Contrast Media Injectors Market Size By Product (Injector Systems (CT Injector, MRI Injector), Consumables (Syringes), Accessories), Application (Radiology, Interventional Cardiology), End User (Hospitals) & Region - Global Forecast to 2025

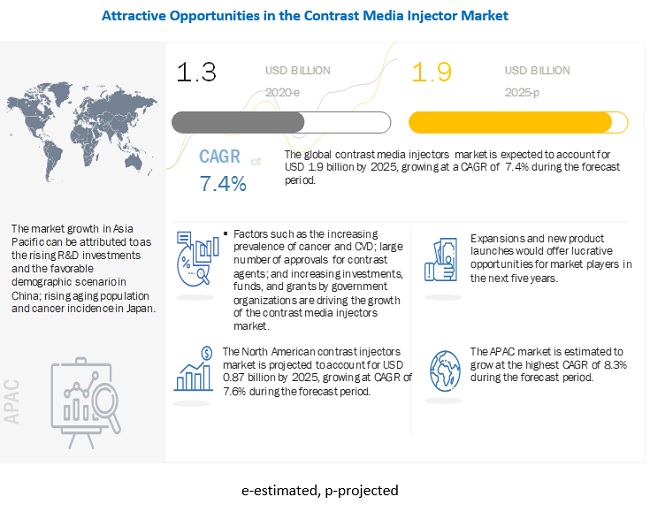

The global size of contrast media injectors market in terms of revenue was estimated to be worth USD 1.3 billion in 2020 and is poised to reach USD 1.9 billion by 2025, growing at a CAGR of 7.4% from 2020 to 2025. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

Factors such as the growing prevalence of cancer and CVD; a large number of approvals for contrast agents; and increasing investments, funds, and grants by government organizations are driving the growth of the global market. However, the high cost of contrast media injectors and consumables & accessories is restraining the growth of the market to a certain extent.

To know about the assumptions considered for the study, Request for Free Sample Report

Contrast Injectors Market Dynamics

Driver: Increasing prevalence of Cancer and CVD

Globally, there has been a significant increase in the number of people suffering from cancer. , the number of people suffering from cancer is expected to increase by 50% to 15 million by 2020 (Source: World Cancer Report, 2003 by WHO). Similarly, CVDs and strokes are the leading causes of death around the world. According to the World Health Organization (WHO), CVDs are the major cause of death globally. The WHO estimated that in 2015, approximately 17.7 million people died of CVDs, which represented 31% of the global deaths; this number is estimated to increase to 23.6 million by 2030. Contrast media injectors are used to inject contrast media at the time of diagnostic imaging to enhance image quality and improve patient safety. Thus, the increase in the number of cancer and CVD cases will stimulate the demand for improved healthcare facilities and advanced diagnostic imaging procedures, which, in turn, will drive the market for contrast media injectors.

Restraint: High cost of contrast media injectors, consumables and accessories

The cost of contrast media injectors varies with the type of injectors (single-head, dual-head, and syringeless injectors) preferred by hospitals. For instance, the GE-Nemoto Dual Shot NCOM (Class 4) CT Injector - Pedestal Mount costs ~USD 40,600, while the GE-Nemoto Dual Shot NCOM (Class 4) CT Injector - Ceiling Mount for Long costs around USD 45,000. The cost of consumables is recurring as the same tube and syringe cannot be reused, considering hygiene and safety issues. This is a major burden for end users, as tubes and syringes cost USD 350–500 each, thus escalating the cost of using contrast media injector systems.

Opportunity: IT-enabled solutions for contrast media injectors

Contrast media injectors are now enabled with an LCD screen to maintain flow rates and monitor patient status. Also, market players are introducing new software for injector systems that can generate data in real-time. Information such as contrast media flow rate, injection pressure, injection speed, and type of contrast media can be easily accessed through this software. The IT department of a hospital can connect this software directly to their hospital information systems or electronic medical records and access patient data from picture archiving and communication systems. This reduces the time, error rate, and effort to upload statistical data and images manually.

Challenge: Dearth of trained professionals

A high degree of technical skill and expertise is required to handle advanced and sophisticated diagnostic imaging systems. According to the US Bureau of Labor Statistics, radiology technicians may witness employment growth of about 21% between 2012 and 2022. Although this is significant, the dearth of specialists and radiologists is an important challenge for countries across the globe

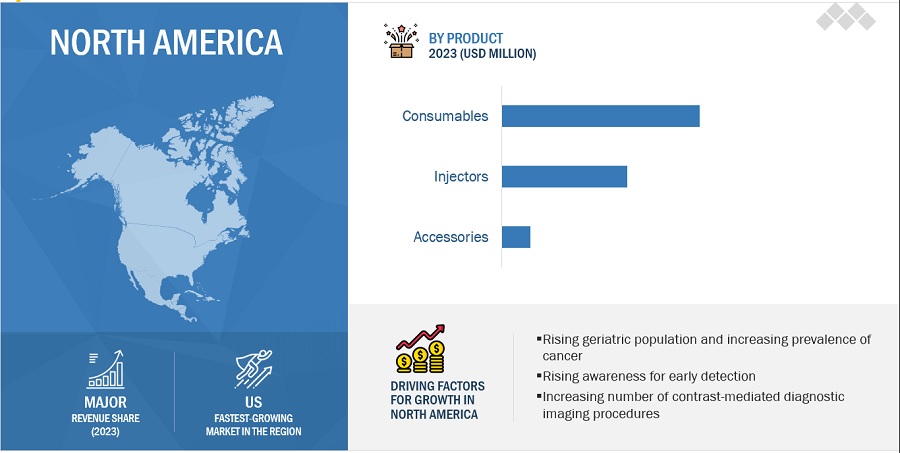

The consumables segment is expected to witness the highest growth rate during the forecast period of the contrast media injectors industry

Based on the product, the market is segmented into injector systems, consumables, and accessories. The consumables segment is expected to witness the highest growth rate during the forecast period. The high growth rate in this segment can be attributed to the growing requirement of consumables to maintain safety and hygienic conditions during diagnostic procedures

The radiology segment will continue to dominate the contrast media injector applications industry during the forecast period

Based on application, the contrast media injectors market is segmented into radiology, interventional radiology, and interventional cardiology. In 2018, the radiology segment accounted for the largest share of the global market. The rising number of radiology procedures using contrast media is driving the growth of this application segment.

The diagnostic imaging centers had the second largest market share of the contrast media injectors industry during the forecast period.

Based on end-user, the market is segmented into hospitals and diagnostic imaging centers. The key factors contributing to the growth of diagnostic imaging centers is the increase in the number of private imaging centers (fueled by the rising demand for early diagnosis and diagnostic imaging) and lack of imaging modalities in small and mid-scale hospitals.

North America accounted for the largest share of the Contrast Media Injector Industry, while the Asia Pacific market is expected to register the highest growth during the forecast period

Geographically, the contrast media injectors market is segmented into North America, Europe, Asia Pacific (APAC), and the Rest of the World. Asia Pacific is expected to grow at the highest CAGR during the forecast period, primarily due to factors such as the rising R&D investments and favorable demographic scenario in China, rising aging population and cancer incidence in Japan, growing investment in the Indian radiology market, and increasing focus of market players & increasing government support to strengthen healthcare service delivery in other countries are driving the growth of this regional segment.

To know about the assumptions considered for the study, download the pdf brochure

Major players in this market include Bayer Ag (Germany), Bracco Imaging S.P.A (Italy), Guerbet Group (France), Ulrich GmbH & Co. KG (Germany), Nemoto Kyorindo Co., Ltd (Japan), Sino Medical-Device Technology Co., Ltd. (Sinomdt) (China), APOLLO RT Co. Ltd. (Hongkong), Shenzhen Anke High-tech Co. Ltd (China), Shenzen Seacrown Electromechanical Co Ltd. (China), and Medtron AG (Germany).

Scope of the Contrast Media Injector Industry:

|

Report Metric |

Details |

|

Market size available for years |

2017–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

By Product, By Application, By End User |

|

Geographies covered |

Asia Pacific, Europe, North America |

|

Companies covered |

The major market players include Bayer AG (Germany), Bracco Imaging S.p.A (Italy), Guerbet Group (France)(Total 10 companies) |

This research report categorizes the contrast media injectors market into following segments and sub-segments:

By Product

-

Consumables

- Syringes

- Tubes

- Other Consumables

-

Injector Systems

- CT Injectors

- MRI Injectors

- Angiography Injectors

- Accessories

By Application

- Radiology

- Interventional Radiology

- Interventional Cardiology

By End User

- Hospitals

- Diagnostic Imaging Centers

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- RoAPAC

-

Rest of the World (RoW)

- LATAM

- Middle East & Africa

Recent Developments of Contrast Media Injector Industry:

- In 2018, Bayer (Germany) launched the Medrad Centargo CT injection system for the CT injection segment

- In 2019, Guerbet Group partnered with IBM Watson Health for AI in medical imaging to support liver cancer diagnostics, utilizing CT and MRI imaging.

Frequently Asked Questions (FAQs):

What is the size of Contrast Media Injectors Market ?

The global contrast media injectors market size is projected to reach USD 1.9 billion by 2025, growing at a CAGR of 7.4%.

What are the major growth factors of Contrast Media Injectors Market ?

Factors such as the growing prevalence of cancer and CVD; a large number of approvals for contrast agents; and increasing investments, funds, and grants by government organizations are driving the growth of the contrast media injectors market. However, the high cost of contrast media injectors and consumables & accessories is restraining the growth of the market to a certain extent.

Who all are the prominent players of Contrast Media Injectors Market ?

Major players in this market include Bayer Ag (Germany), Bracco Imaging S.P.A (Italy), Guerbet Group (France), Ulrich GmbH & Co. KG (Germany), Nemoto Kyorindo Co., Ltd (Japan), Sino Medical-Device Technology Co., Ltd. (Sinomdt) (China), APOLLO RT Co. Ltd. (Hongkong), Shenzhen Anke High-tech Co. Ltd (China), Shenzen Seacrown Electromechanical Co Ltd. (China), and Medtron AG (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 24)

2.1 RESEARCH DESIGN

2.2 RESEARCH APPROACH

2.2.1 RESEARCH METHODOLOGY STEPS

2.2.2 SECONDARY AND PRIMARY RESEARCH METHODOLOGY

2.2.2.1 Secondary research

2.2.2.2 Secondary sources

2.2.2.3 Primary research

2.2.2.4 Key data from primary sources

2.2.2.5 Key insights from primary sources

2.3 MARKET SIZE ESTIMATION METHODOLOGY

2.4 MARKET DATA ESTIMATION AND TRIANGULATION

2.5 ASSUMPTIONS

3 EXECUTIVE SUMMARY (Page No. - 32)

4 PREMIUM INSIGHTS (Page No. - 35)

4.1 CONTRAST MEDIA INJECTORS MARKET OVERVIEW

4.2 GLOBAL MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

4.3 GLOBAL MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

4.4 GLOBAL MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW (Page No. - 38)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing prevalence of cancer and CVD

5.2.1.2 Regulatory approval of a growing number of contrast agents

5.2.1.3 Increasing investments, funds, and grants by government organizations

5.2.2 RESTRAINTS

5.2.2.1 High cost of contrast media injectors, consumables, and accessories

5.2.3 OPPORTUNITIES

5.2.3.1 IT-enabled solutions for contrast media injectors

5.2.4 CHALLENGES

5.2.4.1 Hospital budget cuts

5.2.4.2 Dearth of trained professionals

5.3 IMPACT OF COVID-19 ON THE GLOBAL MARKET

6 CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT (Page No. - 45)

6.1 INTRODUCTION

6.2 INJECTOR SYSTEMS

6.2.1 CT INJECTORS

6.2.1.1 Increasing number of CT scans to boost the market growth

6.2.2 MRI INJECTORS

6.2.2.1 Launch of technologically advanced MRI injectors to drive market growth

6.2.3 ANGIOGRAPHY INJECTORS

6.2.3.1 Rising prevalence of CVD to propel market growth

6.3 CONSUMABLES

6.3.1 SYRINGES

6.3.1.1 Syringes market in the APAC to grow at the highest CAGR during the forecast period

6.3.2 TUBES

6.3.2.1 Depending on their intended use, contrast media injector tubes come in various shapes and sizes

6.3.3 OTHER CONSUMABLES

6.4 ACCESSORIES

7 CONTRAST MEDIA INJECTORS MARKET, BY APPLICATION (Page No. - 56)

7.1 INTRODUCTION

7.2 RADIOLOGY

7.2.1 RISING NUMBER OF RADIOLOGY PROCEDURES USING CONTRAST MEDIA TO DRIVE MARKET GROWTH

7.3 INTERVENTIONAL CARDIOLOGY

7.3.1 RISING BURDEN OF CVD TO DRIVE MARKET GROWTH

7.4 INTERVENTIONAL RADIOLOGY

7.4.1 INCREASING DEMAND FOR MINIMALLY INVASIVE PROCEDURES TO BOLSTER MARKET GROWTH

8 CONTRAST MEDIA INJECTORS MARKET, BY END USER (Page No. - 61)

8.1 INTRODUCTION

8.2 HOSPITALS

8.2.1 INCREASING ADOPTION OF DIAGNOSTIC IMAGING MODALITIES ACROSS HOSPITALS LIKELY TO DRIVE MARKET GROWTH

8.3 DIAGNOSTIC IMAGING CENTERS

8.3.1 INCREASING NUMBER OF PRIVATE IMAGING CENTERS CONTRIBUTES TO MARKET GROWTH

9 CONTRAST MEDIA INJECTORS MARKET, BY REGION (Page No. - 65)

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.1.1 The US dominated the North American market in 2019

9.2.2 CANADA

9.2.2.1 Rising investments towards improving medical imaging drive market growth

9.3 EUROPE

9.3.1 GERMANY

9.3.1.1 Well-developed diagnostic imaging infrastructure is a major factor driving market growth in Germany

9.3.2 UK

9.3.2.1 Increasing government funds and investments to drive market growth in the UK

9.3.3 FRANCE

9.3.3.1 Increasing number of MRI installations to drive market growth in France

9.3.4 ITALY

9.3.4.1 Rising prevalence of cancer and obesity to drive the demand for diagnostic imaging procedures in Italy

9.3.5 SPAIN

9.3.5.1 Shortage of radiologists in the country to restrain the market growth

9.3.6 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 JAPAN

9.4.1.1 Rising geriatric population and cancer incidence to drive market growth in Japan

9.4.2 CHINA

9.4.2.1 High incidence of cancer and stroke disease drives the market growth in China

9.4.3 REST OF ASIA PACIFIC

9.5 REST OF THE WORLD

9.5.1 LATIN AMERICA

9.5.1.1 Growing initiatives to modernize healthcare is likely to boost the market growth in the region

9.5.2 MIDDLE EAST & AFRICA

9.5.2.1 Poor reimbursement system and lack of proper healthcare infrastructure to restrain market growth in MEA

10 COMPETITIVE LANDSCAPE (Page No. - 131)

10.1 OVERVIEW

10.2 MARKET RANKING ANALYSIS

10.3 COMPETITIVE LEADERSHIP MAPPING

10.3.1 VISIONARY LEADERS

10.3.2 INNOVATORS

10.3.3 DYNAMIC DIFFERENTIATORS

10.3.4 EMERGING COMPANIES

10.4 COMPETITIVE SCENARIO

10.4.1 PRODUCT LAUNCHES & APPROVALS

10.4.2 EXPANSIONS

10.4.3 ACQUISITIONS

10.4.4 PARTNERSHIPS

10.5 COMPANY PROFILES

10.5.1 BAYER AG

10.5.1.1 Business overview

10.5.1.2 Products offered

10.5.1.3 Recent developments

10.5.1.4 MnM view

10.5.2 BRACCO IMAGING S.P.A

10.5.2.1 Business overview

10.5.2.2 Products offered

10.5.2.3 Recent developments

10.5.2.4 MnM view

10.5.3 GUERBET GROUP

10.5.3.1 Business overview

10.5.3.2 Products offered

10.5.3.3 Recent developments

10.5.3.4 MnM view

10.5.4 SHENZHEN ANKE HIGH-TECH CO., LTD.

10.5.4.1 Business overview

10.5.4.2 Products offered

10.5.4.3 Recent developments

10.5.5 NEMOTO KYORINDO CO., LTD.

10.5.5.1 Business overview

10.5.5.2 Products offered

10.5.5.3 Recent developments

10.5.6 SINO MEDICAL DEVICE TECHNOLOGY CO., LTD.

10.5.6.1 Business overview

10.5.6.2 Products offered

10.5.6.3 Recent developments

10.5.7 APOLLO RT CO., LTD.

10.5.7.1 Business overview

10.5.7.2 Products offered

10.5.7.3 Recent developments

10.5.8 SHENZHEN SEACROWN ELECTROMECHANICAL CO. LTD.

10.5.8.1 Business overview

10.5.8.2 Products offered

10.5.8.3 Recent developments

10.5.9 ULRICH GMBH & CO. KG.

10.5.9.1 Business overview

10.5.9.2 Products offered

10.5.9.3 Recent developments

10.5.10 MEDTRON AG

10.5.10.1 Business overview

10.5.10.2 Products offered

10.5.10.3 Recent developments

11 ADJACENT & RELATED MARKETS CHAPTER (Page No. - 152)

11.1 CONTRAST MEDIA/CONTRAST AGENTS MARKET

11.1.1 MARKET DEFINITION

11.1.2 MARKET OVERVIEW

11.1.3 CONTRAST MEDIA/CONTRAST AGENTS MARKET, BY MODALITY

11.1.4 CONTRAST MEDIA/CONTRAST AGENTS MARKET, BY REGION

11.2 DIAGNOSTIC IMAGING MARKET

11.2.1 MARKET DEFINITION

11.2.2 MARKET OVERVIEW

11.2.3 DIAGNOSTIC IMAGING MARKET, BY PRODUCT

11.2.4 DIAGNOSTIC IMAGING MARKET, BY REGION

12 APPENDIX (Page No. - 156)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

LIST OF TABLES (226 TABLES)

TABLE 1 KEY INVESTMENTS BY GOVERNMENT BODIES TOWARDS IMPROVING IMAGING INFRASTRUCTURE

TABLE 2 CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 3 GLOBAL MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 4 CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 5 CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 6 CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 7 CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 8 CT INJECTORS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 9 CT INJECTORS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 10 MRI INJECTORS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 11 MRI INJECTORS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 12 ANGIOGRAPHY INJECTORS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 13 ANGIOGRAPHY INJECTORS MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 14 CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 15 CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 16 SYRINGES MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 17 SYRINGES MARKET, BY REGION, 2020-2025 (USD MILLION)

TABLE 18 TUBES MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 19 TUBES MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 20 OTHER CONSUMABLES MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 21 OTHER CONSUMABLES MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 22 CONTRAST MEDIA INJECTOR ACCESSORIES MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 23 CONTRAST MEDIA INJECTOR ACCESSORIES MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 24 CONTRAST MEDIA INJECTORS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 25 GLOBAL MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 26 GLOBAL MARKET FOR RADIOLOGY APPLICATIONS, BY REGION, 2017–2019 (USD MILLION)

TABLE 27 GLOBAL MARKET FOR RADIOLOGY APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 28 GLOBAL MARKET FOR INTERVENTIONAL CARDIOLOGY APPLICATIONS, BY REGION, 2017–2019 (USD MILLION)

TABLE 29 GLOBAL MARKET FOR INTERVENTIONAL CARDIOLOGY APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 30 GLOBAL MARKET FOR INTERVENTIONAL RADIOLOGY APPLICATIONS, BY REGION, 2017-2019 (USD MILLION)

TABLE 31 GLOBAL MARKET FOR INTERVENTIONAL RADIOLOGY APPLICATIONS, BY REGION, 2020–2025 (USD MILLION)

TABLE 32 GLOBAL MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 33 GLOBAL MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 34 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2017–2019 (USD MILLION)

TABLE 35 GLOBAL MARKET FOR HOSPITALS, BY REGION, 2020–2025 (USD MILLION)

TABLE 36 GLOBAL MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2017–2019 (USD MILLION)

TABLE 37 GLOBAL MARKET FOR DIAGNOSTIC IMAGING CENTERS, BY REGION, 2020–2025 (USD MILLION)

TABLE 38 GLOBAL MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 39 GLOBAL MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 40 NORTH AMERICA: CONTRAST MEDIA INJECTORS MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 41 NORTH AMERICA: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 42 NORTH AMERICA: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 43 NORTH AMERICA: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 44 NORTH AMERICA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 45 NORTH AMERICA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 46 NORTH AMERICA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 47 NORTH AMERICA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 48 NORTH AMERICA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 52 US: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 53 US: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 54 US: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 55 US: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 56 US: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 57 US: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 58 US: INJECTORS MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 59 US: INJECTORS MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 60 US: INJECTORS MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 61 US: INJECTORS MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 62 CANADA: CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 63 CANADA: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 64 CANADA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 65 CANADA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 66 CANADA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 67 CANADA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 68 CANADA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 69 CANADA: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 70 CANADA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 71 CANADA: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 72 EUROPE:MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 76 EUROPE: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 77 EUROPE: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 78 EUROPE: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 79 EUROPE: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 84 GERMANY: CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 85 GERMANY: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 86 GERMANY: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 87 GERMANY: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 88 GERMANY: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 89 GERMANY: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 90 GERMANY: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 92 GERMANY: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 94 UK: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 95 UK: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 96 UK: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 97 UK: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 98 UK: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 99 UK: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 100 UK: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 101 UK: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 102 UK: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 103 UK: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 104 FRANCE: CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 105 FRANCE: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 106 FRANCE: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 107 FRANCE: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 108 FRANCE: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 109 FRANCE: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 110 FRANCE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 111 FRANCE: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 112 FRANCE: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 113 FRANCE: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 114 ITALY: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 115 ITALY: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 116 ITALY: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 117 ITALY: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020-2025 (USD MILLION)

TABLE 118 ITALY: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 119 ITALY: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 120 ITALY: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 121 ITALY: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 122 ITALY: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 123 ITALY: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 124 SPAIN: CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 125 SPAIN: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 126 SPAIN: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 127 SPAIN: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 128 SPAIN: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 129 SPAIN: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 130 SPAIN: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 131 SPAIN: MARKET, BY APPLICATION, 2020–2025(USD MILLION)

TABLE 132 SPAIN: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 133 SPAIN: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 134 ROE: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 135 ROE: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 136 ROE: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 137 ROE: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 138 ROE: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 139 ROE: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 140 ROE: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 141 ROE: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 142 ROE: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 143 ROE: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 144 ASIA PACIFIC: CONTRAST MEDIA INJECTORS MARKET, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 148 ASIA PACIFIC: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 149 ASIA PACIFIC: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 150 ASIA PACIFIC: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 151 ASIA PACIFIC: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 155 ASIA PACIFIC: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 156 JAPAN: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 157 JAPAN: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 158 JAPAN: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 159 JAPAN: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 160 JAPAN: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 161 JAPAN: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 162 JAPAN: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 163 JAPAN: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 164 JAPAN: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 165 JAPAN: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 166 CHINA: CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 167 CHINA: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 168 CHINA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 169 CHINA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 170 CHINA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 171 CHINA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 172 CHINA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 173 CHINA: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 174 CHINA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 175 CHINA: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 176 ROAPAC: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 177 ROAPAC: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 178 ROAPAC: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 179 ROAPAC: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 180 ROAPAC: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 181 ROAPAC: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 182 ROAPAC: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 183 ROAPAC: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 184 ROAPAC: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 185 ROAPAC: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 186 ROW: CONTRAST MEDIA INJECTORS MARKET, BY REGION, 2017–2019 (USD MILLION)

TABLE 187 ROW: MARKET, BY REGION, 2020–2025 (USD MILLION)

TABLE 188 ROW: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 189 ROW: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 190 ROW: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 191 ROW: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 192 ROW: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 193 ROW: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 194 ROW: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 195 ROW: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 196 ROW: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 197 ROW: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 198 LATAM: MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 199 LATAM: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 200 LATAM: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 201 LATAM: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 202 LATAM: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 203 LATAM: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 204 LATAM: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 205 LATAM: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 206 LATAM: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 207 LATAM: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 208 MEA: CONTRAST MEDIA INJECTORS MARKET, BY PRODUCT, 2017–2019 (USD MILLION)

TABLE 209 MEA: MARKET, BY PRODUCT, 2020–2025 (USD MILLION)

TABLE 210 MEA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 211 MEA: CONTRAST MEDIA INJECTOR SYSTEMS MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 212 MEA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2017–2019 (USD MILLION)

TABLE 213 MEA: CONTRAST MEDIA INJECTOR CONSUMABLES MARKET, BY TYPE, 2020–2025 (USD MILLION)

TABLE 214 MEA: MARKET, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 215 MEA: MARKET, BY APPLICATION, 2020–2025 (USD MILLION)

TABLE 216 MEA: MARKET, BY END USER, 2017–2019 (USD MILLION)

TABLE 217 MEA: MARKET, BY END USER, 2020–2025 (USD MILLION)

TABLE 218 PRODUCT LAUNCHES & APPROVALS (2017–2019)

TABLE 219 EXPANSIONS (2017–2019)

TABLE 220 ACQUISITIONS (2017–2019)

TABLE 221 PARTNERSHIPS (2017–2019)

TABLE 222 ADJACENT MARKETS FOR CONTRAST INJECTORS MARKET (USD MILLION)

TABLE 223 CONTRAST MEDIA MARKET, BY MODALITY, 2017–2024 (USD MILLION)

TABLE 224 CONTRAST MEDIA MARKET, BY REGION, 2017–2024 (USD MILLION)

TABLE 225 DIAGNOSTIC IMAGING MARKET, BY PRODUCT, 2017–2024 (USD MILLION)

TABLE 226 DIAGNOSTIC IMAGING MARKET, BY REGION, 2017–2024 (USD MILLION)

LIST OF FIGURES (25 FIGURES)

FIGURE 1 RESEARCH DESIGN: CONTRAST MEDIA INJECTORS MARKET

FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

FIGURE 3 GLOBAL MARKET: BOTTOM-UP APPROACH

FIGURE 4 GLOBAL MARKET: TOP-DOWN APPROACH

FIGURE 5 DATA TRIANGULATION METHODOLOGY

FIGURE 6 GLOBAL MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 7 GLOBAL MARKET, BY APPLICATION, 2020 VS. 2025 (USD MILLION)

FIGURE 8 GLOBAL MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 9 GEOGRAPHICAL SNAPSHOT OF THE GLOBAL MARKET

FIGURE 10 INCREASING PREVALENCE OF CANCER AND CVD TO DRIVE THE GROWTH OF THE GLOBAL MARKET

FIGURE 11 CONSUMABLES ACCOUNTED FOR THE LARGEST SHARE OF THE GLOBAL MARKET IN 2019

FIGURE 12 RADIOLOGY SEGMENT WILL CONTINUE TO DOMINATE THE GLOBAL MARKET DURING THE FORECAST PERIOD

FIGURE 13 ASIA PACIFIC TO REGISTER THE HIGHEST GROWTH DURING THE FORECAST PERIOD

FIGURE 14 GLOBAL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

FIGURE 15 IMPACT OF COVID-19 ON THE GLOBAL MARKET

FIGURE 16 NORTH AMERICA COMMANDED THE LARGEST SHARE OF THE GLOBAL MARKET

FIGURE 17 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 18 EUROPE: MARKET SNAPSHOT

FIGURE 19 NORTH AMERICA: MARKET SNAPSHOT

FIGURE 20 KEY DEVELOPMENTS IN THE GLOBAL MARKET, 2017–2019

FIGURE 21 GLOBAL MARKET RANKING (2019)

FIGURE 22 GLOBAL MARKET: COMPETITIVE LEADERSHIP MAPPING (2019)

FIGURE 23 BAYER AG: COMPANY SNAPSHOT (2019)

FIGURE 24 BRACCO IMAGING S.P.A: COMPANY SNAPSHOT (2018)

FIGURE 25 GUERBET GROUP: COMPANY SNAPSHOT (2019)

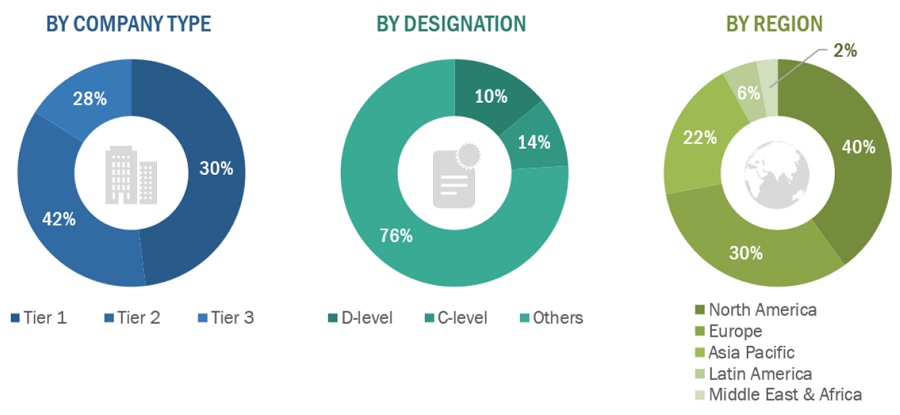

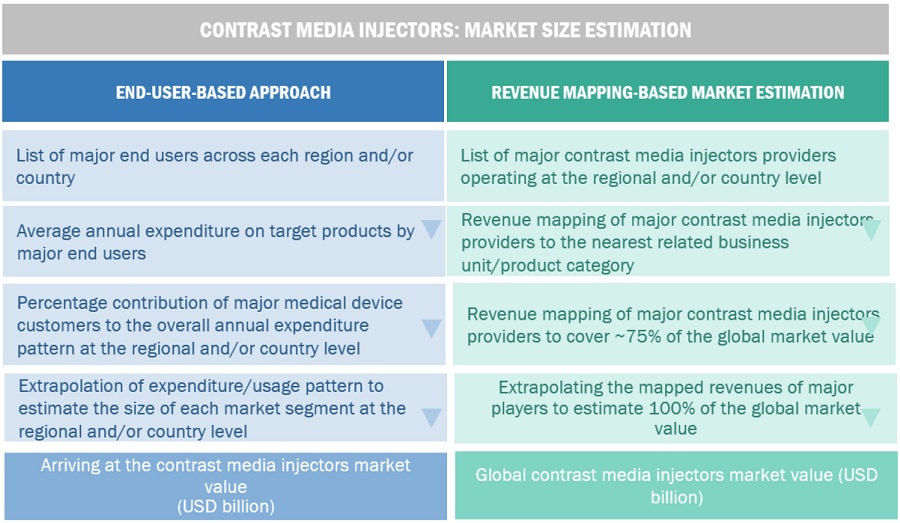

The study involved four major activities in estimating the current market size for contrast media injectors. Exhaustive secondary research was done to collect information on the market and its different subsegments. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that market breakdown and data triangulation was used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to, to identify and collect information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, gold standard & silver standard websites, regulatory bodies, and databases.

Primary Research

Extensive primary research has been conducted after acquiring an understanding of the contrast media injectors market scenario through secondary research. Several primary interviews have been conducted with market experts from both the demand- (hospitals, diagnostic imaging centers) and supply-sidecontrast media injectors market and distributors) players across four major regions, namely, North America, Europe, Asia Pacific, and Rest of the World. Approximately 70% and 30% of primary interviews have been conducted from the demand and supply side, respectively. Primary data has been collected through questionnaires, emails, and telephonic interviews. In the canvassing of primaries, various departments within organizations, such as sales, operations, and administration, were covered to provide a holistic viewpoint in our report.

After interacting with industry experts, brief sessions were conducted with highly experienced independent consultants to reinforce the findings from our primaries. This, along with the in-house subject matter experts’ opinions, has led us to the findings as described in the remainder of this report.:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the contrast media injector market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and to arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides in the contrast media injector industry.

Report Objectives

- To define, describe, and measure the Contrast Media Injector market by product, application, end-user, and region

- To provide detailed information about the major factors influencing market growth (such as drivers, restraints, growth opportunities, and challenges)

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the Contrast Media Injector market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market in North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW)

- To strategically analyze the market structure and profile key players and their core competencies in the Contrast Media Injector market

- To track and analyze competitive developments such as product launches, expansions, acquisitions, partnerships, and collaborations in the Contrast Media Injector market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the Contrast Media Injector market report:

Product Analysis

- Product matrix, which gives a detailed comparison of the software portfolios of the top five companies

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Contrast Media Injectors Market