Dental Laboratories Market Size by Material (Metal Ceramic, CAD/CAM Material (Zirconia, Glass Ceramic)), Equipment (Milling Equipment, CAD/CAM System, 3D Printing System, Scanner, Furnace), Prosthetics (Bridge, Crown, Veneers, Denture) & Region - Global Forecast to 2027

The global size of dental laboratories market In terms of revenue was estimated to be worth USD 35.0 billion in 2022 and is poised to reach USD 46.5 billion by 2027, growing at a CAGR of 5.9% from 2022 to 2027. The research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market.

The new edition of the report provides an updated product portfolio for the companies profiled in the report. The growth of this market is primarily driven by factors such as the rapid growth in the geriatric population and the associated increase in the prevalence of edentulism, growing dental tourism in emerging markets, the development of technologically advanced solutions, and others. Dental materials and equipment used in the design and creation of products to provide efficient restorations and prostheses are included in the dental laboratories market. Dental indirect restorative materials and lab-side equipment help dental technicians provide better treatment options. The market also includes manufactured and customised products such as crowns and dentures.

To know about the assumptions considered for the study, Request for Free Sample Report

Dental Laboratories Market Dynamics

Driver: Growth in the geriatric population and edentulism cases

The market's demand is being driven by the rise in the elderly population and the number of edentulism cases. The market is expanding as a result of the development of new technologies like CAD/CAM and 3D printing, which make it possible to produce dental prostheses like crowns, bridges, dentures, and veneers that are specifically made for each individual patient. Additionally, the market is expanding as a result of rising demand for cosmetic dental procedures and increased oral hygiene awareness.

Opportunity: Growing demand for cosmetic dental procedures

The rising demand for cosmetic dental procedures is anticipated to significantly expand the global market over the coming years. The introduction of new technologies, such as CAD/CAM systems and 3D printing for dental prostheses, as well as improved access to dental care services and growing oral hygiene awareness are the main drivers of this growth. The market is also being driven by the rising demand for cosmetic dentistry procedures like veneers, crowns, implants, and bridges. Moreover, as more patients choose checkups and preventive treatments, the preventive dentistry trend is fueling market expansion. In addition, it is anticipated that the growing geriatric population and rising disposable incomes in emerging economies will further fuel the market.

Restraint: high cost of dental equipment and materials

A significant market constraint may be the high cost of dental supplies and equipment. Many dental laboratories might not be able to afford the most up-to-date equipment and supplies required to stay competitive. It can be challenging for dental laboratories to invest in the most up-to-date tools and supplies required to produce high-quality work if they lack funding or don't have access to financing. Dental laboratories may also face a sizable financial burden due to the cost of staff training, equipment maintenance and repair, and related expenses. As a result, the market's potential for growth may be constrained by the high cost of dental supplies and equipment.

Challenge: Pricing pressure faced by prominent market players

A significant obstacle is the pricing pressure experienced by well-known market players. Many dental laboratories offer their services at reduced rates in an effort to remain competitive in the market, which has hurt their profit margins. Furthermore, the market's competition is getting more intense as a result of the entry of new players offering inexpensive services, which is further pressuring the established players' pricing strategies. Many significant players are concentrating on boosting their productivity and efficiency as well as broadening their service offerings in order to address this challenge. To stay competitive in the market, they are also implementing a number of strategies, including combining their current operations, forming strategic alliances, and utilizing cutting-edge technology.

Metal-ceramics held the largest share of the dental laboratories industry.

47.4% of the materials market was accounted for by the metal ceramics sector. In comparison to ceramics and other indirect restorative materials, this market segment's high share can be attributed primarily to its strength, durability, resistance to fracture, and high biocompatibility.

Milling equipment accounted for the largest share of the dental laboratories industry.

The dental laboratories market is divided into 3D printing systems, integrated CAD/CAM systems, milling equipment, casting machines, articulators, scanners, and others (curing lights, mixing equipment, waxing equipment, handpiece and rotary systems, hygiene, and maintenance devices). 45.5% of the dental lab market was made up of milling equipment. The aging of the population, the rise in dental tourism in emerging markets, the incidence of dental caries and other periodontal diseases, and the rising number of dental laboratories investing in CAD/CAM technologies are all contributing to the demand for milling equipment.

Crowns accounted for the largest share of the dental laboratories industry.

Veneers, dentures, bridges, crowns, and clear aligners are the different product categories in the dental laboratories market. The market for prosthetics was dominated by crowns, then bridges. Glidewell Dental, National Dentex Corporation, Modern Dental, and Dental Services Group are a few of the major players in the prosthetics market. By prosthetic type, crowns held the largest market share with a 46 percent share. The worldwide demand for dental prosthetics is being driven by the rising number of people who lack teeth.

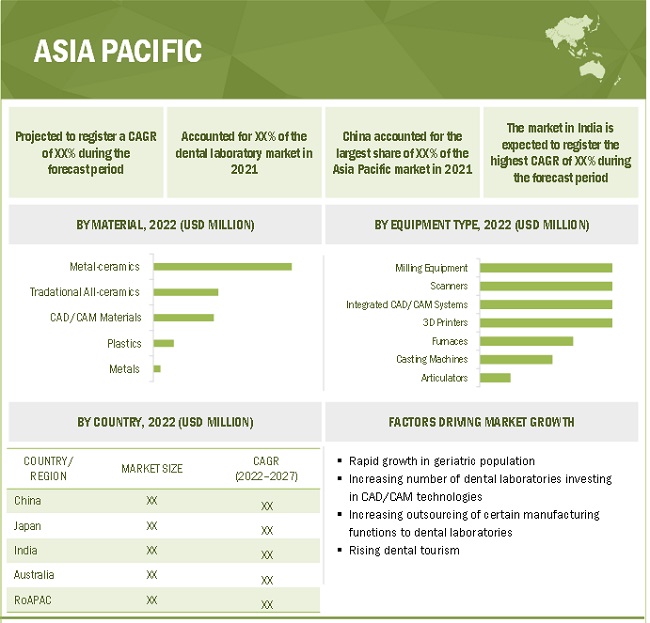

The APAC dental laboratories industry is projected to grow at the highest rate during the forecast period.

Approximately 30% of the global dental laboratories market was in the Asia-Pacific region. Numerous factors, including an aging population, an increase in dental tourism, an increase in the number of dental laboratories, and a rise in the outsourcing of various manufacturing services to the region, are fueling the growth of the APAC market. By 2020, there will be 727 million people worldwide who are 65 or older, according to UN projections. By 2050, there will be 1.5 billion elderly people on the planet. Since this group of people is more likely to experience tooth loss and ailments like cavities and gum disease, demand for dental lab products is predicted to increase. The market is also driven by consumer demand for better aesthetics and the adoption of cutting-edge technology.

To know about the assumptions considered for the study, download the pdf brochure

Prominent players in the dental laboratories market are Dentsply Sirona, Inc. (US), Envista Holdings Corporation (US), 3M Company (US), GC Corporation (Japan), Mitsui Chemicals (Japan), Planmeca Group (Finland), BEGO GmbH & Co, KG (Germany), Ivoclar Vivadent (Liechtenstein), VOCO GmbH (Germany), Shofu Dental Corporation (Japan), VITA Zahnfabrik H. Rauter GmbH & Co. KG (Germany), Kuraray Noritake Dental Inc. (Japan), Amann Girrbach AG (Austria), Schütz Dental GmbH (Germany), Nakanishi Inc. (Japan), COLTENE Holding AG (Switzerland), Institut Straumann AG (Switzerland), A-dec Inc. (US). Stratasys (US and Israel), 3D Systems (US), Formlabs (US), Roland DG Corporation (Japan), SHINING 3D (US), and Zirkonzahn (US).

Scope of the Dental Laboratories Industry

|

Report Metric |

Details |

|

Market Revenue in 2022 |

USD 35.0 billion |

|

Projected Revenue by 2027 |

USD 46.5 billion |

|

Revenue Rate |

Poised to grow at a CAGR of 5.9% |

|

Market Driver |

Growth in geriatric population and edentulism cases |

|

Market Opportunity |

Growing demand for cosmetic dental procedures |

This report categorizes the dental laboratories market to forecast revenue and analyze trends in each of the following submarkets:

By Material

- Metal-Ceramics

- Traditional All-Ceramics

- CAD/CAM Materials

- Plastics

- Metals

By Equipment

- 3D printing systems

- Integrated CAD/CAM systems

- Casting Machines

- Milling Equipment

- Furnaces

- Articulators

- Dental Scanners

- Others

By Prosthetic Type

- Bridges

- Crowns

- Veneers

- Dentures

- Clear Aligners

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- ROE

-

Asia Pacific

- China

- Japan

- India

- Australia

- RoPAC

-

Latin America

- Brazil

- Mexico

- Colombia

- Middle East & Africa

Recent Developments of Dental Laboratories Industry

- National Dentex Corporation Acquires Dental Services of Tennessee: National Dentex Corporation, a leading national network of dental laboratories, announced in February 2021 that it has acquired Dental Services of Tennessee (DST). The acquisition will expand National Dentex’s footprint in the Southeast region of the United States and add new capabilities to its product portfolio.

- Glidewell Acquires Florida-based Dental Lab: Glidewell Laboratories, one of the world’s largest integrated dental companies, announced in March 2021 that it has acquired Citrus Dental Lab, a full-service dental laboratory based in Florida. The acquisition will enable Glidewell to expand its geographic reach and increase its customer base in the southeastern United States.

- 3M Acquires Dental Lab Technology Provider Digital Dental: In April 2021, 3M announced that it has acquired Digital Dental, a developer and provider of software and hardware solutions for dental laboratories and practices. The acquisition will enable 3M to offer an expanded suite of dental lab technology solutions and expand its reach in the dental lab market.

- Patterson Dental Acquires Dental Lab Equipment Manufacturer DMD Solutions: Patterson Dental announced in April 2021 that it has acquired DMD Solutions, a leading manufacturer of dental laboratory equipment. The acquisition will enable Patterson to expand its portfolio of dental lab solutions and provide customers with a more comprehensive range of products and services.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global dental laboratories market?

The global dental laboratories market boasts a total revenue value of USD 46.5 billion by 2027.

What is the estimated growth rate (CAGR) of the global dental laboratories market?

The global dental laboratories market has an estimated compound annual growth rate (CAGR) of 5.9% and a revenue size in the region of USD 35.0 billion in 2022.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 32)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS OF THE STUDY

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

FIGURE 1 GLOBAL DENTAL LABORATORIES MARKET

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

TABLE 1 STANDARD CURRENCY CONVERSION RATES

1.5 LIMITATIONS

1.6 STAKEHOLDERS

1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 37)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 SECONDARY RESEARCH

2.1.3 PRIMARY RESEARCH

FIGURE 3 PRIMARY SOURCES

2.1.3.1 Key data from primary sources

FIGURE 4 INSIGHTS FROM INDUSTRY EXPERTS

2.1.3.2 Breakdown of primary sources

FIGURE 5 BREAKDOWN OF PRIMARY INTERVIEWS: SUPPLY-SIDE AND DEMAND-SIDE PARTICIPANTS

FIGURE 6 PRIMARY SOURCES

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

FIGURE 7 DENTAL LABORATORIES INDUSTRY (INDIRECT RESTORATIVE MATERIALS): BOTTOM-UP APPROACH

FIGURE 8 GLOBAL MARKET (EQUIPMENT): BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

FIGURE 9 TOP-DOWN APPROACH

FIGURE 10 SUPPLY-SIDE MATERIAL AND EQUIPMENT MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 11 SUPPLY-SIDE DENTAL PROSTHETICS MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 12 CAGR PROJECTIONS: SUPPLY-SIDE ANALYSIS

FIGURE 13 CAGR PROJECTIONS FROM THE ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES OF THE DENTAL LABORATORIES MARKET (2022–2027)

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 14 DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ESTIMATION

2.5 ASSUMPTIONS FOR THE STUDY

2.6 RISK ASSESSMENT

TABLE 2 RISK ASSESSMENT: DENTAL LABORATORIES INDUSTRY

2.7 COVID-19 HEALTH ASSESSMENT

2.8 COVID-19 ECONOMIC ASSESSMENT

2.9 ASSESSMENT OF THE IMPACT OF COVID-19 ON THE ECONOMIC SCENARIO

FIGURE 15 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 16 RECOVERY SCENARIO OF THE GLOBAL ECONOMY

3 EXECUTIVE SUMMARY (Page No. - 55)

FIGURE 17 DENTAL LABORATORIES MARKET, BY MATERIAL, 2022 VS. 2027 (USD MILLION)

FIGURE 18 CAD/CAM MATERIALS MARKET, BY TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 19 GLOBAL MARKET, BY EQUIPMENT, 2022 VS. 2027 (USD MILLION)

FIGURE 20 GLOBAL DENTAL LAB NETWORK MARKET, BY PROSTHETIC TYPE, 2022 VS. 2027 (USD MILLION)

FIGURE 21 GEOGRAPHICAL SNAPSHOT OF THE DENTAL LABORATORIES INDUSTRY

4 PREMIUM INSIGHTS (Page No. - 59)

4.1 DENTAL LABORATORIES MARKET OVERVIEW

FIGURE 22 INCREASING NUMBER OF DENTAL LABORATORIES INVESTING IN CAD/ CAM TECHNOLOGIES TO DRIVE MARKET GROWTH

4.2 GLOBAL MARKET, BY EQUIPMENT TYPE (2022–2027)

FIGURE 23 MILLING EQUIPMENT TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD (2022–2027)

4.3 ASIA PACIFIC: MARKET, BY MATERIAL AND COUNTRY (2021)

FIGURE 24 CHINA ACCOUNTED FOR THE LARGEST SHARE OF THE APAC MARKET IN 2021

4.4 GLOBAL MARKET: GEOGRAPHIC MIX

FIGURE 25 INDIA TO REGISTER THE HIGHEST CAGR DURING THE FORECAST PERIOD

4.5 DENTAL LABORATORIES MARKET: DEVELOPED VS. DEVELOPING MARKETS (USD MILLION)

FIGURE 26 DEVELOPING MARKETS TO REGISTER A HIGHER GROWTH RATE DURING THE FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 64)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 27 DENTAL LABORATORIES MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growth in geriatric population and edentulism cases

TABLE 3 INCREASE IN GERIATRIC POPULATION, 2019 VS 2050

TABLE 4 INCREASE IN THE GERIATRIC POPULATION, 2005–2020

5.2.1.2 Development of technologically advanced solutions

TABLE 5 TECHNOLOGICAL ADVANCEMENTS IN LAB EQUIPMENT & INDIRECT RESTORATIVE MATERIALS

5.2.1.3 Rising incidence of dental caries and other periodontal diseases

5.2.1.4 Increasing outsourcing of manufacturing functions to dental laboratories

5.2.1.5 Increasing number of dental laboratories investing in CAD/CAM

5.2.1.6 Growing dental tourism

TABLE 6 AVERAGE COSTS FOR SEVERAL COMMON PROCEDURES IN EACH OF THE TOP 10 DENTAL TOURISM DESTINATIONS

TABLE 7 COUNTRY-WISE DENTAL TREATMENT COST COMPARISON (USD)

5.2.1.7 Increasing dental expenditure along with growth in disposable incomes

TABLE 8 PER CAPITA NATIONAL INCOME (USD)

5.2.2 RESTRAINTS

5.2.2.1 High cost of dental equipment and materials

TABLE 9 AVERAGE COST OF EQUIPMENT

5.2.2.2 Increasing surgical costs and lack of access to reimbursement

TABLE 10 AVERAGE COST OF DENTAL SURGERIES

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for cosmetic dental procedures

5.2.4 CHALLENGES

5.2.4.1 Pricing pressure faced by prominent market players

5.2.4.2 Dearth of skilled lab professionals

5.3 INDUSTRY TRENDS

5.3.1 DIGITALIZATION OF LABORATORIES

FIGURE 28 PENETRATION OF DIGITAL TECHNOLOGIES IN US DENTAL LABS

FIGURE 29 WORKFLOW COMPARISON: TRADITIONAL VS. DIGITAL DENTISTRY

5.3.2 INCREASING ADOPTION OF 3D PRINTING IN DENTAL LABS

5.3.3 FOCUS ON ORGANIC GROWTH STRATEGIES

TABLE 11 NUMBER OF NEW PRODUCT LAUNCHES, BY KEY PLAYER (2019–2021)

5.4 ECOSYSTEM/MARKET MAP

TABLE 12 DENTAL LABORATORIES INDUSTRY: ECOSYSTEM

5.5 PRICING ANALYSIS

TABLE 13 PRICING ANALYSIS OF DENTAL LABORATORY EQUIPMENT (2021)

TABLE 14 PRICING ANALYSIS OF DENTAL LABORATORY MATERIALS (2021)

5.6 ECOSYSTEM ANALYSIS

5.7 PATENT ANALYSIS

5.7.1 PATENT PUBLICATION TRENDS FOR DENTAL LABORATORY

FIGURE 30 PATENT PUBLICATION TRENDS (2011–2021)

FIGURE 31 CAD/CAM SYSTEMS PATENT PUBLICATION TRENDS (2011–2021)

5.7.2 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

FIGURE 32 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR DENTAL LABORATORY PATENTS (JANUARY 2011–FEBRUARY 2022)

FIGURE 33 TOP APPLICANTS & OWNERS (COMPANIES/INSTITUTIONS) FOR CAD/CAM SYSTEM PATENTS (JANUARY 2011–FEBRUARY 2022)

FIGURE 34 TOP APPLICANT COUNTRIES/REGIONS FOR DENTAL LAB PATENTS (JANUARY 2011–FEBRUARY 2022)

FIGURE 35 TOP APPLICANT COUNTRIES/REGIONS FOR CAD/CAM SYSTEM PATENTS (JANUARY 2011–FEBRUARY 2022)

5.8 VALUE CHAIN ANALYSIS

FIGURE 36 DENTAL LABORATORIES INDUSTRY: VALUE CHAIN ANALYSIS

5.9 SUPPLY CHAIN ANALYSIS

FIGURE 37 SUPPLY CHAIN ANALYSIS

5.10 PORTER’S FIVE FORCES ANALYSIS

TABLE 15 RESTORATIVE DENTISTRY MARKET: PORTER’S FIVE FORCES ANALYSIS

5.10.1 THREAT FROM NEW ENTRANTS

5.10.2 THREAT FROM SUBSTITUTES

5.10.3 BARGAINING POWER OF SUPPLIERS

5.10.4 BARGAINING POWER OF BUYERS

5.10.5 INTENSITY OF COMPETITIVE RIVALRY

5.11 KEY STAKEHOLDERS & BUYING CRITERIA

5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 38 INFLUENCE OF STAKEHOLDER IN BUYING PROCESS FOR DENTAL LABORATORIES PRODUCTS

TABLE 16 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS FOR PRODUCT SEGMENTS (%)

5.12 KEY BUYING CRITERIA BY END USERS

FIGURE 39 BUYING CRITERIA BY END USERS

TABLE 17 KEY BUYING CRITERIA FOR PRODUCT SEGMENTS

5.13 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 18 DENTAL LABORATORIES INDUSTRY: DETAILED LIST OF CONFERENCES & EVENTS

5.14 TRENDS & DISRUPTIONS AFFECTING CUSTOMERS’ BUSINESS

FIGURE 40 GLOBAL MARKET: TRENDS & DISRUPTIONS AFFECTING CUSTOMERS’ BUSINESS

5.15 TRADE ANALYSIS

TABLE 19 US DENTAL EQUIPMENT AND SUPPLIES, EXPORTS 2013–2018 (THOUSANDS)

5.16 REGULATORY LANDSCAPE

5.16.1 US

5.16.2 EUROPEAN UNION

5.16.3 UK

5.16.4 CHINA

5.17 COVID-19 IMPACT ON THE DENTAL LABORATORIES INDUSTRY

6 DENTAL LABORATORIES MARKET, BY MATERIAL (Page No. - 96)

6.1 INTRODUCTION

TABLE 20 GLOBAL MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 21 GLOBAL DENTAL LAB NETWORK MARKET FOR MATERIALS, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.1 METAL-CERAMICS

6.1.1.1 Poor esthetics of metal-ceramics may restrain the growth of this market in the forecast period

TABLE 22 METAL-CERAMICS OFFERED BY KEY MARKET PLAYERS

TABLE 23 DENTAL METAL-CERAMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.2 TRADITIONAL ALL-CERAMICS

6.1.2.1 Demand for traditional all-ceramics has increased owing to their excellent aesthetic properties, high strength, and durability BY KEY MARKET PLAYERS

TABLE 24 TRADITIONAL ALL-CERAMIC RESTORATIVE MATERIALS OFFERED

TABLE 25 DENTAL TRADITIONAL ALL-CERAMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.3 CAD/CAM MATERIALS

TABLE 26 CAD/CAM MATERIALS OFFERED BY KEY MARKET PLAYERS

TABLE 27 DENTAL CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 28 DENTAL CAD/CAM MATERIALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.3.1 Zirconia

6.1.3.1.1 Zirconia holds the largest share of the CAD/CAM materials segment

TABLE 29 ZIRCONIA MATERIALS OFFERED BY KEY MARKET PLAYERS

TABLE 30 DENTAL ZIRCONIA MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.3.2 Glass-ceramics

6.1.3.2.1 Glass-ceramics market has seen the development of stronger, tougher materials

TABLE 31 DENTAL GLASS-CERAMICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.3.3 Lithium disilicate

6.1.3.3.1 Lithium disilicate to overtake the glass-ceramics market by 2027

TABLE 32 DENTAL LITHIUM DISILICATE MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.3.4 Other CAD/CAM materials

TABLE 33 OTHER CAD/CAM MATERIALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.4 PLASTICS

6.1.4.1 High resistance and flexibility of thermoplastics support market growth

TABLE 34 PLASTIC MATERIALS OFFERED BY KEY MARKET PLAYERS

TABLE 35 DENTAL PLASTICS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

6.1.5 METALS

6.1.5.1 Anti-leakage properties drive the use of metals in dentistry

TABLE 36 METAL MATERIALS OFFERED BY KEY MARKET PLAYERS

TABLE 37 DENTAL METALS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7 DENTAL LABORATORIES MARKET, BY EQUIPMENT (Page No. - 113)

7.1 INTRODUCTION

TABLE 38 GLOBAL MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 39 GLOBAL MARKET FOR EQUIPMENT, BY COUNTRY, 2020–2027 (USD MILLION)

7.2 MILLING EQUIPMENT

7.2.1 INCREASING DEMAND TO PRODUCE DENTAL RESTORATIVES RAPIDLY AND RISING ADOPTION OF CAD/CAM DRIVE MARKET GROWTH

TABLE 40 DENTAL MILLING EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 41 DENTAL MILLING EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 DENTAL SCANNERS

7.3.1 RISING DEMAND FOR DIGITAL DENTAL PRODUCTS AND INCREASING EFFORTS TO DELIVER FASTER TREATMENT WILL DRIVE GROWTH

TABLE 42 DENTAL SCANNERS OFFERED BY KEY MARKET PLAYERS

TABLE 43 DENTAL SCANNERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 3D PRINTING SYSTEMS

7.4.1 GROWING DEMAND FOR COSMETIC DENTISTRY AND PREVENTIVE DENTAL CARE TO FUEL THE MARKET FOR 3D PRINTING SYSTEMS

TABLE 44 3D PRINTING SYSTEMS OFFERED BY KEY MARKET PLAYERS

TABLE 45 DENTAL 3D PRINTING SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 INTEGRATED CAD/CAM SYSTEMS

7.5.1 INCREASING ADOPTION OF CAD/CAM SYSTEMS IN DENTAL LABORATORIES WILL DRIVE THE MARKET

TABLE 46 INTEGRATED CAD/CAM SYSTEMS OFFERED BY KEY MARKET PLAYERS

TABLE 47 DENTAL INTEGRATED CAD/CAM SYSTEMS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 CASTING MACHINES

7.6.1 RISING DEMAND FOR CUSTOMIZED PROSTHETICS AND COSMETIC DENTISTRY TO FUEL THE GROWTH OF THE CASTING MACHINES MARKET

TABLE 48 CASTING DEVICES OFFERED BY KEY MARKET PLAYERS

TABLE 49 DENTAL CASTING MACHINES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.7 FURNACES

7.7.1 TECHNOLOGICAL INNOVATIONS IN DENTAL FURNACES WILL ENSURE SUSTAINED END-USER DEMAND

TABLE 50 FURNACES OFFERED BY KEY MARKET PLAYERS

TABLE 51 DENTAL FURNACES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.8 ARTICULATORS

7.8.1 ARTICULATORS ARE PRICED LOWER THAN OTHER CAD/CAM EQUIPMENT

TABLE 52 DENTAL ARTICULATORS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.9 OTHER DENTAL LABORATORY EQUIPMENT

TABLE 53 LIGHT-CURING EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 54 OTHER EQUIPMENT OFFERED BY KEY MARKET PLAYERS

TABLE 55 OTHER DENTAL LABORATORY EQUIPMENT MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE (Page No. - 130)

8.1 INTRODUCTION

TABLE 56 GLOBAL DENTAL LAB NETWORK MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

TABLE 57 GLOBAL MARKET FOR PROSTHETICS, BY COUNTRY, 2020–2027 (USD MILLION)

8.2 CROWNS

8.2.1 GROWING GERIATRIC POPULATION AND THE RISING ADOPTION OF ADVANCED DENTISTRY TECHNOLOGIES WILL DRIVE THE MARKET

TABLE 58 CROWNS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 BRIDGES

8.3.1 RISING AWARENESS REGARDING COSMETIC DENTISTRY DRIVES THE BRIDGES MARKET

TABLE 59 BRIDGES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 DENTURES

8.4.1 EMPHASIS ON PHYSICAL APPEARANCE AMONG THE GERIATRIC POPULATION HAS AUGMENTED THE DEMAND FOR DENTURES

TABLE 60 DENTURES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.5 VENEERS

8.5.1 THE RISING DEMAND FOR COSMETIC DENTISTRY AND PREVENTIVE DENTAL CARE IS EXPECTED TO FURTHER FUEL THE GROWTH OF THE VENEERS MARKET

TABLE 61 VENEERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8.6 CLEAR ALIGNERS

8.6.1 INCREASING PREVALENCE OF DENTAL MALOCCLUSION AND MISALIGNMENT TO DRIVE DEMAND FOR ALIGNERS

TABLE 62 CLEAR ALIGNERS MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9 DENTAL LABORATORIES MARKET, BY REGION (Page No. - 138)

9.1 INTRODUCTION

FIGURE 41 DENTAL LABORATORIES INDUSTRY: GEOGRAPHIC SNAPSHOT

TABLE 63 GLOBAL MARKET, BY REGION, 2020–2027 (USD MILLION)

9.2 EUROPE

FIGURE 42 EUROPE: DENTAL LABORATORIES MARKET SNAPSHOT

TABLE 64 EUROPE: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 66 EUROPE: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 68 EUROPE: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.2.1 GERMANY

9.2.1.1 Germany is the largest market for dental lab equipment and products in Europe

FIGURE 43 GERMANY: DENTAL EXPENDITURE IN GERMANY 2010-2019 (IN MILLION USD)

TABLE 69 GERMANY: MACROECONOMIC INDICATORS

TABLE 70 GERMANY: MAJOR LABORATORIES IN GERMANY

TABLE 71 GERMANY: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 72 GERMANY: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 73 GERMANY: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 74 GERMANY: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.2.2 ITALY

9.2.2.1 Rise of local players will drive market growth in Italy

TABLE 75 ITALY: MACROECONOMIC INDICATORS

TABLE 76 ITALY: MAJOR DENTAL LABORATORIES

TABLE 77 ITALY: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 78 ITALY: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 79 ITALY: DENTAL LAB NETWORK MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 80 ITALY: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.2.3 SPAIN

9.2.3.1 Growing number of dentists and labs in the country will drive the growth of the dental laboratories market

TABLE 81 SPAIN: MACROECONOMIC INDICATORS

TABLE 82 SPAIN: MAJOR DENTAL LABORATORIES

TABLE 83 SPAIN: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 84 SPAIN: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 85 SPAIN: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 86 SPAIN: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.2.4 FRANCE

9.2.4.1 Increase in the adoption of CAD/CAM systems in the country will drive the growth in the market

TABLE 87 FRANCE: MACROECONOMIC INDICATORS

TABLE 88 FRANCE: MAJOR DENTAL LABORATORIES

TABLE 89 FRANCE: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 90 FRANCE: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 91 FRANCE: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 92 FRANCE: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.2.5 UK

9.2.5.1 The increasing incidence of dental disorders will drive demand for dental lab equipment

TABLE 93 UK: MACROECONOMIC INDICATORS

TABLE 94 UK: MAJOR DENTAL LABORATORIES

TABLE 95 UK: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 96 UK: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 97 UK: DENTAL LABORSTORIES MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 98 UK: DENTAL LAB NETWORK MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.2.6 REST OF EUROPE

TABLE 99 ROE: NUMBER OF DENTAL LABORATORIES, BY COUNTRY

TABLE 100 ROE: MAJOR DENTAL LABORATORIES

TABLE 101 ROE: DENTAL LABORATORIES INDUSTRY, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 102 ROE: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 103 ROE: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 104 ROE: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.3 NORTH AMERICA

TABLE 105 NORTH AMERICA: DENTAL LABORATORIES MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 106 NORTH AMERICA: MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 107 NORTH AMERICA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 108 NORTH AMERICA: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 109 NORTH AMERICA: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.3.1 US

9.3.1.1 US holds the largest share of the North American market

FIGURE 44 US: RISE IN DENTAL EXPENDITURE, 2010–2019

TABLE 110 US: MACROECONOMIC INDICATORS

TABLE 111 US: MAJOR DENTAL LABORATORIES

TABLE 112 US: DENTAL LABORATORIES INDUSTRY, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 113 US: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 114 US: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 115 US: DENTAL LAB NETWORK MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.3.2 CANADA

9.3.2.1 Rising incidence of dental caries to further fuel the growth of the dental labs market in the country

TABLE 116 CANADA: MACROECONOMIC INDICATORS

TABLE 117 CANADA: MAJOR DENTAL LABORATORIES

TABLE 118 CANADA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 119 CANADA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 120 CANADA: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 121 CANADA: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.4 ASIA PACIFIC

FIGURE 45 ASIA PACIFIC: DENTAL LABORATORIES MARKET SNAPSHOT

TABLE 122 ASIA PACIFIC: MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 124 ASIA PACIFIC: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.4.1 CHINA

9.4.1.1 China holds the largest share of the APAC market

TABLE 127 CHINA: MACROECONOMIC INDICATORS

TABLE 128 CHINA: MAJOR LABORATORIES

TABLE 129 CHINA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 130 CHINA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 131 CHINA: DENTAL LAB NETWORK MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 132 CHINA: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.4.2 JAPAN

9.4.2.1 Growing adoption of CAD/CAM technologies will drive the market

TABLE 133 JAPAN: MACROECONOMIC INDICATORS

TABLE 134 JAPAN: MAJOR LABORATORIES

TABLE 135 JAPAN: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 136 JAPAN: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 137 JAPAN: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 138 JAPAN: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.4.3 INDIA

9.4.3.1 The increase in the dental tourism in the country will drive the growth of the dental laboratories market

TABLE 139 INDIA VS. US, UK, AND AUSTRALIA: DENTAL TREATMENT COST COMPARISON (USD)

TABLE 140 INDIA: MACROECONOMIC INDICATORS

TABLE 141 INDIA: MAJOR DENTAL LABORATORIES

TABLE 142 INDIA: DENTAL LABORATORIES INDUSTRY, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 143 INDIA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 144 INDIA: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 145 INDIA: DENTAL LABORATORIES MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.4.4 AUSTRALIA

9.4.4.1 Growing uptake of low-priced or discounted dental products to drive the growth of the dental laboratories market

TABLE 146 AUSTRALIA: ORAL HEALTH STATUS OF CHILDREN AND ADULTS

TABLE 147 AUSTRALIA: KEY DENTAL LABORATORIES

TABLE 148 AUSTRALIA: DENTAL LABORATORIES INDUSTRY, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 149 AUSTRALIA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 150 AUSTRALIA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 151 AUSTRALIA: DENTAL LAB NETWORK MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.4.5 REST OF ASIA PACIFIC

TABLE 152 ROAPAC: PERCENTAGE OF EDENTULOUS INDIVIDUALS IN GERIATRIC POPULATION AGED 65 AND ABOVE (2019)

TABLE 153 ROAPAC: KEY DENTAL LABORATORIES

TABLE 154 ROAPAC: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 155 ROAPAC: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 156 ROAPAC: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 157 ROAPAC: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.5 LATIN AMERICA

TABLE 158 LATIN AMERICA: DENTAL LABORATORIES INDUSTRY, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 159 LATIN AMERICA: MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 160 LATIN AMERICA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 161 LATIN AMERICA: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 162 LATIN AMERICA: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.5.1 BRAZIL

9.5.1.1 Brazil holds the largest share of the LATAM market

TABLE 163 BRAZIL: GERIATRIC POPULATION BETWEEN 1920 AND 2040

TABLE 164 BRAZIL: KEY DENTAL LABORATORIES

TABLE 165 BRAZIL: DENTAL LABORATORIES INDUSTRY, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 166 BRAZIL: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 167 BRAZIL: DENTAL LABORATORIES MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 168 BRAZIL: DENTAL LAB NETWORK MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.5.2 MEXICO

9.5.2.1 Improving healthcare infrastructure and availability of skilled dentists will support market growth

TABLE 169 US VS. MEXICO: DENTAL PROCEDURE COST COMPARISON

TABLE 170 MEXICO: KEY DENTAL LABORATORIES

TABLE 171 MEXICO: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 172 MEXICO: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 173 MEXICO: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 174 MEXICO: MARKET, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.5.3 COLOMBIA

9.5.3.1 Presence of prominent dental laboratories to drive the Colombian market

TABLE 175 COLOMBIA: KEY DENTAL LABORATORIES

TABLE 176 COLOMBIA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 177 COLOMBIA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 178 COLOMBIA: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 179 COLOMBIA: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.5.4 REST OF LATIN AMERICA

TABLE 180 ROLA: GERIATRIC POPULATION, BY COUNTRY

TABLE 181 ROLA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 182 ROLA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 183 ROLA: DENTAL LAB NETWORK MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 184 ROLA: DENTAL LABORATORIES INDUSTRY, BY PROSTHETIC TYPE, 2020–2027 (USD MILLION)

9.6 MIDDLE EAST AND AFRICA

9.6.1 GROWING AWARENESS OF DENTAL HYGIENE TO DRIVE MARKET GROWTH

TABLE 185 MEA: MAJOR DENTAL LABORATORIES

TABLE 186 MIDDLE EAST & AFRICA: DENTAL LABORATORIES MARKET, BY MATERIAL, 2020–2027 (USD MILLION)

TABLE 187 MIDDLE EAST & AFRICA: CAD/CAM MATERIALS MARKET, BY TYPE, 2020–2027 (USD MILLION)

TABLE 188 MIDDLE EAST & AFRICA: MARKET, BY EQUIPMENT TYPE, 2020–2027 (USD MILLION)

TABLE 189 MIDDLE EAST & AFRICA: MARKET, BY PROSTHETIC TYPE 2020–2027 (USD MILLION)

10 COMPETITIVE LANDSCAPE (Page No. - 212)

10.1 OVERVIEW

FIGURE 46 KEY DEVELOPMENTS BY LEADING PLAYERS IN THE DENTAL LABORATORIES MARKET, JANUARY 2018–APRIL 2022

10.2 KEY PLAYER STRATEGY/RIGHT TO WIN

10.3 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS

FIGURE 47 REVENUE SHARE ANALYSIS OF THE TOP MARKET PLAYERS IN THE DENTAL LABORATORIES (MATERIALS AND EQUIPMENT) MARKET

TABLE 190 DENTAL LAB MARKET, BY INDIRECT RESTORATIVE MATERIALS: DEGREE OF COMPETITION

TABLE 191 GLOBAL MARKET, BY EQUIPMENT: DEGREE OF COMPETITION

10.4 MARKET RANKING ANALYSIS

FIGURE 48 RANK OF COMPANIES IN THE GLOBAL DENTAL LAB MARKET, BY MATERIAL AND EQUIPMENT (2021)

10.5 COMPETITIVE LEADERSHIP MAPPING

10.5.1 STARS

10.5.2 EMERGING LEADERS

10.5.3 PERVASIVE PLAYERS

10.5.4 PARTICIPANTS

FIGURE 49 DENTAL LAB MARKET: COMPETITIVE LEADERSHIP MAPPING (2021)

10.6 COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

10.6.1 PROGRESSIVE COMPANIES

10.6.2 STARTING BLOCKS

10.6.3 RESPONSIVE COMPANIES

10.6.4 DYNAMIC COMPANIES

FIGURE 50 DENTAL LABORATORIES MARKET: COMPETITIVE LEADERSHIP MAPPING FOR START-UPS/SMES (2021)

10.7 COMPETITIVE BENCHMARKING

TABLE 192 GLOBAL MARKET: DETAILED LIST OF KEY START-UPS/SMES

TABLE 193 GLOBAL MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES]

10.8 COMPANY FOOTPRINT

TABLE 194 MARKET, BY MATERIAL: COMPANY FOOTPRINT (KEY PLAYERS)

TABLE 195 GLOBAL MARKET, BY EQUIPMENT TYPE: COMPANY FOOTPRINT (KEY PLAYERS)

TABLE 196 COMPANY REGIONAL FOOTPRINT (20 COMPANIES)

10.9 DENTAL LAB MARKET: R&D EXPENDITURE

FIGURE 51 R&D EXPENDITURE OF KEY PLAYERS IN THE MARKET (2020 VS. 2021)

10.10 COMPETITIVE SITUATION AND TRENDS

10.10.1 PRODUCT LAUNCHES

TABLE 197 DENTAL LAB MARKET: PRODUCT LAUNCHES

10.10.2 DEALS

TABLE 198 GLOBAL MARKET: KEY DEALS

10.10.3 OTHER DEVELOPMENTS

TABLE 199 DENTAL LABORATORIES MARKET: OTHER DEVELOPMENTS

11 COMPANY PROFILES (Page No. - 229)

11.1 KEY PLAYERS

(Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments)*

11.1.1 DENTSPLY SIRONA, INC.

TABLE 200 DENTSPLY SIRONA, INC.: BUSINESS OVERVIEW

FIGURE 52 DENTSPLY SIRONA, INC.: COMPANY SNAPSHOT (2021)

11.1.2 ENVISTA HOLDINGS CORPORATION

TABLE 201 ENVISTA HOLDINGS CORPORATION: BUSINESS OVERVIEW

FIGURE 53 ENVISTA HOLDINGS CORPORATION: COMPANY SNAPSHOT (2021)

11.1.3 3M COMPANY

TABLE 202 3M COMPANY: BUSINESS OVERVIEW

FIGURE 54 3M COMPANY: COMPANY SNAPSHOT (2021)

11.1.4 IVOCLAR VIVADENT AG

TABLE 203 IVOCLAR VIVADENT AG: BUSINESS OVERVIEW

11.1.5 PLANMECA OY

TABLE 204 PLANMECA OY: BUSINESS OVERVIEW

11.2 OTHER PLAYERS

11.2.1 GC CORPORATION

TABLE 205 GC CORPORATION: BUSINESS OVERVIEW

11.2.2 MITSUI CHEMICALS, INC.

TABLE 206 MITSUI CHEMICALS, INC.: BUSINESS OVERVIEW

FIGURE 55 MITSUI CHEMICALS, INC.: COMPANY SNAPSHOT (2021)

11.2.3 KURARAY NORITAKE DENTAL, INC.

TABLE 207 KURARAY NORITAKE DENTAL, INC.: BUSINESS OVERVIEW

FIGURE 56 KURARAY NORITAKE DENTAL, INC.: COMPANY SNAPSHOT (2021)

11.2.4 VOCO GMBH

TABLE 208 VOCO GMBH: BUSINESS OVERVIEW

11.2.5 AMANN GIRRBACH AG

TABLE 209 AMANN GIRRBACH AG: BUSINESS OVERVIEW

11.2.6 BEGO GMBH & CO. KG

TABLE 210 BEGO GMBH & CO. KG: BUSINESS OVERVIEW

11.2.7 SCHÜTZ DENTAL GMBH

TABLE 211 SCHÜTZ DENTAL GMBH: BUSINESS OVERVIEW

11.2.8 INSTITUT STRAUMANN AG

TABLE 212 INSTITUT STRAUMANN AG: BUSINESS OVERVIEW

FIGURE 57 INSTITUT STRAUMANN AG: COMPANY SNAPSHOT (2021)

11.2.9 VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG

TABLE 213 VITA ZAHNFABRIK H. RAUTER GMBH & CO. KG: BUSINESS OVERVIEW

11.2.10 COLTENE GROUP

TABLE 214 COLTENE GROUP: BUSINESS OVERVIEW

FIGURE 58 COLTENE GROUP: COMPANY SNAPSHOT (2021)

11.2.11 SHOFU INC.

TABLE 215 SHOFU INC.: BUSINESS OVERVIEW

FIGURE 59 SHOFU INC.: COMPANY SNAPSHOT (2021)

11.2.12 3D SYSTEMS, INC.

TABLE 216 3D SYSTEMS, INC.: BUSINESS OVERVIEW

FIGURE 60 3D SYSTEMS, INC.: COMPANY SNAPSHOT (2021)

11.2.13 STRATASYS

TABLE 217 STRATASYS: BUSINESS OVERVIEW

FIGURE 61 STRATASYS: COMPANY SNAPSHOT (2021)

11.2.14 NAKANISHI INC.

TABLE 218 NAKANISHI INC.: BUSINESS OVERVIEW

11.2.15 A-DEC INC.

TABLE 219 A-DEC INC.: BUSINESS OVERVIEW

11.2.16 ZIRKONZAHN GMBH

TABLE 220 ZIRKONZAHN GMBH: COMPANY OVERVIEW

11.2.17 SMART DENT

TABLE 221 SMART DENT: COMPANY OVERVIEW

11.2.18 SHINING 3D

TABLE 222 SHINING 3D: COMPANY OVERVIEW

11.2.19 ROLAND DG CORPORATION

TABLE 223 ROLAND DG: BUSINESS OVERVIEW

FIGURE 62 ROLAND DG: COMPANY SNAPSHOT (2020)

11.2.20 FORMLABS

TABLE 224 FORMLABS: COMPANY OVERVIEW

*Business Overview, Products/Services/Solutions Offered, MnM View, Key Strengths and Right to Win, Strategic Choices Made, Weaknesses and Competitive Threats, Recent Developments might not be captured in case of unlisted companies.

12 APPENDIX (Page No. - 291)

12.1 DISCUSSION GUIDE

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

12.3 AVAILABLE CUSTOMIZATIONS

12.4 RELATED REPORTS

12.5 AUTHOR DETAILS

This research study involved the extensive use of secondary sources, directories, and databases (such as D&B Hoovers, Bloomberg Businessweek, and Factiva) to identify and collect information useful to the study. Primary sources were several industry experts from core and related industries and preferred suppliers, manufacturers, distributors, service providers, and technology developers. Primary sources also included standard and certification organizations from companies and organizations related to all segments of this industry’s value chain.

Secondary Research

This research study involved widespread secondary sources; directories; databases such as D&B, Bloomberg Business, and Factiva; white papers; annual reports; and companies’ house documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the dental laboratories market. It was also used to obtain important information about the top players, market classification and segmentation according to industry trends to the bottom-most level, geographic markets, technology perspectives, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research. These secondary sources include World Health Organization (WHO), FDI World Dental Federation, International Federation of Endodontic Association (IFEA), National Dental Association (NDA), American Dental Association (ADA), Canadian Dental Association (CDA), Association for Dental Education in Europe (ADEE), European Association of Dental Public Health (EADPH), European Society of Cosmetic Dentistry (ESCD), European Academy of Esthetic Dentistry (EAED), British Dental Association (BDA), French Dental Association (FDA) (Association Dentaire Française), Asia Pacific Dental Federation (APDF), Japan Dental Association (JDA), Australian Dental Prosthetics Association (ADPA), Indian Dental Association (IDA), 3D Printing Association Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

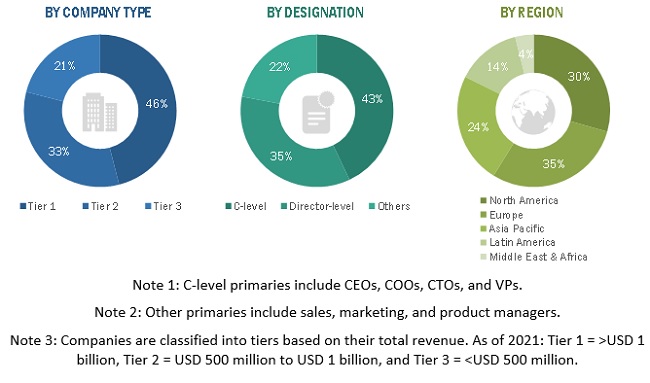

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the dental laboratories market. The primary sources from the demand side include dental laboratories, dental lab groups, laboratory technicians, dental lab directors, traditional laboratories, and digital laboratories. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Given below is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches have been used to estimate and validate the size of the dental laboratories market and other dependent submarkets.

The research methodology used to estimate the market size includes the following details:

- The market value of indirect restorative materials such as metal-ceramics, traditional all-ceramics, CAD/CAM materials, plastics, and metals has been extracted from the repository and validated through secondary and primary research.

- Dental laboratory equipment market shares have been extracted from the repository and validated through secondary and primary research.

- The market shares of the prosthetic type segments have been extracted from the repository and validated through secondary and primary research.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives.

- The bottom-up approach has been applied to different regions and other segments of the market. All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

- This data is consolidated and added with detailed inputs and analysis from MarketsandMarkets and presented in this report.

Approach to calculate the revenue of different players in the Dental Laboratories market

In this report, the global market size was arrived at by using the revenue share analysis of leading players. For this purpose, major players in the market were identified, and their revenues from the dental laboratories business were determined through various insights gathered during the primary and secondary research phases. Secondary research included the study of the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders, such as CEOs, directors, and key market players’ marketing executives.

Approach to derive the market size and estimate market growth

The total size of the dental laboratories market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of the three approaches was taken based on the level of assumptions used in each approach.

Data Triangulation

After arriving at the overall market size from the market size estimation process explained above, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides.

Bottom-up Approach: In this report, the global market size was arrived at using the revenue share analysis of leading players in the indirect restorative materials and lab equipment market. Wherever feasible, revenue share analysis was also employed to determine segmental market size by identifying leading players for the respective industry programs. For this purpose, major players in the market were identified through secondary research, and their revenues from the dental laboratory materials and equipment business were determined through various insights gathered during the primary and secondary research. Secondary research included studying the annual and financial reports of the top market players. In contrast, primary research included extensive interviews with key opinion leaders such as CEOs, directors, and marketing executives of key market players.

Top-up Approach: The overall dental laboratories market size was used in the top-down approach to estimate the sizes of other individual markets (material, equipment, prosthetic type, and region) through percentage splits from secondary and primary research. To calculate each type of specific market segment, the most appropriate, immediate parent market size was used to implement the top-down approach. The bottom-up approach was also implemented (wherever applicable) for data extracted from secondary research to validate the market segment revenues

Geographic market assessment (by region & country): The geographic assessment was conducted using the following approaches:

Approach 1: The geographic revenue contributions/splits of leading players in the material and equipment market (wherever available) and respective growth trends.

Approach 2: Geographic adoption trends for individual dental material and equipment segments for the demand side and growth prospects for each segment (assumptions and indicative estimates validated from primary interviews).

Approach 3: Geographic market size of dental prosthetics and growth prospects for each segment (assumptions and indicative estimates validated from primary interviews).

Report Objectives

- To define, describe, and forecast the global dental laboratories market based on material, equipment, prosthetics, and region

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for key market players

- To forecast the size of the market with respect to five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To profile the key players in the global market and comprehensively analyze their core competencies and market shares in terms of key market developments, product portfolios, and financials

- To track and analyze competitive developments such as mergers and acquisitions, expansions, partnerships, product launches, collaborations, and agreements of leading players in the global market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix: Detailed comparison of the product portfolios of the top companies

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Dental Laboratories Market

What are the latest technological trends in dental laboratories market?

Which segment to dominate the revenue share in market?

Which key factors should be taken into consideration for revenue expansion?