Continuous Renal Replacement Therapy Market by Product (Hemofilter, Bloodline, Machines, Dialysates), Modality (SCUF, CVVH, CVVHD, CVVHDF), Age (Adult, Pediatric), Enduser (Hospitals, Ambulatory), and Region - Global Forecast to 2028

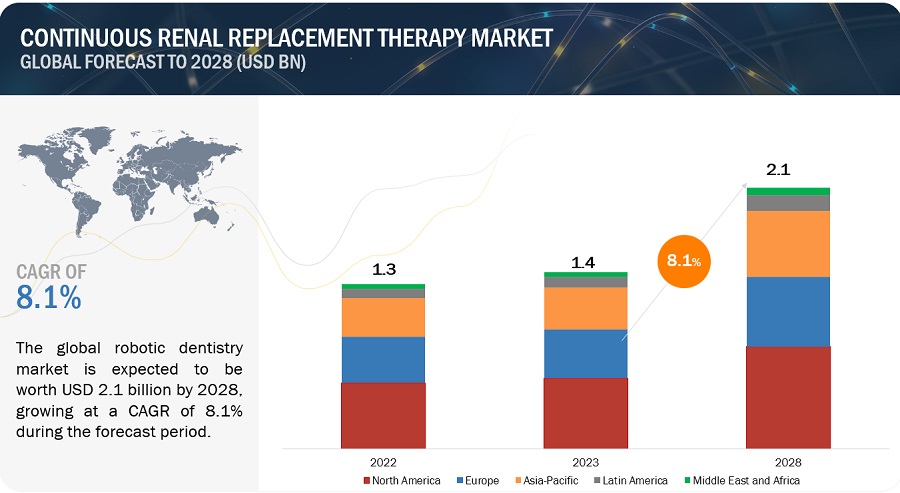

The global continuous renal replacement therapy market in terms of revenue was estimated to be worth $1.4 billion by 2023 and is poised to reach $2.1 billion by 2028, growing at a CAGR of 8.1% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Various factors such as rise in worldwide prevalence of AKI, Growing number of ICU patients with AKI and rising incidences of sepsis, and growing clinical advantage of CRRT over intermittent blood purification are factors likely to accelerate the growth of the market. Moreover, presence of well-established key players focusing on developing and commercializing technologically advanced and initiatives undertaken by government to increase the awareness about CRRT are likely to propel the market growth during the forecast period.

Attractive opportunities CRRT Market

To know about the assumptions considered for the study, Request for Free Sample Report

Continuous Renal Replacement Therapy Market Dynamics

Driver: Increase in the prevalence of incidence of acute kidney injury (AKI)

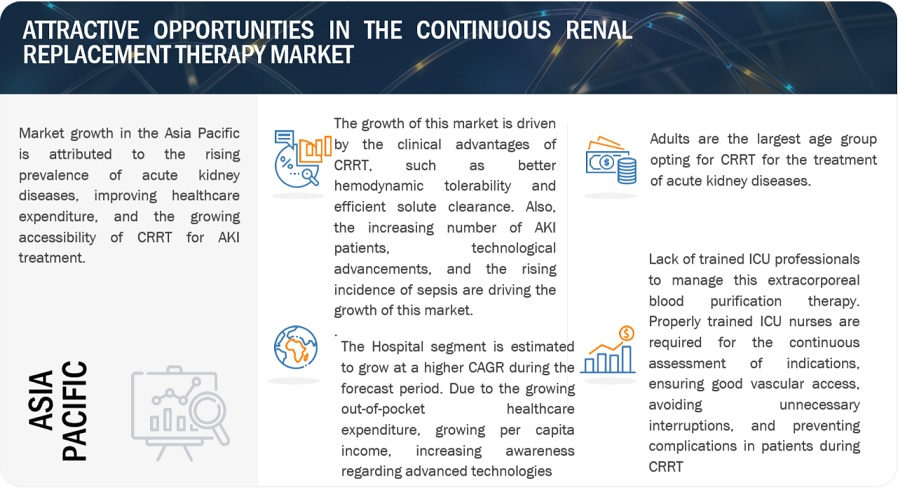

, The primary factor of the market growth is increasing incidences of Acute kidney injury which is, expected to boost the demand for CRRT. For instance , according to the International Society of Nephrology(INR), an estimation of 13.3 million cases of AKI were registered annually worldwide. This is anticipated to boost the adoption of continuous renal replacement therapy at a higherrate. With the increase in the geriatric population globally, the prevalence of kidney-related diseases is expected to grow significantly. This, in turn, is expected to attribute to the growth of the CRRT market at a significant rate during the forecast period.

Restraint: High procedural cost of CRRT

As the population in emerging nations is price-sensitive, they prefer lower-priced products. Although the cost of CRRT in developing countries is high which makes these procedures are still unaffordable for a large portion of the population due to the low purchasing power. This limits the demand and uptake of CRRT in developing as well as developed countries. Because of the high regulatory barriers, number of CRRT products that are approved in other countries have yet to be approved by the FDA. The share of the US in the global CRRT market is mainly due to its large population base of the acute kidney injury (AKI). Hence, the presence of stringent and time-consuming regulatory policies for the approval of new CRRT products in the region poses restraint to the growth of the global CRRT market.

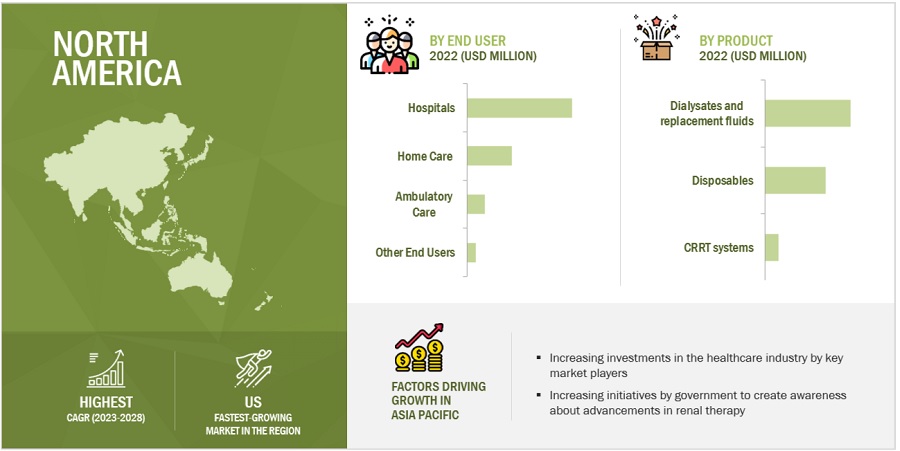

Opportunity: Emerging markets in APAC and RoW

In the Asia Pacific region, China, India, Japan, and South Korea are a few of the major markets for CRRT. The demand for CRRT is being driven by a sharp rise in the number of AKI cases in these nations. Furthermore, the governments of these nations are spending a lot of money on healthcare infrastructure, which is accelerating the expansion of the CRRT market.. Additionally, regulatory policies in the Asia Pacific region are more adaptive and less-stringent. This, along with the increasing competition in the mature markets (Europe, Japan, and Australia), will further boost up the growth of CRRT market in Asia pacific region.

Challenge: Shortage of trained ICU professionals in developing nations

CRRT is a one of the specialized and critical therapy which involves complex nursing care. Precise training of ICU nurses are required for the continuous assessment of indications, ensuring good vascular access, , and prevention of complications in patients during CRRT. Although , currently, there is a lack of registered nurses in ICU settings. Moreover the complexity associated with CRRT are likely to hamper the market growth.

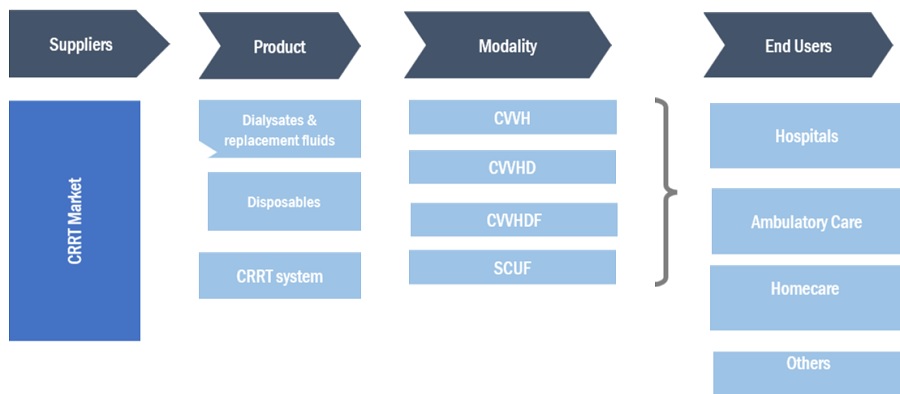

Ecosystem Analysis

The ecosystem map of the overall leukapheresis market comprises the elements present in this market and defines these elements with a demonstration of the bodies involved. CRRT products include systems and disposables. These products vary based on:

- Different types, including dialysates and replacement fluids, disposables and CRRT systems.

Disposables, including Hemofilters, Blood line and tubes and other disposables

By product, dialysates & replacement fluid segment of the continuous renal replacement therapy industry is to capture largest market share during the forecast period.

The largest share of this segment of the continuous renal replacement therapy market is attributed to factors such growing demand for dialysates to remove undesired solutes and restoring the electrolytes and acid-base balance in the blood along with presence of well established players with strong offerings in dialysates & replacement fluid. The dialysates and replacement fluids helps in removing undesired solutes and restores the electrolytes and acid-base balance in the blood. The CRRT procedures utilizes the lactate-buffered solutions or sterilized bicarbonate-buffered solutions as replacement fluids. The consumption of these fluids varies with different CRRT modalities, Hence it is more accurate and convenient to use.

The continuous venovenous hemodiafiltration (CVVHDF) is witnessed to have highest growth rate of the continuous renal replacement therapy industry, by modality during the forecast period.

The high growth rate of the CVVHDF segment can be attributed to its flexibility as compared to other CRRT modalities. The CVVHDF modality also combines the benefits of convection and diffusion for the removal of solutes, which is another major factor supporting its growth. The CVVHDF approach is more effective for the removal of small to medium-sized molecules. This therapy is used in patients with fluid overload, congestive heart failure, and acute renal failure.

Adult segment accounted for the largest share of the continuous renal replacement therapy industry, by age group, in 2022

The increasing demand for invisible braces among adults due to large adult population base with AKI, increase in the hospitalization among adult population, and the large availability of CRRT system and disposables for adults undergoing CRRT procedure. The adult population is the fastest-growing age group in both developed and developing nations. It has resulted in the increasing frequency of aggressive surgical and medical interventions, increasing the risk of developing AKI and further contributing to the market growth.

To know about the assumptions considered for the study, download the pdf brochure

North America is projected to be the largest regional market for continuous renal replacement therapy industry

North America dominates continuous renal replacement therapy market. The north American region is gaining traction with the increasing incidence and prevalence of AKI. Moreover due to strong foothold of major key players in the region, rising approval of CRRT products for multiple application across many countries, and initiatives by government to increase the awareness about the advancements in renal therapy are likely to play a major role in fueling the growth of the CRRT market in North America.

The prominent players operating in the global continuous renal replacement therapy market include Baxter International Inc. (US), Fresenius Medical Care AG & Co. KGaA (Germany), and B. Braun Melsungen AG (Germany),

Scope of the Continuous Renal Replacement Therapy Industry:

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$1.4 billion |

|

Estimated Value by 2028 |

$2.1 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 8.1% |

|

Market Driver |

Increase in the prevalence of incidence of acute kidney injury (AKI) |

|

Market Opportunity |

Emerging markets in APAC and RoW |

This research report categorizes the Continuous Renal Replacement Therapy Market to forecast revenue and analyze trends in each of the following submarkets:

By Product

- Dialysates and Replacement Fluids

- Disposables

- Hemofilters

- Bloodline Sets & Tubes

- Other Disposables

- CRRT Systems

By Modality

- Continuous venovenous hemofiltration (CVVH)

- Continuous venovenous hemodiafiltration (CVVHDF)

- Continuous venovenous haemodialysis (CVVHD)

- Slow continuous ultrafiltration (SCUF)

By Age Group

- Adults

- Pediatrics /Neonates

By End User

- Hospital

- Ambulatory care

- Homecare

- Others

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- RoEU

-

Asia Pacific

- Japan

- China

- India

- Australia

- South Korea

- RoAPAC

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East and Africa

Recent Developments of Continuous Renal Replacement Therapy Industry

- In 2020, Medtronic plc announced the launch of the Carpediem system, the first and only pediatric and neonatal acute dialysis system designed to treat patients weighing 2.5–10 kg (5.5–22 pounds) requiring renal replacement therapy.

- In 2019, Baxter International Inc. introduced the PrisMax CRRT system in the US

- In 2019, Fresenius Medical Care AG & CO. KGaA announced the launch of the 4008A dialysis machine in India.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global continuous renal replacement therapy market?

The global continuous renal replacement therapy market boasts a total revenue value of $2.1 billion by 2028.

What is the estimated growth rate (CAGR) of the global continuous renal replacement therapy market?

The global continuous renal replacement therapy market has an estimated compound annual growth rate (CAGR) of 8.1% and a revenue size in the region of $1.4 billion by 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

The study involved four major activities to estimate the current size of the Continuous Renal Replacement Therapy (CRRT) market. Exhaustive secondary research was carried out to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, and publications from government sources [such as National Institutes of Health (NIH), US FDA, US Census Bureau, World Health Organization (WHO), American Society Nephrology (ASN), American Association of Kidney Patients (AAKP), European Renal Association were referred to identify and collect information for the CRRTmarket study.

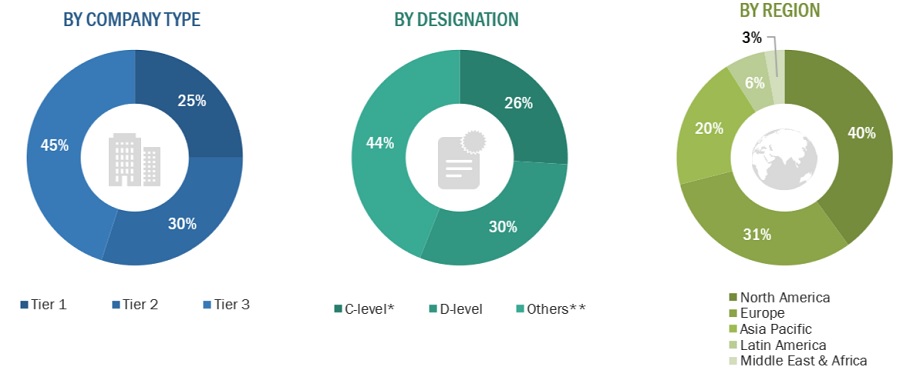

Primary Research

The CRRT market comprises several stakeholders such as manufacturers Of CRRT machine, CRRT disposables, dialysates and replacement fluids, market research and consulting firms. The demand side of this market is characterized by the increasing AKI, growing awareness of CRRT, and increased in number of players in the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

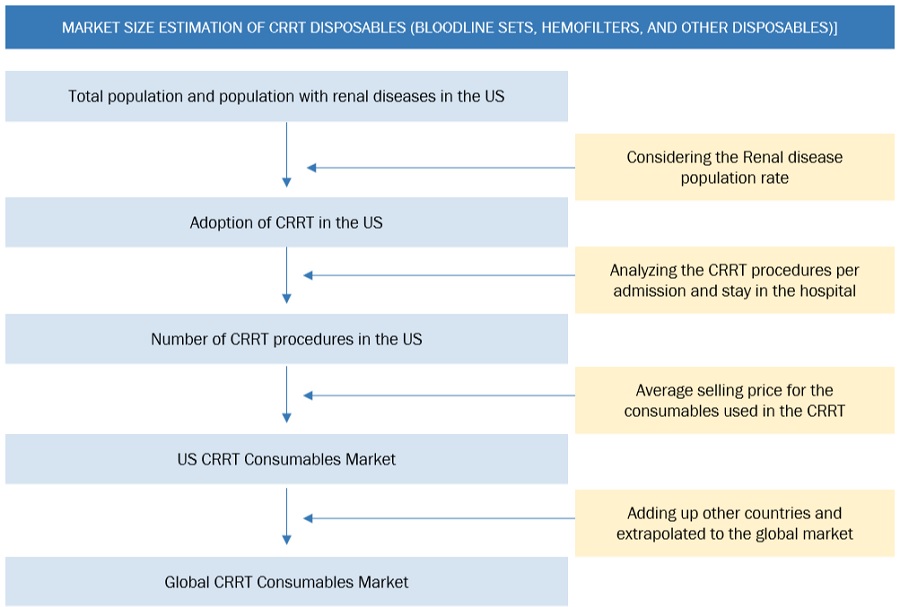

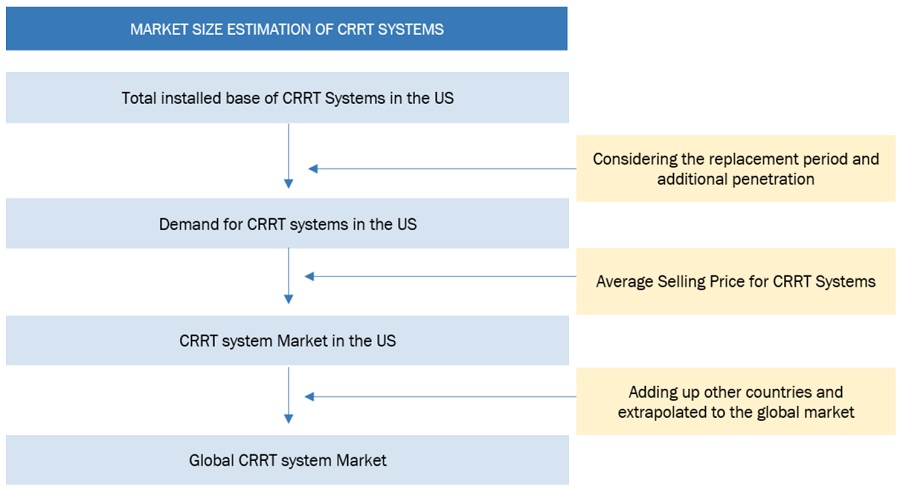

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the CRRT market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall size of the global CRRT market through the above-mentioned methodology, this market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact market value data for the key segments and subsegments. The extrapolated market data was triangulated by studying various macro indicators and regional trends from both demand- and supply-side participants.

Market Definition

Continuous renal replacement therapy (CRRT) is a dialysis modality used to treat critically ill, hospitalised patients in intensive care units (ICUs) with acute kidney injury (AKI). It is designed to provide round the clock treatment for impaired renal function over an extended period. CRRT is one of the preferred treatment choice among nephrologists for the treatment of haemodynamically unstable AKI patients. It offers hemodynamic tolerance by slowly and efficiently removing solutes compared to other dialysis techniques such as intermittent hemodialysis (IHD) and sustained low effiicncy dialysis (SLED).

Key stakeholders

- CRRT manufacturers, vendors, and distributors

- Distributors, channel partners, and third-party suppliers

- CRRT service providers

- Renal research laboratories

- Renal associations and organizations

- Healthcare service providers (including hospitals, critical care centers, and dialysis centers)

- Academic medical centers and universities

- Business research and consulting service providers

- Venture capitalists and other government funding organizations

Report Objectives

- To define, describe, and forecast the global CRRT market on the basis of product, modality, age group and region.

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to individual growth trends, future prospects, and contributions to the overall market

- To analyze the opportunities in the market for key stakeholders and provide details of the competitive landscape for major market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America (the US and Canada), Europe (Germany, the UK, France, Italy, Spain, and Rest of Europe), Asia Pacific (Japan, China, India, Australia, South Korea, and Rest of Asia Pacific), Latin America (Brazil, Mexico, and Rest of Latin America), and the Middle East & Africa

- To profile the key market players and comprehensively analyze their market shares and core competencies2

- To track and analyze competitive developments such as mergers and acquisitions, new product developments, partnerships, agreements, collaborations, and expansions in the global CRRT market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the global CRRT market report

Product Analysis

- Product Matrix, which gives a detailed comparison of the product portfolios of the top five global players.

Company Information

- Detailed analysis and profiling of additional market players (up to 5 OEMs)

Geographic Analysis

- Further breakdown of the Rest of Europe CRRT market into Belgium, Austria,

- Denmark, Greece, Poland, and Russia, among other countries

- Further breakdown of the Rest of Asia Pacific CRRT market into New Zealand, Vietnam, Philippines, Singapore, Malaysia, Thailand, and Indonesia, among other countries

- Further breakdown of the Rest of Latin America CRRT market into Argentina, and Colombia, among other countries.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Continuous Renal Replacement Therapy Market