Cloud ERP Market by Component (Solutions, Services), Business Function (Finance & Accounting, Sales & Marketing, Operations), Deployment Mode (Public Cloud, Private Cloud), Organization Size, Vertical and Region - Global Forecast to 2028

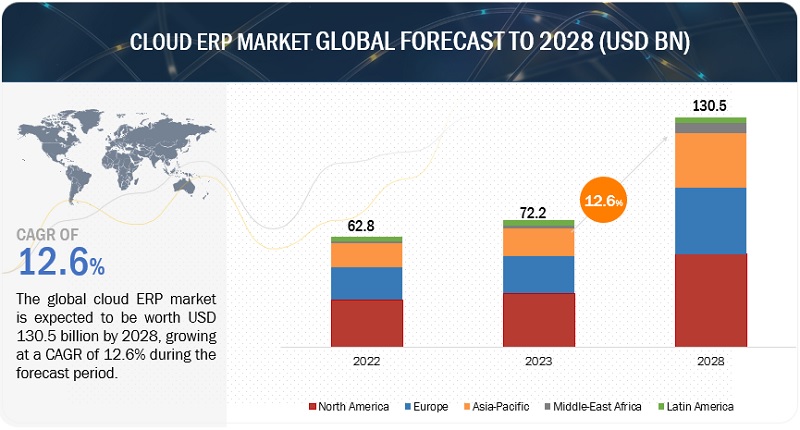

[358 Pages Report] The cloud ERP market size is expected to grow from USD 72.2 billion in 2023 to USD 130.5 billion by 2028 at a compound annual growth rate (CAGR) of 12.6% during the forecast period. Cloud ERP is at the forefront of leveraging the latest technologies to drive business innovation. It integrates with cutting-edge technologies such as artificial intelligence (AI) and machine learning (ML) to enhance data analytics, automation, and predictive insights. IoT (Internet of Things) connectivity enables real-time monitoring of equipment and assets, improving maintenance and resource allocation. Mobile accessibility and remote work capabilities ensure flexibility, while blockchain technology enhances data security and transparency. Cloud ERP facilitates easy integration with other cloud services and APIs, fostering collaboration and expanding functionality. In essence, cloud ERP empowers businesses with the agility to harness the latest tech trends, enabling them to stay competitive, make data-driven decisions, and adapt to evolving market dynamics.

Furthermore, Material Requirement Planning (MRP), Human Capital Management (HCM), and Human Resource Management System (HRMS) are essential components of the cloud ERP market, each offering distinct advantages to users. MRP optimizes manufacturing and inventory operations by efficiently calculating material requirements, minimizing waste, and ensuring timely production. HCM enhances workforce management, covering payroll, employee benefits, and performance evaluations, aiding talent retention and productivity. Conversely, HRMS focuses on HR tasks such as recruitment, training, and compliance. These ERP solutions streamline business operations by providing real-time data, automating critical processes, and improving resource allocation. Users benefit from enhanced cost efficiency, reduced human error, and increased workforce productivity, ultimately contributing to better decision-making, competitive advantage, and organizational growth in the dynamic cloud ERP landscape.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Cloud ERP Market Dynamics

Driver: Implementation of ERP systems to perform core business operations

Implementing ERP systems is a pivotal strategy for modern businesses seeking to streamline and optimize their core operations. ERP systems are comprehensive software solutions integrating various business functions and processes into a unified platform, providing real-time data, automation, and efficiency enhancements. One of the primary advantages of ERP implementation is improved operational efficiency. By centralizing data and automating repetitive tasks, ERP systems reduce manual errors and enable employees to focus on more strategic activities. This results in increased productivity and faster decision-making, as data from different departments is readily accessible and can be analyzed in real-time.

Additionally, ERP systems facilitate data-driven decision-making. It provides executives and managers with accurate, up-to-date information, enabling them to make informed choices regarding resource allocation, inventory management, and production planning. This strategic insight can lead to cost reductions, enhanced customer service, and a competitive edge in the market. Furthermore, ERP systems promote better collaboration among departments. Through data sharing and standardized processes, ERP fosters a culture of cross-functional teamwork, breaking down silos and improving organizational communication. This collaboration improves efficiency and enhances customer service, as customer-related data is easily accessible to all relevant departments.

In conclusion, implementing ERP systems is a strategic move that can transform how businesses operate. It enhances efficiency, data-driven decision-making, and department collaboration, ultimately improving competitiveness and profitability. While it involves challenges and costs, the long-term benefits of ERP implementation make it a worthwhile investment for organizations looking to excel in their core business operations.

Restraint: Availability of limited customization options for SaaS ERP solutions

One notable restraint in the cloud ERP market is the limited customization options available for Software as a Service (SaaS) ERP solutions. While cloud-based ERP systems offer numerous advantages such as scalability, cost-efficiency, and accessibility, they often come with constraints in tailoring the software to meet the specific needs of individual businesses.

SaaS ERP solutions are designed to be highly standardized and modular, aiming to serve a broad range of industries and businesses. As a result, they may lack the level of flexibility and customization that some organizations require. Businesses in various industries often have unique and complex processes that set them apart from their competitors. With their standardized approach, SaaS ERP solutions may not accommodate these distinctive workflows and may require organizations to adapt their processes to fit the software, potentially causing inefficiencies. While SaaS ERP systems offer some degree of customization, it is typically limited compared to on-premises ERP solutions. Users may be unable to modify the software extensively to align it perfectly with their specific business requirements.

Opportunity: Increasing government investment in digitalization

The cloud ERP market is witnessing significant growth opportunities due to increasing government initiatives in digitization. Governments worldwide recognize the transformative potential of digital technologies, which presents several promising prospects for adopting and expanding Cloud ERP solutions. Governments are increasingly investing in the modernization of their operations, aiming to improve efficiency, transparency, and citizen services. Government agencies often operate in silos with disparate systems and data. Cloud ERP solutions can provide a unified platform for data integration and interoperability, allowing different departments to share and access information seamlessly. This promotes better decision-making and enhances overall governance. Moreover, cloud-based ERP systems offer cost savings through reduced infrastructure and maintenance costs. Government initiatives focused on fiscal responsibility can leverage these cost efficiencies to allocate resources more effectively and direct funds toward critical public services.

Furthermore, governments often collaborate with private sector companies to implement digital initiatives. Cloud ERP vendors can partner with governments to provide tailored solutions for public sector needs. In conclusion, increasing government initiatives in digitization present ample opportunities for the cloud ERP market. Governments are recognizing the benefits of cloud-based ERP systems in modernizing their operations, improving service delivery, and achieving cost savings. Cloud ERP vendors should continue collaborating with governments to develop solutions that meet the unique requirements of the public sector while ensuring data security, compliance, and scalability. This synergy between government initiatives and Cloud ERP solutions is poised to drive further growth and innovation in the market.

Challenge: Integration issues with legacy and on-premises ERP systems

The cloud ERP market faces several challenges due to the increasing issues associated with legacy and on-premises ERP systems. These challenges stem from the limitations and complexities of older ERP solutions that organizations seek to replace with cloud-based alternatives. Legacy and on-premises ERP systems often incur significant maintenance and upgrade costs. These expenses can strain an organization’s IT budget, making it financially challenging to keep the system up-to-date and secure. Older ERP systems use outdated technology stacks and may not support modern integrations and functionalities. This can hinder an organization’s ability to adapt to changing business needs and emerging technologies.

Legacy systems may not be easily scalable to accommodate business growth. This can result in inefficiencies and limited capacity, especially for organizations experiencing rapid expansion. Many legacy ERP systems operate in data silos, where different departments have their databases and processes. This leads to inefficiencies, data inconsistencies, and difficulty accessing real-time decision-making information. In summary, the challenges associated with legacy and on-premises ERP systems drive organizations to explore cloud ERP solutions to overcome these limitations. Cloud ERP offers cost-efficiency, scalability, enhanced security, and modern features that can address these challenges and empower organizations to adapt to the evolving business landscape. However, the transition to the cloud is not without its own set of considerations and challenges, and organizations must carefully plan and execute their migration strategies to reap the benefits of cloud ERP systems fully.

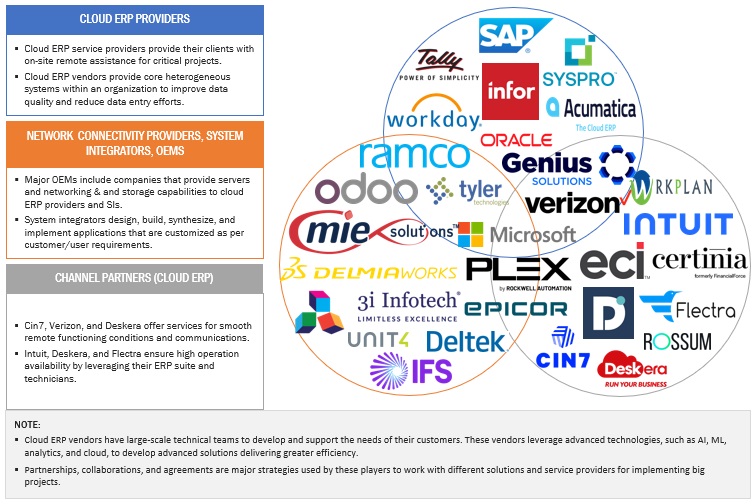

Cloud ERP Market Ecosystem

The ecosystem of the cloud ERP market includes System Integrators (SIs), cloud ERP solution providers, and associated service providers. SIs design, build, synthesize, and implement customized applications as per customer/user requirements. SI players test and authenticate cloud ERP solutions to determine suitability before integration. They own integration capabilities for software, hardware, services, or other related devices to develop a comprehensive cloud ERP system. SI vendors have a strong client base and supply cloud ERP solutions through direct channels and partner networks.

Cloud ERP solution vendors provide the core cloud ERP software. These vendors have the large-scale technical expertise to develop and support cloud ERP solutions. These vendors leverage advanced technologies, such as AI , ML , analytics, and cloud, to develop cutting-edge solutions that deliver greater efficiency. These players offer their software to end users, such as enterprise data centers, colocation data centers, managed data centers, and cloud data centers or third-party integrators.

Partnerships, collaborations, and agreements are major strategies these players use to work with cloud ERP software and service providers for implementing big cloud ERP projects. Some players also provide integrated solutions in the cloud ERP market.

The following figure shows the ecosystem of the cloud ERP market:

Based on vertical, manufacturing vertical is expected to hold the largest market share during the forecast period

Based on the vertical, the cloud ERP market is segmented into BFSI, IT & telecom, government & defense, education, healthcare & life sciences, manufacturing, retail, and other verticals. Among the verticals, the manufacturing segment is expected to hold the largest market share during the forecast period. The manufacturing vertical, encompassing critical aspects such as production planning, quality control, work order management, and bill of materials (BOM), plays an indispensable role in the cloud ERP market. Manufacturing is a complex and highly competitive industry where efficiency, precision, and cost control are paramount. Cloud ERP systems tailored to this vertical revolutionize manufacturers' operations by providing end-to-end visibility and control over their processes. Cloud ERP systems offer sophisticated production planning modules that enable manufacturers to optimize their production schedules, allocate resources efficiently, and respond quickly to changing demand. These tools help balance supply and demand, reduce lead times, and minimize production bottlenecks. Manufacturers can make informed decisions based on real-time data, ensuring production runs smoothly and cost-effectively.

Moreover, quality control is a cornerstone of manufacturing, and cloud ERP solutions in this vertical provide robust quality management features. They facilitate real-time product quality monitoring, enabling manufacturers to identify and rectify defects at the early production stage. Quality data is captured and analyzed to improve processes continuously, enhance product quality, and ensure compliance with industry standards and regulations. Furthermore, work order management functionalities streamline the creation, assignment, and tracking of work orders on the shop floor. This ensures that production tasks are executed in a coordinated and efficient manner. Manufacturers can monitor work order progress, allocate resources optimally, and adjust to meet production targets.

Lastly, BOM management is critical for manufacturers, and cloud ERP systems offer sophisticated BOM functionality. These solutions allow manufacturers to create, update, and manage BOMs efficiently. Materials, components, or design changes can be tracked accurately, ensuring that products are built to the right specifications and inventory levels are managed effectively.

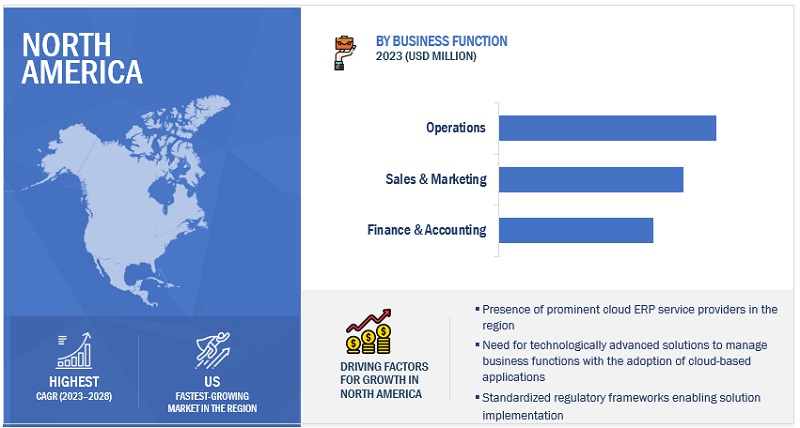

Based on business function, the finance & accounting segment holds the highest CAGR during the forecast period

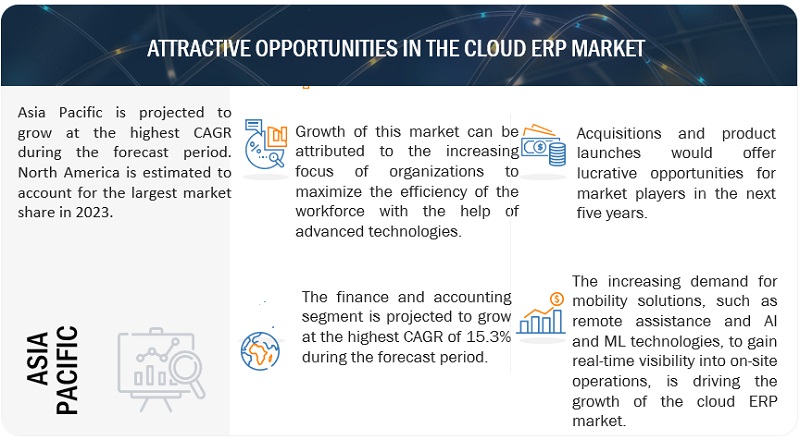

Based on the business function, the cloud ERP market is segmented into finance & accounting, sales & marketing, operations, and human resources. As per the business function, the finance & accounting segment is expected to hold the highest CAGR during the forecast period. The finance & accounting segment is a critical component of the cloud ERP market, serving as the financial backbone of organizations by providing comprehensive tools and functionalities to manage their financial operations efficiently. This segment encompasses several core components, including general ledger, accounts payable, accounts receivable, budgeting and forecasting, and cash flow management, all critical for sound financial management. These tools enable businesses to streamline financial processes, improve accuracy, and gain real-time visibility into their financial health.

The general ledger is the central repository for an organization's financial data, recording all transactions. Cloud ERP systems provide automation and real-time updates, ensuring that financial records are always up to date. This enables finance teams to maintain accurate books efficiently, generate financial statements, and comply with regulatory requirements. Further, accounts payable functionality streamlines managing and paying vendor invoices. Automation in AP reduces manual data entry, speeds up invoice approvals, and minimizes late payments, improving vendor relationships and cash management. Moreover, accounts receivable features help businesses manage customer invoices and collections efficiently. Cloud ERP solutions offer tools for invoice generation, tracking payments, and issuing reminders, which optimize cash flow and reduce the risk of bad debt.

The budgeting and forecasting capabilities in cloud ERP systems empower organizations to plan for the future. They enable finance teams to create detailed budgets, analyze variances, and forecast financial performance, helping businesses make informed decisions and allocate resources effectively. Effective cash flow management is critical for the financial health of any organization. Cloud ERP solutions provide real-time visibility into cash positions, helping companies monitor incoming and outgoing funds. This enables proactive decision-making and the ability to seize investment opportunities or manage liquidity in need.

The US market is projected to contribute the largest share of the cloud ERP market in North America.

North America is expected to lead the cloud ERP market in 2023. The US is estimated to account for the largest market share in North America in 2023, the cloud ERP market, and the trend is expected to continue until 2028. The cloud ERP market in the US plays a pivotal role in transforming how businesses manage their operations, streamline processes, and drive growth. Cloud ERP systems enable US businesses to modernize their operations by replacing legacy, on-premises software with flexible and scalable cloud-based solutions. This transition is essential in a tech-savvy nation such as the US, allowing companies to keep pace with rapidly evolving technology trends. Cloud ERP solutions reduce upfront capital expenses associated with on-premises hardware and maintenance. This cost-effectiveness is particularly valuable in the country's business landscape, where companies constantly seek ways to maximize efficiency and minimize costs. US businesses face stringent regulatory requirements, and cloud ERP providers invest heavily in security measures and compliance certifications. This ensures that companies can meet legal obligations while safeguarding sensitive data.

In conclusion, the cloud ERP market in the US is instrumental in driving digital transformation, cost efficiency, and competitiveness across various industries. It successfully empowers businesses to navigate the dynamic and technology-driven US market while meeting compliance standards and fostering innovation, ultimately contributing significantly to the nation's economic growth.

Key Market Players

The cloud ERP market is dominated by a few globally established players such as Oracle (US), Microsoft (US), SAP (Germany), Workday (US), Infor (US), IFS (Sweden), Plex Systems (US), Epicor Software Corporation (US), Sage Group (UK), and Ramco Systems (India) among others, are the key vendors that secured cloud ERP contracts in last few years. These vendors can bring global processes and execution expertise; the local players only have local expertise. Driven by increased disposable incomes, easy access to knowledge, and fast adoption of technological products, buyers are more willing to experiment/test new things in the cloud ERP market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments Covered |

Component, Business Function, Deployment Mode, Organization Size, Vertical, and Region |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies Covered |

Some of the significant cloud ERP market vendors are Oracle (US), Microsoft (US), SAP (Germany), Workday (US), Infor (US), IFS (Sweden), Plex Systems (US), Epicor Software Corporation (US), Sage Group (UK), Ramco Systems (India), QAD (US), Tally Solutions (India), Odoo (Belgium), SYSPRO (South Africa), Tyler Technologies (US). |

This research report categorizes the cloud ERP market based on components, business functions, verticals, organization sizes, deployment modes, and regions.

Based on the Component:

- Solutions

- Services

Based on the Business Function:

- Finance & Accounting

- Sales & Marketing

- Operations

- Human Resources

Based on the Organization Size:

- Large Enterprises

- SMEs

Based on the Deployment Mode:

- Public Cloud

- Private Cloud

Based on the Vertical:

- BFSI

- IT & Telecom

- Government & Defense

- Retail

- Manufacturing

- Education

- Healthcare & Life Sciences

- Other Verticals

Based on the Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In September 2023, Oracle announced the Fusion Data Intelligence Platform, a next-generation data, analytics, and AI platform that would help Oracle Fusion Cloud Applications customers achieve better business outcomes by combining data-driven insights with intelligent decisions and actions. This new platform, an evolution of the Oracle Fusion Analytics Warehouse product, would deliver business data-as-a-service with automated data pipelines, 360-degree data models for key business entities, rich interactive analytics, AI/ML models, and intelligent applications.

- In July 2023, Microsoft recently introduced Dynamics 365 Copilot, the world’s first AI copilot integrated into CRM and ERP applications in the cloud, designed to augment workflows, uncover insights, identify the subsequent best actions, and reduce time spent on administrative tasks. Organizations relying on on-premise applications would struggle to compete with peers embracing these AI-powered technologies in the cloud.

- In February 2023, Infor introduced an ERP software solution for manufacturers in complex, make-to-order, and engineer-to-order industries. Infor LX was developed by Infor, a global enterprise software company known for its robust functionality tailored to meet the unique requirements of manufacturing businesses. Infor LX covered many business functions, including financial management, manufacturing operations, supply chain management, CRM, HCM, and more. This breadth of functionality enables organizations to manage various operations within a single integrated system.

Frequently Asked Questions (FAQ):

What is Cloud ERP?

According to NetSuite, the cloud ERP system is a setup of enterprise resource planning software and tools hosted and managed offsite in the cloud. This system offers various functions, such as finance and accounting, project management, inventory and order management, and sales and marketing. It also provides a centralized system with backup and disaster recovery functionalities. The ERP system integrates all these processes in one end-to-end system to streamline various business processes and information across the organization. Software as a Service (SaaS) ERP is enterprises’ most popular deployment model.

According to SAP, Cloud ERP is enterprise resource planning software delivered over the Internet. It gives companies access to mission-critical applications at any time, from any location, and the ability to scale and innovate. As per SAP, businesses that choose cloud ERP can fast-track their transformation efforts by having immediate, ongoing access to the tools that can drive change and the flexibility and power to leverage them as opportunities arise.

Which country is an early adopter of Cloud ERP?

The US is an early adopter of Cloud ERP.

Who are vital clients adopting Cloud ERP?

Key clients adopting the cloud ERP market include: -

- Government Agencies

- Resellers and Distributors

- Research Organizations

- Corporates

- Administrators

Which are the key vendors exploring Cloud ERP?

Some of the significant cloud ERP vendors are Oracle (US), Microsoft (US), SAP (Germany), Workday (US), Infor (US), IFS (Sweden), Plex Systems (US), Epicor Software Corporation (US), Sage Group (UK), Ramco Systems (India).

What is the total CAGR expected to be recorded for the cloud ERP market from 2023 to 2028?

The market is expected to record a CAGR of 12.6% from 2023-2028

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

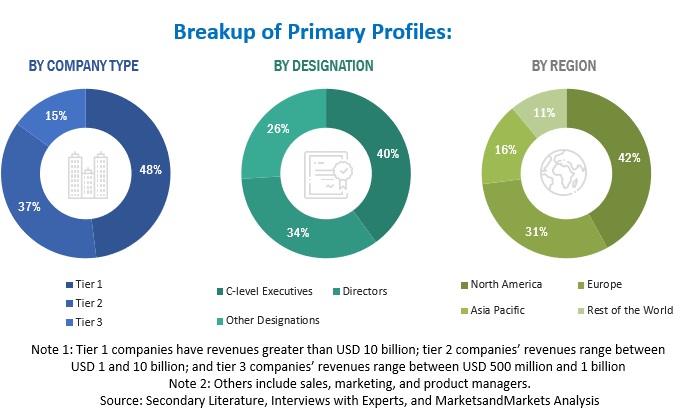

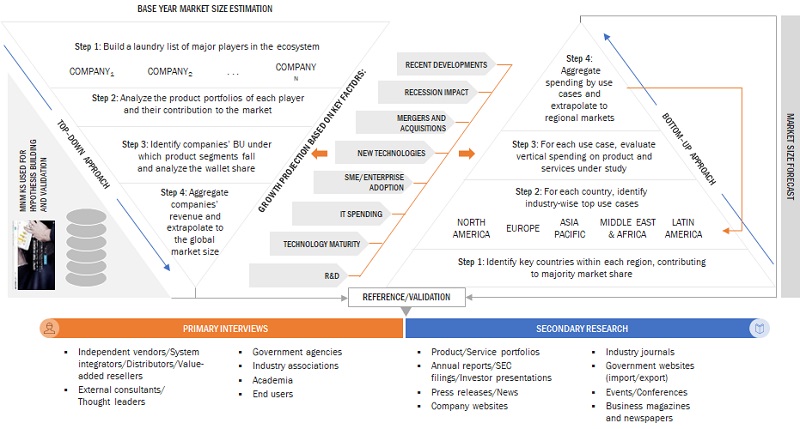

This research study involved extensive secondary sources, directories, and paid databases to identify and collect information useful for this technical, market-oriented, and commercial study of the cloud ERP market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the market prospects.

Secondary Research

The market size of companies offering cloud ERP solutions was determined based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of the major companies in the ecosystem and rating the companies according to their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from major companies and organizations operating in the cloud ERP market.

After the complete market engineering (including calculations for market statistics, market breakups, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also undertaken to identify the segmentation types, industry trends, the competitive landscape of the cloud ERP market players, and key market dynamics such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

To know about the assumptions considered for the study, download the pdf brochure

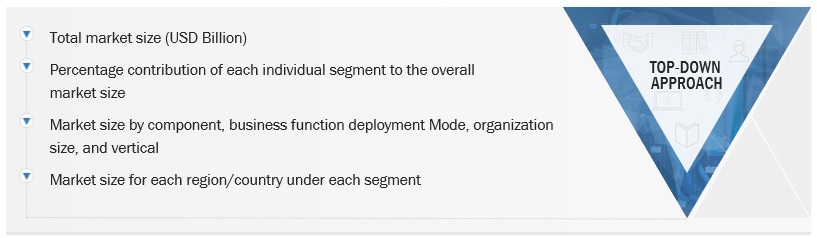

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and forecast the cloud ERP market and other dependent submarkets. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, this study determined and confirmed the exact value of the overall parent market size. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

Top Down and Bottom Up Approach of Cloud ERP Market

To know about the assumptions considered for the study, Request for Free Sample Report

The top-down and bottom-up approaches were used to estimate and validate the size of the cloud ERP market and various other dependent subsegments. The research methodology used to estimate the market size included the following:

Key players in the market were identified through secondary research, and their revenue contributions in respective countries were determined through primary and secondary research.

This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as Chief Executive Officers (CEOs), VPs, directors, and marketing executives.

All percentage splits and breakups were determined using secondary sources and verified through primary sources.

Top Down Approach of Cloud ERP Market

Data Triangulation

After arriving at the overall market size, the market was split into several segments and subsegments—using the market size estimation processes as explained above. Where applicable, data triangulation and market breakdown procedures were employed to complete the overall market engineering process and determine each market segment's and subsegment's exact statistics. The data was triangulated by studying various factors and trends from government agencies’ demand and supply sides.

Market Definition

Cloud ERP is a modern business management software solution that leverages cloud computing to deliver essential tools and functions for various business operations. It provides real-time internet access to data and applications, eliminating the need for on-premises hardware and infrastructure. Cloud ERP centralizes and integrates core functions such as accounting, inventory management, human resources, and customer relationship management, making it easier for organizations to streamline processes, improve decision-making, and adapt to evolving business needs more agile and cost-effectively.

Key Stakeholders

- Cloud Service Providers (CSPs)

- ERP providers (MSPs)

- Technology partners

- Third-party providers

- Consultants/Consultancies/Advisory firms

- Support and maintenance service providers

- Resellers and distributors

- System Integrators (SIs)

- Technology providers

- Governments and standardization bodies

- Enterprise users

Report Objectives

- To define, describe, and forecast the cloud ERP market based on component (solutions and services), business function, deployment mode, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the recession impact on components, verticals, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), the Middle East & and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the cloud ERP market

- To profile the key players in the market and comprehensively analyze their core competencies in each microsegment

- To analyze the competitive developments, such as agreements, alliances, joint ventures, and mergers and acquisitions, in the cloud ERP market

Available Customizations

With the given market data, MarketsandMarkets offers customizations per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- The product matrix provides a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the cloud ERP market

Company Information

- Detailed analysis and profiling of five additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud ERP Market