Conversational AI Market by Offering, Conversational Interface, Business Function (Sales & Marketing, HR, ITSM), Channel, Technology, Vertical (BFSI, Retail & eCommerce, Healthcare & Life Sciences) and Region - Global Forecast to 2028

Updated on : April 11, 2024

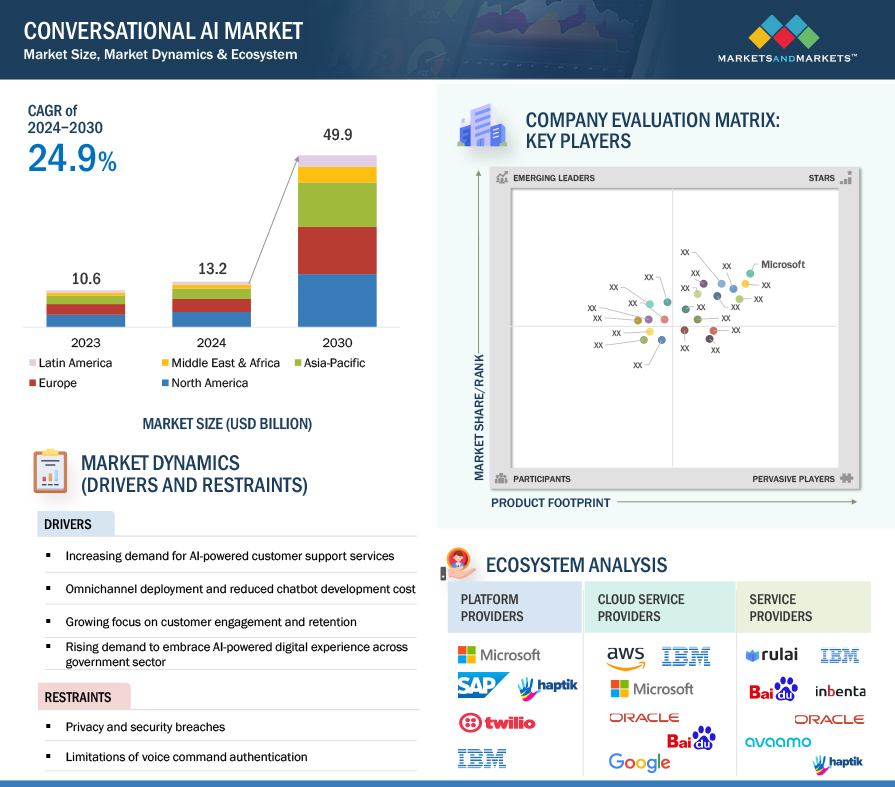

Conversational AI Market Size and Growth

The Conversational AI Market size is anticipated to grow at a projected CAGR of 22.6% from USD 10.7 billion in 2023 to USD 29.8 billion by 2028. There are several commercial utilizes for artificial intelligence (AI) and machine learning. Moreover, the expansion of business across Asian countries would help to strengthen the dominance in the Conversational AI market and garner healthy financials. Integrating ChatGPT into a conversational AI platform can significantly improve its accuracy, fluency, versatility, and user experience in coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Conversational AI Market Dynamics

Driver: Rising demand to embrace AI-powered digital experience across government sector

With governments across the world working to enable broad-scaled digital transformation, public sector organizations are increasingly inclining towards the adoption of conversational AI solutions to redefine the citizen experience. One key reason for this trend is that, globally, citizens are increasingly expecting to be able to engage with their governments online without much delay, with the growth of digital-native populations and the proliferation of mobile devices driving the trend. To meet this demand, more government entities and public sector undertakings will get on the conversational AI trend to improve efficiency and human productivity, streamlining the overall process of delivering citizen services digitally. Conversational AI can step in to improve efficiency and human productivity, streamlining the process of delivering citizen services digitally while keeping humans in the loop. According to data released by Yellow.ai, a leading enterprise-grade conversational AI platform provider, the company has served over 2.7 million unique users across the government sector worldwide and this number will continue to grow in 2023 as well.

Restraint: Privacy and security breaches

With ever-changing times, all businesses are inclined towards using conversational chatbots to effectively engage with customers. Conversational AI is dependent on accumulating data to answer user queries, it is also vulnerable to privacy and security breaches. Developing conversational AI apps with high privacy and security standards and monitoring systems will help to build trust among end users, eventually increasing chatbot usage over time. A few of the threats such as employee impersonation, ransomware and malware, phishing, whaling, and bot repurposing which can lead to data theft and modifications, can cause substantial harm to the organization and customers. Moreover, the mechanisms for detecting and resolving such security flaws continually evolve to ensure early identification and resolution. The security vulnerabilities posed by deploying conversational AI solutions are far more varied and unpredictable, hence falling into the threat and vulnerability categories.

Opportunity: Increasing usage of generative models in Conversational AI

Currently, the usage of generative AI coupled with the rising trend of ChatGPT will offer a huge opportunity in the conversational AI market. Generative models can provide developers with capabilities that help address manual, time-consuming tasks. There would be more focus on how it can be used efficiently by enterprises to solve real business problems. For instance, more focused research on how generative models could be used to generate personalized responses or recommendations based on an individual user’s preferences or history. Or how ChatGPT could be used to create a chatbot that can assist customers with questions or issues related to a product or service. There is also likely to be a trend toward the development of hybrid models that combine generative and discriminative techniques. These models could be more efficient and effective at tasks such as image classification, language translation, and natural language processing. There is still much ground to cover for such tools to be used efficiently and accurately for enterprise use cases to solve real business problems. Furthermore, Generative AI for Conversational AI is one of the most exciting and rapidly developing areas of artificial intelligence. As AI continues to evolve, many generative AI companies have come ahead to harness the ability to generate human-like responses in a conversational setting. It has the potential to revolutionize the way we interact with machines, creating more natural and human-like conversations that are tailored to our individual needs and preferences.

Challenge: Apprehensiveness over disclosing personal or sensitive information

Customers can be anxious about revealing personal or sensitive information, particularly when they realize that they are conversing with a machine instead of a human. Since all the customers will not be early adopters, hence it is vital to educate and socialize the target audiences around the benefits and safety of conversational AI and related technologies to create better customer experiences. This can lead to a bad user experience and reduced performance of the AI and negate the positive effects. Furthermore, at times chatbots are not designed to answer a broad range of user inquiries. Hence it is crucial to provide an alternative channel of communication to tackle these more complex queries, as it’ll be frustrating for the end user if a wrong or incomplete answer is provided. In such scenarios, customers should be given the chance to connect with a human representative of the company. Lastly, conversational AI can also optimize the workflow in a company, leading to a reduction in the workforce for a particular job function. This can generate socioeconomic activism, which can result in a harmful counterattack to a company.

By business function, HR segment to register at the highest CAGR during the forecast period

The conversational AI market by business function is segmented into HR, ITSM, sales and marketing, finance and accounting, and operations and supply chain. The HR segment is to grow at rapid pace during the forecast period. Conversational AI for HR enables organizations to deploy digital HR assistants, intelligent bot that handles a wide range of queries in real-time, accurately, and cost-effectively. A conversational AI chatbot benefits the HR department in the screening process by getting prospective employees’ information directly from the website.

By channel, mobile apps segment to have largest market size during the forecast period

Conversational AI helps businesses focus on a continuous and context-driven messaging experience with features such as triggered messages, contextual information, in-app campaigns, sales bot, and intelligent message routing. Conversational AI assists as a personal assistant in mobile apps is going to come with improved natural language understanding (NLU) technology with advanced seamless integration with business and consumer data, and the ability to run a network of interconnected algorithms rapidly to deliver hyper-personalized content in a human-centric conversational interface.

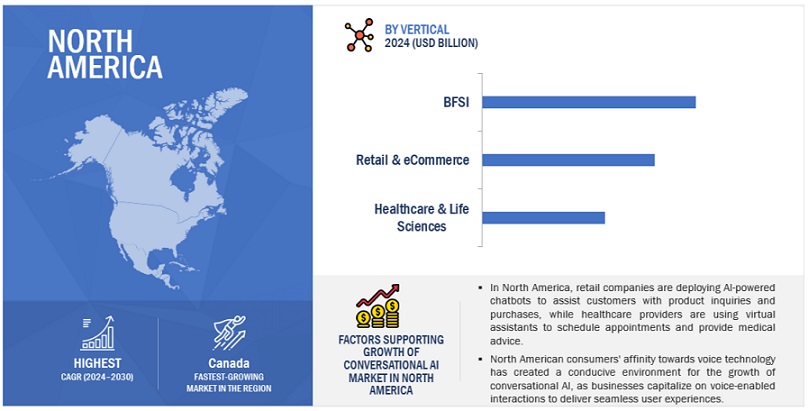

North America to account for the largest market size during the forecast period

North America is expected to have the largest market share in the conversational AI market. Furthermore, conversational AI is widely utilized in integration with intelligent virtual agents or chatbots in order to communicate with a complicated system in a rapid and reliable manner. The growing popularity of voice-based search has propelled the growth of the conversational AI market in North America. The presence of various key market players coupled with highest smartphone penetration rate in the region to spur the growth of the regional market over the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Conversational AIvendors have implemented various types of organic and inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global Conversational AI market include IBM (US), Microsoft (US), Google (US), AWS (US), Artificial Solutions (Sweden), Baidu (China), SAP (Germany), Oracle (US), OpenAI (US), Kore.ai (US), LivePerson (US), Avaamo (US), SoundHound (US), Kasisto (US), MindMeld (US), Solvvy (US), Creative Virtual (UK), Pypestream (US), Saarthi.ai (India), Inbenta (US), Conversica (US), Haptik (India), Gupshup (US), Cognigy (Germany), Yellow.ai (US), AssemblyAI (US), Senseforth.ai (US), Rasa (Germany), Rulai (US), Exceed.ai (US), Clinc (US), and Laiye (China).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Conversational AI Market value in 2028 |

USD 29.8 Billion |

|

Conversational AI Market value in 2023 |

USD 10.7 Billion |

|

Conversational AI Market Growth Rate |

22.6% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2023 |

|

Forecast period |

2023–2028 |

|

Segments covered |

Offering, Conversational Interface, Business Function, Channel, Technology, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Microsoft (US), Google (US), AWS (US), Artificial Solutions (Sweden), Baidu (China), SAP (Germany), Oracle (US), OpenAI (US), Kore.ai (US), LivePerson (US), Avaamo (US), SoundHound (US), Kasisto (US), MindMeld (US), Solvvy (US), Creative Virtual (UK), Pypestream (US) Saarthi.ai (India), Inbenta (US), Conversica (US), Haptik (India), Gupshup (US), Cognigy (Germany), Yellow.ai (US), AssemblyAI (US), Senseforth.ai (US), Rasa (Germany), Rulai (US), Exceed.ai (US), Clinc (US), and Laiye (China). |

This research report categorizes the conversational AI market based on offerings, conversational interface, technology, channel, business function, vertical, and regions.

By Offering:

- Solutions

-

Services

- Training & Consulting

- System Integration & Implementation

- Support & Maintenance

By Conversational Interface:

- Chatbots

- Interactive Voice Routing (IVR)

- Intelligent Virtual Assistants (IVA)

By Business Function:

- Information Technology Service Management (ITSM)

- Human Resource (HR)

- Sales and Marketing

- Operations and Supply Chain

- Finance and Accounting

By Technology:

- ML and Deep Learning

- NLP

- ASR

- Other Technologies

By Channel:

- Emails and Websites

- Mobile Apps

- Telephones

- Messaging Apps

By Vertical:

- Banking, Financial Services and Insurance (BFSI)

- Retail & eCommerce

- Healthcare & Life Sciences

- Travel & Hospitality

- IT & ITES

- Media & Entertainment

- Telecom

- Automobile & Transportation

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- South Korea

- ANZ

- ASEAN

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- Egypt

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In March 2023, Baidu announced that it would finish internal testing of a ChatGPT-style project called "Ernie Bot" in March. Ernie, short for "Enhanced Representation through Knowledge Integration," is a sizable language model powered by AI that was unveiled in 2019. With Ernie, Baidu intends to improve its in-car voice assistant. The Apollo Smart Cabin product line is also getting ERNIE Bot installed, which will advance smart cars in terms of how people interact with them.

- In February 2023, OpenAI introduced a conversational AI called ChatGPT that can converse with anyone, respond to the follow-up inquiries, and correct unfounded assumptions. It is available as a pilot subscription service. On February 10th, 2023, the company opened up ChatGPT Plus to consumers outside of the US.

- In February 2023, Google launched a new Conversational AI service for testers named Bard. Bard aims to bring together the depth of human knowledge with the strength, wit, and inventiveness of Google’s massive language models. It uses data from the internet to deliver original, excellent answers. The company is initially making it available using LaMDA's lightweight variant. It can be scaled to more people and get more input because this much simpler model uses a lot less computer power.

- In January 2023, Microsoft announced the launch of Azure OpenAI Service. More companies can apply for access to the most cutting-edge AI models available, including GPT-3.5, Codex, and DALLE 2, and build cutting-edge applications owing to the infrastructure and enterprise-grade capabilities of Microsoft Azure. Customers will also soon be able to use ChatGPT through Azure OpenAI Service, a refined version of GPT-3.5 that has been trained and performs inference on Azure AI infrastructure.

- In December 2022, AWS announced its partnership with Stable AI to build and grow its AI models for the creation of picture, language, audio, video, and 3D content. Stable AI accelerates its work on open-source generative AI models by utilizing Amazon SageMaker (AWS's end-to-end machine learning service), as well as AWS's established compute and storage infrastructure. Moreover, Stability AI will work with Amazon to make its open-source tools and models accessible to worldwide startups, academics, and businesses.

- In June 2022, Artificial Solutions announced new additions to Teneo, the most adaptable Conversational AI platform. Teneo has a number of new features that enable enterprise-level businesses to create no-code, low-code, and pro-code capabilities for next-generation conversational customer experiences on a single platform.

- In February 2022, IBM has developed an AI-based virtual assistant called IBM Watson Assistant in collaboration with TD Securities that can answer common questions about the TD Precious Metals online store. Customers can purchase actual gold, silver, and platinum bullion and coins online from the convenience of their home through the TD Precious Metals digital store.

Frequently Asked Questions (FAQ):

What is a Conversational AI?

Conversational AI is the simulation of an intelligent conversation by machines. It refers to the different technologies that help machines understand, process, and respond to human language.

They use large volumes of data, machine learning, and natural language processing to help imitate human interactions, recognizing speech and text inputs and translating their meanings across various languages. Conversational AI applications are often used in customer service and can be found on websites, online stores, and social media channels.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, and Italy in the European region.

Which are key verticals adopting Conversational AI solutions and services?

Key verticals adopting conversational AI solutions and services include BFSI, healthcare & life sciences, retail & eCommerce, telecom, IT & ITES, travel and hospitality, automotive & transportation, media & entertainment.

Which are the key drivers supporting the growth of the c onversational AI market?

The key drivers supporting the growth of the Conversational AI market include omnichannel deployment and reduced chatbot development cost, growing focus on customer engagement and retention, and rising demand to embrace AI-powered digital experience across government sector.

Who are the key vendors in the Conversational AI market?

The key vendors in the global Conversational AI market include IBM (US), Microsoft (US), Google (US), AWS (US), Artificial Solutions (Sweden), Baidu (China), SAP (Germany), Oracle (US), OpenAI (US), Kore.ai (US), LivePerson (US), Avaamo (US), SoundHound (US), Kasisto (US), MindMeld (US), Solvvy (US), Creative Virtual (UK), Pypestream (US) Saarthi.ai (India), Inbenta (US), Conversica (US), Haptik (India), Gupshup (US), Cognigy (Germany), Yellow.ai (US), AssemblyAI (US), Senseforth.ai (US), Rasa (Germany), Rulai (US), Exceed.ai (US), Clinc (US), and Laiye (China).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

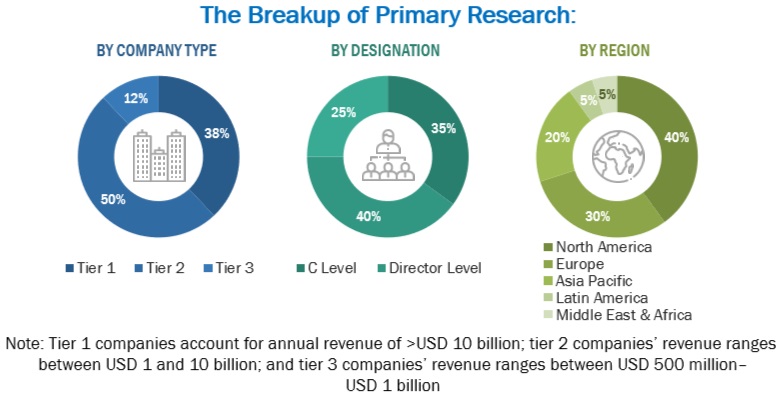

The research methodology for the global conversational AI market report involved the use of extensive secondary sources and directories, as well as various reputed open-source databases to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including the key opinion leaders, subject matter experts, high-level executives of various companies offering conversational AI solutions and services, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports; press releases and investor presentations of companies; and white papers, certified publications, and articles from recognized associations and government publishing sources.

The secondary research was mainly used to obtain the key information about the industry’s value chain, market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the Conversational AImarket ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing Conversational AI software, and solutions; associated service providers; and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

After the complete market engineering (including calculations for market statistics, market breakup, market size estimations, market forecast, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify and validate the segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies.

In the complete market engineering process, both the top-down and bottom-up approaches were extensively used, along with several data triangulation methods to perform the market estimation and market forecast for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to record the key information/insights throughout the report.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

For making market estimates and forecasting the Conversational AI market and the other dependent submarkets, top-down and bottom-up approaches were used. The bottom-up procedure was used to arrive at the overall market size of the global Conversational AI market, using the revenue from the key companies and their offerings in the market. With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering solutions and services in the Conversational AI market was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solution and service offerings, channels, business functions, technologies, conversational interfaces, and verticals. The aggregate of all the revenues of the companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of Conversational AI solutions and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of Conversational AI solutions and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on conversational AI solutions based on some of the key use cases. These factors for the conversational AI industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

Conversational AI is the simulation of an intelligent conversation by machines and thus refers to the different technologies that help machines understand, process, and respond to human language. They use large volumes of data, machine learning, and natural language processing to help imitate human interactions, recognizing speech and text inputs and translating their meanings across various languages. Conversational AI applications are often used in customer service and can be found on websites, online stores, and social media channels.

Key Stakeholders

- Research organizations

- Third-party service providers

- Technology providers

- AI consulting companies

- Independent software vendors (ISVs)

- Service providers and distributors

- Application development vendors

- System integrators

- Consultants/consultancy/advisory firms

- Training and education service providers

- Support and maintenance service providers

- Managed service providers

Report Objectives

- To define, describe, and forecast the Conversational AI market based on offering, conversational interface, technology, channel, business function, vertical, and region.

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the market growth.

- To analyze subsegments with respect to individual growth trends, prospects, and contributions to the total market.

- To analyze opportunities in the market for stakeholders and provide the competitive landscape of the market.

- To forecast the revenue of the market segments with respect to all the five major regions, namely, North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America.

- To profile the key players and comprehensively analyze the recent developments and their positioning related to the Conversational AI market.

- To analyze competitive developments, such as mergers and acquisitions, product developments, and research and development (R&D) activities, in the market.

- To analyze the impact of recession across all the regions across the Conversational AI market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic analysis

- Further breakup of the North American Conversational AI Market

- Further breakup of the European Conversational AI Market

- Further breakup of the Asia Pacific Conversational AI Market

- Further breakup of the Latin American Conversational AI Market

- Further breakup of the Middle East and Africa Conversational AI Market

Company information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Conversational AI Market