Cloud Native Storage Market by Offering (Solutions and Services), Deployment Mode (Public and Private), Application (Backup & Recovery, Content Delivery & Distribution), Vertical (BFSI, Retail & Consumer Goods) and Region - Global Forecast to 2028

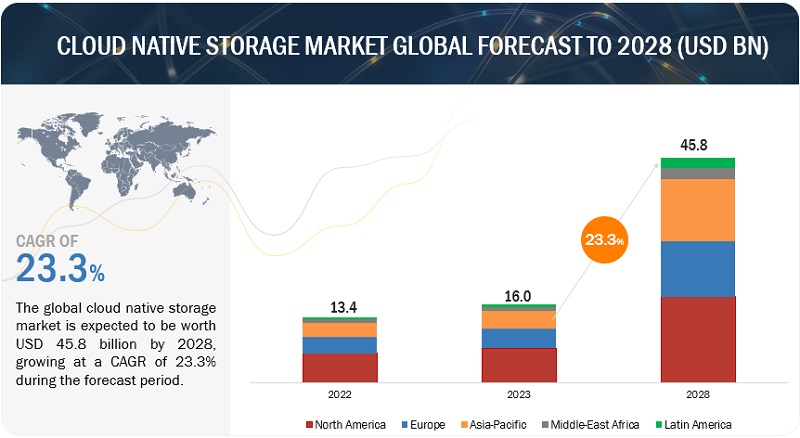

[296 Pages Report] The global cloud native storage market size is anticipated to grow at a CAGR of 23.3% during the forecast period, from USD 16.0 billion in 2023 to USD 45.8 billion by 2028. Automation and orchestration capabilities became essential for managing storage resources in dynamic cloud-native environments. Tools that could automatically provision, scale, and manage storage resources were in high demand.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Cloud Native Storage Market Dynamics

Drivers: Increase in data volume across enterprises

The automation of application updates has ushered in a new era of agility and efficiency in the world of cloud computing. As applications constantly evolve to meet user demands and adapt to changing environments, the need for cloud-native storage solutions has become increasingly apparent. Cloud-native storage is designed to seamlessly integrate with modern cloud-native applications' dynamic and automated nature. It offers scalability, resilience, and performance characteristics that traditional storage systems often struggle to provide in rapidly changing landscapes.

Restraints: Loss of data due to persistent data storing

Cloud-native storage solutions are designed to provide scalability, resilience, and flexibility to modern applications in cloud environments. However, one critical concern that needs to be addressed is the potential loss of data due to persistent data sorting. When data is constantly moved, distributed, or reorganized within a cloud-native storage system, there is a risk of inadvertent data loss or corruption. This can occur during data migrations, upgrades, or other maintenance activities. To mitigate this risk, it is crucial for organizations to implement robust data management strategies that include regular backups, versioning, and data integrity checks.

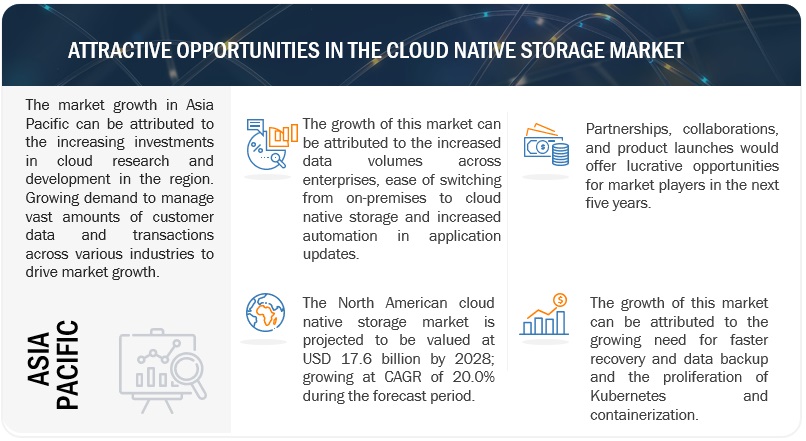

Opportunities: Proliferation of Kubernetes and containerization

Kubernetes adoption is increasing rapidly, making it more important to address ongoing operations and management at scale. Huge numbers of stateful applications mean that the management burden for applications is expected to grow along with the capacity needed to support them. Organizations need tools to help mitigate Kubernetes-based workloads’ complexity to prepare for ongoing operations and scalability. Several companies are implementing containerization to enhance their application’s portability and data from across computing environments. The containers help virtualize storage and other computing resources at the OS level and help developers in the logical isolation of applications. Cloud storage providers, including IBM, AWS, Alibaba Cloud, Microsoft, HPE, Dell, and Google, have added container technology in their cloud storage and cloud native storage solutions to enable persistent storage, with which running applications can easily consume the data on demand. Thus, containers combined with DevOps and cloud storage completely modernize application development, which is expected to create opportunities for cloud native storage providers.

Challenges: Lack of visibility in a distributed system

Cloud-native storage solutions, a significant challenge arises in the form of limited visibility. Unlike traditional on-premises storage setups where administrators enjoy a centralized view of their storage infrastructure, cloud-native environments scatter data across a multitude of containers, microservices, and cloud instances. This decentralized nature makes it exceedingly difficult to obtain a comprehensive understanding of storage performance, health, and resource utilization. Consequently, this lack of visibility can impede the timely resolution of issues, result in inefficient resource allocation, and complicate the identification and management of problems.

Cloud Native Storage Market Ecosystem

By Application, the Backup and Recovery segment holds the largest market size during the forecast period.

Backup and recovery play a crucial role in safeguarding data and ensuring business continuity. These applications are purpose-built to address the unique challenges of modern, dynamic, and often distributed IT environments. By seamlessly integrating with cloud-native technologies and containerized workloads, they provide a layer of resilience that ensures data is protected against loss, corruption, or disasters. These solutions enable organizations to efficiently create backups, perform granular recoveries, and maintain data integrity, thereby supporting the reliable and uninterrupted operation of cloud-native applications and services.

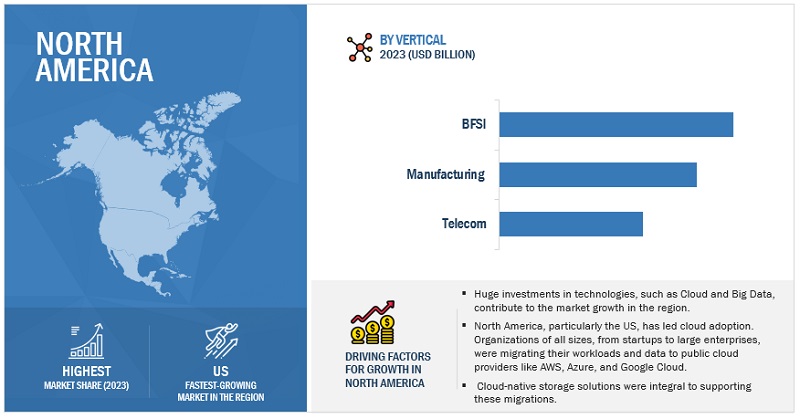

By Vertical, the BFSI segment holds the largest market size during the forecast period.

Cloud-native storage solutions for the Banking, Financial Services, and Insurance (BFSI) sector are designed to seamlessly integrate with modern cloud infrastructure, providing secure, scalable, and highly available data storage and management capabilities. These solutions leverage containerization, microservices, and orchestration technologies to ensure rapid deployment, efficient resource utilization, and flexibility in handling the diverse data needs of BFSI organizations. With built-in data encryption, compliance controls, and data replication features, cloud-native storage in BFSI ensures data integrity, disaster recovery, and regulatory compliance while enabling agile and cost-effective operations in the ever-evolving financial landscape.

North America to hold the largest market size during the forecast period.

The geographic analysis of the cloud native storage market is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Cloud-native storage solutions in North America have rapidly evolved to meet the dynamic demands of modern applications and infrastructure. With a focus on scalability, agility, and resilience, these technologies leverage cloud-based platforms and containerization to efficiently store, manage, and access data. From popular solutions like Amazon EBS and S3 in AWS to Azure Blob Storage and Google Cloud Storage in GCP, organizations across North America are embracing these cloud-native storage options to ensure seamless data handling, high availability, and disaster recovery capabilities, enabling them to thrive in an increasingly digital and data-driven landscape.

Key Market Players

Some of the major cloud native storage market vendors are Microsoft (US), IBM (US), AWS (US), Google (US), Alibaba Cloud (China), VMWare (US), Huawei (China), Citrix (US), Scality (US), Splunk (US), Linbit (US), Rackspace (US), and Robin.Io (US) among others.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2017–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Million/Billion (USD) |

|

Segments Covered |

Offering, Application, Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), AWS (US), Google (US), Alibaba Cloud (China), VMWare (US), Huawei (China), Citrix (US), Tencent Cloud (China), Scality (US), Splunk (US), Linbit (US), Rackspace (US), and Robin.Io (US), MayaData (US), Diamanti (US), Minio (US), Rook (US), Ondat (UK), Ionir (US), Trilio (US), Upcloud (Finland), Arrikto (US). |

This research report categorizes the Cloud Native Storage Market to forecast revenue and analyze trends in each of the following submarkets:

By Offering:

-

Solutions

- File Storage

- Block Storage

- Object Storage

-

Solutions by deployment mode

- Public cloud

- Private cloud

-

Services

- Training & Consulting Services

- System Integration & Implementation Services

- Support & Maintenance

By Verticals:

- Banking, Financial Services, & Insurance (BFSI)

- Government & Public Sector

- Healthcare & Life Sciences

- Telecom

- IT & ITeS

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Retail & Consumer Goods

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Spain

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- Australia and New Zealand (ANZ)

- ASEAN Countries

- Rest of Asia Pacific

-

Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

- Israel

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments

- In August 2023, Microsoft enhanced the Azure Elastic SAN service by introducing support for private endpoints and enabling volume sharing through SCSI (Small Computer System Interface) Persistent Reservation.

- In August 2023, AWS announced the launch of the AWS Israel (Tel Aviv) Region. This launch signifies that developers, startups, entrepreneurs, enterprises, as well as government, education, and nonprofit entities, have an expanded array of options for hosting their applications and serving their end users within Israel's borders.

- In August 2023, Google recently introduced three innovative cloud storage solutions: Cloud Storage FUSE, designed to support Artificial Intelligence (AI) applications needing file system semantics; Parallelstore, a parallel file system tailored for demanding AI and High-Performance Computing (HPC) applications leveraging GPUs; and NetApp.

- In May 2023, IBM introduced IBM Hybrid Cloud Mesh, a Software as a Service (SaaS) solution tailored to empower enterprises in managing their hybrid multi-cloud infrastructure effectively. By adopting IBM Hybrid Cloud Mesh, modern enterprises can streamline their infrastructure operations across hybrid multi-cloud and diverse environments, enhancing overall efficiency and adaptability.

- In November 2022, AWS introduced three new Amazon Elastic Compute Cloud (EC2) instances featuring AWS-designed chips, providing improved compute performance at a lower cost across a variety of workloads.

- In September 2022, IBM announced the general availability of IBM LinuxONE Bare Metal Servers. With this new solution, the LinuxONE platform may now be deployed in an off-premises Infrastructure as a Service (IaaS) model while enjoying all the advantages, including core consolidation, resultant software license savings, and decreased energy consumption to support sustainability goals.

- In September 2022, A new feature from Google Cloud allows users to significantly reduce the cold start time of Cloud Run and Cloud Functions. This is named startup CPU boost for Cloud Run and Cloud Functions 2nd gen.

Frequently Asked Questions (FAQ):

What is cloud native storage?

Cloud-native storage solutions are a category of storage technologies and services designed specifically to support the principles and practices of cloud-native application development and deployment. These solutions are engineered to meet the unique requirements of cloud-native applications, which are typically containerized, highly scalable, and designed to run in dynamic, distributed environments like Kubernetes.

Which countries in Europe are early adopters of cloud native storage?

In Europe, the UK, Germany, and France are initially adopting Cloud Native Storage.

Which are the top 3 key verticals adopting cloud native storage?

The top 3 verticals are BFSI, Manufacturing, and telecom.

Which are the top 5 key vendors exploring cloud native storage?

The top 5 key vendors exploring cloud native storage include Microsoft (US), IBM (US), AWS (US), Google (US), and Alibaba Cloud (China).

Which solution type is covered under the cloud native storage market?

The cloud native storage solutions are bifurcated to file, block, and object storage in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

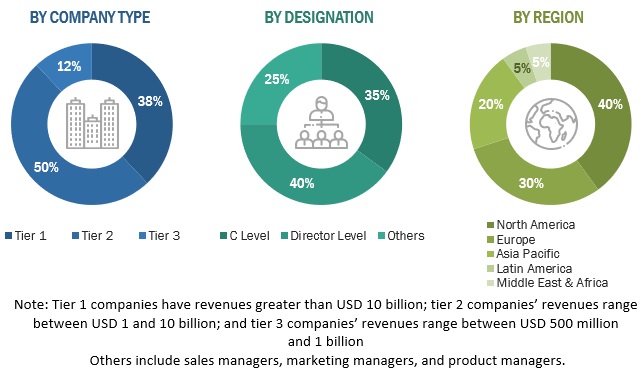

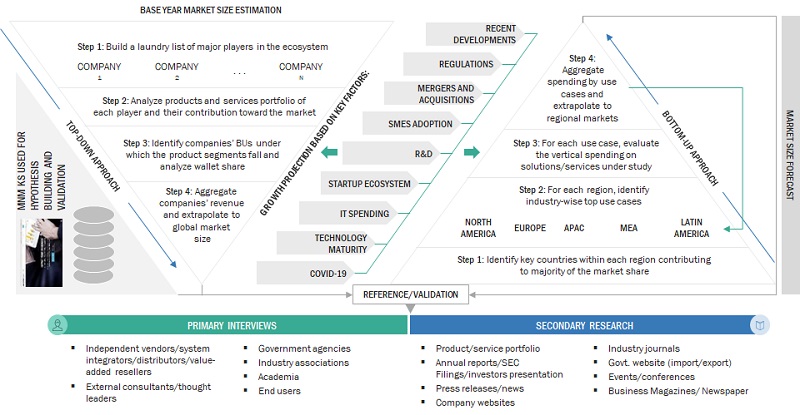

The study involved four major activities in estimating the size of the cloud native storage market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, investor presentations of companies, and whitepapers; certified publications; and articles from recognized associations and government publishing sources, such as the Cloud Native Computing Foundation (CNCF), Kubernetes and Cloud Native Associate (KCNA), Storage Networking Industry Association (SNIA) and Distributed Management Task Force (DMTF).

Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the cloud native storage market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing cloud native storage offerings; associated service providers; and SIs operating in the targeted countries. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to arrive at the final quantitative and qualitative data.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make the estimates and forecasts for the cloud native storage market and other dependent submarkets, both top-down and bottom-up approaches were used. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segments.

Global Cloud Native Storage Market Size: Bottom-Up and Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the BFSI, government & public sector, healthcare & life sciences, telecom, IT & ITeS, manufacturing, energy & utilities, retail & consumer goods, media & entertainment, and other verticals. Others include education, and travel & hospitality.

Market Definition

- Cloud-native technologies empower organizations to build and run scalable applications in modern, dynamic environments such as public, private, and hybrid clouds. Containers, service meshes, microservices, immutable infrastructure, and declarative APIs exemplify this approach.

- Cloud-native architecture and technologies are an approach to designing, constructing, and operating workloads that are built in the cloud and take full advantage of the cloud computing model.

Stakeholders

- Cloud native storage vendors

- Cloud native storage service vendors

- Managed service providers

- Support and maintenance service providers

- System Integrators (SIs)/migration service providers

- Value-Added Resellers (VARs) and distributors

- Distributors and Value-added Resellers (VARs)

- System Integrators (SIs)

- Independent Software Vendors (ISV)

- Third-party providers

- Technology providers

- Independent software vendors

- Value-added resellers and distributors

Report Objectives

- To describe and forecast the cloud native storage market market based on offering, application, verticals, and regions

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape of the major players

- To comprehensively analyze the core competencies of the key players in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product quadrant, which gives a detailed comparison of the product portfolio of each company.

Geographic Analysis

- Further breakup of the North American cloud native storage market

- Further breakup of the European market

- Further breakup of the Asia Pacific market

- Further breakup of the Middle Eastern & African market

- Further breakup of the Latin America cloud native storage market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cloud Native Storage Market