Those that choose a reactive approach will struggle.

Cloud Data Security Market Dynamics

Driver: Rising adoption of cloud services by enterprises

Growth in the usage of cloud services across several sectors leads to an increase in reliance on the cloud for storage and other applications. The increasing number of internet users and the increased use of cloud services are the primary factors driving the adoption of cloud security solutions. As internet commerce develops, its significance will become more apparent. Businesses moving to the cloud increased quickly as a result of the speedy move to remote labor. Specifically, in their respective conference calls, Microsoft and Amazon noted the expansion of their cloud operations. Unlike Microsoft, which reported a 27% rise in revenue from Microsoft Azure and a 39% increase in overall cloud-related revenue, AWS recorded a 33% increase in sales to surpass the USD 10 billion mark. New channels for interacting with and reaching consumers, changes to organizational practices, and maintaining a competitive edge are other significant factors driving the rise in cloud use.

Additionally, the cloud is essential for helping organizations withstand lockout situations and erratic IT infrastructure, enabling them to grow more swiftly and increase their speed to market, agility, and responsiveness. The poll found that 67% of large companies had progressed cloud adoption, compared to 39% of medium-sized enterprises and 38% of small businesses that had just begun their cloud adoption journeys. However, 88% of medium-sized organizations and 92% of small enterprises have trouble managing security-related risks. To close the skill gap and address the significant lack of digital capabilities, organizations focused on new talent acquisition initiatives (73%) and launched automation projects (66%). The different cloud models and cloud service options offer organizations alternatives to implement the cloud in different ways and enable them to plan their technology budgets.

Restraint: Lack of cooperation and distrust between businesses and cloud security service providers

Due to the suspicion of cloud service providers, both big and small organizations are wary of moving their operations to the cloud (CSPs). There is a widespread lack of trust in these services due to unclear Service Level Agreements (SLAs), security or privacy standards, general terms and conditions, the infancy of cloud services, data breaches, and several other issues. Cloud service providers' infrastructure stores critical data for organizations, making them vulnerable to frequent and sophisticated cyberattacks. As a result, businesses may be hesitant to entrust these service providers with their confidential data. Cloud security service providers can assist companies in gaining clients by employing an open information security strategy. Such distrust in cloud computing technology for data storage inhibits the growth of the cloud security market.

Opportunity: Securing social media, OS, and online payment apps

Many financial services firms now require the use of cloud-based payment security solutions. Increased flexibility, security, data integration, and scalability are benefits of cloud-based security technology. The Payment Card Industry Data Security Standard (PCI DSS) must be followed for payment systems and cloud security programs to be compliant. In 2019, an Instagram user data breach exposed the sensitive personal data of at least 49 million users. The breach was caused by a vulnerable AWS server that was connected to the internet. These occurrences act as a warning to social media businesses to spend heavily on cloud security services to avoid security mistakes in the future. Cloud security companies are giving more services to protect home PCs. To secure personal computers, cloud security firms are increasingly providing security cloud subscription services (PCs) for Mac, Android, Windows, or Apple iOS mobile devices as BYOD, CYOD, and work-from-home practices are gaining traction.

Challenge: DevOps, DevSecOps, & automation and privileges & key management

Teams in DevOps and DevSecOps flourish when tasks are finished swiftly and effectively. They create highly automated CI/CD systems to do this. Automation makes faster software development cycles possible by ensuring that security measures are properly identified and applied in all code and templates from the beginning of the software development cycle. However, after the workload has been delivered, security-related changes might threaten the organization's entire security posture. They may possibly lengthen the time to market. Consequently, this poses problems for the industry for cloud data protection. The configuration of cloud user roles is typically quite lax, granting privileges that are neither necessary nor intended. For instance, giving database write or delete privileges to an inexperienced user or a person with no business need to add or delete database assets. Another critical risk at the application level may occur when improperly configured keys and privileges expose sessions to security risks. Thus, creating a challenge for the cloud security market.

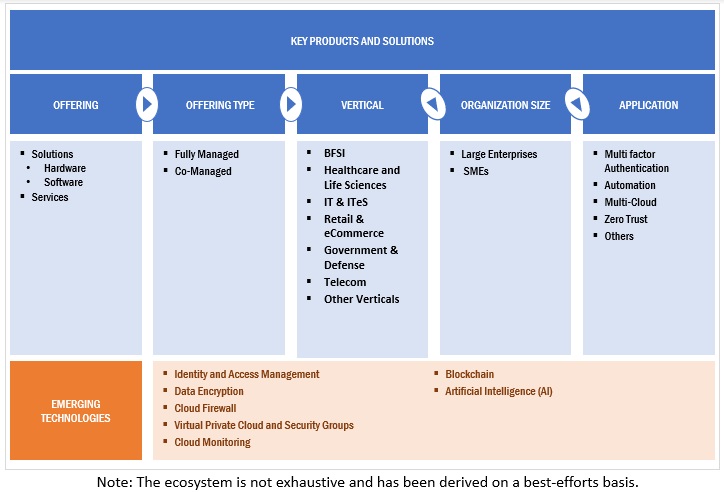

Cloud data security market ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By offering, solutions segment to account for larger market size during forecast period

By offering, the market is segmented into solutions and services. The demand for cloud security solutions has increased within the last two years as many businesses have quickly adopted these solutions to support remote work. This is due to the fact that cloud-based security solutions offer increased flexibility, security, data integration, and scalability. A complete data lifecycle, from creation to disposal, is protected by a strong cloud security solution. Furthermore, a scalable cloud computing solution can adapt capacity, security coverage, and pricing in response to changes in demand. For instance, server capacity is increased to prevent server breakdowns during times of high demand. Additionally, a cloud security solution gives ongoing support for a business's digital assets and offers remedies when environmental disruptions pose a hazard. This includes continuous live monitoring to handle problems immediately, 24x7x365. Thus, cloud security solutions have the highest market size during the forecast period.

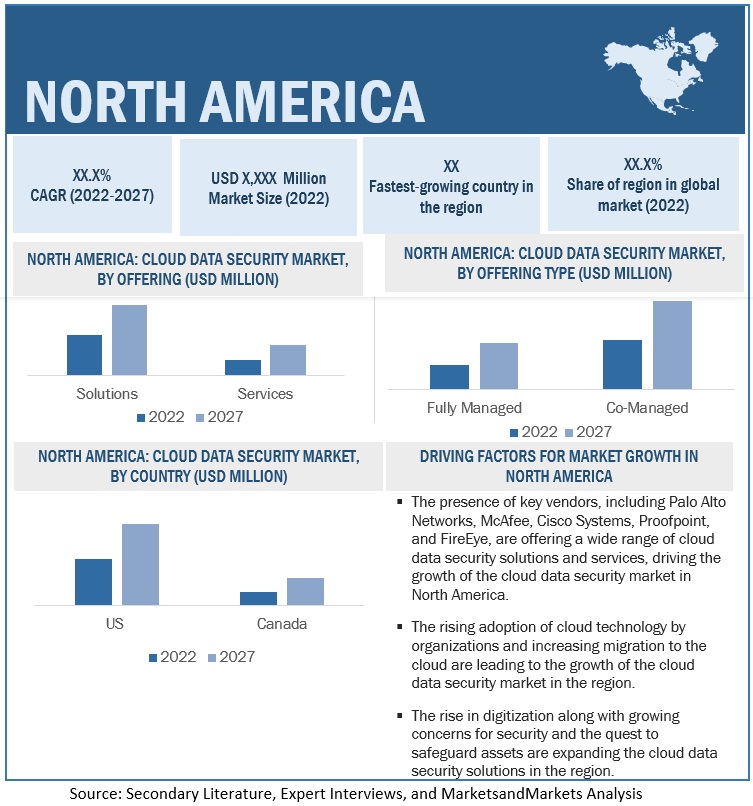

By region, North America to have the largest market size during the forecast period

North America dominates the global cloud data security market with a large number of vendors, such as Crowdstrike, Check Point, IBM, Palo Alto Networks, and Digital Guardian, resulting in the adoption of cloud data security solutions in the region. Increasing incidents of security breaches, rising adoption of cloud technology by organizations in their businesses, and increasing migration to the cloud are leading to the growth of the cloud data security market in the region. Furthermore, the rise in digitization, growing concerns for security, and the quest to safeguard assets are expanding the cloud data security solutions in the North American region.

Key Market Players

CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), and Thales (France) are some of the key players operating in the global cloud data security market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2016–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Million/USD Billion) |

|

Segments covered |

By Offering, By Organization Size, By Offering Type, By Vertical, and By Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Major companies covered |

Major vendors in the global cloud data security market include CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), Thales (France), Sophos (UK), Polar (Israel), Netwrix (US), Informatica (US), Commvault (US), Orca Security (US), Radware (US), Rubrik (US), Veeam (US), Infrascale (US), Druva (US), Faction (US), Cohesity (US), Netskope (US), and Cloudian (US). |

The study categorizes the cloud data security market by offering, organization size, offering type, vertical, and region.

By Offering

- Solution

- Services

By Organization Size

- Large Enterprises

- Small and Medium-Sized Enterprises (SMEs)

By Offering Type

- Fully Managed

- Co-Managed

- Vertical

- BFSI

- Retail and eCommerce

- Government and Defense

- Healthcare and Life Sciences

- IT and ITeS

- Telecom

- Other Verticals

Region

- North America

- Europe

- Middle East and Africa

- Asia Pacific

- Latin America

Recent Development

- In October 2022, Check Point enhanced its solution named Check Point's Quantum Titan, which combines AI and deep learning technology to defend against the most sophisticated attacks, such as zero-day phishing and domain name system exploits. This provides better and more efficient security across a company's complex, distributed networks, both on-premises and in the cloud.

- In July 2022, Crowdstrike unveiled a new service, Falcon OverWatch Cloud Threat Hunting, a service that enables security teams to continually find hidden and sophisticated threats. It continually scans the cloud for suspicious behaviours and threats. The system is built on a cloud sensor network that protects over 1.5 billion containers daily and gives real-time visibility into cloud-based threats.

- In November 2021, Palo Alto Networks partnered with Siemens (Germany). Palo Alto Networks announced the extension of its technology partnership with Siemens to improve the security of mission-critical networks and prevent the threat of cyberattacks on critical infrastructure.

- In October 2021, ZScaler partnered with Crowdstrike (US). This integration allows Zscaler ZIATM to use CrowdStrike Falcon ZTA (Zero Trust Assessment) device scores to configure access policies. With this partnership, clients of Zscaler and CrowdStrike may now extend zero trust security to both internal and external apps using Zscaler.

Frequently Asked Questions (FAQ):

What is the definition of the cloud data security market?

Cloud data security refers to the technology, rules, services, and security procedures that prevent the loss, leakage, or exploitation of any data stored in the cloud through breaches, exfiltration, and unauthorized access.

What is the projected market value of the global cloud data security market?

The global cloud data security market is projected to grow from USD 4.4 billion in 2022 to USD 9.1 billion by 2027 at a Compound Annual Growth Rate (CAGR) of 15.5% during the forecast period.

Who are the key companies influencing the market growth of the cloud data security market?

CrowdStrike (US), Check Point (US), Palo Alto Networks (US), Zscaler (US), IBM (US), Imperva (US), Veritas (US), Digital Guardian (US), VMware (US), Thales (France), Sophos (UK), Polar (Israel), Netwrix (US), Informatica (US), Commvault (US), Orca Security (US), Radware (US), Rubrik (US), Veeam (US), Infrascale (US), Druva (US), Faction (US), Cohesity (US), Netskope (US), and Cloudian (US) are the major vendors in the cloud data security market and are recognized as the star players. These companies account for a major share of the cloud data security market. They offer wide solutions related to cloud data security solutions and services. These vendors offer customized solutions per user requirements and adopt growth strategies to consistently achieve the desired growth and make their presence in the market.

What is the COVID-19 impact on the cloud data security market?

The COVID-19 epidemic has altered how businesses function. Back-end support services are under pressure due to the rise in the number of people working from home. Only service providers with enough architecture and a consistent level of customer service will be able to handle the additional load. In order to ensure they are proactive about meeting demand; cloud providers must also keep an eye on how things are developing. Those that choose a reactive approach will struggle.

What are some of the mandates for cloud data security?

There are several stringent government regulations and policies in Europe, North America, and Asia Pacific countries, such as the International Organization for Standardization (ISO), Sarbanes-Oxley Act of 2002 (SOX), GDPR, HIPAA, and The Payment and Settlements Systems Act (PSS). These sets of regulations and policies are meant to protect individuals and organizations from criminal activities and mandate the incorporation of advanced security solutions, such as cloud data security solutions, in organizations and also for individuals. In case of any breach or security attacks, heavy penalties and fines are imposed per these mandates; therefore, these regions are rapidly adopting cloud data security solutions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

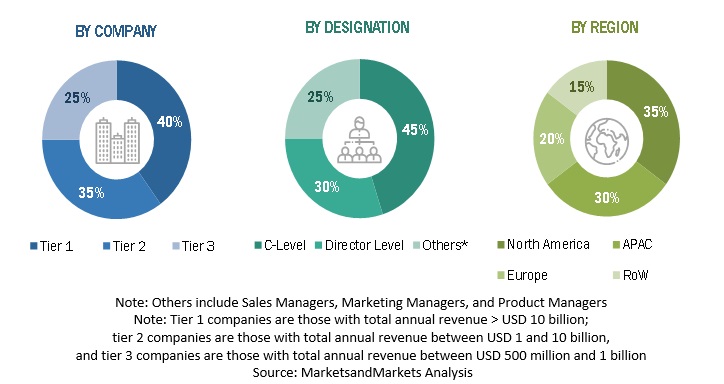

The study involved major activities in estimating the current market size for the cloud data security market. Exhaustive secondary research was done to collect information on the cloud data security industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the cloud data security market.

Secondary research

In the secondary research process, various sources were referred to for identifying and collecting information regarding the study. The secondary sources included annual reports, press releases, investor presentations of cloud data security software and service vendors, forums, certified publications, and white papers. The secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources. The factors considered for estimating the regional market size are technological initiatives undertaken by governments of different countries, Gross Domestic Product (GDP) growth, ICT spending, recent market developments, and market ranking analysis of major cloud data security solution providers.

Primary research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the cloud data security market.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

After the complete market engineering process (including calculations for market statistics, market breakups, market size estimations, market forecasts, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. The primary research was also conducted to identify the segmentation types; industry trends; the competitive landscape of cloud data security market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market size estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global cloud data security market and estimate the size of various other dependent sub-segments in the overall cloud data security market. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their revenue contributions in respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Data triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report objectives

To define, describe, and forecast the cloud data security market based on offerings, organization sizes, offering types, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the cloud data security market

- To profile the key players of the market and comprehensively analyze their market size and core competencies.

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions; and partnerships, agreements, and collaborations in the global cloud data security market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Data Security Market