Connected Toys Market by Application (Education, Entertainment), Age Group (1 -5 Years, 6 -8 Years, 9-12 Years, 13-19 Years), Interfacing Device (Smartphone/Tablet and PC/Laptop), Distribution Channel, Technology and Region - Global Forecast to 2028

Connected Toys Market - Size, Growth, Report & Analysis

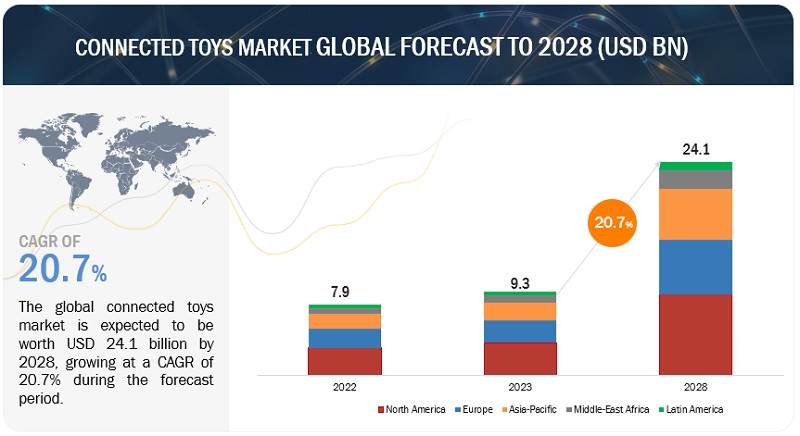

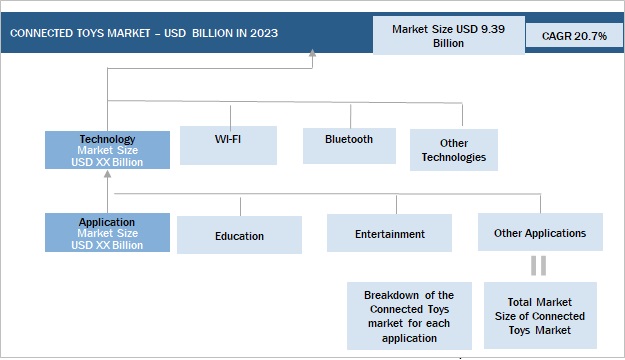

[216 Pages Report] The global Connected Toys Market size was valued $9.3 billion in 2023. The revenue forecast for 2028 is set for the valuation of $24.1 billion. It is projected to grow at a CAGR of 20.7% during the forecast period (2023-2028). The base year for estimation is 2022 and the market size available for the years of 2018 to 2028.

The growing middle class, rising disposable incomes, a decrease in the number of children per family, and increased interest in premium toys with high quality. Also, the need to enhance children’s skills is one of the key factors driving demand for the connected toys market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Connected Toys Market Dynamics:

Driver: Inclination of children toward more interactive and self-engaging toys

Mobile device advancements and the expansion of internet content have triggered a global revolution in how consumers engage with and access online content. Digital devices play a crucial role in content creation in today's world. With the help of mobile devices, excellent learning experiences can be generated. Many kids these days play with toys and technologies that can interact with them, either directly or via an internet app. Because of the popularity of these toys and devices that provide a pleasant and instructive experience, as well as technological advancements, many of these products are on the market to pick. Children like playing in various ways with whatever technology they have access to, and toymakers have responded by inventing experiences that combine the two. Recently, there have been products and technologies that give play experience to spark children's imaginations and seamlessly merge digital interactions with real playthings.

Restraint: Connected toys raise issues for privacy concerns.

Many connected toys collect data about children's interactions, preferences, and usage patterns. Concerns arise when this data is shared with third-party companies or used for targeted advertising without explicit parental consent. Also, connected toys, like any internet-connected devices, are susceptible to cybersecurity threats.

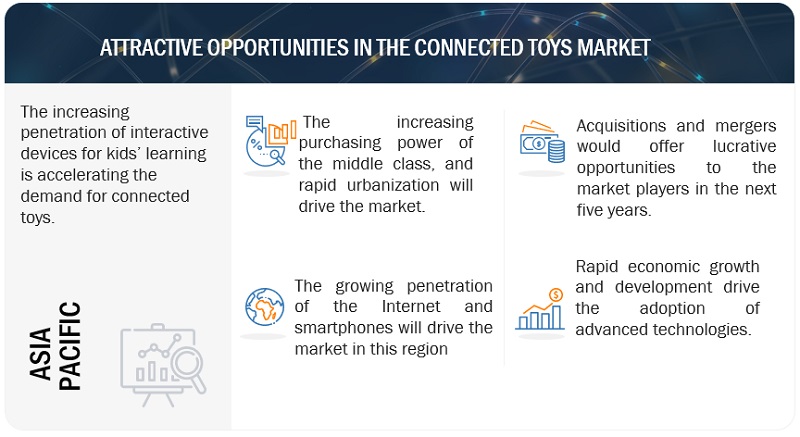

Opportunity: Increasing awareness of the Internet and technology

The increasing awareness of the internet and technology and the growing disposable income of the national population in both developed and developing economies generate opportunities for connected toy vendors. Understanding and interpreting the latest technology builds confidence among the end users regarding smartphone and tablet-based toys. Higher disposable income and growing preference among children in developed countries drive parents to spend more on tech-enabled smart toys, thereby increasing the opportunities for connected toy providers.

Connected toys are emerging in reaction to children's increasing access to screens, modifying traditional objects to include more interaction features those digital displays offer. Toys such as Povi use machine learning to collect data and track the content modules that children consume, their ability to talk about specific topics, and overall engagement level and listening skills.

Challenge: Negative effects on children's cognitive development.

Although the Internet of Things (IoT)-enabled connected toys can help kids learn and stay healthy, there are important considerations as more connected devices become available. For example, many games linked with smart toys have predefined parameters, making flexibility superfluous. They may also over-guide children instead of forcing them to solve difficulties on their own.

These toys may also cause children to become addicted to screens. Excessive screen usage among children harms their physical as well as mental health. In one of the studies, brain scans revealed that kids who spent a lot of time on screens has less growth in areas linked to language and cognition than those who read books. Reaching for a smartphone or a tablet before reaching for a book could hinder a child's development.

Market Ecosystem

Based on the distribution channel, the online segment is expected to grow with the highest CAGR during the forecast period.

The online distribution channel in the connected toys market is is fueled by the convenience and broad accessibility offered by online platforms, providing a wide variety of products from different brands. Exclusive offers, direct-to-consumer approaches, and global market access contribute to the attractiveness of online shopping.

Based on interfacing devices, the smartphone/tablet segment is expected to grow with the highest CAGR during the forecast period.

The expansion of the smartphone/tablet segment in the connected toys market is propelled by the widespread usage and familiarity of smart devices, which act as platforms for interactive play through companion apps. These devices provide versatility, personalized experiences, and seamless connectivity, ensuring that connected toys remain engaging and up-to-date with real-time updates.

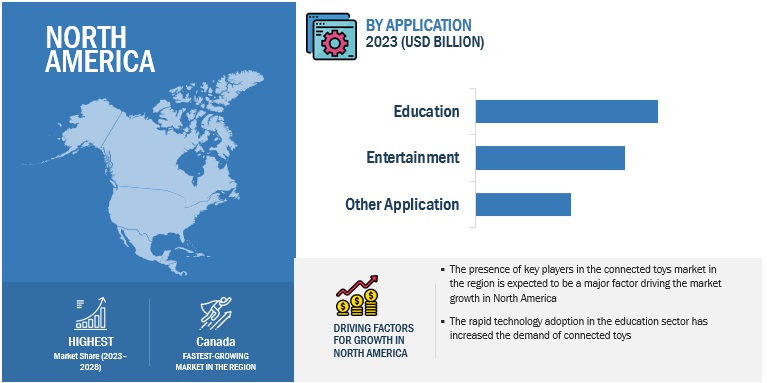

North America is expected to hold the largest market share during the forecast period.

The North American market has shown significant growth in the adoption of connected toys and is expected to continue till 2028. The tech-savvy population in North America, characterized by a strong affinity for digital devices and experiences, is a key driver for the connected toys market. Connected toys cater to this digital lifestyle, offering interactive and engaging play options that resonate with children and teenagers in the region. Also, The region's expertise in advanced technologies contributes to developing cutting-edge, connected toys, keeping North American consumers at the forefront of interactive play experiences.

Market Players:

The major players in the connected toys market Mattel (US), Hasbro (US), LEGO (Denmark), Sony (Japan), VTech (Hong Kong), UBTECH (China), DJI (China), iRobot (US), Sphero (US), Digital Dream Labs (US), Pillar Learning (US), Wonder Workshop (US), TOSY Robotics (Vietnam), Workinman Interactive (New York), WowWee Group (Hong Kong), KEYi Technology (China), Miko (India), Makeblock (China), Smart Teddy (US), Intelino (US), Fischertechnik (Germany), Potensic (China), Mainbot (France), ROYBI (US), PlayShifu (India). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions, to expand their footprint in the connected toys market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments Covered |

Application, Age Group, Distribution Channel, Interfacing Devices, Technology, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Major Vendors - Mattel (US), Hasbro (US), LEGO (Denmark), Sony (Japan), VTech (Hong Kong), UBTECH (China), DJI (China), and iRobot (US). Startup/SME Vendors - Sphero (US), Digital Dream Labs (US), Pillar Learning (US), Wonder Workshop (US), TOSY Robotics (Vietnam), Workinman (New York), WowWee Group (Hong Kong), KEYi Technology (China), Miko (India), Makeblock (China), Smart Teddy (US), Intelino (US), Fischertechnik (Germany), Potensic (China), Mainbot (France), ROYBI (US), and PlayShifu (India). |

This research report categorizes the Connected Toys market to forecast revenues and analyze trends in each of the following submarkets:

Based on application:

- Education

- Entertainment

- Other applications

Based on age group:

- 1- 5 years

- 6-8 years

- 9-12 years

- Teenagers (13-19 years)

Based on interfacing device:

- Smartphone/Tablet

- PC/Laptop

Based on distribution channel:

- Online

- Offline

Based on technology:

- Wi-Fi

- Bluetooth

- Other Technologies

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- India

- Japan

- Rest of Asia Pacific

-

Middle East and Africa

- Middle East

- Africa

- Rest of the Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In June 2023, Hasbro, announced a worldwide administration deal with Sony Music Publishing to support Hasbro’s entire portfolio of fan and family brands, including Peppa Pig, Transformers, My Little Pony and many more.

- In April 2023, Hasbro unveiled several multi-year licensing agreements to create co-branded toys and games. These deals focus on Barbie (Monopoly games launching fall 2023) and Transformers (UNO games hitting shelves later this year and Hot Wheels vehicles set to debut in early 2024).

- In March 2023, The LEGO Group India partnered with Amazon.in to launch LEGO Brand Days.

- In September 2022 iRobot introduced the Roomba Comb j7+, the advanced robot vacuum and mop, along with iRobot OS 5.0 updates. children.

- In May 2022, Mattel partnered with HBO Max and Cartoon Network on a new live-action American Girl based on the hit doll.

Frequently Asked Questions (FAQ):

What is the definition of the connected toys market?

Connected toys are hybrid objects that sit between the toy and the communication tool. Connected toys are internet-enabled devices that operate with the help of Bluetooth, Wi-Fi and other technologies. They aim to provide a more personalized experience through embedded software such as web search functions and speech recognition.

What is the market size of the connected toys market?

The connected toys market size is projected to grow from USD 9.3 billion in 2023 to USD 24.1 billion by 2028, at a CAGR of 20.7% during the forecast period.

What are the major drivers in the connected toys market?

The advancements in technology, particularly in the fields of the Internet of Things (IoT) and artificial intelligence, have enabled the seamless integration of toys with smart devices, providing interactive and immersive play experiences.

Who are the key players operating in the connected toys market?

The key market players profiled in the connected toys market report include Mattel (US), Hasbro (US), LEGO (Denmark), Sony (Japan), VTech (Hong Kong), UBTECH (China), DJI (China), iRobot (US), Sphero (US), Digital Dream Labs (US), Pillar Learning (US), Wonder Workshop (US), TOSY Robotics (Vietnam), Workinman Interactive (New York), WowWee Group (Hong Kong), KEYi Technology (China), Miko (India), Makeblock (China), Smart Teddy (US), Intelino (US), Fischertechnik (Germany), Potensic (China), Mainbot (France), ROYBI (US), PlayShifu (India).

What are the opportunities for new market entrants in the connected toys market?

The opportunities in the connected toys market are a growing inclination toward, increasing government initiatives, developing partnerships industry-specific solutions, penetration of advanced technologies, and increasing content protection policies.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

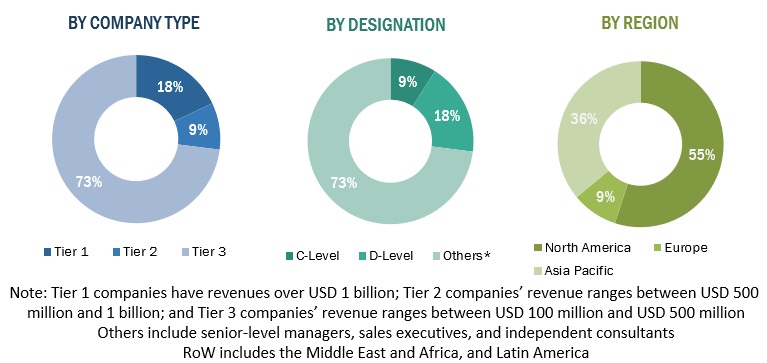

This research study involved the extensive use of secondary sources, directories, and databases, such as Dun and Bradstreet (D&B), Hoovers, and Bloomberg BusinessWeek, to identify and collect information useful for a technical, market-oriented, and commercial study of the Connected Toys market. The study involved four major activities in estimating the current size of the Connected Toys market. Exhaustive secondary research was done to collect information on the Connected Toys industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market breakup and data triangulation procedures were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

The market for the companies offering Connected Toys solutions and services is arrived at based on secondary data available through paid and unpaid sources and by analyzing the product portfolios of the major companies in the ecosystem and rating the companies based on performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications, and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to the industry trends to the bottom-most level, regional markets, and key developments from both market-and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for the report. The primary sources from the supply side included Chief Executive Officers (CEOs), Chief Technology Officers (CTOs), Chief Operating Officers (COOs), Vice Presidents (VPs), Managing Directors (MDs), technology and innovation directors, and related key executives from various key companies and organizations operating in the Connected Toys market. Primary interviews were conducted to gather insights, such as market statistics, data on revenue collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Finance Officers (CFOs), Chief Strategy Officers (CSOs), and the installation team of end users who use Connected Toys, were interviewed to understand buyers’ perspectives on suppliers, products, service providers, and their current usage of Connected Toys, which is expected to affect the overall Connected Toys market growth. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Connected Toys market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- Primary and secondary research processes have determined the industry’s supply chain and market size.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Connected Toys Market: Bottom-Up and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the Connected Toys market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

As per MnM, a connected toy is a hybrid object that sits between the toy and the communication tool. Connected toys are internet-enabled devices that operate with the help of Wi-Fi, Bluetooth, and other technologies. They aim to provide a more personalized experience through embedded software such as speech recognition and web search functions.

Key Stakeholders

- Connected toys vendors

- Service providers

- Toy retailers

- Resellers and distributors

- Research organizations

- Technology providers

- Venture capitalists, private equity firms, and startup companies

Report Objectives

- To determine, segment, and forecast the global Connected Toys market based on component, application, organization size, deployment type, vertical, and region

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and Middle East and Africa (MEA)

- To provide detailed information about the major factors (drivers, opportunities, threats, and challenges) influencing the growth of the Connected Toys market

- To study the complete value chain and related industry segments and perform a value chain analysis of the Connected Toys market landscape

- To strategically analyze macro and micromarkets1 with respect to individual growth trends, prospects, and contributions to the total Connected Toys market

- To analyze industry trends, pricing data, and patents and innovations related to the Connected Toys market

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments of the Connected Toys market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Connected Toys Market

Wanted to know the North America market size of Connected Toys Market