COVID-19 Impact On Intelligent Process Automation Market by Component, Vertical, and Region - Global Forecast to 2025

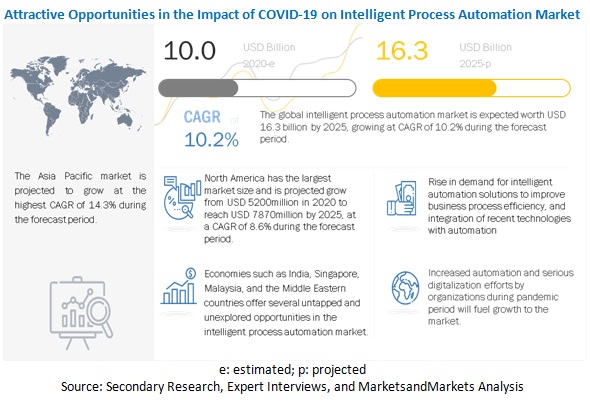

[74 Pages Report] The global Intelligent Process Automation (IPA) market’s pre-COVID size was expected to be USD 10.0 billion in 2020 and reach USD 16.3 billion in 2025, growing at a CAGR of 10.2%. The COVID-19 global pandemic is sending shockwaves throughout the financial markets, disrupting the supply chain, the elasticity of goods, and significantly impacting the way we engage in normal business activities. Early adopters ought to gain a competitive advantage over that of late adopters. IPA solutions can assist organizations in successfully driving value throughout these challenging times, and amid the opportunities they present.

Driver: Need for improved operational efficiency post COVID-19

Faced by the inefficiencies in the legacy systems and limited capacity during the COVID-19 lockdown. Organizations are now prioritizing digital transformation with a focus on RPA and hyper-automation, accelerating the growth of market post-COVID-19 outbreak.

Opportunity: Increased investment in the IPA market

Most non-IT verticals have seen increased adoption of IPA solutions. As per the survey conducted by Bain, more than 50% increase automation is expected in healthcare, life sciences, and manufacturing verticals

Restrain: COVID-19 led lockdown, and supply chain shocks have led to financial crunch

Lockdown due to COVID-19 has resulted in a financial crunch for most of the industry verticals, such as travel and hospitality, manufacturing and logistics, and retail. Even after realizing the need for automation and digitalization to drive work efficiency and time consumption, organizations post COVID-19 will try to spend strategically, not spending much on new operations

Challenge: Poor communication infrastructure to restrict growth

In developing and underdeveloped countries, varied broadband infrastructure will act as a hindrance to support a remote workforce, and provide online healthcare and online learnings. Several manufacturing units in developing countries are still relying on traditional methods of productions with poor communication facilities

The component segment to show the highest growth rate during the forecast period within the global intelligent process automation industry

Owing to the work from home scenario, the majority of industry verticals are facing operational delays and issues in employee supervision, impacting the need for an efficient operational model using digitization and automation. It is expected to affect the IPA solutions industry as the demand increases with more and more organizations adopting digitalization and automation. There is a need to increase digitalization in organizations, making digitalization a major driver for various organizations to adopt the IA process. The other benefits are improved operational efficiency and time management that are increasing the adoption of IPA tools. Applications, such as digital assistance using bots, are being deployed to answer customer queries in various organizations. Amid COVID-19, organizations will increase digital innovations by prioritizing digital channels to ensure operational consistency.

The banking and financial services vertical to record higher investment and growth in 2020 within the global intelligent process automation market

COVID-19 is causing a logistical nightmare for BFS, as they are receiving thousands of requests for customer assistance. The outdated technology and manual processes of smaller banks and credit unions have left them under-equipped and unprepared for economic disaster. COVID-19 has exposed the hole in the outdated banking system and presents an opportunity for these financial institutions to adopt the IA process to streamline their business processes. BFS needs to provide improved customer experience and customer retention for increasing the processing speed and improving the quality, which are some of the factors driving the importance of IA in the market.

Financial institutions are reducing the dependency on bank branches by prioritizing digital channels to ensure operational consistency. Several banks have implemented automated intelligent digital assistance bots to answer customer queries. Automation will help manage and adhere to the latest government guidelines and regulatory/compliance changes as most officials are working from home, while banks are opting for alternate workflow options and risk monitoring. The need for cloud-based process automation solutions to run back-office and front-office operations remotely is expected to increase its adoption. Firms will be opting for digital channel first policies for offering new products and services (personalized loans, micro-insurance, and micro-investing).

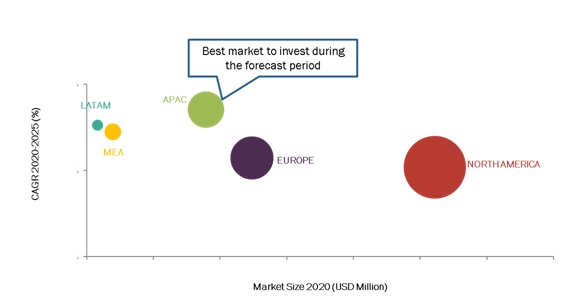

APAC intelligent process automation market to record the highest growth rate during the forecast period

While China being the epicenter of the outbreak, the economic impact was felt across Asia. India, Iran, and China being the most impacted countries in the region. The growing concern of infection has led organizations to operate with limited staff. Beijing (China) and Bangalore (India) are home to leading technology hubs; a large number of vendors are making efforts to make use of this opportunity to increase the adoption of the IA process. China-based Encootech has raised USD 30 million from Sequoia Capital, GSR Ventures, and Future Capital in March 2020. Similarly, Automation Anywhere announced an investment of USD 100 million for its Research and Development (R&D) facility in Bangalore, India, over the next three years.

Under pre-COVID-19 times, APAC was expected to grow at the fastest rate among all regions and expected to reach USD 3515 million market size, growing at 14.3% during the forecast period 2020–2025. This high growth rate is due to the increasing adoption of the IPA technology and the presence of several outsourcing vendors in China and India.

Key Market Players

The major vendors in the IPA market include Accenture (Ireland), Atos (France), IBM (US), Capgemini (US), Cognizant (US), Blue Prism (UK), TCS (India), Wipro (India), CGI (Canada), HCL technologies (India), Tech Mahindra (India), UiPath (US), Xerox (US), DXC Technology (US), NTT Data (Japan) Infosys (India), Pegasystems (US), PwC (UK), These players have adopted various growth strategies, such as partnerships and new service launches, to expand their presence further in the impact of COVID-19 on the IPA market and broaden their customer base.

IBM (US) is a major player in the global IPA market. The company is working closely with the White House Office of Science and Technology Policy, and the US Department of Energy to launch COVID-19 High-Performance Computing Consortium to help researchers understand COVID-19 cures and treatment. COVID-19 diagnostics, research, and testing.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

:

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

USD Million |

|

Segments covered |

Component (solutions and services) |

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

|

Companies covered |

Accenture (Ireland), Atos (France), Blue Prism (UK), Capgemini (US), Cognizant (US), CGI (Canada), HCL Technologies (India), IBM (US), Infosys (India), Pegasystems (US), PwC (UK), TCS (India), Tech Mahindra (India), UiPath (US), Wipro (India), Xerox (US), NTT Data (Japan) and DXC Technology (US) |

The research report categorizes the Impact of COVID-19 on the IPA market based on the components, verticals, and regions.

By Components:

- Solutions

- Services

By Vertical:

- Banking and Finance Services

- Manufacturing and Logistics

- Retail and Consumer Goods

- Information Technology

- Healthcare

- Insurance

- Telecommunication

- Media

- Life Sciences

- Public Services

- Energy and Utilities

- Travel and Hospitality

By Region:

- North America

- Europe

- UK

- Ireland

- Continental Europe

- APAC

- MEA

- Latin America

Recent Developments

- Drawing upon a long-term partnership with the British Columbia Ministry of Health, CGI collaborated with five provincial government agencies to rapidly develop a chatbot in just seven days.

- Cognizant’s expertise in life sciences supports Verily's Baseline COVID-19 Testing Program to increase individuals' access to test scheduling. This effort is part of Cognizant's broader commitment to support communities addressing the immediate and long-term impacts of the virus

- IBM is working closely with the White House Office of Science and Technology Policy, and the US Department of Energy to launch COVID-19 High-Performance Computing Consortium to help researchers understand COVID-19 cures and treatment.

- The launch of a Crisis Small Business Lending reference application by Pegasystems helps financial institutions manage the thousands of emergency loan applications pouring in from small businesses seeking COVID-19 financial relief, leveraging case management and automation, the solution helps banks dramatically improve processing efficiency from application through fulfillment.

Frequently Asked Questions (FAQ):

What are the growth opportunities in the impact of COVID-19 on the IPA market?

Increased adoption of IPA solution in BFS to provide seamless customer experience and enabling the vertical to operate with limited staff increased investment in healthcare and life sciences verticals to mitigate the health impact of the novel coronavirus and potentially limiting the growth of any future outbreak are growing demand for IPA solutions. Higher automation practices followed by manufacturing and logistics firms to manage the routine tasks efficiently to present growth opportunities in the IPA market. The rising trend towards AI and cloud-based solutions by SME’s across verticals to further the growth of the market

What is the impact of COVID-19 on enterprises, and what impact it has on the IPA market?

The impact of COVID-19 on enterprises is transforming their business models. Every business is affected due to the novel coronavirus. Organizations are struggling to revamp their supply chains to make the working environment safe. To mitigate pandemic risks, organizations around the world are taking adequate measures, such as enabling remote working capabilities, Business Process Automation (BPA), cloud-based collaboration, and telehealth.

Which region to show the highest growth rate due to the impact of COVID-19 on the IPA market?

APAC is estimated to grow at the fastest rate as both developed, and developing countries in the region are buying interest in IPA amid lockdowns. Technology, healthcare, and life sciences verticals are witnessing increased investments from both the public and private sectors. The travel and hospitality vertical is one of the prominent vertical in the Middle East region that is severely impacted.

How has the impact of COVID-19 on IPA segments evolved from traditional technologies?

The outdated technology and manual processes of organizations have left them under-equipped and unprepared for economic disaster. COVID-19 has exposed the hole in the outdated processing system and presents an opportunity to adopt the IA process to streamline business processes.

What are the dynamics of the impact of COVID-19 on the IPA market?

The COVID-19 pandemic has a medium impact on the IPA market, and it has majorly impacted tourism and hospitality, transportation and logistics, manufacturing, and retail. Telecommunication, education, and government verticals are slightly impacted. On the contrary, verticals, such as healthcare and life sciences, technology, and banking, are significantly adopting Intelligent Automation (IA) process. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 10)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

2 RESEARCH METHODOLOGY (Page No. - 16)

2.1 RESEARCH ASSUMPTION

2.2 DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.3 PRIMARY DATA

2.3.1 BREAKDOWN OF PRIMARY PROFILES

FIGURE 7 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.3.2 INCLUSION/EXCLUSION

2.4 STAKEHOLDERS

2.5 MARKET SIZE ESTIMATION

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

3 EXECUTIVE SUMMARY (Page No. - 21)

3.1 SUMMARY OF KEY FINDINGS

4 IMPACT ON ECOSYSTEM AND EXTENDED ECOSYSTEM (Page No. - 22)

4.1 BY STAKEHOLDER

4.1.1 TECHNOLOGY PROVIDERS

4.1.2 SOLUTION DESIGNERS AND DEVELOPERS/CONSULTANTS

4.1.3 SYSTEM INTEGRATORS

4.1.4 RESELLERS

4.1.5 MANAGED SERVICE PROVIDERS

FIGURE 10 INTELLIGENT PROCESS AUTOMATION ECOSYSTEM: BY TECHNOLOGY

4.2 COVID-19 PANDEMIC-DRIVEN MARKET DYNAMICS AND FACTOR ANALYSIS

4.2.1 DRIVERS AND OPPORTUNITIES

4.2.2 RESTRAINS AND CHALLENGES

4.2.3 CUMULATIVE GROWTH ANALYSIS

5 BUSINESS IMPLICATIONS OF COVID-19 ON INTELLIGENT PROCESS AUTOMATION MARKET (Page No. - 28)

5.1 INTRODUCTION

FIGURE 11 COVID-19 IMPACT: INTELLIGENT PROCESS AUTOMATION MARKET (2019–2025)

5.2 COVID-19 IMPLICATIONS ON COMPONENT SEGMENT (PESSIMISTIC, PRE-COVID-19, AND OPTIMISTIC)

5.2.1 SOLUTIONS FORECAST (2019–2025)

5.2.1.1 Forecast 2019–2025 (optimistic/pre-COVID-19/pessimistic)

FIGURE 12 IMPACT OF COVID-19 ON INTELLIGENT PROCESS AUTOMATION COMPONENT MARKET SIZE, BY SOLUTION

5.2.1.2 MNM View

5.2.2 SERVICES FORECAST (2019–2025)

5.2.2.1 Forecast 2019–2025 (optimistic/pre-COVID-19/pessimistic)

FIGURE 13 IMPACT OF COVID-19 ON INTELLIGENT PROCESS AUTOMATION COMPONENT MARKET SIZE, BY SERVICE

5.2.2.2 MNM View

6 COVID-19 IMPACT ON MAJOR VERTICALS WITH USE CASES AND HOW CLIENTS ARE RESPONDING TO THE CURRENT SITUATION (Page No. - 31)

6.1 BANKING AND FINANCE SERVICES

6.1.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 14 BANKING AND FINANCE SERVICES: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.1.2 KEY USE CASES

TABLE 1 COVID-19 USE CASES: BANKING AND FINANCE SERVICES

6.1.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.2 MANUFACTURING AND LOGISTICS

6.2.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 15 MANUFACTURING AND LOGISTICS: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.2.2 KEY USE CASES

TABLE 2 COVID-19 USE CASES: MANUFACTURING AND LOGISTICS

6.2.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.3 RETAIL AND CONSUMER GOODS

6.3.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 16 RETAIL AND CONSUMER GOODS: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.3.2 KEY USE CASES

TABLE 3 COVID-19 USE CASES: RETAIL AND CONSUMER GOODS

6.3.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.4 INFORMATION TECHNOLOGY

6.4.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 17 INFORMATION TECHNOLOGY: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.4.2 KEY USE CASES

TABLE 4 COVID-19 USE CASES: INFORMATION TECHNOLOGY

6.4.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.5 HEALTHCARE

6.5.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 18 HEALTHCARE: MARKET SIZE, 2019–2025 (USD MILLION)

6.5.2 KEY USE CASES

TABLE 5 COVID-19 USE CASES: HEALTHCARE

6.5.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.6 INSURANCE

6.6.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 19 INSURANCE: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.6.2 KEY USE CASES

TABLE 6 COVID-19 USE CASES: INSURANCE

6.6.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.7 TELECOMMUNICATION

6.7.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 20 TELECOMMUNICATION: MARKET SIZE, 2019–2025 (USD MILLION)

6.7.2 KEY USE CASES

TABLE 7 COVID-19 USE CASES: TELECOMMUNICATION

6.7.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.8 MEDIA

6.8.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 21 MEDIA: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.8.2 KEY USE CASES

TABLE 8 COVID-19 USE CASES: MEDIA

6.8.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.9 LIFE SCIENCES

6.9.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 22 LIFE SCIENCES: MARKET SIZE, 2019–2025 (USD MILLION)

6.9.2 KEY USE CASES

TABLE 9 COVID-19 USE CASES: LIFE SCIENCES

6.9.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.10 PUBLIC SERVICES

6.10.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 23 PUBLIC SERVICES: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.10.2 KEY USE CASES

TABLE 10 COVID-19 USE CASES: PUBLIC SERVICES

6.10.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.11 ENERGY AND UTILITIES

6.11.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 24 ENERGY AND UTILITIES: MARKET SIZE, 2019–2025 (USD MILLION)

6.11.2 KEY USE CASES

TABLE 11 COVID-19 USE CASES: ENERGY AND UTILITIES

6.11.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

6.12 TRAVEL AND HOSPITALITY

6.12.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 25 TRAVEL AND HOSPITALITY: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

6.12.2 KEY USE CASES

TABLE 12 COVID-19 USE CASES: TRAVEL AND HOSPITALITY

6.12.3 MNM VIEW (RESPONSE OF THE VERTICAL TO COVID-19)

7 COVID-19 IMPACT ON REGION (Page No. - 51)

7.1 INTRODUCTION

7.2 NORTH AMERICA

7.2.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 26 NORTH AMERICA: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

7.3 EUROPE

7.3.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 27 EUROPE: MARKET SIZE, 2019–2025 (USD MILLION)

7.3.2 UNITED KINGDOM

7.3.2.1 Forecast 2019–2025 (optimistic/pre-COVID-19/pessimistic)

FIGURE 28 UNITED KINGDOM: MARKET SIZE, 2019–2025 (USD MILLION)

7.3.3 IRELAND

7.3.3.1 Forecast 2019–2025 (optimistic/pre-COVID-19/pessimistic)

FIGURE 29 IRELAND: MARKET SIZE, 2019–2025 (USD MILLION)

7.3.4 CONTINENTAL EUROPE

7.3.4.1 Forecast 2019–2025 (optimistic/pre-COVID-19/pessimistic)

FIGURE 30 CONTINENTAL EUROPE: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

7.4 ASIA PACIFIC

7.4.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 31 ASIA PACIFIC: MARKET SIZE, 2019–2025 (USD MILLION)

7.5 MIDDLE EAST AND AFRICA

7.5.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 32 MIDDLE EAST AND AFRICA: MARKET SIZE, 2019–2025 (USD MILLION)

7.6 LATIN AMERICA

7.6.1 FORECAST 2019–2025 (OPTIMISTIC/PRE-COVID-19/PESSIMISTIC)

FIGURE 33 LATIN AMERICA: INTELLIGENT PROCESS AUTOMATION MARKET SIZE, 2019–2025 (USD MILLION)

8 COMPANY PROFILES (Page No. - 60)

8.1 COVID-19-ORIENTED PROFILES OF KEY INTELLIGENT PROCESS AUTOMATION VENDORS

TABLE 13 COVID-19-ORIENTED PROFILES OF KEY INTELLIGENT PROCESS AUTOMATION VENDORS

9 APPENDIX (Page No. - 67)

9.1 INDUSTRY EXCERPTS

9.2 DISCUSSION GUIDE

9.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

9.4 AVAILABLE CUSTOMIZATIONS

9.5 RELATED REPORTS

9.6 AUTHOR DETAILS

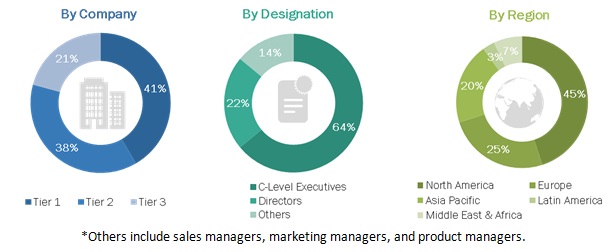

The study involved four major steps in estimating the current market size for the impact of COVID-19 on the Intelligent Process Automation (IPA) market. Exhaustive secondary research was done to collect information on the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation methods were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources, such as annual reports, presentations, websites, and press releases of IPA services players, news articles and journals, and paid databases, have been referred to, to identify and collect information for the study.

Primary Research

The Impact of COVID-19 on the IPA market comprises several stakeholders, such as AI, Robotic Process Automation (RPA), and automation vendors, IA platform providers, system integrators, consultancy firms/advisory firms, and workforce optimization solution providers from various key companies and organizations operating in the IPA market. The extensive primary research was conducted to gather information and verify and validate the findings. Primary research was conducted further to identify the segmentation types; industry trends; key players; the competitive landscape of different market players; and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key strategies. Following is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the overall size of the market. These methods were used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the industry and markets have been identified through extensive secondary research.

- The impact of COVID 19 on IPA market expenditure across regions, along with the geographic split in various segments, have been considered to arrive at the overall market size.

- All percentage shares split, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size, using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand side and supply side in the Impact of COVID 19 on the IPA market.

Report Objectives:

- To define, describe, and forecast the Impact of COVID 19 on the IPA market by components, verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the IPA market growth

- To analyze opportunities in the market and provide details about the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments concerning five main regions, namely, North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the Impact of COVID 19 on the IPA market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the IPA market report:

Geographic Analysis

- Further breakup of additional countries in the Europe market

Growth opportunities and latent adjacency in COVID-19 Impact On Intelligent Process Automation Market