Digital Forensics Market by Component (Software, Hardware, and Services), Type (Network Forensics, Mobile Device Forensics, Cloud Forensics), Deployment Mode (Cloud and On-Premise), Vertical and Region - Global Forecast to 2028

Digital Forensics Market Size & Revenue Forecast, Global Trends

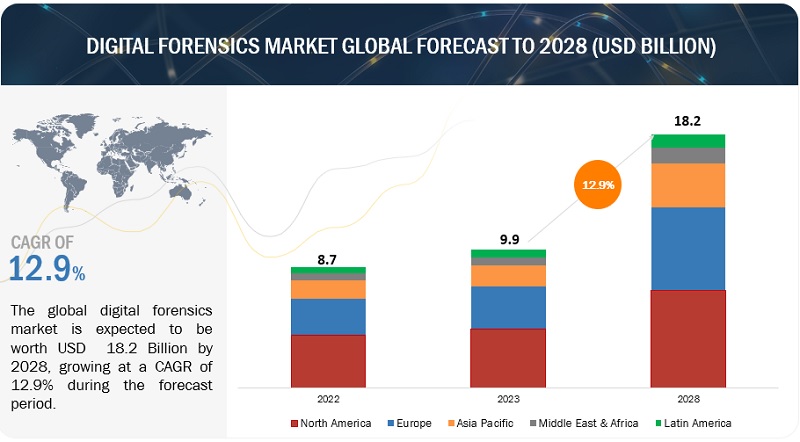

[304 Pages Report] The global Digital Forensics Market size was valued at worth $9.9 billion in 2023. It is expected to grow at a Compound Annual Growth Rate (CAGR) of 12.9% in between 2023-2028. The revenue forecast for 2028 is projected to reach $18.2 billion by 2028. The base year considered for estimation is 2022 and the historical data spans from 2023 to 2028.

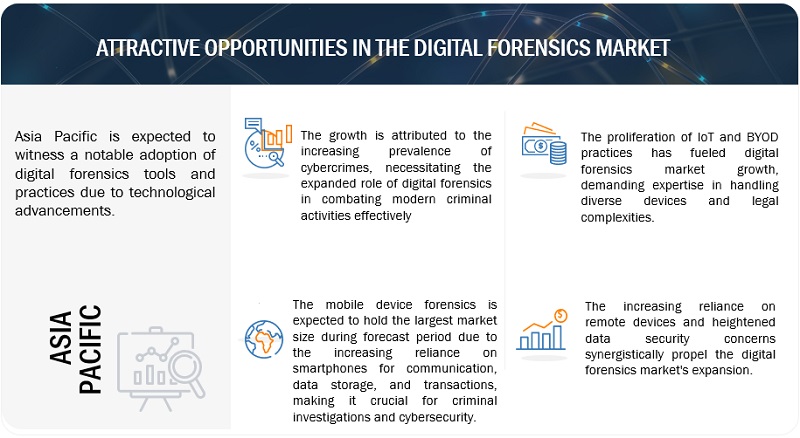

The rise in cybercrimes has elevated digital forensics to a pivotal role in law enforcement and security. Initially focused on computer forensics, it has expanded to encompass all digital data devices, reflecting its growing significance. With the widespread use of digital devices, traditional investigative methods fail to address modern cybercriminal tactics. Digital forensics excels in identifying and prosecuting malicious actors, uncovering criminal intent, and aiding in civil dispute resolutions. The proliferation of IoT and BYOD practices adds complexity, requiring expertise in handling diverse devices and navigating legal intricacies.

Moreover, the demand for digital forensics has surged due to increased remote device usage, driving both investigations and data security solutions, making it an essential component in understanding and fortifying against cyber threats. As a result, the digital forensics market continues to grow rapidly.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Digital Forensics Market Growth Dynamics

Driver: Digital Forensics Driven by Remote Device Monitoring and the Growing Need for Data Security Solutions

The increasing use of remote devices, such as IoT gadgets and remote workstations, has significantly expanded the potential targets for cyber threats. Digital forensics has become crucial for investigating and mitigating these emerging risks. The need to monitor and investigate security breaches or suspicious activities on remote devices has led to a higher demand for digital forensics services and tools. At the same time, the growing awareness of data breaches and continuous cyberattacks has pushed organizations to invest heavily in robust data security solutions. However, despite preventive measures, security incidents persist. Digital forensics is now vital for dissecting these incidents, identifying vulnerabilities, and providing valuable insights to enhance data security. This demand for data security solutions and the critical role of digital forensics in investigating security incidents contributes to the ongoing growth of the digital forensics market.

Restraint: Expensive Nature of Digital Forensic Tools and Services

The high costs linked to digital forensics tools and services present a significant challenge in the industry. This financial burden affects law enforcement and private organizations, making it difficult to acquire state-of-the-art forensic software and hardware and the expertise to use them effectively. Ongoing technology advancements also drive up expenses due to the need for constant updates and training. This disadvantages smaller agencies and organizations as they struggle to keep up with rising costs. There's a pressing need for innovative solutions like open-source tools and collaborative initiatives to address this financial barrier, ensuring that digital forensics remains accessible and fair to all, regardless of financial constraints.

Opportunity: Utilization of cryptocurrency

The rise of cryptocurrencies like Bitcoin and Ethereum has opened up significant opportunities for digital forensics. These digital assets are decentralized and offer anonymity, making them attractive to criminals involved in money laundering, ransomware attacks, and cybercrimes. As a result, digital forensic experts are increasingly tasked with investigating such cases. Cryptocurrencies are built on blockchain technology, which provides a transparent and immutable record of transactions. Digital forensics investigators can leverage this technology to track financial movements and identify individuals linked to criminal activities. With the development of specialized tools and techniques for blockchain analysis, a growing subfield of digital forensics is emerging. As cryptocurrencies evolve, expertise in investigating these assets will be crucial in the ongoing fight against cybercrime.

Challenge: Challenges Arising from Encryption and Insufficient Advance Digital Forensics Preparation in Enterprises

Digital forensics faces significant challenges due to the widespread use of strong encryption in enterprises and the absence of comprehensive pre-planning strategies. While encryption is essential for safeguarding sensitive data, it often obstructs forensic investigators from accessing and analyzing digital evidence. Enterprises increasingly rely on robust encryption methods, making it difficult to retrieve data during investigations. Additionally, the lack of adequate pre-planning within organizations worsens the situation, as crucial evidence may be lost or made inaccessible during incidents, leading to prolonged investigations, higher costs, and potential legal issues. To tackle these challenges, enterprises must balance data security and effective digital forensics by implementing robust pre-planning strategies to preserve and access digital evidence.

Digital forensics Market Ecosystem

By vertical, the law enforcement segment is to grow at the highest CAGR during the forecast period.

For several reasons, the law enforcement vertical is experiencing remarkable growth in the digital forensics market. Foremost among these is the escalating prevalence of cybercrime, compelling law enforcement agencies to rely increasingly on digital forensics to investigate and prosecute cybercriminals. Moreover, the ubiquitous adoption of digital devices, such as smartphones, laptops, and tablets, has given rise to a surge in criminal activities involving these technologies, necessitating digital forensics tools and expertise. Furthermore, regulatory compliance requirements mandate implementing digital forensics measures to safeguard data and systems. Additionally, growing awareness of the benefits of digital forensics, including its efficacy in evidence collection, suspect identification, and event reconstruction, has further fueled its demand in the law enforcement sector. With the proliferation of cloud computing and the Internet of Things, the evolving landscape has introduced new challenges that demand digital forensics solutions for effective investigation and prosecution of cybercrimes.

By deployment mode, the cloud deployment segment is to grow at the highest CAGR during the forecast period.

Cloud deployment mode is experiencing explosive growth in the digital forensics market, offering a compelling array of advantages. Law firms gravitate towards cloud-based solutions primarily due to cost savings; these solutions eliminate the need for expensive on-premises hardware and software, reducing IT expenditure significantly. Scalability is another pivotal factor, as law firms can effortlessly adjust their digital forensics capabilities to match the demands of diverse cases. Accessibility proves crucial for firms with remote employees and multiple locations, enabling seamless access to digital evidence from anywhere with an internet connection. Moreover, the security provided by reputable cloud providers ensures the confidentiality of sensitive data. Cloud-based digital forensics solutions offer specialized features tailored to law firms, such as eDiscovery for compliance, collaboration tools, and comprehensive reporting capabilities. This complete suite of benefits propels cloud deployment to unprecedented growth in the digital forensics market.

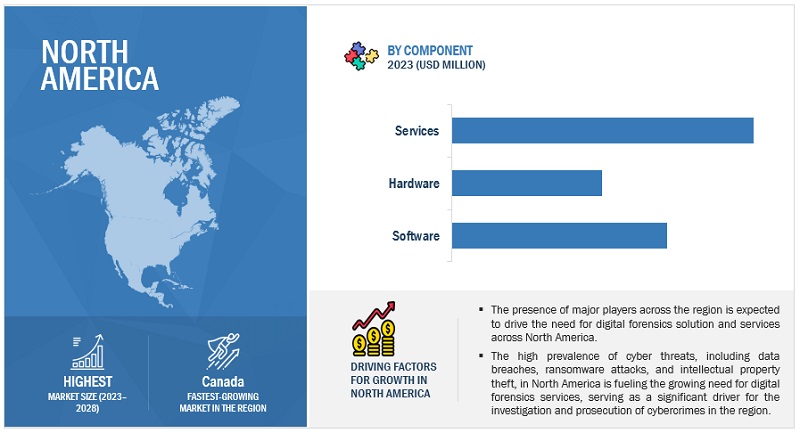

By region, North America accounts for the highest market size during the forecast period.

The digital forensics market in North America is experiencing rapid growth, primarily owing to several key factors. This region is renowned for its early adoption of new technologies, granting North American organizations a competitive edge in combating cybercrime. With its substantial economy and concentration of businesses and government agencies, North America is a prime target for cybercriminals, necessitating a heightened demand for digital forensics services to investigate and prosecute cyber threats. Moreover, the stringent regulatory compliance requirements imposed on North American organizations further fuel the growth of the digital forensics market. Additionally, major digital forensics vendors such as IBM and Cisco and a well-established ecosystem of skilled digital forensics professionals ensure easy access to cutting-edge tools and expertise, consolidating North America’s dominance in this crucial sector.

Key Market Players

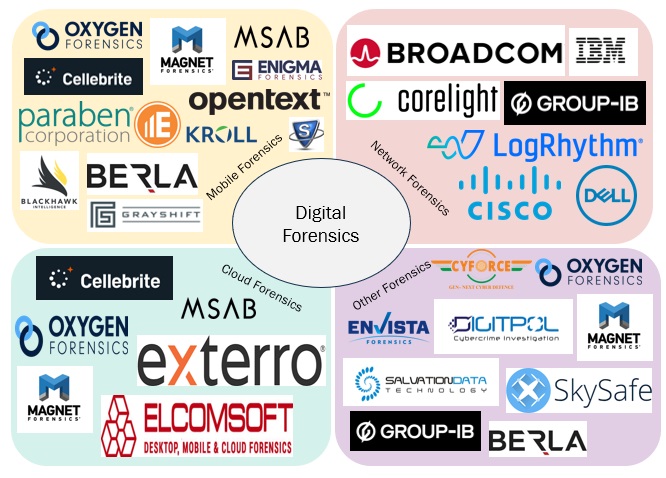

IBM (US), Cisco (US), Cellebrite (US), OpenText (Canada), Nuix (Australia), Exterro (US), MSAB (Sweden), Magnet Forensics (Canada), LogRhythm (US), KLDiscovery (US), Paraben (US), Cyfor (UK), Oxygen Forensics (US), Griffeye (Sweden), CCL Solutions Group Ltd (England), Global Digital Forensics Inc (US), Kroll Inc (US), Digital Intelligence (US), Optiv Security Ltd (US), Cado Security (England), Elcomsoft (Russia), Binalyze (Estonia), Varutra (US), Bluevoyant (US), Binary Intelligence (US), and Bounga Informatics (Singapore) are the key players and other players in the digital forensics market

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metrics |

Details |

|

Market size available for years |

|

|

Base year considered |

|

|

Forecast period |

|

|

Forecast units |

|

|

Segments Covered |

|

|

Geographies covered |

|

|

Companies covered |

|

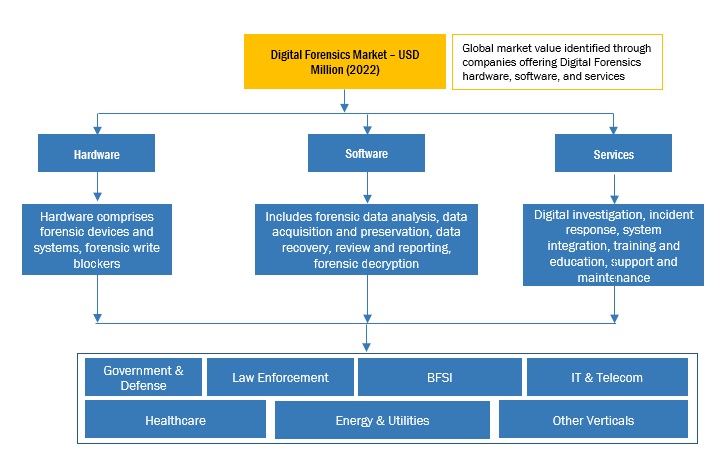

The study categorizes the Digital forensics market by segments - component, type, deployment mode, application, vertical, and region.

By Component:

- Software

- Hardware

- Services

By Type:

- Network Forensics

- Mobile Device Forensics

- Cloud Forensics

- Others

By Deployment Mode:

- Cloud

- On-Premise

Vertical:

- Government and Defense

- Law Enforcement

- Banking, Financial Services, and Insurance (BFSI)

- IT & Telecom

- Healthcare

- Energy and Utilities

- Other Verticals

By Region:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- Latin America

Recent Developments

- In March 2023, Nuix expanded its partnership with Fujitsu, enhancing its European portfolio with a focus on investigative analytics and intelligence software to tackle crime, data privacy, and fraud challenges, enabling data-driven decision-making and comprehensive data management.

- In February 2023, IBM and Palo Alto Networks partnered to improve incident response capabilities. This partnership uses Palo Alto Networks' Cortex products to enhance IBM's X-Force security, offering customers a holistic view of cyber threats, speeding up responses, and enhancing cybersecurity resilience.

- In August 2022, OpenText's EnCase Forensic v22.3 introduced AFF4 functionality, enabling comprehensive digital evidence analysis with support for physical and logical image reading, expediting security investigations, and truth discovery.

- In May 2022, Cisco AppDynamics and Alertops joined forces in a technology integration partnership, empowering users with advanced alerting, escalation policies, workflows, and scheduling for efficient major incident resolution.

- In February 2021, Cellebrite and Axon joined forces, integrating Cellebrite's Digital Intelligence platform with Axon Evidence. This partnership streamlines digital evidence management for law enforcement, enhancing efficiency and speeding up the justice process.

Frequently Asked Questions (FAQ):

What are the opportunities in the global digital forensics market?

The proliferation of IoT and the widespread adoption of BYOD practices are some of the factors contributing to the growth and creating new opportunities for the digital forensics market.

What is the definition of the digital forensics market?

According to MarketsandMarkets, Digital forensics is identifying, preserving, analyzing, and documenting digital evidence. It is a branch of forensic science that focuses on recovering, analyzing, and preserving digital data from electronic devices, such as computers, smartphones, and servers. It systematically examines digital artifacts to uncover evidence related to cybercrimes, data breaches, and other digital incidents. Digital forensics experts use specialized techniques and tools to collect, preserve, and analyze electronic evidence, helping to support legal investigations and court proceedings. This evidence can be used in criminal or civil investigations or internal investigations by organizations. Digital forensics aims to extract data from digital devices in a way that preserves its integrity and admissibility in court. This can be a complex and challenging task, as digital evidence is often volatile and can be easily altered or destroyed. Digital forensics professionals use various tools and techniques to recover and analyze digital evidence. These tools include hardware devices, software applications, and specialized knowledge of digital devices and data storage formats.

Which region is expected to show the highest market share in the digital forensics market?

North America is expected to account for the largest market share during the forecast period.

What are the major market players covered in the report?

Major vendors in the global digital forensics market include IBM (US), Cisco (US), Cellebrite (US), OpenText (Canada), Nuix (Australia), Exterro (US), MSAB (Sweden), Magnet Forensics (Canada), LogRhythm (US), KLDiscovery (US), Paraben (US), Cyfor (UK), Oxygen Forensics (US), Griffeye (Sweden), CCL Solutions Group Ltd (England), Global Digital Forensics Inc (US), Kroll Inc (US), Digital Intelligence (US), Optiv Security Ltd (US), Cado Security (England), Elcomsoft (Russia), Binalyze (Estonia), Varutra (US), Bluevoyant (US), Binary Intelligence (US), and Bounga Informatics (Singapore).

What is the current size of the global digital forensics market?

The global digital forensics market size is projected to grow from USD 9.9 billion in 2023 to USD 18.2 billion by 2028 at a Compound Annual Growth Rate (CAGR) of 12.9% during the forecast period.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

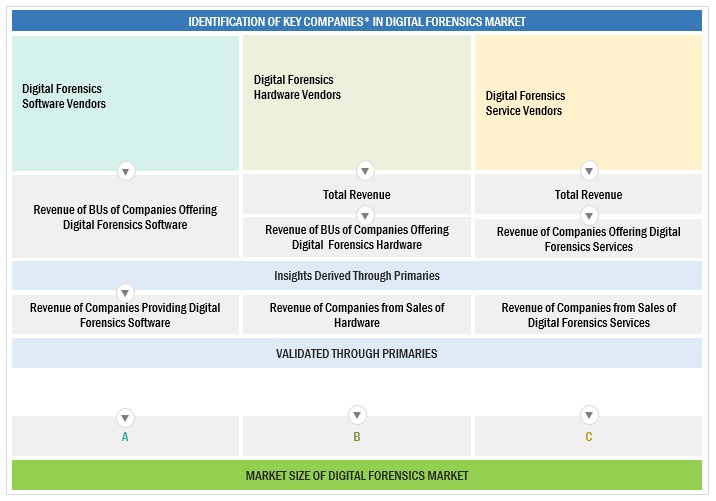

The study involved major activities in estimating the current market size for the digital forensics market. Exhaustive secondary research was done to collect information on the digital forensics industry. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Different approaches, such as top-down and bottom-up, were employed to estimate the total market size. After that, the market breakup and data triangulation procedures were used to estimate the market size of the segments and subsegments of the Digital forensics market.

Secondary Research

The market for the companies offering digital forensics solutions and services is arrived at by secondary data available through paid and unpaid sources, analyzing the product portfolios of the major companies in the ecosystem, and rating the companies by their performance and quality. Various sources were referred to in the secondary research process to identify and collect information for this study. The secondary sources include annual reports, press releases, investor presentations of companies, white papers, journals, certified publications and articles from recognized authors, directories, and databases.

In the secondary research process, various secondary sources were referred to for identifying and collecting information related to the study. Secondary sources included annual reports, press releases, and investor presentations of Digital forensics vendors, forums, certified publications, and whitepapers. The secondary research was used to obtain critical information on the industry’s value chain, the total pool of key players, market classification, and segmentation from the market and technology-oriented perspectives.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the digital forensics market.

After the complete market engineering (calculations for market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information and verify and validate the critical numbers arrived at. Primary research was also conducted to identify the segmentation types, industry trends, competitive landscape of digital forensics solutions offered by various market players, and key market dynamics, such as drivers, restraints, opportunities, challenges, industry trends, and key player strategies.

In the complete market engineering process, the top-down and bottom-up approaches were extensively used, along with several data triangulation methods, to perform the market estimation and market forecasting for the overall market segments and subsegments listed in this report. Extensive qualitative and quantitative analysis was performed on the complete market engineering process to list the key information/insights throughout the report.

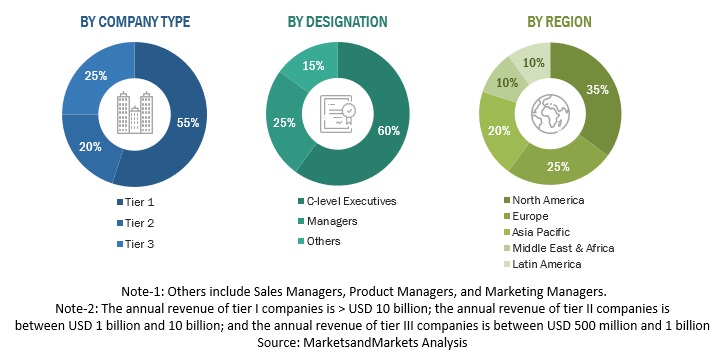

Following is the breakup of the primary study:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Top-down and bottom-up approaches were used to estimate and validate the size of the global digital forensics market and estimate the size of various other dependent sub-segments in the overall digital forensics market. The research methodology used to estimate the market size includes the following details: key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure included the study of the annual and financial reports of the top market players, and extensive interviews were conducted for key insights from the industry leaders, such as CEOs, VPs, directors, and marketing executives.

All percentage splits and breakdowns were determined using secondary sources and verified through primary sources. All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets.

Infographic Depicting Bottom-up and Top-Down Approaches

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size using the market size estimation processes explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Market Definition

According to MarketsandMarkets, Digital forensics is the process of identifying, preserving, analyzing, and documenting digital evidence. It is a branch of forensic science that focuses on recovering, analyzing, and preserving digital data from electronic devices, such as computers, smartphones, and servers. It involves the systematic examination of digital artifacts to uncover evidence related to cybercrimes, data breaches, and other digital incidents. Digital forensics experts use specialized techniques and tools to collect, preserve, and analyze electronic evidence, helping to support legal investigations and court proceedings. This evidence can be used in criminal civil, or internal investigations by organizations. Digital forensics aims to extract data from digital devices in a way that preserves its integrity and admissibility in court. This can be a complex and challenging task, as digital evidence is often volatile and can be easily altered or destroyed. Digital forensics professionals use a variety of tools and techniques to recover and analyze digital evidence. These tools include hardware devices, software applications, and specialized knowledge of digital devices and data storage formats.

Key Stakeholders

- Information Technology (IT) Professionals

- Government Agencies

- Investors and Venture Capitalists

- Small & Medium-Sized Enterprises (SMEs) And Large Enterprises

- Professional Service Providers

- Digital Forensics Vendors

- Independent Software Vendors

- Consultants/Consultancies/Advisory Firms

- System Integrators

- Third-Party Providers

- Value-added Resellers (VARs)

- Project Managers

- Business Analysts

Report Objectives

- To define, describe, and forecast the digital forensics market based on - component, type, deployment mode, vertical, and region.

- To define, describe, and forecast the market by - component, security type, authentication type, vertical, and region.

- To forecast the market size of five main regions: North America, Europe, Asia Pacific (APAC), Middle East & Africa (MEA), and Latin America

- To analyze the subsegments of the market concerning individual growth trends, prospects, and contributions to the overall market

- To provide detailed information related to the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze opportunities in the market for stakeholders by identifying high-growth segments of the market

- To profile the key players of the market and comprehensively analyze their market size and core competencies in the market

- To track and analyze competitive developments, such as new product launches; mergers and acquisitions, and partnerships, agreements, and collaborations in the global Digital forensics market.

Customization Options

With the given market data, MarketsandMarkets offers customizations based on company-specific needs. The following customization options are available for the report:

Geographic Analysis

- Further breakup of the Asia Pacific market into countries contributing 75% to the regional market size

- Further breakup of the North American market into countries contributing 75% to the regional market size

- Further breakup of the Latin American market into countries contributing 75% to the regional market size

- Further breakup of the Middle Eastern and African market into countries contributing 75% to the regional market size

- Further breakup of the European market into countries contributing 75% to the regional market size

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Growth opportunities and latent adjacency in Digital Forensics Market