COVID-19 Impact on Fraud Detection and Prevention (FDP) Market by Fraud Type, Verticals and Region - Global Forecast to 2021

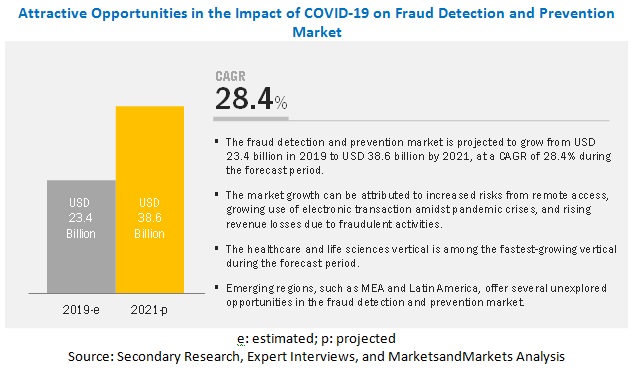

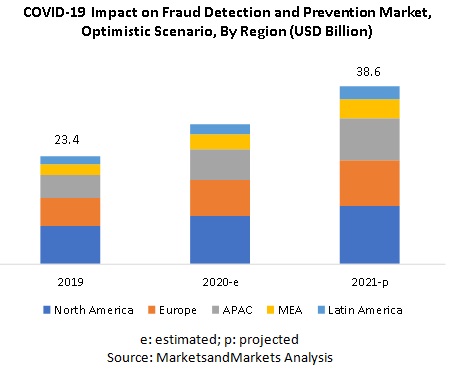

The COVID-19 impact on the global Fraud Detection and Prevention (FDP) market size is projected to grow from USD 23.4 billion in 2019 to USD 38.6 billion by 2021, at a Compound Annual Growth Rate (CAGR) of 28.4% during the forecast period, considering the optimistic scenario. The market growth can be attributed to increased risks from remote access, growing use of electronic transaction amidst pandemic crises, and the rising revenue losses due to fraudulent activities.

Payment card frauds segment projected to grow at a higher CAGR over the forecast period.

Credit card or debit card frauds are a type of theft, which involves conducting fraud using a customer’s payment card, such as credit card or debit card, to obtain goods without paying or to obtain unauthorized funds from the compromised account. Rising e-commerce transactions and the increasing fraudulent attacks to steal card-related information and unauthorized purchase of goods are driving the demand for FDP solutions.

Healthcare segment projected to attain the highest growth rate during the forecast period.

COVID-19 poses an occupational health risk to healthcare workers; thousands of healthcare workers worldwide have been infected by COVID-19. Hence, preventing intra-hospital transmission of this communicable disease is a key priority for healthcare institutions and administrative bodies. The strategies and measures are based on the Systems Engineering Initiative for Patient Safety (SEIPS) model and are widely adopted to ensure occupational safety for healthcare professionals in hospitals. In general, the goal for all healthcare systems is to achieve the principle of zero occupational infection. According to NEMEXIS, a Berlin-based international anti-fraud consulting firm found that fraud and corruption are on the rise in healthcare and healthcare systems. The company surveyed almost 58 countries in its survey, which focused on issues such as fraud involving PPE and ventilators, the existence of black markets and faulty equipment, cyber-attacks on healthcare systems, the embezzlement of healthcare funds, and bribes taken by medical personnel. Out of which 80% supported the impact of fraud and corruption on their country’s healthcare system to be important

North America projected to account for the largest market share during the forecast period

North America is expected to maintain the largest share in the global fraud detection and prevention market. At the same time, Asia Pacific (APAC) is projected to grow at the highest CAGR during the forecast period. The high growth rate in Asia Pacific can be attributed to organizations in the region, grabbing opportunities to go beyond ensuring their regulations and compliances and applying technology to curtail threats on enterprise devices. The government organizations across countries in Asia have published guidelines for protection from cybercrimes and fraudulent activities. The Cyberspace Administration of China (CAC) on the 9th of February published a notice emphasizing rules and regulations on data privacy and big data analysis, including China’s Cybersecurity Law, which includes rules on personal information protection.

North America is the most significant revenue contributor to the global fraud detection and prevention market. As the COVID-19 pandemic continues to impact North America, fraudsters have seized the opportunity to prey on consumers. According to the Federal Trade Commission (FTC), Americans have lost USD 13.4 million to coronavirus-related fraud since the beginning of the year. The top fraud categories for COVID-19 scams are related to travel and vacations, online shopping, bogus text messages, and imposter scams. Multiple federal agencies are working together to analyze the complaints, investigate ongoing fraud, phishing, or malware schemes, and assemble vetted referrals.

Key Market Players

Major vendors in the global FDP market include IBM (US), FICO (US), SAS Institute (US), BAE Systems (UK), DXC Technology (US), SAP (Germany), ACI Worldwide (US), Fiserv (US), NICE Systems (Israel), Experian (US), LexisNexis Risk Solutions (US), TransUnion (US), FRISS (Netherlands), Dell Technologies (US), Wirecard (Germany), Software AG (Germany), Easy Solutions (US), Hitachi Vantara (US), Kount(US), and Simility (US). These vendors have adopted various organic and inorganic growth strategies, such as new product launches, partnerships and collaborations, and mergers and acquisitions, to strengthen their presence in the FDP market.

SAP has contributed USD 3.2 million to the COVID-19 Emergency Fund to support the urgent needs of the WHO, the CDC Foundation, and smaller nonprofit organizations and social enterprises that work on the front lines serving local communities in crisis. Similarly, Dell Technologies has donated USD 284,000 to provide surgical masks, protective clothing, and eye protectors in local hospitals within China.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2019–2021 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2021 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Fraud Type, Verticals, and Regions |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies Covered |

Twenty major vendors: IBM (US), FICO (US), SAS Institute (US), BAE Systems (UK), DXC Technology (US), SAP (Germany), ACI Worldwide (US), Fiserv (US), NICE Systems (Israel), Experian (US), LexisNexis Risk Solutions (US), TransUnion (US), Friss (Netherlands), Dell Technologies (US), Wirecard (Germany), Software AG (Germany), Easy Solutions (US), Kount(US), Hitachi Vantara(US), and Simility (US). |

The research report categorizes the impact of COVID-19 on the FDP market based on fraud type, vertical, and region.

On the basis of fraud type, the FDP market has the following segments:

- Check fraud

- Identity fraud

- Internet sales fraud

- Investment fraud

- Payment card fraud

- Others (Insurance fraud, Work-from-home fraud, and Charity fraud)

On the basis of vertical, the FDP market has the following segments:

- Banking, financial services, and insurance (BFSI)

- Retail and e-Commerce

- Healthcare

- Manufacturing

- Government and the public sector

- Travel and transportation

- Others (Telecommunication, energy and power, and media and entertainment)

On the basis of region, the FDP market has the following segments:

- North America

- Europe

- Asia Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Recent Developments

- In March 2020, IBM partnered with The White House and the US Department of Energy have created a consortium to bring together the best supercomputers. This partnership would help researchers run large numbers of calculations in epidemiology, bioinformatics, and molecular modeling.

- In March 2020, JR Automation, a wholly-owned subsidiary of Hitachi, Ltd., partnered with General Motors (GM) to help produce face masks to combat the COVID-19 outbreak.

- In March 2020, DXC Technology partnered with Tradeshift to leverage its expertise in AI, ML, and robotic process automation platform and to benefit customers from the emerging technology and accelerate digital transformation.

Key questions addressed by the report

- What are the COVID-19 crisis-driven growth opportunities in the fraud detection and prevention market?

- Which types of frauds are impacted the most due to the COVID-19 crisis?

- How are key vendors responding to the crisis and devising their short-term strategies?

- What are the COVID-19 driven dynamics impacting the fraud detection and prevention market?

- Which verticals are deploying fraud detection and prevention solutions at scale to address COVID-19 specific use cases?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (PAGE NO. - 11)

1.1 COVID-19 HEALTH ASSESSMENT

1.2 COVID-19 ECONOMIC ASSESSMENT

1.2.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

2 RESEARCH METHODOLOGY (PAGE NO. - 17)

2.1 RESEARCH SCOPE

2.1.1 OBJECTIVES OF THE STUDY

2.1.2 MARKET DEFINITION

2.1.3 INCLUSIONS/EXCLUSIONS

2.2 ASSUMPTIONS

2.3 DATA TRIANGULATION

2.3.1 PRIMARY BREAKDOWN

2.4 STAKEHOLDERS

3 EXECUTIVE SUMMARY (PAGE NO. - 21)

4 IMPACT ON THE ECOSYSTEM AND EXTENDED ECOSYSTEM (PAGE NO. - 23)

4.1 FRAUD DETECTION AND PREVENTION ECOSYSTEM ANALYSIS, BY STAKEHOLDER

4.1.1 TECHNOLOGY PROVIDERS

4.1.2 REGULATORY AUTHORITIES INCLUDING GOVERNMENT OR INDUSTRY ASSOCIATIONS

4.1.3 SOLUTION DESIGNERS AND DEVELOPERS/CONSULTANTS

4.1.4 SYSTEM INTEGRATORS

4.1.5 RESELLERS

4.2 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

4.2.1 DRIVERS AND OPPORTUNITIES

4.2.2 RESTRAINTS AND CHALLENGES

5 BUSINESS IMPLICATIONS OF COVID-19 ON THE FRAUD DETECTION AND PREVENTION MARKET (PAGE NO. - 32)

5.1 IMPLICATION ON FRAUD TYPES (PESSIMISTIC, PRE-COVID-19, AND OPTIMISTIC SCENARIOS)

5.1.1 CHECK FRAUD FORECAST (2019–2021)

5.1.1.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

5.1.2 IDENTITY FRAUD FORECAST (2019–2021)

5.1.2.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

5.1.3 INTERNET SALES FRAUD FORECAST (2019–2021)

5.1.3.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

5.1.4 INVESTMENT FRAUDS FORECAST (2019–2021)

5.1.4.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

5.1.5 PAYMENT CARD FRAUDS FORECAST (2019–2021)

5.1.5.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

5.1.6 OTHER FRAUDS FORECAST (2019–2021)

5.1.6.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6 COVID-19 IMPACT ON MAJOR VERTICALS WITH USE CASES AND HOW CLIENTS ARE RESPONDING TO THE CURRENT SITUATION (PAGE NO. - 39)

6.1 BANKING, FINANCIAL SERVICES, AND INSURANCE

6.1.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6.1.2 KEY USE CASES

6.1.3 MNM VIEWPOINT (VERTICAL’S RESPONSE TO COVID-19)

6.2 HEALTHCARE

6.2.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6.2.2 KEY USE CASES

6.2.3 MNM VIEWPOINT (VERTICAL’S RESPONSE TO COVID-19)

6.3 RETAIL AND E-COMMERCE

6.3.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6.3.2 KEY USE CASES

6.3.3 MNM VIEWPOINT (VERTICAL’S RESPONSE TO COVID-19)

6.4 MANUFACTURING

6.4.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6.4.2 KEY USE CASES

6.4.3 MNM VIEWPOINT (VERTICAL’S RESPONSE TO COVID-19)

6.5 GOVERNMENT AND PUBLIC SECTOR

6.5.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6.5.2 KEY USE CASES

6.5.3 MNM VIEWPOINT (VERTICAL’S RESPONSE TO COVID-19)

6.6 TRAVEL AND TRANSPORTATION

6.6.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6.6.2 KEY USE CASES

6.6.3 MNM VIEWPOINT (VERTICAL’S RESPONSE TO COVID-19)

6.7 OTHERS

6.7.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

6.7.2 MNM VIEWPOINT (VERTICAL’S RESPONSE TO COVID-19)

7 COVID-19 IMPACT ON REGIONS (PAGE NO. - 52)

7.1 INTRODUCTION

7.2 NORTH AMERICA

7.2.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

7.3 EUROPE

7.3.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

7.4 ASIA PACIFIC

7.4.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

7.5 MIDDLE EAST & AFRICA

7.5.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

7.6 LATIN AMERICA

7.6.1 FORECAST, 2019–2021 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

8 COVID-19 FOCUSED PROFILES OF KEY VENDORS (PAGE NO. - 61)

8.1 INTRODUCTION

8.2 COMPANY PROFILES

9 APPENDIX (PAGE NO. - 69)

9.1 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

LIST OF TABLES (7 TABLES)

TABLE 1 COVID-19-RELATED BANKING, FINANCIAL SERVICES, AND INSURANCE USE CASES

TABLE 2 COVID-19-RELATED HEALTHCARE USE CASES

TABLE 3 COVID-19-RELATED RETAIL AND E-COMMERCE: USE CASES

TABLE 4 COVID-19-RELATED MANUFACTURING USE CASES

TABLE 5 COVID-19-RELATED GOVERNMENT AND PUBLIC UTILITY USE CASES

TABLE 6 COVID-19-RELATED TRAVEL AND TRANSPORTATION USE CASES

TABLE 7 COVID-19-ORIENTED PROFILES OF KEY ANALYTICS VENDORS

LIST OF FIGURES (25 FIGURES)

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT (GDP) FORECASTS FOR SELECT G20 COUNTRIES IN 2020

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

FIGURE 6 BREAKUP OF PRIMARY RESPONDENT PROFILES

FIGURE 7 GLOBAL FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 8 CHECK FRAUD MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 9 IDENTITY FRAUD MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 10 INTERNET SALES FRAUD MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 11 INVESTMENT FRAUDS MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 12 PAYMENT CARD FRAUDS MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 13 OTHER FRAUDS MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 14 BANKING, FINANCIAL SERVICES, AND INSURANCE: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD

MILLION)

FIGURE 15 HEALTHCARE: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 16 RETAIL AND E-COMMERCE: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 17 MANUFACTURING: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 18 GOVERNMENT AND PUBLIC SECTOR: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 19 TRAVEL AND TRANSPORTATION: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 20 OTHERS: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 21 NORTH AMERICA: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 22 EUROPE: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 23 ASIA PACIFIC: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 24 MIDDLE EAST & AFRICA: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

FIGURE 25 LATIN AMERICA: FRAUD DETECTION AND PREVENTION MARKET GROWTH RATE, 2019–2021 (USD MILLION)

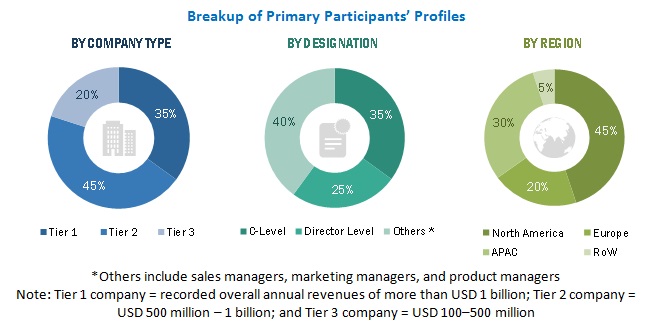

The study includes four major activities to estimate the current market size for the Impact of COVID-19 on the Fraud Detection and Prevention (FDP) market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The study has employed both the top-down and bottom-up approaches to estimate the overall market size. After that, market breakup and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, the study has referred to various secondary sources such as D&B Hoovers and Bloomberg BusinessWeek for identifying and collecting information. The secondary sources include company websites, press releases, annual reports, TechTarget reports, Association of Certified Fraud Examiners (ACFE), Information Security Research Association (ISRA), Information Systems Security Association (ISSA), RSA Security, Cloud Security Alliance reports, SC Magazine, and SANS Institute studies.

Primary Research

The FDP market comprises several stakeholders, such as fraud detection solution providers, FDP vendors, government agencies, independent software vendors (ISVS), consulting firms, system integrators, technology consultants, Value-Added Resellers (VARs), Managed Security Service Providers (MSSPs), and IT agencies. Primary sources were mainly industry experts from the core and related verticals, and preferred suppliers, manufacturers, distributors, service providers, technology developers, and technologists from companies and organizations related to all the segments of the FDP market’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects. The market size was estimated by analyzing various driving factors, including increasing risks from remote access, growing use of electronic transaction amidst pandemic crises, and rising revenue losses due to fraudulent activities.

Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the FDP market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Identifying key players in the industry and markets through extensive secondary research

- Determining the industry’s supply chain and market size, in terms of value, through primary and secondary research processes

- Determining all percentage shares, splits, and breakups using secondary sources and verifying through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakup procedures were employed, wherever applicable. Extensive qualitative and quantitative analyses were performed on the complete market engineering process to list the key information/insights throughout the report.

Report Objectives

- To define, describe, and forecast the impact of the COVID-19 on FDP market by fraud type, vertical, and region

- To provide detailed information about the impact of the COVID-19 on major factors (drivers, restraints, opportunities, and challenges) influencing the trends of the FDP market

- To study the impact of the COVID-19 on key industries that are severely impacted due to this health and economic pandemic

- To examine the shift in revenue patterns of FDP vendors in 2020 and their capabilities to address the demand emerging from industry sectors during the global lockdown due to the COVID-19 outbreak

- To analyze the change in short-term strategies of companies, such as goodwill offerings, to instill relevance and confidence among their customers

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per company-specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix that gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American Impact of COVID-19 on the FDP market

- Further breakup of the European Impact of COVID-19 on the FDP market

- Further breakup of the Asia Pacific Impact of COVID-19 on the FDP market

- Further breakup of the Middle Eastern & African Impact of COVID-19 on the FDP market

- Further breakup of the Latin American Impact of COVID-19 on the FDP market

Growth opportunities and latent adjacency in COVID-19 Impact on Fraud Detection and Prevention (FDP) Market