Data Monetization Market by Component (Tools and Services), Data Type (Customer Data, Financial Data), Business Function, Deployment Type, Organization Size, Industry Vertical and Region - Global Forecast to 2027

Data Monetization Market Growth & Trends

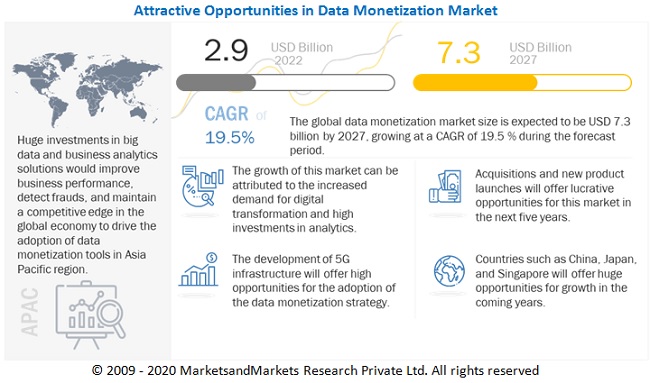

The global Data Monetization Market size in terms of revenue was reasonably estimated at $2.9 billion in 2022 and is anticipated to increase up to $7.3 billion by the end of 2027, exhibits a CAGR of 19.5%. Due to Covid-19 pandemic, new technologies have emerged which offers predictive and prescriptive analysis to its customers, allowing cost-reduction decisions by simplifying their business processes. This way of monetizing data provides the most value to customers and allows product teams to build and scale actionable analytics apps and integrate them with other applications. Data monetization tools and services help enterprises extract concealed information, which can add value to the business data. Moreover, these tools and services enhance the operational efficiency of enterprises by predicting anomalies faster in a business cycle. These tools and services also cater to consumers’ intrinsic needs by comprehending their buying behaviors and patterns, thereby enhancing the overall customer experience. They are expected to gain traction, as they offer numerous benefits. The benefits include generation of recurring revenue streams, increased operational efficiency, and better customer engagement.

To know about the assumptions considered for the study, Request for Free Sample Report

Data monetization market Dynamics

Drivers: Growth in the adoption of data-driven decision-making

Organizations are making the use of data to make critical decisions. Initially, data analysis decisions were based on traditional practices, such as intuitions, hunches, or opinions; however, with the use of Business Intelligence (BI) software and tools, organizations have started realizing that these practices improve profitability and can be used to make better strategic decisions. Many organizations are following the suit of adopting BI; for instance, data-driven decision-making tripled from 2005 to 2010 among the US manufacturers, according to the U.S. Central Bureau Surveys. As per the report of Forbes 53% of companies are adopting big data analytics and in 2019, 60% of IT professionals using big data descriptive and predictive statistics. The increasing demand for analyzing relevant data in various industry verticals is driving the need to find answers to business questions Organizations have access to data and are working to optimize it for making appropriate decisions, but they are struggling to generate meaningful insights from their data. Data monetization provides tools and services used to analyze and process data for generating insights that can be helpful in decision-making.

Restraints: Lack of 0rganizational capabilities and cultural barriers

Organizational capabilities and culture are the major barriers related to big data utilization. Barriers such as lack of sufficient roles and responsibilities, inefficient organizational procedures, lack of management’s focus and support, and missing procedures and quality measurements are expected to restrain the implementation of data monetization tools. Data monetization requires a specific set of processes, resources, skills, and most importantly, a suitable culture that sufficiently supports the creation of new offerings. To derive new revenue streams and monetize data, a clear business strategy and a strong business unit leader with a capable team is the need of the hour as data monetization is all about creating a new line of business. It is not enough to provide the right data set and relevant tools to employees. It is also necessary to brief them about organizational culture, structure, required capabilities, processes, and habits needed to support the chosen data monetization business model.

Opportunities: Rising adoption of AI for data processing

The generation of massive amounts of data and the need to analyze this data in real-time have compelled organizations to adopt new technologies, such as AI, IoT, machine learning, and deep learning. Organizations are focusing on adopting BI tools, as they are highly useful in collecting and processing huge amounts of data. Data monetization solutions can process huge amounts of data and help extract valuable insights from the available data. Nowadays, to achieve a dominant position in the market, companies have started adopting BI tools. For instance, various organizations are taking advantage of the BI tools for analyzing their products, services, and customer behavioral patterns from a huge amount of data, as well as analyzing large data sets and deriving analytical insights, which could be used to identify market opportunities and potential threats and formulate business strategies. As organizations are looking for solutions to meet these requirements, data monetization tools can come handy for data management and integration. The BI tools and data monetization technology can help business users to extract meaningful business insights to stay competitive in the data monetization market. Therefore, the growing use of BI tools is expected to provide high-growth opportunities for data monetization vendors.

Challenges: Increase in complexities in data structures

The adoption of data monetization which creates a new source of revenue and business line is growing across industries and data quality is one of the important factors while monetizing data. The accurate data enables organizations to make the right decisions. Data sharing across various industries and integrating data products with existing systems might result in reduced data quality.

The inappropriate data quality might result in false facts and inconsistency. Hence, appropriate data quality directly impacts organizations’ ability to make the right decisions. Without quality, data is not of any use and can lead to undesired outcomes. Hence, the quality of data collected by organizations is expected to challenge the adoption of data monetization tools, thereby restraining the growth of data monetization vendors.

Data monetization market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

Based on component, tools segment to be a larger contributor of the data monetization market growth during the forecast period

The tools segment is expected to account for largest market share during the forecast year. Data monetization tools are used into business applications to enhance their capabilities and derive insights from the business data, thereby enabling enterprises to make effective business decisions. The data monetization platform offers predefined features to integrate structured and unstructured data across technologies. The data monetization solution, on the other hand, enables data monetization providers to increase their market shares and generate more revenue by enhancing their capabilities to cater to the specific needs of their clients.

Based on services, integration and implementation services to be a larger contributor to the data monetization market growth during the forecast period

The integration and implementation service to hold the largest market share during the forecast period. Trained technical professionals who ensure the accurate deployment of data monetization tools also provide implementation and integration services. These services aid organizations in gathering and analyzing data for improving the decision-making process, building effectiveness, and reducing costs.

Based on data type, customer data segment to be a larger contributor to the data monetization market during the forecast period

The customer data segment has the large market size in the estimated year. The critical information about the customer helps organizations in formulating their business strategies. Organizations collect customer data from campaigns, surveys, social media, and websites and compile the data with the help of Customer Relationship Management (CRM) systems. The customer data enables companies to reposition themselves and create adjacent revenue streams for their core business. It also helps companies in understanding the buying patterns of their customers and their decisions related to product design and pricing, which assist companies in customizing their products/services for their customers. For instance, Facebook analyzes and sells user data to third parties to place personalized advertisements.

Based on deployment type, the on-premises deployment to be a larger contributor to the data monetization market growth during the forecast period

The on-premises deployment is expected to share large revenues in the estimated year. The on-premises deployment type refers to the implementation of data monetization solutions on the client’s premises using their IT infrastructure. In the on-premises type of delivery model, software or solutions are installed and operated from customers’ in-house server and computing infrastructure. The cost of installing on-premises solutions is included in the Capital Expenditure (CAPEX) of companies. The companies must maintain hardware, implement cybersecurity applications, train staff, update new versions, and arrange backup for the data or damaged parts. Due to such huge initial upfront costs and the need for manual intervention, the on-premises deployment type can be usually afforded by large enterprises. SMEs, on the other hand, lack budget and skill sets. Therefore, it is not practical for them to install on-premises data monetization tools and services. The growing number of large organizations are deploying on-premises data monetization tools and services, due to privacy and security concerns related to confidential data. This is expected to contribute to the segment’s larger market size.

Based on organization size, the large enterprises to be a larger contributor to the data monetization market growth during the forecast period

Large enterprises constantly adopt new and emerging technologies to capture a higher market share and increase overall productivity and efficiency in today's highly competitive world. Large enterprises have a large corporate network and many revenue streams. Hence, there is a huge amount of data generated by them. Large enterprises are keen to invest in new and latest technologies to effectively run their business. Their customers are scattered across regions; therefore, it is necessary for them to adopt data monetization to handle customer demands and manage supply chains while maintaining business efficiency to sustain in a competitive market. These enterprises prefer to implement tools and their associated services on-premises. This deployment type can assist them in increasing their profits and maintaining data confidentiality. The market size of the large enterprises segment in the global data monetization market is expected to hold a larger market size as compared to the SMEs segment during the forecast period.

Based on vertical, telecommunication industry vertical to be a larger contributor to the data monetization market growth during the forecast period

The telecommunication industry vertical accounts for largest market share during the forecast period. The telecommunication industry vertical is experiencing increased data generation due to the advancements in technologies such as 3G and 4G. The introduction of 5G technology in the near future is expected to generate a large volume of data. It is a challenge for telecommunication providers to manage this data and retain the existing customers as well as enhance the customer experience. In recent years, the telecommunication providers have started investing in data monetization tools and services for getting actionable insights from their customer data sets. With righteous accessibility to these massive data sets, companies operating in the telecommunication industry vertical are emerging as the major adopters of data monetization tools and services. Hence, organizations operating in this industry vertical gain higher customer satisfaction, enhanced customer experience, possess the ability to create new revenue sources, and generate opportunities by cross-selling and upselling products with the help of customer geolocation data.

Asia Pacific to grow at the highest CAGR during the forecast period

Asia Pacific is expected to experience extensive growth opportunities in the next few years due to the rising adoption of advanced technologies, such as IoT and cloud computing. There is an increase in the number of enterprises in Asia Pacific countries. For instance, there are more than 2,00,000 enterprises in Singapore. This is one of the major factors contributing to the highest growth rate in Asia Pacific. Huge investments in big data and business analytics solutions would improve business performance, detect frauds, and maintain a competitive edge in the global economy to drive the adoption of data monetization tools in BFSI, retail, healthcare, and life sciences industry verticals. Asia Pacific countries such as Japan, China, and Australia have a high population. Hence, organizations in these countries are expected to adopt data monetization at a high rate to handle a large amount of data. The increasing adoption of digital services, such as IoT, mobility, AI, cloud, and over-the-top services, and the rising investments in technological updates in the region are the major factors boosting the market growth. China is the largest revenue generator in the regional market and this is attributed to the presence of a large number of MSMEs and major firms, as well as the constant digitization of business processes, and the increase in the volume of data generated every day. The growing enterprise rivalry is also pushing organizations to capitalize on the value of data, which, in turn, increases the adoption of data monetization solutions.

The data monetization market is dominated by companies such as Microsoft Corporation (US), Oracle(US), Salesforce(US), SAS (US), TIBCO (US), IBM (US), Qlik (US), SAP (Germany), Looker (US), ThoughtSpot (US), Sisense (US), Domo (US), Accenture (Ireland), Virtusa (US), Infosys (India), 1010Data(US) and more. These vendors have a large customer base and strong geographic footprint along with organized distribution channels, which helps them to increase revenues.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size value in 2022 |

USD 2.9 Billion |

|

Market size value in 2027 |

USD 7.3 Billion |

|

Growth rate |

CAGR of 19.5% |

|

Market size available for years |

2022-2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2027 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

Components (Tools And Services), Data Type, Business Functions, Deployment Types, Organization Size, Industry Verticals, And Regions |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies covered |

Microsoft Corporation (Microsoft), Salesforce.com, Inc. (Salesforce), Oracle Corporation (Oracle), SAP SE (SAP), SAS Institute Inc. (SAS), Sisense Inc, (Sisense), TIBCO Software Inc. (TIBCO Software), IBM Corporation (IBM), QlikTech International AB (Qlik), Domo, Inc. (Domo), Accenture plc (Accenture), Virtusa Corporation (Virtusa), Infosys Limited (Infosys), 1010DATA(US) and more. |

This research report categorizes the data monetization market to forecast revenue and analyze trends in each of the following submarkets:

Based on the Component:

- Tools

- Services

- Consulting

- Support and Maintenance

- Implementation and Integration

Based on the DataType:

- Customer Data

- Product Data

- Financial Data

- Supplier Data

Based on the Business Function:

- Supply Chain Management

- Sales and Marketing

- Operations

- Finance

- Others (Legal, R&D, and HR)

Based on the Deployment Type:

- On-premises

- Cloud

Based on the Organization Size:

- Small and Medium-Sized Enterprises(SMEs)

- Large Enterprises

Based on the Vertical:

- BFSI

- Telecom

- Consumer Goods and Retail

- Media and Entertainment

- Manufacturing

- IT

- Transportation and Logistics

- Energy and Utilities

- Healthcare

- Others (Government and Defense, Travel and Hospitality, Agriculture and Education)

Based on Regions:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Singapore

- Rest of Asia Pacific

-

Middle East and Africa

- United Arab Emirates

- Kingdom of Saudi Arabia

- South Africa

- Rest of Middle East and Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments

- In April 2022, Nrby, Inc. a leader in dynamic location intelligence for service provider operations, and Sisense, have partnered to create Nrby VU, a new business intelligence tool that provides unparalleled visibility into network events, trends, and workforce activities for broadband service providers.

- In April 2022, The Eaxct company announced an OEM partnership with Exact to serve small and mid-sized businesses across the globe with Qlik Sense enterprise-grade analytics capabilities.

- In March 2022, Domo has made a new agreement with Moss Adams, one of the nation's largest accounting, consulting, and wealth management firms. This partnership will enable Moss Adams to assist its clients in implementing analytics leveraging Domo's modern BI platform to further enhance its client-centric strategy.

- In February 2022, Yieldbroker, the licensed electronic trading platform for Australian and New Zealand debt securities and derivatives has collaborated with Sisense to use its AI-driven interactive data visualization capabilities for Yieldbroker’s new data and analytics product, “YBEdge.”

- In February 2022, the national government of India has published a policy ‘Draft India Data Accessibility & Use Policy 2022’ for all the data collected, generated, and stored by every government ministry and department, under which all the data will be open and shareable barring certain exceptions.

- In March 2022, Domo has launched Data Apps, new low-code data tools for everyone across an organization, designed to bring the benefit of data-driven decisions and actions to those who are underserved by traditional business intelligence (BI) and analytics.

- In Ferbruary 2022, Tableau and Salesforce revealed three new tools that infuse Tableau CRM's analytics capabilities into Salesforce. Salesforce has unveiled Revenue Intelligence, CDP Direct Data and Tableau CRM for Net Zero Cloud as part of its Spring '22 Release, and each brings enhanced analytics functionality to Salesforce tools using Tableau.

- In January 2021, The company acquired Information Builders, a data and analytics company to strengthen TIBCO’s connected intelligence platform with Information Builders data management and analytics capabilities.

- In October 2020, Microsoft has partnered with C3.ai and Adobe and they have announced the launch of C3 AI CRM powered by Microsoft Dynamics 365. C3 AI CRM leverages Dynamics 365 as the foundation for end-to-end, intelligent customer engagement, with Adobe Experience Cloud providing real-time customer profile and customer journey management, together with C3.ai’s industry-specific enterprise AI capabilities.

Frequently Asked Questions (FAQ):

What is the projected market value of the data monetization market?

The data monetization market size is expected to grow from USD 2.9 billion in 2022 to USD 7.3 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 19.5% during the forecast period.

Which region has the highest market share in the data monetization market?

North American region has a higher market share in the data monetization market.

Which component is expected to witness high adoption in the coming years?

Services is expected to witness the highest rate adoption in the coming five years.

Which are the major vendors in the data monetization market?

Microsoft, Oracle, Salesforce, SAS, and TIBCO are major vendors in data monetization market.

What are some of the drivers in the data monetization market?

Increase in use of external data sources

The increase in adoption of technology and analytics .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 31)

2.1 RESEARCH DATA

FIGURE 1 DATA MONETIZATION MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

2.1.2.1 Breakup of primary profiles

FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 3 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF DATA MONETIZATION FROM VENDORS

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF DATA MONETIZATION VENDORS

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): DATA MONETIZATION MARKET

FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): ILLUSTRATION OF VENDOR REVENUE ESTIMATION

2.4 COMPANY EVALUATION MATRIX METHODOLOGY

FIGURE 9 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.5 STARTUP/SME EVALUATION MATRIX METHODOLOGY

FIGURE 10 STARTUP/SME EVALUATION MATRIX: CRITERIA WEIGHTAGE

2.6 ASSUMPTIONS FOR THE STUDY

2.7 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 11 DATA MONETIZATION MARKET: GLOBAL SNAPSHOT, 2020-2027

FIGURE 12 TOP-GROWING SEGMENTS IN THE MARKET

FIGURE 13 TOOLS SEGMENT TO ACCOUNT FOR A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 14 INTEGRATION AND IMPLEMENTATION SERVICE TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 15 FINANCE SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 16 ON-PREMISES SEGMENT TO HOLD A LARGER MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 17 CUSTOMER DATA SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

FIGURE 19 TELECOMMUNICATION INDUSTRY VERTICAL TO HOLD THE LARGEST MARKET DURING THE FORECAST PERIOD

FIGURE 20 NORTH AMERICA TO ACCOUNT FOR THE LARGEST MARKET SHARE DURING THE FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 50)

4.1 BRIEF OVERVIEW OF DATA MONETIZATION MARKET

FIGURE 21 INCREASING USE OF EXTERNAL DATA SOURCES TO DRIVE THE GROWTH OF THE MARKET DURING THE FORECAST PERIOD

4.2 MARKET, BY COMPONENT, 2022 VS. 2027

FIGURE 22 TOOLS SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2027

4.3 MARKET, BY SERVICES, 2022 VS. 2027

FIGURE 23 INTEGRATION AND IMPLEMENTATION SERVICE TO ACCOUNT FOR THE HIGHEST MARKET SHARE BY 2027

4.4 MARKET, BY DATA TYPE, 2022 VS. 2027

FIGURE 24 CUSTOMER DATA SEGMENT TO ACCOUNT FOR THE HIGHEST MARKET SHARE BY 2027

4.5 MARKET, BY DEPLOYMENT TYPE, 2022 VS. 2027

FIGURE 25 ON-PREMISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2027

4.6 MARKET, BY ORGANIZATION SIZE, 2022 VS. 2027

FIGURE 26 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2027

4.7 DATA MONETIZATION MARKET, BY BUSINESS FUNCTION, 2022 VS. 2027

FIGURE 27 FINANCE SEGMENT TO ACCOUNT FOR A LARGER MARKET SHARE BY 2027

4.8 MARKET, BY INDUSTRY VERTICAL, 2022 VS. 2027

FIGURE 28 TELECOMUNICATION VERTICAL TO ACCOUNT FOR A LARGER MARKET SHARE BY 2027

4.9 MARKET—INVESTMENT SCENARIO

FIGURE 29 ASIA PACIFIC TO EMERGE AS THE BEST MARKET FOR INVESTMENT IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 54)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 30 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: DATA MONETIZATION MARKET

5.2.1 DRIVERS

5.2.1.1 Increase in volume of data generation and lower cost of data storage

5.2.1.2 Rapid adoption of advanced analytics and visualization

5.2.1.3 Increase in use of external data sources

5.2.1.4 Growth in the adoption of data-driven decision-making

5.2.1.5 Rise in business data volume and variety

5.2.2 RESTRAINTS

5.2.2.1 Varying structure of regulatory policies

5.2.2.2 Lack of 0rganizational capabilities and cultural barriers

5.2.3 OPPORTUNITIES

5.2.3.1 Increasing need to create insights from a pool of data

5.2.3.2 Rising adoption of AI for data processing

5.2.4 CHALLENGES

5.2.4.1 Quality of data collected by organizations for monetization

5.2.4.2 Privacy and security concerns

5.2.4.3 Increase in complexities in data structures

5.3 ECOSYSTEM

FIGURE 31 DATA MONETIZATION MARKET: ECOSYSTEM

5.4 SUPPLY CHAIN ANALYSIS

FIGURE 32 MARKET: SUPPLY CHAIN

5.5 TYPES OF DATA MONETIZATION

FIGURE 33 DIRECT VS INDIRECT DATA MONETIZATION

5.5.1 DIRECT DATA MONETIZATION

5.5.2 INDIRECT DATA MONETIZATION

5.6 TECHNOLOGICAL ANALYSIS

5.6.1 DATA AS A SERVICE

5.6.2 INSIGHT AS A SERVICE

5.6.3 ANALYTICS-ENABLED PLATFORM AS A SERVICE

5.6.4 EMBEDDED ANALYTICS

5.7 COVID-19 DRIVEN MARKET DYNAMICS

5.7.1 DRIVERS AND OPPORTUNITIES

5.7.2 RESTRAINTS AND CHALLENGES

5.8 PATENT ANALYSIS

FIGURE 34 NUMBER OF PATENTS PUBLISHED, 2012–2022

FIGURE 35 TOP FIVE PATENT OWNERS (GLOBAL)

TABLE 2 TOP TEN PATENT APPLICANTS (UNITED STATES)

5.9 CASE STUDY ANALYSIS

5.9.1 CASE STUDY 1: TO IMPROVE THE ACCURACY OF CUSTOMER CHURN PREDICTION THROUGH NEW MODELS, AND ALSO IMPROVE THE DATA MONETIZATION INITIATIVE

5.9.2 CASE STUDY 2: TO UTILIZE THE AVAILABLE DATA AND GAIN A COMPETITIVE ADVANTAGE IN THE MARKET

5.9.3 CASE STUDY 3: TO ENHANCE THE SAFETY AND MANAGE THE HUGE AMOUNT OF DATA GENERATED BY KEY PERFORMANCE INDICATORS (KPIS) USED FOR CONSTANT REPORTING ON SAFETY

5.9.4 CASE STUDY 4: TO PROVIDE A COMPLETE VIEW OF BUSINESS PERFORMANCE AND SHARE THE INFORMATION WITH ITS EMPLOYEES IN REAL-TIME ACROSS FINANCE, HCM, WORKFORCE MANAGEMENT, AND ASSET MANAGEMENT DEPARTMENTS.

5.9.5 CASE STUDY 5: TO FIND OUT INEFFICIENCIES IN THE HEALTHCARE CHAIN ON A PER PATIENT BASIS

5.10 AVERAGE SELLING PRICE: DATA MONETIZATION MARKET

TABLE 3 PRICING ANALYSIS: MARKET

5.11 TARIFF AND REGULATORY LANDSCAPE

5.11.1 REGULATIONS

5.11.1.1 North America

5.11.1.2 Europe

5.11.1.3 Asia Pacific

5.11.1.4 Middle East and South Africa

5.11.1.5 Latin America

6 DATA MONETIZATION MARKET, BY COMPONENT (Page No. - 72)

6.1 INTRODUCTION

FIGURE 36 SERVICES SEGMENT TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 4 MARKET, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 5 MARKET, BY COMPONENT, 2021–2027 (USD MILLION)

6.1.1 COMPONENT: MARKET DRIVERS

6.1.2 COMPONENT: COVID-19 IMPACT

6.2 TOOLS

TABLE 6 TOOLS: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 7 TOOLS: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3 SERVICES

FIGURE 37 CONSULTING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 8 SERVICES: DATA MONETIZATION MARKET SIZE, BY TYPE, 2016–2020 (USD MILLION)

TABLE 9 SERVICES: MARKET SIZE, BY TYPE, 2021–2027 (USD MILLION)

TABLE 10 SERVICES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 11 SERVICES: MARKET, BY REGION, 2021–2027 (USD MILLION)

6.3.1 SUPPORT AND MAINTENANCE

TABLE 12 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 13 SUPPORT AND MAINTENANCE MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3.2 CONSULTING

TABLE 14 CONSULTING MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 15 CONSULTING MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

6.3.3 IMPLEMENTATION AND INTEGRATION

TABLE 16 IMPLEMENTATION AND INTEGRATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 17 IMPLEMENTATION AND INTEGRATION MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7 DATA MONETIZATION MARKET, BY DATA TYPE (Page No. - 81)

7.1 INTRODUCTION

FIGURE 38 FINANCIAL DATA SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 18 MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 19 MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

7.1.1 DATA TYPE: MARKET DRIVERS

7.1.2 DATA TYPE: COVID-19 IMPACT

7.2 CUSTOMER DATA

TABLE 20 CUSTOMER DATA: DATA MONETIZATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 21 CUSTOMER DATA: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.3 PRODUCT DATA

TABLE 22 PRODUCT DATA: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 23 PRODUCT DATA: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.4 FINANCIAL DATA

TABLE 24 FINANCIAL DATA: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 25 FINANCIAL DATA: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

7.5 SUPPLIER DATA

TABLE 26 SUPPLIER DATA: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 27 SUPPLIER DATA: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8 DATA MONETIZATION MARKET, BY BUSINESS FUNCTION (Page No. - 88)

8.1 INTRODUCTION

FIGURE 39 SALES AND MARKETING SEGMENT TO GROW AT THE HIGHEST CAGR DURING THE FORECAST PERIOD

TABLE 28 MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 29 MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

8.1.1 BUSINESS FUNCTION: MARKET DRIVERS

8.1.2 BUSINESS FUNCTION: COVID-19 IMPACT

8.2 SALES AND MARKETING

TABLE 30 SALES AND MARKETING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 31 SALES AND MARKETING: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.3 SUPPLY CHAIN MANAGEMENT

TABLE 32 SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 33 SUPPLY CHAIN MANAGEMENT: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.4 OPERATIONS

TABLE 34 OPERATIONS: DATA MONETIZATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 35 OPERATIONS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.5 FINANCE

TABLE 36 FINANCE: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 37 FINANCE: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

8.6 OTHERS

TABLE 38 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 39 OTHERS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

9 DATA MONETIZATION MARKET, BY DEPLOYMENT TYPE (Page No. - 96)

9.1 INTRODUCTION

FIGURE 40 CLOUD DEPLOYMENT EXPECTED TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 40 MARKET, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 41 MARKET, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

9.1.1 DEPLOYMENT TYPE: MARKET DRIVERS

9.1.2 DEPLOYMENT TYPE: COVID-19 IMPACT

9.2 CLOUD

TABLE 42 CLOUD: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 43 CLOUD: MARKET, BY REGION, 2021–2027 (USD MILLION)

9.3 ON-PREMISES

TABLE 44 ON-PREMISES: MARKET, BY REGION, 2016–2020 (USD MILLION)

TABLE 45 ON-PREMISES: MARKET, BY REGION, 2021–2027 (USD MILLION)

10 DATA MONETIZATION MARKET, BY ORGANIZATION SIZE (Page No. - 101)

10.1 INTRODUCTION

FIGURE 41 SMALL AND MEDIUM-SIZED ENTERPRISES(SMES) TO GROW AT A HIGHER CAGR DURING THE FORECAST PERIOD

TABLE 46 MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 47 MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

10.1.1 ORGANIZATION SIZE: MARKET DRIVERS

10.1.2 ORGANIZATION SIZE: COVID-19 IMPACT

10.2 LARGE ENTERPRISES

TABLE 48 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 49 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

10.3 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 50 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 51 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11 DATA MONETIZATION MARKET, BY INDUSTRY VERTICAL (Page No. - 106)

11.1 INTRODUCTION

FIGURE 42 TELECOMMUNICATION VERTICAL EXPECTED TO ACCOUNT FOR THE LARGEST MARKET SIZE DURING THE FORECAST PERIOD

TABLE 52 MARKET, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 53 MARKET, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

11.1.1 INDUSTRY VERTICAL: MARKET DRIVERS

11.1.2 INDUSTRY VERTICAL: COVID-19 IMPACT

11.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

TABLE 54 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, REGION, 2016–2020 (USD MILLION)

TABLE 55 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.3 TELECOMMUNICATION

TABLE 56 TELECOMMUNICATION: DATA MONETIZATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 57 TELECOMMUNICATION: MARKET SIZE, BY REGION, 2021–2027(USD MILLION)

11.4 CONSUMER GOODS AND RETAIL

TABLE 58 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 59 CONSUMER GOODS AND RETAIL: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.5 INFORMATION TECHNOLOGY

TABLE 60 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 61 INFORMATION TECHNOLOGY: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.6 HEALTHCARE

TABLE 62 HEALTHCARE: DATA MONETIZATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 63 HEALTHCARE: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.7 MANUFACTURING

TABLE 64 MANUFACTURING: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 65 MANUFACTURING: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.8 MEDIA AND ENTERTAINMENT

TABLE 66 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 67 MEDIA AND ENTERTAINMENT: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.9 TRANSPORTATION AND LOGISTICS

TABLE 68 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 69 TRANSPORTATION AND LOGISTICS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.10 ENERGY AND UTILITIES

TABLE 70 ENERGY AND UTILITIES: DATA MONETIZATION MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 71 ENERGY AND UTILITIES: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

11.11 OTHERS

TABLE 72 OTHERS: MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 73 OTHERS: MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

12 DATA MONETIZATION MARKET, BY REGION (Page No. - 120)

12.1 INTRODUCTION

FIGURE 43 ASIA PACIFIC TO SHOW THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

TABLE 74 MARKET SIZE, BY REGION, 2016–2020 (USD MILLION)

TABLE 75 MARKET SIZE, BY REGION, 2021–2027 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

FIGURE 44 NORTH AMERICA: MARKET SNAPSHOT

TABLE 76 NORTH AMERICA: DATA MONETIZATION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 79 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 80 NORTH AMERICA: MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 81 NORTH AMERICA: MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

TABLE 82 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 83 NORTH AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: DATA MONETIZATION MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 85 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 87 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 88 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 89 NORTH AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

TABLE 90 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 91 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.2.3 UNITED STATES

TABLE 92 UNITED STATES: DATA MONETIZATION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 93 UNITED STATES: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 94 UNITED STATES: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 95 UNITED STATES: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 96 UNITED STATES: MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 97 UNITED STATES: MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

TABLE 98 UNITED STATES: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 99 UNITED STATES: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

TABLE 100 UNITED STATES: DATA MONETIZATION MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 101 UNITED STATES: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 102 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 103 UNITED STATES: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 104 UNITED STATES: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020(USD, MILLION)

TABLE 105 UNITED STATES: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

12.2.4 CANADA

TABLE 106 CANADA: DATA MONETIZATION MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 107 CANADA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 108 CANADA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 109 CANADA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 110 CANADA: MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 111 CANADA: MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

TABLE 112 CANADA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 113 CANADA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

TABLE 114 CANADA: DATA MONETIZATION MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 115 CANADA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 116 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 117 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 118 CANADA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 119 CANADA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: DATA MONETIZATION MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

TABLE 120 EUROPE: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 121 EUROPE: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 122 EUROPE: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 123 EUROPE: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 124 EUROPE: MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 125 EUROPE: MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

TABLE 126 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 127 EUROPE: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

TABLE 128 EUROPE: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 129 EUROPE: DATA MONETIZATION MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 130 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 131 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 132 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 133 EUROPE: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

TABLE 134 EUROPE: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 135 EUROPE: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.3.3 UNITED KINGDOM

12.3.4 GERMANY

12.3.5 FRANCE

12.3.6 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: DATA MONETIZATION MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

FIGURE 45 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 136 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 137 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 138 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 139 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 140 ASIA PACIFIC: MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 141 ASIA PACIFIC: MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020(USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 145 ASIA PACIFIC: DATA MONETIZATION MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.4.3 AUSTRALIA AND NEW ZEALAND

12.4.4 CHINA

12.4.5 JAPAN

12.4.6 SINGAPORE

12.4.7 REST OF ASIA PACIFIC

12.5 MIDDLE EAST AND AFRICA

12.5.1 MIDDLE EAST AND AFRICA: DATA MONETIZATION MARKET DRIVERS

12.5.2 MIDDLE EAST AND AFRICA: COVID-19 IMPACT

TABLE 152 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 153 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 154 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 155 MIDDLE EAST AND AFRICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 156 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 157 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

TABLE 158 MIDDLE EAST AND AFRICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 159 MIDDLE EAST AND AFRICA: DATA MONETIZATION MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

TABLE 160 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 161 MIDDLE EAST AND AFRICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 162 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 163 MIDDLE EAST AND AFRICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 164 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020(USD MILLION)

TABLE 165 MIDDLE EAST AND AFRICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

TABLE 166 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 167 MIDDLE EAST AND AFRICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.5.3 KINGDOM OF SAUDI ARABIA

12.5.4 UNITED ARAB EMIRATES

12.5.5 SOUTH AFRICA

12.5.6 REST OF MIDDLE EAST AND AFRICA

12.6 LATIN AMERICA

12.6.1 LATIN AMERICA: DATA MONETIZATION MARKET DRIVERS

12.6.2 LATIN AMERICA: COVID-19 IMPACT

TABLE 168 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2016–2020 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET SIZE, BY COMPONENT, 2021–2027 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2016–2020 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET SIZE, BY SERVICE, 2021–2027 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET SIZE, BY DATA TYPE, 2016–2020 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET SIZE, BY DATA TYPE, 2021–2027 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2016–2020 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET SIZE, BY BUSINESS FUNCTION, 2021–2027 (USD MILLION)

TABLE 176 LATIN AMERICA: DATA MONETIZATION MARKET SIZE, BY DEPLOYMENT TYPE, 2016–2020 (USD MILLION)

TABLE 177 LATIN AMERICA: MARKET SIZE, BY DEPLOYMENT TYPE, 2021–2027 (USD MILLION)

TABLE 178 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2016–2020 (USD MILLION)

TABLE 179 LATIN AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2021–2027 (USD MILLION)

TABLE 180 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2016–2020 (USD MILLION)

TABLE 181 LATIN AMERICA: MARKET SIZE, BY INDUSTRY VERTICAL, 2021–2027 (USD MILLION)

TABLE 182 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2016–2020 (USD MILLION)

TABLE 183 LATIN AMERICA: MARKET SIZE, BY COUNTRY, 2021–2027 (USD MILLION)

12.6.3 BRAZIL

12.6.4 MEXICO

12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE (Page No. - 169)

13.1 INTRODUCTION

FIGURE 46 MARKET EVALUATION FRAMEWORK

13.2 MARKET SHARE ANALYSIS

FIGURE 47 MARKET SHARE ANALYSIS OF COMPANIES IN THE DATA MONETIZATION MARKET

13.3 MARKET RANKING

FIGURE 48 MARKET RANKING IN 2021

13.4 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

FIGURE 49 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2017-2021

13.5 KEY MARKET DEVELOPMENTS

13.5.1 NEW LAUNCHES

TABLE 184 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019-2022

TABLE 185 MARKET: DEALS, 2019-2020

13.6 COMPANY EVALUATION QUADRANT

13.6.1 STARS

13.6.2 EMERGING LEADERS

13.6.3 PERVASIVE PLAYERS

13.6.4 PARTICIPANTS

FIGURE 50 DATA MONETIZATION MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

14 COMPANY PROFILES (Page No. - 178)

14.1 INTRODUCTION

14.2 KEY COMPANIES

(Business overview, Products/solutions/services offered, Recent Developments, MNM view)*

14.2.1 MICROSOFT

TABLE 186 MICROSOFT: BUSINESS OVERVIEW

FIGURE 51 MICROSOFT: COMPANY SNAPSHOT

TABLE 187 MICROSOFT: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 188 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 189 MICROSOFT: DEALS

14.2.2 ORACLE

TABLE 190 ORACLE: BUSINESS OVERVIEW

FIGURE 52 ORACLE: COMPANY SNAPSHOT

TABLE 191 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 192 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 193 ORACLE: DEALS

14.2.3 SALESFORCE

TABLE 194 SALESFORCE: BUSINESS OVERVIEW

FIGURE 53 SALESFORCE: COMPANY SNAPSHOT

TABLE 195 SALESFORCE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 196 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 197 SALESFORCE: DEALS

14.2.4 SAS

TABLE 198 SAS: BUSINESS OVERVIEW

TABLE 199 SAS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 200 SAS: DEALS

14.2.5 TIBCO SOFTWARE

TABLE 201 TIBCO SOFTWARE: BUSINESS OVERVIEW

TABLE 202 TIBCO SOFTWARE: SOLUTIONS/SERVICES OFFERED

TABLE 203 TIBCO SOFTWARE: PRODUCT LAUNCHES

TABLE 204 TIBCO SOFTWARE: DEALS

14.2.6 IBM

TABLE 205 IBM: BUSINESS OVERVIEW

FIGURE 54 IBM: COMPANY SNAPSHOT

TABLE 206 IBM: SOLUTIONS OFFERED

TABLE 207 IBM: PRODUCT LAUNCHES

14.2.7 QLIK

TABLE 208 QLIK: BUSINESS OVERVIEW

TABLE 209 QLIK: SOLUTIONS OFFERED

TABLE 210 QLIK: DEALS

14.2.8 SAP

TABLE 211 SAP: BUSINESS OVERVIEW

FIGURE 55 SAP: COMPANY SNAPSHOT

TABLE 212 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 213 SAP: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 214 SAP: DEALS

14.2.9 LOOKER

TABLE 215 LOOKER: BUSINESS OVERVIEW

TABLE 216 LOOKER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 217 LOOKER: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 218 LOOKER: DEALS

14.2.10 THOUGHTSPOT

TABLE 219 THOUGHTSPOT: BUSINESS OVERVIEW

TABLE 220 THOUGHTSPOT: PRODUCTS/SOLUTION/SOLUTIONS OFFERED

TABLE 221 THOUGHTSPOT: PRODUCT LAUNCHES

TABLE 222 THOUGHTSPOT: DEALS

14.2.11 SISENSE

TABLE 223 SISENSE: BUSINESS OVERVIEW

TABLE 224 SISENSE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 225 SISENSE: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 226 SISENSE: DEALS

14.2.12 DOMO

TABLE 227 DOMO: BUSINESS OVERVIEW

FIGURE 56 DOMO: COMPANY SNAPSHOT

TABLE 228 DOMO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 229 DOMO: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 230 DOMO: DEALS

14.2.13 ACCENTURE

14.2.14 VIRTUSA

14.2.15 INFOSYS

14.2.16 1010DATA

14.2.17 INFOR

14.2.18 RELTIO

14.2.19 DATAROBOT

14.2.20 OPENWAVE MOBILITY

14.2.21 NETSCOUT

14.2.22 ADASTRA

14.2.23 OPTIVA

14.2.24 NESS

14.2.25 COMVIVA

14.3 STARTUP/SME PROFILES

14.3.1 MONETIZE

14.3.2 ELEVONDATA

14.3.3 EMU ANALYTICS

14.3.4 NARRATIVE

*Details on Business overview, Products/solutions/services offered, Recent Developments, MNM view might not be captured in case of unlisted companies.

15 ADJACENT MARKET (Page No. - 233)

15.1 INTRODUCTION

15.1.1 RELATED MARKETS

15.1.2 LIMITATIONS

15.2 MASTER DATA MANAGEMENT MARKET

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.3 INTRODUCTION

TABLE 231 MASTER DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2014–2019 (USD MILLION)

TABLE 232 MASTER DATA MANAGEMENT MARKET SIZE, BY COMPONENT, 2020–2025 (USD MILLION)

15.2.4 SOLUTIONS

TABLE 233 SOLUTIONS: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 234 SOLUTIONS: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 235 SOLUTIONS: NORTH AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 236 SOLUTIONS: NORTH AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 237 SOLUTIONS: EUROPE MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 238 SOLUTIONS: EUROPE MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 239 SOLUTIONS: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 240 SOLUTIONS: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 241 SOLUTIONS: MIDDLE EAST AND AFRICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 242 SOLUTIONS: MIDDLE EAST AND AFRICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 243 SOLUTIONS: LATIN AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 244 SOLUTIONS: LATIN AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.2.5 SERVICES

TABLE 245 SERVICES: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2014–2019 (USD MILLION)

TABLE 246 SERVICES: MASTER DATA MANAGEMENT MARKET SIZE, BY REGION, 2020–2025 (USD MILLION)

TABLE 247 SERVICES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 248 SERVICES: NORTH AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 249 SERVICES: EUROPE MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 250 SERVICES: EUROPE MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 251 SERVICES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 252 SERVICES: ASIA PACIFIC MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 253 SERVICES: MIDDLE EAST AND AFRICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 254 SERVICES: MIDDLE EAST AND AFRICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

TABLE 255 SERVICES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2014–2019 (USD MILLION)

TABLE 256 SERVICES: LATIN AMERICA MASTER DATA MANAGEMENT MARKET SIZE, BY COUNTRY, 2020–2025 (USD MILLION)

15.3 DATA SCIENCE PLATFORM MARKET

15.3.1 MARKET DEFINITION

15.3.2 MARKET OVERVIEW

TABLE 257 GLOBAL DATA SCIENCE PLATFORM MARKET SIZE AND GROWTH RATE, 2017–2024 (USD MILLION, Y-O-Y %)

15.3.3 DATA SCIENCE PLATFORM MARKET, BY DEPLOYMENT MODE

TABLE 258 DATA SCIENCE PLATFORM MARKET SIZE, BY DEPLOYMENT MODE, 2017–2024 (USD MILLION)

15.3.4 ON-PREMISES

TABLE 259 ON-PREMISES: DATA SCIENCE PLATFORM MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

15.3.5 CLOUD

TABLE 260 CLOUD: DATA SCIENCE PLATFORM MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

15.3.6 DATA SCIENCE PLATFORM MARKET, BY ORGANIZATION SIZE

TABLE 261 DATA SCIENCE PLATFORM MARKET SIZE, BY ORGANIZATION SIZE, 2017–2024 (USD MILLION)

15.3.7 LARGE ENTERPRISES

TABLE 262 LARGE ENTERPRISES: DATA SCIENCE PLATFORM MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

15.3.8 SMALL AND MEDIUM-SIZED ENTERPRISES

TABLE 263 SMALL AND MEDIUM-SIZED ENTERPRISES: DATA SCIENCE PLATFORM MARKET SIZE, BY REGION, 2017–2024 (USD MILLION)

16 APPENDIX (Page No. - 247)

16.1 DISCUSSION GUIDE

16.2 DATA MONETIZATION IN AGRICULTURE

16.2.1 INCREASING ADOPTION OF MOBILE TECHNOLOGIES AND DATA SENSING TECHNOLOGIES

16.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.4 AVAILABLE CUSTOMIZATIONS

16.5 RELATED REPORTS

16.6 AUTHOR DETAILS

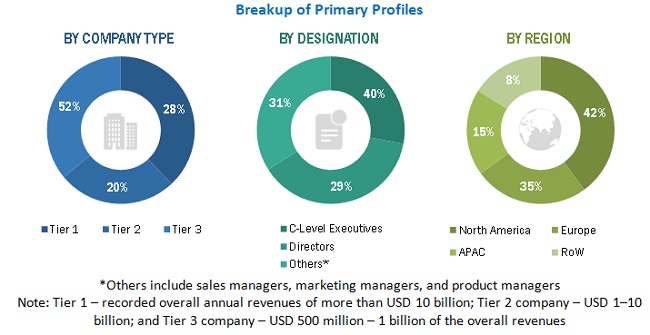

The study involved 4 major activities to estimate the current market size of data monetization. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for this study. The secondary sources included annual reports, press releases, and investor presentations of companies; whitepapers; certified publications; and articles from recognized associations, such as data center knowledge and government publishing sources. The research study involved the use of extensive secondary sources, directories, and databases, such as D&B Hoovers, DiscoverOrg, Factiva, Bloomberg BusinessWeek, Statista.com, Cloud Computing Association, OpenFog Consortium, Association for Computer Operations Management (AFCOM), European Data Centre Association (EUDCA), Open Data Center Alliance (ODCA), Data Center Alliance (DCA), Asia Data Center Alliance (ADCA), and European Telecommunications Standards Institute (ETSI)to identify and collect information useful for this technical, market-oriented, and commercial study of the data monetization market. Secondary research was mainly used to obtain key information about the industry’s value chain, the total pool of key players, market classification and segmentation as per the industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations providing data monetization tools. The primary sources from the demand side included the end-users of event management software solutions, which included Chief Information Officers (CIOs), IT technicians and technologists, and IT managers at public and investor-owned utilities.

The following figure depicts the breakup of the primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the data monetization market. They were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakup procedures were employed, wherever applicable. The data was triangulated by studying several factors and trends from both, the demand and supply sides, in the data monetization market.

Report Objectives

- To define, describe, and forecast the data monetization market based on components (tools and services), data types, business functions, deployment types, organization size, industry verticals, and regions

- To provide detailed information about the major factors (drivers, restraints, opportunities, and industry-specific challenges) influencing the growth of the market

- To analyze the market with respect to individual growth trends, prospects, and contribution to the overall market

- To analyze the impact of COVID-19 on the market

- To forecast the market size of main regions: North America, Europe, Asia Pacific (APAC), Middle East and Africa (MEA), and Latin America

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key players in the data monetization market and comprehensively analyze their core competencies in each subsegment

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs and on best effort basis for profiling of additional market players.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Monetization Market

Analyse the market dynamics and trends in data monetization.

Interested in data monetization and how it is related to connected car technology.

Gather insights into Telco data monetization, Action field, Potential customers, Revenue estimation.

Understand the Data Monetization Market.