DataOps Platform Market by Offering (Platform and Services), Type (Agile Development, DevOps, and Lean Manufacturing), Deployment Mode, Vertical (BFSI, Telecommunications, and Healthcare & Life Sciences) and Region - Global Forecast to 2028

DataOps Platform Market - Analysis, Industry Size & Forecast

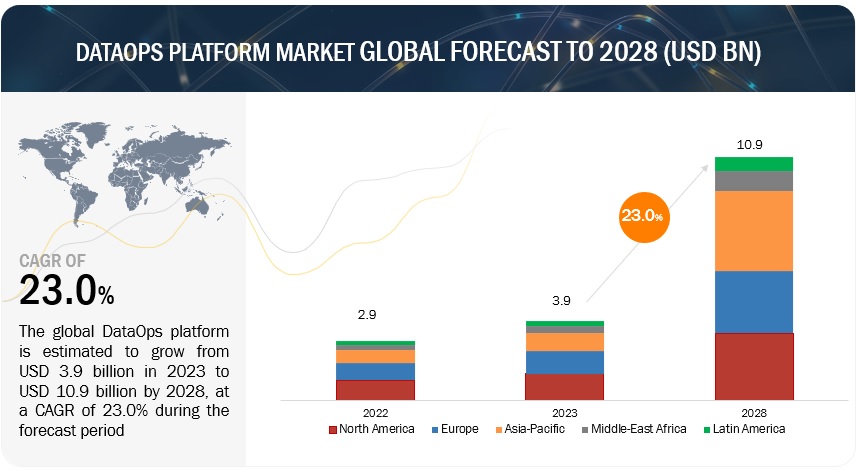

The global DataOps platform market size was valued at USD 3.9 billion in 2023 and is expected to grow at a CAGR of 23.0% from 2023 to 2028. The revenue forecast for 2028 is projected to reach $10.9 billion. The base year for estimation is 2022, and the historical data spans from 2023 to 2028.

DataOps is a holistic approach to data management that goes beyond technology and aims to combine agile methodologies, automation, and collaboration across data professionals to improve the quality, speed, and business value of data-related activities. DataOps platform is a transformational shift from traditional DevOps that aims to enhance communication, integration, and automation of data flow between data providers and data consumers.

Technology Roadmap of DataOps Platform till 2030

DataOps platform market report covers technology roadmap till 2030, with insights around short-term, mid-term, and long-term developments.

Short-term roadmap (2023-2025)

- An increase in the adoption of DataOps platforms is expected across diverse industries and verticals.

- As more organizations migrate their data operations to the cloud, DataOps platforms are expected to incorporate cloud-native solutions.

- Automation and AI/ML will be the key focus areas for DataOps platform capabilities.

Mid-term roadmap (2026-2028)

- As organizations increasingly rely on real-time data for decision-making, DataOps platforms are expected to offer efficient real-time data processing and analytics.

- Emphasis on developing DataOps platform with automated data privacy and security management functionalities.

Long-term roadmap (2029-2030)

- As AI becomes prevalent across industries, AI governance will form a key enabler of DataOps platform adoption.

- With the rise of metaverse, the deployment of DataOps platform will enable efficient data processing and management in virtual environments.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Increased data complexity and accelerating data volumes

Organizations are dealing with ever-increasing data complexity, including large volumes of data from diverse sources, structured and unstructured data formats, and real-time data streams. Traditional data management approaches often struggle to keep up with the scale, velocity, and diversity of data, leading to inefficiencies, errors, and delays in data processing and analysis. DataOps platforms offer the necessary tools and technologies to handle this complexity and enable organizations to integrate, process, and analyse data efficiently. DataOps platforms can support batch processing as well as real-time data streaming data. These platforms are often integrated with big data technologies and cloud-based infrastructure to handle large-scale data processing. The volume of data being generated is growing exponentially, with the proliferation of digital technologies, IoT devices, social media, and other data sources. DataOps platforms provide scalable infrastructure and distributed computing capabilities that can handle massive data volumes and ensure optimal performance. Hence, organizations are turning to DataOps to gain better control over their data, improve data quality and governance, and enhance the efficiency and agility of their data operations.

Restraint: Data privacy and security concerns

Organizations are increasingly aware of the importance of protecting sensitive data and complying with data privacy regulations. DataOps platforms deal with sensitive and confidential data. Ensuring data privacy and compliance with regulations (such as GDPR or CCPA) and maintaining strong security measures can be a significant challenge. Organizations need to address these concerns and implement robust security frameworks. DataOps platforms rely on the integration of various tools and systems, which can increase the attack surface and potential vulnerabilities. Organizations may worry about the risk of data breaches and the potential impact on data privacy if the DataOps platform is not adequately secured.

Opportunity: Need to bridge gap between data engineers and data analysts

DataOps emerged also as a way to bridge the gap between data engineers and data analysts, who have different priorities and objectives. DataOps platforms foster collaboration and cross-functional alignment among different teams, including data engineers, data scientists, business analysts, and IT operations involved in data operations. DataOps platforms enable seamless collaboration, knowledge sharing, and consistent practices across teams, leading to improved productivity and outcomes by providing shared tools and workflows. Furthermore, DataOps platforms break down barriers between teams, encourage knowledge sharing, and enhance the overall effectiveness and efficiency of data operations by fostering collaboration and cross-functional alignment. This collaborative environment enables organizations to harness the collective expertise of their teams, drive innovation, and deliver high-quality data-driven insights.

Challenge: Need to mitigate the challenges of skilled talent shortage

One of the main challenges faced in the DataOps platform market is the scarcity of highly skilled professionals. DataOps platforms require individuals with extensive knowledge in data engineering, data science, software development, and operations. However, the industry is currently experiencing a significant shortage of professionals with these specific skills, resulting in a talent gap. Consequently, organizations are encountering difficulties in finding suitable candidates to build, implement, and sustain DataOps platforms. This shortage of skilled talent is further exacerbated by the rapid pace of technological advancements. Existing team members may need additional training or retraining to adapt to the DataOps approach. Additionally, the lack of skilled talent is not limited to data scientists and machine learning engineers alone. DataOps platforms also require individuals specializing in areas such as data management, data visualization, and cloud computing. It is essential for organizations to address these skill gaps through initiatives that encompass training, recruitment, and knowledge sharing. These efforts are crucial for ensuring the successful adoption and implementation of DataOps platforms.

By offering, platform segment to account for the largest market size during the forecast period

Based on offerings DataOps platform market has been segmented into platform and services. DataOps platform and services are designed to streamline data management and analysis processes, allowing organizations to make more informed decisions and improve operational efficiency period. The platform segment is estimated to account for a larger market size during the forecast period. The increasing amount of data organizations need to manage, process, and analyze offers key lucrative opportunities to the DataOps platform market.

By deployment, cloud to account for the largest market size during the forecast period

The DataOps platform market has been segmented based on deployment mode into cloud and on-premises. In the DataOps platform market, deployment mode plays a significant role in setting up the required IT infrastructure for managing the IT ecosystem. It can either be on-premises or in the cloud, depending on the specific needs of a business. The ability to have greater control over data location and accessibility across a network is driving the adoption of cloud deployment mode in the DataOps platform market.

By type, agile development segment to account for the largest market size during the forecast period

The DataOps platform market has been segmented based on type into Agile Development, DevOps, Lean Manufacturing. DataOps combines Agile development, DevOps, and lean manufacturing principles to streamline the development and operation of data analytics. Agile development is a core principle of the DataOps platform, which emphasizes the importance of flexibility and rapid response to changing business needs. The need to adapt quickly changing requirements and market conditions drives the demand for agile development in DataOps platform.

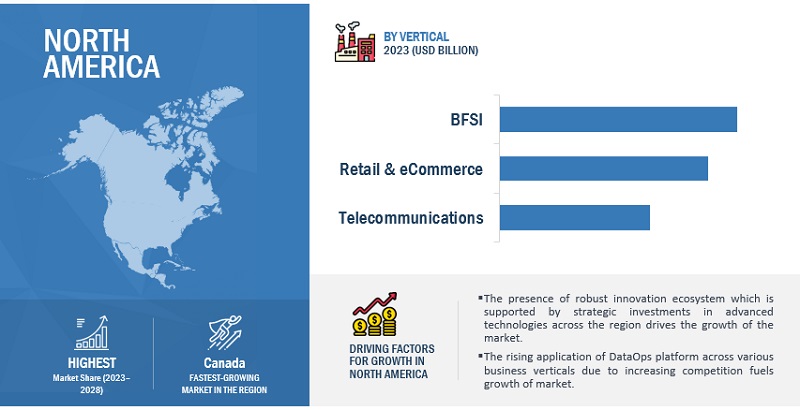

North America to account for the largest market size during the forecast period

North America has emerged as a frontrunner in adopting DataOps platforms, driven by its flourishing technology industry and a steadfast commitment to innovation and digital transformation. The region encompasses major countries such as the United States and Canada, with the United States leading the adoption of DataOps due to the presence of numerous world-renowned technology companies. The key driver behind the widespread adoption of DataOps platforms in North America lies in the region's unwavering emphasis on innovation and digital transformation. North American businesses are continuously seeking novel approaches to foster innovation and gain a competitive edge, recognizing the potent capabilities of DataOps platforms in managing and analyzing data to extract insights that drive growth and spur innovation. Additionally, the thriving technology industry in North America plays a pivotal role in propelling the adoption of DataOps platforms. With many global technology giants headquartered in the region, substantial investments are being made in data infrastructure and analytics capabilities, reinforcing the momentum of DataOps platforms, and enabling businesses to effectively harness the power of data.

Key Market Players

Key players operating in the DataOps platform market across the globe are Microsoft (US), IBM (US), Oracle (US), AWS (US), Informatica (US), Teradata (US), Wipro (India), Accenture (Ireland), SAS Institute (US), Hitachi Vantara (US), DataKitchen (US), Atlan (Singapore), Dataiku (US), Fosfor (India), Databricks (US), StreamSets (US), Talend (US), Collibra (US), Celonis (US), BMC Software (US), Saagie (France), Composable Analytics (US), Tengu.io (Belgium), Unravel Data (US), Monte Carlo Data (US), Census (US), RightData (US), Zaloni (US), Datafold (US), DataOps.live (UK), and K2view (Israel). These DataOps platform vendors have adopted various organic and inorganic strategies to sustain their positions and increase their market shares in the global market.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Forecast units |

USD Billion |

|

Segments covered |

Offering, Type, Deployment Mode, Vertical, and Region |

|

Geographies covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Microsoft (US), IBM (US), Oracle (US), AWS (US), Informatica (US), Teradata (US), Wipro (India), Accenture (Ireland), SAS Institute (US), Hitachi Vantara (US), DataKitchen (US), Atlan (Singapore), Dataiku (US), Fosfor (India), Databricks (US), StreamSets (US), Talend (US), Collibra (US), Celonis (US), BMC Software (US), Saagie (France), Composable Analytics (US), Tengu.io (Belgium), Unravel Data (US), Monte Carlo Data (US), Census (US), RightData (US), Zaloni (US), Datafold (US), DataOps.live (UK), K2view (Israel). |

This research report categorizes the DataOps platform market based on offering, type, deployment mode, vertical, and region.

By Component:

-

Platform

- Data Integration

- Data Quality

- Data Governance

- Master Data Management

- Data Analytics

- Automation

- Collaboration

- Data Visualization

- Others

-

Services

- Consulting Services

- Deployment & integration

- Training, support & maintenance services

By Type:

- Agile Development

- DevOps

- Lean Manufacturing

By Deployment Mode:

-

Cloud

- Public

- Private

- Hybrid

- On-premises

By Vertical:

- BFSI

- Healthcare & life sciences

- Retail & eCommerce

- Manufacturing

- Government and Defense

- Telecommunications

- Transportation, and Logistics

- IT & ITeS

- Media and Entertainment

- Other Verticals

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- ASEAN

- Australia and New Zealand

- India

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of the Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In April 2023, DataOps.live partnered with AWS and joined the AWS Partner Network on the Software Path and obtained the AWS Qualified Software Certification after successfully completing the AWS Foundational Technical Review.

- In March 2023, Blechwarenfabrik Limburg GmbH collaborated with Hitachi Vantara and adopted its Lumada DataOps Platform which includes Pentaho, to achieve real-time, standardized, integrated data analysis for increased sustainability and accelerated production.

- In February 2023, Informatica announced the launch of Cloud Data Integration-Free and PayGo, which is the only free cloud data loading, integration, and ETL/ELT service. This new service targets data practitioners and non-technical users such as in marketing, sales, and revenue operations teams to build data pipelines within minutes.

- In November 2022, Wipro had announced the launch of Data Intelligence Suite speeding up the cloud modernization and data monetization, focused on modernizing data estates, including data stores, pipelines, and visualizations, running on Amazon Web Services. It also provides a dependable and safe way to migrate from existing platforms and fragmented legacy systems to the cloud.

- In June 2022, Teradata announced the general availability and integration of the Teradata Vantage multi-cloud data and analytics platform with Amazon SageMaker. It enables organizations to widely employ advanced analytics to fully leverage their data.

Frequently Asked Questions (FAQ):

What is DataOps platform?

DataOps is a set of practices and technologies that operationalize data management and integration to ensure resiliency and agility in the face of constant change. It helps you tease order and discipline out of the chaos and solve the big challenges to turning data into business value.

DataOps platforms act as command centers for DataOps. These solutions orchestrate people, processes, and technology to deliver a trusted data pipeline to their users. DataOps platforms assemble several types of data management software into an individual and integrated environment.

Which countries are considered in the European region?

The report includes an analysis of the UK, Germany, France, Spain, and Italy in the European region.

Which are key verticals adopting DataOps platform and services?

Key verticals adopting DataOps platform and services include BFSI, retail and ecommerce, telecommunications, manufacturing, healthcare & life sciences, government & defense, IT/ITeS, transportations & logistics, media & entertainment, and other varticals.

Which are the key drivers supporting the market growth for DataOps platform?

The key drivers supporting the market growth for DataOps platform include increased data complexity and volumes, rise in need to gain real-time insights, increased demand for cloud solutions, and extensive focus on data-driven insights.

Who are the key vendors in the market for DataOps platform?

The key vendors operating in the DataOps platform market across the globe are Microsoft (US), IBM (US), Oracle (US), AWS (US), Informatica (US), Teradata (US), Wipro (India), Accenture (Ireland), SAS Institute (US), Hitachi Vantara (US), DataKitchen (US), Atlan (Singapore), Dataiku (US), Fosfor (India), Databricks (US), StreamSets (US), Talend (US), Collibra (US), Celonis (US), BMC Software (US), Saagie (France), Composable Analytics (US), Tengu.io (Belgium), Unravel Data (US), Monte Carlo Data (US), Census (US), RightData (US), Zaloni (US), Datafold (US), DataOps.live (UK), and K2view (Israel).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

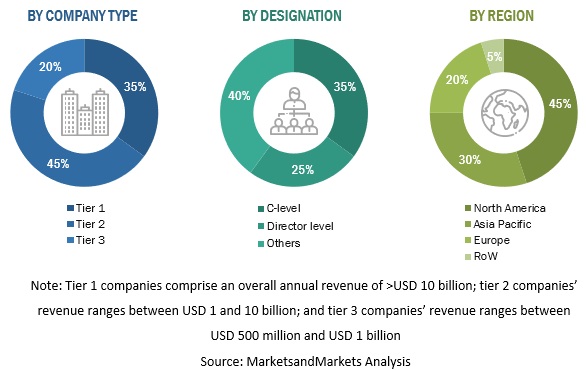

The research study for the DataOps platform market involved the use of extensive secondary sources and directories, as well as various reputed open-source databases, to identify and collect information useful for this technical and market-oriented study. In-depth interviews were conducted with various primary respondents, including key opinion leaders, subject matter experts, high-level executives of multiple companies offering the DataOps platform, and industry consultants to obtain and verify critical qualitative and quantitative information, as well as assess the market prospects and industry trends.

Secondary Research

In the secondary research process, various secondary sources were referred to, to identify and collect information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. The secondary research was mainly used to obtain the key information about the industry’s value chain, the market’s monetary chain, the overall pool of key players, market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides of the DataOps platform market ecosystem were interviewed to obtain qualitative and quantitative information for this study. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various vendors providing DataOps platform offerings, associated service provider, and system integrators operating in the targeted regions. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used for conducting market estimation and forecasting the DataOps platform market and the other dependent submarkets. The bottom-up procedure was used to arrive at the overall market size of the global DataOps platform market, using the revenue of the key companies from their offerings in the market. With data triangulation and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segments.

In the top-down approach, an exhaustive list of all the vendors offering DataOps platform was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. The offerings of each of these vendors were evaluated based on the breadth of solution and service offerings, cloud type, organization size, and verticals. The aggregate of all the revenues of the companies was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

In the bottom-up approach, the adoption rate of the DataOps platform and services among different end-users in key countries with respect to their regions contributing the most to the market share was identified. For cross-validation, the adoption of DataOps platform and services among industries, along with different use cases with respect to their regions, was identified and extrapolated. Weightage was given to use cases identified in different regions for the market size calculation.

All the possible parameters that affect the market covered in the research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. The data is consolidated and added with detailed inputs and analysis from MarketsandMarkets.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service’s website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency, USD, remains constant during the next five years.

- Vendor-side analysis: The market size estimates of associated solutions and services are factored in from the vendor side by assuming an average of licensing and subscription-based models of leading and innovative vendors.

- Demand/end-user analysis: End users operating in verticals across regions are analyzed in terms of market spending on DataOps platform based on some of the key use cases. These factors for the DataOps platform industry per region are separately analyzed, and the average spending was extrapolated with an approximation based on assumed weightage. This factor is derived by averaging various market influencers, including recent developments, regulations, mergers and acquisitions, enterprise/SME adoption, startup ecosystem, IT spending, technology propensity and maturity, use cases, and the estimated number of organizations per region.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation and market breakup procedures were employed, wherever applicable. The overall market size was then used in the top-down procedure to estimate the size of other individual markets via percentage splits of the market segmentation.

Market Definition

DataOps platforms act as command centers for DataOps. These solutions orchestrate people, processes, and technology to deliver a trusted data pipeline to their users. DataOps platforms assemble several types of data management software into an individual and integrated environment.

According to StreamSets, DataOps is a set of practices and technologies that operationalize data management and integration to ensure resiliency and agility in the face of constant change. It helps you tease order and discipline out of the chaos and solve the big challenges to turning data into business value.

Key Stakeholders

- DataOps service providers

- Managed service providers

- Support and maintenance service providers

- System integrators (SIs)/Migration service providers

- Value-added resellers (VARs) and distributors

- Independent software vendors (ISVs)

- Third-party providers

- Technology providers

Report Objectives

- To define, describe, and predict the DataOps platform market, by offering (platform and services), type, deployment mode, organization size, vertical, and region

- To provide detailed information related to major factors, such as drivers, restraints, opportunities, and industry-specific challenges influencing the market growth

- To analyze the micro markets with respect to individual growth trends, prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To analyze opportunities in the market and provide details of the competitive landscape for stakeholders and market leaders

- To forecast the market size of segments for five main regions: North America, Europe, Asia Pacific, the Middle East and Africa, and Latin America

- To profile the key players and comprehensively analyze their market ranking and core competencies

- To analyze competitive developments, such as partnerships, product launches, and mergers and acquisitions, in the market

- To analyze the impact of recession on the DataOps platform market across all the regions

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American market for DataOps platform market

- Further breakup of the European market for market

- Further breakup of the Asia Pacific market for market

- Further breakup of the Latin American market for market

- Further breakup of the Middle East & Africa market for DataOps platform market

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in DataOps Platform Market