Crypto Asset Management Market by Solution (Custodian and Wallets), Application Type (Web-based and Mobile-based), End User (Individuals and Enterprises (Institutions (BFSI, Hedge Funds), Retail and eCommerce)), and Region - Global Forecast to 2026

Updated on : March 21, 2024

Crypto Asset Management Market Size

The crypto asset management market was estimated at $0.4 billion in 2021, and the crypto asset management industry is expected to increase at a compound annual growth rate (CAGR) of 21.5% from 2021 to 2026, reaching $1.2 billion.The major factors that are expected to drive the growth of the crypto asset management market include the high remittances in developing countries, the growth in venture capital investments, the need for safeguarding cryptocurrency assets, and the proliferation of blockchain technology.

Various opportunities in the crypto asset management market are the untapped markets in different countries, the adoption of cryptocurrency among industries, and the new investment opportunities amid the COVID-19 crisis. Various challenges faced by end users in the market include security, privacy, and control issues. The lack of technical expertise and infrastructure, and the long delays caused to complete a cryptocurrency transfer are some of the additional challenges in the market. The lack of a uniform regulatory framework and unverified cryptocurrency providers act as the major restraining factors for the crypto asset management market.

Attractive Opportunities in Crypto Asset Management Market

To know about the assumptions considered for the study, Request for Free Sample Report

Crypto Asset Management Market Dynamics

Driver: Proliferation of blockchain technology

Prior to the availability of blockchain technology, cryptocurrencies, and digital assets were worthless. With the emergence of blockchain, the cryptocurrency market is growing at a rapid pace. Blockchain has the potential to provide high-level security for digital assets and cryptocurrencies. Using blockchain, users can authorize transactions without taking any permission from central authorities.

Some of the major use cases of blockchain include fund exchange, smart contracts, and voting. Blockchain has varied use cases and application areas in every line of business. In a nutshell, blockchain is a decentralized digital ledger that keeps and maintains transactional information across the peer-to-peer network. Cryptocurrencies were the first application use case of blockchain and have dramatically changed the way businesses are pursuing digital assets.

Financial institutions are exploring the idea of blockchain to transit and store cryptocurrency and digital assets over the internet ecosystem. The availability of blockchain technology is fueling the growth of cryptocurrencies, which will tangentially increase the demand for crypto asset management solutions. The growing usage of cryptocurrency among businesses has compelled financial stakeholders to implement crypto asset management solutions.

Restraint: Lack of awareness and technical understanding regarding cryptocurrency

The major limitation for the adoption of cryptocurrency is the lack of awareness about the use cases and the limited technical understanding regarding transaction processes. End users in most verticals do not know about the benefits of cryptocurrency and also lack understanding of how it works. This restricts the investment by companies in cryptocurrency as it is decentralized and has an uncertain regulatory status. As investors, the public and entrepreneurs do not widely adopt cryptocurrency, its potential for transforming transaction processes has not yet been realized.

Cryptocurrency uses cryptographic algorithms running across a vast network of independent computers. Therefore, sound technical knowledge about the related technology is crucial to explore the benefits of cryptocurrency in use cases. The lack of knowledge and public awareness is one of the biggest restraints for the adoption of cryptocurrency.

However, the increasing adoption and use of distributed ledger technology would make the understanding of cryptocurrency essential in the coming future. This would lead to the establishment and proliferation of platforms to provide training and maintain knowledge in this field. However, the challenges of legacy infrastructure would continue to be an obstacle as the practicality of implementing decentralized cryptosystems is beyond the traditional IT development skillset.

Opportunity: Adoption of cryptocurrency across verticals

The growth of cryptocurrency over the last few years has been remarkable across developed countries. The cryptocurrency market is growing at an astounding rate for consumers as well as enterprises. Financial institutions are the frontrunner in adopting cryptocurrencies for trading and exchange.

Blockchain has enhanced the popularity of cryptocurrencies owing to greater security and scalability. Its diverse features are attracting organizations to deploy this new technology across their business transactions. Presently, the world’s largest financial institutions are utilizing cryptocurrency for currency exchange and trading. Several projects are going on across the globe to explore the benefits of cryptocurrency and blockchain, which are disrupting various industries, including BFSI, government, retail and eCommerce, and media and entertainment.

Many verticals such as retail and eCommerce, media and entertainment, healthcare, and government are expected to utilize digital assets for various use cases. Nowadays, many large enterprises, banks, and financial institutes are investing heavily to safeguard their digital assets. In a nutshell, the current and future trends in cryptocurrency, digital assets, and blockchain technology would further fuel the adoption of crypto asset management solutions during the forecast period.

Based on vertical, Retail and eCommerce is to grow with the fastest growing CAGR

The retail vertical functions in an environment that is relatively diversified as compared to other verticals. They are highly tech-savvy in terms of the adoption of advanced technologies and cryptocurrency is not the exception. The retail and eCommerce application area are an associated global network of suppliers, retailers, eCommerce portals, and customers interacting in physical stores, as well as digital online channels. The retail and eCommerce application area faces steep challenges in the form of limited supply visibility that leads to instability, increasing customer demand for product authenticity, and high transaction fees from third-party payment processors.

Overstock.com was the first retailer to accept eCommerce payments via cryptocurrency. Digital currency offers several benefits, such as secure transaction, low cost, and less processing time. Currently, many retailers are skeptical about exploring the opportunities of cryptocurrency. As per industry experts and crypto asset solution providers, retail and eCommerce businesses are expected to leverage the cryptocurrency for the online and offline payment process. Hence, the demand for crypto asset management solutions in the retail and eCommerce industry is expected to increase during the forecast period.

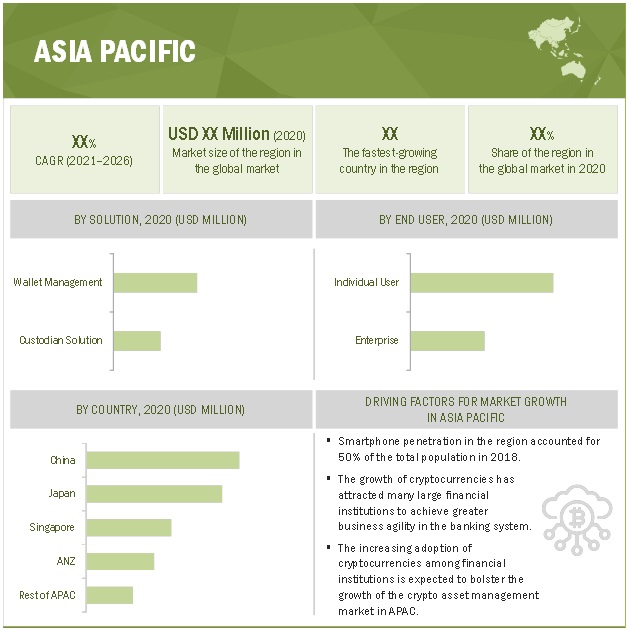

Asia Pacific is to grow with the fastest growing CAGR during the forecast period

To know about the assumptions considered for the study, download the pdf brochure

The APAC region is expected to provide significant growth opportunities for vendors operating in the cryptocurrency management market during the forecast period. Rapid advancements in the network infrastructure, cloud computing, economic growth, and stable geopolitical system have provided a platform for the growth of solution providers in the APAC region. The presence and use of digital currency significantly influence the financial system in APAC. The growth of cryptocurrencies has attracted many large financial institutions to achieve greater business agility in the banking systems. Cryptocurrency, which is powered by blockchain technology, allows institutional clients to conduct transactions and exchanges, thus trading more quickly. Digital currency does not need any third-party intervention owing to its decentralized networks.

Top Companies in Crypto Asset Management Market

This research study outlines the market potential, market dynamics, and key and innovative companies in the crypto asset management market include

- Coinbase, Inc. (US)

- Gemini Trust Company, LLC. (US)

- Crypto Finance AG (Germany)

- Vo1t Ltd (UK)

- Bakkt, LLC (US)

- BitGo, Inc. (US)

- Ledger SA (France)

- METACO SA (Switzerland)

- Iconomi Ltd. (UK)

- EXODUS MOVEMENT, INC. (US)

- Xapo, Inc. (Switzerland)

- Paxos Trust Company, LLC. (US)

- Koine Money Ltd (England)

- Amberdata, Inc. (US)

- Tradeium Capital, LLC. (Germany)

- Opus Labs CVBA (Belgium)

- Kryptographe Inc (UK)

The study includes an in-depth competitive analysis of these key players in the crypto asset management market with their company profiles, recent developments, and key market strategies.

Crypto Asset Management Market Report Scope

|

Report Metrics |

Details |

|

Market value in 2021 |

USD 0.4 Billion |

|

Market value in 2026 |

USD 1.2 Billion |

|

Market Growth Rate |

CAGR of 21.5% |

|

Segments covered |

Solution, End User, Enterprise Vertical, Application Type, Deployment Type, Mobile Operating System (OS), and Regions. |

|

Geographies Covered |

North America, Europe, APAC, ROW. |

|

Available Customizations |

|

This research report categorizes the crypto asset management market to forecast revenues and analyze trends in each of the following submarkets:

Market Based on Solution

- Custodian Solution

- Wallet Management

Market Based on Deployment Mode:

- Cloud

- On-premises

Market Based on Application Type:

- Web-based

- Mobile

Market on Mobile Operating System:

- iOS

- Android

Market on End User:

- Individual

- Enterprise

Market on Enterprise Vertical:

- Institutions

- Retail and eCommerce

- Healthcare

- Travel and Hospitality

- Others (Includes government, and media and entertainment)

Crypto Asset Management Market Based on Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Rest of Europe (other EU and non-EU countries)

-

APAC

- China

- Japan

- Australia and New Zealand

- Singapore

- Rest of APAC (India, Indonesia, Taiwan, and South Korea)

-

RoW

- The Middle East and Africa

- Latin America

Recent Developments in Crypto Asset Management Market:

- In April 2020, Coinbase partnered with Oobit to provide a crypto wallet, custodial services, and escrow for the users of Oobits’ new product, which is known as Oobit Hunter.

- In April 2020, BitGo acquired Lumina, a provider of software solutions that offer digital asset dealers a financial platform that accelerates the mass adoption of digital assets by bridging the gap between traditional finance and crypto.

- In March 2020, Gemini partnered with Itviti to enable cryptocurrency holders to trade through Itiviti's NYFIX.

- In March 2020, Bakkt acquired certain assets of Rosenthal Collins Group, an independent futures commission merchant.

- In January 2020, Blox and Origin Protocol Collaborate to Introduce Crypto Finance Tools for Decentralized Marketplace Businesses.

Frequently Asked Questions (FAQ):

What is the projected market value of the global crypto asset management market?

The global market of crypto asset management is projected to reach USD 1.2 billion.

What is the estimated growth rate (CAGR) of the global crypto asset management market for the next five years?

The global crypto asset management market is projected to grow at a Compound Annual Growth Rate (CAGR) of 21.5% from 2022 to 2026.

What are the major revenue pockets in the crypto asset management market currently?

The APAC region is expected to provide significant growth opportunities for vendors operating in the cryptocurrency management market during the forecast period. Rapid advancements in the network infrastructure, cloud computing, economic growth, and stable geopolitical system have provided a platform for the growth of solution providers in the APAC region. The presence and use of digital currency significantly influence the financial system in APAC. The growth of cryptocurrencies has attracted many large financial institutions to achieve greater business agility in the banking systems. Cryptocurrency, which is powered by blockchain technology, allows institutional clients to conduct transactions and exchanges, thus trading more quickly. Digital currency does not need any third-party intervention owing to its decentralized networks

Who are the major vendors in the crypto asset management market?

Coinbase, Inc. (US), Gemini Trust Company, LLC. (US), Crypto Finance AG (Germany), Vo1t Ltd (UK), Bakkt, LLC (US), BitGo, Inc. (US), Ledger SA (France), METACO SA (Switzerland), Iconomi Ltd. (UK), EXODUS MOVEMENT, INC. (US), Xapo, Inc. (Switzerland), Paxos Trust Company, LLC. (US), Koine Money Ltd (England), Amberdata, Inc. (US), Tradeium Capital, LLC. (Germany), Opus Labs CVBA (Belgium), Kryptographe Inc (UK), and others.

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: THE GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GDP FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF THE STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 REGIONS COVERED

1.6.3 PERIODIZATION CONSIDERED FOR THE STUDY

1.7 CURRENCY CONSIDERED

TABLE 1 USD EXCHANGE RATES, 2017–2020

1.8 STAKEHOLDERS

1.9 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 38)

2.1 RESEARCH DATA

FIGURE 6 CRYPTO ASSET MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE FROM SOLUTIONS/WALLETS OF CRYPTO ASSET MANAGEMENT VENDORS

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS, APPS, AND WALLETS OF CRYPTO ASSET MANAGEMENT VENDORS

FIGURE 9 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 3, TOP-DOWN (DEMAND SIDE): SHARE OF CRYPTO ASSET MANAGEMENT THROUGH THE OVERALL INFORMATION TECHNOLOGY MARKET

2.4 MARKET FORECAST

TABLE 2 FACTOR ANALYSIS

2.5 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING METHODOLOGY

FIGURE 10 STARTUP/SME COMPETITIVE LEADERSHIP MAPPING MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 49)

FIGURE 11 GLOBAL CRYPTO ASSET MANAGEMENT MARKET TO WITNESS A STEADY GROWTH DURING THE FORECAST PERIOD

FIGURE 12 GEOGRAPHIC DISTRIBUTION OF CRYPTO WALLET USERS, 2019

FIGURE 13 MOBILE APP STORE MARKET SHARE, 2017–2020

FIGURE 14 SEGMENTS WITH HIGH GROWTH RATES DURING THE FORECAST PERIOD

FIGURE 15 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 54)

4.1 ATTRACTIVE OPPORTUNITIES IN THE CRYPTO ASSET MANAGEMENT MARKET

FIGURE 16 INCREASING VENTURE CAPITAL FUNDING AND GROWING INVESTMENTS IN CRYPTO ASSET MANAGEMENT TECHNOLOGY TO DRIVE THE MARKET GROWTH

4.2 MARKET, BY SOLUTION, 2020 VS. 2026

FIGURE 17 WALLET MANAGEMENT SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.3 MARKET, BY END USER, 2020 VS. 2026

FIGURE 18 INDIVIDUAL USERS SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT MODE, 2020 VS. 2026

FIGURE 19 CLOUD SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.5 MARKET, BY APPLICATION TYPE, 2020 VS. 2026

FIGURE 20 MOBILE SEGMENT TO LEAD THE CRYPTO ASSET MANAGEMENT MARKET DURING THE FORECAST PERIOD

4.6 MARKET, BY MOBILE OPERATING SYSTEM, 2020 VS. 2026

FIGURE 21 ANDROID SEGMENT TO HOLD A LARGER MARKET SHARE DURING THE FORECAST PERIOD

4.7 MARKET, BY ENTERPRISE VERTICAL, 2018–2026

FIGURE 22 INSTITUTIONS ENTERPRISE VERTICAL TO LEAD THE MARKET DURING 2018–2026

4.8 MARKET INVESTMENT SCENARIO

FIGURE 23 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD IN THE INDIVIDUAL USERS SEGMENT

FIGURE 24 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENTS DURING THE FORECAST PERIOD IN THE ENTERPRISES SEGMENT

5 MARKET OVERVIEW (Page No. - 59)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 25 CRYPTO ASSET MANAGEMENT MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 High remittances in developing countries

FIGURE 26 GLOBAL REMITTANCE FLOWS, 2015–2020

FIGURE 27 TOP REMITTANCE RECEIVERS, 2018

5.2.1.2 Growth in venture capital investments

TABLE 3 FUNDING IN THE CRYPTOCURRENCY MARKET, 2014–2020 (USD MILLION)

FIGURE 28 TOTAL FUNDING, 2015–2019 (USD BILLION)

5.2.1.3 Safeguarding cryptocurrency assets

5.2.1.4 Proliferation of blockchain technology

5.2.1.5 COVID-19 Impact

5.2.2 RESTRAINTS

5.2.2.1 Lack of regulatory framework

5.2.2.2 Lack of awareness and technical understanding regarding cryptocurrency

5.2.3 OPPORTUNITIES

5.2.3.1 Adoption of cryptocurrency across verticals

5.2.3.2 Potential untapped markets

5.2.3.3 COVID-19 Impact

5.2.4 CHALLENGES

5.2.4.1 Security, privacy, and control issues

5.2.4.2 Technical challenges pertaining to scalability

5.2.4.3 COVID-19 Impact

5.3 INDUSTRY TRENDS

5.3.1 INITIAL COIN OFFERING

5.3.1.1 Trends

5.3.1.1.1 Initial Exchange Offer

5.3.1.1.2 Security Token Offering

5.3.1.1.3 Simple Agreement for Future Tokens:

5.3.2 CRYPTOCURRENCIES

TABLE 4 TOP CRYPTOCURRENCIES CURRENT MARKET CAPITALIZATION, 2021

5.3.2.1 Bitcoin

5.3.2.2 Ethereum

5.3.2.3 Binance Coin

5.3.2.4 Cardano

5.3.2.5 Tether

5.3.2.6 Ripple

5.3.2.7 Dashcoin

5.3.2.8 Litecoin

5.3.3 STATE OF CRYPTOCURRENCY

5.3.3.1 United States

5.3.3.2 European Union

5.3.3.3 United Kingdom

5.3.3.4 Switzerland

5.3.3.5 Japan

5.3.3.6 South Korea

5.3.3.7 China

5.3.3.8 India

5.4 CRYPTO ASSET MANAGEMENT MARKET: VALUE CHAIN ANALYSIS

FIGURE 29 CRYPTO ASSET MANAGEMENT: VALUE CHAIN ANALYSIS

5.4.1 RESEARCH AND DEVELOPMENT

5.4.2 DESIGN COMMISSION, SOFTWARE AND TESTING

5.4.3 INTEGRATION, FINAL PRODUCT, AND END USERS

5.5 ECOSYSTEM

FIGURE 30 CRYPTO ASSET MANAGEMENT: ECOSYSTEM

5.6 REGULATION OF CRYPTOCURRENCY

TABLE 5 CRYPTOCURRENCY STATUS BY COUNTRY, 2019

6 CRYPTO ASSET MANAGEMENT MARKET, BY SOLUTION (Page No. - 76)

6.1 INTRODUCTION

6.1.1 SOLUTIONS: MARKET DRIVERS

FIGURE 31 IMPACT OF COVID-19 ON THE MARKET, BY SOLUTION

TABLE 6 PRE-COVID-19: MARKET SIZE, BY SOLUTION, 2018–2026 (USD MILLION)

FIGURE 32 WALLET MANAGEMENT SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 7 POST-COVID-19: MARKET SIZE, BY SOLUTION, 2018–2026 (USD MILLION)

TABLE 8 SOLUTION: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

6.2 CUSTODIAN SOLUTION

6.2.1 CUSTODIAN SOLUTION: MARKET DRIVERS

TABLE 9 CUSTODIAN SOLUTION: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

6.3 WALLET MANAGEMENT

6.3.1 WALLET MANAGEMENT: MARKET DRIVERS

6.3.2 WALLET MANAGEMENT: MARKET COVID-19 IMPACT

TABLE 10 WALLET MANAGEMENT: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

7 CRYPTO ASSET MANAGEMENT MARKET BY DEPLOYMENT MODE (Page No. - 81)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT MODES: MARKET DRIVERS

FIGURE 33 IMPACT OF COVID-19 ON THE MARKET, BY DEPLOYMENT MODE

TABLE 11 PRE-COVID-19: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

FIGURE 34 CLOUD SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 12 POST-COVID-19: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 13 DEPLOYMENT MODE: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

7.2 ON-PREMISES

7.2.1 ON-PREMISES: MARKET DRIVERS

7.2.2 ON-PREMISES: MARKET COVID-19 IMPACT

TABLE 14 ON-PREMISES: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

7.3 CLOUD

7.3.1 CLOUD: MARKET DRIVERS

7.3.2 CLOUD: MARKET COVID-19 IMPACT

TABLE 15 CLOUD: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8 CRYPTO ASSET MANAGEMENT MARKET, BY APPLICATION TYPE (Page No. - 86)

8.1 INTRODUCTION

FIGURE 35 IMPACT OF COVID-19 ON THE MARKET, BY APPLICATION TYPE

TABLE 16 PRE-COVID-19: MARKET SIZE, BY APPLICATION TYPE, 2018–2026 (USD MILLION)

FIGURE 36 MOBILE SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 17 POST-COVID-19: MARKET SIZE, BY APPLICATION TYPE, 2018–2026 (USD MILLION)

TABLE 18 APPLICATION TYPE: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.2 WEB-BASED

8.2.1 WEB-BASED: MARKET DRIVERS

8.2.2 WEB-BASED: MARKET COVID-19 IMPACT

TABLE 19 WEB-BASED: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

8.3 MOBILE-BASED

8.3.1 MOBILE-BASED: MARKET DRIVERS

8.3.2 MOBILE-BASED: MARKET COVID-19 IMPACT

TABLE 20 MOBILE-BASED: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

9 CRYPTO ASSET MANAGEMENT MARKET BY MOBILE OPERATING SYSTEM (Page No. - 91)

9.1 INTRODUCTION

FIGURE 37 IMPACT OF COVID-19 ON THE MARKET, BY MOBILE OPERATING SYSTEM

TABLE 21 PRE-COVID-19: MARKET SIZE, BY MOBILE OPERATING SYSTEM, 2018–2026 (USD MILLION)

FIGURE 38 IOS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 22 POST-COVID-19: MARKET SIZE, BY MOBILE OPERATING SYSTEM, 2018–2026 (USD MILLION)

TABLE 23 MOBILE OPERATING SYSTEM: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

9.2 IOS

9.2.1 IOS: MARKET DRIVERS

TABLE 24 IOS: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

9.3 ANDROID

9.3.1 ANDROID: MARKET DRIVERS

TABLE 25 MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

10 CRYPTO ASSET MANAGEMENT MARKET BY END USER (Page No. - 96)

10.1 INTRODUCTION

FIGURE 39 IMPACT OF COVID-19 ON THE MARKET, BY END USER

TABLE 26 PRE-COVID-19: MARKET SIZE, BY END USER, 2018–2026 (USD MILLION)

FIGURE 40 INDIVIDUAL USER SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 27 POST-COVID-19: MARKET SIZE, BY END USER, 2018–2026 (USD MILLION)

TABLE 28 END USER: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

10.2 INDIVIDUAL USER

10.2.1 INDIVIDUAL USER: MARKET DRIVERS

10.2.2 INDIVIDUAL USER: MARKET COVID-19 IMPACT

TABLE 29 INDIVIDUAL USER: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

10.3 ENTERPRISE

10.3.1 ENTERPRISE: MARKET DRIVERS

10.3.2 ENTERPRISE: MARKET COVID-19 IMPACT

TABLE 30 ENTERPRISE: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

11 CRYPTO ASSET MANAGEMENT MARKET BY ENTERPRISE VERTICAL (Page No. - 101)

11.1 INTRODUCTION

FIGURE 41 IMPACT OF COVID-19 ON THE MARKET, BY ENTERPRISE VERTICAL

TABLE 31 PRE-COVID-19: MARKET SIZE, BY ENTERPRISE VERTICAL, 2018–2026 (USD THOUSAND)

FIGURE 42 RETAIL AND ECOMMERCE SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 32 POST-COVID-19: MARKET SIZE, BY ENTERPRISE VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 33 ENTERPRISE VERTICAL: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

11.2 INSTITUTIONS

11.2.1 INSTITUTIONS: MARKET DRIVERS

11.2.2 INSTITUTIONS: MARKET COVID-19 IMPACT

TABLE 34 INSTITUTIONS: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

11.2.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.2.4 HEDGE FUNDS

11.2.5 BROKERAGE FIRMS

11.2.6 OTHER INSTITUTIONS

11.3 RETAIL AND ECOMMERCE

11.3.1 RETAIL AND ECOMMERCE: CRYPTO ASSET MANAGEMENT MARKET DRIVERS

11.3.2 RETAIL AND ECOMMERCE: CRYPTO ASSET MANAGEMENT COVID-19 IMPACT

TABLE 35 RETAIL AND ECOMMERCE: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

11.4 HEALTHCARE

11.4.1 HEALTHCARE: MARKET DRIVERS

11.4.2 HEALTHCARE: MARKET COVID-19 IMPACT

TABLE 36 HEALTHCARE: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

11.5 TRAVEL AND HOSPITALITY

11.5.1 TRAVEL AND HOSPITALITY: MARKET DRIVERS

11.5.2 TRAVEL AND HOSPITALITY: MARKET COVID-19 IMPACT

TABLE 37 TRAVEL AND HOSPITALITY: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

11.6 OTHER ENTERPRISE VERTICALS

TABLE 38 OTHER ENTERPRISE VERTICALS: MARKET SIZE, BY REGION, 2018–2026 (USD THOUSAND)

12 CRYPTO ASSET MANAGEMENT MARKET BY REGION (Page No. - 110)

12.1 INTRODUCTION

FIGURE 43 IMPACT OF COVID-19 ON THE MARKET, BY REGION

TABLE 39 PRE-COVID-19 SCENARIO: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

FIGURE 44 ASIA PACIFIC: HOTSPOT FOR INVESTORS DURING THE FORECAST PERIOD

FIGURE 45 SINGAPORE TO ACCOUNT FOR THE HIGHEST CAGR DURING THE FORECAST PERIOD

FIGURE 46 ASIA PACIFIC TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 40 POST-COVID-19: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

TABLE 41 INDIVIDUAL: MARKET SIZE, BY REGION, 2018–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

TABLE 42 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 47 NORTH AMERICA: MARKET SNAPSHOT

TABLE 43 NORTH AMERICA: MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

FIGURE 48 IMPACT OF COVID-19 ON THE MARKET IN NORTH AMERICA

FIGURE 49 WALLET MANAGEMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN NORTH AMERICA

TABLE 44 NORTH AMERICA: CRYPTO ASSET MANAGEMENT MARKET SIZE, BY END USER, 2018–2026 (USD MILLION)

TABLE 45 NORTH AMERICA: INDIVIDUAL USER MARKET SIZE, BY PRE-AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 46 NORTH AMERICA: ENTERPRISE MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 47 NORTH AMERICA: CRYPTO ASSET MANAGEMENT MARKET SIZE, BY ENTERPRISE VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 48 NORTH AMERICA: MARKET SIZE, BY SOLUTION, 2018–2026 (USD MILLION)

TABLE 49 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 50 NORTH AMERICA: MARKET SIZE, BY APPLICATION TYPE, 2018–2026 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET SIZE, BY MOBILE OPERATING SYSTEM, 2018–2026 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

FIGURE 50 NORTH AMERICA: COUNTRY-WISE ANALYSIS

12.2.2 UNITED STATES

FIGURE 51 UNITED STATES: MOBILE OPERATING SYSTEM MARKET SHARE, 2017-2020

12.2.3 CANADA

FIGURE 52 CANADA: MOBILE OPERATING SYSTEM MARKET SHARE, 2017-2020

12.3 EUROPE

12.3.1 EUROPE: CRYPTO ASSET MANAGEMENT MARKET DRIVERS

TABLE 53 EUROPE: REGULATORY LANDSCAPE

FIGURE 53 IMPACT OF COVID-19 ON THE MARKET IN EUROPE

TABLE 54 EUROPE: MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

FIGURE 54 WALLET MANAGEMENT SOLUTIONS SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN EUROPE

TABLE 55 EUROPE: MARKET SIZE, BY END USER, 2018–2026 (USD MILLION)

TABLE 56 EUROPE: INDIVIDUAL USER MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 57 EUROPE: ENTERPRISE MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 58 EUROPE: CRYPTO ASSET MANAGEMENT MARKET SIZE, BY ENTERPRISE VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 59 EUROPE: MARKET SIZE, BY SOLUTION, 2018–2026 (USD MILLION)

TABLE 60 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 61 EUROPE: MARKET SIZE, BY APPLICATION TYPE, 2018–2026 (USD MILLION)

TABLE 62 EUROPE: MARKET SIZE, BY MOBILE OPERATING SYSTEM, 2018–2026 (USD MILLION)

TABLE 63 EUROPE: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

FIGURE 55 EUROPE: COUNTRY-WISE ANALYSIS

12.3.2 UNITED KINGDOM

FIGURE 56 UNITED KINGDOM: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

12.3.3 GERMANY

FIGURE 57 GERMANY: MOBILE OPERATING SYSTEM MARKET SHARE, 2016–2019

12.3.4 FRANCE

FIGURE 58 FRANCE: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

12.3.5 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: CRYPTO ASSET MANAGEMENT MARKET DRIVERS

TABLE 64 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 59 IMPACT OF COVID-19 ON THE MARKET IN ASIA PACIFIC

FIGURE 60 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 65 ASIA PACIFIC: MARKET SIZE, BY PRE-AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

FIGURE 61 WALLET MANAGEMENT SOLUTIONS TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN ASIA PACIFIC

TABLE 66 ASIA PACIFIC: MARKET SIZE, BY END USER, 2018–2026 (USD MILLION)

TABLE 67 ASIA PACIFIC: INDIVIDUAL USER MARKET SIZE, BY PRE-AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 68 ASIA PACIFIC: ENTERPRISE MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 69 ASIA PACIFIC: CRYPTO ASSET MANAGEMENT MARKET SIZE, BY ENTERPRISE VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 70 ASIA PACIFIC: MARKET SIZE, BY SOLUTION, 2018–2026 (USD MILLION)

TABLE 71 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 72 ASIA PACIFIC: MARKET SIZE, BY APPLICATION TYPE, 2018–2026 (USD MILLION)

TABLE 73 ASIA PACIFIC: MARKET SIZE, BY MOBILE OPERATING SYSTEM, 2018–2026 (USD MILLION)

TABLE 74 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2018–2026 (USD MILLION)

FIGURE 62 ASIA PACIFIC: COUNTRY-WISE ANALYSIS

12.4.2 AUSTRALIA AND NEW ZEALAND

FIGURE 63 AUSTRALIA AND NEW ZEALAND: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

12.4.3 CHINA

FIGURE 64 CHINA: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

12.4.4 JAPAN

FIGURE 65 JAPAN: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

12.4.5 SINGAPORE

FIGURE 66 SINGAPORE: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

12.4.6 REST OF ASIA PACIFIC

12.5 REST OF THE WORLD

12.5.1 REST OF THE WORLD: CRYPTO ASSET MANAGEMENT MARKET DRIVERS

TABLE 75 REST OF THE WORLD: REGULATORY LANDSCAPE

FIGURE 67 IMPACT OF COVID-19 ON THE MARKET IN THE REST OF THE WORLD

TABLE 76 REST OF THE WORLD: MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

FIGURE 68 WALLET MANAGEMENT SOLUTIONS TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD IN THE REST OF THE WORLD

TABLE 77 REST OF THE WORLD: MARKET SIZE, BY END USER, 2018–2026 (USD MILLION)

TABLE 78 REST OF THE WORLD: INDIVIDUAL MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 79 REST OF THE WORLD: ENTERPRISE MARKET SIZE, BY PRE- AND POST-COVID-19 SCENARIO, 2018–2026 (USD MILLION)

TABLE 80 REST OF THE WORLD: CRYPTO ASSET MANAGEMENT MARKET SIZE, BY ENTERPRISE VERTICAL, 2018–2026 (USD THOUSAND)

TABLE 81 REST OF THE WORLD: MARKET SIZE, BY SOLUTION, 2018–2026 (USD MILLION)

TABLE 82 REST OF THE WORLD: MARKET SIZE, BY DEPLOYMENT MODE, 2018–2026 (USD MILLION)

TABLE 83 REST OF THE WORLD: MARKET SIZE, BY APPLICATION TYPE, 2018–2026 (USD MILLION)

TABLE 84 REST OF THE WORLD: MARKET SIZE, BY MOBILE OPERATING SYSTEM, 2018–2026 (USD MILLION)

TABLE 85 REST OF THE WORLD: MARKET SIZE, BY REGION 2018–2026 (USD MILLION)

12.5.2 MIDDLE EAST AND AFRICA

FIGURE 69 MIDDLE EAST AND AFRICA: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

12.5.3 LATIN AMERICA

FIGURE 70 LATIN AMERICA: MOBILE OPERATING SYSTEM MARKET SHARE, 2017–2020

13 COMPETITIVE LANDSCAPE (Page No. - 149)

13.1 INTRODUCTION

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 71 MARKET EVALUATION FRAMEWORK

13.3 REVENUE ANALYSIS OF TOP MARKET PLAYERS

FIGURE 72 REVENUE ANALYSIS OF CRYPTO ASSET MANAGEMENT MARKET IN 2020

13.4 INVESTOR FUNDING

TABLE 86 MARKET: COMPANY’S INVESTMENT FUNDING, 2020-2021

13.5 STARTUP/SME EVALUATION MATRIX, 2020

13.5.1 PROGRESSIVE COMPANIES

13.5.2 RESPONSIVE COMPANIES

13.5.3 DYNAMIC COMPANIES

13.5.4 STARTING BLOCKS

FIGURE 73 CRYPTO ASSET MANAGEMENT MARKET (GLOBAL), STARTUP/SME EVALUATION MATRIX, 2020

13.6 RANKING OF KEY PLAYERS IN THE MARKET, 2020

FIGURE 74 RANKING OF KEY PLAYERS, 2020

14 CRYPTO ASSET MANAGEMENT COMPANY PROFILES (Page No. - 155)

14.1 INTRODUCTION

(Business Overview, Products, Solutions, & Services, Key Insights, Recent Developments, MnM View)*

14.2 COINBASE

TABLE 87 COINBASE: SERVICES OFFERED

TABLE 88 COINBASE: PRODUCT LAUNCHES

TABLE 89 COINBASE: DEALS

14.3 GEMINI

TABLE 90 GEMINI: SERVICES OFFERED

TABLE 91 GEMINI: PRODUCT LAUNCHES

TABLE 92 GEMINI: DEALS

14.4 CRYPTO FINANCE

TABLE 93 CRYPTO FINANCE: SERVICES OFFERED

TABLE 94 CRYPTO FINANCE: DEALS

14.5 VO1T

TABLE 95 VO1T: SERVICES OFFERED

TABLE 96 VO1T: PRODUCT LAUNCHES

TABLE 97 VO1T: DEALS

14.6 BAKKT

TABLE 98 BAKKT: PRODUCT OFFERED

TABLE 99 BAKKT: SERVICES OFFERED

TABLE 100 BAKKT: PRODUCT LAUNCHES

TABLE 101 BAKKT: DEALS

14.7 BITGO

TABLE 102 BITGO: SOLUTION OFFERED

TABLE 103 BITGO: PRODUCT LAUNCHES

TABLE 104 BITGO: DEALS

14.8 LEDGER

TABLE 105 LEDGER: SOLUTION OFFERED

TABLE 106 LEDGER: PRODUCT OFFERED

TABLE 107 LEDGER: PRODUCT LAUNCHES

TABLE 108 LEDGER: DEALS

14.9 METACO SA

TABLE 109 METACO SA: PRODUCT OFFERED

TABLE 110 METACO SA: SOLUTIONS OFFERED

TABLE 111 METACO SA: PRODUCT LAUNCHES

TABLE 112 METACO SA: DEALS

14.10 ICONOMI

TABLE 113 ICONOMI: SOLUTIONS OFFERED

TABLE 114 ICONOMI: PRODUCT LAUNCHES

14.11 EXODUS MOVEMENT

TABLE 115 EXODUS: PRODUCTS OFFERED

TABLE 116 EXODUS: PRODUCT LAUNCHES

14.12 XAPO

TABLE 117 XAPO: SERVICES OFFERED

14.13 ITBIT (PAXOS)

TABLE 118 ITBIT: SERVICES OFFERED

TABLE 119 ITBIT: PRODUCTS OFFERED

TABLE 120 ITBIT: PRODUCT LAUNCHES

TABLE 121 ITBIT: DEALS

14.14 KOINE FINANCE

TABLE 122 KOINE FINANCE: SERVICES OFFERED

TABLE 123 KOINE FINANCE: DEALS

14.15 AMBERDATA

TABLE 124 AMBERDATA: SOLUTION OFFERED

TABLE 125 AMBERDATA: PRODUCT LAUNCHES

14.16 GEM

TABLE 126 GEM: SERVICE OFFERED

TABLE 127 GEM: PRODUCTS OFFERED

TABLE 128 GEM: PRODUCT LAUNCHES

14.17 TRADEIUM

14.18 BLOX

14.19 OPUS LABS

14.20 BINANCE

14.21 KRYPTOGRAPE

14.22 KOINLY

14.23 ALTPOCKET

14.24 MINTFORT

14.25 COINSTATS

14.26 ANCHORAGE

14.27 COINTRACKER

*Details on Business Overview, Products, Solutions & Services, Key Insights, Recent Developments, MnM View might not be captured in case of unlisted companies.

15 ADJACENT MARKET (Page No. - 183)

15.1 CRYPTOCURRENCY MARKET

15.1.1 INTRODUCTION

TABLE 129 CRYPTOCURRENCY MARKET SIZE, BY REGION, 2015–2024 (USD MILLION)

15.1.2 CRYPTOCURRENCY MARKET, BY PROCESS

TABLE 130 CRYPTOCURRENCY MARKET SIZE, BY PROCESS, 2015–2024 (USD MILLION)

15.1.2.1 Mining

TABLE 131 MINING: CRYPTOCURRENCY MARKET SIZE, BY OFFERING, 2015–2024 (USD MILLION)

TABLE 132 MINING: CRYPTOCURRENCY MARKET SIZE, BY REGION, 2015–2024 (USD MILLION)

TABLE 133 MINING: CRYPTOCURRENCY MARKET SIZE, BY TYPE, 2015–2024 (USD MILLION)

15.1.2.1.1 Solo Mining

15.1.2.1.2 Pool Mining

15.1.2.2 Cloud mining

15.1.3 TRANSACTION

TABLE 134 TRANSACTION: CRYPTOCURRENCY MARKET SIZE, BY OFFERING, 2015–2024 (USD MILLION)

TABLE 135 TRANSACTION: CRYPTOCURRENCY MARKET SIZE, BY REGION, 2015–2024 (USD MILLION)

TABLE 136 TRANSACTION: CRYPTOCURRENCY MARKET SIZE, BY TYPE, 2015–2024 (USD MILLION)

15.1.3.1 Exchange

15.1.3.2 Wallet

15.2 BLOCKCHAIN DEVICES MARKET

15.2.1 INTRODUCTION

15.2.2 BLOCKCHAIN DEVICES MARKET, BY TYPE

TABLE 137 BLOCKCHAIN DEVICES MARKET SIZE, BY TYPE, 2016–2024 (USD THOUSAND)

TABLE 138 BLOCKCHAIN DEVICES MARKET SIZE, BY REGION, 2016–2024 (USD MILLION)

TABLE 139 BLOCKCHAIN DEVICES MARKET, BY TYPE, 2016–2024 (UNITS)

TABLE 140 BLOCKCHAIN DEVICES MARKET, BY REGION, 2016–2024 (THOUSAND UNITS)

15.2.2.1 Blockchain smartphones

TABLE 141 BLOCKCHAIN SMARTPHONES: BLOCKCHAIN DEVICES MARKET SIZE, BY REGION, 2018–2024 (USD MILLION)

15.2.2.2 Crypto hardware wallets

TABLE 142 CRYPTO HARDWARE WALLETS: BLOCKCHAIN DEVICES MARKET SIZE, BY REGION, 2016–2024 (USD MILLION)

15.2.2.3 Crypto ATMs

TABLE 143 CRYPTO ATMS: BLOCKCHAIN DEVICES MARKET SIZE, BY REGION, 2016–2024 (USD THOUSAND)

TABLE 144 CRYPTO ATMS: BLOCKCHAIN DEVICES MARKET SIZE, BY TYPE, 2016–2024 (USD MILLION)

15.2.2.3.1 One-way crypto ATMs

15.2.2.3.2 Two-way crypto ATMs

15.2.2.4 PoS Devices

TABLE 145 POS DEVICES: BLOCKCHAIN DEVICES MARKET SIZE, BY REGION, 2016–2024 (USD THOUSAND)

15.2.2.5 Others

TABLE 146 OTHERS: BLOCKCHAIN DEVICES MARKET SIZE, BY REGION, 2016–2024 (USD THOUSAND)

16 APPENDIX (Page No. - 198)

16.1 PREVIOUS DEVELOPMENTS

TABLE 147 PREVIOUS DEVELOPMENTS, 2012–2016

16.2 INSIGHTS OF INDUSTRY EXPERTS

16.3 DISCUSSION GUIDE

16.4 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.5 AVAILABLE CUSTOMIZATIONS

16.6 RELATED REPORTS

16.7 AUTHOR DETAILS

The study involved four major activities in estimating the current size of the crypto asset management market. Exhaustive secondary research was done to collect information related to the market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the size of the market segments and subsegments.

Crypto Asset Management Market Secondary Research

In the secondary research process, various sources were referred to, for identifying and collecting information for this crypto asset management market study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. The data was also collected from secondary sources, such as the American Blockchain and Cryptocurrency Association (ABCA), United States Blockchain & Cryptocurrency Association, European Crypto Association, The British Blockchain Association, Crypto Country Association (CCA), International Decentralized Association of Cryptocurrency and Blockchain (IDACB), Asia Blockchain and Crypto Association (ABACA), Singapore Cryptocurrency and Blockchain Industry Association, Israel Bitcoin Association, Brazilian Association of Crypto and Blockchain (ABCB), and Bermuda Crypto Association. The crypto asset management investment and spending of various countries were extracted from their respective security associations, such as Government Blockchain Association (GBA).

Crypto Asset Management Market Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the crypto asset management market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, related key executives from crypto asset management solution vendors, wallet providers, industry associations, independent crypto asset management consultants, and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand the various trends related to technology, application, deployment, and region. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), and the installation teams of governments/end users using crypto asset management solutions, were interviewed to understand the buyer’s perspective on the suppliers, solution and service providers, and their current use of crypto asset management solutions, which would affect the overall crypto asset management market.

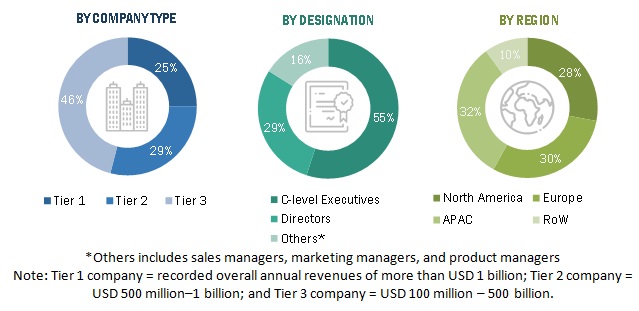

Following is the breakup of the primary respondent:

To know about the assumptions considered for the study, download the pdf brochure

Crypto Asset Management Industry Size Estimation

Multiple approaches were adopted to estimate and forecast the size of the crypto asset management market. The first approach involves the estimation of the market size by summation of companies’ revenue generated through the sale of solutions and wallets. In this market estimation approach, we identified key companies offering crypto asset management solutions, such as Coinbase, Gemini, Crypto Finance, Vo1t, Bakkt, BitGo, Ledger, Metaco SA, Iconomi, and Exodus Movement. After confirming these companies with industry experts through primary interviews, we estimated their total revenue through annual reports, Securities and Exchange Commission (SEC) filings, and paid databases. These companies’ revenue pertaining to the Business Units (BUs) that offer crypto asset management solutions was identified through similar sources. We then collected the data of revenue generated through specific crypto asset management solutions via primaries. With the assumption that the rest of the market is contributed by smaller players (part of the unorganized market), the market size of organized players (55%–60%) and unorganized players (40%–45%) collectively, was assumed to be the market size of the global crypto asset management market for Financial Year (FY) 2020.

The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakups have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall crypto asset management market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at each market segment's exact statistics and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Crypto Asset Management Market Report Objectives

- To define, describe, and forecast the crypto asset management market by solution, end user, enterprise vertical, application type, deployment type, mobile operating system (OS), and region

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze the opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of the segments with respect to four main regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as mergers and acquisitions, new product developments, and research and development (R&D) activities, in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the APAC market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the MEA market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Crypto Asset Management Market