Data Security as a Service Market by Type (Data Encryption and Masking as a Service, Data Governance and Compliance as a Service), Organization Size, Vertical (BFSI, IT and ITeS, Healthcare, Manufacturing, Education) and Region - Global Forecast to 2027

Data Security as a Service Market Size

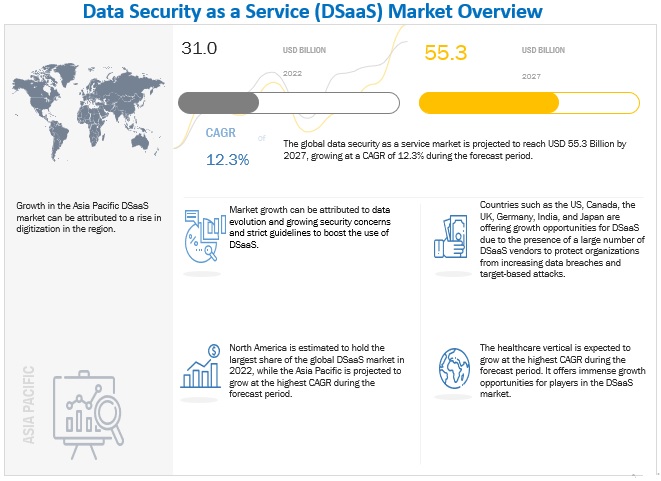

The data security as a service (DSaaS) market size is projected to grow at a CAGR of 12.3% during the forecast period to reach USD 55.3 billion by 2027 from an estimated USD 31.0 billion in 2022.

Data Security as a Service Market Growth

Factors driving market growth include the growing adoption of data security as a service (DSaaS) due to the rising amount of generated data and its associated security issues; and the prime focus on the significant data loss caused by the increasing number of data breaches and thefts. However, integration with existing infrastructure, low-security budget, and spending is expected to hinder market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Security as a Service Market Dynamics

Driver: Data evolution and growing security problems

Enterprises are becoming more concerned about enhanced data security and privacy protections because of the growing data evolution. At the same time, they do not want to expose the data to internal monitoring and breaches. In today's digitally transformed world, every endpoint gateway, sensor, and smartphone has become a potential target for hackers. Enterprises require data security services since the data needs to be safeguarded and backed up at every instance. Some businesses have constrained memory, computing power, and battery life. It indicates that traditional IT security systems sometimes cannot handle security situations due to cyberattacks. Addressing the issue would accelerate the adoption of data security services drastically.

Restraint: Low data security spending and expensive installation

High installation costs and complicated integration requirements hamper the initial adoption of data security solutions. Due to the integration of high-quality hardware, data security systems have a significant initial investment and ongoing maintenance costs. The budgets set aside to address cybersecurity issues are not keeping up with the growth of the necessary resources. Most small businesses lack the necessary resources and IT security skills to embrace improved cybersecurity solutions and services and protect their networks and IT infrastructure from various cyberattacks. For certain SMEs, a lack of capital resources can be a significant barrier to adopting a data security architecture.

Due to their limited financial resources, many businesses lack an adequate IT security infrastructure, which slows the adoption of new technologies and corporate security solutions and services. Appropriately administrating projected budget money for various operational issues and business continuity planning burdens small businesses. Organizations must recognize which program elements and information assets are more crucial to growing security threats since data security budgets will not be sufficient to meet data security needs. Due to the availability of cloud-based solutions and ongoing market advancements in data security as a service, this factor's impact will diminish during the projected period.

Opportunity: Increased adoption of cloud technology in enterprises

Multiple enterprises are willingly choosing the technologies that best correspond with their various platforms, making multi-cloud strategies the standard rather than the exception. Building robust architectures that can coexist and work with several cloud service providers is crucial.

Cloud-based data security solutions and service providers are anticipated to see increased growth prospects as SMEs focus on cloud solutions to protect their data from security breaches and vulnerabilities. Infrastructure as a service (laaS), platform as a service (PaaS), and software as service (SaaS) models are all offered by cloud service providers. These approaches are vulnerable to application vulnerabilities, malware, viruses, advanced persistent threats (APTs), distributed denial-of-service (DDoS) assaults, and access management and data security breaches. Data security measures like encryption, tokenization, DLP, and masking are effectively provided by cloud access security brokers (CASBS), who effectively protect data residing in cloud and on-premises environments.

With growing concerns about cloud data security, the demand for integrated, cloud-based data security solutions has increased, propelling the data security as a service market forward.

Challenge: Synchronizing management of unstructured to structured data

Enterprises struggle with managing unstructured information significantly, and solution suppliers work to ensure data security. The data retrieved through emails, social media posts, and client conversations is known as unstructured data. Although managing unstructured data can be challenging, it can also be a prosperous source of information for businesses. Unstructured data presents issues in quantity, quality, usability, and relevancy. Since unstructured data does not integrate well with conventional backup solutions, managing it becomes exceedingly challenging. As the data created is in terabytes, the file size is one of the most significant issues in the backup procedure. The issue is getting worse every day because of the massive growth in data. Another big problem for providers is the variety of data because it is challenging to optimize. These are some of the main obstacles preventing the market for data security as a service from expanding.

Data Security as a Service (DSaaS) Market Ecosystem

To know about the assumptions considered for the study, download the pdf brochure

By type, Data Governance & Compliance as a Service segment to grow at the highest CAGR during the forecast period

Data governance is a process that helps organizations manage and secure both structured and unstructured data in their enterprise workstations and cloud environments. As unstructured data accounts for a large portion of enterprise data and is expected to grow rapidly, managing it can be difficult. Data governance solutions provide an automated, scalable, and interoperable platform to address these challenges, making it easier to govern access to this large amount of data. With a data governance solution, organizations can identify where data resides and determine who is responsible for it and who has access to it, making it a critical tool for managing and securing data.

By vertical, the Healthcare segment is to grow at the highest CAGR during the forecast period

The healthcare segment includes various entities such as hospitals, clinics, pharmaceuticals, and life sciences. Data security is critical in this vertical as it deals with sensitive personal health information and critical patient data. There is a growing need to protect internal healthcare data within organizations, as many organizations prioritize protecting customer data but neglect internal data protection.

Data security as a service (DSaaS) solutions ensure that the organization's data is available in different silos and remain integrated, confidential, and available. Some of the significant data measures adopted by the healthcare vertical are encryption, tokenization, and masking. Encryption solutions help healthcare professionals secure personal health information on their mobile devices, such as laptops and smartphones. Further, the encryption of data, files, and folders helps healthcare professionals ensure the security and privacy of confidential data, financial transactions, and medical records related to the patient.

Implementing regulatory compliances, such as HIPAA, helps secure sensitive data, protect identities by providing a digital signature, and protect network gateways and databases. With the increasing instances of medical record thefts and awareness of regulatory compliances, the adoption rate of DSaaS solutions is expected to rise in the coming years.

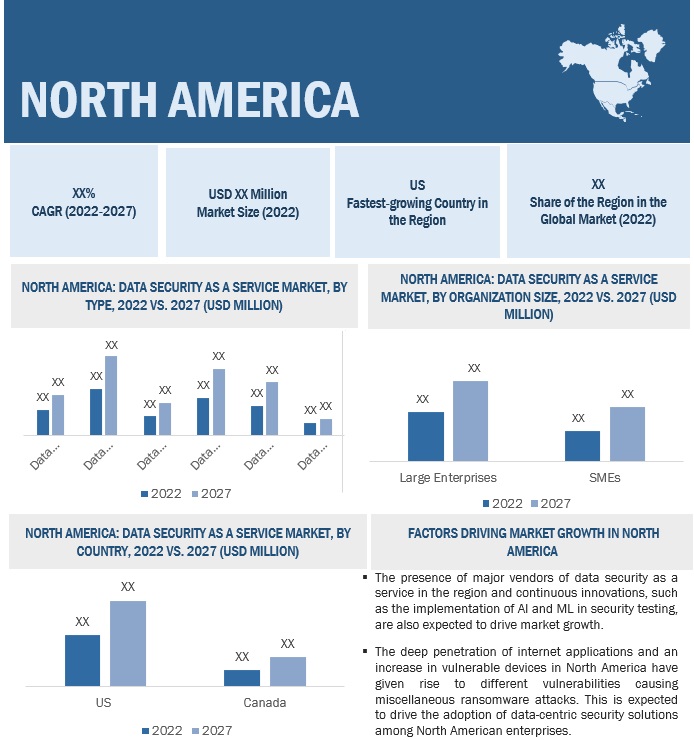

By region, North America to hold largest highest market size during the forecast period

North America is the most affected region regarding data security breaches and, as a result, has the most significant number of DSaaS providers. Hence, the global data security as a service (DSaaS) market is expected to be dominated by North America. It is the most advanced region adopting data protection solutions with relevant infrastructure. Data security is recognized as the most serious economic and national security challenge by regional organizations and governments. The growing concern about the security of critical infrastructure and sensitive data has increased the government's intervention in data security in recent years. Specific budget allocations, support from the government, and mandated data protection policies are expected to make North America the most profitable region for the growth of data protection providers.

Key Market Players

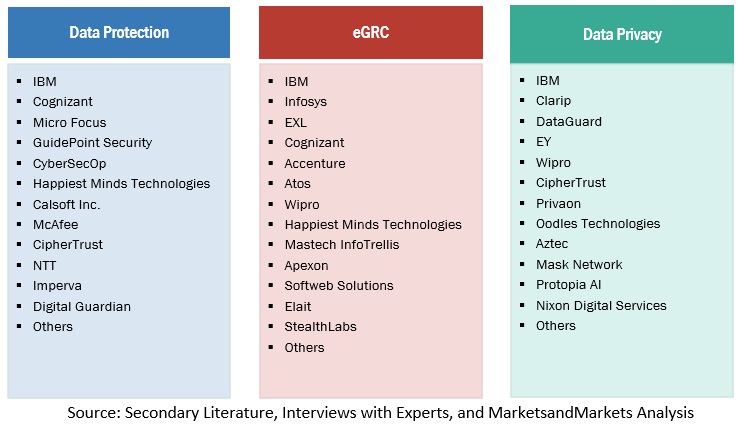

Key players in the global data security as a service (DSaaS) market include Cisco (US), AWS (US), Thales (France), IBM (US), Cognizant (US), Micro Focus (UK), Microsoft (US), Varonis Systems (US), Imperva (US), Commvault (US), HPE (US), Acronis (Switzerland), Veritas Technologies (US), Asigra (Canada), NetApp (US), GuidePoint Security (US), Informatica (US), Carbonite (US), TrustArc(US), Cloudian(US), NetWrix (US), Alation (US), Infrascale (US), Securiti (US), DataGuard (Germany), Cobalt Iron (US), Storagepipe (Canada), Polar Security (Israel), Clarip (US) and SEQRITE (India).

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 55.3 Billion |

|

Market value in 2022 |

USD 31.0 Billion |

|

Market Growth Rate |

12.3% CAGR |

|

Largest Market |

North America |

|

Market size available for years |

2019–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Segments Covered |

|

|

Geographies covered |

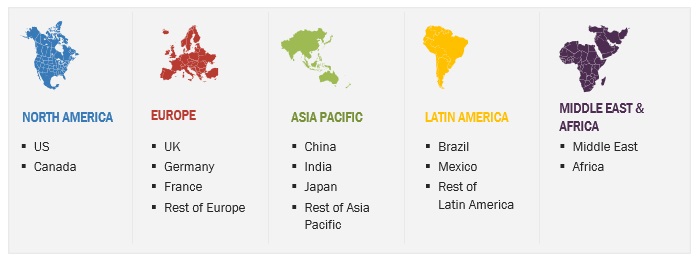

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Major companies covered |

Cisco (US), AWS (US), Thales (France), IBM (US), Cognizant (US), Micro Focus (UK), Microsoft (US), Varonis Systems (US), Imperva (US), Commvault (US), HPE (US), Acronis (Switzerland), Veritas Technologies (US), Asigra (Canada), and NetApp (US). |

Market Segmentation

Recent Developments

- In October 2022, Imperva collaborated with Oracle. Oracle Cloud Infrastructure (OCI) is now supported by Imperva's award-winning hybrid data security technology, making migration easier for users and providing automated compliance monitoring of cloud data instances.

- In July 2022, Oracle and Commvault partnered to provide metallic data management. Critical data assets will be safeguarded in the cloud or on-premises by preserving flexibility between customer-controlled storage or a SaaS-delivered data protection service, including managed cloud storage, using Oracle cloud infrastructure storage for air-gapped ransomware protection.

- In November 2021, NetApp announced the acquisition of CloudCheckr. It is a cloud optimization platform that provides visibility and insights to lower costs, maintain security and Compliance, and optimize cloud resources.

Frequently Asked Questions (FAQ):

What is the definition of Data Security as a Service?

MarketsandMarkets defines data security as a service (DSaaS) as data security as a service that enables organizations to mitigate risks, protect data from hackers, and remove compliance burdens with the help of cloud-native services. Effective data security entails a set of controls, applications, and techniques that evaluate the importance of various datasets and apply the best security measures.

What is the projected value of the global data security as a service market?

The global data security as a service (DSaaS) market is expected to grow from an estimated USD 31.03 billion in 2022 to 55.33 billion USD by 2027, at a Compound Annual Growth Rate (CAGR) of 12.3% from 2022 to 2027.

Which are the key companies influencing the growth of the data security as a service market?

Cisco (US), AWS (US), Thales (France), IBM (US), Cognizant (US), Micro Focus (UK), and Microsoft (US). Some key companies in the data security as a service (DSaaS) market are recognized as star players. These companies account for a significant share of the data security as a service (DSaaS) market. They offer comprehensive solutions related to DSaaS services. These vendors offer customized solutions as per user requirements and adopt growth strategies to consistently achieve the desired growth and mark their presence in the market.

Which vertical segment is expected to grow at the highest CAGR during the forecast period?

The healthcare vertical is expected to grow at the highest CAGR during the forecast period.

Which country in the Asia Pacific region is expected to hold the largest market size during the forecast period?

China is expected to hold the largest market size during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

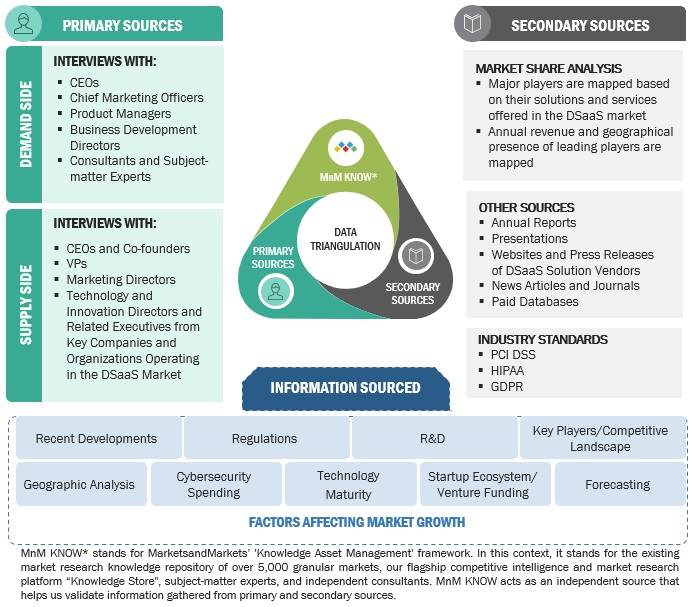

This study involved multiple steps in estimating the current size of the data security as a service (DSaaS) market. Exhaustive secondary research was carried out to collect information on the data security as a service (DSaaS) industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. The top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the data security as a service (DSaaS) market.

Secondary Research

In the secondary research process, various sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of data security as a service (DSaaS) vendors, forums, certified publications, and whitepapers. This research was used to obtain key information related to the industry's value chain, the total pool of key players, market classification, and segmentation from the market- and technology-oriented perspectives.

Factors Considered to Estimate Regional-Level Market Size:

- Gross Domestic Product (GDP) Growth

- Information and Communication Technology (ICT) Security Spending

- Recent Market Developments

- Market Ranking Analysis of Major DSaaS Providers

Primary Research

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. These sources from the supply side included various industry experts, including Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various companies and organizations operating in the data security as a service (DSaaS) market.

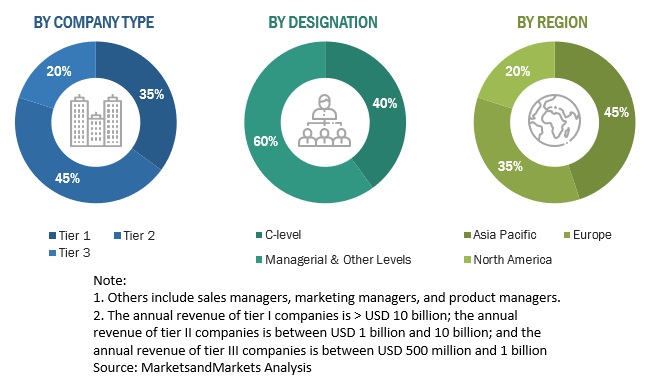

Following is the breakup of the primary interviews:

To know about the assumptions considered for the study, download the pdf brochure

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

To know about the assumptions considered for the study, Request for Free Sample Report

Report Objectives

- To define, describe, and forecast the data security as a service (DSaaS) market based on type, organization size, vertical, and region

- To provide detailed information about the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the data security as a service (DSaaS) market

- To forecast the data security as a service (DSaaS) market size across five main regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa

- To analyze subsegments of the market with respect to individual growth trends, prospects, and contributions to the overall market

- To profile the key players of the data security as a Service (DSaaS) market and comprehensively analyze their market size and core competencies

- To profile the key players and comprehensively analyze their market rankings and core competencies

- To map the companies to get competitive intelligence based on company profiles, key player strategies, and game-changing developments such as product launches, collaborations, and acquisitions

- To track and analyze competitive developments such as product launches and enhancements, acquisitions, partnerships, and collaborations in the DSaaS market

Available Customization

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Data Security as a Service Market