Customer Intelligence Platform Market by Component, Application (Customer Data Collection & Management, and Customer Segmentation & Targeting), Deployment Mode, Organization Size, Data Channel, Vertical and Region - Global Forecast to 2027

Customer Intelligence Platform Market Overview, Industry Share and Forecast

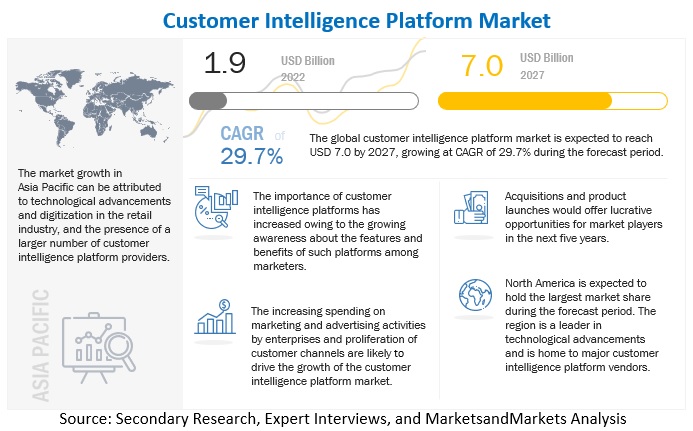

[322 Pages Report] The Customer Intelligence Platform Market size as per revenue was reasonably estimated at $1.9 billion in 2022 and is poised to generate revenue around $7.0 billion by the end of 2027, exhibits a CAGR of 29.7%.

The growing need for personalized customer experiences, the demand to gain a holistic view of customer data, combined with the rising adoption of customer intelligence platforms to monitor changes in the market as they occur are some of the key factors boosting the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Customer Intelligence Platform Market Growth Dynamics

Driver: Need to gain a holistic view of customer data

Large amounts of customer data flow into an organization through various channels, including customer activity on the website and/or app, purchase and return patterns, customer-initiated communications, and customer responses to previous company-initiated communications (the information collected for analysis includes behavioral data, demographic data, customer sentiment, survey data, social media actions, customer preferences, etc.). Although practically every system used by B2B and B2C organizations stores and uses customer data, the information is frequently erroneous, partial, and segregated. Because of this, programs that promote a superior customer experience cannot fully utilize that data. Companies must create a real 360-degree customer picture by combining what they already know and what they can infer about their customer to get the most value out of massive amounts of customer data. The creation of a single unified customer profile for each customer, which combines profile, transactional, and behavioral data from across the businesses, is at the heart of the customer intelligence platform. Hence the rising need to gain a holistic view of customer data is driving the adoption of customer intelligence platforms.

Restraint: Need to ensure compliance with data privacy laws and protect customer data

Customer intelligence platforms combine first-party customer data from multiple channels and sources to create a single customer view. According to the General Data Protection Regulation (GDPR) and other data privacy laws, it is necessary for marketers to receive marketing consent from consumers. Customer data is highly vulnerable to cyberattacks and breaches. Thus, it is necessary for a customer intelligence platform to understand the key challenges associated with the management of data, such as the protection of sensitive customer information and the marketing consent of consumers. A customer intelligence platform should be based on a consent-based data model; this helps store the information of customer journey and consent for marketing and provides customers transparency and control over how their data is used. If the customer has opted out of permission to use their data, then the customer intelligence platform should include them in a direct mail suppression list and ensure that it does not receive any unwanted marketing content through any other channels. In countries with less stringent or no laws around customer data privacy, customer intelligence platform solutions are implemented with existing data privacy scenarios or in anticipation of the laws that might surface in the near future. It could create complications when such new laws are introduced around customer data privacy. Thus, the need to ensure the privacy of customer data and compliance with data privacy laws is key to the adoption of customer intelligence platforms.

Opportunity: Heightened adoption of customer intelligence platforms to monitor changes in the market as they occur

The ability to understand the market has evolved into an everyday challenge. This means that a lack of market awareness causes a significant setback for businesses in increasingly competitive domains like eCommerce, retail, and other consumer-facing industries. It only takes a few seconds to fall behind the competition, and those few seconds can mean the difference between profitable operations and crippling losses. Customer intelligence focuses on providing a steady stream of data that quickly converts into actionable insights. Customer intelligence offers data to give users a better experience. Marketers gather customer intelligence (CI) and analyze the information regarding customers’ details and activities to build deeper and more effective relationships and improve decision-making. In today’s customer-centric world, gathering customer intelligence allows brands to tap into critical information, gain a competitive advantage, enhance customer loyalty, and improve profitability. Businesses can make better decisions for customers as well as incorporate predictive and prescriptive analytics into their strategy as and when market changes occur.

Challenge: Organizational failures pertaining to optimized use of customer data

Modern-day businesses have access to an unprecedented amount of customer data; however, in most cases, they do not know what to do with all this data. In fact, this data deluge has created more problems for organizations because they still operate with legacy systems that make it difficult to achieve their goals for data integration, standardization, and quality. Poor data quality is yet another issue that regularly hampers efforts to create a single customer view. Without accurate and reliable data, the effort to create a single customer view is wasted. Customer experience teams need to align with data owners across the organization to better understand the data collection process and how it can be improved to reduce or altogether eliminate the chances of human error. Data also becomes redundant or outdated quickly. It is important to monitor data sources over time to ensure that the quality of data is not deteriorating.

Retail & eCommerce vertical to grow at highest CAGR during the forecast period

A customer intelligence platform enables retailers to tap into growing opportunities effortlessly. Customer intelligence platform delivers intelligent and automated personalized experiences, conversational AI-based customer care, loyalty engagement and cost optimization. This is an outcome of leveraging data to extract behavioral insights that shape personalized customer communication and deliver value across channels. A customer intelligence platform is easy to implement and has a proven ability to rapidly unlock incremental revenues.

Mobile data channel segment to hold the highest CAGR during the forecast period

The developing level of big data overloaded customer-facing teams left them with no practical way to successfully integrate all customer data points to ensure a completely data-driven decision-making approach. So, designed with the business user in mind, a customer intelligence platform emphasizes on creating a central location for all customer data, including socio-demographic data, product portfolio, transactional data to web and mobile browsing history, email, chat, and phone interactions with the brand, social media behavior, and more. The interface through smartphone devices enables users to communicate with businesses in a more personalized manner. The penetration of smartphones and tablets has been increasing at a rapid pace and generating huge amounts of data. Thus, enterprises are implementing customer intelligence platforms to analyze smartphone data.

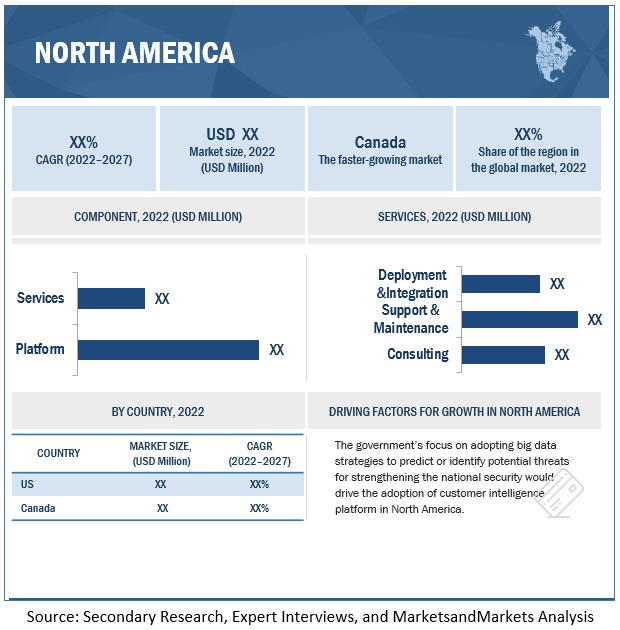

North America to account for the largest market size during the forecast period

The customer intelligence platform market has been segmented into five regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Among these regions, North America is projected to hold the largest market size during the forecast period. Increasing technological advancements favor the growth of the customer intelligence platform market in North America. The growing number of customer intelligence platform players across regions is expected to drive market growth.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The customer intelligence platform vendors have implemented various organic and inorganic growth strategies, such as new product launches, product upgrades, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. The major vendors in the global customer intelligence platform market include IBM (US), Oracle (US), Microsoft (US), Adobe (US), SAS (US), Salesforce(US), Google (US), Accenture (Ireland), Informatica (US), SAP (Germany), Verint (US), Teradata (US), Zeta Global (US), TIBCO (US), NICE (Israel), TransUnion (US), Alida (Canada), Algonomy (US), NetBase Quid (US), NGDATA (Belgium), Zeotap (Germany), ActionIQ (US), Amperity(US), UserIQ (US), Datashift (Belgium), Staircase AI (US), Terminus(US), and Lifesight (Singapore).The study includes an in-depth competitive analysis of these key players in the customer intelligence platform market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

>

|

Report Metrics |

Details |

|

Market size available for years |

2018–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

USD Billion |

|

Segments covered |

Component, Deployment Mode, Organization Size, Application, Data Channel, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

IBM (US), Oracle (US), Microsoft (US), Adobe (US), SAS Institute (US), Salesforce (US), Google (US), Accenture (Ireland), Informatica (US), SAP (Germany), Verint (US), Teradata (US), Zeta Global (US), TIBCO (US), NICE (Israel), TransUnion (US), Alida (Canada), Algonomy (US), NetBase Quid (US), NGDATA (Belgium), Zeotap (Germany), ActionIQ (US), Amperity (US), UserIQ (US), Datashift (Belgium), Staircase AI (US), Terminus (US), and Lifesight (Singapore). |

This research report categorizes the customer intelligence platform market based on component, deployment mode, organization size, application, data channel, vertical, and region.

By Component:

- Platform

-

Services

- Consulting Services

- Support & Maintenance

- Deployment & Integration

By Deployment Mode:

- Cloud

- On-premises

By Organization Size:

- Large Enterprises

- Small & Medium-sized Enterprises (SMEs)

By Application:

- Customer Data Collection & Management

- Customer Segmentation & Targeting

- Customer Behaviour Analytics

- Customer Experience Management

- Customer Retention & Engagement

- Personalized Recommendation

- Omnichannel Marketing

- Other Applications

By Data Channel:

- Web

- Social Media

- Mobile

- In-store

- Call Centers

- Other Data Sources (Surveys, Promotional Data, and Sales Representatives)

By Vertical:

- BFSI

- Retail & eCommerce

- Healthcare & Life Sciences

- Telecom

- Government & Defense

- Travel & hospitality

- Manufacturing

- Energy & Utilities

- Media & Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- India

- Australia

- Rest of APAC

-

MEA

- KSA

- UAE

- South Africa

- Rest of MEA

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In December 2022, Accenture acquired Fiftyfive5 to boost its customer intelligence capability in Australia and New Zealand. Fiftyfive5’, with its 200 employees across New Zealand, Australia and Singapore, is now a part of Accenture Song, formerly Accenture Interactive. This acquisition enabled to strengthen Accenture’s capabilities across product innovation, commerce, marketing, sales and service, helping the company to strengthen its foothold in the growing global customer analytics market.

- In September 2022, new Customer 360 innovations from Salesforce were released that give businesses access to robust automation and intelligence solutions to promote efficient growth, deliver individualised customer experiences at scale, and enable clients to accomplish more with less.

- In June 2022, Zeta Global launched Opportunity Explorer(SM), a real-time market and consumer data analytics and insights solution. Zeta Global is a data-driven marketing technology firm that uses unique data and artificial intelligence to help businesses acquire, grow, and retain consumers. Opportunity Explorer(SM) gathers demographic, behavioural, and location signals from Zeta's proprietary data set of 2.4 billion identities globally, synthesises the data in real time, and produces a customizable, interactive display of actionable insights. It is designed to assist marketers in identifying, segment, and act upon growth opportunities for their businesses.

- In July 2020, SAS released four new service offerings and updates to SAS Customer Intelligence 360 to help brands accelerate the value delivered through analytics with a hybrid marketing approach.

Frequently Asked Questions (FAQ):

What is a customer intelligence platform?

A customer intelligence platform collects customer data from a range of relevant data sources and unifies that data to make it analysis-ready. The platform then applies sophisticated analytics, using AI/ML as well as human-driven analytics to glean actionable insight from customer data.

Which countries are considered in Europe?

The report includes an analysis of the UK, Germany, and France in Europe.

Which are key verticals adopting customer data platform solutions and services?

Key verticals adopting customer intelligence platforms and services include BFSI, retail & e-commerce, healthcare & life sciences, telecom, government & defense, travel & hospitality, manufacturing, energy & utilities, media & entertainment, and other verticals (IT & ITeS, transportation & logistics, and education).

Which are the key drivers supporting the growth of the customer intelligence platform market?

The key drivers supporting the growth of the customer data platform market include rising need to gain holistic view of customer data, intensifying need to deliver omnichannel experience, rising demand for personalized customer experiences, and shift toward data-driven marketing and advertising.

Who are the key vendors in the customer intelligence platform market?

The key vendors operating in the customer intelligence platform market are IBM (US), Oracle Corporation (US), Microsoft (US), Adobe (US), SAS (US), Salesforce (US), Google (US), Accenture (Ireland), Informatica (US), SAP (Germany), Verint (US), Teradata (US), Zeta Global (US), TIBCO Software (US), NICE Systems Ltd.(Israel), TransUnion (US), Alida (Canada), Algonomy (US), NetBase Quid (US), NGDATA (Belgium), Zeotap (Germany), ActionIQ (US), Amperity (US), UserIQ (US), Datashift (Belgium), Staircase AI (US), Terminus(US), and Lifesight (Singapore).These vendors have adopted different types of organic and inorganic growth strategies such as new product launches, product enhancements, partnerships, and mergers and acquisitions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

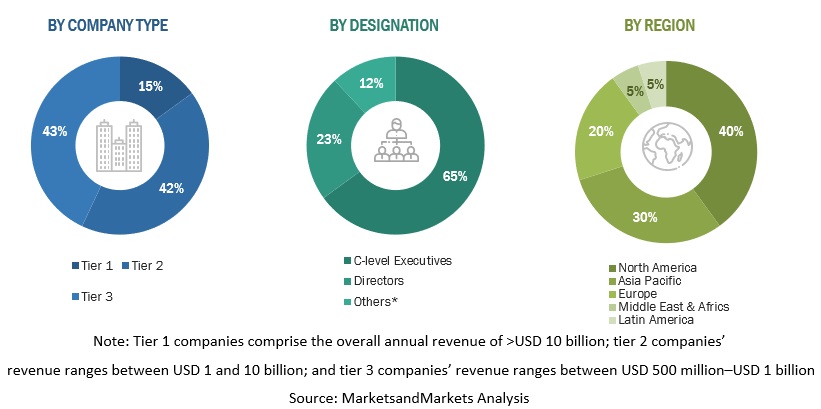

The research study for the customer intelligence platform market report involved the use of extensive secondary sources, directories, as well as several journals and magazines to identify and collect information that is useful for this technical and market-oriented study. During the production cycle of the report, in-depth interviews were conducted with various primary respondents, including key opinion leaders, subject-matter experts, high-level executives of various companies offering customer intelligence platforms and services, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, investor presentations of companies; white papers; journals; and certified publications and articles from recognized authors, directories, and databases. Secondary research was used to obtain key information about the industry’s value chain and supply chain to identify the key players according to their offerings and industry trends related to technology, application, and region, and key developments from both market and technology-oriented perspectives.

Primary Research

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using customer intelligence platform, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of customer intelligence platform and services, which would impact the overall customer intelligence platform market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the top-down approach, an exhaustive list of all the vendors offering platforms and services in the customer int<

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For converting various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors in the market.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Report Objectives

- To define, describe, and predict the customer intelligence platform market by component (platform and services), organization size, data channel, deployment mode, application, vertical, and region

- To provide detailed information related to major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the market growth

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To profile key players and comprehensively analyze their market rankings and core competencies

- To analyze competitive developments, such as partnerships, new product launches, and mergers and acquisitions, in the customer intelligence platform market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American customer intelligence platform market

- Further breakup of the European customer intelligence platform market

- Further breakup of the APAC customer intelligence platform market

- Further breakup of the Latin American customer intelligence platform market

- Further breakup of the MEA customer intelligence platform market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Customer Intelligence Platform Market