Data Converter Market Size, Share, Statistics and Industry Growth Analysis Report by Type (Analog-to-Digital Converters, Digital-to-Analog Converters), Sampling Rate (High-Speed Data Converters, General-Purpose Data Converters), Application and Region (North America, Europe, APAC, RoW) - Global Forecast to 2028

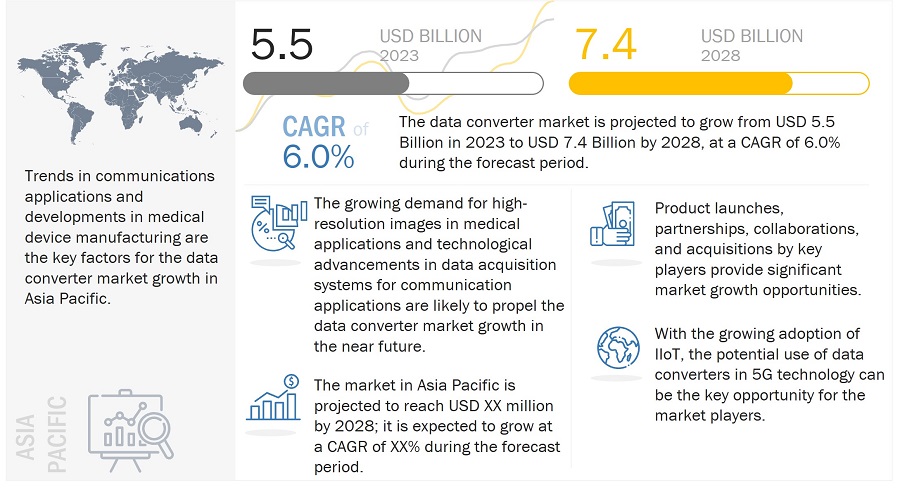

[227 Pages Report] The Data Converter Market Size is valued at USD 5.5 Billion in 2023 and is anticipated to be USD 7.4 Billion by 2028; growing at a CAGR of 6.0% from 2023 to 2028.

Factors such as the rising demand for test & measurement (T&M) solutions by end users, growing demand for high-resolution images in scientific and medical applications, and the increasing adoption of technologically advanced data acquisition systems are driving the growth of the data converter industry during the forecast period.

Data Converter Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Data Converter Market Dynamics

Driver: Increasing adoption of technologically advanced data acquisition systems

The transition of end users from traditional data acquisition (DAQ) systems to computer-based systems have been the key factor behind the growth of the data converter market. The computer-based systems convert and measure analog signals, such as voltage and current, to digital signals with the help of ADCs. The DAQ system mainly consists of the ADC, DAC, multiplexer, high-speed timer, and random-access memory (RAM) card. Technological advancements have led to the development of computer-based data acquisition systems, which, in turn, provide end users flexibility, along with reduced cost and time. Furthermore, in the computer-based data acquisition system, engineers can customize the software according to their requirements, which increases overall productivity.

Moreover, high-speed DAQ systems are used to achieve high accuracy and repeatability without compromising on bit resolution, memory depth, and streaming performance. For instance, Texas Instruments Incorporated (US) provides ADS8691, ADS8695, and ADS8699 devices in the integrated data acquisition system family. These devices are based on a high-speed, high-precision successive approximation (SAR) ADC.

Restraint: Integration of RF data converters into FPGA and system-on-chip (SoC)

The trend of integrating data converter design intellectual properties (IPs) into SoC and field-programmable gate array (FPGA) devices could be a restraining factor for the discrete data converter market growth. Analog Devices, an American multinational semiconductor company specializing in data conversion and signal processing technology, provides the intermediate frequency (IF) and radio frequency (RF) receivers with integrated data converters. The programmable system integration eliminates the need for discrete ADCs, DACs, and FPGA-to-analog interface power and accelerates design productivity. Thus, the trend of data converter integration helps the communications industry improve product design flexibility. The added flexibility constrains the growth of the 5G market and the adoption of millimeter-wave wireless backhaul systems.

Opportunity: Potential use of data converters in developing advanced 5G infrastructure

The use of high-bandwidth equipment, such as routers, repeaters, access points, and wireless antennas, in wireless networks, would face congestion in data networking due to enormous data generated by various devices and more data consumption by smartphones in the coming years. The need for high-speed communication networks and the requirement for network congestion control are expected to increase with the adoption of 5G technology. The aggregate data rates supported by the 5G technology are expected to be 1,000 and 100 times faster than the existing 3G and 4G data rates, respectively. The deployment of 5G would significantly increase the number of mobile subscribers, creating a requirement for developed infrastructure that can handle user data requests. To provide high bandwidth to several use cases, the 5G technology is likely to be operated at higher frequency bands, leading to the adoption of the small cell network concept. This would, in turn, create an opportunity for high-speed data converters in the development of advanced 5G infrastructure, as high-speed data converters are among the key components of communication transceivers.

Challenge: Development of low-power consumption data converters

The data converter is an electronic circuit that converts the data from analog sensor nodes to the digital domain. During the signal conversion, the data converter consumes large amounts of power. Several types of portable battery-operated equipment have limitations in terms of power capacity. It is one of the key challenges to providing greener designs of data converters with minimum power consumption.

In low-power data acquisition (DAQ) systems, integrating an ADC into the controller decreases the component count, cost, and power consumption. However, this approach may increase the overall power consumption of DAQ systems. Hence, low-power consumption data converters pose a major challenge for data converter manufacturers. With the increasing demand for sensor-based low-power DAQ systems, predictive monitoring and analytics solutions will be the key opportunities in the market.

Analog-to-Digital Converters (ADCS) to hold the largest market share of data converter market during the forecast period

ADCs can measure and convert real-world signals such as temperature, pressure, acceleration, and speed into digital signals. During the conversion process, the ADC compares the analog input signal to a known reference input and then produces a digital representation of the analog input. Many systems employ a higher resolution ADC to avoid a loss of information. The converter's accuracy determines how many bits in the digital output code represent useful information about the input signal. Therefore, a sampling rate plays a vital role in ADC devices as it determines how precisely the ADC converts the analog signal into a digital form. The growing adoption of industrial DAQ and medical devices, including cardiac monitors, hemodynamic monitors, respiratory monitors, multi-parameter monitors, digital thermometers, endoscopes, and ophthalmoscopes, is likely to drive the market for ADCs.

General-Purpose data converters to hold the second largest market share data converter market during the forecast period

General-purpose data converters operate with a sampling rate of up to 10 MSPS. These converters are used for several medical, industrial, and automotive applications. These data converters ensure output reliability and accuracy during data conversion from analog to digital or vice versa. The Fourth Industrial Revolution (Industry 4.0) has led to the integration of sensing technologies into the industrial process. Manufacturers use sensors to monitor, control, and automate processes while enhancing safety. The use of sensors in industrial applications has a number of benefits, including improved asset management, higher operational effectiveness, and more adaptable product development. Increasing use of various types of control systems, such as programmable logic controllers (PLCs), supervisory control and data acquisition (SCADA), and distributed control systems (DCS), and the rising deployment of sensor-based technologies for industrial applications are expected to create the demand for general-purpose data converters in the near future. General-Purpose data converters are primarily used for medical and automotive applications. The growing adoption of remote monitoring and automated solutions is one of the key factors for the general-purpose data converter market growth.

Medical application is expected to witness the highest CAGR during the forecast period

The medical application involves the use of imaging and monitoring devices. Monitoring devices such as cardiac, hemodynamic, and respiratory monitors require general-purpose data converters. On the other hand, imaging devices such as computed tomography (CT) scanners, magnetic resonance imaging (MRI) scanners, and ultrasound systems may require high-speed data converters to operate, which is one of the key driving factors for the high-speed data converter market growth. The rising demand for personalized, easy-to-use, and advanced medical devices and the increasing adoption of wearable electronics are the major factors for the growth of the market for electronic medical devices. These devices have one or more sensors and probes depending on the requirement. Data converters play a crucial role by converting the data into digital form for analysis purposes which is resulting in the growth of the data converter market.

Asia Pacific to hold the largest share of the data converter market during the forecast period

Asia Pacific has many emerging economies, which are likely to create opportunities for the growth of the data converter market. Australia, Japan, China, India, and Taiwan are the key countries in Asia Pacific. Asia Pacific is home to numerous OEMs as well as semiconductor device and product manufacturers. Favorable regulatory policies for the approval of new semiconductor technologies and the saturation of the market in developed countries are further intensifying the interest of foreign players in expanding their businesses in Asia Pacific, especially in China. The growing digitization in the industrial sector, adoption of IIoT, and penetration of connected devices will create a need for data converters in the region. The high-speed data converter market growth is driven by the growing communications sector in Asia Pacific and the growing demand for communication systems.

Data Converter Market Statistics by Region

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

The Data Converter Companies is dominated by a few globally established players such as Texas Instruments (US), Analog Devices (US), Skyworks Solutions, Inc. (US), Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), Qorvo, Inc. (US), NXP Semiconductor (Netherlands), ON Semiconductor (US), Microchip Technology (US), Renesas Electronics Corporation (Japan), Cirrus Logic (US), Asahi Kasei Microdevices (Japan), Faraday Technology (Taiwan), Avia Semiconductor (Xiamen), Data Device Corporation (DDC) (US), IQ-Analog (US), ROHM Semiconductor (Japan), Synopsys (US), Omni Design Technologies (US), iSine Inc. (US), AMS OSRAM (Austria), ADSANTEC Inc. (US), Phoenix Contact (Germany), MaxLinear, Inc. (US), and Antelope Audio (US).

Data Converter Market Report Scope:

|

Report Metric |

Details |

|

Estimated Market Size in 2023 |

USD 5.5 Billion |

|

Projected Market Size in 2028 |

USD 7.4 Billion |

|

Growth Rate |

CAGR of 6.0% |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Type, By Sampling Rate, By Applications, and By Region |

|

Region covered |

North America, Europe, Asia Pacific, and Rest of World |

|

Companies covered |

The key players in the data converter market are Texas Instruments (US), Analog Devices (US), Skyworks Solutions, Inc. (US), Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), Qorvo, Inc. (US), NXP Semiconductor (Netherlands), ON Semiconductor (US), Microchip Technology (US), Renesas Electronics Corporation (Japan), Cirrus Logic (US), Asahi Kasei Microdevices (Japan), Faraday Technology (Taiwan), Avia Semiconductor (Xiamen), Data Device Corporation (DDC) (US), IQ-Analog (US), ROHM Semiconductor (Japan), Synopsys (US), Omni Design Technologies (US), iSine Inc. (US), AMS OSRAM (Austria), ADSANTEC Inc. (US), Phoenix Contact (Germany), MaxLinear, Inc. (US), and Antelope Audio (US). |

Data Converter Market Highlights

The study categorizes the data converter market based on type, sampling rate, applications, and region

|

Aspect |

Details |

|

By Type |

|

|

By Sampling Rate |

|

|

By Application |

|

|

BY Geography |

|

Recent Developments

- In May 2022, Analog Devices (US) launched the next generation of 16 to 24-bit, ultra-high precision successive approximation register (SAR) analog-to-digital converters (ADCs), simplifying the frequently complex process of designing ADCs for instrumentation, industrial, and healthcare applications.

- In May 2022, Analog Devices (US) launched AD3541R which is a low drift, single channel, ultra-fast, 12-/16-bit accuracy, voltage output digital-to-analog converter (DAC) that can be configured in multiple voltage span ranges.

- In December 2021, Texas Instruments (US) launched ADS127L11 which is a 24-bit wideband ADC, which accurately measures signals at wider bandwidths for industrial systems.

- In August 2021, Analog Devices (US) acquired Maxim Integrated Inc. (US) With this acquisition strengthens Analog Devices’ position as a high-performance analog semiconductor company.

- In October 2020, Microchip Technology (US) acquired Tekron International (New Zealand). This acquisition enables Microchip to expand its offering across a broad customer base in the rapidly expanding smart energy and industrial markets.

Frequently Asked Questions (FAQ):

What is the current size of the global data converter market?

The data converter market size is valued at USD 5.5 Billion in 2023 and is anticipated to be USD 7.4 Billion by 2028; growing at a CAGR of 6.0% from 2023 to 2028.

Which is the fastest growing region for the data converter market?

The Asia Pacific region is expected to have the highest CAGR in the data converter market. The trends in communications applications and developments in medical device manufacturing are critical factors for the data converter market growth in Asia Pacific.

What is the type that dominates the data converter market?

The Analog-to-Digital Converters (ADCS) segment is significantly growing in the data converter market.

What are the key strategies adopted by key companies in the data converter market?

The key companies have been focusing on collaborations, acquisitions, and partnerships to significantly grow in the data converter market.

Which are the major companies in the data converter market?

Texas Instruments (US), Analog Devices (US), Skyworks Solutions, Inc. (US), Infineon Technologies AG (Germany), STMicroelectronics (Switzerland), Qorvo, Inc. (US), NXP Semiconductor (Netherlands), ON Semiconductor (US), Microchip Technology (US), Renesas Electronics Corporation (Japan) are the players dominating the global data converter market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

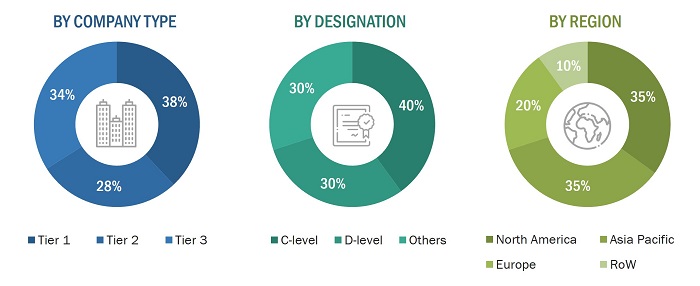

The study involved four major activities in estimating the size of the data converter market. Exhaustive secondary research has been done to collect information on the market, peer market, and parent market. Validation of these findings, assumptions, and sizing with industry experts across the value chain through primary research has been the next step. Both top-down and bottom-up approaches have been employed to estimate the global market size. After that, market breakdown and data triangulation have been used to estimate the market sizes of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information important for this study. The secondary sources include corporate filings (such as annual reports, investor presentations, and financial statements), trade shows, professional associations, white papers, process and communication-related journals, websites, and certified publications. They also include articles from recognized authors, gold- and silver-standard websites, directories, and databases. The secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and key developments from both market- and technology-oriented perspectives. The secondary data was collected and analyzed to arrive at the overall market size, which was further validated through primary research.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from the major companies and organizations operating in the data converter market.

After the complete market engineering (which includes calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at in this process. Primary research was conducted to identify segmentation types, industry trends, key players, competitive landscape, and key market dynamics, such as drivers, restraints, opportunities, and challenges, along with the key strategies adopted by the players operating in the data converter market.

Extensive primary research was conducted after acquiring knowledge about the data converter market through secondary research. Several primary interviews were conducted with market experts from the demand and supply sides across four major regions—North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW). RoW comprises the Middle East and Africa. Approximately 60% and 40% of primary interviews were conducted with both the demand and supply sides, respectively. This primary data was collected through questionnaires, emails, and telephonic interviews.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the total size of the data converter market. These methods have also been extensively used to estimate the sizes of various market subsegments. The research methodology used to estimate the market sizes includes the following:

- Identifying various applications that use or are expected to use data converters market.

- Analyzing historical and current data pertaining to the size of the data converters market for each application

- Analyzing the average selling prices of data converters based on different technologies

- Studying various paid and unpaid sources, such as annual reports, press releases, white papers, and databases

- Identifying leading providers of data converters, studying their portfolios, and understanding features of their products and their underlying technologies, as well as the types of data converters products offered

- Tracking ongoing and identifying upcoming developments in the market through investments, research and development activities, product launches, expansions, and partnerships, and forecasting the market size based on these developments and other critical parameters

- Carrying out multiple discussions with key opinion leaders to understand the technologies used in data converters, and products wherein they are deployed, and analyze the break-up of the scope of work carried out by key manufacturers of data converters providers

- Verifying and crosschecking estimates at every level through discussions with key opinion leaders, such as CXOs, directors, and operations managers, and finally with domain experts at MarketsandMarkets

Market Size Estimation Methodology-Bottom-up Approach

Data Triangulation

After arriving at the overall market size-using the market size estimation processes explained above—the market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides.

Growth Opportunities and Niche Threats for High Speed Data Converter Market in the Future

The high-speed data converter market is expected to experience significant growth in the future due to the increasing demand for high-speed data transfer in various industries, such as telecommunications, automotive, and industrial automation. The growth opportunities in this market include the increasing adoption of 5G technology, the rising demand for high-resolution imaging systems, and the growing use of digital signal processing (DSP) in various applications.

One of the niche threats facing the high-speed data converter market is the increasing adoption of integrated circuits (ICs) with built-in ADCs and DACs, which could replace standalone data converters. Additionally, the high cost of high-speed data converters may limit their adoption in certain applications, and the complexity of designing and integrating these components into systems may also pose a challenge.

Despite these challenges, the high-speed data converter market is expected to grow due to the increasing demand for high-speed data transfer and processing in various applications. Key players in this market include Analog Devices Inc., Texas Instruments, Maxim Integrated Products Inc., STMicroelectronics, and NXP Semiconductors, among others.

Potential Growth Opportunities and threats for Analog to Digital Converter Market

Growth opportunities:

- Increasing demand for high-speed data converters in various applications such as healthcare, automotive, telecommunications, and aerospace.

- Growing adoption of Internet of Things (IoT) devices that require ADCs for signal processing.

- Advancements in ADC technology, including the development of high-resolution and low-power ADCs.

- Increasing demand for wireless communication systems, which require high-speed ADCs for signal processing.

- The rise of 5G technology and the need for high-speed data converters to support faster data transfer speeds.

Niche threats:

- The availability of alternative technologies, such as digital signal processing, that can replace the use of ADCs in some applications.

- The cost of ADCs, which can be high compared to alternative technologies, may limit their adoption in some applications.

- The complexity of ADCs and the need for specialized expertise to design and implement them may limit their adoption in some applications.

- The impact of the COVID-19 pandemic on global supply chains, which may lead to shortages of key components and materials used in the manufacturing of ADCs.

Market Scope of Digital to Analog Converter Market

The digital-to-analog converter (DAC) market has a broad scope, as it is used in a wide range of applications, including audio systems, industrial automation, and instrumentation, among others. DACs are used to convert digital signals into analog signals, which are required to drive a wide range of equipment and systems. The market for DACs is expected to grow in the coming years, driven by the increasing demand for high-quality audio systems, the growing use of digital communication protocols in industrial automation, and the increasing adoption of IoT devices and sensors.

The market for DACs can be segmented based on the type of application, the end-use industry, and the region. The major end-use industries for DACs include consumer electronics, automotive, industrial automation, telecommunications, and aerospace and defense. The Asia Pacific region is expected to be the fastest-growing market for DACs, due to the increasing demand for high-quality audio systems and the growing adoption of IoT devices and sensors in the region.

The market for DACs is highly competitive, with a large number of players operating in the market. Some of the key players in the DAC market include Texas Instruments, Analog Devices, Maxim Integrated, Microchip Technology, Cirrus Logic, NXP Semiconductors, STMicroelectronics, and ON Semiconductor. These companies are investing in R&D to develop new and innovative products and to expand their market share. Additionally, companies are also focusing on strategic partnerships and acquisitions to strengthen their position in the market.

Futuristic Growth Use-Cases of Analog to Digital Converter Market

The analog-to-digital converter (ADC) market is expected to experience significant growth in the coming years, driven by the increasing demand for high-speed and high-resolution data conversion in various industries. Some of the futuristic growth use-cases of the analog to digital converter market include:

Internet of Things (IoT): The increasing adoption of IoT devices is creating a need for high-speed and high-resolution data conversion. Analog to digital converters are used to convert analog signals from sensors into digital signals that can be processed by IoT devices and the cloud.

Autonomous Vehicles: The automotive industry is rapidly adopting autonomous driving technologies, which require accurate and high-speed data conversion. Analog to digital converters are used in sensors that capture data about the environment, such as light, sound, and temperature.

Augmented Reality and Virtual Reality (AR/VR): The AR/VR market is growing rapidly, and these applications require high-speed and high-resolution data conversion to provide a seamless experience. Analog to digital converters are used to convert analog signals from cameras and other sensors into digital signals that can be processed by AR/VR devices.

5G Networks: 5G networks are expected to revolutionize the way we communicate and transfer data. Analog to digital converters are used to convert analog signals from the antennas into digital signals that can be processed by 5G base stations.

Medical Applications: The medical industry is adopting new technologies that require high-speed and high-resolution data conversion, such as medical imaging and monitoring equipment. Analog to digital converters are used to convert analog signals from sensors and equipment into digital signals that can be processed by medical devices and systems.

The Main Objectives of this Study are as follows:

- To define, describe, segment, and forecast the data converter market, in terms of value, based on type, sampling rate, applications, and region.

- To forecast the size of the market and its segments with respect to four main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the total market

- To provide detailed information regarding the key factors influencing market growth, such as drivers, restraints, opportunities, and challenges

- To provide a detailed analysis of the data converter value chain

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To strategically profile the key players and comprehensively analyze their market ranking and core competencies2

- To analyze key growth strategies such as expansions, contracts, joint ventures, acquisitions, product launches and developments, and research and development activities undertaken by players operating in the data converter market.

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Further breakdown of the market in different regions to the country-level

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Converter Market