Construction Equipment Market by Equipment Type (Excavator, Loader, Dozer, Dump Truck, Compactor, Crane), Propulsion, Power Output, Engine Capacity, Application, Electric Construction Equipment, Battery Chemistry & Region - Global Forecast to 2030

Construction Equipment Market Size, Growth Report & Forecast

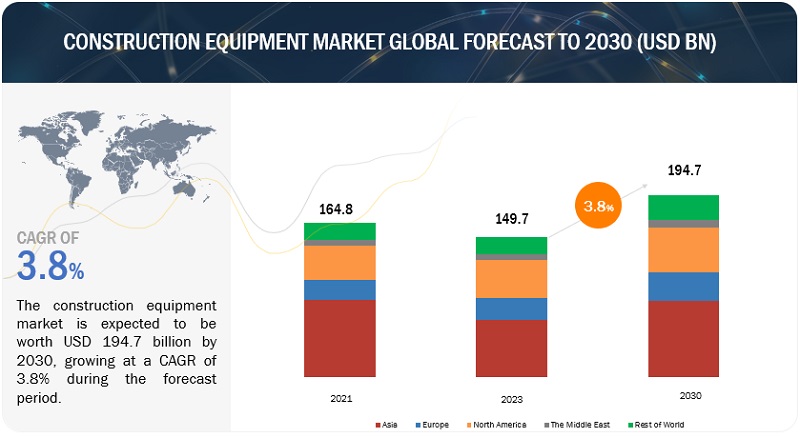

[471 Pages Report] The global construction equipment market worldwide size is valued at USD 149.7 billion in 2023 and is expected to reach USD 194.7 billion by 2030, at a CAGR of 3.8%. Construction equipment refers to heavy machinery that performs specific construction or demolition functions. This equipment is transportable, semi-permanent, or permanent and is primarily used for earthmoving, lifting containers or materials, drilling holes in the earth or rock, and concrete and paving applications. It is also used in other applications such as infrastructure, residential, commercial, and industrial buildings. Asia remains the key market for construction equipment, though the demand is also substantial in North America and Europe.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Construction Equipment Market Growth Dynamics

DRIVER: Growth in infrastructure development globally and rising demand for compact construction equipment

According to Oxford Economics, the construction industry is expected to grow from USD 9.7 trillion in 2022 to USD 13.9 trillion in 2037, driven by significant construction markets such as China, the US and India. The industry’s growth is mainly driven by increasing urbanization, population growth, technological advancements, the need to modernize existing infrastructure, and increased focus on developing sustainable green projects. Further, the construction equipment market has grown gradually with an increase in new equipment sales due to increased construction projects and planned new investments in the construction sector.

As per the declaration in June 2022, the European Union would invest nearly USD 5.4 billion in transport infrastructure development. The European Union has selected around 135 infrastructure projects to disburse development funds. In China, 102 mega projects were included in Beijing’s 2021-25 development plan. In December 2021, China’s finance ministry declared it had offered local governments an early allocation of ~USD 229 billion in quotas for 2022 for special-purpose bonds to support infrastructure investments. According to the UK Construction Leadership Council, planned investments include 700 projects and over USD 645.7 billion in the National Infrastructure Pipeline. Such planned investments and growing construction activities for infrastructure development would drive the demand for construction equipment during the forecast period.

RESTRAINT: Regulations and International trade policies

Construction equipment manufacture, import, and export laws and restrictions vary by nation. Nations levy different import taxes to prevent unfair trade practices and benefit domestic producers. Most of the time, countries sign bilateral trade agreements with other nations to lower tariffs and obstacles to a free trade zone or one market. While useful, this can also result in more international competitiveness. The impact of foreign affairs on trade is more significant. If disagreements with other nations, trade agreements might be halted or, in the worst-case scenarios, limitations enforced, completely restricting commerce. Consequently, the effects of global trade policies and Regulations provide barriers to the selling and growth of the building industry. Thus, international trade policies and regional regulations are one of the critical restraints observed for the construction equipment market.

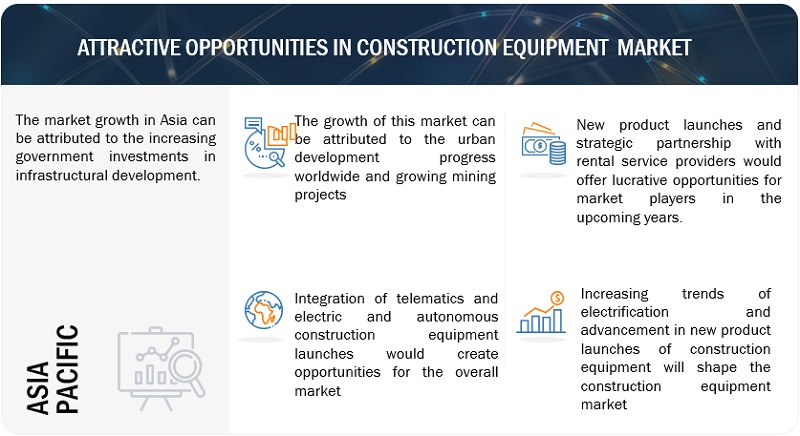

OPPORTUNITY : Government mandates telematics and e-call services

The construction equipment market is witnessing a lot of technological advancements for more optimized and reliable products. The off-highway industry is progressively embracing autonomous operating technologies. Construction activities are well-suited for autonomous machinery as the tasks are repetitive, physical, precise, and time-sensitive. Due to this, there is an increased need for automation in construction equipment. Manufacturers are creating wireless, autonomous construction machinery. using radio waves from other devices to obstruct communication technology, receive instructions, and report conditions. It guarantees enhanced production, decreased unplanned maintenance, and higher safety. Consequently, the growing popularity of autonomous construction equipment would present a business opportunity for the industry.

Thus, the growing popularity of automation and electrification is expected to offer futuristic growth opportunities in the construction equipment market.

CHALLENGE: Limited battery capacity in electric equipment would restrict optimized performance delivery

The battery is the heaviest component of an electric construction machine, and its size and weight can significantly impact the machine’s performance and maneuverability. Larger batteries can provide longer operating ranges but add weight and make the machine more difficult to transport and maneuver. Also, the cost of batteries is still a major barrier to adopting electric construction equipment. In recent years, lithium-ion batteries have been declining, but they are still expensive compared to traditional diesel engines. In addition to this, the charging time for electric construction equipment can be a major inconvenience. Depending on the battery’s size and the charger’s power, it can take several hours to charge a battery fully. Using electric construction equipment on long or continuous jobs can make it difficult.

Thus, electric construction equipment battery threats are expected to pose a challenge for the construction equipment market.

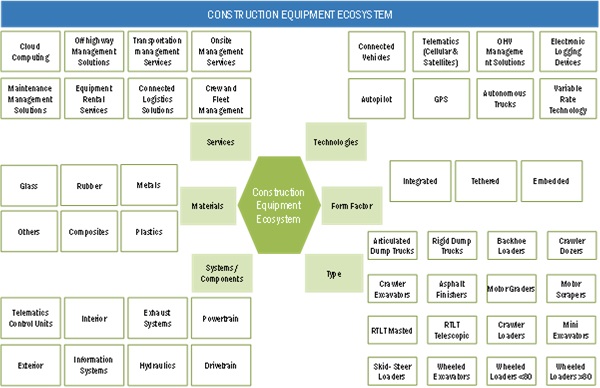

Construction Equipment Market Ecosystem.

The construction equipment ecosystem comprises component suppliers, assembly lines, distribution and service, rental service components, and end users.

The ecosystem comprises component suppliers who supply engines and drivetrains and specialized suppliers for boom and cabin. These components are assembled at the second level of the ecosystem. This stage brings together components for the assembly and fabrication of construction equipment. At the distribution and service level, the dealer sells construction equipment independently without the intervention of the manufacturers.

Manufacturers directly deal with construction companies for sales. Rental services include construction equipment manufacturers who undertake both sales of new equipment and rental services, and the end user completes the ecosystem

“The Electric Dump Truck is expected to lead the electric & hybrid construction equipment segment.”

Electric dump truck is the largest market in the electric & hybrid construction equipment segment. Dump trucks, also known as dumpers, tipper dumpers, and tipper trucks, carry materials in surface and underground mining applications. Electric & hybrid dump trucks have emerged as a promising alternative to traditional diesel-powered vehicles owing to its range of advantages such as reduced or negligible fuel consumption, low noise, regenerative braking technology extending its driving range, and ability to handle heavy loads efficiently. The currently available battery technologies are undergoing tremendous developments and may not provide the required power output every time, so a majority of dump trucks are operating on hybrid-electric propulsion. The hybrid dump truck is powered by an additional electric motor, which delivers equivalent performance to counterparts with less fuel consumption and prevents electricity shortage in the case of pure electric dump trucks. Many companies are designing prototypes or pilot equipment showcased at trade shows or used at job sites to get real working experience. With the upcoming stringent emission laws in off-highway vehicles, such as China IV engine emission laws, the industry would anticipate a rapid shift towards electrification, driving the market demand for electric & hybrid dump trucks in future years.

The diesel propulsion type segment will lead the Construction Equipment market.

By propulsion type, the diesel segment is anticipated to hold the largest share at a global level in 2023. Diesel Construction machinery is conventional machinery with high penetration in the worldwide market due to its ability to provide substantial torque and consistent performance, essential to handle medium to heavy-duty tasks in any given working condition. Diesel engines are efficient and trustworthy options that deliver reliable performance. Further, as it is a well-tested and saturated technology, easy availability of spare parts and aftersales services, lower cost, and hassle-free maintenance make the diesel-powered equipment a suitable option. Alternatively, rising government stringent laws and rising development to reach zero emission targets are fuelling the demand for CNG/LNG/RNG alternatives; hence, this segment is experiencing a swift upsurge during the forecast period. However, it is still considered to have a limited share by 2030, and diesel will continue to dominate the global construction equipment market in the future.

“Infrastructure segment is anticipated to be the fastest-growing segment for construction equipment market, by application.”

The infrastructure segment is expected to grow at the highest CAGR from 2023 to 2030, owing to massive changes in infrastructural developments such as mega corridor projects and dams in developing and developed countries. Developmental activities in commercial and residential applications like the construction of commercial complexes, corporate offices, residential societies and buildings, construction of airports and ports, expansion of roads, and other activities are a significant part of the infrastructure development plans globally. Further, rapid urbanization has increased government infrastructure spending and increased construction activities for dams, roads, bridges, metro stations and railway tracks, airports, hydroelectric projects, and other activities. Infrastructural activities are projected to grow in the coming years as they are critical in improving connectivity and promoting sustainable growth. Heavy equipment and compact construction equipment, including small excavators and compact wheel loaders, have significant demand as they offer several advantages while operating on a range of tasks. Mini excavators are often lightweight, portable, easy to use, excellent for limited spaces, and may be used for interior demolition or construction projects. In Europe, 70% of mini excavators sold are below 3 tonnes. Likewise, compact wheel loaders are easy to operate and maneuver in small spaces. They can also be driven on public roads in some countries, subject to legislation, road homologation, and registration. Thus, with rising capital-intensive infrastructure projects, the demand for construction equipment is speculated to grow in the coming years.

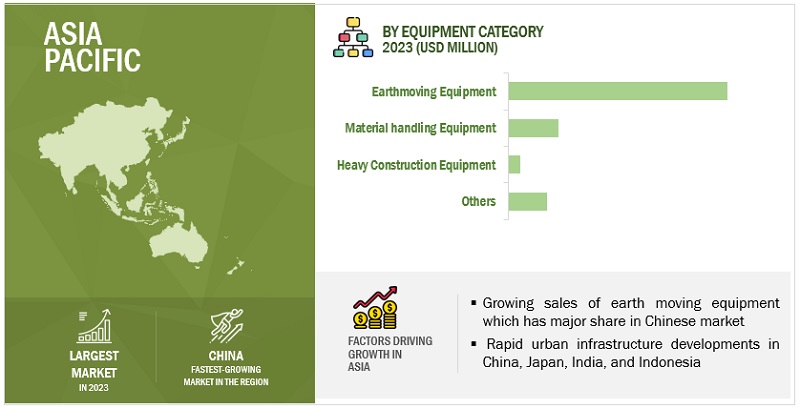

Asia is projected to be the largest regional market.

Asia holds the largest share of the Construction Equipment market, which China dominates, followed by Japan and India. The growth of the Chinese market is mainly supported by stimulus spending provided by the government in 2020, which resulted in tremendous growth in the next two years. However, there was a sharp decline noticed in 2022 with a significant margin as the market started to fall to get normal to reach before 2020 sales. Due to this, the market is expected to remain downward in 2023. It will slowly recover in 2024, mainly due to the anticipated growing demand for compact equipment and the gradual increase in residential housing projects. Alternatively, demand for construction equipment in Japan is expected to grow because the government is heavily investing in reconstructing properties destroyed by natural disasters such as earthquakes and tsunamis.

Further, many of the population is also moving to cities in India, where urbanization is increasing, seeking better work opportunities and higher living standards. Due to this, the market grew in 2022 and is likely to remain upward in 2023 owing to several plans for infrastructure investment, which act as a driving force for the market. Developing nations such as Indonesia, Thailand, Malaysia, and others are pushing market growth due to increased public spending on housing and government expenditure on infrastructural developments.

Key Market Players

The construction equipment market is dominated by players such as Caterpillar (US), Komatsu Ltd. (Japan), Hitachi Construction Machinery Co., Ltd. (Japan), Xuzhou Construction Machinery Group (China), and Deere & Company (US). These companies have strong distribution networks at the global level. These companies have adopted comprehensive expansion strategies and undertaken collaborations, partnerships, and mergers & acquisitions to gain traction in the growing market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018–2030 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2030 |

|

Forecast units |

Volume (Units) and Value (USD Million/Billion) |

|

Segments Covered |

By Equipment Type, Equipment Category, Power Output, Propulsion, Engine Capacity, Application, Rental Application, Electric Equipment Type, Battery Chemistry, Compact Equipment Shipment By OEM, Aftertreatment Device and Region. |

|

Geographies covered |

Asia, North America, Europe, The Middle East, and the Rest of the World [RoW] |

|

Companies covered |

Caterpillar (US), Komatsu Ltd. (Japan), Deere & Company (US), Hitachi Construction Machinery Co., Ltd., Xuzhou Construction Machinery Group (China), SANY Group (China), and AB Volvo (US) |

Along with the given market data, MarketsandMarkets offers customizations in accordance with the company’s specific needs

The study segments the construction equipment market :

By Equipment Type

- Articulated Dump Trucks

- Asphalt Finishers

- Backhoe Loaders

- Crawler Dozers

- Crawler Excavators

- Crawler Loaders

- Mini Excavators

- Motor Graders

- Motor Scrapers

- Rigid Dump Trucks

- Road Rollers

- Rough Terrain Lift Truck (RTLT) Masted

- Rough Terrain Lift Truck (RTLT) Telescopic

- Skid-Steer Loaders

- Wheeled Excavators

- Wheeled Loaders <80 HP

- Wheeled Loaders >80 HP

- Compactors

- Pick and Carry Cranes

By Equipment Category

- Earthmoving Equipment

- Material Handling Equipment

- Heavy Construction Equipment

- Other Equipment

By Propulsion Type

- Diesel

- CNG/LNG/RNG

By Power Output

- <100HP

- 101-200HP

- 201-400HP

- >400 HP

By Engine Capacity

- <5L

- 5-10L

- >10L

By Application

- Commercial

- Residential

- Infrastructure

By Aftertreatment Device

- Diesel Oxidation Catalyst

- Diesel Particulate Filter

- Exhaust Gas RecirculationSelective Catalyst Reduction

By Rental Applicatio

- Commercial

- Residential

- Infrastructure

Electric & Hybrid Construction Equipment Market, By Equipment Type

- Electric Dump Trucks

- Electric Dozers

- Electric Loaders

- Electric Excavators

- Electric Motor Graders

- Electric Load Haul Dump

Electric Construction Equipment Market, By Battery Chemistry

- Lithium Iron Phosphate

- Lithium Nickel Manganese Cobalt

- Other Batteries

Compact Construction Equipment Market, Global Shipment by OEM

- Bobcat

- Caterpillar

- Hitachi Construction Equipment

- CNH Industrial

- Hyundai Construction Equipment Co., Ltd

- JCB

- Deere & Company

- Komatsu

- Kubota Corporation

- Liebherr

- Liugong Machinery Co., Ltd

- Terex Corporation

- AB Volvo

- Wacker Neuson SE

- Yanmar Holdings Co., Ltd

- Kobelco

By Region

- Asia

- North America

- Europe

- Middle East

- Rest of the World [RoW]

Recent Developments

- In June 2023, Caterpillar Inc. launched the new Cat 995 Wheel Loader, which increased to 19% more than the previous model. Also, it will deliver up to 13% lower hourly fuel consumption and offer an additional 8% efficiency gain.

- In June 2022, Komatsu Ltd. and Cummins Inc. collaborated on developing zero-emission haulage equipment. Building on the legacy of diesel engine partnership across various mining and construction equipment. This collaboration with Cummins Inc. helps the company to provide zero-emission solutions for its global customers.

- In March 2023, Deere & Company unveiled the new 85 P-Tier and 510 P-Tier current generation excavator models at CONEXPO-CON/AGG 2023 in Las Vegas, US.

- In June 2022, Deere & Company and Wacker Neuson collaborated on developing < 5 metric tons of excavators designed and manufactured by Wacker Neuson. Also, Deere & Company will develop and manufacture 5-9-metric-ton excavators, incorporating designs from Wacker Neuson. Per the agreement, distribution, parts, service, and support will continue through the Deere & Company dealer network.

- In May 2023, Hitachi Construction Machinery invested in and formed a commercial partnership with aptpod, Inc. In the future, Hitachi Construction machines will use the high-speed IoT platform offered by Autopod to co-create real-time "digital twins*1" for construction sites and will design systems for remote control and autonomous operation of construction machines using the digital twins

Frequently Asked Questions (FAQ):

What is the current size of the global Construction Equipment market?

The construction equipment market is projected to grow from USD 149.7 billion in 2023 to USD 194.7 billion by 2030, at a CAGR of 3.8%.

Which equipment category is currently leading the Construction Equipment market?

The Earthmoving equipment category is leading in the Construction Equipment market.

Many companies are operating in the Construction Equipment market space across the globe. Do you know who the front leaders are and what strategies they have adopted?

The Construction Equipment market is dominated by Caterpillar (US), Komatsu (Japan), XCMG (China), JohnDeere (US), and Sany (China) these are the top players in the market.

How does the demand for Construction Equipment vary by region?

Asia is estimated to be the largest market for Construction Equipment during the forecast period, followed by North America. The growth of the Construction Equipment market in Asia-Pacific is mainly attributed to the rising urban infrastructure development.

What are the growth opportunities for the Construction Equipment supplier?

Government mandates and the emergence of various technologies, such as 5G and AI, would create growth opportunities for the Construction Equipment market.

Which battery chemistry segment is the fastest-growing segment?

The CNG/LNG/RNG segment is the fastest growing segment, with the highest growth rate of 5.9%. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involves four main activities to estimate the current size of the construction equipment market.

- Exhaustive secondary research was done to collect information on the market, such as equipment type, equipment category, power output, propulsion, engine capacity, application, rental application, electric & hybrid equipment type, battery chemistry, compact equipment shipment by OEM, aftertreatment device, and region.

- The next step was to validate these findings, assumptions, and market analysis with industry experts across value chains through primary research.

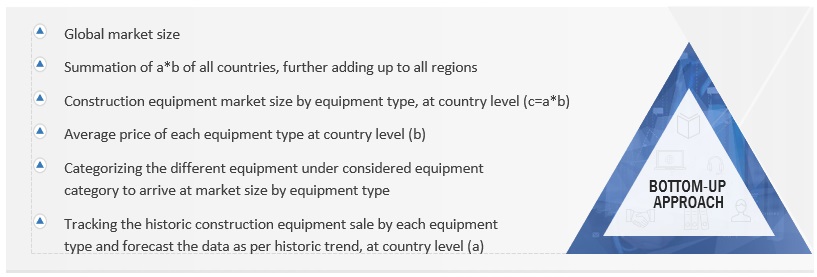

- Bottom-up and top-down approaches were employed to estimate the complete market size for different segments considered in this study.

- Thereafter, market breakdown and data triangulation processes were used to estimate the market size of segments and subsegments.

Secondary Research

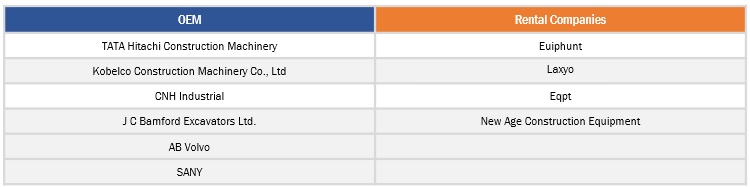

- The secondary sources referred to the company's annual reports/presentations, industry association publications, directories, technical handbooks, World Economic Outlook, technical articles, and databases were used to identify and collect information for an extensive study of the construction equipment market. Association of Equipment Manufacturers, the Committee for European Construction Equipment (CECE), corporate filings (such as annual reports, investor presentations, and financial statements), and off-highway associations. Secondary data was collected and analyzed to determine the overall market size, further validated through primary research. The primary sources—experts from related industries, OEMs, rental service players, and component suppliers—were interviewed to obtain and verify critical information and assess prospects and market estimations. Historical sales data has been collected and analyzed, and the industry trend is considered to arrive at the forecast, which is further validated by primary research.

Primary Research

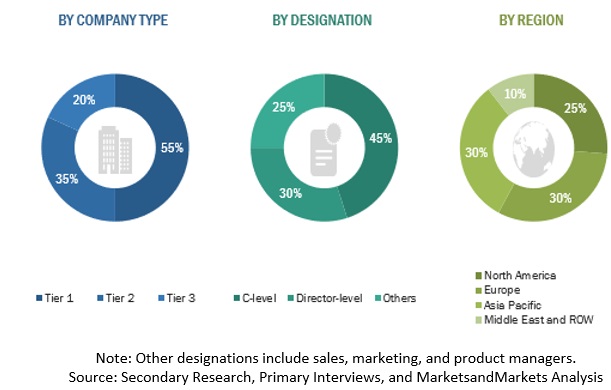

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as CXOs, Vice Presidents, Directors from business development, marketing, product development/innovation teams, and related key executives from various key companies. Various system integrators, industry associations, independent consultants/industry veterans, and key opinion leaders were also interviewed.

Through secondary research, extensive primary research was conducted after understanding the construction equipment market. Several primary interviews were conducted with market experts from both the demand- (rental players and distributors) and supply-side (off-highway OEMs, component suppliers, and others) players across five major regions—namely, North America, Europe, Asia, Middle East, and Rest of the World (Latin America and Africa). Approximately 70% and 30% of primary interviews were conducted with the OEMs and rental companies. The primary research data was collected through questionnaires, E-mails, and telephonic interviews.

After interacting with industry participants, brief sessions with highly experienced independent consultants were conducted to reinforce the findings from the primaries. This, along with the in-house subject matter experts’ opinions, has led to the conclusions described in the remainder of this report.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

A detailed market estimation approach was followed to estimate and validate the value of the construction equipment market and other dependent submarkets, as mentioned below.

- The bottom-up approach was used to estimate and validate the construction equipment market size. The market size of the market, by equipment and country, was derived by mapping the historical sales of different equipment at the country level. These data points were largely fetched from the country-level associations, off-highway databases, and OEM data excerpts. The market size, by value, was derived by multiplying the equipment-wise average selling price with the respective equipment volume calculated in units. Each country/region's total volume and value of each country/ region are then summed up to reveal the total volume of the global market for each type. The data was validated through primary interviews with industry experts. The market is further segmented into the equipment category, power output, engine capacity, propulsion, and electric construction equipment. The penetration of different segments was derived from secondary research and primary interviews.

- The gathered market data was consolidated, enhanced with detailed inputs, analyzed, and presented in this report.

Bottom-up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Top-Down Approach

Market Definition

Construction Equipment:

Construction equipment refers to heavy machinery that performs specific construction or demolition functions. This equipment is transportable, semi-permanent, or permanent and is primarily used for earthmoving, lifting containers or materials, drilling holes in the earth or rock, and concrete and paving applications. It is also used in other applications such as infrastructure, residential, commercial, and industrial buildings.

Key Stakeholders

- Construction Equipment manufacturers

- Raw Material Suppliers for Construction Equipment component/system manufacturers

- Consulting companies (Road, Building & Infrastructure)

- Tier 1 companies (Aftertreatment device manufacturers & component suppliers)

- Battery, motor, and other electric construction equipment part suppliers

- Equipment service providers

- Off-Vehicle Safety Regulatory Bodies

- Government and research institutions

- Off-highway and heavy equipment associations

- Rental equipment service providers

Report Objectives

-

To define, describe, and forecast the Construction Equipment market in terms of value (USD million) and volume (thousand units) based on the following segments:

- By Equipment Type (Articulated Dump Trucks, Asphalt Finishers, Backhoe Loaders, Crawler Dozers, Crawler Excavators, Crawler Loaders, Mini Excavators, Motor Graders, Motor Scrapers, Rigid Dump Trucks, Road Rollers, Rough Terrain Lift Truck (RTLT) Masted, Rough Terrain Lift Truck (RTLT) Telescopic, Skid-Steer Loaders, Wheeled Excavators, Wheeled Loaders <80 HP, Wheeled Loaders >80 HP, Compactors, and Pick and Carry Cranes)

- By Equipment Category (Earthmoving, Material Handling, Heavy Construction Vehicles, Others)

- By Propulsion Type (Diesel, CNG/LNG/RNG)

- By Power Output (<100HP, 101-200HP, 201-400HP, >400 HP)

- By Engine Capacity (<5L, 5-10L,>10L)

- By Application (Commercial, Residential, Infrastructure)

- By Aftertreatment Device (Diesel Oxidation Catalyst, Diesel Particulate Filter, Exhaust Gas Recirculation, Selective Catalyst Reduction)

- Rental, by Application (Commercial, Residential, Infrastructure)

- Electric & hybrid Construction Equipment Market, By Equipment Type (Electric Dump Truck, Electric Dozer, Electric Loader, Electric Excavator, Electric Motor Grader, Electric Load Haul Dump)

- Electric Construction Equipment Market, By Battery Chemistry (Lithium Iron Phosphate, Lithium Nickel Manganese Cobalt Oxide, Others)

- Compact construction Equipment Market, Global Shipment by OEM (Bobcat, Caterpillar, Hitachi Construction Equipment, CNH Industrial, Hyundai Construction Equipment Co., Ltd, JCB, Deere & Company, Komatsu, Kubota Corporation, Liebherr, Liugong Machinery Co., Ltd, Terex Corporation, AB Volvo, Wacker Neuson SE, Yanmar Holdings Co., Ltd, Kobelco)

- By Region (Asia Pacific, Europe, North America, The Middle East, and the Rest of the World)

- To understand the dynamics (drivers, restraints, opportunities, and challenges) of the market

- To analyze the market share of leading players operating in the construction equipment market and evaluate the company evaluation quadrant.

- To analyze the key player strategies/right to win and strategically analyze the market with driving and restraining factors, supply chain analysis, market ecosystem, technology trends, and trade analysis

- To analyze recent developments, including supply contracts, new product launches, expansions, and mergers & acquisitions, undertaken by key industry participants in the market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations in accordance with a company’s specific needs

Construction Equipment Market, By End-Use Industry

- Construction& Infrastructure

- Mining

- Oil & Gas

- Manufacturing

- Others

Construction Equipment Market, By Emission Regulation

- STAGE II

- STAGE III

- STAGE III a

- STAGE III b

- STAGE IV

- STAGE V

- STAGE VI

- TIER 3

- TIER 4

- TIER 5

Electric Construction Equipment Market, By Country

- China

- India

- Japan

- Indonesia

- US

- Canada

- Mexico

- Germany

- UK

- France

- Italy

- Spain

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Construction Equipment Market

We would like to know more about how electric construction equipment market and special application products for the further expansion of the European market.

Who are the top vendors in the Construction Equipment Market? How is the competitive scenario among them?

we are looking at setting up a website to sell new and used construction and mining equipment for Africa, there is nothing at the moment

My company deals with construction equipment, we buy equipment in large number and then sell them to export from Japan to all over the world.

We are trying to evaluate the market size of backhoes, excavators, dozers, skid steers, front end loaders, and articulated dump trucks. This will help prioritize where time and energy are spent.

Looking to identify U.S. market share by brand (Case, Cat, etc...) for various types of construction equipment.