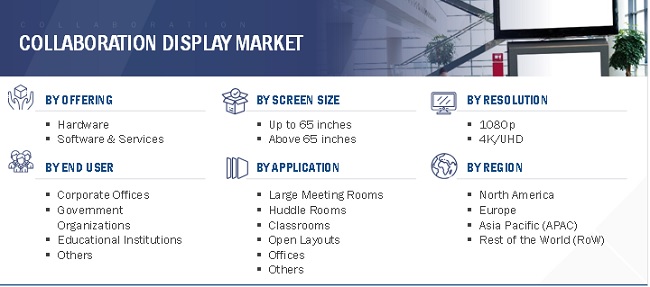

Collaboration Display Market by Offering (Hardware, Software and Services), Screen Size (Up to 65 Inches, above 65 Inches), Resolution (1080P, 4K/UHD), End User, Application, and Geography (2021-2026)

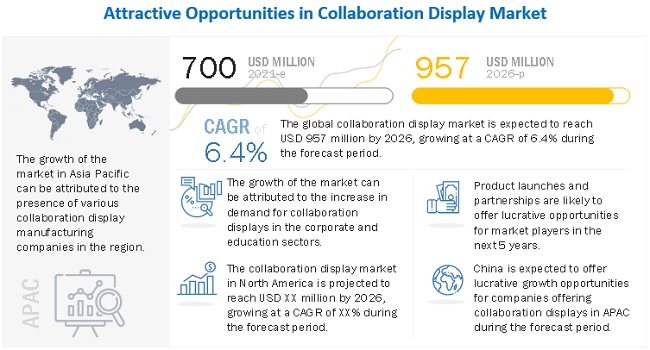

The global collaboration display market size is projected to reach USD 957 million by 2026 from USD 700 million in 2021; it is expected to grow at a CAGR of 6.4 % from 2021 to 2026.

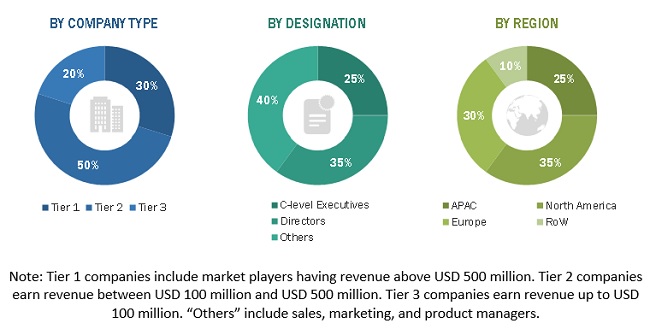

Major drivers for the growth of the market are surged demand for collaboration displays in educational institutions and corporate offices as well as increase in remote and hybrid work models amid COVID-19. The increased digital transformation throughout the globe and adoption of ever-changing technology is also a reason for the increased demand of collaboration displays in corporate offices, educational institutions, and government organizations. Collaboration display is a display tool for conducting meetings, presentations, training sessions, communication and collaborating worldwide. It comes with 4K/UHD, and 1080p resolution in different screen sizes for different sectors and purposes. Collaboration display can be used for collaborating, content sharing, brainstorming sessions, etc. It comes with integrated collaboration software, 4K camera and microphone.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Collaboration Display Market:

The world is facing an economic crisis caused by COVID-19 pandemic. The pandemic has severely affected various vertical such as education, government, corporate, etc. Manufacturing units are hampered due to shutdowns and the availability of labor or raw materials. The outbreak of the COVID-19 pandemic led to the closure or partial shutdown of factories, businesses and institutes globally. This was complemented by the implementation of other lockdown measures, which included strict social distancing norms, restricted travel, and limited entry to places of public gatherings, restaurants, theme parks, cinema halls, and malls. Moreover, most of the industries globally witnessed disruption in supply chain operations and logistics-related services.

The limited consumer and corporate spending, along with lockdown measures supplemented by supply chain disruption, has had an impact on the growth of the collaboration display market. The COVID-19 pandemic further impacted the infrastructure spending and investments by governments worldwide to focus more on improving healthcare facilities. Additionally, users also stopped focusing on these markets and were distracted with other important factors such as health, work from home facilities, well-being of employees, etc. All these factors together hampered the demand for collaboration display in the first half of 2020.

To date, North America and Europe continue to be the most impacted regions due to the resurgence of COVID-19 cases from time to time. As a result, the demand for collaboration displays in the North American and European markets, such as the US, France, Germany, and the UK, continue to stay low. This has impacted the market growth for collaboration display industry in these regions.

Collaboration Display Market Dynamics:

Driver: Remote collaboration necessitated by COVID-19 pandemic

The global spread of COVID-19 has impacted business operations worldwide. At the same time, remote working has emerged as a key trend for organizations worldwide. Collaboration displays help people from different places to connect, and share, understand, and discuss work. By using these displays, teams located in different parts of the world can collaborate for projects. Moreover, presently, it’s common for multinational corporations to have factions of various teams located across different geographies. Remote collaboration is an ideal solution to limitations imposed by distance. Collaboration displays facilitate collaboration from centralized locations, such as headquarters of a company. Employees located at remote locations can then join collaborative efforts with the help of collaborative software and tools. This type of remote collaboration is similar to video conferencing but with the added functionalities, such as simultaneous real-time annotation by multiple users to have brain storming sessions, content sharing and discussion in real time, as well as data offered by various types of sensors.

Restraint: Relatively higher cost of collaboration displays compared with traditional whiteboards

The high cost of collaboration displays is one of the major restraints for the market. These displays are different than other display solutions in terms of integrated sensors and IoT integration. In addition to the product cost, costs of accessories, connecting devices, and installation are also involved. A traditional whiteboard costs approximately USD 20, whereas a standard collaboration display costs about USD 2,000 to 7,000. High cost of collaboration displays makes it difficult for small institutions and schools to install these displays, thus restraining the market growth. However, with rising competition, the prices of these displays are expected to reduce in the coming years, which will lessen the impact of this factor during the forecast period.

Opportunity: Government funding for installation of interactive displays in educational institutes

Government funding is playing a crucial role in the adoption of interactive displays in schools across countries. For example, the US Department of Education's Office of Special Education Programs offers technology grants for children with special needs, which also includes the installation of interactive displays in schools. Lately, governments of multiple countries have been supplying interactive displays to non-profit organizations and state schools. Apart from governments of different countries, leading companies, such as SMART technologies and Promethean, are also involved in the funding of interactive displays for educational institutions that cannot afford them. For instance, in November 2018, Nawaka Educational Charitable Trust (Fiji), and Promethean (US) donated interactive displays worth over USD 20,000 to the Nawaka District School in Nadi, Fiji, to create a digital study environment. Such initiatives are expected to generate ample opportunities for collaboration displays players in the coming years.

Challenge: Reluctance among professionals to switch from traditional to advanced technologies

Traditional whiteboards are easy-to-use products with no technology to operate. On the other hand, collaboration displays are technology-based and integrated with various technologies. Professionals need to be trained to operate collaboration displays and have to be made aware of their various features. However, many professionals, teachers, in particular, are reluctant to spend additional time to understand the product. This, in turn, acts as a challenge for the growth of the collaboration display market.

According to a research study conducted by the Wadi El-Neel University, Sudan, teachers in many schools are not comfortable using advanced technologies such as interactive displays and prefer chalk-and-talk methods and pen-paper-based assessments in classrooms. A similar research survey was conducted by the Curriculum and Instruction Department, King Saud University, Riyadh, Saudi Arabia, to understand the attitude of teachers towards the adoption of interactive displays in English medium schools. This study, conducted on a sample group of 43 teachers of different secondary schools in Riyadh, focused on questions regarding their views about interactive displays.

Among vertical, the corporate offices segment projected to hold the largest share of the collaboration display market during the forecast period.

Collaboration displays offer a tool to improve understanding, collaborate, and increase productivity through effective presentations and meetings in the corporate sector. The use of collaboration displays in this segment has increased over the recent years, as collaboration displays help improve productivity, share real-time contents, and coordinate on a global scale. Some of the most major applications of collaboration displays in the corporate offices are enlisted below:

- Enables the user to share contents and screen in real time with remote attendees

- Turns meetings and seminars into collaborative productions by enabling participants to engage interactively

- Offers mobile connectivity

- Provides multi-touch points to allow multiple people to annotate simultaneously

Companies such as Sharp, ViewSonic, Microsoft, Cisco, and Smart Technologies are working on developing more advanced collaboration displays by adding more advanced features and technologies. For example, Sharp recently announced a new series of collaboration displays for the corporate sector, the Aquous Board series that comes with the Sharp pen software, multi-purpose applications, display connect, etc.

The above 65 inch segment, in market by screen size, of the collaboration display market projected to hold larger share during the forecast period.

Collaboration displays with screen size above 65 inches have seen a greater adoption rate. Such displays are mostly preferred in the corporate, government, and education sectors. In the corporate sector, collaboration displays are used in large conference halls, conference rooms, meeting rooms, etc. Collaboration displays help in keeping people together. They come with multiple features such as approximately 40 multi-touch points that allow 40 people to coordinate simultaneously at the same time. They also come with collaboration tools and software that allow people to connect worldwide in real time and share real-time content. The focus of these displays is to bring people together and help them coordinate with each other easily. These displays are available in multiple resolutions, i.e., 1080p, and 4K/UHD.

To know about the assumptions considered for the study, download the pdf brochure

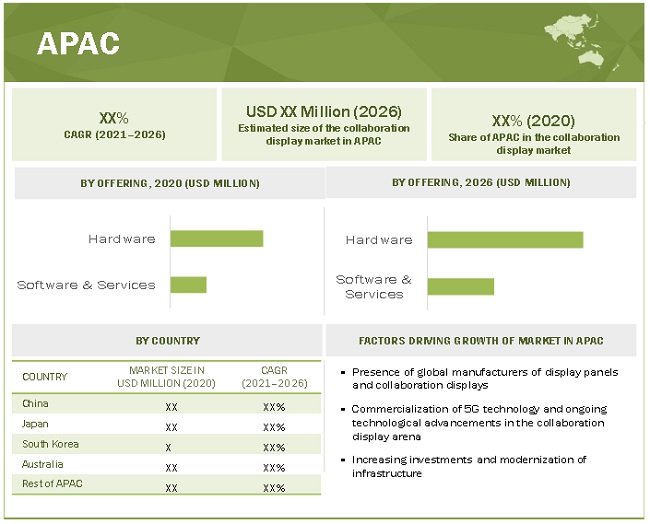

The collaboration display market in APAC projected to have highest CARG during the forecast period (2021-2026)

The collaboration display market in APAC is expected to grow at the highest CAGR during the forecast period owing to the rapidly changing face of industries from a product-centric to customer-centric approach due to increasing competition and changing customer behavior in high-potential markets such as China, Japan, South Korea, and Australia. Due to advancements in technology and the emergence of new business models in the region, the collaboration display market is exhibiting an upbeat outlook. The booming corporate and education sectors would further fuel the adoption of collaboration displays in APAC. Furthermore, growth in end-use sectors and mounting investments from government bodies are also favoring the growth of the collaboration display market in the region.

APAC, being one of the fastest-growing markets for technology and digital products, provides attractive opportunities for players offering collaboration displays; as a result, many companies are expanding their footprint in this region. China, South Korea, and Japan are among the key digital hubs in APAC that occupy the maximum share of the market of the region. Some of the major companies offering collaboration displays in the APAC region are Sharp, LG Electronics, Samsung Electronics, Senses, Hitachi, Cisco, etc.

Collaboration Display Companies - Key Market Players

The collaboration display companies are Sharp (Japan), ViewSonic (US), Cisco (US), Microsoft (US), Smart Technologies (Canada), Google (US), LG Electronics (South Korea), Samsung Electronics (South Korea), Avocor (US), IBV Solutions (Switzerland), BenQ (Taiwan), Panasonic (Japan), Luidia (US), Qomo (US), Hitachi (Japan), Senses (India), Newline (US), Sony Professionals (UK), Planar (US), InFocus (US), Promethean World (US), Clear Touch (US) and Elo Touch (US).

Report Scope

The report covers the demand and supply side segmentation of the collaboration display market. The supply-side market segmentation includes offering, screen size, and resolution, whereas the demand-side market segmentation includes application, vertical, and region. The following figure represents an overview of the micro-markets covered in the report.

The following are the years considered:

Collaboration Display Market Segmentation:

In this report, the collaboration display market has been segmented into the following categories:

By Offering:

- Hardware

- Software & Services

By End-Users:

- Corporate Offices

- Educational Institutions

- Government Organizations

- Others

By Screen Size:

- Up to 65 Inches

- Above 65 Inches

By Resolution:

- 4K/UHD

- 1080p

By Applications:

- Large Meeting Rooms

- Huddle Rooms

- Classrooms

- Open Layouts

- Offices

- Others

By Region:

- North America

- Europe

- APAC

- RoW

Recent Developments

- In February 2021, Smart Technologies launches a new software SMART Learning Suit Software to help teachers navigate the reality of hybrid teaching. It is a new teacher-driven enhancement software. It consists of a library of ready-made activities and lessons

- In December 2020, Sharp Imaging and Information Company of America (SIICA), a division of Sharp Electronics Corporation (SEC), introduced the new Sharp 4T-B70CT1U AQUOS BOARD interactive display, which is used for interactive classrooms and meeting rooms.

- In December 2020, Cisco acquired Dashbase which will provide customers broader support and more unique data support through the cloud. With its event log and analytics technology, Cisco can upgrade its products with the latest features.

- In November 2020, NEC and SHARP agreed to have a joint venture in effect from 2nd November 2020. According to the terms of the agreement, NEC had to transfer 66% of the NDS shares to SHARP keeping on 34% with them. With the joint venture, the name was changed to Sharp NEC Display Solutions (SNDS).

- In September 2020, ViewSonic’s collaborates with Microsoft for the ViewBoard IFP70 series. It has been certified by Microsoft Windows Collaboration Display certification. The interactive technology will help people once they return to offices by delivering next-generation collaboration displays to communicate easily.

- In May 2020, Windows came up with its new product Surface Hub 2S, the all-in-one digital whiteboard that can be used for meetings, teamwork, presenting, etc. It includes a Surface Hub 2 Camera and Pen.

Frequently Asked Questions (FAQ):

Which are the major companies in the collaboration display market? What are their major strategies to strengthen their market presence?

The major companies in the collaboration display market are –Sharp, ViewSonic, Microsoft, Cisco and Smart Technologies. The major strategies adopted by these players are product launches, expansions, agreements and acquisitions.

Which is the potential market for collaboration display in terms of region?

Asia Pacific (APAC) being one of the fastest-growing markets for technology and digital products, provides attractive opportunities for players offering collaboration displays; as a result, many companies are expanding their footprint in this region. China, South Korea, and Japan are among the key digital hubs in APAC that occupy the maximum share of the market of the region. The booming corporate and education sectors would further fuel the adoption of collaboration displays in APAC. Furthermore, growth in end-use sectors and mounting investments from government bodies are also favoring the growth of the collaboration display market in the region.

Which end user segment are expected to drive the growth of the market in the next 5 years?

Corporate offices and Education institutions segments are expected to grow at significant CAGRs in coming years. Collaboration displays offer a tool to improve understanding, collaborate, and increase productivity through effective presentations and meetings in the corporate sector. Collaboration displays help improve productivity, share real-time contents, and coordinate on a global scale. Collaboration displays also have up to 40 multi-touch points that allow 40 people to simultaneously touch and share. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 29)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 GENERAL INCLUSIONS & EXCLUSIONS

1.2.2 INCLUSIONS AND EXCLUSIONS AT OFFERING LEVEL

1.2.3 INCLUSIONS AND EXCLUSIONS AT RESOLUTION LEVEL

1.2.4 INCLUSIONS AND EXCLUSIONS AT VERTICAL LEVEL

1.2.5 INCLUSIONS AND EXCLUSIONS AT APPLICATION LEVEL

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 COLLABORATION DISPLAY MARKET SEGMENTATION

1.3.2 GEOGRAPHIC ANALYSIS

1.3.3 YEARS CONSIDERED

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 35)

2.1 RESEARCH DATA

FIGURE 2 COLLABORATION DISPLAY MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Breakdown of primary interviews

2.1.2.3 Primary interviews with experts

2.1.2.4 Key participants in primary processes across value chain of smart card market

2.1.2.5 Key industry insights

2.1.3 SECONDARY AND PRIMARY RESEARCH

2.2 MARKET SIZE ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE): REVENUE GENERATED BY KEY MARKET PLAYERS IN COLLABORATION DISPLAY MARKET

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE): ILLUSTRATION OF REVENUE ESTIMATION OF KEY PLAYERS IN COLLABORATION DISPLAY MARKET

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE)—BOTTOM-UP ESTIMATION OF COLLABORATION DISPLAY MARKET, BY END USER INDUSTRY

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for capturing market size by bottom-up analysis

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.4.1 ASSUMPTIONS

2.4.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 46)

FIGURE 9 COMPARISON OF SCENARIO-BASED IMPACT OF COVID-19 ON COLLABORATION DISPLAY MARKET

3.1 SCENARIO ANALYSIS

3.1.1 REALISTIC SCENARIO (POST-COVID-19)

3.1.2 PESSIMISTIC SCENARIO (POST-COVID-19)

3.1.3 OPTIMISTIC SCENARIO (POST-COVID-19)

FIGURE 10 SOFTWARE & SERVICES SEGMENT TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

FIGURE 11 4K UHD RESOLUTION SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 12 CORPORATE OFFICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 COLLABORATION DISPLAY MARKET IN APAC TO EXHIBIT HIGHEST CAGR FROM 2021 TO 2026

4 PREMIUM INSIGHTS (Page No. - 52)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN COLLABORATION DISPLAY MARKET

FIGURE 14 GROWING ADOPTION OF COLLABORATION DISPLAYS IN CORPORATE, EDUCATION, AND GOVERNMENT SECTORS TO SUPPORT MARKET GROWTH

4.2 COLLABORATION DISPLAY MARKET, BY SCREEN SIZE

FIGURE 15 ABOVE 65 INCHES SEGMENT TO ACCOUNT FOR LARGER SHARE OF COLLABORATION DISPLAY MARKET IN 2026

4.3 COLLABORATION DISPLAY MARKET IN APAC, BY OFFERING AND COUNTRY

FIGURE 16 HARDWARE SEGMENT AND CHINA TO ACCOUNT FOR LARGEST SHARES OF COLLABORATION DISPLAY MARKET IN APAC IN 2026

4.4 COLLABORATION DISPLAY MARKET, BY COUNTRY

FIGURE 17 COLLABORATION DISPLAY MARKET IN REST OF APAC TO REGISTER HIGHEST CAGR FROM 2021 TO 2026

5 MARKET OVERVIEW (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 COLLABORATION DISPLAY MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Remote collaboration necessitated by COVID-19 pandemic

5.2.1.2 Superior features offered by collaboration displays

5.2.1.3 Heightened demand for collaboration displays in education sector

FIGURE 19 COLLABORATION DISPLAY MARKET DRIVERS: IMPACT ANALYSIS

5.2.2 RESTRAINTS

5.2.2.1 Relatively higher cost of collaboration displays compared with traditional whiteboards

TABLE 1 INDICATIVE PRICES OF COLLABORATION DISPLAYS

FIGURE 20 COLLABORATION DISPLAY MARKET RESTRAINTS: IMPACT ANALYSIS

5.2.3 OPPORTUNITIES

5.2.3.1 Government funding for installation of interactive displays in educational institutes

5.2.3.2 Integration of advanced technologies with collaboration displays

FIGURE 21 COLLABORATION DISPLAY MARKET OPPORTUNITIES: IMPACT ANALYSIS

5.2.4 CHALLENGES

5.2.4.1 Reluctance among professionals to switch from traditional to advanced technologies

TABLE 2 SURVEY RESULTS REPRESENTING VIEWS OF TEACHERS ON USE OF INTERACTIVE DISPLAYS

5.2.4.2 Rising adoption of smartphones and tablets in education sector

FIGURE 22 COLLABORATION DISPLAY MARKET CHALLENGES: IMPACT ANALYSIS

5.3 VALUE CHAIN ANALYSIS

FIGURE 23 VALUE CHAIN ANALYSIS: COLLABORATION DISPLAY MARKET

5.4 MARKET MAP/MARKET ECOSYSTEM

TABLE 3 COLLABORATION DISPLAY MARKET: ECOSYSTEM

FIGURE 24 KEY PLAYERS IN COLLABORATION DISPLAY MARKET

5.5 KEY TECHNOLOGY TRENDS

TABLE 4 AI BASED COLLABORATION DISPLAYS: LEADING TREND AMONG KEY MARKET PLAYERS

5.6 TECHNOLOGY ANALYSIS

5.6.1 RESOLUTION ANALYSIS

TABLE 5 COMPARISON OF BENEFITS OF 1080P AND 4K/UHD TECHNOLOGIES OF COLLABORATION DISPLAYS

5.7 PRICE TREND ANALYSIS

TABLE 6 INDICATIVE PRICES OF COLLABORATION DISPLAYS

FIGURE 25 AVERAGE SELLING PRICE (ASP) TREND OF COLLABORATION DISPLAYS (Page No. - )

5.8 CASE STUDY ANALYSIS

5.8.1 COLLABORATION DISPLAY IN HEALTHCARE

5.8.2 AVOCOR HELPED NORTH WEST BOROUGHS HEALTHCARE NHS FOUNDATION TRUST TO REDUCE TRAVEL FOR THEIR STAFF

5.8.3 DISPLAY FOR CORPORATE

TABLE 7 DMG EVENTS CORPORATE OFFICE GETS COLLABORATIVE WITH BENQ CORPORATE INTERACTIVE FLAT PANELS

5.8.4 DISPLAY FOR BANKING

TABLE 8 AVOCOR HELPS WESTERN UNION EMPLOYEES WORK HAND-IN-HAND WORLDWIDE

5.9 PATENT ANALYSIS

5.9.1 DOCUMENT TYPE

TABLE 9 PATENTS FILED

FIGURE 26 PATENTS FILED FROM 2011 TO 2020

5.9.2 PUBLICATION TREND

FIGURE 27 NO. OF PATENTS FILED EACH YEAR FROM 2011 TO 2020

5.9.3 JURISDICTION ANALYSIS

FIGURE 28 JURISDICTION ANALYSIS

5.9.4 TOP PATENT OWNERS

FIGURE 29 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS FROM 2011 TO 2020

TABLE 10 TOP 20 PATENT OWNERS IN LAST 10 YEARS

5.10 TRADE ANALYSIS

FIGURE 30 COUNTRY-WISE EXPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 8537, 2016–2020

TABLE 11 EXPORT SCENARIO FOR HS CODE: 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

FIGURE 31 COUNTRY-WISE IMPORT DATA FOR PRODUCTS CLASSIFIED UNDER HS CODE: 8537, 2016–2020

TABLE 12 IMPORT SCENARIO FOR HS CODE: 8537-COMPLIANT PRODUCTS, BY COUNTRY, 2016–2020 (USD THOUSAND)

5.11 PORTER’S FIVE FORCES ANALYSIS

FIGURE 32 PORTER’S FIVE FORCES ANALYSIS

TABLE 13 PORTER’S FIVE FORCES ANALYSIS WITH THEIR WEIGHTAGE IMPACT

5.11.1 THREAT OF NEW ENTRANTS

FIGURE 33 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

FIGURE 34 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

FIGURE 35 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

FIGURE 36 BARGAINING POWER OF BUYERS

5.11.5 DEGREE OF COMPETITIVE RIVALRY

FIGURE 37 COMPETITIVE RIVALRY

5.12 REGULATORY LANDSCAPE

TABLE 14 REGULATIONS: DISPLAY ECOSYSTEM

6 COLLABORATION DISPLAY MARKET, BY SCREEN SIZE (Page No. - 79)

6.1 INTRODUCTION

FIGURE 38 SEGMENTATION BY SCREEN SIZE

FIGURE 39 ABOVE 65 INCHES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 15 COLLABORATION DISPLAY MARKET SHIPMENT BY SCREEN SIZE, 2017–2020 (THOUSAND UNITS)

TABLE 16 COLLABORATION DISPLAY MARKET SHIPMENT BY SCREEN SIZE, 2021–2026 (THOUSAND UNITS)

6.2 UP TO 65 INCHES

6.2.1 SMALL-SCREEN DISPLAYS ARE PORTABLE AND CAN BE EASILY TRANSPORTED

TABLE 17 COLLABORATION DISPLAY MARKET FOR SCREEN SIZE OF UP TO 65 INCHES, BY REGION, 2017–2020 (USD MILLION)

TABLE 18 COLLABORATION DISPLAY MARKET FOR SCREEN SIZE OF UP TO 65 INCHES, BY REGION, 2021–2026 (USD MILLION)

6.3 ABOVE 65 INCHES

6.3.1 LARGE-SCREEN DISPLAYS OFFER BETTER CLARITY

TABLE 19 COLLABORATION DISPLAY MARKET FOR SCREEN SIZE OF ABOVE 65 INCHES, BY REGION, 2017–2020 (USD MILLION)

TABLE 20 COLLABORATION DISPLAY MARKET FOR SCREEN SIZE OF ABOVE 65 INCHES, BY REGION, 2021–2026 (USD MILLION)

7 COLLABORATION DISPLAY MARKET, BY END USER (Page No. - 85)

7.1 INTRODUCTION

FIGURE 40 SEGMENTATION BY END USER

FIGURE 41 CORPORATE OFFICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 21 COLLABORATION DISPLAY MARKET, BY END USER, 2017–2020 (USD MILLION)

TABLE 22 COLLABORATION DISPLAY MARKET, BY END USER, 2021–2026 (USD MILLION)

7.2 CORPORATE OFFICES

7.2.1 COLLABORATION DISPLAYS SERVE AS EFFECTIVE MEDIUM TO ESTABLISH COMMUNICATION BETWEEN BUSINESSES

TABLE 23 COLLABORATION DISPLAY MARKET FOR CORPORATE OFFICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 24 COLLABORATION DISPLAY MARKET FOR CORPORATE OFFICES, BY REGION, 2021–2026 (USD MILLION)

7.3 GOVERNMENT ORGANIZATIONS

7.3.1 COLLABORATION DISPLAYS ENABLE GOVERNMENT ORGANIZATIONS TO CONDUCT MEETINGS, BRIEFINGS, AND TRAINING SESSIONS FOR VARIOUS PARTICIPANTS WORLDWIDE

TABLE 25 COLLABORATION DISPLAY MARKET FOR GOVERNMENT ORGANIZATIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 26 COLLABORATION DISPLAY MARKET FOR GOVERNMENT ORGANIZATIONS, BY REGION, 2021–2026 (USD MILLION)

7.4 EDUCATIONAL INSTITUTIONS

7.4.1 COLLABORATION DISPLAYS HELP TO FACILITATE BETTER TEACHING AND LEARNING EXPERIENCE IN EDUCATIONAL INSTITUTIONS

TABLE 27 COLLABORATION DISPLAY MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2017–2020 (USD MILLION)

TABLE 28 COLLABORATION DISPLAY MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2021–2026 (USD MILLION)

7.5 OTHERS

TABLE 29 COLLABORATION DISPLAY MARKET FOR OTHERS, BY REGION, 2017–2020 (USD MILLION)

TABLE 30 COLLABORATION DISPLAY MARKET FOR OTHERS, BY REGION, 2021–2026 (USD MILLION)

8 COLLABORATION DISPLAY MARKET, BY OFFERING (Page No. - 92)

8.1 INTRODUCTION

FIGURE 42 SEGMENTATION BY OFFERING

FIGURE 43 SOFTWARE & SERVICES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 31 COLLABORATION DISPLAY MARKET, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 32 COLLABORATION DISPLAY MARKET, BY OFFERING, 2021–2026 (USD MILLION)

8.2 HARDWARE

8.2.1 DISPLAYS

8.2.1.1 4K resolution displays are widely used in collaboration displays

8.2.2 CAMERAS

8.2.2.1 High-definition cameras are critical components of collaboration displays

8.2.3 SENSORS

8.2.3.1 New sensor technologies make collaboration displays better tool for communication

8.2.4 OTHER ACCESSORIES

TABLE 33 COLLABORATION DISPLAY MARKET FOR HARDWARE, BY REGION, 2017–2020 (USD MILLION)

TABLE 34 COLLABORATION DISPLAY MARKET FOR HARDWARE, BY REGION, 2021–2026 (USD MILLION)

8.3 SOFTWARE AND SERVICES

8.3.1 INCREASED ADOPTION OF COLLABORATION DISPLAYS HAVE FUELED DEMAND FOR ASSOCIATED SOFTWARE AND SERVICES

TABLE 35 COLLABORATION DISPLAY MARKET FOR SOFTWARE & SERVICES, BY REGION, 2017–2020 (USD MILLION)

TABLE 36 COLLABORATION DISPLAY MARKET FOR SOFTWARE & SERVICES, BY REGION, 2021–2026 (USD MILLION)

9 COLLABORATION DISPLAY MARKET, BY APPLICATION (Page No. - 98)

9.1 INTRODUCTION

FIGURE 44 SEGMENTATION BY APPLICATION

9.2 LARGE MEETING ROOMS

9.2.1 COLLABORATION DISPLAYS ARE MOSTLY INSTALLED IN LARGE MEETING ROOMS/CONFERENCE ROOMS FOR ACHIEVING BETTER COORDINATION

9.3 HUDDLE ROOMS

9.3.1 COLLABORATION DISPLAYS SERVE AS ALL-IN-ONE SOLUTION OR HUDDLE ROOMS

9.4 CLASSROOMS

9.4.1 COLLABORATION DISPLAYS HELP TO CREATE BETTER LEARNING EXPERIENCES IN CLASSROOMS

9.5 OPEN LAYOUTS

9.5.1 ABOVE 65 INCHES COLLABORATION DISPLAYS ARE MAINLY DEPLOYED IN OPEN LAYOUTS

9.6 OFFICES

9.6.1 OFFICES ARE ADOPTING COLLABORATION DISPLAYS TO ACHIEVE REMOTE COLLABORATION BETWEEN HYBRID WORKFORCE

9.7 OTHERS

10 COLLABORATION DISPLAY MARKET, BY RESOLUTION (Page No. - 102)

10.1 INTRODUCTION

FIGURE 45 SEGMENTATION BY RESOLUTION

FIGURE 46 4K/UHD SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

10.2 4K/UHD

10.2.1 4K COLLABORATION DISPLAYS OFFER ENHANCED BRIGHTNESS AND EXTENSIVE COLOR GAMUT

TABLE 37 COLLABORATION DISPLAY MARKET FOR 4K RESOLUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 38 COLLABORATION DISPLAY MARKET FOR 4K RESOLUTION, BY REGION, 2021–2026 (USD MILLION)

10.3 1080P

10.3.1 LIMITED COMPANIES OFFER COLLABORATION DISPLAYS WITH 1080P RESOLUTION

TABLE 39 COLLABORATION DISPLAY MARKET FOR 1080P RESOLUTION, BY REGION, 2017–2020 (USD MILLION)

TABLE 40 COLLABORATION DISPLAY MARKET FOR 1080P RESOLUTION, BY REGION, 2021–2026 (USD MILLION)

11 COLLABORATION DISPLAY MARKET, BY REGION (Page No. - 107)

11.1 INTRODUCTION

FIGURE 47 MARKET SEGMENT BY GEOGRAPHY

FIGURE 48 NORTH AMERICA CAPTURED LARGEST SHARE OF COLLABORATION DISPLAY MARKET IN 2020

FIGURE 49 COLLABORATION DISPLAY MARKET IN APAC TO GROW AT HIGHEST CAGR FROM 2021 TO 2026

TABLE 41 COLLABORATION DISPLAY MARKET, BY REGION, 2017–2020 (USD MILLION)

TABLE 42 COLLABORATION DISPLAY MARKET, BY REGION, 2021–2026 (USD MILLION)

11.2 NORTH AMERICA

FIGURE 50 SNAPSHOT: COLLABORATION DISPLAY MARKET IN NORTH AMERICA

TABLE 43 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 44 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 45 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY END USER, 2017–2020 (USD MILLION)

TABLE 46 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY END USER, 2021–2026 (USD MILLION)

TABLE 47 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 48 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 49 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY SCREEN SIZE, 2017–2020 (USD MILLION)

TABLE 50 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY SCREEN SIZE, 2021–2026 (USD MILLION)

TABLE 51 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 52 COLLABORATION DISPLAY MARKET IN NORTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 53 COLLABORATION DISPLAY MARKET IN US, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 54 COLLABORATION DISPLAY MARKET IN US, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 55 COLLABORATION DISPLAY MARKET IN US, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 56 COLLABORATION DISPLAY MARKET IN US, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 57 COLLABORATION DISPLAY MARKET IN CANADA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 58 COLLABORATION DISPLAY MARKET IN CANADA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 59 COLLABORATION DISPLAY MARKET IN CANADA, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 60 COLLABORATION DISPLAY MARKET IN CANADA, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 61 COLLABORATION DISPLAY MARKET IN MEXICO, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 62 COLLABORATION DISPLAY MARKET IN MEXICO, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 63 COLLABORATION DISPLAY MARKET IN MEXICO, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 64 COLLABORATION DISPLAY MARKET IN MEXICO, BY RESOLUTION, 2021–2026 (USD MILLION)

11.2.1 US

11.2.1.1 US to continue to account for largest share of collaboration display market in North America during forecast period

11.2.2 CANADA

11.2.2.1 Canada to be fastest-growing market in North America during forecast period

11.2.3 MEXICO

11.2.3.1 Mexico holds smallest but significant share in collaboration display market in North America

11.3 EUROPE

FIGURE 51 SNAPSHOT: COLLABORATION DISPLAY MARKET IN EUROPE

TABLE 65 COLLABORATION DISPLAY MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 66 COLLABORATION DISPLAY MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 67 COLLABORATION DISPLAY MARKET IN EUROPE, BY END USER, 2017–2020 (USD MILLION)

TABLE 68 COLLABORATION DISPLAY MARKET IN EUROPE, BY END USER, 2021–2026 (USD MILLION)

TABLE 69 COLLABORATION DISPLAY MARKET IN EUROPE, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 70 COLLABORATION DISPLAY MARKET IN EUROPE, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 71 COLLABORATION DISPLAY MARKET IN EUROPE, BY SCREEN SIZE, 2017–2020 (USD MILLION)

TABLE 72 COLLABORATION DISPLAY MARKET IN EUROPE, BY SCREEN SIZE, 2021–2026 (USD MILLION)

TABLE 73 COLLABORATION DISPLAY MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 74 COLLABORATION DISPLAY MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 75 COLLABORATION DISPLAY MARKET IN UK, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 76 COLLABORATION DISPLAY MARKET IN UK, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 77 COLLABORATION DISPLAY MARKET IN UK, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 78 COLLABORATION DISPLAY MARKET IN UK, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 79 COLLABORATION DISPLAY MARKET IN GERMANY, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 80 COLLABORATION DISPLAY MARKET IN GERMANY, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 81 COLLABORATION DISPLAY MARKET IN GERMANY, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 82 COLLABORATION DISPLAY MARKET IN GERMANY, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 83 COLLABORATION DISPLAY MARKET IN FRANCE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 84 COLLABORATION DISPLAY MARKET IN FRANCE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 85 COLLABORATION DISPLAY MARKET IN FRANCE, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 86 COLLABORATION DISPLAY MARKET IN FRANCE, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 87 COLLABORATION DISPLAY MARKET IN REST OF EUROPE, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 88 COLLABORATION DISPLAY MARKET IN REST OF EUROPE, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 89 COLLABORATION DISPLAY MARKET IN REST OF EUROPE, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 90 COLLABORATION DISPLAY MARKET IN REST OF EUROPE, BY RESOLUTION, 2021–2026 (USD MILLION)

11.3.1 GERMANY

11.3.1.1 Market in Germany is expected to capture highest CAGR during forecast period

11.3.2 UK

11.3.2.1 UK to continue to hold largest size of collaboration display market in Europe

11.3.3 FRANCE

11.3.3.1 Government investment in digital transformation to support market growth in France

11.3.4 REST OF EUROPE

11.4 APAC

FIGURE 52 SNAPSHOT: COLLABORATION DISPLAY MARKET IN APAC

TABLE 91 COLLABORATION DISPLAY MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 92 COLLABORATION DISPLAY MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 93 COLLABORATION DISPLAY MARKET IN APAC, BY END USER, 2017–2020 (USD MILLION)

TABLE 94 COLLABORATION DISPLAY MARKET IN APAC, BY END USER, 2021–2026 (USD MILLION)

TABLE 95 COLLABORATION DISPLAY MARKET IN APAC, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 96 COLLABORATION DISPLAY MARKET IN APAC, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 97 COLLABORATION DISPLAY MARKET IN APAC, BY SCREEN SIZE, 2017–2020 (USD MILLION)

TABLE 98 COLLABORATION DISPLAY MARKET IN APAC, BY SCREEN SIZE, 2021–2026 (USD MILLION)

TABLE 99 COLLABORATION DISPLAY MARKET IN APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 100 COLLABORATION DISPLAY MARKET IN APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 101 COLLABORATION DISPLAY MARKET IN CHINA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 102 COLLABORATION DISPLAY MARKET IN CHINA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 103 COLLABORATION DISPLAY MARKET IN CHINA, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 104 COLLABORATION DISPLAY MARKET IN CHINA, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 105 COLLABORATION DISPLAY MARKET IN JAPAN, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 106 COLLABORATION DISPLAY MARKET IN JAPAN, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 107 COLLABORATION DISPLAY MARKET IN JAPAN, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 108 COLLABORATION DISPLAY MARKET IN JAPAN, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 109 COLLABORATION DISPLAY MARKET IN SOUTH KOREA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 110 COLLABORATION DISPLAY MARKET IN SOUTH KOREA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 111 COLLABORATION DISPLAY MARKET IN SOUTH KOREA, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 112 COLLABORATION DISPLAY MARKET IN SOUTH KOREA, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 113 COLLABORATION DISPLAY MARKET IN AUSTRALIA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 114 COLLABORATION DISPLAY MARKET IN AUSTRALIA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 115 COLLABORATION DISPLAY MARKET IN AUSTRALIA, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 116 COLLABORATION DISPLAY MARKET IN AUSTRALIA, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 117 COLLABORATION DISPLAY MARKET IN REST OF APAC, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 118 COLLABORATION DISPLAY MARKET IN REST OF APAC, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 119 COLLABORATION DISPLAY MARKET IN REST OF APAC, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 120 COLLABORATION DISPLAY MARKET IN REST OF APAC, BY RESOLUTION, 2021–2026 (USD MILLION)

11.4.1 CHINA

11.4.1.1 China to continue to hold largest share of collaboration display market in APAC during the forecast period

11.4.2 JAPAN

11.4.2.1 Presence of key collaboration display manufacturers to underpin market growth in Japan

11.4.3 SOUTH KOREA

11.4.3.1 Presence of Samsung and LG boosts market growth in South Korea

11.4.4 AUSTRALIA

11.4.4.1 Manufacturing of various collaboration display components to drive market growth in Australia

11.4.5 REST OF APAC

11.5 ROW

FIGURE 53 SNAPSHOT: COLLABORATION DISPLAY MARKET IN ROW

TABLE 121 COLLABORATION DISPLAY MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 122 COLLABORATION DISPLAY MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

TABLE 123 COLLABORATION DISPLAY MARKET IN ROW, BY END USER, 2017–2020 (USD MILLION)

TABLE 124 COLLABORATION DISPLAY MARKET IN ROW, BY END USER, 2021–2026 (USD MILLION)

TABLE 125 COLLABORATION DISPLAY MARKET IN ROW, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 126 COLLABORATION DISPLAY MARKET IN ROW, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 127 COLLABORATION DISPLAY MARKET IN ROW, BY SCREEN SIZE, 2017–2020 (USD MILLION)

TABLE 128 COLLABORATION DISPLAY MARKET IN ROW, BY SCREEN SIZE, 2021–2026 (USD MILLION)

TABLE 129 COLLABORATION DISPLAY MARKET IN ROW, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 130 COLLABORATION DISPLAY MARKET IN ROW, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 131 COLLABORATION DISPLAY MARKET IN MIDDLE EAST, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 132 COLLABORATION DISPLAY MARKET IN MIDDLE EAST, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 133 COLLABORATION DISPLAY MARKET IN MIDDLE EAST, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 134 COLLABORATION DISPLAY MARKET IN MIDDLE EAST, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 135 COLLABORATION DISPLAY MARKET IN SOUTH AMERICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 136 COLLABORATION DISPLAY MARKET IN SOUTH AMERICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 137 COLLABORATION DISPLAY MARKET IN SOUTH AMERICA, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 138 COLLABORATION DISPLAY MARKET IN SOUTH AMERICA, BY RESOLUTION, 2021–2026 (USD MILLION)

TABLE 139 COLLABORATION DISPLAY MARKET IN AFRICA, BY OFFERING, 2017–2020 (USD MILLION)

TABLE 140 COLLABORATION DISPLAY MARKET IN AFRICA, BY OFFERING, 2021–2026 (USD MILLION)

TABLE 141 COLLABORATION DISPLAY MARKET IN AFRICA, BY RESOLUTION, 2017–2020 (USD MILLION)

TABLE 142 COLLABORATION DISPLAY MARKET IN AFRICA BY RESOLUTION, 2021–2026 (USD MILLION)

11.5.1 MIDDLE EAST

11.5.1.1 Middle East is expected to register highest CAGR during forecast period

11.5.2 AFRICA

11.5.2.1 Collaboration display market in Africa is currently nascent stage

11.5.3 SOUTH AMERICA

11.5.3.1 Presence of multiple manufacturers and distributors favors collaboration display market growth in South America

12 COMPETITIVE LANDSCAPE (Page No. - 148)

12.1 OVERVIEW

FIGURE 54 KEY DEVELOPMENTS UNDERTAKEN BY LEADING PLAYERS IN COLLABORATION DISPLAY MARKET FROM 2018 TO 2020

12.2 MARKET SHARE AND RANKING ANALYSIS

FIGURE 55 COLLABORATION DISPLAY MARKET: MARKET SHARE ANALYSIS

TABLE 143 COLLABORATION DISPLAY MARKET: DEGREE OF COMPETITION

TABLE 144 COLLABORATION DISPLAY MARKET: MARKET RANKING ANALYSIS

12.3 5-YEAR COMPANY REVENUE ANALYSIS

FIGURE 56 REVENUE ANALYSIS FOR KEY COMPANIES IN PAST 5 YEARS

12.4 COMPANY EVALUATION QUADRANT, 2020

FIGURE 57 COLLABORATION DISPLAY MARKET (GLOBAL) COMPANY EVALUATION MATRIX, 2020

12.4.1 STAR

12.4.2 PERVASIVE

12.4.3 EMERGING LEADER

12.4.4 PARTICIPANT

12.5 COMPETITIVE BENCHMARKING

TABLE 145 COMPANY APPLICATION FOOTPRINT (25 COMPANIES)

TABLE 146 COMPANY REGION FOOTPRINT (25 COMPANIES)

12.6 STARTUP/SME EVALUATION MATRIX, 2020

FIGURE 58 COLLABORATION DISPLAY MARKET (GLOBAL) STARTUP/SME EVALUATION MATRIX, 2020

12.6.1 PROGRESSIVE COMPANY

12.6.2 RESPONSIVE COMPANY

12.6.3 DYNAMIC COMPANY

12.6.4 STARTING BLOCK

12.7 COMPETITIVE SCENARIO AND TRENDS

12.7.1 PRODUCT LAUNCHES

TABLE 147 COLLABORATION DISPLAYS: NEW PRODUCT LAUNCHES, BY COMPANY, JANUARY 2019–FEBRUARY 2021

12.7.2 DEALS

TABLE 148 COLLABORATION DISPLAYS: DEALS, BY COMPANY, JANUARY 2019–FEBRUARY 2021

13 COMPANY PROFILES (Page No. - 163)

(Business Overview, Products/Solutions/Services Offered, COVID-19-related developments, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

13.1 INTRODUCTION

13.2 KEY PLAYERS

13.2.1 SHARP

TABLE 149 SHARP: BUSINESS OVERVIEW

FIGURE 59 SHARP: COMPANY SNAPSHOT

13.2.2 IBV SOLUTIONS

TABLE 150 IBV SOLUTIONS: BUSINESS OVERVIEW

13.2.3 AVOCOR

TABLE 151 AVOCOR: BUSINESS OVERVIEW

13.2.4 CISCO

TABLE 152 CISCO: BUSINESS OVERVIEW

FIGURE 60 CISCO: COMPANY SNAPSHOT

13.2.5 INFOCUS

TABLE 153 INFOCUS: BUSINESS OVERVIEW

13.2.6 MICROSOFT

TABLE 154 MICROSOFT: BUSINESS OVERVIEW

FIGURE 61 MICROSOFT: COMPANY SNAPSHOT

13.2.7 VIEWSONIC

TABLE 155 VIEWSONIC: BUSINESS OVERVIEW

13.2.8 PLANAR SYSTEMS

TABLE 156 PLANAR: BUSINESS OVERVIEW

13.2.9 PANASONIC

TABLE 157 PANASONIC: BUSINESS OVERVIEW

FIGURE 62 PANASONIC: COMPANY SNAPSHOT

13.2.10 LG ELECTRONICS

TABLE 158 LG ELECTRONICS: BUSINESS OVERVIEW

FIGURE 63 LG ELECTRONICS: COMPANY SNAPSHOT

13.3 OTHER PLAYERS

13.3.1 SAMSUNG ELECTRONICS

13.3.2 SENSES

13.3.3 ELO TOUCH

13.3.4 NEWLINE

13.3.5 BENQ

13.3.6 SMART TECHNOLOGIES

13.3.7 HITACHI

13.3.8 CLEAR TOUCH

13.3.9 GOOGLE

13.3.10 SONY PROFESSIONAL

13.3.11 LUIDIA

13.3.12 QOMO

13.3.13 SPECKTRON

13.3.14 DONGGUAN RIOTOUCH TECHNOLOGY

13.3.15 PROMETHEAN WORLD

*Details on Business Overview, Products/Solutions/Services offered, COVID-19-related Developments, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

14 APPENDIX (Page No. - 204)

14.1 INSIGHTS OF INDUSTRY EXPERTS

14.2 QUESTIONNAIRE FOR COLLABORATION DISPLAY MARKET

14.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.4 AVAILABLE CUSTOMIZATIONS

14.5 RELATED REPORTS

14.6 AUTHOR DETAILS

This study involves the usage of extensive secondary sources, directories, and databases such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource to identify and collect information useful for this technical, market-oriented, and commercial study of the collaboration display market. Primary sources include several industry experts from the core and related industries, along with preferred suppliers, manufacturers, distributors, service providers, and technology developers. In-depth interviews have been conducted with key industry participants, subject matter experts (SMEs), C-level executives of key companies operating in the collaboration display market, and industry consultants, among other experts, to obtain and verify qualitative and quantitative information, as well as to assess prospects. The following illustrative figure shows the market research methodology applied in making this report on the collaboration display market.

Secondary Research

In the secondary research process, various secondary sources have been utilized for identifying and collecting information for this study. Secondary sources referred to for this research study include annual reports, investor presentations, and financial statements; trade, business, and professional associations; white papers, collaboration display-related journals, certified publications, and articles from recognized authors; and directories and databases. The global size of the collaboration display market has been obtained from the secondary data made available through paid and unpaid sources. It has also been gathered by analysing the product portfolios of the leading companies and rating them based on the quality of their offerings.

Secondary research has been used to gather key information about the industry’s supply chain, the market’s monetary chain, the total number of key players, and market segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both the market- and technology-oriented perspectives. Secondary research has also been conducted to identify and analyse the industry trends in the market and key developments that have been undertaken from both the market- and technology perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides have been interviewed to obtain the qualitative and quantitative information related to the market across 4 main regions—APAC, North America, Europe, and RoW (the Middle East, Africa, and South America). Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology directors, and some other related key executives from major companies and organizations that are operating in the collaboration display market or related markets.

After the completion of market engineering, primary research has been conducted to gather information and verify and validate critical numbers that were obtained from other sources. Primary research has also been conducted to identify various market segments; industry trends; key players; competitive landscape; and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with key strategies adopted by market players. Approximately 70% and 30% of the primary interviews have been conducted with the supply and demand side, respectively. This primary data has been collected through questionnaires, mails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches have been used extensively in the market engineering process. Several data triangulation methods have also been used to perform the market forecasting and market estimation for the overall market segments and sub-segments in the report. Multiple qualitative and quantitative analyses have been performed on the market engineering process to gain key insights throughout the report.

Secondary research has been used to identify the key players of the collaboration display market. The revenues of those key players have been determined through both primary and secondary research. The revenues have been identified geographically as well as market segment-wise using financial statements and analyzing annual reports of the key market players. Interviews with CEOs, VPs, directors, and marketing executives were also conducted to gain insights on the key players and the collaboration display market. All the market shares have been estimated using secondary and primary research. This data has been consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Data Triangulation

After arriving at the overall market size from the market size estimation process that is explained above, the total market is then split into several segments and sub segments. Data triangulation procedure has been employed to complete the market engineering process and arrive at the exact statistics for all segments and sub segments. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Study Objectives

- To estimate, segment, and forecast the overall size of the collaboration display market by offering, resolution, screen size, end user, and region, in terms of value

- To describe and forecast the market size with respect to various segments across 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges influencing the growth of the market

- To study the complete value chain of the collaboration display market and provide price and technology trends, Porter’s five forces analysis, patent analysis, and case studies

- To describe the impact of COVID-19 on the collaboration display market

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To strategically profile the key players and comprehensively analyze their market positions in terms of their ranking and core competencies, as well as provide detailed information on the competitive landscape of the collaboration display market

- To analyze competitive developments such as product launches & developments, collaborations, acquisitions, contracts, expansion, joint ventures, and partnerships in the collaboration display market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for this report:

Regional Analysis

- Country-wise breakdown of the collaboration display market for North America, Europe, APAC, and RoW

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Collaboration Display Market