TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 63)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

FIGURE 1 INSURANCE PLATFORMS MARKET SEGMENTATION

TABLE 1 MARKET DETAILED SEGMENTATION

1.3.2 REGIONS COVERED

FIGURE 2 MARKET SEGMENTATION, BY REGION

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 2 USD EXCHANGE RATES, 2018–2022

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

1.6.1 IMPACT OF RECESSION

2 RESEARCH METHODOLOGY (Page No. - 73)

2.1 RESEARCH DATA

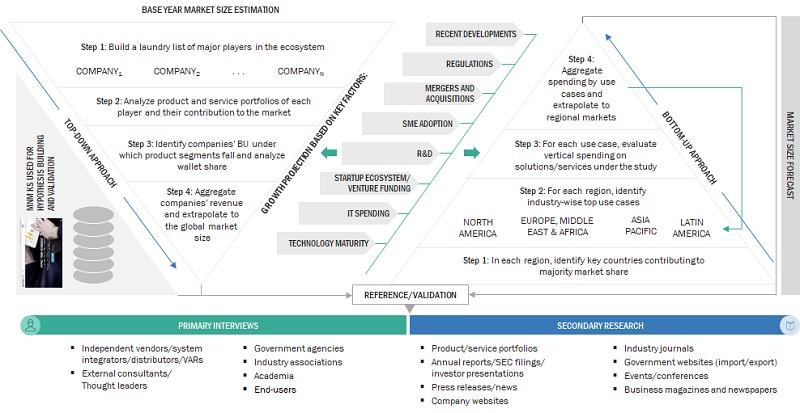

FIGURE 3 INSURANCE PLATFORMS MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

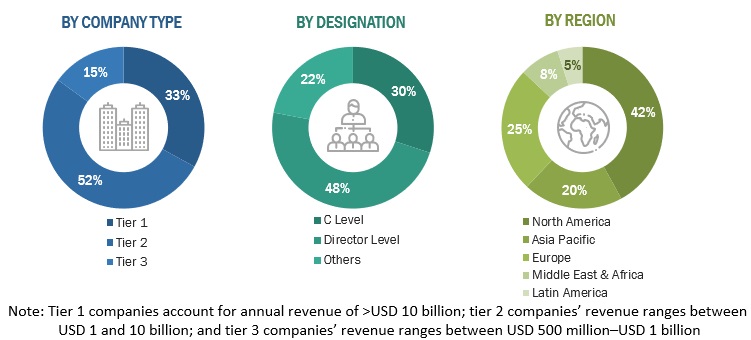

2.1.2 PRIMARY DATA

TABLE 3 PRIMARY INTERVIEWS

2.1.2.1 Breakup of primary profiles

2.1.2.2 Key industry insights

2.2 MARKET FORECAST

TABLE 4 FACTOR ANALYSIS

2.3 MARKET SIZE ESTIMATION

FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

2.3.2 BOTTOM-UP APPROACH

FIGURE 5 APPROACH 1 - BOTTOM-UP (SUPPLY-SIDE): REVENUE FROM SOLUTIONS/SERVICES OF INSURANCE PLATFORMS MARKET

FIGURE 6 APPROACH 2 - BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF INSURANCE PLATFORMS

FIGURE 7 APPROACH 3 - BOTTOM-UP (SUPPLY-SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF INSURANCE PLATFORMS

FIGURE 8 APPROACH 4 - BOTTOM-UP (DEMAND-SIDE): SHARE OF INSURANCE PLATFORM THROUGH OVERALL INSURANCE PLATFORM SPENDING

2.4 DATA TRIANGULATION

FIGURE 9 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.6 LIMITATIONS

2.7 IMPLICATIONS OF RECESSION ON MARKET

TABLE 5 IMPACT OF RECESSION ON GLOBAL MARKET

3 EXECUTIVE SUMMARY (Page No. - 87)

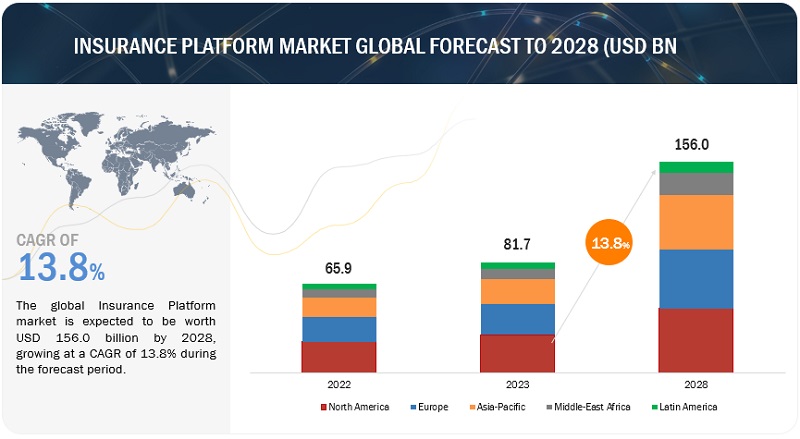

TABLE 6 INSURANCE PLATFORMS MARKET SIZE AND GROWTH RATE, 2018–2022 (USD MILLION, Y-O-Y)

TABLE 7 MARKET SIZE AND GROWTH RATE, 2023–2028 (USD MILLION, Y-O-Y)

FIGURE 10 INSURANCE PLATFORM SOFTWARE TO DOMINATE MARKET OVER SERVICES IN 2023

FIGURE 11 INSURANCE POLICY MANAGEMENT TO LEAD AMONG SOFTWARE IN 2023

FIGURE 12 PROFESSIONAL SERVICES TO WITNESS SIGNIFICANT LEAD OVER MANAGED SERVICES MARKET IN 2023

FIGURE 13 CONSULTING & ADVISORY SEGMENT TO LEAD AMONG PROFESSIONAL SERVICES IN 2023

FIGURE 14 PLATFORM HOSTING & INFRASTRUCTURE MANAGEMENT SEGMENT TO LEAD AMONG MANAGED SERVICES IN 2023

FIGURE 15 AI & ML PLATFORMS TO BE MOST ADOPTED TECHNOLOGY IN INSURANCE INDUSTRY IN 2023

FIGURE 16 CLAIMS MANAGEMENT TO BE LARGEST APPLICATION MARKET IN 2023

FIGURE 17 LIFE INSURANCE TO POSE HIGHEST DEMAND FOR INSURANCE PLATFORMS IN 2023

FIGURE 18 ACTUARIES TO BE HIGHEST END USERS OF INSURANCE PLATFORMS DURING FORECAST PERIOD

FIGURE 19 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE IN 2023

4 PREMIUM INSIGHTS (Page No. - 94)

4.1 ATTRACTIVE OPPORTUNITIES FOR INSURANCE PLATFORMS MARKET PLAYERS

FIGURE 20 INCREASE IN CONSUMER DEMAND FOR QUICK CLAIMS PROCESSING AND EASIER POLICY MANAGEMENT TO DRIVE MARKET GROWTH

4.2 MARKET: TOP THREE APPLICATIONS

FIGURE 21 POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT APPLICATION TO ACCOUNT FOR HIGHEST GROWTH RATE DURING FORECAST PERIOD

4.3 NORTH AMERICA: MARKET, BY OFFERING & END USER

FIGURE 22 SOFTWARE AND INSURANCE COMPANIES TO BE LARGEST SHAREHOLDERS IN MARKET IN NORTH AMERICA IN 2023

4.4 MARKET, BY REGION

FIGURE 23 NORTH AMERICAN MARKET TO LEAD AMONG REGIONS IN 2023

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 96)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: INSURANCE PLATFORMS MARKET

5.2.1 DRIVERS

5.2.1.1 Rise of data analytics and big data

FIGURE 25 INCREASE IN PREDICTING LARGE LOSS CLAIMS TO BE LARGEST BENEFIT OF BIG DATA ANALYTICS IN INSURANCE SECTOR

5.2.1.2 Increase in demand for digital insurance channels

5.2.1.3 Need for cloud-based digital solutions

5.2.2 RESTRAINTS

5.2.2.1 Complexity involved with integration of insurance platforms with legacy systems

5.2.2.2 Data security and privacy concerns

5.2.2.3 Lack of standardization

5.2.3 OPPORTUNITIES

5.2.3.1 Growth of digital economy

5.2.3.2 Advancements in development of digital product innovations

5.2.3.3 Integration with IoT and sensor technologies for real-time data collection and visualization

5.2.4 CHALLENGES

5.2.4.1 Rise in cyberattacks and their threats

5.2.4.2 Lack of technical expertise

5.2.4.3 Managing high volumes of data

5.3 EVOLUTION OF INSURANCE PLATFORMS

FIGURE 26 INSURANCE PLATFORMS MARKET EVOLUTION

5.4 VALUE CHAIN ANALYSIS

FIGURE 27 MARKET: VALUE CHAIN ANALYSIS

TABLE 8 MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM ANALYSIS

TABLE 9 MARKET: ECOSYSTEM

FIGURE 28 MARKET: ECOSYSTEM ANALYSIS

5.5.1 INSURANCE PLATFORM PROVIDERS

5.5.2 INSURANCE CARRIERS

5.5.3 THIRD-PARTY SERVICE PROVIDERS

5.5.4 INSURANCE PLATFORM DATA PROVIDERS

5.5.5 INSURANCE PLATFORM RATING AGENCIES

5.5.6 INSURANCE PLATFORM END USERS

5.5.7 INSURANCE PLATFORM REGULATORY BODIES

5.6 INSURANCE PLATFORMS INVESTMENT LANDSCAPE

5.6.1 DEALS & FUNDING

FIGURE 29 INVESTOR FUNDING IN INSURANCE PLATFORMS SOARED IN 2021, DECLINING SHARPLY IN 2022

5.6.2 COUNTRIES WITH MOST DEALS

FIGURE 30 US EMERGED AS CLEAR LEADER IN INSURANCE PLATFORMS INVESTMENT, SECURING 238 DEALS IN 2022

5.7 BEST PRACTICES IN INSURANCE PLATFORMS MARKET

TABLE 10 BEST PRACTICES IN MARKET

5.8 CASE STUDY ANALYSIS

5.8.1 SALESFORCE ASSISTED AXA BUSINESS INSURANCE IN ENHANCING CUSTOMER SATISFACTION

5.8.2 AON ITALY TRANSFORMED INSURANCE AND RISK MANAGEMENT OPERATIONS USING IBM CLOUD PAKS

5.8.3 PING AN IMPROVED CUSTOMER EXPERIENCE AND BUSINESS PROCESSES WITH HELP OF ACCENTURE

5.8.4 IBM HELPED SUN LIFE FINANCIAL MODERNIZE DIGITAL INSURANCE SOLUTIONS

5.8.5 ARAG GROUP EXPEDITED INTERNATIONAL REPORTING THROUGH IMPLEMENTATION OF SAP

5.8.6 QBE IMPLEMENTED MODERN REINSURANCE MANAGEMENT SYSTEM WITH HELP OF DUCK CREEK TECHNOLOGIES

5.9 TECHNOLOGY ANALYSIS

5.9.1 KEY TECHNOLOGIES

5.9.1.1 Artificial intelligence (AI) and machine learning (ML)

5.9.1.2 Blockchain

5.9.1.3 Cloud computing

5.9.1.4 IoT

5.9.1.5 Big data and analytics

5.9.2 ADJACENT TECHNOLOGIES

5.9.2.1 Cybersecurity

5.9.2.2 Digital identity verification

5.9.2.3 Telematics & GPS

5.9.3 COMPLEMENTARY TECHNOLOGIES

5.9.3.1 Robotic process automation (RPA)

5.9.3.2 Application programming interface (API)

5.9.3.3 Augmented reality/virtual reality (AR/VR)

5.10 TARIFF AND REGULATORY LANDSCAPE

5.10.1 TARIFF RELATED TO INSURANCE PLATFORM SOFTWARE

TABLE 11 TARIFF RELATED TO INSURANCE PLATFORM SOFTWARE, 2022

5.10.2 REGULATORY LANDSCAPE

5.10.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 15 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 16 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.10.4 REGULATIONS: INSURANCE PLATFORMS MARKET

5.10.4.1 North America

5.10.4.1.1 Health insurance portability and accountability act (HIPAA)

5.10.4.1.2 The gramm-leach-bliley act (GLBA)

5.10.4.1.3 Personal information protection and electronic documents act (PIPEDA)

5.10.4.2 Europe

5.10.4.2.1 General data protection regulation (GDPR)

5.10.4.2.2 Insurance distribution directive (IDD)

5.10.4.2.3 Solvency II directive

5.10.4.3 Asia Pacific

5.10.4.3.1 Insurance regulatory and development authority of India (IRDAI) regulations (India)

5.10.4.3.2 Financial services agency (FSA) regulations (Japan)

5.10.4.3.3 Insurance authority (IA) regulations (Hong Kong)

5.10.4.4 Middle East & Africa

5.10.4.4.1 Insurance authority (IA) regulations (United Arab Emirates)

5.10.4.4.2 Financial sector conduct authority (FSCA) regulations (South Africa)

5.10.4.4.3 Central bank of Nigeria (CBN) regulations (Nigeria)

5.10.4.5 Latin America

5.10.4.5.1 Superintendency of securities and insurance (SVS) regulations

5.10.4.5.2 Superintendence of private insurance (SUSEP) regulations

5.10.4.5.3 National insurance and bonding commission (CNSF) regulations

5.11 PATENT ANALYSIS

5.11.1 METHODOLOGY

5.11.2 PATENTS FILED

TABLE 17 PATENTS FILED, BY DOCUMENT TYPE, 2013–2023

5.11.3 INNOVATION AND PATENT APPLICATIONS

FIGURE 31 ANNUAL NUMBER OF PATENTS GRANTED, 2013–2023

5.11.3.1 Top applicants

FIGURE 32 TOP TEN PATENT APPLICANT COMPANIES, 2013–2023

FIGURE 33 REGIONAL ANALYSIS OF PATENTS GRANTED, 2013–2023

TABLE 18 TOP 20 PATENT OWNERS, 2013–2023

TABLE 19 LIST OF TOP PATENTS IN INSURANCE PLATFORMS MARKET, 2023

5.12 PRICING ANALYSIS

5.12.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY SOFTWARE FUNCTIONALITY

FIGURE 34 AVERAGE SELLING PRICES OF KEY PLAYERS FOR TOP 3 SOFTWARE FUNCTIONALITIES

TABLE 20 AVERAGE SELLING PRICES OF KEY PLAYERS, BY SOFTWARE FUNCTIONALITY

5.12.2 INDICATIVE PRICING ANALYSIS OF INSURANCE PLATFORMS, BY APPLICATION

TABLE 21 INDICATIVE PRICING ANALYSIS OF INSURANCE PLATFORMS, BY APPLICATION

5.13 TRADE ANALYSIS

5.13.1 EXPORT SCENARIO OF INSURANCE SERVICES

FIGURE 35 INSURANCE SERVICES EXPORT, BY KEY COUNTRY, 2015–2022 (USD BILLION)

5.13.2 IMPORT SCENARIO OF INSURANCE SERVICES

FIGURE 36 INSURANCE SERVICES IMPORT, BY KEY COUNTRY, 2015–2022 (USD BILLION)

5.14 KEY CONFERENCES AND EVENTS

TABLE 22 INSURANCE PLATFORMS MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.15 PORTER’S FIVE FORCES ANALYSIS

FIGURE 37 MARKET: PORTER’S FIVE FORCES ANALYSIS

5.15.1 THREAT OF NEW ENTRANTS

5.15.2 THREAT OF SUBSTITUTES

5.15.3 BARGAINING POWER OF SUPPLIERS

5.15.4 BARGAINING POWER OF BUYERS

5.15.5 INTENSITY OF COMPETITIVE RIVALRY

5.16 INSURANCE PLATFORM TECHNOLOGY ROADMAP UNTIL 2030

TABLE 23 INSURANCE PLATFORM TECHNOLOGY ROADMAP UNTIL 2030

5.16.1 SHORT-TERM (2023–2025)

5.16.2 MID-TERM (2026–2028)

5.16.3 LONG-TERM (2029–2030)

5.17 INSURANCE PLATFORM BUSINESS MODELS

5.17.1 PLATFORM LICENSING MODEL

5.17.2 SOFTWARE AS A SERVICE MODEL (SAAS)

5.17.3 PAY-PER-TRANSACTION MODEL

5.17.4 API INTEGRATION AND DEVELOPER SERVICES MODEL

5.17.5 WHITE LABEL INSURANCE PLATFORMS MODEL

5.18 TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS OF INSURANCE PLATFORMS MARKET

FIGURE 38 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS/CLIENTS

5.19 KEY STAKEHOLDERS AND BUYING CRITERIA

5.19.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 39 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

TABLE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

5.19.2 BUYING CRITERIA

FIGURE 40 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

TABLE 25 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

6 INSURANCE PLATFORMS MARKET, BY OFFERING (Page No. - 149)

6.1 INTRODUCTION

6.1.1 OFFERING: MARKET DRIVERS

FIGURE 41 INSURANCE PLATFORM SERVICES TO WITNESS FASTER GROWTH DURING FORECAST PERIOD

TABLE 26 MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 27 INSURANCE PLATFORMS MARKET, BY OFFERING, 2023–2028 (USD MILLION)

6.2 SOFTWARE

FIGURE 42 INSURANCE WORKFLOW AUTOMATION TO BE LARGEST SOFTWARE SEGMENT IN 2023

TABLE 28 INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 29 INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.1 INTELLIGENT DOCUMENT PROCESSING

TABLE 30 INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 31 INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.1.1 Digital document depository

TABLE 32 DIGITAL DOCUMENT DEPOSITORY SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 33 DIGITAL DOCUMENT DEPOSITORY SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.1.2 Document collaboration

TABLE 34 DOCUMENT COLLABORATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 35 DOCUMENT COLLABORATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.1.3 Document verification

TABLE 36 DOCUMENT VERIFICATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 37 DOCUMENT VERIFICATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.1.4 Document version control

TABLE 38 DOCUMENT VERSION CONTROL SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 39 DOCUMENT VERSION CONTROL SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.2 INSURANCE LEAD MANAGEMENT

TABLE 40 INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 41 INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.2.1 Lead tracking & assignment

TABLE 42 LEAD TRACKING & ASSIGNMENT SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 43 LEAD TRACKING & ASSIGNMENT SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.2.2 Lead scoring & nurturing

TABLE 44 LEAD SCORING & NURTURING SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 45 LEAD SCORING & NURTURING SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.2.3 Lead analytics

TABLE 46 LEAD ANALYTICS SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 47 LEAD ANALYTICS SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.2.4 Cross-selling & upselling

TABLE 48 CROSS-SELLING & UPSELLING SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 49 CROSS-SELLING & UPSELLING SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.3 INSURANCE WORKFLOW AUTOMATION

TABLE 50 INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 51 INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.3.1 Claims workflow automation

TABLE 52 CLAIMS WORKFLOW AUTOMATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 53 CLAIMS WORKFLOW AUTOMATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.3.2 Underwriting workflow automation

TABLE 54 UNDERWRITING WORKFLOW AUTOMATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 55 UNDERWRITING WORKFLOW AUTOMATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.3.3 Customer onboarding automation

TABLE 56 CUSTOMER ONBOARDING AUTOMATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 57 CUSTOMER ONBOARDING AUTOMATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.3.4 Compliance workflow automation

TABLE 58 COMPLIANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 59 COMPLIANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.4 POLICY MANAGEMENT

TABLE 60 POLICY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 61 POLICY MANAGEMENT SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.4.1 Policy issuance & renewal

TABLE 62 POLICY ISSUANCE & RENEWAL SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 63 POLICY ISSUANCE & RENEWAL SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.4.2 Policy documentation

TABLE 64 POLICY DOCUMENTATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 65 POLICY DOCUMENTATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.4.3 Policy premium calculations

TABLE 66 POLICY PREMIUM CALCULATIONS SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 67 POLICY PREMIUM CALCULATIONS SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.4.4 Policy quotation management

TABLE 68 POLICY QUOTATION MANAGEMENT SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 69 POLICY QUOTATION MANAGEMENT SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.5 VIDEO KYC/EKYC

TABLE 70 VIDEO KYC/EKYC SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 71 VIDEO KYC/EKYC SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.5.1 Identity & biometric verification

TABLE 72 IDENTITY & BIOMETRIC VERIFICATION SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 73 IDENTITY & BIOMETRIC VERIFICATION SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.5.2 Compliance reporting

TABLE 74 COMPLIANCE REPORTING SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 75 COMPLIANCE REPORTING SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.5.3 Audit trails

TABLE 76 AUDIT TRAILS SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 77 AUDIT TRAILS SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6 API & MICROSERVICES

TABLE 78 API & MICROSERVICES SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 79 API & MICROSERVICES SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.6.1 API-driven insurance integration platforms

TABLE 80 API-DRIVEN INSURANCE INTEGRATION PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 81 API-DRIVEN INSURANCE INTEGRATION PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.2 Partner ecosystem integration platforms

TABLE 82 PARTNER ECOSYSTEM INTEGRATION PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 83 PARTNER ECOSYSTEM INTEGRATION PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.3 API-enabled insurance distribution platforms

TABLE 84 API-ENABLED INSURANCE DISTRIBUTION PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 85 API-ENABLED INSURANCE DISTRIBUTION PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.4 Microservices

TABLE 86 MICROSERVICE SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 87 MICROSERVICE SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.2.6.4.1 Rating microservices

TABLE 88 RATING MICROSERVICE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 89 RATING MICROSERVICE SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.4.2 Document generation microservices

TABLE 90 DOCUMENT GENERATION MICROSERVICE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 91 DOCUMENT GENERATION MICROSERVICE SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.4.3 Transaction microservices

TABLE 92 TRANSACTION MICROSERVICE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 93 TRANSACTION MICROSERVICE SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.4.4 Workflow microservices

TABLE 94 WORKFLOW MICROSERVICE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 95 WORKFLOW MICROSERVICE SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.4.5 Utility microservices

TABLE 96 UTILITY MICROSERVICE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 97 UTILITY MICROSERVICE SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.4.6 Metadata microservices

TABLE 98 METADATA MICROSERVICE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 99 METADATA MICROSERVICE SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.6.4.7 Product management microservices

TABLE 100 PRODUCT MANAGEMENT MICROSERVICE SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 101 PRODUCT MANAGEMENT MICROSERVICE SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.2.7 OTHER SOFTWARE

TABLE 102 OTHER INSURANCE PLATFORM SOFTWARE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 103 OTHER INSURANCE PLATFORM SOFTWARE MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3 SERVICES

FIGURE 43 MANAGED SERVICES TO REGISTER HIGHEST CAGR IN INSURANCE PLATFORMS MARKET

TABLE 104 INSURANCE PLATFORM SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 105 INSURANCE PLATFORM SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.3.1 PROFESSIONAL SERVICES

6.3.1.1 Specialized expertise tailored to meet specific needs

FIGURE 44 CUSTOM PLATFORM DESIGN & DEVELOPMENT SERVICES SEGMENT TO BE FASTEST GROWING AMONG PROFESSIONAL SERVICES

TABLE 106 INSURANCE PLATFORM PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 107 INSURANCE PLATFORM PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.3.1.1.1 Consulting & advisory services

TABLE 108 INSURANCE PLATFORM CONSULTING & ADVISORY SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 109 INSURANCE PLATFORM CONSULTING & ADVISORY SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.1.1.2 Integration & implementation services

TABLE 110 INSURANCE PLATFORM INTEGRATION & IMPLEMENTATION SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 111 INSURANCE PLATFORM INTEGRATION & IMPLEMENTATION SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.1.1.3 Custom platform design & development services

TABLE 112 CUSTOM INSURANCE PLATFORMS DESIGN & DEVELOPMENT SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 113 CUSTOM INSURANCE PLATFORMS DESIGN & DEVELOPMENT SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.1.1.4 Training & education services

TABLE 114 INSURANCE PLATFORM TRAINING & EDUCATION SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 115 INSURANCE PLATFORM TRAINING & EDUCATION SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2 MANAGED SERVICES

6.3.2.1 End-to-end management to help businesses focus on core competencies

FIGURE 45 DATA MANAGEMENT & BACKUP SERVICES SUBSEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 116 INSURANCE PLATFORM MANAGED SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 117 INSURANCE PLATFORM MANAGED SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

6.3.2.1.1 Platform Hosting & Infrastructure Management Services

TABLE 118 INSURANCE PLATFORM HOSTING & INFRASTRUCTURE MANAGEMENT SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 119 INSURANCE PLATFORM HOSTING & INFRASTRUCTURE MANAGEMENT SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2.1.2 Platform maintenance & support services

TABLE 120 INSURANCE PLATFORM MAINTENANCE & SUPPORT SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 121 INSURANCE PLATFORM MAINTENANCE & SUPPORT SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2.1.3 Data management & backup services

TABLE 122 INSURANCE PLATFORM DATA MANAGEMENT & BACKUP SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 123 INSURANCE PLATFORM DATA MANAGEMENT & BACKUP SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

6.3.2.1.4 Security & compliance services

TABLE 124 INSURANCE PLATFORM SECURITY & COMPLIANCE SERVICES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 125 INSURANCE PLATFORM SECURITY & COMPLIANCE SERVICES MARKET, BY REGION, 2023–2028 (USD MILLION)

7 INSURANCE PLATFORMS MARKET, BY APPLICATION (Page No. - 204)

7.1 INTRODUCTION

7.1.1 APPLICATION: MARKET DRIVERS

FIGURE 46 CLAIMS MANAGEMENT APPLICATION SEGMENT TO ACCOUNT FOR LARGEST MARKET IN 2023

TABLE 126 MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 127 MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

7.2 CLAIMS MANAGEMENT

TABLE 128 MARKET IN CLAIMS MANAGEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 129 MARKET IN CLAIMS MANAGEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.2.1 VIRTUAL CLAIMS HANDLING

7.2.1.1 Need to facilitate remote assessments and damage evaluations

TABLE 130 MARKET IN VIRTUAL CLAIMS HANDLING, BY REGION, 2018–2022 (USD MILLION)

TABLE 131 MARKET IN VIRTUAL CLAIMS HANDLING, BY REGION, 2023–2028 (USD MILLION)

7.2.2 CLAIMS PROCESSING

7.2.2.1 Real-time updates and transparency for policyholders

TABLE 132 MARKET IN CLAIMS PROCESSING, BY REGION, 2018–2022 (USD MILLION)

TABLE 133 MARKET IN CLAIMS PROCESSING, BY REGION, 2023–2028 (USD MILLION)

7.2.3 CLAIMS ANALYTICS

7.2.3.1 New insights from data to improve efficiency of reporting and mitigate risks

TABLE 134 MARKET IN CLAIMS ANALYTICS, BY REGION, 2018–2022 (USD MILLION)

TABLE 135 MARKET IN CLAIMS ANALYTICS, BY REGION, 2023–2028 (USD MILLION)

7.3 UNDERWRITING & RATING

TABLE 136 MARKET IN UNDERWRITING & RATING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 137 MARKET IN UNDERWRITING & RATING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.3.1 GROUP INSURANCE UNDERWRITING

7.3.1.1 Need to evaluate collective risk and characteristics

TABLE 138 MARKET IN GROUP INSURANCE UNDERWRITING, BY REGION, 2018–2022 (USD MILLION)

TABLE 139 MARKET IN GROUP INSURANCE UNDERWRITING, BY REGION, 2023–2028 (USD MILLION)

7.3.2 CUSTOMER RISK PROFILING

7.3.2.1 Optimization of risk assessment process and accurate premiums

TABLE 140 MARKET IN CUSTOMER RISK PROFILING, BY REGION, 2018–2022 (USD MILLION)

TABLE 141 MARKET IN CUSTOMER RISK PROFILING, BY REGION, 2023–2028 (USD MILLION)

7.3.3 COLLABORATION & SELF-SERVICE

7.3.3.1 Demand for streamlined underwriting process, ensuring quick and accurate policy issuance

TABLE 142 MARKET IN COLLABORATION & SELF-SERVICE, BY REGION, 2018–2022 (USD MILLION)

TABLE 143 MARKET IN COLLABORATION & SELF-SERVICE, BY REGION, 2023–2028 (USD MILLION)

7.3.4 PRICING & QUOTE MANAGEMENT

7.3.4.1 Sophisticated pricing algorithms and market dynamics to calculate accurate rates

TABLE 144 MARKET IN PRICING & QUOTE MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

TABLE 145 MARKET IN PRICING & QUOTE MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

7.4 CUSTOMER RELATIONSHIP MANAGEMENT (CRM)

TABLE 146 MARKET IN CUSTOMER RELATIONSHIP MANAGEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 147 MARKET IN CUSTOMER RELATIONSHIP MANAGEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.4.1 CUSTOMER DATA MANAGEMENT

7.4.1.1 Benefits offered by deriving actionable insights and storing data

TABLE 148 MARKET IN CUSTOMER DATA MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

TABLE 149 MARKET IN CUSTOMER DATA MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

7.4.2 CUSTOMER INTERACTION & ENGAGEMENT

7.4.2.1 Real-time updates and personalized recommendations for policyholders

TABLE 150 MARKET IN CUSTOMER INTERACTION & ENGAGEMENT, BY REGION, 2018–2022 (USD MILLION)

TABLE 151 MARKET IN CUSTOMER INTERACTION & ENGAGEMENT, BY REGION, 2023–2028 (USD MILLION)

7.4.3 CUSTOMER SUPPORT & SERVICE

7.4.3.1 Boosting customer satisfaction with multi-channel support and virtual assistants

TABLE 152 MARKET IN CUSTOMER SUPPORT & SERVICE, BY REGION, 2018–2022 (USD MILLION)

TABLE 153 MARKET IN CUSTOMER SUPPORT & SERVICE, BY REGION, 2023–2028 (USD MILLION)

7.5 BILLING & PAYMENTS

TABLE 154 MARKET IN BILLING & PAYMENTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 155 MARKET IN BILLING & PAYMENTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.5.1 PREMIUM BILLING & INVOICING

7.5.1.1 Enhanced critical components of policy administration and process streamlining

TABLE 156 MARKET IN PREMIUM BILLING & INVOICING, BY REGION, 2018–2022 (USD MILLION)

TABLE 157 MARKET IN PREMIUM BILLING & INVOICING, BY REGION, 2023–2028 (USD MILLION)

7.5.2 ONLINE PAYMENT PROCESSING

7.5.2.1 Lower payment processing costs and improved cash flow

TABLE 158 MARKET IN ONLINE PAYMENT PROCESSING, BY REGION, 2018–2022 (USD MILLION)

TABLE 159 MARKET IN ONLINE PAYMENT PROCESSING, BY REGION, 2023–2028 (USD MILLION)

7.5.3 RECONCILIATION & ACCOUNTING

7.5.3.1 Reduction of manual errors and enhancement of overall efficiency

TABLE 160 MARKET IN RECONCILIATION & ACCOUNTING, BY REGION, 2018–2022 (USD MILLION)

TABLE 161 MARKET IN RECONCILIATION & ACCOUNTING, BY REGION, 2023–2028 (USD MILLION)

7.6 DATA ANALYTICS

TABLE 162 MARKET IN DATA ANALYTICS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 163 MARKET IN DATA ANALYTICS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.6.1 SUBROGATION ANALYTICS

7.6.1.1 Real-time insights into effectiveness of subrogation efforts

TABLE 164 MARKET IN SUBROGATION ANALYTICS, BY REGION, 2018–2022 (USD MILLION)

TABLE 165 MARKET IN SUBROGATION ANALYTICS, BY REGION, 2023–2028 (USD MILLION)

7.6.2 PERFORMANCE TRACKING & REPORTING

7.6.2.1 Advanced analytics to gather, analyze, and visualize key performance indicators (KPIs)

TABLE 166 MARKET IN PERFORMANCE TRACKING & REPORTING, BY REGION, 2018–2022 (USD MILLION)

TABLE 167 MARKET IN PERFORMANCE TRACKING & REPORTING, BY REGION, 2023–2028 (USD MILLION)

7.6.3 FRAUD DETECTION & PREVENTION

7.6.3.1 Enabling insurers to adapt their anti-fraud strategies proactively

TABLE 168 MARKET IN FRAUD DETECTION & PREVENTION, BY REGION, 2018–2022 (USD MILLION)

TABLE 169 MARKET IN FRAUD DETECTION & PREVENTION, BY REGION, 2023–2028 (USD MILLION)

7.7 COMPLIANCE & REPORTING

TABLE 170 MARKET IN COMPLIANCE & REPORTING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 171 MARKET IN COMPLIANCE & REPORTING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.7.1 REGULATORY COMPLIANCE MANAGEMENT

7.7.1.1 Automating compliance checks and data monitoring to mitigate risk

TABLE 172 MARKET IN REGULATORY COMPLIANCE MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

TABLE 173 MARKET IN REGULATORY COMPLIANCE MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

7.7.2 REPORTING AUTOMATION

7.7.2.1 Provision of access to up-to-the-minute insights into their operations

TABLE 174 MARKET IN REPORTING AUTOMATION, BY REGION, 2018–2022 (USD MILLION)

TABLE 175 MARKET IN REPORTING AUTOMATION, BY REGION, 2023–2028 (USD MILLION)

7.7.3 COMPLIANCE AUDITING

7.7.3.1 Advanced data analytics to systematically review and verify insurer’s operations

TABLE 176 MARKET IN COMPLIANCE AUDITING, BY REGION, 2018–2022 (USD MILLION)

TABLE 177 MARKET IN COMPLIANCE AUDITING, BY REGION, 2023–2028 (USD MILLION)

7.8 POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT

TABLE 178 MARKET IN POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 179 MARKET IN POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.8.1 POLICY CREATION & MODIFICATION

7.8.1.1 Seamless modification of existing policies to enhance efficiency

TABLE 180 MARKET IN POLICY CREATION & MODIFICATION, BY REGION, 2018–2022 (USD MILLION)

TABLE 181 MARKET IN POLICY CREATION & MODIFICATION, BY REGION, 2023–2028 (USD MILLION)

7.8.2 PREMIUM COLLECTION

7.8.2.1 Improved financial stability with timely and accurate premium collection

TABLE 182 MARKET IN PREMIUM COLLECTION, BY REGION, 2018–2022 (USD MILLION)

TABLE 183 MARKET IN PREMIUM COLLECTION, BY REGION, 2023–2028 (USD MILLION)

7.8.3 PAYOUT & DISBURSEMENT MANAGEMENT

7.8.3.1 Real-time tracking and reporting capabilities to benefit policy administration

TABLE 184 MARKET IN PAYOUT & DISBURSEMENT MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

TABLE 185 MARKET IN PAYOUT & DISBURSEMENT MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

7.9 SALES & MARKETING

TABLE 186 MARKET IN SALES & MARKETING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 187 MARKET IN SALES & MARKETING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.9.1 AGENT & BROKER MANAGEMENT

7.9.1.1 Facilitating efficient communication and collaboration among parties

TABLE 188 MARKET IN AGENT & BROKER MANAGEMENT, BY REGION, 2018–2022 (USD MILLION)

TABLE 189 MARKET IN AGENT & BROKER MANAGEMENT, BY REGION, 2023–2028 (USD MILLION)

7.9.2 DIRECT-TO-CONSUMER SALES

7.9.2.1 Bypassing traditional distribution channels such as agents and brokers

TABLE 190 MARKET IN DIRECT-TO-CONSUMER SALES, BY REGION, 2018–2022 (USD MILLION)

TABLE 191 MARKET IN DIRECT-TO-CONSUMER SALES, BY REGION, 2023–2028 (USD MILLION)

7.9.3 DIGITAL SALES ENABLEMENT

7.9.3.1 Enabled sales agents with deep understanding of customer preferences and behavior

TABLE 192 MARKET IN DIGITAL SALES ENABLEMENT, BY REGION, 2018–2022 (USD MILLION)

TABLE 193 MARKET IN DIGITAL SALES ENABLEMENT, BY REGION, 2023–2028 (USD MILLION)

7.10 PROPERTY ESTIMATION

TABLE 194 MARKET IN PROPERTY ESTIMATION, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 195 MARKET IN PROPERTY ESTIMATION, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.10.1 PROPERTY VALUATION

7.10.1.1 Real-time risk assessment and policy pricing

TABLE 196 MARKET IN PROPERTY VALUATION, BY REGION, 2018–2022 (USD MILLION)

TABLE 197 MARKET IN PROPERTY VALUATION, BY REGION, 2023–2028 (USD MILLION)

7.10.2 CLAIMS ESTIMATION

7.10.2.1 Technological synergy between data analytics and claims estimation to provide cost efficiencies

TABLE 198 MARKET IN CLAIMS ESTIMATION, BY REGION, 2018–2022 (USD MILLION)

TABLE 199 MARKET IN CLAIMS ESTIMATION, BY REGION, 2023–2028 (USD MILLION)

7.10.3 PROPERTY INSPECTION

7.10.3.1 Delivering insights into potential hazards, safety measures, and maintenance requirements

TABLE 200 MARKET IN PROPERTY INSPECTION, BY REGION, 2018–2022 (USD MILLION)

TABLE 201 MARKET IN PROPERTY INSPECTION, BY REGION, 2023–2028 (USD MILLION)

7.11 PREDICTIVE MODELING/EXTREME EVENT FORECASTING

TABLE 202 MARKET IN PREDICTIVE MODELING/EXTREME EVENT FORECASTING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 203 MARKET IN PREDICTIVE MODELING/EXTREME EVENT FORECASTING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

7.11.1 CLAIMS SEVERITY MODELING

7.11.1.1 More prudent allocation of resources and informed underwriting decisions

TABLE 204 MARKET IN CLAIMS SEVERITY MODELING, BY REGION, 2018–2022 (USD MILLION)

TABLE 205 MARKET IN CLAIMS SEVERITY MODELING, BY REGION, 2023–2028 (USD MILLION)

7.11.2 POLICY RECOMMENDATION ENGINES

7.11.2.1 Improvement of customer satisfaction with highly personalized insurance policy recommendations

TABLE 206 MARKET IN POLICY RECOMMENDATION ENGINES, BY REGION, 2018–2022 (USD MILLION)

TABLE 207 MARKET IN POLICY RECOMMENDATION ENGINES, BY REGION, 2023–2028 (USD MILLION)

7.11.3 EXTREME EVENT ANALYSIS

7.11.3.1 Proactive approach to disaster preparedness and risk management

TABLE 208 MARKET IN EXTREME EVENT ANALYSIS, BY REGION, 2018–2022 (USD MILLION)

TABLE 209 MARKET IN EXTREME EVENT ANALYSIS, BY REGION, 2023–2028 (USD MILLION)

7.11.4 CATASTROPHE MODELING

7.11.4.1 Fortified risk assessment and mitigation strategies

TABLE 210 MARKET IN CATASTROPHE MODELING, BY REGION, 2018–2022 (USD MILLION)

TABLE 211 MARKET IN CATASTROPHE MODELING, BY REGION, 2023–2028 (USD MILLION)

7.12 OTHER APPLICATIONS

TABLE 212 MARKET IN OTHER APPLICATIONS, BY REGION, 2018–2022 (USD MILLION)

TABLE 213 MARKET IN OTHER APPLICATIONS, BY REGION, 2023–2028 (USD MILLION)

8 INSURANCE PLATFORMS MARKET, BY TECHNOLOGY (Page No. - 251)

8.1 INTRODUCTION

8.1.1 TECHNOLOGY: MARKET DRIVERS

FIGURE 47 AI & ML SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

TABLE 214 MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

TABLE 215 MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

8.2 AI & ML

8.2.1 GENERATIVE AI TO BE SIGNIFICANT OPPORTUNITY FOR MARKET GROWTH

TABLE 216 AI & ML PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 217 AI & ML PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

8.2.2 AI-POWERED UNDERWRITING PLATFORMS

TABLE 218 AI-POWERED UNDERWRITING PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 219 AI-POWERED UNDERWRITING PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.2.3 ML-BASED CLAIMS PROCESSING PLATFORMS

TABLE 220 ML-BASED CLAIMS PROCESSING PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 221 ML-BASED CLAIMS PROCESSING PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.2.4 AI-DRIVEN CUSTOMER SERVICE & CHATBOT PLATFORMS

TABLE 222 AI-DRIVEN CUSTOMER SERVICE & CHATBOT PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 223 AI-DRIVEN CUSTOMER SERVICE & CHATBOT PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.2.5 GENERATIVE AI-BASED CONTENT MARKETING

TABLE 224 GENERATIVE AI-BASED CONTENT MARKETING PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 225 GENERATIVE AI-BASED CONTENT MARKETING PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.2.6 ROBOTIC PROCESS AUTOMATION

TABLE 226 ROBOTIC PROCESS AUTOMATION PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 227 ROBOTIC PROCESS AUTOMATION PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.2.7 OTHER AI & ML TECHNOLOGIES

TABLE 228 OTHER AI & ML PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 229 OTHER AI & ML PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.3 IOT

8.3.1 DATA-DRIVEN RISK ASSESSMENT TO ENCOURAGE PERSONALIZED POLICIES

TABLE 230 IOT PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 231 IOT PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

8.3.2 IOT-ENABLED TELEMATICS PLATFORMS

TABLE 232 IOT-ENABLED TELEMATICS PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 233 IOT-ENABLED TELEMATICS PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.3.3 CONNECTED HOME & PROPERTY INSURANCE PLATFORMS

TABLE 234 CONNECTED HOME & PROPERTY MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 235 CONNECTED HOME & PROPERTY MARKET, BY REGION, 2023–2028 (USD MILLION)

8.3.4 WEARABLE DEVICE INTEGRATION FOR HEALTH INSURANCE

TABLE 236 WEARABLE DEVICE INTEGRATION PLATFORMS FOR HEALTH INSURANCE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 237 WEARABLE DEVICE INTEGRATION PLATFORMS FOR HEALTH INSURANCE MARKET, BY REGION, 2023–2028 (USD MILLION)

8.3.5 OTHER IOT PLATFORMS

TABLE 238 OTHER IOT PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 239 OTHER IOT PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.4 BLOCKCHAIN

8.4.1 NEED TO PROVIDE SECURE AND TRANSPARENT PLATFORMS

TABLE 240 BLOCKCHAIN PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 241 BLOCKCHAIN PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

8.4.2 BLOCKCHAIN-BASED INSURANCE PLATFORMS

TABLE 242 BLOCKCHAIN-BASED MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 243 BLOCKCHAIN-BASED MARKET, BY REGION, 2023–2028 (USD MILLION)

8.4.3 SMART CONTRACT INSURANCE PLATFORMS

TABLE 244 SMART CONTRACT MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 245 SMART CONTRACT MARKET, BY REGION, 2023–2028 (USD MILLION)

8.4.4 DECENTRALIZED INSURANCE PLATFORMS

TABLE 246 DECENTRALIZED MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 247 DECENTRALIZED MARKET, BY REGION, 2023–2028 (USD MILLION)

8.4.5 OTHER BLOCKCHAIN TECHNOLOGIES

TABLE 248 OTHER BLOCKCHAIN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 249 OTHER BLOCKCHAIN PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.5 DATA ANALYTICS & BIG DATA

8.5.1 INTEGRATION OF THIRD-PARTY DATA SOURCES, BEHAVIORAL ECONOMICS, AND UNSTRUCTURED DATA ANALYTICS TO UNDERSTAND CUSTOMER BEHAVIOR

TABLE 250 DATA ANALYTICS & BIG DATA PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 251 DATA ANALYTICS & BIG DATA PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

8.5.2 BIG DATA ANALYTICS FOR RISK ASSESSMENT

TABLE 252 BIG DATA ANALYTICS FOR RISK ASSESSMENT PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 253 BIG DATA ANALYTICS FOR RISK ASSESSMENT PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.5.3 PREDICTIVE ANALYTICS FOR PRICING & UNDERWRITING

TABLE 254 PREDICTIVE ANALYTICS PLATFORMS FOR PRICING & UNDERWRITING MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 255 PREDICTIVE ANALYTICS PLATFORMS FOR PRICING & UNDERWRITING MARKET, BY REGION, 2023–2028 (USD MILLION)

8.5.4 DATA-DRIVEN CLAIMS PROCESSING PLATFORMS

TABLE 256 DATA-DRIVEN CLAIMS PROCESSING PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 257 DATA-DRIVEN CLAIMS PROCESSING PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.5.5 OTHER PREDICTIVE ANALYTICS TECHNOLOGIES

TABLE 258 OTHER PREDICTIVE ANALYTICS PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 259 OTHER PREDICTIVE ANALYTICS PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.6 REGULATORY TECHNOLOGY (REGTECH)

8.6.1 STREAMLINING COMPLIANCE AND RISK MANAGEMENT

TABLE 260 REGULATORY TECHNOLOGY PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 261 REGULATORY TECHNOLOGY PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

8.6.2 REGULATORY COMPLIANCE & REPORTING PLATFORMS

TABLE 262 REGULATORY COMPLIANCE & REPORTING PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 263 REGULATORY COMPLIANCE & REPORTING PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.6.3 KYC & AML COMPLIANCE SOLUTIONS

TABLE 264 KYC & AML COMPLIANCE SOLUTIONS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 265 KYC & AML COMPLIANCE SOLUTIONS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.6.4 REGULATORY RISK ASSESSMENT & MANAGEMENT

TABLE 266 REGULATORY RISK ASSESSMENT & MANAGEMENT PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 267 REGULATORY RISK ASSESSMENT & MANAGEMENT PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.6.5 OTHER REGULATORY TECHNOLOGIES

TABLE 268 OTHER REGTECH PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 269 OTHER REGTECH PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

8.7 OTHER TECHNOLOGIES

TABLE 270 OTHER INSURANCE PLATFORM TECHNOLOGIES MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 271 OTHER INSURANCE PLATFORM TECHNOLOGIES MARKET, BY REGION, 2023–2028 (USD MILLION)

9 INSURANCE PLATFORMS MARKET, BY INSURANCE TYPE (Page No. - 283)

9.1 INTRODUCTION

9.1.1 INSURANCE TYPE: MARKET DRIVERS

FIGURE 48 LIFE INSURANCE TO ACCOUNT FOR LARGEST MARKET AMONG INSURANCE TYPES DURING FORECAST PERIOD

TABLE 272 MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

TABLE 273 MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

9.2 GENERAL INSURANCE

9.2.1 OPTIMIZING RISK PROTECTION WITH INTEGRATION OF VITAL PLATFORMS OF VARIOUS DOMAINS

FIGURE 49 AUTOMOBILE INSURANCE TO BE LARGEST GENERAL INSURANCE TYPE SEGMENT IN 2023

TABLE 274 GENERAL MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 275 GENERAL MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.2.2 HEALTHCARE INSURANCE

TABLE 276 HEALTHCARE MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 277 HEALTHCARE MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.2.2.1 Individual health insurance

TABLE 278 INDIVIDUAL HEALTH MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 279 INDIVIDUAL HEALTH MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.2.2 Family floater insurance

TABLE 280 FAMILY FLOATER MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 281 FAMILY FLOATER MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.2.3 Critical illness coverage

TABLE 282 CRITICAL ILLNESS COVERAGE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 283 CRITICAL ILLNESS COVERAGE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.2.4 Senior citizen health insurance

TABLE 284 SENIOR CITIZEN HEALTH MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 285 SENIOR CITIZEN HEALTH MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.2.5 Group health insurance

TABLE 286 GROUP HEALTH MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 287 GROUP HEALTH MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.3 AUTOMOBILE INSURANCE

TABLE 288 AUTOMOBILE MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 289 AUTOMOBILE MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.2.3.1 Car insurance

TABLE 290 CAR MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 291 CAR MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.3.2 Bike insurance

TABLE 292 BIKE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 293 BIKE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.3.3 Commercial vehicle insurance

TABLE 294 COMMERCIAL VEHICLE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 295 COMMERCIAL VEHICLE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.4 HOMEOWNER’S INSURANCE

TABLE 296 HOMEOWNER’S MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 297 HOMEOWNER’S MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.2.4.1 Home building insurance

TABLE 298 HOME BUILDING MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 299 HOME BUILDING MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.4.2 Public liability coverage

TABLE 300 PUBLIC LIABILITY COVERAGE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 301 PUBLIC LIABILITY COVERAGE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.4.3 Standard fire & special perils policy

TABLE 302 STANDARD FIRE & SPECIAL PERILS POLICY PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 303 STANDARD FIRE & SPECIAL PERILS POLICY PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.5 TRAVEL INSURANCE

TABLE 304 TRAVEL MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 305 TRAVEL MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.2.5.1 Trip cancellation

TABLE 306 TRIP CANCELLATION MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 307 TRIP CANCELLATION MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.5.2 Medical coverage

TABLE 308 MEDICAL COVERAGE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 309 MEDICAL COVERAGE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.2.5.3 Baggage loss

TABLE 310 BAGGAGE LOSS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 311 BAGGAGE LOSS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3 LIFE INSURANCE

9.3.1 SECURING FUTURES AND BUILDING WEALTH WITH DIVERSE LIFE INSURANCE OFFERINGS

FIGURE 50 WHOLE LIFE INSURANCE TO REGISTER HIGHEST GROWTH IN LIFE MARKET DURING FORECAST PERIOD

TABLE 312 LIFE MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 313 LIFE MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.3.2 TERM LIFE INSURANCE

TABLE 314 TERM LIFE MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 315 TERM LIFE MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.3.2.1 Level term life insurance

TABLE 316 LEVEL TERM LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 317 LEVEL TERM LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.2.2 Increasing term insurance

TABLE 318 INCREASING TERM MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 319 INCREASING TERM MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.2.3 Decreasing term insurance

TABLE 320 DECREASING TERM MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 321 DECREASING TERM MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.2.4 Return of premium term insurance

TABLE 322 RETURN OF PREMIUM TERM MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 323 RETURN OF PREMIUM TERM MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.2.5 Convertible term plans

TABLE 324 CONVERTIBLE TERM PLANS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 325 CONVERTIBLE TERM PLANS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.3 UNIT-LINKED INSURANCE PLANS (ULIP)

TABLE 326 UNIT-LINKED INSURANCE PLAN PLATFORMS MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 327 UNIT-LINKED INSURANCE PLAN PLATFORMS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.3.3.1 Type 1 ULIP

TABLE 328 TYPE 1 ULIP PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 329 TYPE 1 ULIP PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.3.2 Type 2 ULIP

TABLE 330 TYPE 2 ULIP PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 331 TYPE 2 ULIP PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4 WHOLE LIFE INSURANCE

TABLE 332 WHOLE LIFE MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 333 WHOLE LIFE MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.3.4.1 Indexed whole life insurance

TABLE 334 INDEXED WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 335 INDEXED WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.2 Guaranteed issue whole life insurance

TABLE 336 GUARANTEED ISSUE WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 337 GUARANTEED ISSUE WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.3 Limited payment whole life insurance

TABLE 338 LIMITED PAYMENT WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 339 LIMITED PAYMENT WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.4 Joint whole life insurance

TABLE 340 JOINT WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 341 JOINT WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.5 Modified whole life insurance

TABLE 342 MODIFIED WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 343 MODIFIED WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.6 Reduced paid-up whole life insurance

TABLE 344 REDUCED PAID-UP WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 345 REDUCED PAID-UP WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.7 Simplified issue whole life insurance

TABLE 346 SIMPLIFIED ISSUE WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 347 SIMPLIFIED ISSUE WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.8 Single-premium whole life insurance

TABLE 348 SINGLE-PREMIUM WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 349 SINGLE-PREMIUM WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.9 Variable whole life insurance

TABLE 350 VARIABLE WHOLE LIFE MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 351 VARIABLE WHOLE LIFE MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.4.10 Whole life insurance for children

TABLE 352 WHOLE LIFE INSURANCE FOR CHILDREN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 353 WHOLE LIFE INSURANCE FOR CHILDREN PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.5 ENDOWMENT PLANS

TABLE 354 ENDOWMENT PLAN PLATFORMS MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 355 ENDOWMENT PLAN PLATFORMS MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.3.5.1 Unit linked endowment plan

TABLE 356 UNIT LINKED ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 357 UNIT LINKED ENDOWMENT PLAN: MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.5.2 Guaranteed endowment plan

TABLE 358 GUARANTEED ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 359 GUARANTEED ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.5.3 Full/with profit endowment plan

TABLE 360 FULL/WITH PROFIT ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 361 FULL/WITH PROFIT ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.5.4 Low-cost endowment plan

TABLE 362 LOW-COST ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 363 LOW-COST ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.3.5.5 Non-profit endowment plan

TABLE 364 NON-PROFIT ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 365 NON-PROFIT ENDOWMENT PLAN PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.4 CYBERSECURITY INSURANCE

9.4.1 MITIGATING RISK AND PROTECTING SENSITIVE INFORMATION

FIGURE 51 DATA BREACH COVERAGE TO LEAD AMONG CYBERSECURITY INSURANCE PLATFORMS DURING FORECAST PERIOD

TABLE 366 CYBERSECURITY MARKET, BY SUBTYPE, 2018–2022 (USD MILLION)

TABLE 367 CYBERSECURITY MARKET, BY SUBTYPE, 2023–2028 (USD MILLION)

9.4.2 DATA BREACH COVERAGE

TABLE 368 DATA BREACH COVERAGE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 369 DATA BREACH COVERAGE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.4.3 CYBER EXTORTION & RANSOMWARE COVERAGE

TABLE 370 CYBER EXTORTION & RANSOMWARE COVERAGE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 371 CYBER EXTORTION & RANSOMWARE COVERAGE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.4.4 REGULATORY FINES & PENALTIES COVERAGE

TABLE 372 REGULATORY FINES & PENALTIES COVERAGE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 373 REGULATORY FINES & PENALTIES COVERAGE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

9.4.5 CYBERTERRORISM INSURANCE

TABLE 374 CYBERTERRORISM MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 375 CYBERTERRORISM MARKET, BY REGION, 2023–2028 (USD MILLION)

9.5 OTHER INSURANCE TYPES

TABLE 376 OTHER INSURANCE TYPE PLATFORMS MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 377 OTHER INSURANCE TYPE PLATFORMS MARKET, BY REGION, 2023–2028 (USD MILLION)

10 INSURANCE PLATFORMS MARKET, BY END USER (Page No. - 342)

10.1 INTRODUCTION

10.1.1 END USER: MARKET DRIVERS

FIGURE 52 INSURANCE COMPANIES TO LEAD IN ADOPTION OF PLATFORMS DURING FORECAST PERIOD

TABLE 378 MARKET, BY END USER, 2018–2022 (USD MILLION)

TABLE 379 MARKET, BY END USER, 2023–2028 (USD MILLION)

10.2 INSURANCE COMPANIES

10.2.1 EXTENSIVE RESOURCES OF LARGE INSURANCE COMPANIES TO GRANT ACCESS TO TECHNOLOGY INFRASTRUCTURE

TABLE 380 MARKET FOR INSURANCE COMPANIES, BY TYPE, 2018–2022 (USD MILLION)

TABLE 381 MARKET FOR INSURANCE COMPANIES, 2023–2028 (USD MILLION)

10.2.2 LARGE CARRIERS

TABLE 382 MARKET FOR LARGE CARRIERS, BY REGION, 2018–2022 (USD MILLION)

TABLE 383 MARKET FOR LARGE CARRIERS, BY REGION, 2023–2028 (USD MILLION)

10.2.3 MID-SIZED CARRIERS

TABLE 384 MARKET FOR MID-SIZED CARRIERS, BY REGION, 2018–2022 (USD MILLION)

TABLE 385 MARKET FOR MID-SIZED CARRIERS, BY REGION, 2023–2028 (USD MILLION)

10.2.4 SMALL & STARTUP INSURERS

TABLE 386 MARKET FOR SMALL & STARTUP INSURERS, BY REGION, 2018–2022 (USD MILLION)

TABLE 387 MARKET FOR SMALL & STARTUP INSURERS, BY REGION, 2023–2028 (USD MILLION)

10.3 INSURANCE AGENCIES & BROKERS

10.3.1 NEED TO ENHANCE ACCESSIBILITY AND UNDERSTANDING OF INSURANCE PRODUCTS

TABLE 388 MARKET FOR INSURANCE AGENCIES & BROKERS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 389 MARKET FOR INSURANCE AGENCIES & BROKERS, BY TYPE, 2023–2028 (USD MILLION)

10.3.2 INDEPENDENT AGENCIES

TABLE 390 MARKET FOR INDEPENDENT AGENCIES, BY REGION, 2018–2022 (USD MILLION)

TABLE 391 MARKET FOR INDEPENDENT AGENCIES, BY REGION, 2023–2028 (USD MILLION)

10.3.3 BROKERAGE FIRMS

TABLE 392 MARKET FOR BROKERAGE FIRMS, BY REGION, 2018–2022 (USD MILLION)

TABLE 393 MARKET FOR BROKERAGE FIRMS, BY REGION, 2023–2028 (USD MILLION)

10.3.4 ONLINE AGGREGATORS

TABLE 394 MARKET FOR ONLINE AGGREGATORS, BY REGION, 2018–2022 (USD MILLION)

TABLE 395 MARKET FOR ONLINE AGGREGATORS, BY REGION, 2023–2028 (USD MILLION)

10.4 THIRD-PARTY ADMINISTRATORS (TPAS)

10.4.1 OPTIMIZING EFFICIENCY AND ACCURACY WITHIN INSURANCE ECOSYSTEM

TABLE 396 MARKET FOR THIRD-PARTY ADMINISTRATORS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 397 MARKET FOR THIRD-PARTY ADMINISTRATORS, BY TYPE, 2023–2028 (USD MILLION)

10.4.2 CLAIMS HANDLING FIRMS

TABLE 398 MARKET FOR CLAIMS HANDLING FIRMS, BY REGION, 2018–2022 (USD MILLION)

TABLE 399 MARKET FOR CLAIMS HANDLING FIRMS, BY REGION, 2023–2028 (USD MILLION)

10.4.3 POLICY MANAGEMENT SERVICE PROVIDERS

TABLE 400 MARKET FOR POLICY MANAGEMENT SERVICE PROVIDERS, BY REGION, 2018–2022 (USD MILLION)

TABLE 401 MARKET FOR POLICY MANAGEMENT SERVICE PROVIDERS, BY REGION, 2023–2028 (USD MILLION)

10.5 ACTUARIES

10.5.1 EVALUATING POTENTIAL FINANCIAL IMPACT OF VARIOUS RISKS WITH HELP OF ACTUARIES

TABLE 402 MARKET FOR ACTUARIES, BY REGION, 2018–2022 (USD MILLION)

TABLE 403 MARKET FOR ACTUARIES, BY REGION, 2023–2028 (USD MILLION)

10.6 REINSURERS

10.6.1 SAFEGUARDING FINANCIAL STABILITY OF PRIMARY INSURERS BY OFFERING ADDITIONAL LAYER OF RISK PROTECTION

TABLE 404 MARKET FOR REINSURERS, BY REGION, 2018–2022 (USD MILLION)

TABLE 405 MARKET FOR REINSURERS, BY REGION, 2023–2028 (USD MILLION)

11 INSURANCE PLATFORMS MARKET, BY REGION (Page No. - 359)

11.1 INTRODUCTION

FIGURE 53 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 54 SINGAPORE TO WITNESS HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 406 MARKET, BY REGION, 2018–2022 (USD MILLION)

TABLE 407 MARKET, BY REGION, 2023–2028 (USD MILLION)

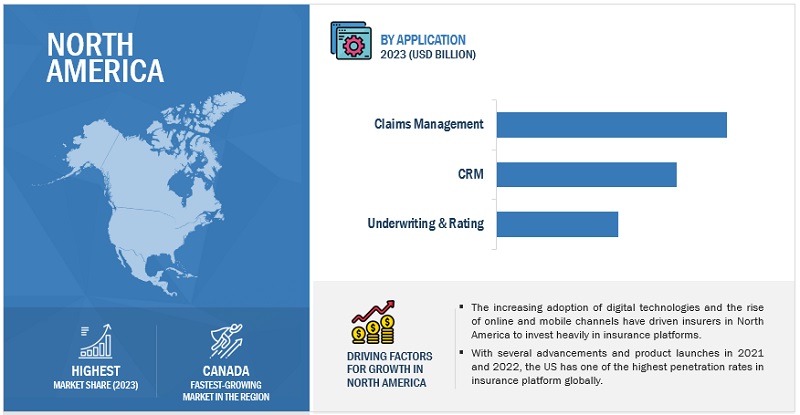

11.2 NORTH AMERICA

11.2.1 NORTH AMERICA: MARKET DRIVERS

11.2.2 NORTH AMERICA: RECESSION IMPACT

FIGURE 55 NORTH AMERICA: INSURANCE PLATFORMS MARKET SNAPSHOT

TABLE 408 NORTH AMERICA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 409 NORTH AMERICA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 410 NORTH AMERICA: INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 411 NORTH AMERICA: INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 412 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 413 NORTH AMERICA: INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 414 NORTH AMERICA: INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 415 NORTH AMERICA: INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 416 NORTH AMERICA: INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 417 NORTH AMERICA: INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 418 NORTH AMERICA: INSURANCE POLICY MANAGEMENT SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 419 NORTH AMERICA: INSURANCE POLICY MANAGEMENT SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 420 NORTH AMERICA: VIDEO KYC/EKYC SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 421 NORTH AMERICA: VIDEO KYC/EKYC SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 422 NORTH AMERICA: INSURANCE PLATFORM API & MICROSERVICES SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 423 NORTH AMERICA: INSURANCE PLATFORM API & MICROSERVICES SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 424 NORTH AMERICA: INSURANCE PLATFORM MICROSERVICES SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 425 NORTH AMERICA: INSURANCE PLATFORM MICROSERVICES SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 426 NORTH AMERICA: INSURANCE PLATFORM SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 427 NORTH AMERICA: INSURANCE PLATFORM SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 428 NORTH AMERICA: INSURANCE PLATFORM PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 429 NORTH AMERICA: INSURANCE PLATFORM PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 430 NORTH AMERICA: INSURANCE PLATFORM MANAGED SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 431 NORTH AMERICA: INSURANCE PLATFORM MANAGED SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 432 NORTH AMERICA: INSURANCE PLATFORMS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 433 NORTH AMERICA: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 434 NORTH AMERICA: MARKET IN CLAIMS MANAGEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 435 NORTH AMERICA: MARKET IN CLAIMS MANAGEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 436 NORTH AMERICA: MARKET IN UNDERWRITING & RATING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 437 NORTH AMERICA: MARKET IN UNDERWRITING & RATING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 438 NORTH AMERICA: MARKET IN CUSTOMER RELATIONSHIP MANAGEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 439 NORTH AMERICA: MARKET IN CUSTOMER RELATIONSHIP MANAGEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 440 NORTH AMERICA: MARKET IN BILLING & PAYMENTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 441 NORTH AMERICA: MARKET IN BILLING & PAYMENTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 442 NORTH AMERICA: MARKET IN DATA ANALYTICS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 443 NORTH AMERICA: MARKET IN DATA ANALYTICS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 444 NORTH AMERICA: MARKET IN COMPLIANCE & REPORTING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 445 NORTH AMERICA: MARKET IN COMPLIANCE & REPORTING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 446 NORTH AMERICA: MARKET IN POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 447 NORTH AMERICA: INSURANCE PLATFORMS MARKET IN POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 448 NORTH AMERICA: MARKET IN SALES & MARKETING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 449 NORTH AMERICA: MARKET IN SALES & MARKETING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 450 NORTH AMERICA: MARKET IN PROPERTY ESTIMATION, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 451 NORTH AMERICA: MARKET IN PROPERTY ESTIMATION, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 452 NORTH AMERICA: MARKET IN PREDICTIVE MODELING/ EXTREME EVENT FORECASTING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 453 NORTH AMERICA: MARKET IN PREDICTIVE MODELING/ EXTREME EVENT FORECASTING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 454 NORTH AMERICA: INSURANCE PLATFORMS MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

TABLE 455 NORTH AMERICA: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 456 NORTH AMERICA: AI & ML PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 457 NORTH AMERICA: AI & ML PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 458 NORTH AMERICA: IOT PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 459 NORTH AMERICA: IOT PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 460 NORTH AMERICA: BLOCKCHAIN PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 461 NORTH AMERICA: BLOCKCHAIN PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 462 NORTH AMERICA: DATA ANALYTICS & BIG DATA PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 463 NORTH AMERICA: DATA ANALYTICS & BIG DATA PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 464 NORTH AMERICA: REGTECH PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 465 NORTH AMERICA: REGTECH PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 466 NORTH AMERICA: MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

TABLE 467 NORTH AMERICA: INSURANCE PLATFORMS MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

TABLE 468 NORTH AMERICA: GENERAL MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 469 NORTH AMERICA: GENERAL MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 470 NORTH AMERICA: HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 471 NORTH AMERICA: HEALTHCARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 472 NORTH AMERICA: AUTOMOBILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 473 NORTH AMERICA: AUTOMOBILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 474 NORTH AMERICA: HOMEOWNER’S MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 475 NORTH AMERICA: HOMEOWNER’S MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 476 NORTH AMERICA: TRAVEL MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 477 NORTH AMERICA: TRAVEL MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 478 NORTH AMERICA: LIFE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 479 NORTH AMERICA: LIFE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 480 NORTH AMERICA: TERM LIFE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 481 NORTH AMERICA: TERM LIFE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 482 NORTH AMERICA: UNIT-LINKED INSURANCE PLAN PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 483 NORTH AMERICA: UNIT-LINKED INSURANCE PLAN PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 484 NORTH AMERICA: WHOLE LIFE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 485 NORTH AMERICA: WHOLE LIFE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 486 NORTH AMERICA: ENDOWMENT PLAN PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 487 NORTH AMERICA: ENDOWMENT PLAN PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 488 NORTH AMERICA: CYBERSECURITY MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 489 NORTH AMERICA: CYBERSECURITY MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 490 NORTH AMERICA: INSURANCE PLATFORMS MARKET, BY END USER, 2018–2022 (USD MILLION)

TABLE 491 NORTH AMERICA: MARKET, BY END USER, 2023–2028 (USD MILLION)

TABLE 492 NORTH AMERICA: MARKET FOR INSURANCE COMPANIES, BY TYPE, 2018–2022 (USD MILLION)

TABLE 493 NORTH AMERICA: MARKET FOR INSURANCE COMPANIES, BY TYPE, 2023–2028 (USD MILLION)

TABLE 494 NORTH AMERICA: MARKET FOR INSURANCE AGENCIES & BROKERS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 495 NORTH AMERICA: MARKET FOR INSURANCE AGENCIES & BROKERS, BY TYPE, 2023–2028 (USD MILLION)

TABLE 496 NORTH AMERICA: MARKET FOR THIRD-PARTY ADMINISTRATORS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 497 NORTH AMERICA: MARKET FOR THIRD-PARTY ADMINISTRATORS, BY TYPE, 2023–2028 (USD MILLION)

TABLE 498 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 499 NORTH AMERICA: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

11.2.3 US

11.2.3.1 Innovation and regulation to encourage InsurTech ecosystem growth

TABLE 500 US: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 501 US: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.2.4 CANADA

11.2.4.1 Higher adoption of insurance solutions by enterprises

TABLE 502 CANADA: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 503 CANADA: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.3 EUROPE

11.3.1 EUROPE: MARKET DRIVERS

11.3.2 EUROPE: RECESSION IMPACT

TABLE 504 EUROPE: INSURANCE PLATFORMS MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 505 EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 506 EUROPE: INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 507 EUROPE: INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 508 EUROPE: INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 509 EUROPE: INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 510 EUROPE: INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 511 EUROPE: INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 512 EUROPE: INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 513 EUROPE: INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 514 EUROPE: INSURANCE POLICY MANAGEMENT SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 515 EUROPE: INSURANCE POLICY MANAGEMENT SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 516 EUROPE: VIDEO KYC/EKYC SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 517 EUROPE: VIDEO KYC/EKYC SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 518 EUROPE: INSURANCE PLATFORM API & MICROSERVICES SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 519 EUROPE: INSURANCE PLATFORM API & MICROSERVICES SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 520 EUROPE: INSURANCE PLATFORM MICROSERVICES SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 521 EUROPE: INSURANCE PLATFORM MICROSERVICES SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 522 EUROPE: INSURANCE PLATFORM SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 523 EUROPE: INSURANCE PLATFORM SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 524 EUROPE: INSURANCE PLATFORM PROFESSIONAL SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 525 EUROPE: INSURANCE PLATFORM PROFESSIONAL SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 526 EUROPE: INSURANCE PLATFORM MANAGED SERVICES MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 527 EUROPE: INSURANCE PLATFORM MANAGED SERVICES MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 528 EUROPE: INSURANCE PLATFORMS MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

TABLE 529 EUROPE: MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

TABLE 530 EUROPE: MARKET IN CLAIMS MANAGEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 531 EUROPE: MARKET IN CLAIMS MANAGEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 532 EUROPE: MARKET IN UNDERWRITING & RATING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 533 EUROPE: MARKET IN UNDERWRITING & RATING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 534 EUROPE: MARKET IN CUSTOMER RELATIONSHIP MANAGEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 535 EUROPE: MARKET IN CUSTOMER RELATIONSHIP MANAGEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 536 EUROPE: MARKET IN BILLING & PAYMENTS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 537 EUROPE: MARKET IN BILLING & PAYMENTS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 538 EUROPE: MARKET IN DATA ANALYTICS, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 539 EUROPE: MARKET IN DATA ANALYTICS, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 540 EUROPE: MARKET IN COMPLIANCE & REPORTING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 541 EUROPE: MARKET IN COMPLIANCE & REPORTING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 542 EUROPE: MARKET IN POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 543 EUROPE: MARKET IN POLICY ADMINISTRATION, COLLECTION, AND DISBURSEMENT, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 544 EUROPE: INSURANCE PLATFORMS MARKET IN SALES & MARKETING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 545 EUROPE: MARKET IN SALES & MARKETING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 546 EUROPE: MARKET IN PROPERTY ESTIMATION, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 547 EUROPE: MARKET IN PROPERTY ESTIMATION, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 548 EUROPE: MARKET IN PREDICTIVE MODELING/EXTREME EVENT FORECASTING, BY SUBAPPLICATION, 2018–2022 (USD MILLION)

TABLE 549 EUROPE: MARKET IN PREDICTIVE MODELING/EXTREME EVENT FORECASTING, BY SUBAPPLICATION, 2023–2028 (USD MILLION)

TABLE 550 EUROPE: MARKET, BY TECHNOLOGY, 2018–2022 (USD MILLION)

TABLE 551 EUROPE: MARKET, BY TECHNOLOGY, 2023–2028 (USD MILLION)

TABLE 552 EUROPE: AI & ML PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 553 EUROPE: AI & ML PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 554 EUROPE: IOT PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 555 EUROPE: IOT PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 556 EUROPE: BLOCKCHAIN PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 557 EUROPE: BLOCKCHAIN PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 558 EUROPE: DATA ANALYTICS & BIG DATA PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 559 EUROPE: DATA ANALYTICS & BIG DATA PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 560 EUROPE: REGTECH PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 561 EUROPE: REGTECH PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 562 EUROPE: MARKET, BY INSURANCE TYPE, 2018–2022 (USD MILLION)

TABLE 563 EUROPE: INSURANCE PLATFORMS MARKET, BY INSURANCE TYPE, 2023–2028 (USD MILLION)

TABLE 564 EUROPE: GENERAL MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 565 EUROPE: GENERAL MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 566 EUROPE: HEALTHCARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 567 EUROPE: HEALTHCARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 568 EUROPE: AUTOMOBILE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 569 EUROPE: AUTOMOBILE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 570 EUROPE: HOMEOWNER’S MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 571 EUROPE: HOMEOWNER’S MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 572 EUROPE: TRAVEL MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 573 EUROPE: TRAVEL MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 574 EUROPE: LIFE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 575 EUROPE: LIFE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 576 EUROPE: TERM LIFE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 577 EUROPE: TERM LIFE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 578 EUROPE: UNIT-LINKED INSURANCE PLAN PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 579 EUROPE: UNIT-LINKED INSURANCE PLAN PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 580 EUROPE: WHOLE LIFE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 581 EUROPE: WHOLE LIFE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 582 EUROPE: ENDOWMENT PLAN PLATFORMS MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 583 EUROPE: ENDOWMENT PLAN PLATFORMS MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 584 EUROPE: CYBERSECURITY MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 585 EUROPE: CYBERSECURITY MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 586 EUROPE: INSURANCE PLATFORMS MARKET, BY END USER, 2018–2022 (USD MILLION)

TABLE 587 EUROPE: MARKET, BY END USER, 2023–2028 (USD MILLION)

TABLE 588 EUROPE: MARKET FOR INSURANCE COMPANIES, BY TYPE, 2018–2022 (USD MILLION)

TABLE 589 EUROPE: MARKET FOR INSURANCE COMPANIES, BY TYPE, 2023–2028 (USD MILLION)

TABLE 590 EUROPE: MARKET FOR INSURANCE AGENCIES & BROKERS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 591 EUROPE: MARKET FOR INSURANCE AGENCIES & BROKERS, BY TYPE, 2023–2028 (USD MILLION)

TABLE 592 EUROPE: MARKET FOR THIRD-PARTY ADMINISTRATORS, BY TYPE, 2018–2022 (USD MILLION)

TABLE 593 EUROPE: MARKET FOR THIRD-PARTY ADMINISTRATORS, BY TYPE, 2023–2028 (USD MILLION)

TABLE 594 EUROPE: MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

TABLE 595 EUROPE: MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

11.3.3 UK

11.3.3.1 Increase in digitization and rise in demand for personalized insurance products

TABLE 596 UK: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 597 UK: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.3.4 GERMANY

11.3.4.1 Digitalization and integration of InsurTech solutions streamlining insurance processes

TABLE 598 GERMANY: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 599 GERMANY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.3.5 FRANCE

11.3.5.1 Stable economy with regulatory authorities constantly accommodating changing tech landscape

TABLE 600 FRANCE: INSURANCE PLATFORMS MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 601 FRANCE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.3.6 ITALY

11.3.6.1 Aging population and COVID-19 bolstered adoption of long-term care insurance

TABLE 602 ITALY: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 603 ITALY: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.3.7 SPAIN

11.3.7.1 Adoption of emerging technologies enhanced underwriting processes and claims management

TABLE 604 SPAIN: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 605 SPAIN: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.3.8 SWITZERLAND

11.3.8.1 Regulatory flexibility to encourage insurers to invest in insurance platforms

TABLE 606 SWITZERLAND: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 607 SWITZERLAND: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

11.3.9 REST OF EUROPE

TABLE 608 REST OF EUROPE: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 609 REST OF EUROPE: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

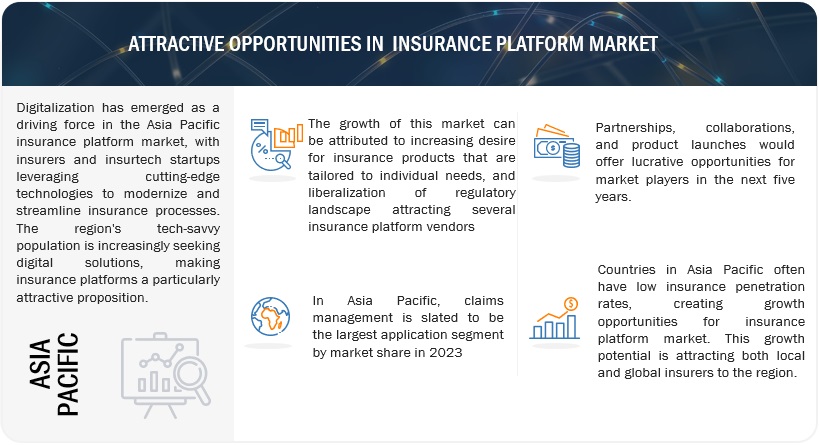

11.4 ASIA PACIFIC

11.4.1 ASIA PACIFIC: MARKET DRIVERS

11.4.2 ASIA PACIFIC: RECESSION IMPACT

FIGURE 56 ASIA PACIFIC: INSURANCE PLATFORMS MARKET SNAPSHOT

TABLE 610 ASIA PACIFIC: MARKET, BY OFFERING, 2018–2022 (USD MILLION)

TABLE 611 ASIA PACIFIC: MARKET, BY OFFERING, 2023–2028 (USD MILLION)

TABLE 612 ASIA PACIFIC: INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 613 ASIA PACIFIC: INSURANCE PLATFORM SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 614 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 615 ASIA PACIFIC: INTELLIGENT DOCUMENT PROCESSING SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 616 ASIA PACIFIC: INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 617 ASIA PACIFIC: INSURANCE LEAD MANAGEMENT SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 618 ASIA PACIFIC: INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2018–2022 (USD MILLION)

TABLE 619 ASIA PACIFIC: INSURANCE WORKFLOW AUTOMATION SOFTWARE MARKET, BY TYPE, 2023–2028 (USD MILLION)

TABLE 620 ASIA PACIFIC: INSURANCE POLICY MANAGEMENT SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)

TABLE 621 ASIA PACIFIC: INSURANCE POLICY MANAGEMENT SOFTWARE, BY TYPE, 2023–2028 (USD MILLION)

TABLE 622 ASIA PACIFIC: VIDEO KYC/EKYC SOFTWARE, BY TYPE, 2018–2022 (USD MILLION)