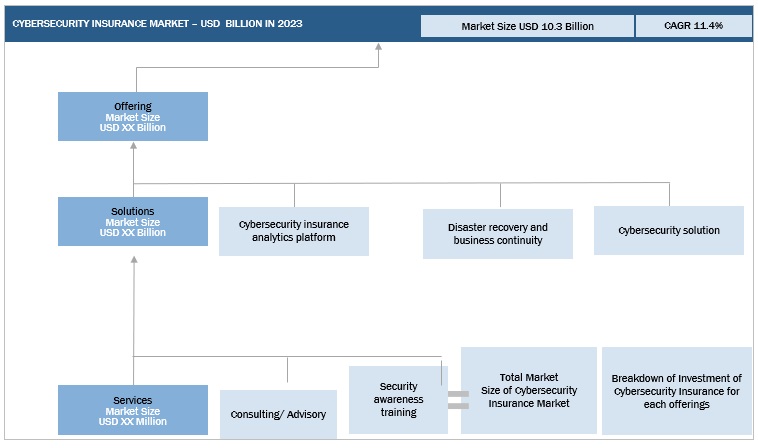

Cybersecurity Insurance Market by Component (Solutions and Services), Type (Standalone & Packaged), Coverage (Data Breach & Cyber Liability), Compliance Requirement, End User (Technology & Insurance) and Region - Global Forecast to 2028

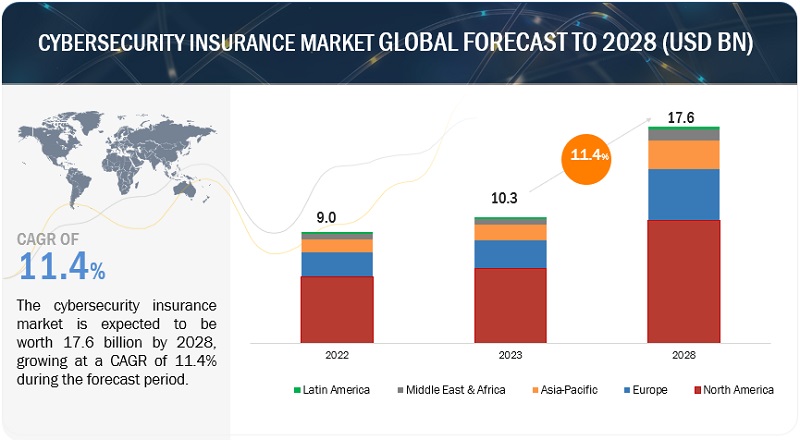

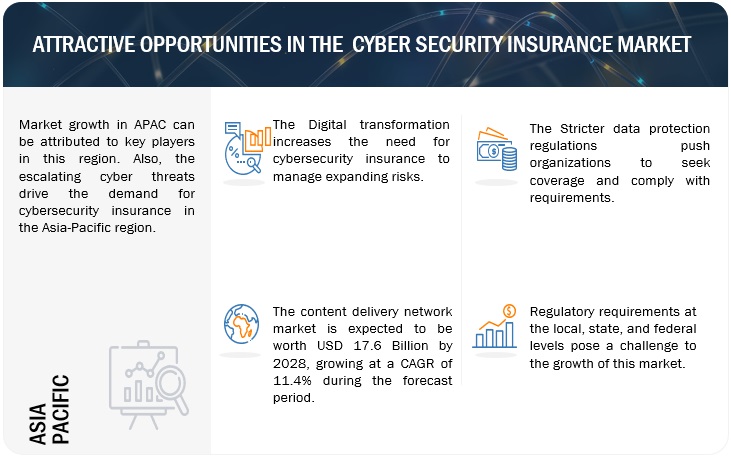

[373 Pages Report] The cybersecurity insurance market size is projected to grow from USD 10.3 billion in 2023 to USD 17.6 billion by 2028, at a CAGR of 11.4% during the forecast period. As digital transformation advances, the expanded use of digital technologies and emerging tech increases the vulnerability to cyber threats. Cybersecurity insurance assists organizations in managing and mitigating these risks.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Cybersecurity Insurance Market Dynamics

Driver: Increase in frequency and sophistication of cyber threats

Instances of massive cyberattacks are on the rise globally, causing substantial financial losses for individuals, enterprises, and governments. Cybercriminals target various IT infrastructure, aiming for political, financial, reputational, or radical interests. Ransomwares like WannaCry, Petya, NotPetya, and BadRabbit have affected organizations extensively. For instance, the SamSam ransomware attack disrupted municipal services in Atlanta, demanding a ransom of around USD 50,000. Cyber threats hamper business productivity and necessitate safeguarding critical IT infrastructure and data. Enterprises are increasingly investing in cybersecurity products and services to mitigate the risk of data breaches. As cyberattacks become more sophisticated, organizations worldwide turn to cybersecurity insurance to counteract the financial impact of swarm cyberattack losses.

Restraint: Lack of awareness related to cybersecurity insurance and reluctance in choosing cybersecurity insurance over cybersecurity solutions

With the increasing awareness of security risks and the rise in cyberattacks, governments and organizations are increasing their cybersecurity expenditure. However, many enterprises neglect cybersecurity insurance, which can help combat financial losses. The annual cost of cybercrime is estimated to reach USD 1.5 trillion, with only a small fraction covered by insurance companies. The lack of clarity and awareness about cybersecurity insurance hinders market growth, with some enterprises mistaking it for Errors and Omissions insurance. Enterprises globally should realize that the financial damage from a security incident can surpass the initial investment in cybersecurity insurance.

Opportunity: Exclusion of cybersecurity insurance cover from Property and Casualty (P&C) insurance

With the rise in social media usage and IoT, the risks of cyberattacks are growing massively. In the past, casualty policies only insured against third-party damage to only tangible computer property. However, with the proliferation of digital devices and advancements in new technologies, casualty insurers have realized that the rise of cyber exposures has also soared. The regulatory pressure from the EU GDPR and the Prudential Regulatory Authority (PRA) is also persuading insurers to manage cyber risks with a dedicated cybersecurity insurance policy. Insurers and regulators are concentrating on developing standalone cybersecurity insurance policies for better clarity and eliminating the ‘silent cyber’ claims. Hence, insurers are looking forward to adopting the usage of exclusive cybersecurity insurance policies to prevent unintended exposure from unclear cyber cover.

Challenge: Data privacy concerns

Data privacy concerns about how critical enterprise data or personal information to be used or misused is a barrier to adopting cybersecurity insurance. The global spread of COVID-19 has generated many questions about data protection, privacy, security, and compliance. Due to COVID-19, companies and organizations are reviewing their privacy policies to ensure the appropriate disclosure of Personally Identifiable Information (PII) to government agencies and cyber insurers to ensure data privacy. Some enterprises hesitate to reveal reliable information related to environmental risk exposures, making it burdensome for insurers to guide effective cybersecurity insurance policies. Insureds are reluctant to share information with insurers due to the fear of disclosure risks. Enterprises are wary of revealing cyber incident data as they feel that the exposed data could further intensify attacks and expose it to regulatory fines or legal fees.

Cybersecurity insurance Market Ecosystem

Prominent companies in this market include well-established, financially stable providers of cybersecurity insurance solutions and services. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include CyberCube, BitSight Technologies, and SecurityScorecard.

By insurance coverage, the cyber liability segment expected to hold a larger market size during the forecast period

Cyber risk insurance or cyber liability insurance helps organizations recover from the financial costs associated with data breaches, viruses, and other cyber-attacks. This insurance covers expenses incurred by the organization itself (first-party claims) and expenses arising from claims made by external parties (third-party claims). The policy reimburses various costs such as investigation expenses, business losses, legal proceedings, extortion, privacy issues, and notifications. Due to the increasing sophistication of cyber-attacks and stricter regulations, businesses are encouraged to adopt cybersecurity insurance solutions proactively. By offering both first-party and third-party coverage, cyber liability insurance policies can help insurers mitigate the negative consequences of a security breach, which could otherwise lead to significant business losses. Key vendors in the cybersecurity insurance market include Allianz Group, AIG, Chubb, Aon, Zurich, AXA, and Berkshire Hathaway, among others.

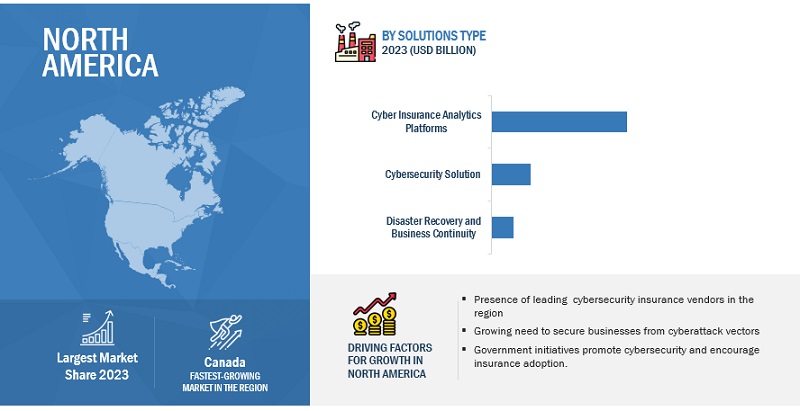

By solution, cybersecurity insurance analytics platform is expected to register higher CAGR during forecast period

Analytics platforms for cybersecurity insurance provide valuable insights into security risks and targeted attacks, offering actionable intelligence. These platforms cater to insurance brokers, insurers, reinsurance brokers, and reinsurers, providing them with a comprehensive view of enterprise risk profiles. CyberCube, a leading cyber risk analytics platform, has partnered with major insurance industry players, including Aon, Chubb, Hiscox, CNA, Woodruff Sawyer, and Munich RE. These collaborations empower insurance companies with data-driven risk assessment solutions. In 2019, CyberCube collaborated with Aon to deliver their insurance clients an effective cybersecurity insurance analytics platform for improved risk management and exposure measurement. The growing impact of cyber threats has led insurance companies to adopt data risk and analytics platforms more extensively. Arceo.ai, for example, offers a range of tools to assist brokers and underwriters in covering cyber risks. Verisk, a data analytics provider, introduced the Cyber Underwriting Report in 2020, utilizing AI modeling and ML capabilities to help insurers underwrite cyber policies based on data from 100,000 cyberattacks. Other companies such as Corax, and Cytegic also provide AI-based risk management solutions to insurance providers.

Based on region, North America is expected to hold the largest market size during the forecast

North America dominates the global cybersecurity insurance market, with the US and Canada leading the way. This region benefits from advanced infrastructure and widespread adoption of cyber technology. It is expected to hold the largest market share in terms of size. The US, in particular, presents significant opportunities for cybersecurity insurance solution providers due to strict regulations and a diverse range of industries. Cyberattacks have a substantial financial impact on enterprises of all sizes, including critical industries. According to a report by Emsisoft featured in The New York Times, 205,280 organizations in North America fell victim to ransomware attacks in 2019. With the increasing frequency of attacks and the rise of Bring Your Own Device (BYOD), especially in the context of the COVID-19 pandemic, US and Canadian enterprises are recognizing the importance of securing their data and mitigating financial losses through cybersecurity insurance policies.

Market Players:

The major vendors in this market include BitSight (US), Prevalent (US), RedSeal (US), SecurityScorecard (US), Cyber Indemnity Solutions (Australia), Cisco (US), UpGuard (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), and Founder Shield (US). The insurance vendors covered in the cybersecurity insurance market are Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher & Co (US), Travelers Insurance (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax Financial (Canada), Liberty Mutual (US), Lloyd’s of London (UK), Lockton (US), Munich Re Group (Germany), and Sompo International (Bermuda). The startup vendors covered in the cybersecurity insurance market are At-Bay (US), Cybernance (US), Coalition (US), Resilience (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Cronus Cyber Technologies (Israel). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, new product launches and product enhancements, and acquisitions to expand their footprint in the cybersecurity insurance market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2018-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) Million/Billion |

|

Segments covered |

By Offering, Insurance coverage, Insurance type, Compliance Requirements, End user, and Region |

|

Region covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

BitSight (US), Prevalent (US), RedSeal (US), SecurityScorecard (US), Cyber Indemnity Solutions (Australia), Cisco (US), UpGuard (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), and Founder Shield (US). The insurance vendors covered in the cybersecurity insurance market are Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher & Co (US), Travelers Insurance (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax Financial (Canada), Liberty Mutual (US), Lloyd’s of London (UK), Lockton (US), Munich Re Group (Germany), and Sompo International (Bermuda). The startup vendors covered in the cybersecurity insurance market are At-Bay (US), Cybernance (US), Coalition (US), Resilience (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Cronus Cyber Technologies (Israel). |

This research report categorizes the cybersecurity insurance market to forecast revenues and analyze trends in each of the following submarkets:

Based on offering:

-

Solution

- Cybersecurity insurance analytics platform

- Disaster recovery and business continuity

-

Cybersecurity solution

- Cyber risk and vulnerability assessment

- Cybersecurity resilience

-

Service

- Consulting/ Advisory

- Security awareness training

- Others (infrastructure services, implementation, and support and maintenance)

Based on insurance coverage:

-

Data breach

- Data loss

- Denial of service and down-time

- Ransomware attacks

- Others (third party data, business disruption, and social engineering)

-

Cyber liability

-

Type

- Data protection and privacy costs

- Non-compliance penalty

- Brand and related intellectual property protection

- Others (human error, systems failure, controls framework, Inadequate IT security measures, and non-security related IT)

-

Source/ Target

- Internal

- External

-

Type

Compliance Requirements:

- Healthcare Compliance

- Financial Services Compliance

- GDPR Compliance

- Data Privacy Compliance

- Other Compliances

Based on the insurance type:

- Packaged

- Stand-alone

Based on the end user:

-

Technology provider

- Insurance companies

- Third-party administrators, brokers, and consultancies

- Government agencies

-

Insurance provider

- Financial services

- IT and ITES

- Healthcare and life science

- Retail and ecommerce

- Telecom

- Travel, tourism, and hospitality

- Others (Education, Manufacturing, Energy and Utilities, and Government)

By Region:

-

North America

- United States (US)

- Canada

-

Europe

- United Kingdom (UK)

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Southeast Asia

- Rest of Asia Pacific

-

Middle East and Africa

- UAE

- KSA

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In May 2022, Microsoft developed Defender to support security systems of SMEs and reduce cyber risk. The solution provides end-point security, which includes Endpoint Detection and Response (EDR).

- In April 2022, AttackIQ entered into partnership with Vectra, an AI based threat detection and response platform. This integration enabled customers to use AttackIQ’s PCAP and Vectra AI Platform to check efficacy.

- In November 2021, BitSight and Marsh McLennan collaborated to improve cybersecurity performance and efficiency of the organization and help to reduce cyber risk. The Cyber Risk Analytics Center offered by Marsh McLenna leverage the capabilities of BitSight rating, data which help client to monitor their cyber security system performance.

Frequently Asked Questions (FAQ):

What is cybersecurity insurance?

Cybersecurity insurance, also referred to as cyber risk insurance or cyber liability insurance, is a form of insurance that assists organizations in managing and mitigating financial risks associated with cyber incidents. It offers protection against losses resulting from data breaches, cyberattacks, ransomware, business disruptions, legal liabilities, and other related expenses. Cybersecurity insurance policies cover costs such as investigation and remediation, legal fees, notification services, regulatory fines, and public relations efforts. By providing financial support, cybersecurity insurance helps organizations recover from cyber incidents, minimize financial damages, and navigate the complex world of cyber threats.

What is the market size of the cybersecurity insurance market?

The cybersecurity insurance market size is projected to grow from USD 10.3 billion in 2023 to USD 17.6 billion by 2028, at a CAGR of 11.4% during the forecast period.

What are the major drivers in the cybersecurity insurance market?

The major drivers in the cybersecurity insurance market include the increasing frequency of cyber threats, stricter regulatory requirements, the financial impact of cyber incidents, digital transformation, industry-specific risks, risk awareness and preparedness, and the shortage of cybersecurity talent. These factors have led to a rising demand for cybersecurity insurance as organizations seek financial protection and risk mitigation against cyber risks.

Who are the key players operating in the cybersecurity insurance market?

The key vendors operating in the cybersecurity insurance market include BitSight (US), Prevalent (US), RedSeal (US), SecurityScorecard (US), Cyber Indemnity Solutions (Australia), Cisco (US), UpGuard (US), Microsoft (US), Check Point (US), AttackIQ (US), SentinelOne (US), Broadcom (US), Accenture (Ireland), Cylance (US), Trellix (US), CyberArk (US), CYE (Israel), SecurIT360 (US), and Founder Shield (US). The insurance vendors covered in the cybersecurity insurance market are Allianz (Germany), AIG (US), Aon (UK), Arthur J. Gallagher & Co (US), Travelers Insurance (US), AXA XL (US), AXIS Capital (Bermuda), Beazley (UK), Chubb (Switzerland), CNA Financial (US), Fairfax Financial (Canada), Liberty Mutual (US), Lloyd’s of London (UK), Lockton (US), Munich Re Group (Germany), and Sompo International (Bermuda). The startup vendors covered in the cybersecurity insurance market are At-Bay (US), Cybernance (US), Coalition (US), Resilience (US), Kovrr (Israel), Sayata Labs (Israel), Zeguro (US), Ivanti (US), SafeBreach (US), and Cronus Cyber Technologies (Israel).

What are the opportunities for new market entrants in the cybersecurity insurance market?

New entrants in the cybersecurity insurance market have opportunities to capitalize on the growing demand for coverage against cyber threats. They can target niche segments, offer customized solutions, leverage technological innovation, form strategic partnerships, explore global expansion, and provide value-added regulatory compliance services. With agility and innovation, new entrants can establish themselves as competitive players in this evolving market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

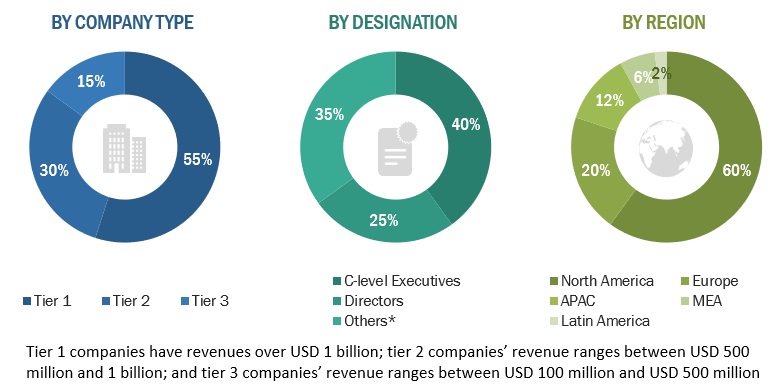

The research study for the cybersecurity insurance market involves extensive secondary sources, directories, and databases, such as D&B Hoovers and Bloomberg BusinessWeek to identify and collect information useful for a technical, market-oriented, and commercial study of the cybersecurity insurance market. The study involved four major activities in estimating the current size of the cybersecurity insurance market. Exhaustive secondary research was done to collect information on the cybersecurity insurance industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the overall market size. Thereafter, market break-up and data triangulation procedures were used to estimate the size of the segments and sub-segments of the market.

Secondary Research

In the secondary research process, various sources were used to identify and collect information for this study. Secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases. Data was also collected from Information Systems Security Association (ISSA), Information Security Forum (ISF), European Cyber Security Organization (ECSO), European Union Agency for Cybersecurity (ENISA), UK Cyber Security Association (UKCSA), Association of Information Security Professionals (AISP), Japan Network Security Association (JNSA), National Association of Software and Services Companies (NASSCOM), Professional Information Security Association (PISA), Australian Information Security Association (AISA), Information Systems Security Association (ISSA), National Cyber Security Authority (NCA), American Risk and Insurance Association (ARIA), American Association of Insurance Services (AAIS), Cybersecurity insurance Association, European Insurance and Occupational Pensions Authority (EIOPA), ASEAN Insurance Council (AIC), DIFC Insurance Association NPIO, Association of Insurance Supervisors in Latin America (ASSAL), and OECD. These secondary sources included annual reports, press releases and investor presentations of companies, whitepapers, certified publications and articles by recognized authors, gold standard and silver standard websites, regulatory bodies, trade directories, and databases.

Primary Research

The cybersecurity insurance market comprises several stakeholders: service providers, solution vendors, system integrators, technology partners, consulting firms, research organizations, Managed Service Providers (MSPs), government agencies, financial bodies, resellers and distributors, enterprise users, and technology providers. The supply side includes cybersecurity insurance solutions providers. Various primary sources from the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Primary interviews were conducted to gather insights, such as market statistics, data of revenue collected from the products and services, market break-ups, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, deployment, and region. The demand side of the market consists of financial institutions, investors, and insurance companies. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Strategy Officers (CSOs), and installation teams of governments/end users using cybersecurity insurance solutions were interviewed to understand the buyer’s perspective.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Multiple approaches were adopted to estimate and forecast the Cybersecurity insurance market. The first approach involves estimating the market size by summating companies’ revenue generated through Cybersecurity insurance solutions. In this approach for market estimation, we identified the key companies offering Cybersecurity insurance by offerings: solutions, and services.

Both top-down and bottom-up approaches were used to estimate and validate the total size of the Cybersecurity insurance market. These methods were extensively used to estimate the size of various segments in the market. The research methodology used to estimate the market size includes the following:

- Key players in the market have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and break-ups have been determined using secondary sources and verified through primary sources.

Cybersecurity insurance Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the cybersecurity insurance market was divided into several segments and subsegments. The data triangulation procedures were used to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with data triangulation and market breakdown, the market size was validated by the top-down and bottom-up approaches.

Market Definition

The cybersecurity insurance market refers to the sector within the insurance industry that provides coverage and financial protection against cyber risks and losses resulting from cyber incidents. It encompasses insurance policies specifically designed to address the financial impact of data breaches, cyberattacks, ransomware, business interruption, legal liabilities, and other related expenses. The market offers various types of cybersecurity insurance coverage options tailored to different industries and organizational needs. The primary purpose of cybersecurity insurance is to help organizations mitigate financial risks, recover from cyber incidents, and provide support in navigating the complex landscape of cyber threats.

Key Stakeholders

- Cybersecurity insurance solution providers

- Independent Software Vendors (ISVs)

- Investors and Venture Capitalists (VCs)

- Support and maintenance service providers

- Value-added Resellers (VARs) and distributors

Report Objectives

- To determine and forecast the global Cybersecurity insurance market by offering (solutions, and services), insurance coverage, insurance type, compliance requirements, end user, and region from 2023 to 2028, and analyze the various macroeconomic and microeconomic factors that affect the market growth.

- To forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Latin America, and the Middle East and Africa (MEA).

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the Cybersecurity insurance market.

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the overall Cybersecurity insurance market.

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the Cybersecurity insurance market.

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market.

- In the market, track and analyze competitive developments, such as mergers and acquisitions, product developments, partnerships and collaborations, and Research and Development (R&D) activities.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Geographic Analysis

- Further break-up of the Asia Pacific market into countries contributing 75% to the regional market size

- Further break-up of the North American market into countries contributing 75% to the regional market size

- Further break-up of the Latin American market into countries contributing 75% to the regional market size

- Further break-up of the MEA market into countries contributing 75% to the regional market size

- Further break-up of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Cybersecurity Insurance Market