Digital Pathology Market by Product (Scanner, Software, Storage System), Type (Human, Veterinary), Application (Teleconsulation, Training, Disease Diagnosis, Drug Discovery), End User (Pharma & Biotech, Academia, Hospitals) & Region - Global Forecast to 2028

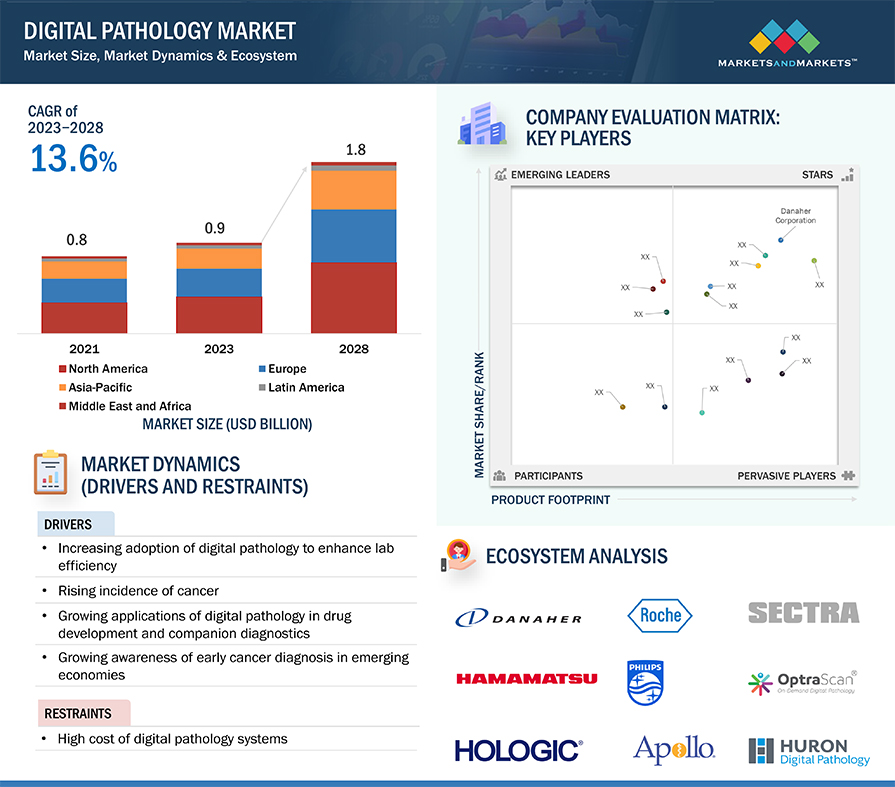

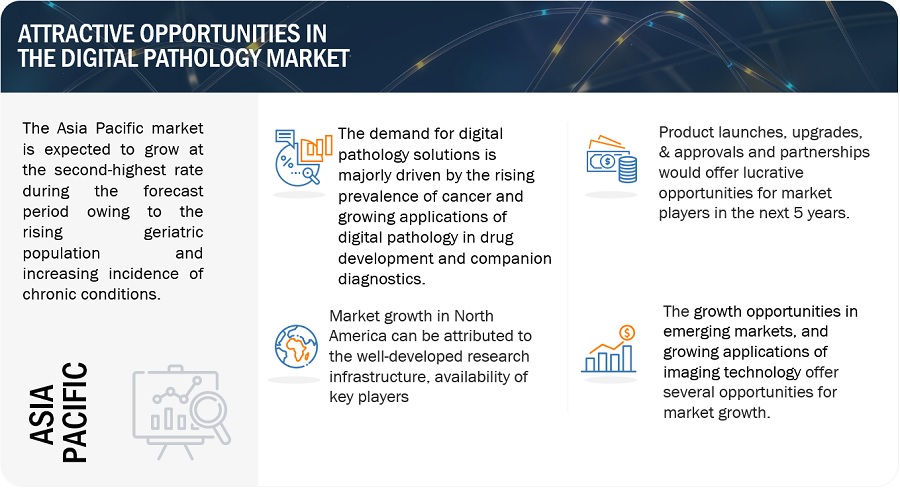

The global digital pathology market in terms of revenue was estimated to be worth $0.9 billion in 2023 and is poised to reach $1.8 billion by 2028, growing at a CAGR of 13.6% from 2023 to 2028. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. The growth in the digital pathology industry is mainly driven by factors such as the growing awareness of early cancer diagnosis in emerging economies, growing applications of digital pathology in drug development and companion diagnostics, and the increasing adoption of digital pathology to enhance lab efficiency.

However, the high cost of digital pathology systems are expected to restrain market growth to a certain extent.

Global Digital Pathology Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Pathology Market Dynamics

Driver: Increasing adoption of digital pathology to enhance lab efficiency

Digital pathology helps improve lab efficiency by reducing costs, decreasing turnaround times, and providing users with access to subject-matter expertise. Improvements in lab efficiency are critical as patients and physicians depend on lab results for diagnostic decisions, and diagnostic tests must be completed and reported quickly & accurately. Moreover, access to digital slides via web services reduces shipping costs and travel time for pathologists. Currently, the demand for digital pathology solutions has increased as pathologists can remotely view diagnostic results for primary diagnosis.

Restraint: High cost of digital pathology systems

A typical digital pathology system, which includes a slide scanner, an image server, and software, costs around USD 500,000 to USD 10,00,000. A full-featured scanner itself costs around USD 2,50,000. The average price of a digital pathology scanner in the Asia Pacific is around USD 110,000 to USD 130,000. Healthcare providers, particularly in developing countries like India, Brazil, and Mexico, have low financial resources to invest in such costly technologies. he high cost of these systems, coupled with the challenge of a dearth of skilled personnel to operate digital pathology systems, is expected to limit the adoption of these systems.

Opportunity: Introduction of affordable scanners for private pathology practices

The price point of digital pathology hardware, including scanners, is a major restraint to market growth. Therefore, the development of affordable scanners is expected to offer growth opportunities for players operating in the digital pathology industry. Most private medical practices are small businesses and cannot afford expensive digital pathology systems. The introduction of affordable scanners and the propensity of small players to move towards digitization of pathology workflow will encourage its adoption among pathologists with low or limited budgets.

Challenge: Shortage of trained pathologists

The demand for pathology services has increased significantly for clinical applications due to the increasing prevalence of cancer. However, there is a gap between the supply and demand of pathologists worldwide, especially in Africa and the Asia Pacific region countries. According to Zippia, in 2021, the US had over 7,695 pathologists, 59.3% of them were women, while 40.7% were men. On the other hand, laboratories are under pressure to process an increasing number of specimens with limited staff. This is expected to hamper the growth of the cancer diagnostics market.

Digital Pathology Market Ecosystem Map

By product, the scanners segment is projected to lead the market of the Digital Pathology Industry in 2023

By product, the global digital pathology market is segmented into scanners, software, and storage systems. The software segment is projected to lead the global market in 2023 due to the increased adoption of digital pathology software solutions in various healthcare facilities such as hospitals and diagnostic laboratories to utilize these solutions for remote primary diagnosis.

By type, the human pathology segment is projected to lead the market of the Digital Pathology Industry during the forecast period

By type, the digital pathology market is segmented into human pathology and veterinary pathology. The human pathology segment is projected to lead the global market in 2023. The highest growth of this segment can be attributed to the increasing number of cancer research activities , and growing collaborations among academic research institutes, universities, and pathology laboratories.

By application, the drug discovery segment is projected to lead the market of the Digital Pathology Industry in 2023

By application, the digital pathology market is segmented into drug discovery, disease diagnosis, and training & education. The drug discovery segment is projected to lead the global market during the forecast period due the growth in increasing use of toxicology testing for illicit drugs, the rising number of preclinical & clinical studies, and the rising pharmaceutical & biotechnology R&D expenditure.

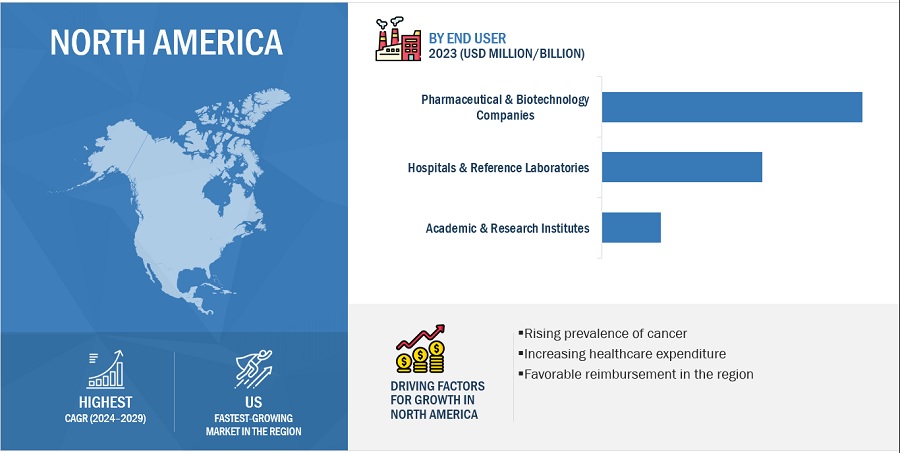

By end user, the pharmaceutical & biotechnology companies is projected to lead the market of the Digital Pathology Industry during the forecast period

By end user, the digital pathology market is broadly segmented into pharmaceutical & biotechnology companies, hospitals & reference laboratories, and academic & research institutes. Pharmaceutical & biotechnology companies segment is projected to lead the global market in 2023. The high growth rate of this segment can be attributed to the advancing drug discovery and development, oncology clinical trials, and growing use of digital pathology for drug toxicology testing.

North America Region of the Digital Pathology Industry to witness significant growth from 2023 to 2028

On the basis of region, the digital pathology market is divided into North America, Europe, Asia Pacific, Latin America, and Middle east & Africa. In 2023, North America projected to lead market share of the nuclear medicine market. This can be attributed to the rising prevalence of cancer, increasing healthcare expenditure, and the favorable reimbursement in the region are driving the growth of the market in North America.

To know about the assumptions considered for the study, download the pdf brochure

Some of the prominent players operating in the digital pathology market include Fujifilm Holdings Corporation (Japan), Proscia Inc. (US), KONFOONG BIOTECH INTERNATIONAL CO., LTD. (China), Mikroscan Technologies, Inc. (US), PathAI (US), Danaher Corporation (US), Koninklijke Philips N.V. (Netherlands), Hamamatsu Photonics K.K. (Japan), F. Hoffmann-La Roche Ltd. (Switzerland), 3DHISTECH (Hungary), Apollo Enterprise Imaging (US), XIFIN, Inc. (US), Huron Digital Pathology (Canada), Hologic, Inc. (US), Corista (US), Indica Labs Inc. (US), Objective Pathology Services Limited (Canada), Sectra AB (Sweden), OptraSCAN (US), Akoya Biosciences, Inc. (US), Glencoe Software, Inc. (US), Aiforia (Finland), Paige AI, Inc. (US), Motic Digital Pathology (US), and Kanteron Systems (Spain).

Scope of the Digital Pathology Industry

|

Report Metric |

Details |

|

Market Revenue in 2023 |

$0.9 billion |

|

Projected Revenue by 2028 |

$1.8 billion |

|

Revenue Rate |

Poised to Grow at a CAGR of 13.6% |

|

Market Driver |

Increasing adoption of digital pathology to enhance lab efficiency |

|

Market Opportunity |

Introduction of affordable scanners for private pathology practices |

This report categorizes the global digital pathology market to forecast revenue and analyze trends in each of the following submarkets:

By Product

-

Scanners

- Brightfield Scanners

- Other Scanners

-

Software

- Integrated Software

- Standalone Software

- Information Management Software

- Image Visualization & Analysis Software

- Storage Systems

By Type

- Human Pathology

- Veterinary Pathology

By Application

- Drug Discovery

- Disease Diagnosis

- Training & Education

By End User

- Pharmaceutical & Biotechnology Companies

- Hospitals & Reference Laboratories

- Academic & Research Institutes

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Sweden

- Denmark

- Rest of Europe (RoE)

-

Asia Pacific

- Japan

- China

- India

- Rest of APAC (RoAPAC)

-

Latin America

- Brazil

- Mexico

- Rest of Latin America (RoLATAM)

- Middle East & Africa

Recent Developments of Digital Pathology Industry

- In 2022, Danaher Corporation partnered with Indica Labs to deliver compatible digital pathology workflow solutions by maintaining file compatibility between Leica Biosystems Aperio GT 450 family of scanners with Indica Labs Halo family of software solutions.

- In 2022, Hamamatsu received US FDA 510(k) clearance for the NanoZoomer S360MD Slide scanner system for primary diagnostic use.

- In 2022, F. Hoffmann-LA roche ltd. Launched the VENTANA DP 600 slide scanner for digital pathology, enhancing patient care with precision diagnostics.

- In 2021, Koninklijke Philips launched the next-generation digital pathology solution, which features a comprehensive and scalable suite of software tools and capabilities in digital pathology.

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global digital pathology market?

The global digital pathology market boasts a total revenue value of $1.8 billion by 2028.

What is the estimated growth rate (CAGR) of the global digital pathology market?

The global digital pathology market has an estimated compound annual growth rate (CAGR) of 13.6% and a revenue size in the region of $0.9 billion in 2023.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

This study involved four major activities in estimating the size of the digital pathology market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

The secondary research process involved the widespread use of secondary sources, directories, databases (such as Bloomberg Businessweek, Factiva, and D&B Hoovers), white papers, annual reports, company house documents, investor presentations, and SEC filings of companies. Some non-exclusive secondary sources include the World Health Organization (WHO), US Food and Drug Administration (FDA), National Health Service (NHS), Indian Council of Medical Research (ICMR), Association of Australian Medical Research Institutes (AAMRI), Asian Funds for Cancer Research (AFCR), Academic Medical Center (AMC), American Society for Clinical Pathology (ASCP), Digital Imaging and Communications in Medicine (DICOM), Digital Pathology Association (DPA), Annual Reports, SEC Filings, Investor Presentations, Journals, Publications from Government Sources and Professional Associations, Expert Interviews, and MarketsandMarkets Analysis.

Secondary research was used to identify and collect information useful for the extensive, technical, market-oriented, and commercial study of the clinical decision support system market. It was also used to obtain important information about the key players and market classification and segmentation according to industry trends to the bottom-most level, and key developments related to market and technology perspectives. A database of the key industry leaders was also prepared using secondary research.

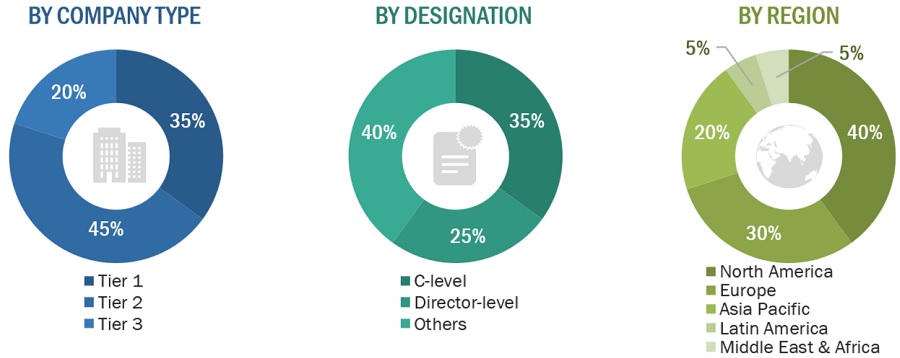

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology & innovation directors, and related key executives from various key companies and organizations operating in the clinical decision support system market. The primary sources from the demand side included industry experts, consultants, healthcare providers, hospital administration, and government bodies. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on key industry trends and key market dynamics.

Breakdown of Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Note 1: Companies are classified into tiers based on their total revenue. As of 2021: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = <USD 500 million.

Note 2: C-level executives include CEOs, COOs, CTOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

To know about the assumptions considered for the study, download the pdf brochure

|

OptraScan |

Product Specialist |

|

Huron Digital Pathology |

General Manager |

|

Koninklijke Philips N.V. |

Chief Marketing Officer |

Market Size Estimation

Bottom-up approaches was used to estimate and validate the total size of the digital pathology market. This method was also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets have been identified through extensive secondary research

- The industry’s supply chain and market size, in terms of value, have been determined through primary and secondary research processes

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides, in the provider, payer, and other industries.

Market Definition

Digital pathology is an image-based information environment for managing and interpreting pathology information generated from digitized glass slides. The process involves the conversion of glass slides to digital pathology slides using digital pathology scanning solutions. A digital image is then generated, which enables high-resolution viewing of the slide.

Key Stakeholders

- Senior Management

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, and forecast the digital pathology market based on the product, type, application, end user, and region

- To provide detailed information regarding the major factors influencing the market growth (such as drivers, restraints, opportunities, and challenges)

- To analyze the micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall digital pathology market

- To analyze the opportunities for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely,

- North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa.

- To profile the key players and analyze their market shares and core competencies2

- To track and analyze competitive developments such as product launches, partnerships, agreements, and collaborations in the overall digital pathology market

- To benchmark players within the market using the proprietary "Company Evaluation Quadrant " framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

- Further breakdown of the Rest of the Asia Pacific digital pathology market into South Korea, Australia, New Zealand, and other countries

- Further breakdown of the Rest of Europe digital pathology market into Italy, Spain, Belgium, Russia, the Netherlands, Switzerland, and other countries

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Pathology Market

Keen to Know about Digital Pathology Market Size, Share and Trend Analysis Report by Product (ArtificiaI Intelligence, Scanner, Software, Storage), Type (Human, Veterinary), Application (Teleconsultation, Training, Disease Diagnosis, Drug Discovery), and Pharma, Diagnostic Labs, Hospitals as well as Academia, Hospitals - Global Forecast to 2031

Looking to gain more insights on the global Industrial Digital Pathology Market

What are the growth opportunities in Digital Pathology Market?

What are the growth opportunities in Digital Pathology Market?

Can you enlighten us on geographical growth analysis in Digital Pathology Market?