Companion Animal Pharmaceuticals Market by Animal Type (Dogs, Cats, Horses), Route of Administration (Oral, Injectable, Topical), Indication (Antibiotics, Parasiticides), Distribution Channel (Veterinary Hospitals & Clinics) & Region - Global Forecasts to 2027

Updated on : March 23, 2023

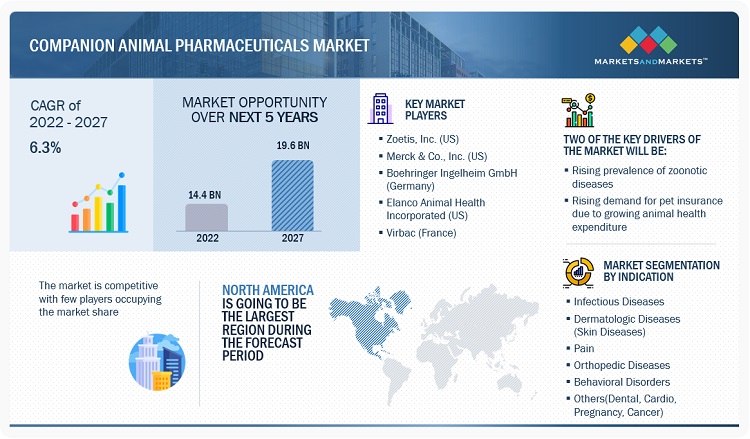

The global companion animal pharmaceuticals market in terms of revenue was estimated to be worth $14.4 billion in 2022 and is poised to reach $19.6 billion by 2027, growing at a CAGR of 6.3% from 2022 to 2027.

The growth in this market is majorly driven by the growth in adoption rate of companion animals, rising zoonotic diseases in companion animals, rising demand for pet insurance, and initiatives by various government agencies and animal associations. On the other hand, the limited launch of new antibiotics, rising pet care costs, and high cost of vaccines and complexities associated with storage are expected to restrain the growth of this market during the forecast period.

Attractive Opportunities in the Companion Animal Pharmaceuticals Market

To know about the assumptions considered for the study, Request for Free Sample Report

Companion Animal Pharmaceuticals Market Dynamics

Drivers: Rising demand for pet insurance due to growing animal health expenditure

Pet healthcare expenditure has significantly increased in recent years. Pet healthcare spending includes pet food, supplies/OTC medication, veterinary care, pet insurance policies, live animal purchases, and other services such as companion animal diagnostic and treatment services. According to the American Pet Products Association (APPA), veterinary expenditure in the US increased from USD 66.75 billion in 2016 to USD 103.6 billion in 2020 and USD 109.6 billion by 2021. Moreover, the APPA estimated that pet owners in the US spent USD 32.3 billion on vet care and product sales alone in 2021, up from USD 31.4 billion in 2020. This shows that the number of consumers (pet owners) spending on pet medical care has consistently risen yearly. The North American Pet Health Insurance Association (NAPHIA) announced that North America’s pet insurance sector exceeded USD 2.83 billion at the end of 2021, and industry growth more than doubled over the past four years (2018–2021). The adoption of pet insurance is also on the rise as insurance helps pet owners manage the cost of preventive care, acute & chronic illnesses, and emergency medical care costs for their respective pets.

Restraints: Limited number of new product developments

The current pipeline for novel pharmaceuticals for human and veterinary use is very limited. There are a limited number of new chemical entities entering and many novel drugs leaving the pipeline. Big pharmaceutical companies have been continuously halting funding for research on anti-infectives in favor of more lucrative pharmaceuticals.

The overuse and misuse of drugs in animals and humans are contributing to the rising threat of drug-drug reactions and drug resistance. The WHO introduced new recommendations that aim to help preserve the effectiveness of pharmaceuticals that are important for humans by reducing their unnecessary use in animals. In some countries, approximately 80% of the total consumption of medically important anti-infectives is in the animal sector, largely for growth promotion in healthy animals; this leads to the limited production of new pharmaceuticals. Typically, antibiotics are the last line of therapy in most serious infections, limiting their revenue potential. As antibiotics are used for a short duration, their revenue per treatment cycle is also lower than other drug classes. Moreover, there are numerous antibiotics available as generics, which are priced significantly lower than their branded counterparts. Also, the market life of anti-infectives is often short as bacteria become resistant despite preventive measures. All these factors add to the reluctance of pharmaceutical manufacturers to invest in this market, resulting in a shorter pipeline than the other segments in the pharmaceutical industry

Opportunities: Growing prevalence of chronic animal diseases

Globally, the prevalence of several chronic conditions has increased in companion animals over the last decade. According to Banfield Pet Hospital’s 2019 State of Pet Health report, one in six pets in the US is overweight. The report also states that between 2010 and 2019, the number of overweight dogs in the US has increased by 183%, and this figure is 174% in cats. Similarly, the prevalence of diabetes mellitus in dogs increased from 15.2 cases per 10,000 in 2008 to 28.5 cases per 10,000 in 2019, representing a 79.7% increase. In cats, the prevalence of diabetes mellitus increased from 60.2 cases per 10,000 in 2008 to 69.6 cases per 10,000 in 2019. Also, in 2018, Nationwide Pet Insurance received more than 82,000 claims from policyholders whose pets were either diagnosed and/or treated for cancer, which was an increase of 12% from the previous year.

Challenges: Limited awareness on vaccines coverage

In many cases, despite initiatives to promote the use of vaccines, the overall vaccine coverage is found to be low. This is mainly due to the lack of awareness about vaccination and inadequate surveillance and reporting systems. Even when vaccines are available, inadequate data can complicate decisions on vaccine requirement for various areas. Moreover, surveillance and reporting systems are still inadequate for many diseases and in many countries, which is resulting in the late diagnosis and reporting of disease outbreaks. This issue is primarily related to funding, as pet owners are often reluctant to pay for diagnostic tests or surveillance and reporting. Investments and funding for improving surveillance and reporting systems are expected to ultimately transfer the benefits to human health by reducing the overall prevalence of zoonotic diseases. However, until such investments are made available, the inadequate surveillance and reporting systems for vaccines is expected to restrain the adoption of vaccines for companion animals.

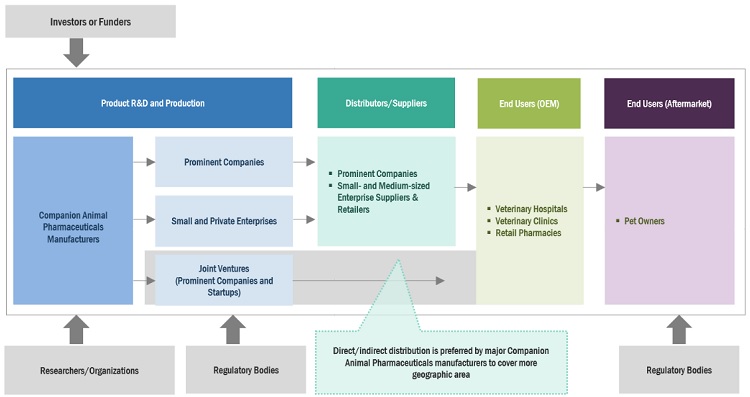

Companion Animal Pharmaceuticals Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of Companion Animal Pharmaceuticals. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include Zoetis Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim GmbH (Germany), Elanco Animal Health Incorporated (US), Virbac (France), Ceva Santé Animale (France), Vetoquinol S.A. (France), and Dechra Pharmaceuticals plc (UK).

The dermatologic diseases segment is expected to grow at the highest CAGR, in the companion animal pharmaceuticals market by indication, in the forecast period

The market is divided into infectious diseases, dermatologic diseases, orthopaedic diseases, pain, behavioural diseases, and other indications based on the prescription of medications for a wide range of illnesses commonly seen in animals. Throughout the projected period, the segment for dermatologic disorders is anticipated to increase at the greatest CAGR. Some of the main reasons influencing the growth of this market include the rising prevalence of arthritis, the rising need for cutting-edge orthopaedic medications, and the rising pet population.

The dogs segment holds the largest share in the animal type segment of Companion Animal Pharmaceuticals Market, in the forecast period.

The market is segmented into dogs, cats, horses, and other companion animals based on animal type. The market segment 2021 that accounts for the biggest share belongs to dogs. The large share of this market is driven to factors such the rising ownership rate and dog population, the prevalence of zoonotic infections and other skin allergies in dogs, the rising cost of veterinary care for dogs, and the expansion of pet insurers globally.

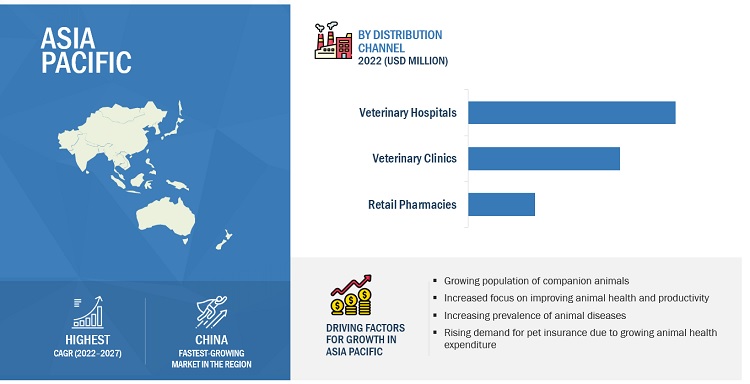

Veterinary hospitals is expected to grow at the highest CAGR in the companion animal pharmaceuticals market by distribution channel segment in the forecast period.

The global market, based on the distribution channel is divided segmented into veterinary hospitals, veterinary clinics, and retail pharmacies. Throughout the projected period, the segment for veterinary hospitals is projected to grow at the greatest CAGR. Some of the major factors propelling the growth of this market include the increased use of animal parasiticides and antibiotics in hospitals, rising incidence of infectious diseases, rising number of veterinary hospitals, rising ownership of companion animals, rising veterinary expenses, and rising awareness of animal health in developing nations.

Asia Pacific will grow by highest CAGR in the companion animal pharmaceuticals market, by region.

In 2021, Asia Pacific will grow by highest CAGR in the market, by region, followed by Latin America, Europe, Middle East & Africa and North America. The highest CAGR of Asia Pacific can be attributed to the well-established base of animal health industries, the high adoption of companion animals, rising incidence of parasitic infections, the large number of hospitals and clinics, growing pool of veterinarians, and growing expenditure on animal health in the region. The growing number of research activities and funding and awareness campaigns in the field of veterinary health management is also expected to drive the growth of this market.

To know about the assumptions considered for the study, download the pdf brochure

The prominent players in the global companion animal pharmaceuticals market are Zoetis Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim Internation GmbH (Germany), Elanco Animal Health Incorporated (US), Virbac (France), Ceva Santé Animale (France), Vetoquinol (France), and Dechra Pharmaceuticals plc (UK).

Companion Animal Pharmaceuticals Market Report Scope:

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments Covered |

By Indication, By Route of Administration, By Animal type, By Distribution Channel |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East & Africa |

|

Companies Covered |

Zoetis, Inc. (US), Merck & Co., Inc. (US), Boehringer Ingelheim International GmbH (Germany), Elanco Animal Health Incorporated (US), Eco Animal Health Group PlC (UK), Virbac (France), Dechra Pharmaceuticals PLC (UK), Vetoquinol (France), Neogen Corporation (US), Orion Group (Finland), Zenex Animal Health India Private Limited (India), Norbrook Holdings Limited (UK), Chanelle Pharma (Ireland), HIPRA (Spain), Ceva Sante Animale (France), Tianjin Ringpu Bio-Technology Co Ltd. (China), Kyoritsu Seiyaku (Japan), Endovac Animal Health (US), Indian Immunologicals Ltd (India), Ashish Life Sciences Pvt Ltd (India), Lutim Pharma Pvt Ltd (India), Biogénesis Bagó (US), Brilliant Bio Pharma (India), Intas Pharmaceuticals (India), and Vetindia Pharmaceuticals limited (India). |

The study categorizes the Companion Animal Pharmaceuticals market into following segments & sub-segments:

By Indication

- Infectious Diseases

- Dermatologic Diseases (Skin Diseases)

- Pain

- Orthopedic Diseases

- Behavioral Disorders

- Others(Dental, Cardio, Pregnancy, Cancer)

By Route of Administration

- Oral

- Injectable

- Topical

By Animal Type

- Dogs

- Cats

- Horses

- Other Companion Animals

By Distribution Channel

- Veterinary Hospitals

- Veterinary Clinics

- Retail Pharmacies

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments:

- In November 2022, The company launched MOVOFLEX, a new joint supplement for dogs, in Europe

- In January 2022, Zoetis received the US FDA Approval of Simparica Trio (sarolaner, moxidectin, and pyrantel chewable tablets), a new label Indication for the prevention of Borrelia burgdorferi Infections in dogs.

- In July 2020, Merck acquired the US rights from Virbac for the SENTINEL brand of combination parasiticides used to protect dogs against fleas and common intestinal parasites.

- In December 2020, Elanco entered into an agreement with Kindred Biosciences to acquire the exclusive global rights to KIND-030, a first-of-its-kind monoclonal antibody developed to treat and prevent canine parvovirus (CPV).

Frequently Asked Questions (FAQ):

What is the projected market value of the global companion animal pharmaceuticals market?

The global market of companion animal pharmaceuticals is projected to reach USD 19.6 billion.

What is the estimated growth rate (CAGR) of the global companion animal pharmaceuticals market for the next five years?

The global companion animal pharmaceuticals market is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.3% from 2022 to 2027.

What are the major revenue pockets in the companion animal pharmaceuticals market currently?

In 2021, Asia Pacific will grow by highest CAGR in the market, by region, followed by Latin America, Europe, Middle East & Africa and North America. The highest CAGR of Asia Pacific can be attributed to the well-established base of animal health industries, the high adoption of companion animals, rising incidence of parasitic infections, the large number of hospitals and clinics, growing pool of veterinarians, and growing expenditure on animal health in the region. The growing number of research activities and funding and awareness campaigns in the field of veterinary health management is also expected to drive the growth of this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

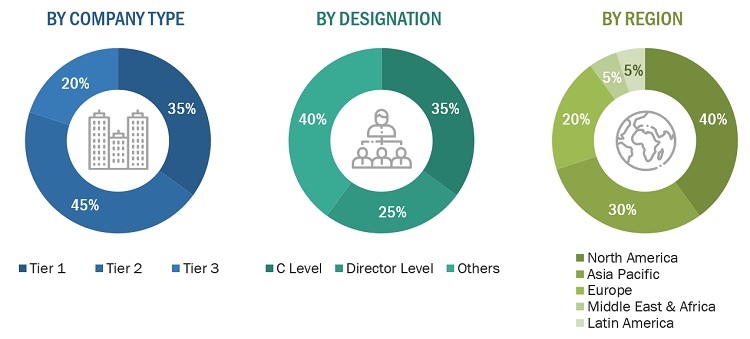

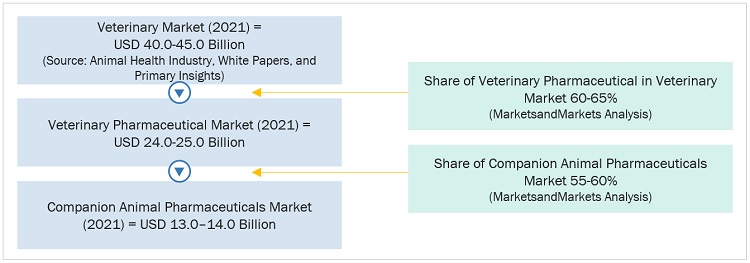

The study involved four major activities in estimating the current size of the Companion Animal Pharmaceuticals market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering Companion Animal Pharmaceuticals and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the Companion Animal Pharmaceuticals market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the Companion Animal Pharmaceuticals market scenario through secondary research. Several primary interviews were conducted with market experts from both, the demand and supply sides across major countries of North America, Europe, Asia Pacific, Latin America and the Middle East & Africa. Primary data was collected through questionnaires, emails, and telephonic interview. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors, from business development, marketing, product development/innovation teams, and related key executives from Companion Animal Pharmaceuticals manufacturers; distributors; and key opinion leaders.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, customer/end users who are using Companion Animal Pharmaceuticals were interviewed to understand the buyer’s perspective on the suppliers, products, and their current usage of Companion Animal Pharmaceuticals and future outlook of their business which will affect the overall market.

The breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the Companion Animal Pharmaceuticals market includes the following details.

The market sizing of the market was undertaken from the global side.

Global Companion Animal Pharmaceuticals Market Size: Top Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Companion animal pharmaceuticals are used to treat animals to improve their performance and health. Animal health products, especially pharmaceuticals, are the most widely used products for animal healthcare. The animal health products covered in this report include antimicrobials, antibiotics, vaccines, and parasiticides for treating infectious diseases or other disorders in companion animals.

Key Stakeholders

- Senior Management

- End Users

- Veterinarians

- Finance/Procurement Department

Report Objectives

- To define, describe, segment, and forecast the companion animal pharmaceuticals market by indication, route of administration, animal type, distribution channel, and region

- To provide detailed information about the factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in five main regions along with their respective key countries, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa

- To profile the key players in the market and comprehensively analyze their core competencies and market shares

- To track and analyze competitive developments, such as acquisitions, product launches, expansions, and partnerships of the leading players in the market

- To evaluate and analyze the impact of the recession on the market across the globe

Available Customizations

- MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the Companion Animal Pharmaceuticals market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the Companion Animal Pharmaceuticals Market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Companion Animal Pharmaceuticals Market