Digital Education Market by Type (Self-paced Online Education and Instructor-led Online Education), Course Type, End User (Academic Institutions and Enterprises & Public Sector) and Region - Global Forecast to 2028

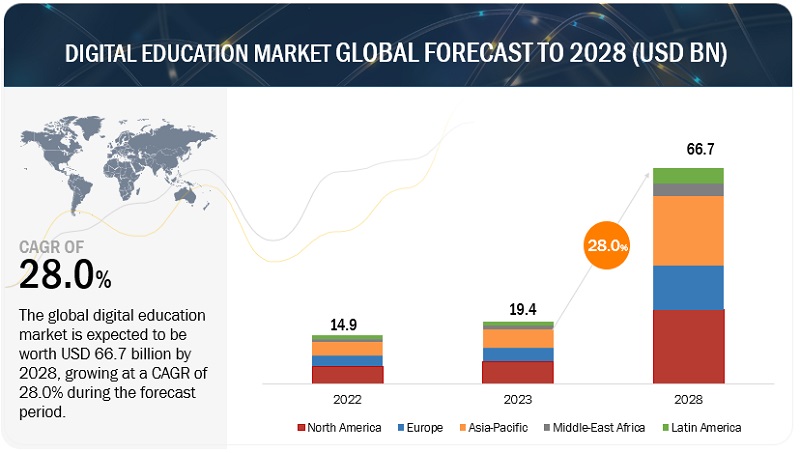

[230 Pages Report] The Global Digital Education Market size to grow from USD 19.4 billion in 2023 to USD 66.7 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 28.0% during the forecast period. Development of platforms by companies that provide personalized learning experiences for students, provision that offer data-driven insights to educators, access to education making it more affordable and convenient, self-paced learning courses, digital learning platforms offering a wide range of courses, ranging from basic literacy to advanced professional skills development, and rising demand for microlearning are expected to be the major driving forces in the growth of the Digital Education Market.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Recession Impact on the Global Digital Education Market

Digital education companies have been hit the hardest of all startups, as funding dried up due to the recession, among other factors, forcing them to workforce downsizing. According to a survey, Indian startups have laid off nearly 10,000 workers between July 2022 and March 2023, accounting for roughly one-third of those in the digital education sector. The rising digital education boom across the globe may not be sufficient to withstand the economic downturns caused by a recession. Economic insecurity and job losses can reduce spending on digital education infrastructure, such as laptops, mobile phones, and tablets, eventually reducing revenue streams for digital education companies. As a result, it is more important than ever for digital education companies to develop a resilient and adaptable business model to combat the recession. Thus, digital education companies are expected to focus on the government sector and educational institutes instead of targeting individual customers and enterprises. Further, the companies are also offering free courses to individuals to upskill themselves during testing times.

Digital Education Market Dynamics

Driver: Ever-growing internet penetration

An internet connection is a necessity for digital education. Internet penetration has increased globally in recent years, with distinct growth in mobile subscriptions and broadband connections. The penetration of mobile internet is one of the critical factors that has connected people even in remote places. According to GSMA Intelligence, in 2018, almost 300 million people were connected to the internet for the first time. A GSMA report (State of the Mobile Internet Connectivity – 2022) stated that, by the end of 2021, 4.3 billion people were using mobile internet, an increase of almost 300 million quantifiable customers/users since the end of 2020.

Restraint: Health concerns alert owing to increase in screen-time

Most of the parents are concerned about the health hazards of having their children spend so many hours staring at a screen. This increase in screen time is one of the biggest concerns and disadvantages of online learning. Sometimes learners also develop bad posture and other physical problems due to staying hunched in front of a screen. Excessive screen time can lead to many physical ailments, such as poor posture or headaches. But it can also be a personal issue for learners who struggle with learning from or focusing on screens, primarily since the internet is geared to distract learners with social media and entertainment. Some online learning platforms and software have tools and features to keep learners engaged.

Opportunity: Growing inclination towards adaptive learning

Adaptive learning is an educational system that modifies the content based on the student’s performance. The adaptive learning system makes use of AI to alter the content. AI helps online education providers to provide more personalized courses to students. Adaptive learning offers a more personalized learning experience for students. Students opting for online courses have different backgrounds, different levels of proficiency in the subject, and different levels of aptitude. Matching the pace of each student is difficult in a traditional system; however, with adaptive learning, online course providers can provide more appropriate content. Adaptive learning represents a significant opportunity for digital education providers in the upcoming years.

For students, adaptive learning respects their prior knowledge, responds to their learning needs, and reduces gaps in their understanding. By ensuring that students reach mastery before moving on, adaptive learning avoids “teaching to the middle” and understands students’ learning experiences from scratch. Meanwhile, instructors can more easily monitor which students need assistance, measure curriculum performance, and maximize learning outcomes. Instructors can better understand content areas where students are struggling, and system metrics enable intervention before individual students are at risk of withdrawal or failure in those areas. In these ways, the role of the instructor changes from the content provider to the learning facilitator. For the institution, adaptive learning enables the delivery of personalized learning at scale, contributing to greater academic success for more students cost-efficiently while reducing cheating because the content and assessments can vary for each student.

Challenge: Urge for additional training

Instructors must deeply understand the different approaches to teaching and learning to avoid the direct replication of the physical class environment and miss out on all the added advantages and tools that online and blended learning offer. Instructors also require effective and efficient training to tackle the technical aspects of online learning, such as the use of video & audio recording equipment, virtual classroom & lecture capture software, smart learning system, and learning management software (LMS). These new skills represent a steep learning curve for the instructor; however, thoughtful investment in proper training will pay off for the institution, the instructor, and the learners.

By Type, the Instructor-led Online Education segment to have higher CAGR during the forecast period

This mode involves instructor-delivered content: the instructor directly instructs students individually or in groups. All courses that include an instructor-led component are considered under this segment. Workshops, seminars, crash courses, and any other form of training activity led by a live instructor can be termed instructor-led online education. It enables the trainer to build assessment sections into the training program. These assessment sections are electronically conducted through an LMS, which can store learners’ responses, process them into meaningful reports, and present them to trainers. The LMS can also store the training content, which means trainers can provide learners with a repository or supporting training content, simplifying and engaging learners.

By Course Type, Science and Technology Courses segment to have the highest CAGR during the forecast period

Under Course Type, the Science and Technology Courses segment is expected to have the highest CAGR during the forecast period. Science and technology courses include courses for computer science, health and medicine, engineering, chemistry, physics, and many others. Computer science and programming courses involve the experimentation and engineering of computational systems comprising algorithms. The increasing adoption of IoT in various enterprises demands a skilled workforce to handle the data through various tools, techniques, and computer languages. Companies have started relying on digital education platforms to upskill their workforce. Hence, the computer science and programming course has witnessed increased adoption in recent years.

By Region, Asia Pacific to record the significant growth during the forecast period

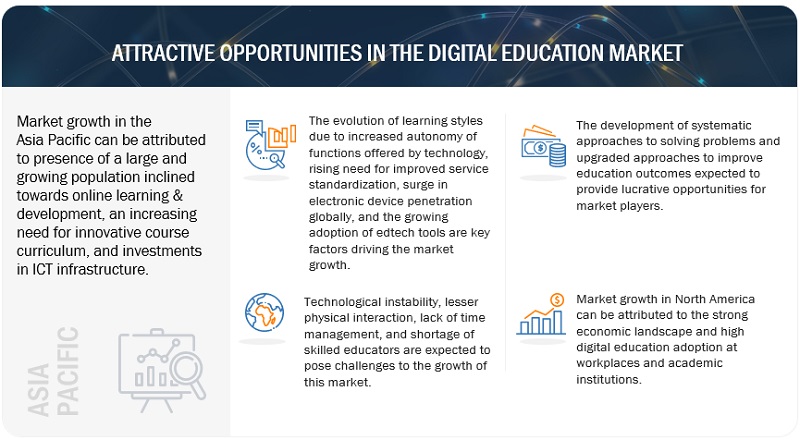

The Asia Pacific Digital Education Market is estimated to have strong growth in the future. In the Asia Pacific education sector, distance education, vocational course, correspondence course, and eLearning are becoming more popular due to the growing internet penetration and electronic appliances usage. The region has the highest student population, and with advancing technologies, there is a growing demand for eLearning and distance education. This region is also receiving foreign investments to boost the online learning sector. Thus, the digital education solution vendors need to continuously innovate to meet the diversified educational requirements of learners across various countries, such as Australia and New Zealand (ANZ), Japan, China, Singapore, South Korea, India, Indonesia, Hong Kong. Educational institutions in this region are encouraging the implementation of digital solutions to make the learning process more engaging for young minds and help them retain information longer with accessibility. The region has broadly embraced different K-12 approaches and advanced education organizations to offer better learning experience to users. Numerous Asia Pacific schools and colleges took COVID-19 pandemic as an opportunity to be more productive and competitive by adopting online training and teaching classes, as well as for developing professional skills. Additionally, the ease of convenient teaching is enhanced by the smart classrooms, which is anticipated to positively impact the market in the region during the forecast period. Due to this progress, South Asia is entering into learning assessment collaborations. The significant advantages of regional assessment intervention are such as the aid in research and knowledge sharing, development of tools, periodical instructor skills training, national and international assessments, and research projects on enhancing the digital education in the region. Several countries in South Asia are somewhat lagging in integrating systematic monitoring and evaluation of education, which permits them to measure their education programs and policies' implications. The Asia Pacific region has great growth opportunities for digital education solutions providers.

Key Market Players

The report includes the study of key players offering Digital education solutions and services. It profiles major vendors in the global market. The major vendors in the Digital Education Market include Coursera (US), edX (US), Pluralsight (US), Udemy (US), Udacity (US), Edureka (India), Alison (Ireland), LinkedIn Learning (US), Jigsaw Academy (India), Iversity (Germany), Miriadax (Spain), Intellipaat (India), FutureLearn (UK), Edmodo (US), SWAYAM (India), Novoed (US), Xuetangx (China), Khan Academy (US), Kadenze (US), Federica Web Learning (Italy), My Mooc (France), Treehouse (US), Skillshare (US), CreativeLive (US), CXL (US), Go1 (Australia), Byju’s (India), Datacamp (US), Platzi (US), Thinkful (US). These players have adopted various strategies to grow in the global Digital Education Market.

The study includes an in-depth competitive analysis of these key players in the Digital Education Market with their company profiles, recent developments, and key market strategies.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

2019-2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023-2028 |

|

Forecast units |

Value (USD Million/Billion) |

|

Segments covered |

By Type, Course Type, End User, and Region |

|

Regions covered |

North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

|

Companies covered |

Coursera (US), edX (US), Pluralsight (US), Udemy (US), Udacity (US), Edureka (India), Alison (Ireland), LinkedIn Learning (US), Jigsaw Academy (India), Iversity (Germany), Miriadax (Spain), Intellipaat (India), FutureLearn (UK), Edmodo (US), SWAYAM (India), Novoed (US), Xuetangx (China), Khan Academy (US), Kadenze (US), Federica Web Learning (Italy), My Mooc (France), Treehouse (US), Skillshare (US), CreativeLive (US), CXL (US), Go1 (Australia), Byju’s (India), Datacamp (US), Platzi (US), Thinkful (US) |

This research report categorizes the Digital Education market to forecast revenues and analyze trends in each of the following subsegments:

By End User:

- Academic Institutions

- Enterprises and Public Sector

By Type:

- Self-paced Online Education

- Instructor-led Online Education

By Course Type:

- Science and Technology Courses

- Entrepreneurship and Business Management Courses

- Other Courses

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- Japan

- China

- India

- Australia

- Rest of Asia Pacific

-

Middle East & Africa

- Middle East

- Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In February 2023, edX partnered with AWS, with an aim to launch its first Professional Certificate program. The Professional Certificate program in Cloud Solutions Architecture provides the knowledge and skills required/desired to start building a career in cloud architecture and helps prepare learners for the AWS Certified Solutions Architect - Associate exam.

- In May 2022, Coursera launched Clips, a software that offers over 10,000 bite-sized videos and lessons from leading companies and universities; the company seeks to upscale to over 200,000 videos by 2023 end. With Clips, companies can make the most valuable, in-demand skill development content more accessible to their employees, allowing them to begin learning new skills in under 10 minutes.

- In September 2021, Udemy enhanced its Udemy Business Pro, which will enable business customers to boost their skill development with in-depth learning experiences for employees through new features like Udemy Paths, skills assessments, workspaces, and hands-on labs across critical skills in IT, software development, data & analytics.

Frequently Asked Questions (FAQ):

What is the projected market value of the global Digital Education Market?

The Global Digital Education Market size to grow from USD 19.4 billion in 2023 to USD 66.7 billion by 2028, at a Compound Annual Growth Rate (CAGR) of 28.0% during the forecast period.

Which region has the largest market share in the Digital Education Market?

North America is estimated to hold the largest share in the Digital Education Market in 2023. The region is well-connected with advanced infrastructure, which helps Digital Education vendors offer quality services to their clients. North America also has the presence of most of the top market vendors, such as Coursera, edX, Pluralsight, Udemy and Udacity.

Which end user is expected to have the highest growth during the forecast period?

By end user, the Academic Institutions segment is expected to have higher growth during the forecast period due to the increasing use of mobile phones and smart devices among the young generation, and virtual mode of teaching adopted significantly by institutions.

What are some of the challenges in the Digital education market?

Few challenges include lack of robust infrastructure, digital literacy, technical glitches, few of which take longer before a solution, reduced in-person interaction, collaboration and physical monitoring.

Who are the major vendors in the Digital Education Market?

Major vendors in the Digital Education Market include Coursera (US), edX (US), Pluralsight (US), Udemy (US), Udacity (US), Edureka (India), Alison (Ireland), LinkedIn Learning (US), Jigsaw Academy (India), and iversity (Germany).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

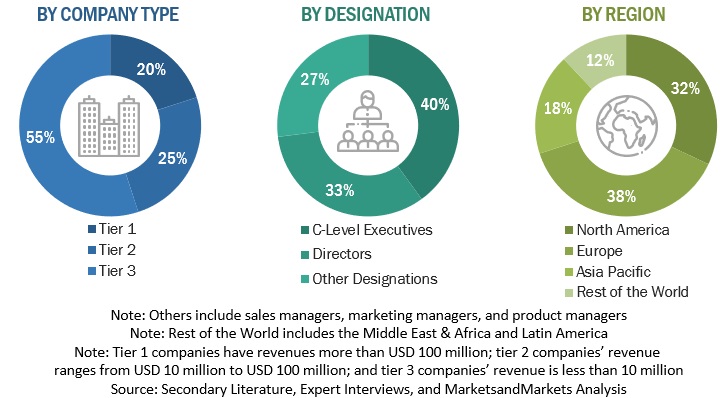

The study involved four major activities in estimating the current size of the Digital Education market. Exhaustive secondary research was done to collect information on the lending industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of the Digital Education market.

Secondary Research

The market size of the companies offering Digital Education solutions and services was arrived at based on the secondary data available through paid and unpaid sources. It involved analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to, for identifying and collecting information for the study. Secondary sources included annual reports; press releases and investor presentations of companies; product data sheets, white papers, journals, and certified publications; and articles from recognized authors, government websites, directories, and databases.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs), Vice Presidents (VPs), directors from business development, marketing, and product development/innovation teams, and related key executives from Digital Education vendors, managed Digital Education providers, industry associations, independent consultants, and key opinion leaders. Various stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), and Chief Security Officers (CSOs), and installation teams, of governments/end users using digital education solutions, project teams were interviewed. This interview helped to understand the buyer’s perspective on the suppliers, products, service providers, and their current use of solutions, which would affect the overall digital education market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the Digital Education market and various other dependent sub-markets in the overall market.

In the top-down approach, an exhaustive list of all vendors offering digital education solutions was prepared. The revenue contribution of all vendors in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor was evaluated based on its product/solution offerings, type, course type, end user, and regional presence. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CEOs (Chief Executive Officer), VPs (Vice President), directors, and marketing executives. These market numbers were further triangulated with the existing MarketsandMarkets’ repository for validation.

In the bottom-up approach, the adoption trend of digital education solutions among different end users in key countries with respect to the regions that contribute to most of the market share was identified. For cross-validation, the adoption trend of solutions, along with different use cases, with respect to their business segments, has been identified and extrapolated. Weightage has been given to the use cases identified in the different application areas for the calculation.

In the bottom-up approach, the adoption trend of digital educations solutions between the major two industry verticals in key countries, with respect to regions that contribute to most of the market share, has been identified. For cross-validation, the adoption trend of digital education, along with different use cases with respect to their business segments, has been identified and generalized. Weightage has been given to the use cases identified in different solution areas for calculation. An exhaustive list of all vendors offering solutions and services in the digital education market has been prepared. The revenue contribution of all vendors in the market has been estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Vendors with digital education or online learning offerings have been considered to evaluate the market size. Each vendor has been evaluated based on its solution and service offerings across verticals. The aggregate of all companies' revenue has been extrapolated to reach the overall market size. Each sub-segment has been studied and analyzed for its market size and regional penetration. Based on these numbers, primary and secondary sources have determined the region split.

All possible parameters affecting the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data has been consolidated and added with detailed inputs and analysis from MarketsandMarkets.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

Digital education, virtual learning or online learning is a form of distance education that leverages digital technology and Internet connectivity to aid learning. In digital education, teaching services are delivered over the Internet; students and instructors are not required to be available at the same time and place to carry out the learning process. The digital education market includes all the online courses and programs offered by online education service providers to individuals or organizations.

Key stakeholders of the market include:

- Digital education Platform providers

- Digital education Service providers

- Independent Consultants

- Governments and Standardization Bodies

- Educational institutions

- Industry Associations

- Distributors

- Partners and IT team of end users

- Executives from key companies and enterprises

- Value-added Resellers and Distributors

Report Objectives

- To describe and forecast the size of the Digital Education market by type, course type, end user, and region.

- To describe and forecast the size of the market segments with respect to five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America.

- To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the growth of the market.

- To analyze the impact of Recession on the market.

- To analyze micro markets with respect to the individual growth trends, prospects, and contributions to the overall Digital Education market.

- To analyze opportunities in the market for stakeholders by identifying the high-growth segments

- To profile key market players, including top vendors and startups, provide comparative analysis based on business overviews, regional presence, product offerings, business strategies, and key financials, and provide a detailed competitive landscape of the market

- To analyze competitive developments, such as mergers and acquisitions; new product launches and product enhancements; partnerships, collaborations, and acquisitions; business expansions and agreements; and Research and Development (R&D) activities in the market.

Available Customizations

Along with the market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern & African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Education Market