Digital Shipyard Market by Shipyard Type (Commercial, Military), Capacity (Large, Medium, Small), End Use (Implementation, Upgrades & Services), Digitalization Level, Process, Technology, and Region-Global Forecast to 2030

Updated on : May 10, 2023

Digital Shipyard Market Size

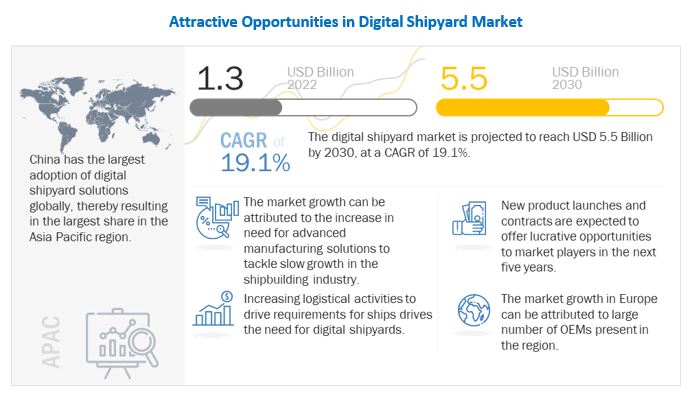

[327 Pages Report] The Digital Shipyard Market is projected to grow from $ 1.3 billion in 2022 to $ 5.5 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 19.1% during the forecast period.

The growth of the Digital Shipyard Industry can be attributed to several factors, such as the growing need to adopt digital solutions to streamline the shipbuilding process to tackle the low growth in the shipbuilding industry. It is also to reduce the turnaround time in the shipbuilding process.

To know about the assumptions considered for the study, Request for Free Sample Report

Digital Shipyard Industry Dynamics:

Driver: Increasing Use of Product Lifecycle Management (PLM) Solutions

Traditional shipbuilding involved the availability of old data rather than updated information, resulting in low growth and revenue. Product lifecycle management (PLM) solutions offer a complete approach to shipbuilding to improve the overall shipyard’s collaboration, synchronization, and productivity, along with service and support. This can be achieved by optimizing processes such as design & engineering and supply chain management using PLM solutions.

In recent years, the demand for PLM solutions has been increasing as a result of the rising need for optimization of shipbuilding processes by shipyards across the world. PLM is a customizable platform that provides tailored services according to customer requirements. This is expected to create new opportunities for developers of cloud-based shipbuilding software. PLM solutions also benefit tier II and tier III shipyards due to the introduction of the pay-as-you-use model, which leads to reduced expenses. Additionally, PLM solutions for shipbuilding service & product support process solutions offer shipyards and fleet operators a single source of service knowledge that increases accuracy and coordination across the global service network, enabling fleet upgrades, improvements, and crucial modifications to overall fleet performance.

Restraint: Increased Vulnerability to Cyber Threats

As processes get digitalized, concerns regarding their security arise. Software companies are continuously upgrading their solutions to make them resistant to hacking. Shipyards and ship operators have large pools of sensitive information stored in their IT platforms, including ship and part information. Hence, these companies are at a high risk of cyberattacks, which could lead to significant losses. Increasing adoption of digitalization could result in the rise of cyber-threats and cybercrimes to steal crucial ship operational data, thus causing threats to national security. To counter such attacks, sophisticated solutions are required. Developing such solutions would call for increased investments by software companies. Hence, the maritime industry recognizes the importance of protection against cyber threats and risk. In 2021, the International Maritime Organization (IMO) published brief guidelines for cyber risk management, which are suitable for different marine organizations.

Opportunity: Augmented Reality in Shipbuilding

Augmented reality (AR) can also increase the efficiency and effectiveness of digital shipyards. AR headsets offer a high-quality immersion experience and also have the benefit of being relatively hands-free. AR headsets can access key information such as the state of a worker’s alertness, in terms of a fatigue index, with the help of a screen pointed at the concerned worker. AR headsets can also help with quality checks during shipbuilding. For instance, rather than conducting a manual quality checklist for each compartment of the ship, the officer can wear an AR camera. The headset scans the barcode or IIoT tags and can obtain associated media from a server or applications such as those used for PLM. The headset can also display lists of items that have been checked, and an officer can mark off items once they are inspected through a gesture. AR headsets or AR-enabled tablets can be equipped with cameras to add photos and videos once they are inspected. This would reduce the turnaround time and increase the efficiency of the shipyard.

Challenge: Stringent Regulatory Framework

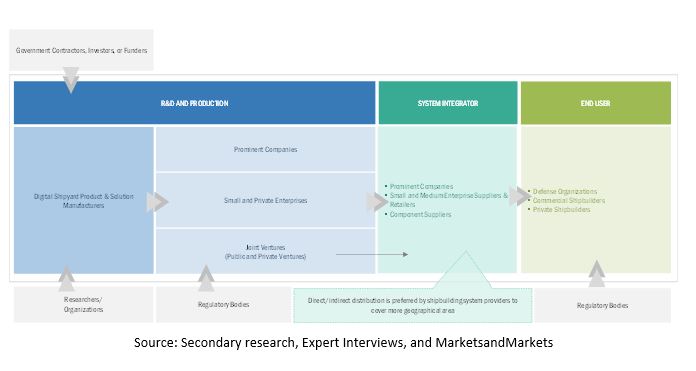

Prominent companies who manufacture and provide digital shipyard solutions, private & small enterprises, distributors/suppliers/retailers, and end customers are key stakeholders in this ecosystem. Investors, funders, academic researchers, integrators, service providers, and licensing authorities serve as major influencers in the industry.

Digital Shipyard Market Ecosystem

The Commercial Shipyard Segment is Estimated to Lead the Digital Shipyard Market in 2022

Based on Shipyard Type, the Commercial segment of the digital shipyard market is accounted for the largest growth during the forecast period. The digitalization of commercial shipyards has helped commercial ship owners and operators to meet lower lifecycle costs, pursue capital improvements, streamline construction, increase operational availability, and lower overhead expenses to operate ships.

The Artificial Intelligence & Big Data Analytics is Expected to Grow at the Highest CAGR During the Forecast Period

Based on technology, artificial intelligence and big data analytics is expected to grow the largest during the forecast period. Artificial Intelligence (AI) is one of the most enabling digital transformation technologies in the shipbuilding industry. Pairing technologies such as IoT, blockchain, big data, and robotic process automation with AI and ML has many benefits in shipyard applications such as resource management, predictive maintenance, design, and production.

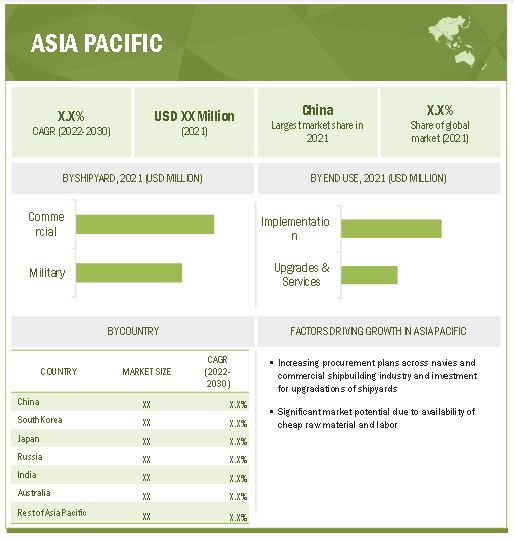

Asia Pacific Region is Expected to Have the Highest Market Share During the Forecast Period

Asia Pacific region constitutes that largest aircraft generator manufacturers among all the regions. Asia Pacific has witnessed rapid economic development over the years, increasing maritime trade. An increase in the demand for advancements in the processes, quick deliveries, reduced cost, high regulation standards, etc., is expected to grow more in the forecast period and is thus leading to the growth of the digital shipyard market in emerging economies such as India and China.

To know about the assumptions considered for the study, download the pdf brochure

Top Digital Shipyard Companies - Key Market Players

The Digital Shipyard Companies are dominated by globally established players such as Siemens (Germany), Dassault Systemes (France), Accenture (Ireland), SAP (Germany), BAE Systems (UK) among others. These key players offer solutions and services to different key stakeholders.

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

Request Sample Scope of the Report

Get online access to the report on the World's First Market Intelligence Cloud

- Easy to Download Historical Data & Forecast Numbers

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

|

Report Metric |

Details |

|

Market size available for years |

2018-2030 |

|

Base year considered |

2021 |

|

Forecast period |

2022-2030 |

|

Forecast units |

Value (USD) |

|

Segments covered |

Shipyard Type, Technology, Capacity, Process, End Use, Digitalization Level And Region |

|

Geographies covered |

North America, Europe, Asia Pacific, the Middle East, Rest of the World |

|

Companies covered |

Siemens (Germany), Dassault Systemes (France), Accenture (Ireland), SAP (Germany), BAE Systems (UK) |

This research report categorizes the digital shipyard market into Shipyard Type, Technology, Capacity, Process, End Use, Digitalization Level And Region

By Shipyard Type

- Commercial

- Military

By Technology

- AR/VR

- Digital Twin & Simulation

- Addictive Manufacturing

- Artificial Intelligence & Big Data Analytics

- Robotic Process Automation

- Industrial Internet of Things (IIoT)

- Cybersecurity

- Block Chain

- Cloud & Master Data Management

By Capacity

- Large Shipyard

- Medium Shipyard

- Small Shipyard

By End Use

- Implementation

- Upgrades & Services

By Process

- Research & Development

- Design & Engineering

- Manufacturing & Planning

- Maintenance & Support

- Training & Simulation

By Digitalization Level

- Fully Digital Shipyard

- Semi Digital Shipyard

- Partially Digital Shipyard

By Region

- North America

- Europe

- Asia Pacific

- Middle East

- Rest of the World

Recent Developments

- In June 2022, BAE Systems has collaborated with Dematec Automation to build a digital platform capability demonstrator that connects robots, welding machines, hardware subsystems, devices, and sensors across typical shipyard workflows. Industry 4.0 technologies connect workers, robotic plants, equipment, and potentially the Hunter class frigates.

- In June 2022, A Memorandum of Understanding (MoU) has been signed between Fameline Holding Group (FHG), its subsidiaries, and Inmarsat. The MoU expresses the intent of both organizations to explore joint initiatives across the maritime and energy sectors to benefit both parties.

Frequently Asked Questions (FAQ):

What is the Current Size of the Digital Shipyard Market?

The Digital Shipyard Market is projected to grow from $ 1.3 billion in 2022 to $ 5.5 billion by 2030, at a Compound Annual Growth Rate (CAGR) of 19.1% during the forecast period.

Who Are the Winners and Small Enterprises in the Digital Shipyard Market?

Major players operating in the digital shipyard market include Siemens (Germany), Dassault Systemes (France), Accenture (Ireland), SAP (Germany), BAE Systems (UK) among others. These key players offer digital shipyard solutions and services to different key stakeholders.

What Are Some of the Technological Advancements in the Market?

Digital twins are among the many emerging technologies in digital shipyards. A digital twin concept is a 3D virtual replica of a physical product. Data is fed into the digital twin, presenting a replica of the real physical product and the environmental conditions to which it is exposed. As a virtual replica of the real product, the twin allows one to view the current status and real-time condition of the product even if it is not present at the same location.

What Are the Factors Driving the Growth of the Market?

In recent years, the demand for PLM solutions has been increasing as a result of the rising need for optimization of shipbuilding processes by shipyards across the world. PLM is a customizable platform that provides tailored services according to customer requirements. This is expected to create new opportunities for developers of cloud-based shipbuilding software. PLM solutions also benefit tier II and tier III shipyards due to the introduction of the pay-as-you-use model, which leads to reduced expenses. Additionally, PLM solutions for shipbuilding service & product support process solutions offer shipyards.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 41)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.3.1 MARKETS COVERED

1.3.2 REGIONAL SCOPE

1.3.3 YEARS CONSIDERED

1.4 INCLUSIONS AND EXCLUSIONS

TABLE 1 INCLUSIONS AND EXCLUSIONS IN DIGITAL SHIPYARD MARKET

1.5 CURRENCY CONSIDERED

TABLE 2 USD YEARLY AVERAGE EXCHANGE RATES

1.6 LIMITATIONS

1.7 STAKEHOLDERS

1.8 SUMMARY OF CHANGES

FIGURE 1 DIGITAL SHIPYARD MARKET TO GROW AT HIGHER RATE THAN PREVIOUS ESTIMATES

2 RESEARCH METHODOLOGY (Page No. - 46)

2.1 RESEARCH DATA

FIGURE 2 RESEARCH PROCESS FLOW

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.2 DEMAND- AND SUPPLY-SIDE ANALYSIS

2.2.1 INTRODUCTION

2.2.2 DEMAND-SIDE INDICATORS

2.2.2.1 Procurement of advanced vessels by navies worldwide

2.2.2.2 Rise in global seaborne trade

2.2.3 SUPPLY-SIDE INDICATORS

2.2.3.1 High regulations and need for reduced overheads

2.3 MARKET SIZE ESTIMATION

2.3.1 SEGMENTS AND SUBSEGMENTS

2.4 RESEARCH APPROACH AND METHODOLOGY

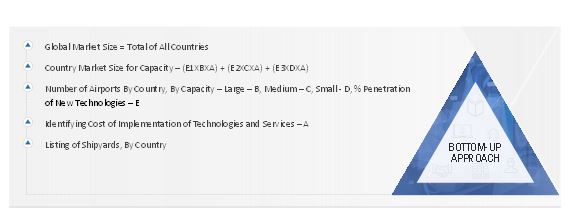

2.4.1 BOTTOM-UP APPROACH

2.4.1.1 Digital Shipyard Market: Bottom-up approach

2.4.1.2 Market, by Shipyard Type

2.4.1.3 Market, by Capacity

2.4.1.4 Market, by End Use

2.4.1.5 Market, by Process

2.4.1.6 Market, by Country

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

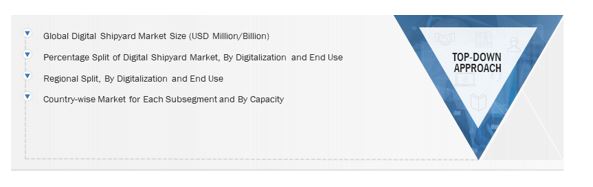

2.4.2 TOP-DOWN APPROACH

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: TOP-DOWN APPROACH

2.4.3 TRIANGULATION THROUGH SECONDARY RESEARCH

FIGURE 6 DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS

2.5.1 GROWTH RATE ASSUMPTIONS

2.5.2 ASSUMPTIONS FOR RESEARCH STUDY

2.5.3 RISKS

3 EXECUTIVE SUMMARY (Page No. - 58)

FIGURE 7 COMMERCIAL SHIPYARD SEGMENT PROJECTED TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 8 MANUFACTURING & PLANNING SEGMENT HAD LARGEST MARKET IN 2021

FIGURE 9 ASIA PACIFIC DOMINATED THE MARKET IN 2021

4 PREMIUM INSIGHTS (Page No. - 61)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN INDUSTRY

FIGURE 10 INCREASING NEED FOR ADVANCED MANUFACTURING SOLUTIONS IN SHIPBUILDING EXPECTED TO DRIVE MARKET FROM 2022 TO 2030

4.2 MARKET by END USE

FIGURE 11 IMPLEMENTATION SEGMENT TO LEAD MARKET FROM 2022 TO 2030

4.3 MARKET, BY CAPACITY

FIGURE 12 LARGE SHIPYARD SEGMENT PROJECTED TO HAVE HIGHEST CAGR DURING FORECAST PERIOD

4.4 MARKET, BY COUNTRY

FIGURE 13 DIGITAL SHIPYARD MARKET IN UK PROJECTED TO REGISTER HIGHEST CAGR FROM 2022 TO 2030

5 MARKET OVERVIEW (Page No. - 63)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 14 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Product lifecycle management (PLM) solutions

5.2.1.2 Cloud-based maintenance systems

5.2.1.3 New manufacturing technologies in shipbuilding

5.2.2 RESTRAINTS

5.2.2.1 Increased vulnerability to cyber threats

5.2.3 OPPORTUNITIES

5.2.3.1 Digital twin in shipbuilding industry

5.2.3.2 Augmented reality in shipbuilding

5.2.4 CHALLENGES

5.2.4.1 High acquisition costs of digital shipyard software solutions

5.3 OPERATIONAL DATA

TABLE 3 TOTAL SHIPYARD TYPES ACROSS REGIONS, 2021

5.4 PRICING ANALYSIS

TABLE 4 AVERAGE SELLING PRICE RANGE: BY TECHNOLOGY (USD)

FIGURE 15 PRICING ANALYSIS FOR DIGITAL SHIPYARD SOLUTIONS, BY TECHNOLOGY (USD)

5.5 VALUE CHAIN

FIGURE 16 VALUE CHAIN ANALYSIS

5.6 INDUSTRY ECOSYSTEM

5.6.1 PROMINENT COMPANIES

5.6.2 PRIVATE AND SMALL ENTERPRISES

5.6.3 END USERS

FIGURE 17 INDUSTRY ECOSYSTEM MAP

TABLE 5 MARKET ECOSYSTEM

5.7 TRADE DATA STATISTICS

TABLE 6 TRADE DATA TABLE FOR SHIPYARD

5.8 TECHNOLOGY TRENDS IN MARKET

5.8.1 DIGITAL TWIN

5.8.2 INTERNET OF THINGS (IOT)

5.9 CASE STUDY ANALYSIS

5.9.1 KD MARINE DESIGN IMPLEMENTS AR AND VR INNOVATIONS TO STREAMLINE SHIP DESIGN

5.9.2 3D DESIGN IN JAPANESE SHIPBUILDING

5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

5.10.1 REVENUE SHIFT AND NEW REVENUE POCKETS FOR PRODUCT AND SOLUTION MANUFACTURERS

FIGURE 18 REVENUE SHIFT IN THE MARKET

5.11 PORTER'S FIVE FORCES ANALYSIS

TABLE 7: PORTER'S FIVE FORCE ANALYSIS

FIGURE 19: PORTER'S FIVE FORCE ANALYSIS

5.11.1 THREAT OF NEW ENTRANTS

5.11.2 THREAT OF SUBSTITUTES

5.11.3 BARGAINING POWER OF SUPPLIERS

5.11.4 BARGAINING POWER OF BUYERS

5.11.5 INTENSITY OF COMPETITIVE RIVALRY

5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

FIGURE 20 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS

TABLE 8 INFLUENCE OF STAKEHOLDERS IN BUYING PROCESS OF DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS (%)

5.12.2 BUYING CRITERIA

FIGURE 21 KEY BUYING CRITERIA FOR DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS

TABLE 9 KEY BUYING CRITERIA FOR DIGITAL SHIPYARD PRODUCTS AND SOLUTIONS

5.13 KEY CONFERENCES AND EVENTS IN 2022–2023

TABLE 10 DIGITAL SHIPYARD MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

5.14 TARIFF AND REGULATORY LANDSCAPE

TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 14 REST OF WORLD: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

6 INDUSTRY TRENDS (Page No. - 83)

6.1 INTRODUCTION

6.2 TECHNOLOGICAL ADVANCEMENTS IN SHIPYARDS

6.2.1 AUGMENTED REALITY

6.2.2 BLOCKCHAIN

6.2.3 ROBOTICS

6.3 EMERGING TRENDS IN SHIPBUILDING

6.3.1 3D PRINTING

6.3.2 BIG DATA

6.3.3 PREDICTIVE MAINTENANCE

6.4 SUPPLY CHAIN ANALYSIS

FIGURE 22 DIGITAL SHIPYARD MARKET: SUPPLY CHAIN ANALYSIS

6.5 USE CASES

6.5.1 DAMEN SHIPYARD IN COLLABORATION WITH RAMLAB TO MANUFACTURE FIRST 3D-PRINTED PROPELLER

6.5.2 DEMATEC TO DEVELOP DIGITAL PLATFORM CAPABILITY FOR BAE SYSTEMS SHIPYARD IN AUSTRALIA

6.5.3 PEMAMEK DESIGNED MODULAR PLATFORM SOLUTION TO FACILITATE PROCESSES WITH PROSTEP AG

6.6 INNOVATION AND PATENT ANALYSIS

TABLE 15 INNOVATIONS AND PATENT REGISTRATIONS

7 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE (Page No. - 89)

7.1 INTRODUCTION

FIGURE 23 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030

TABLE 16 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 17 DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

7.2 COMMERCIAL SHIPYARDS

7.2.1 INCREASING MARITIME TRADE BOOSTS DEMAND FOR COMMERCIAL SHIPYARDS

7.3 MILITARY SHIPYARDS

7.3.1 PROCUREMENT OF ADVANCED VESSELS BY NAVIES WORLDWIDE DRIVES SEGMENT

8 DIGITAL SHIPYARD MARKET, BY TECHNOLOGY (Page No. - 92)

8.1 INTRODUCTION

FIGURE 24 MARKET SHARE, BY TECHNOLOGY, 2022–2030 (USD MILLION)

TABLE 18 MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 19 MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

8.2 AUGMENTED & VIRTUAL REALITY (AR & VR)

8.2.1 AR & VR DEVICES FOR SHIPBUILDING TO AID MARKET GROWTH

8.3 DIGITAL TWIN & SIMULATION

8.3.1 DIGITAL TWIN & SIMULATION TO BE EMERGING TECHNOLOGIES

8.4 ADDITIVE MANUFACTURING

8.4.1 ADDITIVE MANUFACTURING ASSISTS NAVIES IN DESIGNING AND ENGINEERING SOLUTIONS

8.5 ARTIFICIAL INTELLIGENCE & BIG DATA ANALYTICS

8.5.1 INCREASING GLOBAL MARITIME TRADE FUELS DEMAND FOR AI-POWERED ANALYTICS

8.6 ROBOTIC PROCESS AUTOMATION

8.6.1 SOPHISTICATED AND TIME-SAVING SOLUTIONS TO DRIVE DEMAND

8.7 INDUSTRIAL INTERNET OF THINGS (IIOT)

8.7.1 DEMAND FOR TECHNOLOGICAL ADVANCEMENTS TO BOOST SEGMENT

8.8 CYBERSECURITY

8.8.1 NEED TO COMBAT INCREASING CYBERTHREATS TO FUEL SEGMENT

8.9 BLOCKCHAIN

8.9.1 RISING DEMAND FOR BLOCKCHAIN TECHNOLOGY IN MEDIUM AND LARGE SHIPYARDS

8.1 CLOUD COMPUTING & MASTER DATA MANAGEMENT

8.10.1 INCREASED ADOPTION OF PLM AND CLOUD-BASED MAINTENANCE SYSTEMS ACROSS SHIPBUILDING

9 DIGITAL SHIPYARD MARKET, BY CAPACITY (Page No. - 101)

9.1 INTRODUCTION

FIGURE 25 MARKET, BY CAPACITY, 2022–2030

TABLE 20 MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 21 MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

9.2 SMALL SHIPYARD

9.2.1 INCREASE IN MODERNIZATION PLANS OF SMALL SHIPYARDS DRIVES MARKET

9.3 MEDIUM SHIPYARD

9.3.1 SMART SOLUTIONS TO INCREASE MARKET SHARE FOR MEDIUM SHIPYARDS

9.4 LARGE SHIPYARD

9.4.1 UPGRADING AND PROCUREMENT PLANS BY NAVIES GLOBALLY DRIVE SEGMENT

10 DIGITAL SHIPYARD MARKET, BY PROCESS (Page No. - 105)

10.1 INTRODUCTION

FIGURE 26 MARKET, BY PROCESS, 2022–2030

TABLE 22 MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 23 MARKET, BY PROCESS, 2022–2030 (USD MILLION)

10.2 RESEARCH & DEVELOPMENT

10.2.1 DEMAND FOR MODERNIZATION DRIVES R&D ACTIVITIES IN DIGITAL SHIPYARDS

10.3 DESIGN & ENGINEERING

10.3.1 DEMAND FOR SOPHISTICATED DESIGN & ENGINEERING SOLUTIONS TO INCREASE

10.4 MANUFACTURING & PLANNING

10.4.1 USE OF ADVANCED MANUFACTURING TECHNOLOGIES AND PLM SOLUTIONS ON RISE

10.5 MAINTENANCE & SUPPORT

10.5.1 HIGH-END TECHNOLOGIES FOR MAINTENANCE & SUPPORT OF PRODUCTS & SERVICES DRIVE SEGMENT

10.6 TRAINING & SIMULATION

10.6.1 TRAINING & SIMULATION PROGRAMS FOR SKILLED WORKFORCE EXPECTED TO BE HIGH

11 DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL (Page No. - 110)

11.1 INTRODUCTION

FIGURE 27 MARKET, BY DIGITALIZATION LEVEL, 2022–2030

TABLE 24 MARKET, BY DIGITALIZATION LEVEL, 2018–2021 (USD MILLION)

TABLE 25 MARKET, BY DIGITALIZATION LEVEL, 2022–2030 (USD MILLION)

11.2 FULLY DIGITAL SHIPYARD

11.2.1 PROCUREMENT PLANS FOR ADVANCED VESSELS BY NAVIES GLOBALLY TO DRIVE SEGMENT

11.3 SEMI DIGITAL SHIPYARD

11.3.1 MODERNIZATION PLANS TO LEAD GROWTH IN SMALL AND MEDIUM-SIZED SEMI DIGITAL SHIPYARDS

11.4 PARTIALLY DIGITAL SHIPYARD

11.4.1 INCREASE IN ADOPTION OF PLM SOLUTIONS DRIVES MARKET

12 DIGITAL SHIPYARD MARKET, BY END USE (Page No. - 114)

12.1 INTRODUCTION

FIGURE 28 MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 26 MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 27 MARKET, BY END USE, 2022–2030 (USD MILLION)

12.2 IMPLEMENTATION

12.2.1 PROCUREMENT PLANS BY NAVIES DRIVE IMPLEMENTATION OF DISRUPTIVE TECHNOLOGIES IN SHIPYARDS

12.3 UPGRADES & SERVICES

12.3.1 NEED TO UPGRADE EXISTING TECHNOLOGIES DRIVES SEGMENT GROWTH

13 REGIONAL ANALYSIS (Page No. - 117)

13.1 INTRODUCTION

FIGURE 29 ASIA PACIFIC ESTIMATED TO ACCOUNT FOR LARGEST SHARE OF DIGITAL SHIPYARD MARKET IN 2022

TABLE 28 MARKET, BY REGION, 2018–2021 (USD MILLION)

TABLE 29 MARKET, BY REGION, 2022–2030 (USD MILLION)

13.2 NORTH AMERICA

FIGURE 30 NORTH AMERICA: DIGITAL SHIPYARD MARKET SNAPSHOT

13.2.1 PESTLE ANALYSIS: NORTH AMERICA

TABLE 30 NORTH AMERICA: INDUSTRY, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 31 NORTH AMERICA: INDUSTRY, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 32 NORTH AMERICA: INDUSTRY, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 33 NORTH AMERICA: INDUSTRY, BY TECHNOLOGY, 2022–2030 (USD MILLION)

TABLE 34 NORTH AMERICA: INDUSTRY, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 35 NORTH AMERICA: INDUSTRY, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 36 NORTH AMERICA: INDUSTRY, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 37 NORTH AMERICA: INDUSTRY, BY PROCESS, 2022–2030 (USD MILLION)

TABLE 38 NORTH AMERICA: INDUSTRY, BY DIGITALIZATION LEVEL, 2018–2021 (USD MILLION)

TABLE 39 NORTH AMERICA: INDUSTRY, BY DIGITALIZATION LEVEL, 2022–2030 (USD MILLION)

TABLE 40 NORTH AMERICA: INDUSTRY, BY END USE, 2018–2021 (USD MILLION)

TABLE 41 NORTH AMERICA: INDUSTRY, BY END USE, 2022–2030 (USD MILLION)

TABLE 42 NORTH AMERICA: INDUSTRY, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 43 NORTH AMERICA: INDUSTRY, BY COUNTRY, 2022–2030 (USD MILLION)

13.2.2 US

13.2.2.1 Modern technologies led to digitalization of shipyards in US

TABLE 44 US: INDUSTRY, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 45 US: INDUSTRY, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 46 US: INDUSTRY, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 47 US: INDUSTRY, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 48 US: INDUSTRY, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 49 US: INDUSTRY, BY PROCESS, 2022–2030 (USD MILLION)

13.2.3 CANADA

13.2.3.1 Shipyards in Canada to move toward Industry 4.0

TABLE 50 CANADA: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 51 CANADA: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 52 CANADA: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 53 CANADA: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 54 CANADA: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 55 CANADA: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.3 EUROPE

FIGURE 31 EUROPE: DIGITAL SHIPYARD MARKET SNAPSHOT

13.3.1 PESTLE ANALYSIS: EUROPE

TABLE 56 EUROPE: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 57 EUROPE: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 58 EUROPE: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 59 EUROPE: MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

TABLE 60 EUROPE: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 61 EUROPE: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 62 EUROPE: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 63 EUROPE: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

TABLE 64 EUROPE: MARKET, BY DIGITALIZATION LEVEL, 2018–2021 (USD MILLION)

TABLE 65 EUROPE: MARKET, BY DIGITALIZATION LEVEL, 2022–2030 (USD MILLION)

TABLE 66 EUROPE: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 67 EUROPE: MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 68 EUROPE: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 69 EUROPE: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.3.2 UK

13.3.2.1 Strong currency value of UK over US drives growth in maritime sector

TABLE 70 UK: INDUSTRY, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 71 UK: INDUSTRY, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 72 UK: INDUSTRY, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 73 UK: INDUSTRY, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 74 UK: INDUSTRY, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 75 UK: INDUSTRY, BY PROCESS, 2022–2030 (USD MILLION)

13.3.3 GERMANY

13.3.3.1 Expansion of shipyards to lead to digitalization

TABLE 76 GERMANY: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 77 GERMANY: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 78 GERMANY: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 79 GERMANY: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 80 GERMANY: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 81 GERMANY: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.3.4 FRANCE

13.3.4.1 Acquisitions and collaborations to drive market

TABLE 82 FRANCE: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 83 FRANCE: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 84 FRANCE: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 85 FRANCE: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 86 FRANCE: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 87 FRANCE: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.3.5 ITALY

13.3.5.1 Modernization and procurement plans in navy to result in digitalization of shipyards

TABLE 88 ITALY: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 89 ITALY: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 90 ITALY: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 91 ITALY: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 92 ITALY: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 93 ITALY: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.3.6 NETHERLANDS

13.3.6.1 Highly successful network of shipyards, suppliers, and service providers to aid market growth

TABLE 94 NETHERLANDS: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 95 NETHERLANDS: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 96 NETHERLANDS: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 97 NETHERLANDS: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 98 NETHERLANDS: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 99 NETHERLANDS: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.3.7 SPAIN

13.3.7.1 Complex construction projects in shipyards to attract investments in modernization programs

TABLE 100 SPAIN: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 101 SPAIN: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 102 SPAIN: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 103 SPAIN: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 104 SPAIN: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 105 SPAIN: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.3.8 REST OF EUROPE

13.3.8.1 Collaborations, contracts, and aftermarket services to enhance maritime presence

TABLE 106 REST OF EUROPE: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 107 REST OF EUROPE: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 108 REST OF EUROPE: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 109 REST OF EUROPE: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 110 REST OF EUROPE: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 111 REST OF EUROPE: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.4 ASIA PACIFIC

FIGURE 32 ASIA PACIFIC: DIGITAL SHIPYARD MARKET SNAPSHOT

13.4.1 PESTLE ANALYSIS: ASIA PACIFIC

TABLE 112 ASIA PACIFIC: MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

TABLE 116 ASIA PACIFIC: MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 117 ASIA PACIFIC: MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 118 ASIA PACIFIC: MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 119 ASIA PACIFIC: MARKET, BY PROCESS, 2022–2030 (USD MILLION)

TABLE 120 ASIA PACIFIC: MARKET, BY DIGITALIZATION LEVEL, 2018–2021 (USD MILLION)

TABLE 121 ASIA PACIFIC: MARKET, BY DIGITALIZATION LEVEL, 2022–2030 (USD MILLION)

TABLE 122 ASIA PACIFIC: MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 123 ASIA PACIFIC: MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 124 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 125 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.4.2 CHINA

13.4.2.1 Advancements in marine industry fuel demand for digitalization in China

TABLE 126 CHINA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 127 CHINA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 128 CHINA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 129 CHINA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 130 CHINA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 131 CHINA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.4.3 SOUTH KOREA

13.4.3.1 Major shipyard mergers to give stiff competition to rival yards

TABLE 132 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 133 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 134 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 135 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 136 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 137 SOUTH KOREA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.4.4 JAPAN

13.4.4.1 Shipbuilders to leverage technical capability and R&D resources

TABLE 138 JAPAN: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 139 JAPAN: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 140 JAPAN: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 141 JAPAN: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 142 JAPAN: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 143 JAPAN: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.4.5 RUSSIA

13.4.5.1 Geographic location allows leveraging high-end technologies

TABLE 144 RUSSIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 145 RUSSIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 146 RUSSIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 147 RUSSIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 148 RUSSIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 149 RUSSIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.4.6 INDIA

13.4.6.1 Shows remarkable progress in use of new technologies and initiatives

TABLE 150 INDIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 151 INDIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 152 INDIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 153 INDIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 154 INDIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 155 INDIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.4.7 AUSTRALIA

13.4.7.1 Transformation of shipbuilding industry to develop market

TABLE 156 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 157 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 158 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 159 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 160 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 161 AUSTRALIA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.4.8 REST OF ASIA PACIFIC

13.4.8.1 New technologies and sophisticated processes drive digitalization opportunities

TABLE 162 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 163 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 164 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 165 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 166 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 167 REST OF ASIA PACIFIC: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.5 MIDDLE EAST

13.5.1 PESTLE ANALYSIS: MIDDLE EAST

TABLE 168 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 169 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 170 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 171 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

TABLE 172 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 173 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 174 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 175 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

TABLE 176 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018–2021 (USD MILLION)

TABLE 177 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022–2030 (USD MILLION)

TABLE 178 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 179 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 180 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 181 MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.5.2 UAE

13.5.2.1 Adopting cutting-edge technologies to bring higher operational efficiency

TABLE 182 UAE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 183 UAE: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 184 UAE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 185 UAE: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 186 UAE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 187 UAE: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.5.3 TURKEY

13.5.3.1 Construction of modern and large ships to increase

TABLE 188 TURKEY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 189 TURKEY: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 190 TURKEY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 191 TURKEY: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 192 TURKEY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 193 TURKEY: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.5.4 REST OF MIDDLE EAST

13.5.4.1 Development of new shipyards to provide scope for digitalization

TABLE 194 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 195 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 196 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 197 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 198 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 199 REST OF MIDDLE EAST: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.6 REST OF THE WORLD

13.6.1 PESTLE ANALYSIS: REST OF THE WORLD

TABLE 200 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 201 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 202 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2018–2021 (USD MILLION)

TABLE 203 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY TECHNOLOGY, 2022–2030 (USD MILLION)

TABLE 204 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 205 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 206 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 207 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

TABLE 208 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2018–2021 (USD MILLION)

TABLE 209 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY DIGITALIZATION LEVEL, 2022–2030 (USD MILLION)

TABLE 210 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY END USE, 2018–2021 (USD MILLION)

TABLE 211 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY END USE, 2022–2030 (USD MILLION)

TABLE 212 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2018–2021 (USD MILLION)

TABLE 213 REST OF THE WORLD: DIGITAL SHIPYARD MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

13.6.2 LATIN AMERICA

13.6.2.1 Shipping sector to witness growth by overseas investments

TABLE 214 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 215 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 216 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 217 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 218 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 219 LATIN AMERICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

13.6.3 AFRICA

13.6.3.1 Presence of aftermarket service companies to drive market growth

TABLE 220 AFRICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2018–2021 (USD MILLION)

TABLE 221 AFRICA: DIGITAL SHIPYARD MARKET, BY SHIPYARD TYPE, 2022–2030 (USD MILLION)

TABLE 222 AFRICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2018–2021 (USD MILLION)

TABLE 223 AFRICA: DIGITAL SHIPYARD MARKET, BY CAPACITY, 2022–2030 (USD MILLION)

TABLE 224 AFRICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2018–2021 (USD MILLION)

TABLE 225 AFRICA: DIGITAL SHIPYARD MARKET, BY PROCESS, 2022–2030 (USD MILLION)

14 COMPETITIVE LANDSCAPE (Page No. - 191)

14.1 INTRODUCTION

14.2 MARKET SHARE ANALYSIS, 2021

TABLE 226 DEGREE OF COMPETITION

FIGURE 33 MARKET SHARE OF TOP PLAYERS IN DIGITAL SHIPYARD MARKET, 2021 (%)

14.3 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS, 2021

FIGURE 34 REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS IN DIGITAL SHIPYARD MARKET

14.4 COMPANY EVALUATION QUADRANT

14.4.1 STARS

14.4.2 EMERGING LEADERS

14.4.3 PERVASIVE PLAYERS

14.4.4 PARTICIPANTS

FIGURE 35 DIGITAL SHIPYARD MARKET COMPETITIVE LEADERSHIP MAPPING, 2021

TABLE 227 COMPANY PRODUCT FOOTPRINT

TABLE 228 COMPANY FOOTPRINT BY TYPE

TABLE 229 COMPANY FOOTPRINT BY END USE

TABLE 230 COMPANY REGION FOOTPRINT

14.5 STARTUPS/SME EVALUATION QUADRANT

14.5.1 PROGRESSIVE COMPANIES

14.5.2 RESPONSIVE COMPANIES

14.5.3 DYNAMIC COMPANIES

14.5.4 STARTING BLOCKS

FIGURE 36 DIGITAL SHIPYARD MARKET STARTUPS/SME COMPETITIVE LEADERSHIP MAPPING, 2021

14.6 COMPETITIVE BENCHMARKING

TABLE 231 DIGITAL SHIPYARD MARKET: DETAILED LIST OF KEY STARTUP/SMES

TABLE 232 DIGITAL SHIPYARD MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [STARTUPS/SMES]

14.7 COMPETITIVE SCENARIO

14.7.1 DEALS

TABLE 233 DEALS, 2018–2022

14.7.2 PRODUCT LAUNCHES

TABLE 234 PRODUCT LAUNCHES, 2018–2022

14.7.3 OTHERS

TABLE 235 OTHERS: 2018-2022

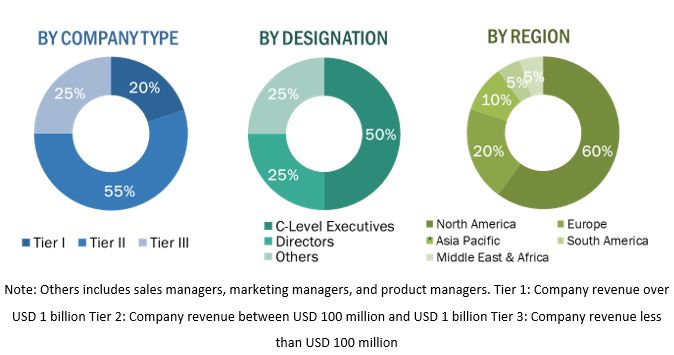

The research study conducted on the digital shipyard market involved extensive use of secondary sources, directories, and databases such as Hoovers, Bloomberg Businessweek, and Factiva to identify and collect information relevant to the digital shipyard market. The primary sources considered included industry experts from the digital shipyard market as well as raw material providers, digital shipyard solution providers, technology developers, alliances, government agencies, and aftermarket service providers related to all segments of the value chain of this industry. In-depth interviews with various primary respondents, including key industry participants, Subject Matter Experts (SMEs), industry consultants, and C-level executives have been conducted to obtain and verify critical qualitative and quantitative information pertaining to the digital shipyard market as well as to assess the growth prospects of the market.

Secondary Research

The ranking of companies operating in the digital shipyard market was arrived at based on secondary data made available through paid and unpaid sources, the analysis of product portfolios of the major companies in the market and rating them on the basis of their performance and quality. These data points were further validated by primary sources.

Secondary sources referred for this research study on the digital shipyard market included government sources, such as corporate filings that included annual reports, investor presentations, and financial statements, and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall market size, which was further validated by various primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the size of the digital shipyard market. The following figure offers a representation of the overall market size estimation process employed for the purpose of this study on the digital shipyard market.

The research methodology used to estimate the market size includes the following details:

- Key players in this market were identified through secondary research, and their market share was determined through primary and secondary research. This included a study of the annual and financial reports of top market players and extensive interviews of leaders such as Chief Executive Officers (CEOs), directors, and marketing executives of leading companies operating in the digital shipyard market.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Market size estimation methodology: Bottom-up approach

Market size estimation methodology: Top-Down approach

Data triangulation

After arriving at the overall market size through the market size estimation process explained above, the total market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegments, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand- and supply-sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Report Objectives

- To define, describe, segment, and forecast the digital shipyard market based on shipyard type, technology, capacity, process, end use, digitalization level and region

- To analyze demand- and supply-side indicators influencing the growth of the market

- To understand the market structure by identifying high-growth segments and subsegments of the market

- To provide in-depth market intelligence regarding key market dynamics, such as drivers, restraints, opportunities, and challenges, influencing the growth of the market

- To forecast the revenues of market segments with respect to 5 main regions: North America, Europe, Asia Pacific, the Middle East, and Rest of the World

- To analyze technological advancements and new product launches in the market from 2018 to 2022

- To provide a detailed competitive landscape of the market, in addition to market share analysis of leading players

- To identify the financial position, product portfolio, and key developments of leading players operating in the market

- To analyze micromarkets with respect to their individual growth trends, prospects, and contribution to the overall market

- To provide a comprehensive analysis of business and corporate strategies adopted by key market players

- To profile key market players and comprehensively analyze their core competencies

Available customizations

Along with the market data, MarketsandMarkets offers customizations as per the specific needs of companies. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the market segments at country-level

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Digital Shipyard Market