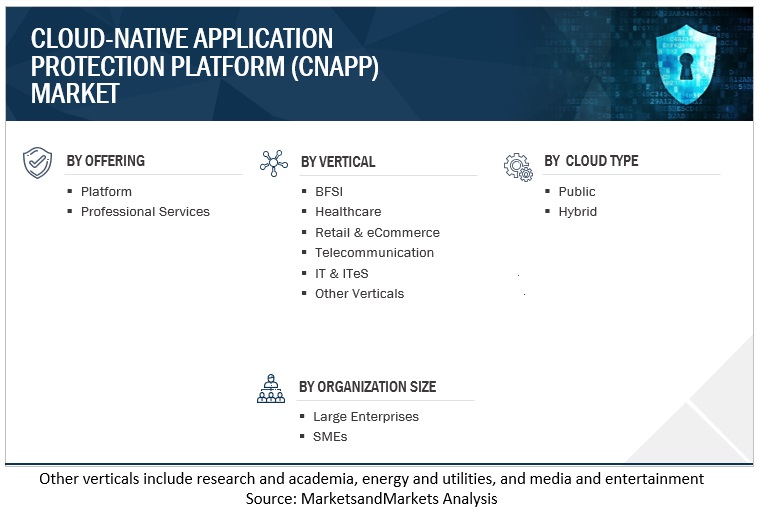

Cloud-native Application Protection Platform (CNAPP) Market by Offering (Platform, Professional Services), Cloud Type (Public Cloud, Hybrid Cloud), Organization Size, Vertical (BFSI, Healthcare, IT and ITeS) and Region - Global Forecast to 2027

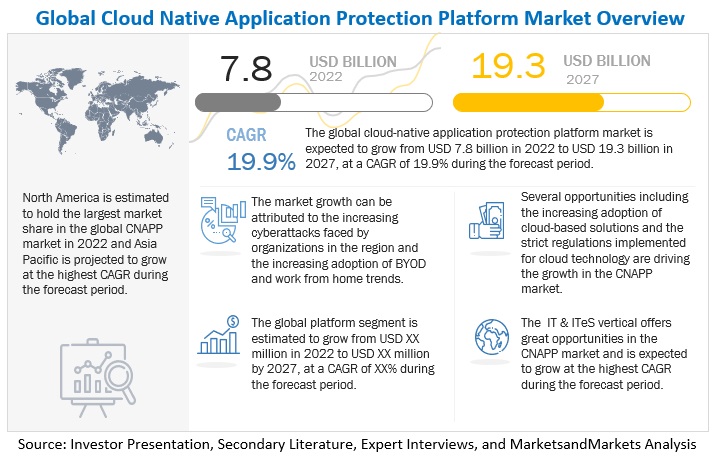

[208 Pages Report] The global CNAPP market is projected to grow from an estimated values of USD 7.8 billion in 2022 to USD 19.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 19.9 % from 2022 to 2027. There has been an increase in cyber threats in the recent years. This factor is expected to contribute to the growth of the CNAPP market. There is a significant demand for CNAPP across verticals, such as BFSI, healthcare, retail and e-commerce, telecommunication, and others.

To know about the assumptions considered for the study, Request for Free Sample Report

Cloud-Native Application Protection Platform Market Dynamics

Driver: Adoption of BYOD and remote work options among SMEs

Organizations utilizing the BYOD concept with cloud-based systems enable employees to work remotely while using the office network. With the increasing popularity of public cloud offerings and BYOD policies, enterprises are eventually moving to the cloud deployment model. Organizations are rapidly adopting BYOD and work-from-home initiatives. Remote work helps companies avoid loss of productivity and protects public health. The health and economic crisis related to the COVID-19 pandemic and the required physical distancing measures force many firms to introduce work-from-home on a large scale. This may further catalyze wider adoption of teleworking practices after the crisis, with a wide range of impacts and uncertain net effects on productivity and other indicators. Cloud technologies help implement the work-from-home trend effectively. Also, a significant portion of SMEs is adopting the BYOD trend to reduce initial infrastructure expenses. Such high dependence on the BYOD and WFH trends urges organizations to secure their office cloud servers to enhance their security and maintain business continuity. This factor has enhanced the adoption of CNAPP solutions.

Restraint: Limited skilled expertise to implement and maintain CNAPP

The implementation and maintenance of CNAPP solutions require the necessary technical skills and knowledge. However, in recent years, organizations have been hiring security executives that lack the required expertise and knowledge. According to a report by Forbes in 2020, The Cloud Talent Drought Continues, advanced cloud and security skills are in higher demand than ever before; however, there is a significant lack of qualified, skilled professionals to support this movement, especially in non-tech-related industries. During the talent drought within the IT market that is affecting enterprise organizations, causing competitive disadvantages, security issues, and compliance risk, the pandemic has further accelerated the demand. According to the Challenges in Cloud Transformation report by Logic works in 2020, 86% of IT leaders thought a shortage of cloud talent would slow down cloud projects in 2020. According to an article by the Wall Street Journal in 2021, between 2017 and 2020, the annual postings of cloud jobs grew more than 90%, which is four times the rate of tech job growth overall in the same period, according to labor and economics research firm Emsi. The growing demand and lack of skilled professionals in the cloud technology sector is a restraint in deploying CNAPP solutions.

Opportunity: Increase in use of cloud-based solutions

Cloud-based solutions are increasingly being deployed across verticals. Cloud-based solutions support more efficient working and enable emerging capabilities in machine learning and artificial intelligence. Traditional security tools and approaches were designed to protect on-premises data centers and endpoints, not cloud-native apps and services. With the shift to cloud technologies, security teams need to be able to identify security issues and vulnerabilities early in development, speed up remediation and provide consistent security. According to the Flexera 2022 State of the Cloud Report, 57% of organizations are migrating more workloads to the cloud. The consumption of cloud, whether public, private, or a hybrid approach, continued to expand across all industry verticals and disrupt the ways in which IT provisions, manages, and orchestrates resources. In 2022, 53% of small and medium-sized businesses are now spending over USD 1.2 million annually, up from 38% in 2021. CNAPP provides an integrated set of security and compliance capabilities to secure cloud-native applications across development and production. Factors like cost optimization, flexible computing power, and lower cost are contributing to the increase in the use of cloud-based solutions, thus also driving the use of CNAPP solutions.

Challenge: Complexities in use of CNAPP solutions

In recent years, there has been a significant shift to the use of cloud services, which has given organizations unprecedented flexibility and scalability, enabling them to move forward with digital transformation efforts. For some organizations, it has also led to complex strategies in the deployment of the cloud. The reliance on multiple cloud vendors to run the entire IT infrastructure and the multiple/hybrid cloud strategy can result in complexities and challenges. This has also resulted in increased complexity in deploying CNAPP solutions. As cloud environments become more complex, the challenge of protecting data and applications in the cloud is even greater, and the controlling costs can also increase. As microservices expand with the increase in cloud services, the complexity of managing them also increases. Moreover, the cloud models are available in various service models such as Software-as-a-Service, Platform-as-a-Service, and Infrastructure-as-a-Service. Organizations face a crucial challenge when selecting the right infrastructure to deploy cloud security solutions as per the requirements. The more complex a cloud strategy becomes, the more difficult it becomes to determine the return on investment from the various services in use and to deploy the CNAPP solutions.

Cloud-native Application Protection Platform Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

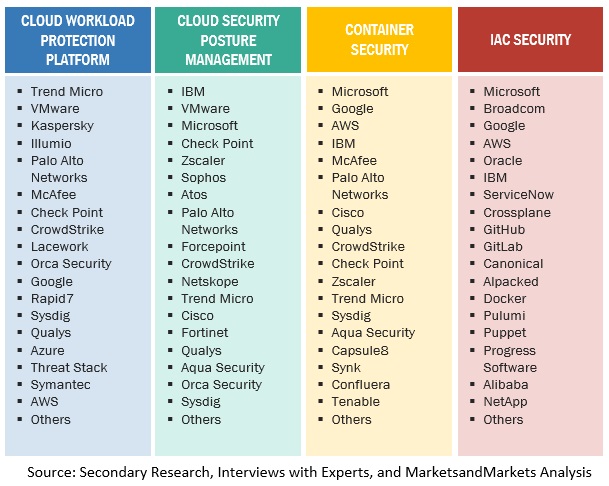

By offering, platform to grow at a higher CAGR during the forecast period

A CNAPP is an all-in-one cloud native software that simplifies monitoring, detecting, and acting on potential cloud security threats and vulnerabilities. CNAPP combines multiple tools and capabilities into a single software solution, minimizing complexity. CNAPP offers end-to-end cloud and application security throughout the CI/CD application lifecycle, from development to production. A CNAPP typically includes many tools to help scan and protect the cloud infrastructure and services. CNAPP solutions provide cloud application security tools, with the features added being vendor specific. Some of the CNAPP features include Cloud Security Posture Management (CSPM), Infrastructure-as-Code (IaC) Scanning, Cloud Workload Protection Platform (CWPP), and Cloud Infrastructure Entitlement Management (CIEM). The benefits of CNAPP include preventing cybersecurity threats by decreasing the number of cloud misconfigurations, providing combined and unique visibility of risks, allowing for prompt response to threats, and reducing complexity by eliminating the need to run and maintain multiple cloud security tools.

By organization size, large enterprises to hold a larger market size during the forecast period

Large enterprises are increasingly adopting CNAPP platform and the related professional services. The large enterprises have increasingly started deploying cloud-based solutions over on-premises solutions. The Covid-19 pandemic has accelerated the adoption of the BYOD and work from home trend, which has increased risks with the usage of cloud based solutions. This factor has led to market growth in the use of CNAPP. Large enterprises deploy cloud-based solutions due to high flexibility, and low maintenance costs. As businesses are moving towards using cloud for storing information, the requirement for CNAPP is also increasing. The increasing cyberattacks faced by large organizations is prompting them to adopt CNAPP platform and the associated services. For example, in the CNAPP market, Fortinet provides FortiCNP. FortiCNP simplifies cloud security operations and enables security teams to take actions by utilizing deep integrations with a broad range of cloud security products, services, and technologies.

By vertical, BFSI to hold a larger market size during the forecast period

The financial institutions are increasingly deploying cloud based solutions because of more convenience and reduced maintenance costs. Cloud deployment provides increased flexibility. The total costs of usage are reduced while using cloud based solutions as the costs related to deployment and maintenance is lesser than the on-premises counterparts. The pandemic has further prompted organizations to shift their data storage to the cloud environment. There is a growing need for security solutions in the BFSI industry to combat the growing physical and cyberattacks on the critical infrastructures that are taking place due to the increasing adoption of BYOD and Work from Home (WFH) trends. Additionally, financial institutions need to be compliant with several regulations and laws, including the PIPEDA and PCI DSS. This has further contributed to the growing use of CNAPP. CNAPP is a requirement by financial institutions to secure cloud resources and thus CNAPP has a significant application in the BFSI industry.

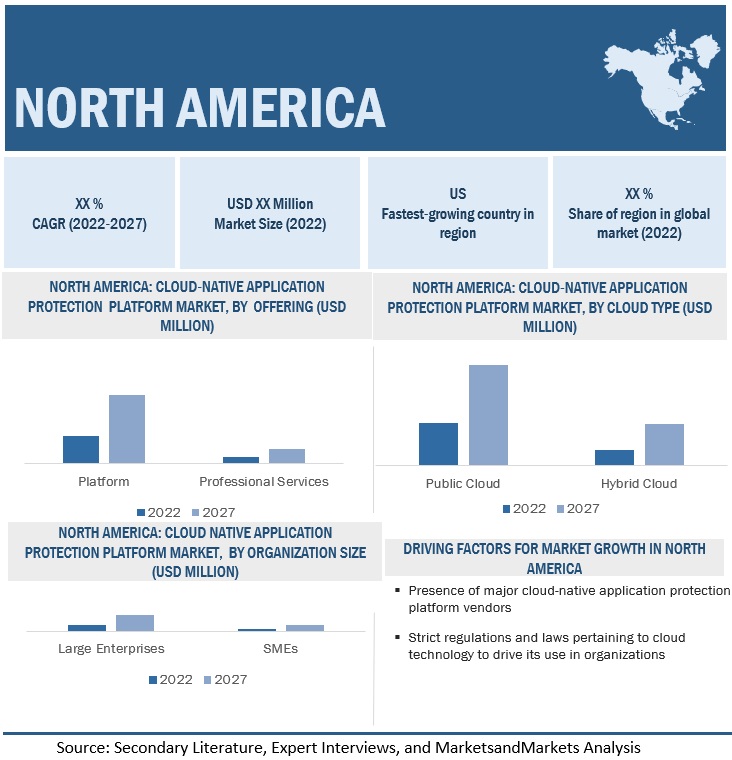

By region, North America to account for the largest market size during the forecast period

North America is expected to be the largest contributor to the global CNAPP market in terms of market share. It is one of the most advanced regions regarding security technology adoption and infrastructure. The region has recently experienced increasing digitalization and cloud technology adoption. IT spending on system infrastructure is slowly shifting from traditional solutions to cloud. Organizations are rapidly using cloud services for new initiatives or to replace existing systems. The regional presence of key industry players offering CNAPP contributes to driving the market growth in North America. The increasing cyberattacks witnessed in the region contribute to the growth of the CNAPP market in the region. According to the Internet Crime Report 2021 by the FBI, IC3 continued to receive a record number of complaints from the American public; 8,47,376 complaints were reported during the year, which was a 7% increase from 2020, with potential losses exceeding USD 6.9 billion. The strengthening of safety standards and regulations is another factor contributing to the growth of the CNAPP market in the region. The Cybersecurity and Infrastructure Security Agency (CISA) leads the national effort to understand, manage, and reduce cyber and physical infrastructure risks. It helps connect industry and government stakeholders with resources, analyses, and tools to help them build cyber, communications, physical security, and resilience. The PIPEDA applies to private sector organizations across Canada that collect, use, or disclose personal information during commercial activity. Organizations covered by the PIPEDA must generally obtain an individual’s consent when they collect, use, or disclose that individual’s personal information. People have the right to access their personal information held by an organization. The countries analyzed in the North America region include the US and Canada.

Key Market Players

The major vendors in the CNAPP market include Check Point (Israel), Trend Micro (Japan), Palo Alto Networks (US), CrowdStrike (US), Fortinet (US), Forcepoint (US), Proofpoint (US), Radware (Israel), Zscaler (US), Sophos (UK), Aqua Security (Israel), Cequence Security (US), Illumio (US), Runecast (UK), Data Theorem (US), MetaSecure (US), Tigera (US), Orca Security (US), Skyhigh Security (US), Caveonix (US), Wiz.io (US), Ermetic (US), Banyan Cloud (US), and Accuknox (US).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

| Market size available for years | 2020–2027 |

| Base year considered | 2021 |

| Forecast period | 2022–2027 |

| Forecast units | Value (USD Million/ Billion) |

| Segments covered | Offering, Cloud Type, Organization Size, Vertical, and Region |

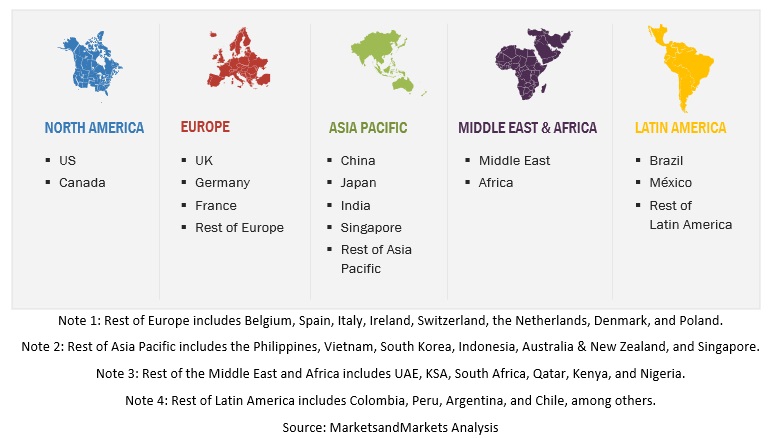

| Geographies covered | North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

| Major companies covered | Check Point (Israel), Trend Micro (Japan), Palo Alto Networks (US), CrowdStrike (US), Fortinet (US), Forcepoint (US), Proofpoint (US), Radware (Israel), Zscaler (US), Sophos (UK), Aqua Security (Israel), Cequence Security (US), Illumio (US), Runecast (UK), Data Theorem (US), MetaSecure (US), Tigera (US), Orca Security (US), Skyhigh Security (US), Caveonix (US), Wiz.io (US), Ermetic (US), Banyan Cloud (US), and AccuKnox (US) |

Market Segmentation

Recent Developments

- In June 2022, Zscaler announced the launch of its Posture Control solution designed to give organizations unified CNAPP functionality to secure cloud workloads. Integrated into the Zscaler Zero Trust Exchange, the Posture Control solution enables DevOps and security teams to efficiently prioritize and remediate risks in cloud-native applications earlier in the development lifecycle. The solution correlates and prioritizes risks, such as unpatched vulnerabilities in containers and VMs, excessive entitlements and permissions, and cloud service misconfigurations.

- In September 2022, Zscaler announced the acquisition of ShiftRight, a leader in closed-loop security workflow automation. ShiftRight’s workflow automation technology is integrated into the Zscaler Zero Trust Exchange cloud security platform to automate security management for the growing influx of risks and incidents.

- In March 2022, Radware announced that it is expanding its partnership with Presidio, a global digital services and solutions provider that accelerates business transformation through security technology modernization. To protect its customers in on-premises, cloud, or hybrid environments, Presidio is adding Radware’s application and API security solutions, bot manager, DDoS protection, and Cloud Native Protector to its cybersecurity suite.

Frequently Asked Questions (FAQ):

What is the definition of CNAPP?

According to MarketsandMarkets, CNAPP combines the capabilities of cloud security components such as CSPM, CWPP, Kubernetes Security Posture Management (KSPM), API discovery and protection, and serverless security into one single platform.

What is the projected market value of the global CNAPP market?

The global CNAPP market is projected to grow from an estimated value of USD 7.8 billion in 2022 to USD 19.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 19.9 % from 2022 to 2027.

Who are the key companies influencing market growth?

Check Point, Trend Micro, Palo Alto Networks, CrowdStrike, etc., are the leaders in the CNAPP market, recognized as the star players. These companies account for a major share of the CNAPP market. They offer wide solutions related to CNAPP. These vendors offer customized solutions per user requirements and are adopting growth strategies to consistently achieve the desired growth and make their presence in the market.

Which emerging startups/SMEs are significantly supporting market growth?

Skyhigh Security, Caveonix, Wiz.io, Ermetic, and Banyan Cloud are some emerging startups that nurture market growth with their technical skills and expertise. These startups focus on developing product/service portfolios and bringing innovations to the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

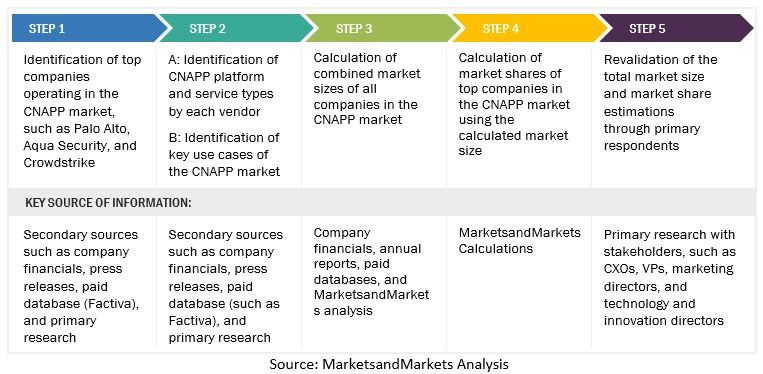

The study involved major activities in estimating the current market size of the CNAPP market. Exhaustive secondary research was done to collect information on the CNAPP industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down, bottom-up, etc., were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub-segments of the CNAPP market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of CNAPP vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain key information related to the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

The factors considered for estimating the regional-level market size include GDP growth, ICT security spending, recent market developments, technology adoption of CNAPP, and market ranking analysis of major CNAPP vendors.

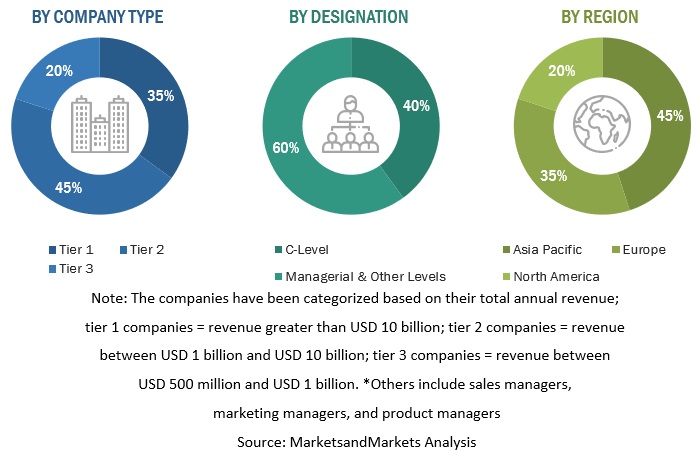

Primary Research

Various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report in the primary research process. The primary sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the CNAPP market.

Following is the breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To know about the assumptions considered for the study, Request for Free Sample Report

Multiple approaches were adopted to estimate and forecast the size of the CNAPP market. In the market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and sub-segments listed in this report. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list key information/insights throughout the report. This entire procedure included the study of the annual and financial reports of top market players and extensive interviews for key insights from industry leaders, such as CEOs, VPs, directors, and marketing executives. All percentage splits and breakups were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes, as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segments. The data was triangulated by studying various factors and trends from the demand and supply sides.

Report Objectives

- To describe and forecast the global cloud-native application protection platform (CNAPP) market by offering, cloud type, organization size, vertical, and region

- To forecast the market size of five main regions: North America, Europe, the Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape details of major players

- To profile the key players of the CNAPP market and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as mergers and acquisitions (M&A), new product developments, partnerships, and collaborations in the market

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Cloud Infrastructure Entitlement Management Market & Its Impact on Cloud Native Application Protection Platform Market

Cloud Infrastructure Entitlement Management (CIEM) is focused on managing access and permissions to cloud resources and ensuring that users only have access to the resources they need to do their jobs. It involves identifying and analyzing user permissions, setting policies for access control, and monitoring activity to detect any unauthorized access or changes.

CIEM solutions are becoming increasingly important as more organizations move their applications and data to the cloud. CIEM solutions provide visibility and control over access to cloud resources, which is critical for maintaining security and compliance. As such, CIEM solutions are expected to become a standard part of the cloud security toolkit for many organizations.

The growing adoption of CIEM solutions is likely to have a positive impact on the Cloud Native Application Protection Platform (CNAPP) market. As more organizations become adept at managing access to cloud resources with CIEM solutions, they will be able to better identify potential security risks and vulnerabilities. This can help inform the development of CNAPP policies and strategies for securing cloud-native applications and services.

Furthermore, CIEM solutions can help ensure that only authorized users have access to sensitive data and applications. This reduces the risk of unauthorized access and data breaches, which are among the most significant security threats faced by organizations today. This can also help reduce the impact of security incidents and make it easier to respond to security events.

Futuristic Growth Use-Cases of Cloud Infrastructure Entitlement Management Market

- Zero-Trust Security: CIEM solutions can be used to implement a zero-trust security model, where all access requests are verified and authenticated before access is granted. This can help reduce the risk of unauthorized access and data breaches, which are among the most significant security threats faced by organizations today.

- Automated Compliance: CIEM solutions can automate the process of monitoring and reporting on compliance with security policies and regulations. This can help organizations to achieve and maintain compliance with a range of industry-specific regulations and standards, such as HIPAA, PCI DSS, and GDPR.

- Data Governance: CIEM solutions can help organizations to enforce data governance policies and ensure that sensitive data is only accessed by authorized personnel. This can help prevent data leaks, reduce the risk of insider threats, and ensure compliance with data privacy regulations.

- Identity and Access Management (IAM) Integration: CIEM solutions can be integrated with IAM systems to provide a comprehensive view of user access and permissions across cloud resources. This can help organizations to manage user access more efficiently and effectively, reducing the risk of security incidents and enabling rapid response to security events.

- DevOps Integration: CIEM solutions can be integrated into DevOps processes to ensure that security policies are built into the development and deployment of cloud-native applications. This can help reduce the risk of security vulnerabilities and ensure that cloud applications are secure by design.

Top Players in Cloud Infrastructure Entitlement Management Market

- Okta

- IBM

- SailPoint

- CyberArk

- Microsoft

- OneLogin

- Symantec

Industries Getting Impacted in Future by Cloud Infrastructure Entitlement Management Market

- Healthcare: Healthcare organizations are responsible for managing a large amount of sensitive data, including patient records and medical information. CIEM solutions can help healthcare organizations manage access to this data and ensure compliance with regulations such as HIPAA.

- Financial Services: Financial institutions are responsible for managing large amounts of sensitive financial data, including customer account information and transaction records. CIEM solutions can help financial organizations manage access to this data and ensure compliance with regulations such as PCI DSS.

- Retail: Retail organizations are responsible for managing customer data, including personal information and payment details. CIEM solutions can help retail organizations manage access to this data and ensure compliance with regulations such as GDPR.

- Manufacturing: Manufacturing organizations are responsible for managing data related to production processes and supply chain operations. CIEM solutions can help manufacturing organizations manage access to this data and ensure compliance with regulations such as ISO 27001.

- Education: Educational institutions are responsible for managing student data, including academic records and personal information. CIEM solutions can help educational institutions manage access to this data and ensure compliance with regulations such as FERPA.

New Business Opportunities in Cloud Infrastructure Entitlement Management Market

- CIEM Consulting Services: Many organizations are still new to cloud infrastructure entitlement management, and they may not have the internal expertise to implement and manage a CIEM solution. Consulting services that offer guidance and support for CIEM implementation and management can be in high demand.

- CIEM Managed Services: Some organizations may prefer to outsource the management of their CIEM solution to a third-party provider. Managed services that offer ongoing management and support for CIEM solutions can be a valuable business opportunity.

- CIEM Integration Services: CIEM solutions may need to be integrated with other systems and tools, such as identity and access management (IAM) systems or security information and event management (SIEM) solutions. Integration services that help organizations integrate CIEM solutions with their existing technology stack can be in high demand.

- CIEM Software Development: CIEM solutions require specialized software development expertise. Software development firms that specialize in CIEM solutions can be in high demand as organizations look to implement and customize CIEM solutions.

- CIEM Analytics and Reporting: CIEM solutions generate a significant amount of data related to user access and permissions. Analytics and reporting services that help organizations make sense of this data can be a valuable business opportunity.

Key Challenges for Growing Cloud Infrastructure Entitlement Management Business in the Future Market

- Balancing Security and User Convenience: One of the key challenges in CIEM is to strike a balance between security and user convenience. A CIEM solution that is too restrictive may discourage users from adopting cloud services, while a solution that is too permissive may put sensitive data at risk.

- Meeting Regulatory Requirements: Organizations in heavily regulated industries such as finance, healthcare, and government may face specific regulatory requirements related to data privacy and security. CIEM providers will need to ensure that their solutions comply with these regulations, which can be complex and time-consuming.

- Cloud Vendor Compatibility: As cloud providers continue to expand their offerings, CIEM solutions will need to be compatible with a growing number of cloud platforms and services. This can be challenging for CIEM providers as they seek to keep pace with evolving cloud architectures and API integrations.

- Addressing Shadow IT: Shadow IT refers to the use of cloud services by employees without the knowledge or approval of the IT department. CIEM solutions will need to address this challenge by providing visibility into all cloud services being used across the organization and ensuring that only authorized users have access to them.

- Keeping Up with Emerging Threats: Cybersecurity threats are constantly evolving, and CIEM providers will need to keep pace with emerging threats to ensure that their solutions remain effective in protecting against data breaches and other cyber threats.

Speak to our Analyst today to know more about the "Cloud Infrastructure Entitlement Management Market".

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud-native Application Protection Platform (CNAPP) Market